Today, we are fortunate to present a guest contribution written by Laurent Ferrara (SKEMA Business School and QuantCube Technology), Alice Froidevaux (QuantCube Technology) and Thanh-Long Huynh (QuantCube Technology).

On July 17, 2020, the National Bureau of Statistics of China published its preliminary quarterly accounts for the second quarter of 2020. After a drop of -6.8% in 2020q1, the China’s GDP bounced-back in positive territory to 3.2% (expressed in year-over-year growth), against a background of government expenses and cut in lending rates and banks’ reserve requirements. While much below its pre-Covid dynamics, China’s GDP annual growth was above expectations according to a Reuters poll done few days before.

Official GDP figures often come with some skepticism about their reliability. While Chinese authorities have decided to give up the strategy of having a GDP target (see explanations in this OECD blog), this time is no exception. There are only few China’s GDP nowcasts publicly available on the market. The San Francisco Fed has released a China Cyclical Activity Tracker but as today it stops in 2019Q2. But various public and private institutions have also developed their own China’s GDP nowcasts. Within QuantCube Technology, we have put forward nowcasting tools to track in real-time the Chinese productive economic activity, by using various sources of alternative data. We recently highlighted in an Econbrowser post that, especially during crisis periods, alternative data are extremely useful to complement official economic data to assess economic activity.

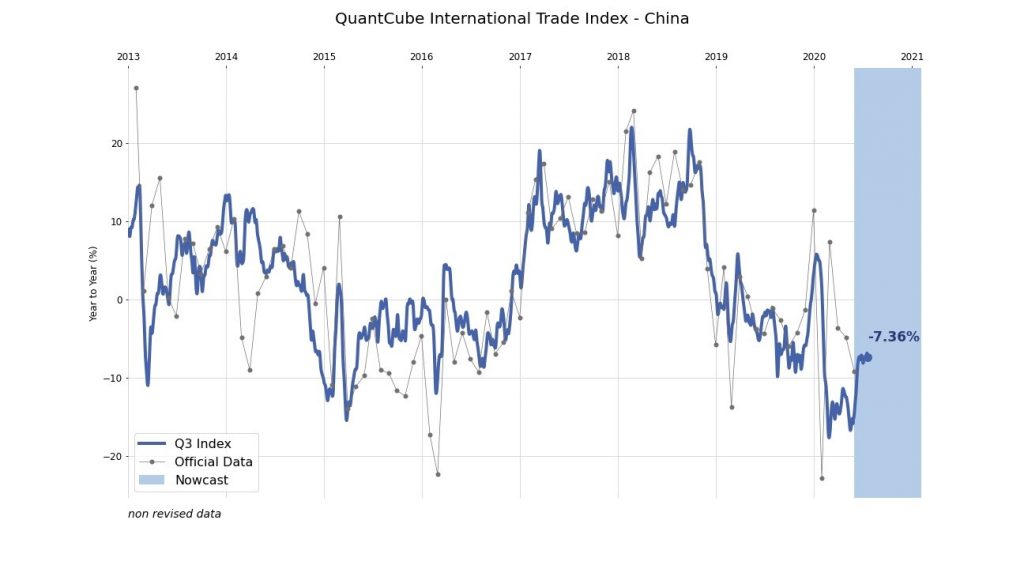

The first source of information is the international trade of goods and commodities. The QuantCube International Trade Index that we have developed tracks in real-time the evolution of official China’s external trade numbers by analyzing shipping data from ports located all over the world and by taking into account the characteristics of those ships. Recent results are presented in Figure 1 below. They show that, at beginning of July, the annual growth rate of China’s international trade is still very negative at -7.6%, reflecting thus a persistently low world demand.

Figure 1: International trade index for China (year-over-year growth). Source: QuantCube Technology

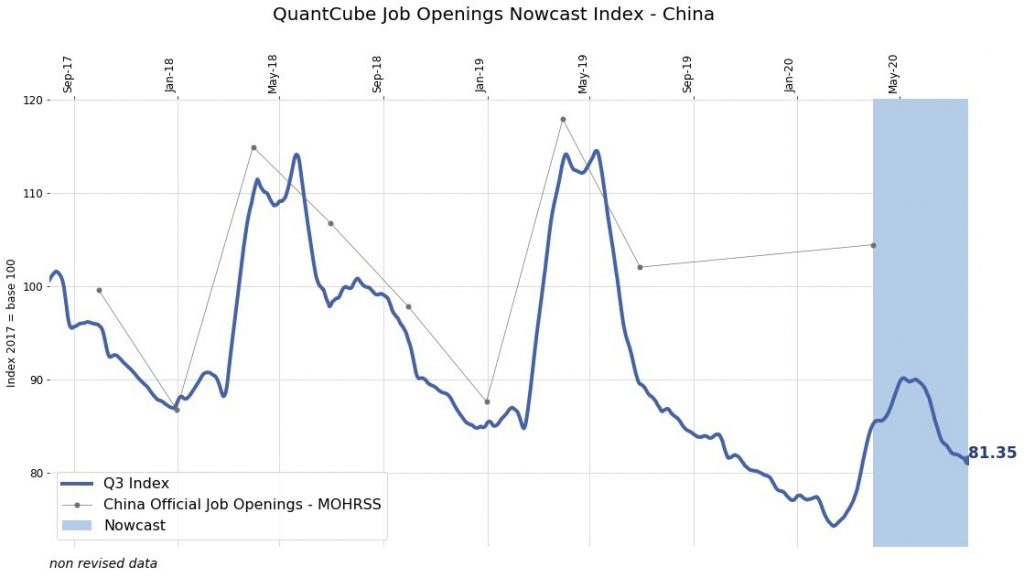

The second tool that we developed is a proxy of the job market created by aggregating the job offers per sectors available on websites. This index tracks China’s job openings by scraping data from various websites. It shows that the activity on the job market at beginning of July is still below the level estimated one year before. Interestingly, the index points out that after a recovery following the trough in February 2020, it seems that the job market is again slowing down since May 2020, reflecting some new concerns about the evolution of the Covid-19 virus within China.

Figure 2: Job openings index for China. Source: QuantCube Technology

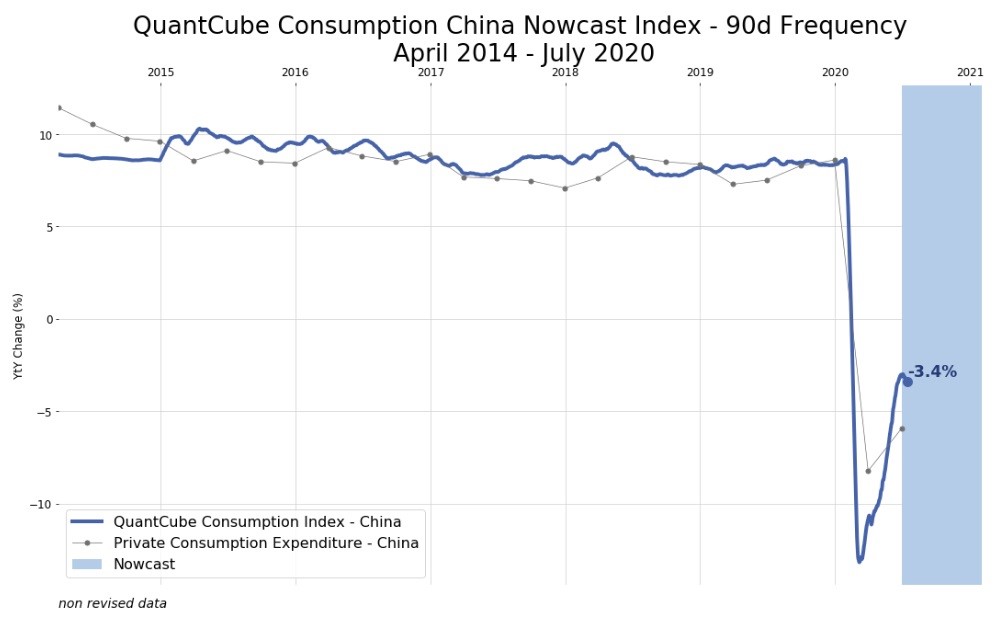

The third index is an index of China’s total private consumption based on on-line queries for some specific keywords related to household consumption. We identified that China’s household consumption is driven by few important sectors such as luxury, retail sales, services or leisure. Consequently, we created indexes for each component of the consumption index using related search queries retrieved by means of the Google Trends and Baidu applications. The overall consumption index expressed in year-over-year growth is presented in Figure 3 below. It shows that the index is still negative at -3.4% at beginning of July, in spite of a recovery since the trough in February 2020. This index reflects a still sluggish internal demand in China, also in line with the weak labor market .

Figure 3: Private consumption for China (year-over-year growth). Source: QuantCube Technology

Overall those alternative indexes that we developed tend to suggest that the China’s productive economic activity is currently likely to grow at a lower annual rate than 3.2%, the official GDP annual growth rate for 2020q2 released by the National Bureau of Statistics.

This post written by Laurent Ferrara, Alice Froidevaux and Thanh-Long Huynh.

Some people have a very kind and generous way to say that other people are full of cr__ , don’t they?? I guess that’s to be admired in some aspects.

Like the numbers and the graphs. Outstanding guest post by Ferrara, Thanh-Long , and Froidevaux

This reminds me…….. in the third index above, have the authors been able to isolate the private consumption numbers for the month of May?? It could be a “record” increase. Which, by some Shenandoah Valley “mathematical economists” weights on the May consumption numbers, could mean that GDP has kicked over to the positive side of 0% and possibly even indicate the “enduring” chance of a “V-shaped recovery”.

https://www.youtube.com/watch?v=ebanS7YL6V4

China allways give make up GDP, allways tell you lie

@ Minh Huynh

I want to address this in a very personally respectful way towards you Sir,

I am sometimes tempted to say this is a cultural issue, but often my wiser side pulls me back, to say that I think some of this is the demands of Beijing on province leaders (or regional leaders) for unrealistic results. And it’s not that China’s regional leaders get some “thrill” out of lying, it is that the system (“the system”= Beijing) thrusts and imposes on them the burden of telling those lies. I think eventually China will “mature” out of telling these lies. This is what I keep telling myself repeatedly in my mind anyway.

But, Mr. Minh Huynh, we see these things (all through America’s 200+ years history, but arguably more so in the last 3 years) in America as well. What are we to make of the CDC’s recent lies??

https://www.nytimes.com/2020/07/24/health/cdc-schools-coronavirus.html

They are an American government institution responsible for the shaping of policy which effects millions of people’s health, safety, and whether or not they live or die. Do the CDC officials (or say for example “experts” such as Deborah Birx) get some “thrill” out of telling what they must no doubt consciously know is a boldfaced LIE?? Or are they saying things in order to professionally survive and foster their own careers??

I don’t see a large difference, at least on moral grounds, there, between the CDC lies and China’s GDP lies. They are BOTH morally vacuous.

But, but, but… if we can’t believe the bureaucracy, who can we believe? The FBI? HHS? Census.gov? BLS.gov? No, no, no!

Oh, The New York Times? Yes, yes, yes! Pure as the driven snow. Oh, wait, that’s too white. I’ll have to come up with another simile.

Bruce Hall: We have lots of information regarding distortion of statements/statistics — either intentional or unintentional — from various agencies. I have little faith in children-held-in-detention statistics particularly when they emanate from the current WH spokesperson. Do you?

It is a sign of the times that WH documents/speeches are no longer fact-checked (and I am writing as somebody who *did* factchecking on White House documents and statements by the President himself). So beware government statistics, yes.box

Do you have evidence of misstatement by NYT regarding CDC documents in this case? We have a leaked CDC draft, which the WH has not denied are real, which differs from that which was released a couple days ago. I trust NYT more than I trust the random dropbox doucuments you link to (which are *secondhand* representations of CDC data with minimal documentation).

That is the question. Can any truth be derived from these numbers… Does it matter. Human models are toys.

On another note, I find it comical reading this site on a daily basis. In what I would characterize as an idealogical wasteland, only moses and rosser are independent thinkers(other than those shunned righties). It’s easy to guess where most of you stand.

I just wish people were more inclined to think of ways of helping society, investigating what is true. Was it right to intubate an older population where their bodies have adjusted a lower o2 saturation(NY?). I’m not blaming the Cuoumo, as he doesn’t know anything.

Should a generation of children be left behind from what some would characterize as the strong flu?

Are excess deaths being harvested just to keep the fear going? Well, that we know.

Trump has been terrible for the country. He was not a typical politician, and therefore people have devolved into their tribalistic tendencies. I personally wonder if Hillary was the figurehead we needed during this time. Perhaps I’ll vote for Biden.

I often question whether government healthcare is the answer. I’m guessing we would have nothing to fear right now if there were no incentive…

“Should a generation of children be left behind from what some would characterize as the strong flu?”

another one succumbed to the trump propaganda machine. rather than question the chinese data, you should be more concerned about the propaganda coming from our own administration. if this were just a “strong flu”, then the medical community would not be as concerned as they are. in south texas, they are sending people home to die rather than let them die in a hospital bed. that is not a “strong flu”. you sound more like a conspiracy theorist than an independent thinker, mrp.

@ mrp

I don’t think me arguing with Rosser, proves any kind of “independent thinking”. Probably more like a certain degree of crotchetiness and a place to put negative energy that does not include violence. We have a decent degree of independent thinkers on this blog. One of our two benevolent hosts has surprised a multiple number of blog visitors that his thoughts on China cannot be stereotyped. He shows a respect and love for his ethnic group while at the same time showing respect and love for his country, an extremely difficult tightrope to walk (and I do not envy him that “burden”). Having only my surface view of Menzie and his great attitude to life, he may not even view that as a “burden”. One certainly cannot tell by Menzie’s positive attitude, his dry (but joyful) humor, and his smile that he carries any burden. I suspect it is not any fraternal love to ethnicity or fraternal love to country (though I feel very certain both are strong for Menzie) which lends him his great objectivity and an air of comfortable self-assurance. But that his personal self-assurance comes from kinking his neck around any and all corners searching for wherever the truth lies.

i.e. We’re lucky (“Independent thinkers” or NOT) to have this blog from Sirs Hamilton and Chinn, to help gently guide us in the truth search.

Sometime ago Menzie agreed here that the May consumption number looked very high. I called that here before anyone else. I also said it would probably be followed by a slowdown. I have also made it clear, I hope, that I am making no forecasts about the third quarter.

@ Barkley Junior

You did give predictions for the 2nd Quarter though, and your words will be linked back to at the appropriate times, both the “advanced” GDP number and the revisions. Don’t you worry about that now Junior. I’d also like to see your “call” on consumption. As I remember it, it was NOT a “call” on consumption. You pointed out numbers that were already made public by BEA, and then sadly tried to contort those already public consumption numbers into a call for positive 2nd Quarter SAAR numbers. When you realized no one in their right mind was boarding your crazy train on 2nd Quarter GDP, you tried to pretend you didn’t know those numbers everyone quotes on GDP have been SAAR for decades, even as you have labeled yourself a “mathematical economist”. You attempt over and over and over and over revisionist history on your own words. I am not going to allow that, and will link back to your words in the permalinks.

I strongly suspect (but do not “know”) you are accustomed to bullying your own students into never correcting what must be your ungodly amount of oral errors in the classroom, and through that bullying have students to involuntarily give your EGO an infant booster seat. But on this blog you have no power over the final grade, and you will be handed no infant booster seat here.

https://www.google.com/imgres?imgurl=https://i5.walmartimages.com/asr/365f3229-06ae-485d-bc52-22c3307ad684_1.cc5028435d2727e225f5bcf2807ca849.jpeg?odnWidth%3D612%26odnHeight%3D612%26odnBg%3Dffffff&imgrefurl=https://www.walmart.com/ip/Infantino-Go-Gaga-Music-Lights-3-in-1-Discovery-Seat-Booster/495026258&tbnid=H89ChCqWFKtidM&vet=1&docid=sMpU8nFadp7i_M&w=400&h=400&q=infantino+go+gaga&source=sh/x/im

Oh great, more “borderline hate” from Moses.

My “call” on May consumption was indeed simply me being the first person here to see the actual number from BEA and note that it was much higher than expected and that would shift the likely outcome on second quarter GDP, although not necessarily all the way to positive. For quite some time yu kept insisting that I had provided an inaccurarw May consumption number and was mischaracterizing it. Menzie corrected you. I was right and you were wwrong, Moses, period. But you keep trynig to twist this around somehow to make it into somehow that you were right after all.

This is beginning to look like a certain well known person going on and on about how a test for dementia was actually a test showing how he is some great geniuus. And now I have again let myself get dragged into one of these pointless exchanges with you, Moses, especially given that it appears that most people here seem to know how totally messed up your discussion of these matters is without me having to point it out.

Laurent Ferrara, Alice Froidevaux and Thanh-Long Huynh:

Official GDP figures often come with some skepticism about their reliability. While Chinese authorities have decided to give up the strategy of having a GDP target…, this time is no exception….

[ What is so impressive about Chinese economic planning is that it works so well, which seems to make it that much more important for Western or Washington Consensus or neoliberal economists to question and challenge. ]

Definitive Western thinking in 1980 and 2015 and now; only North Atlantic institutions will do:

http://www.bradford-delong.com/2015/12/ever-since-i-became-an-adult-in-1980-i-have-been-a-stopped-clock-with-respect-to-the-chinese-economy-i-have-said-alw.html

December 1, 2015

China’s Market Crash Means Chinese Supergrowth Could Have Only 5 More Years to Run

Now that 90 days have passed, from the Huffington Post from Last August: *

Ever since I became an adult in 1980, I have been a stopped clock with respect to the Chinese economy. I have said–always–that Chinese supergrowth has at most ten more years to run, and more probably five or less. There will then, I have said, come a crash–in asset values and expectations if not in production and employment. After the crash, China will revert to the standard pattern of an emerging market economy without successful institutions that duplicate or somehow mimic those of the North Atlantic: its productivity rate will be little more than the 2%/year of emerging markets as a whole, catch-up and convergence to the North Atlantic growth-path norm will be slow if at all, and political risks that cause war, revolution, or merely economic stagnation rather than unexpected but very welcome booms will become the most likely sources of surprises.

* http://www.huffingtonpost.com/brad-delong/china-market-crash-5-years_b_8045742.html

— Brad DeLong

What is necessary to understand is that the Trump administration has completed the undermining of Chinese-American relations, has so fostered prejudice against the Chinese people and Chinese society, that an academic who would counter the ceaseless criticism of China is taking a significant career risk. Then do question Chinese growth data, since the Chinese being Chinese are neither clever nor honest enough to publish objective data.

Here we have the broad problem framed, however scary and saddening. The problem is us:

https://www.nytimes.com/2020/07/25/world/asia/us-china-trump-xi.html

July 25, 2020

Officials Push U.S.-China Relations Toward Point of No Return

Top aides to President Trump want to leave a lasting legacy of ruptured ties between the two powers. China’s aggression has been helping their cause.

By Edward Wong and Steven Lee Myers

ltr,

I may be willing to agree that the US government has been more hostile towards China on certain issues that is deserrved, with trade being one such area. However, it is quite inappropriate of you to suggest that either this post by Ferrara et al or the comments by Brad de Long are part of an inappropriate campaign against China by the US government. None of these people are associated with the Chinese government and are clearly making their own estimates independently. I understand that someone from the PRC might not believe that such independence from the wishes of the government by private analysts may not be possible, but if you think that, you are mistaken.

Indeed, for quite some time there has been doubt by many about the precise accuracy of GDP growth data reported by the Chinese government, with the PRC in this regard imitating the former Soviet government, which was also thought not to be always accurate in such matters. But right now it looks like the inaccuracy in reporting may be larger than usual, and I do not think in recent years the PRC has always been inaccurate in its reporting od such data.

Ooops. I meant to say “none of these people are associated with the US government,” not with the Chinese government. Obviously the latter is not correct. I note also that I have just seen an article reporting that trade is the area where currently US-Chinese relations are modestly stable, with both sides not wanting to upset the deal they came to in January at a time when in so many areas the relationship is getting worse.

“Indeed, for quite some time there has been doubt by many about the precise accuracy of GDP growth data reported by the Chinese….”

A range of western analysts have been doubting Chinese data for years and have been wrong in doubting for years. The reason for the doubting as with the prominent University of California economics professor is that the Chinese do not have the necessary North Atlantic social structures to be counted efficient or honest. I take this as definitively prejudiced:

“After the crash, China will revert to the standard pattern of an emerging market economy without successful institutions that duplicate or somehow mimic those of the North Atlantic: its productivity rate will be little more than the 2%/year of emerging markets as a whole, catch-up and convergence to the North Atlantic growth-path norm will be slow if at all, and political risks that cause war, revolution, or merely economic stagnation…” *

* http://www.bradford-delong.com/2015/12/ever-since-i-became-an-adult-in-1980-i-have-been-a-stopped-clock-with-respect-to-the-chinese-economy-i-have-said-alw.html

ltr: Seriously? There have been a number of Chinese economists, usually residing outside of the People’s Republic of China, that had their doubts about the accuracy of GDP statistics — even without attributing an intent to deceive. Why else do we have the Li Kiqiang index (both number 1 and number 2)?

I.e., don’t throw the baby out with the bathwater…

Here is the reference to the article mentioned by Barkley Rosser:

https://www.nytimes.com/2020/07/25/business/economy/us-china-trade-diplomacy.html

July 25, 2020

Once a Source of U.S.-China Tension, Trade Emerges as an Area of Calm

The trade deal is providing a rare point of stability as relations between the United States and China fray over Hong Kong, the coronavirus and accusations of espionage.

By Ana Swanson and Keith Bradsher

“Indeed, for quite some time there has been doubt by many about the precise accuracy of GDP growth data reported by the Chinese government, with the PRC in this regard imitating the former Soviet government…”

Ridiculous and unfortunately demeaning.

Imagine the idea of a country that has experienced the most profound growth ever recorded for more than 40 years, a once terribly poor country, a country that is now 1.4 billion, that is actually about to have ended severe poverty. The Chinese need to know just what is happening through the economy and work at that knowing continually which has allowed for the astonishing transformation.

To briefly interrupt the usual fecal weather event about the Chinese-American relationship and get back to the original post–it seems to me that the three indicia cited to question the official numbers–private sector consumption, private sector hiring activity and international trade, may not be as indicative in the post-pandemic environment as they would be in more normal circumstances. It’s pretty easy to see them being swamped by offsetting public sector measures which would themselves be typically opaque.

https://en.wikipedia.org/wiki/Li_Keqiang_index

Li Keqiang index is an economic measurement index created by The Economist to measure China’s economy using three indicators, as reportedly preferred by Li Keqiang, currently the Premier of the People’s Republic of China, as a better economic indicator than official numbers of GDP.

According to a State Department memo, Li Keqiang (then the Party Committee Secretary of Liaoning) told a US ambassador in 2007 that the GDP figures in Liaoning were unreliable and that he himself used three other indicators: the railway cargo volume, electricity consumption and loans disbursed by banks.

[ As Li has explained there are various checks used to make sure growth data are properly estimated and recorded. Li also looks to excavating equipment as a gauge of growth. Nonetheless, Chinese growth, with and after checks, is accurately recorded. ]

Mr. Ferrara is right on all counts, and my thanks for the post.