Today, we’re pleased to present a guest contribution written by Catherine Doz (Paris School of Economics), Laurent Ferrara (SKEMA Business School and International Institute of Forecasters) and Pierre-Alain Pionnier. The views presented represent those of the authors, and not necessarily those of the institutions the authors are affilliated with.

The Covid-19 crisis is expected to trigger a recession in most countries in the world. However, tracking a recession in real-time is not an easy task. The Great Recession and the subsequent period of subdued GDP growth in most advanced countries have highlighted that macroeconomic forecasters need to account for sudden and deep recessions, periods of higher macroeconomic volatility, and low-frequency fluctuations in trend GDP growth. Focusing on the US economy, we recently circulated a Paris School of Economics Working Paper in which we put forward an extension of the standard Markov-Switching Dynamic Factor Model (MS-DFM) by incorporating two new features: switches in volatility and time-variation in trend GDP growth. First, we show that volatility switches largely improve the detection of business cycle turning points in the low-volatility environment prevailing since the mid-1980s. Second, our model also captures a continuous decline in the US GDP growth trend that started a few years before the Great Recession. These two extensions of the standard MS-DFM framework are supported by information criteria, marginal likelihood comparisons and improved real-time GDP forecasting performance. Updated results including March 2020 data show that the probability of being in recession is currently equal to 0.74 in the US and the factor summarizing economic activity is already well below previous recession episodes since the 70’s.

The Covid-19 crisis is expected to trigger a recession in the U.S. as well as in most countries in the world (see previous Econbrowser posts here and here, as well as the latest IMF forecasts). However, forecasters and economists know very well that tracking a recession in real-time is challenging. Some papers are claiming that this is impossible, and that detecting a recession just after it occurs is already a great outcome (Hamilton, 2011). In a recent paper (Doz, Ferrara and Pionnier, 2020), we put forward an extension of the standard Markov-Switching Dynamic Factor Model (MS-DFM) developed by Diebold and Rudebusch (1996) by incorporating two new features: switches in volatility and time-variation in trend GDP growth.

Why extend the MS-DFM model?

Macroeconomic forecasts are often made by separating two objectives: providing the growth rate of the variable of interest (usually GDP) and detecting turning points in the economic cycle. Yet the 2008-09 Great Recession and the period of weak growth that followed in most advanced economies showed that it could be crucial to combine these two approaches. To do that, macroeconomic forecasters need models accounting for: (i) sudden and deep recessions, (ii) periods of increasing macroeconomic volatility, and (iii) fluctuations in trend GDP growth.

In our paper, we offer an econometric model that integrates these three characteristics, and we show that this model both anticipates the detection of turning points in the US economic cycle and improves GDP forecasts since the last recession. This model is an extension of the Markov-Switching Dynamic Factor Model (MS-DFM). In a DFM, economic series are assumed to be linked to one or several latent variables called factors, which give them common dynamic properties. In our case, one factor summarizes the dynamics of five variables, namely quarterly GDP and the four monthly variables used by the National Bureau of Economic Research to date turning points in the US economic cycle (i.e. industrial production, trade and sales, personal income and employment) and represents the underlying state of the economy. In addition, the MS-DFM introduces regime shifts in economic dynamics: the average value of the underlying factor during periods of recession differs from its average value during periods of expansion, and the probability of the economy being in one state or the other is updated at each date according to the latest available macroeconomic information.

We extend the MS-DFM model by adding two new characteristics to it. On the one hand, we introduce the possibility that the amplitude of factor fluctuations (volatility) also has two different regimes: a low-volatility and a high-volatility regime. The probability of switching from one macroeconomic volatility regime to the other, as well as the values associated with that volatility, is part of the estimated parameters. On the other hand, we allow trend GDP growth to change over time. Once the parameters are calculated, the model can evaluate the probability that economic cycle turning points have occurred and forecast current and future GDP values.

In-sample results

In-sample results estimated by using data from January 1970 to December 2017 reveal two salient facts.

First, the inclusion of switches in volatility in the state equation of the model enables to distinguish four periods in the sample, as shown in Figure 1: a period of high macroeconomic volatility from 1970 to 1984, a period of low volatility from 1984 to 2007 corresponding to the Great Moderation, a second period of high macroeconomic volatility corresponding to the Great Recession (2007-2009), and a period of low volatility from the end of the Great Recession to the end of the sample (2009-2017). From Figure 1, we conclude that the increase in volatility at the time of the Great Recession was only temporary and did not put an end to the Great Moderation, which is in line with Gadea-Rivas et al. (2018). In addition, we show that accounting for volatility switches clearly improves the identification of economic cycle turning points, especially during the period of low volatility prevailing since the mid-1980s (the “Great Moderation”).

Figure 1. Extended MS-DFM: Smoothed probability of being in a high-volatility regime (Jan. 1970 – Dec. 2017)

Estimation sample: 1970M01-2017M12. Data vintage: 2017M12. Estimation based on 1 5000 draws of the Gibbs Sampler (the first 5 000 are discarded).

Second, similarly to Antolin-Diaz et al. (2017), we identify a decrease in the US long-term GDP growth rate which started in the early 2000s, i.e. before the Great Recession, and continued thereafter (see Figure 2). This result is compatible with the view that the Great Recession may have negatively affected the US trend growth rate and reinforced pre-existing factors. As compared to 2000, the estimated US long-term GDP growth rate is lower by around one percentage point per year in 2010 and seems to have stabilized since then. This slowdown in US long-term GDP growth follows an increase in the second half of the 1990s, which corresponds to a period of increase in US productivity growth (Jorgenson et al. 2008).

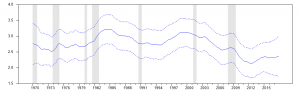

Figure 2. Extended MS-DFM: Smoothed estimate of the US annual long-run GDP growth rate (Jan. 1970 – Dec. 2017)

Estimation sample: 1970M01-2017M12. Data vintage: 2017M12. Estimation based on 15 000 draws of the Gibbs Sampler (the first 5 000 are discarded). Dashed lines delineate the 68% credibility interval.

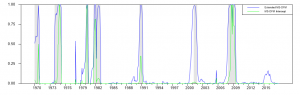

The probability of being in a recession stemming from the model is presented in Figure 3 (blue line). As shown in Figure 3, allowing for switches in volatility in the state equation and for different expansion and recession characteristics across volatility regimes leads to an excellent match with the recession dates provided by the NBER Business Cycle Dating Committee. In particular, the inclusion of a time-varying volatility helps to better capture the two recessions that occurred during the Great Moderation period (in 1991 and 2001), compared with a MS-DFM that does not allow for switches in volatility (green line).

Figure 3. Extended MS-DFM: Smoothed probability of being in a recession (Jan. 1970 – Dec. 2017)

Estimation sample: 1970M01-2017M12.

Finally, a real-time forecasting exercise, using the vintages of variables available at each date to forecast GDP, shows that the model has a better forecasting performance over 2007-2017 than a model that would not account for regime switches and fluctuations in trend GDP growth.

Latest results, with data up to March 2020

Finally, we estimate our model with the latest available data (April 15, 2020). That is, we use U.S. GDP growth until 2019q4 as well as sales until January, personal income until February and employment and industrial production until March. See the 4 monthly series in this Econbrowser post. Our estimation method is able to deal with missing values, so we can estimate the model until March 2020.

With data up to March 2020, the recession probability computed by the model currently stands at 0.74. Formally, we should wait two additional months to send a clear signal of recession according to the decision rule advocated in our paper. Nevertheless, given the current conditions it is very likely that the probability will stay above 0.70 in April and May and that a recession is ongoing (the date of the peak is likely to be in February 2020, but is subject to future revisions after new data integration).

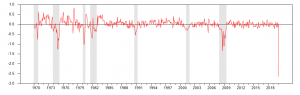

In addition to this recession signal, the model gives an indication of how deep the recession could be and allows tracking economic activity in real time. Figure 4 shows a large drop in the factor estimated by the model, driven by the March decline in employment and industrial production. The drop in monthly employment is itself largely consistent with the huge increase in unemployment claims in the US. The factor estimated by the model has already reached record low levels that have not been seen before over the sample, largely below the Great Recession and oil shocks in the 70’s.

Figure 4. Extended MS-DFM: Underlying factor summarizing economic activity (Jan. 1970 – Mar. 2020)

Estimation sample: 1970M01-2020M3.

This post written by Catherine Doz, Laurent Ferrara and Pierre-Alain Pionnier.

Can I just say this: The yield-curve inverted (recession warning, monthly basis) in May 2019, long before the present crisis. So is it really appropriate to keep saying the pandemic is to blame for the recession?

Maybe if it wasn’t the pandemic it just would have been something else, “real” economic/financial reasons?

Sebastian

@ Sebastian

I agree with you on some of the, what I would call “tip over” or “nudge the drink glass sitting on the edge of the table” effects. Would the equities markets and consumer demand have destroyed this economy even had it been on a solid foundation?? YES. But….. things like bond defaults and problems for large corporations making loan payments wouldn’t have happened if some bad corporate habits weren’t already in place.

https://blogs.imf.org/2020/04/14/covid-19-crisis-poses-threat-to-financial-stability/

I also wanted to point out an unrelated issue to Sebastian’s worthy observation. This story is a big story, and is somehow being lost underneath the COVID-19 headlines. When people such as Mike Bloomberg “kill stories” this provides encouragement to Chinese officials to hide things such as the COVID-19 that can destroy thousands of lives. We cannot expect Chinese officials and the Chinese government to change their behavior, when we hold out a chocolate chip cookie to them for behavior that amounts to mass manslaughter, and tell journalists such as Mike Forsythe (after his wife and children were mortally threatened by Xi Jinping and his goons) to go suck on a rotten egg.

Check the size of that current downward stripe in the recession factor in figure 4. That is pretty telling. Whatever circumstances prevailed prior to the arrival of Covid=19, something new and terrible has happened.

It’s also open for debate whether the yield curve was as predictive of future economic activity in the recent expansion as in the past. Low long-end yields as the result of low inflation expectations and high demand for safe, long-duration assets may well represent a regime change in the financial economy.

The story I should have attached in the above comment:

https://www.npr.org/2020/04/14/828565428/bloomberg-news-killed-investigation-fired-reporter-then-sought-to-silence-his-wi

Uh-Oh……. Russian tourism taking off like crazy in Wuhan AGAIN !!!!! Those crazy любители водки and their obsession with Wuhan cuisine!!!!!!!!

From NYT:

“Faced with mounting skepticism over its official figures, China on Friday revised up its death toll in the city where the coronavirus first emerged.

Officials placed the new tally at 3,869 deaths from the coronavirus in the central Chinese city of Wuhan, an increase of 1,290, or 50 percent, from the previous figure. The number of confirmed infections in the city was also revised upward to 50,333, an increase of 325.”

From The Guardian:

“…….. The news came as Chinese authorities revised the death toll in Wuhan, the hardest hit city and where the virus first emerged, up by 50%, to 3,869 from 2,579. Citing the number of patients who had died at home before reaching hospital, as well as late and inaccurate reporting, the city’s task force on virus prevention and control said: ‘Every loss of life during the epidemic is not just a source of sorrow for their family, but for the city as well. We would like to send our sincere sympathies to the family members.’

The economic contraction, reported by China’s National Bureau of Statistics on Friday, comes after months of paralysis as the country went into lockdown to contain the virus, which emerged in central Hubei province in December. It has now infected more than 2 million people globally and killed more than 140,000.”

https://www.theguardian.com/world/2020/apr/17/china-economy-shrinks-record-wuhan-covid-19-death-toll-rises-50-percent

Oh those Beijing practical jokers!!!!! I thought Grandma Wu’s skin was kinda cold the last few weeks, but who is to argue with local great and “New Zhejiang Army” crony Ying Yong anyway??

https://en.wikipedia.org/wiki/Ying_Yong

You think I can get “New ZhiJiang Army” as a snazzy print on some T-shirts??

New York City had to revise upwards its reported Coronavirus death count, which is now at 8893. The true number may be even higher. Of course the right wing is saying we are inflating this figure. Sort of like they did with the death toll from Maria. Ah yes – the reason Fox and Friends kept inviting Princeton Stevie on their show. Deny, deny, deny!

Based on weakening subprime banking lending, census layoffs and most importantly, non bank investment slowdowns, no pandemic 2nd half of 2020 would have been interesting. Smells like a credit crunch. Ex-census it looks like q3 2018 was the peak and we were just growing enough to maintain since then.

Smells like a credit crunch? Rather than using your nose – try sourcing market data for a change such as the rising credit spreads I noted here:

http://econospeak.blogspot.com/2020/04/corporate-bond-spreads-and-pandemic.html

Economists do evidence. The Rage is allergic to evidence.

I’m curious how the authors (or anyone) thinks the Great Recession lowered the trend growth (or even just the level) of potential GDP? I had a similar question when I read a previous guest post trying to guess whether Covid will cause a V, J or L-shaped recession. I’ve got my own ideas about path dependence/hysteresis, but they come from Keynesian economics, not from mainstream macro. So I’m curious.

One of my better personal habits of the few I have (and hence the reason for my common visitation to the writings of Chinn and Hamilton) is searching out people much more intelligent than myself to provide me with answers. And so, Tom, I will present you the following:

https://www.nytimes.com/2018/09/30/opinion/the-economic-future-isnt-what-it-used-to-be-wonkish.html

Don’t let Krugman’s descriptor “Wonkish” scare you off. Most can grasp what is written there.

“I’m curious how the authors (or anyone) thinks the Great Recession lowered the trend growth (or even just the level) of potential GDP?”

Danny Yagan wrote this paper:

https://www.nber.org/papers/w23844

Employment Hysteresis from the Great Recession

This paper uses U.S. local areas as a laboratory to test whether the Great Recession depressed 2015 employment. In full-population longitudinal data, I find that exposure to a 1-percentage-point-larger 2007-2009 local unemployment shock caused working-age individuals to be 0.4 percentage points less likely to be employed at all in 2015, evidently via labor force exit. These shocks also increased 2015 income inequality. General human capital decay and persistently low labor demand each rationalize the findings better than lost job-specific rents, lost firm-specific human capital, or reduced migration. Simple extrapolation suggests the recession caused most of the 2007-2015 age-adjusted employment decline.

Other papers noted the decline in investment in capital.

Can they run the model to year end 2020? What does it say?

Who knew – Dr. Phil and Dr. Oz work for Princeton Steve!

https://talkingpointsmemo.com/news/2400-deaths-60000-fox-news-tv-doctor-guests-muse-on-cost-of-ending-covid-orders

2,400 Deaths? 60,000? Fox News’ TV Doctor Guests Muse On Cost Of Ending COVID Orders

And here, I thought those two men (at least at one time) worked for “the great advocate for the working women of America”, Oprah Winfrey. Geez, how do I always get these people all screwed up around in my head???

For the uninitiated on what a FRAUD Oprah has been for decades. She is no more than a funnel for products which separate the average American stay-at-home mom from her savings.

https://www.thedailybeast.com/its-time-for-oprah-to-renounce-dr-phil-and-dr-oz-over-their-dangerous-coronavirus-propoganda

how similar and different is using markov-switching vs kalman filter?

Thank you!