With increasing term spreads (or, steepening of the yield curve), fears of imminent recession have waned. Does this make sense?

In previous posts [1], I have been reporting estimates of a recession-month 12 months ahead, using probit models, estimated 1985 onward. Here, I use unadjusted 10yr-3mo spreads as well as adjusted by estimated term premium, 1967-onward. But what might be of greater interest is whether a recession will start any time within the next twelve months.

In order to assess this, I estimate two probit regressions, 1967-2019M11. First, the conventional specification.

Prob(recessiont+12) = -0.245 – 0.752 spreadt + ut+12

McFadden R2 = 0.31, NObs = 623. Coefficients significant at 5% msl bold. The spread is in percentage points.

Next, the specification for recession any time within the next twelve months

Prob(recessiont,t+12) = 0.266 – 0.595 spreadt + ut+12

McFadden R2 = 0.21, NObs = 623. Coefficients significant at 5% msl bold. The spread is in percentage points.

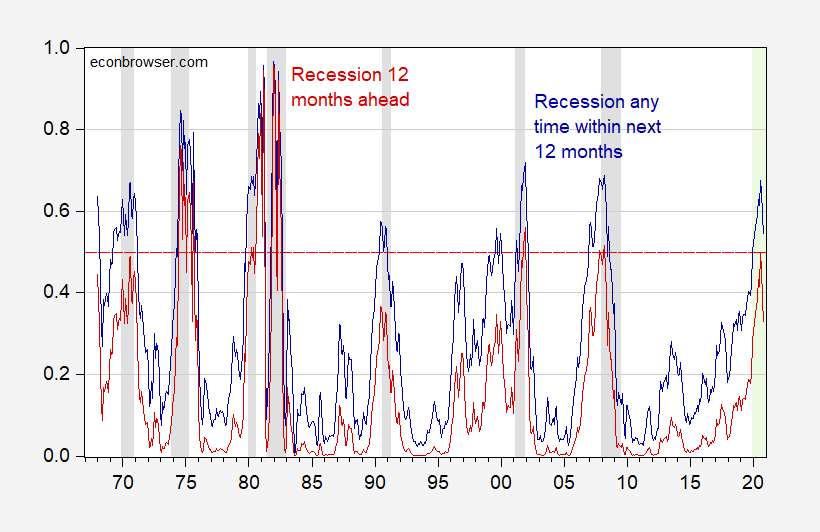

The resulting recession probabilities are shown in Figure 1.

Figure 1: Estimated probability of recession within 12 months up to indicated date (blue), and in indicated month (red). NBER recession shaded gray. Light green shading denotes forecast period. Source: NBER and author’s calculations.

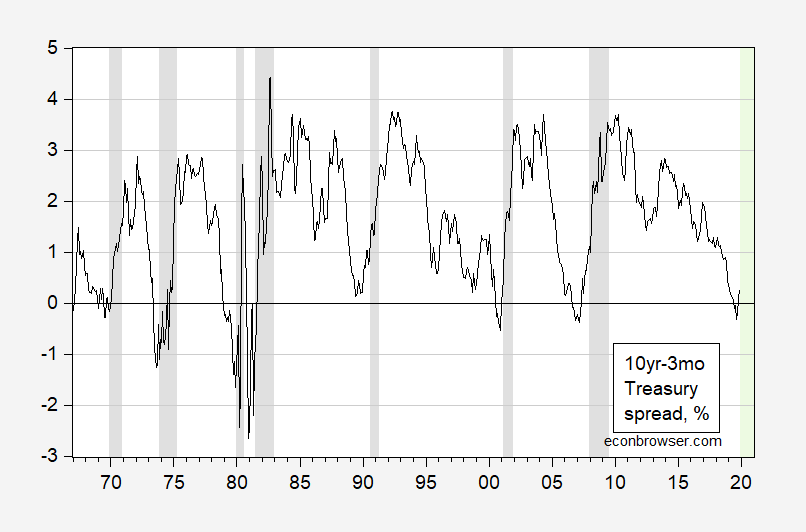

These estimates based on the 10yr-3mo spread (3 month is Treasury bill secondary market).

Figure 2: Ten year-three month Treasury spread, % (black). NBER defined recession dates shaded gray. Light green shading denotes forecast period. Source: Federal Reserve via FRED, and NBER.

While the estimated probability of recession in November 2020 is 33%, down from 50% for August 2020, the estimated probability of a recession within the next twelve months is fairly high, at 54%.

So, too early to relax…

Addendum:

I should give proper credit to where I got the idea to try to estimate the cumulative probability; it’s from Johansson, Meldrum, “Predicting Recession Probabilities Using the Slope of the Yield Curve,” FEDS Notes, March 2018.

what is your definition of recession. It varies

Not Trampis: Per graphs, I use the NBER definition.

Well, I promised Menzie I would try to pull back and minimize my Youtube links here. So I’m already kinda semi-breaking my word here, but I’m going to argue this is a substantive link because they are interviewing a Presidential candidate and a Presidential candidate who has been short-changed on coverage and how he is treated by the general media and short-changed on his time allotment on TV debates. So I think if anyone wants to know more about Yang, or is still on the fence about voting for him maybe this interview could help you know “the real” Andrew Yang, and help you make a better decision in your primary vote. He’s not my first choice, but I’m very glad he’s running because he’s increased the quality of the dialogue by participating:

https://youtu.be/Ieg8sfGPORg?t=2388

The hosts hats that they are wearing is a good example of how Yang improves the dialogue. Maybe a Yang presidency would help to encourage white kids etc to take mathematics as seriously and intently as Asian children do in their studies. That would make America a better place, would it not?? No pun intended—it gets my vote.

Thanks Chinny ( an aussie variation )

I consider myself better politically read than most Americans (OK, a low bar to set myself against, but at least better than that). Up to now, I have found Pete Buttigieg largely a mystery “OK he’s gay, he’s pretty articulate on the debate stage, can exchange verbal punches impromptu “. The former I can live with, the latter a positive. Really honestly that’s pretty much ALL “the take away” I was getting out of this guy. Until I saw this blog post which I found on Charles Pierce’s webpage over on Esquire magazine. I think this really taps in to who we are dealing with here.

http://www.lawyersgunsmoneyblog.com/2019/12/pete-buttigieg-is-bad-news

Might I add, what I read in the comments section I was quite impressed with. They seem devoid of “Peaktrader” types, which I think speaks highly of the content that attracts such readers.

Really good twitter thread, related to Buttigieg. Many solid comments calling out Buttigieg’s straight out LIES:

https://twitter.com/lizcgoodwin/status/1202642363287511041

This is possibly the biggest knowing and intentional lie we’ve seen on the presidential campaign trail since donald trump told gay voters he had no problem with transgender bathrooms.

Professor Chinn,

Would you consider showing more detail on how to replicate your model for recession within twelve months?

Thanks

if the unconditional prob of recession in any future quarter is .15. The unconditional probability of no recession in any 4 quarter period is therefore (1 – .15)^4 = .52.

Bob Flood: I was thinking of applying this approach and using by-the-horizon *conditional* forecasts. This yields something like 500% probability of recession if monthly probabilities are serially uncorrelated…So my guess is that recession probabilities are elevated right now.

bob flood: Just checking: 1947-2019 assuming no recession in 2019, uncond’l prob is 0.185, so prob no recession in any 4 quarter period is 0.44. For Great Moderation (1986-2019), corresponding calculation is 0.605. Interesting!

Foaming-at-the-mouth Democrats must be pleased with these results. A recession soon is their best shot at getting rid of He Who Must Be Hated Beyond All Reason.

Feeling defensive about the clown in chief, are ya there?

He Who is An Abject Failure and Has Been For Decades will be gone next year anyway. He was elected by a fluke and the fluke is unlikely to repeat. No need to sneer at “Foaming at the mouth Democrats” any more than there is a need to sneer at “Too Dumb to Understand Trump’s History Republicans.” If the Republicans wanted to field a reasonable candidate, they could nominate John Kasich, who I disagree with on most everything. He is, however, a reasonable American and an apparently honest man, and he would also prove to be competent and effective at running the government as the executive. He would not attempt to run the government as his own private fief. The rest of the world would not be laughing at him on a regular basis, like they do with the current erratic buffoon.

A recession, they don’t need. Real economy growth has been terrible since the middle of 2000.

Maybe the Rage does not get that population growth is lower today than it was in the period from WWII to 2000. Yes per capita real income has not been growing by 2% per year but it is growing by 1% per year. Not great but “terrible”? Oh yea – this is the comment one would expect from someone who calls himself “The Rage”!

@ John Smith

Have you talked to your neighborhood psychiatrist about your issues with projection?? I hear they have pills for every problem now. Good luck.

Foaming at the mouth? At least I am not drunk on an excessive amount of beer in the morning like you MAGA hat wearers!

Don’t denigrate drunks please. On top of the fact it’s unfair, it’s an issue I’m overly-sensitive to.

New Nom de Plume?

dilbert dogbert: Just call him “Obergruppenführer”.

John Smith, never to be mistaken for Adam Smith.

It’s called a debt bust. When it blows, the cycle is over. Powell is wrong there, heat of a economy is not only driven by real growth overinvestment, but debt growth credit growth. When credit contraction begins, the shape of the economy does not matter. Can they still push debt up???? Have commercial banks run out of reserves??? Default rate sign is bad news. 2020 and early decadal recession signals have been there since 2014.

More of your usual babbling. Could you provide a single shred of actual data? Didn’t think so!

“It’s called a debt bust.”

Princeton Stevie pooh says we have no such concern now. OK – Stevie is a like like you – a clueless troll. But let’s check with FRED:

https://fred.stlouisfed.org/series/NCBCMDPMVCE

Nonfinancial corporate business; debt as a percentage of the market value of corporate equities

Debt (D) as a percent of equity (E) have fallen to only 33%.

BTW – basic accounting says D + E = assets (A) which means the debt to asset (D/A) ratio is a mere 25%.

Come on Raged One. Try checking actual facts before your next troll comment!

Your not getting it. Look at the whole market. Subprime debt in consumer loans is a bubble. It.pops, down goes auto industry. Only so many lame loans can be piled on one another.

I’m not getting it? Well try providing some actual data for once in your life.

Subprime consumer loan debt is the Bubble this cycle. It’s insane considering the slow population growth.

If we assume that a recession arises as a result of certain imbalances, it might be worthwhile doing a piece on what that might be.

– Not housing

– Not oil prices (for the moment)

– Not wage pressure

– Inflation?

– Stock market bubble?

– Not consumer debt

– Corporate debt?

– Financial institutions debt?

– China?

– War with Iran? (Like 1991?)

And I accused The Rage of babbling! Sorry Stevie pooh – I did not mean to place you in 2nd place in the art of utter nonsense!

‘War with Iran? (Like 1991?)’

How did I miss this one. I guess somewhere in your warped brain, we attacked Iran but we didn’t. We pushed Iraq out of Kuwait in 1991. I guess in your Princeton little basement, you flunked basis history too!

1000 cuts. Trade friction and the resulting slowdowns

Taxes on wealthy people already cut so far they cannot be cut any farther, so no more salivating over the next party at the trough.

Corporate profit slowdown.

Economic stresses radiating out from the agricultural sector.

Private lending slowdown in time.

I don’t know which one. Maybe all the above. Maybe some misstep by somebody somewhere that cannot be predicted now. Maybe we get lucky and dodge a bullet.

– Fed

I’m not a Jerome Powell fan, but your statement is laughable. The Fed has only played a small role in this, and what negative role they have played has been largely forced on them by large commercial banks and their influence over Republican legislators such as Phil Gramm, Dick Armey and a laundry list of others.

This is why we have the current repo mess, which is just a form of welfare for banks, but we can’t call it welfare for banks, so we play all kinds of games with lexicon such as “liquidity problems” and “plumbing”. Let them pay the higher rates, if those banks fail then they deserve to fail. No one ever cries for the guy who has the high credit card rate or uses payday loans. Some banks had to pay 10% on an overnight loan?? I guess they’ll stop doing it if that 10% rate bothers them that much. Tough shit. Raise the ratio of your on-hand capital and you won’t have to worry about it. See, banks play this game with desperate people, but when banks are told they need to pay a higher rate we act like some humanitarian disaster has just occurred. It’s not the Fed’s job to hold banks and dealers by the hand when they want to operate like a fly-by-night operation and shove off solvency issues on the Fed.

Good news from the payroll survey of employment:

https://www.bls.gov/news.release/empsit.nr0.htm

Total nonfarm payroll employment rose by 266,000 in November, and the unemployment rate was little changed at 3.5 percent.

That is the headline news but let’s dig a bit deeper. Yea I know old John Smith will call me a “foaming-at-the-mouth Democrat” but the details matter. The fall in the unemployment rate came from a decline in the labor force participation rate as the employment/population ratio remained flat at 61.0%. According to the household survey, employment grew by 83.000.

lol, the BLS birth/death model nonsense makes those figures dead. I go with ADP. I think their formula which once was shaky has been improved. When it comes to manufacturing employment, almost surely. BLS looks like a mess. Doesn’t match total output or hours involved. Revise down NFP now!!!!

More incoherent babbling and once again no actual data.

Too bad there is no Nobel Prize for haruspicy. When the regression you’ve been pushing for months no longer gives you the answer you want, redefine the regression until it does!

The chance that Trump will remain your President continues to rise. But keep rummaging through the data. Maybe you’ll find something.

Does THE RICK even know what haruspicy means?

https://www.merriam-webster.com/dictionary/haruspicy

“the art or practice of divination”.

Come on Ricky – please give us the CORRECT specification of this regression. LORD!

I don’t use haruspicy for predictions. I use a dowsing rod. And it says Trump will not remain my president or anybody else’s in a little over a year. The magic dowsing rod never fails.

Just saw a film called “Luce”. I would put it in the top 10 best films I’ve seen in the last two years. Get it on Netscape or whatever. Reminds me of “The Natural” or “Blade Runner” when it came out (as far as ticket sales in comparison to the quality of the film). Really great film making and great acting. Only maybe two things in the entire film I thought were unrealistic. The fact that the school’s principal wasn’t a complete d*ckhead (98% of the time they are) and something that happens in a school office near to the very end of the film. It was the only thing in the entire film I thought “wouldn’t happen in real life” in a typical suburban school setting. I don’t want to give too much away. They leave a lot of grey area in the film, and many questions unresolved until the very end of the film, which is part of the brilliance of the film. It’s worth having in your disc collection if you have one you’re still adding to.