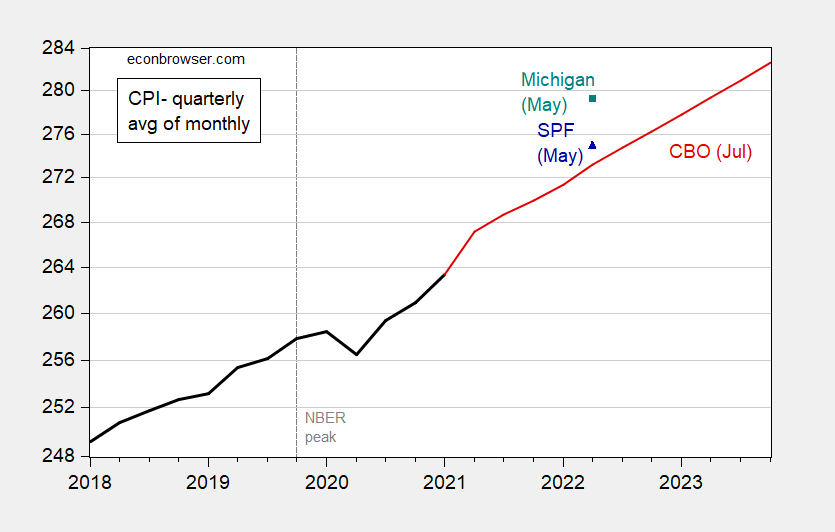

Pretty big spread in views, illustrated:

Figure 1: CPI (1982-84=100) as reported (black), CBO July ’21 projection (red line), Survey of Professional Forecasters (blue triangle), Michigan survey (teal square). SPF forecast applies median inflation to reported May CPI; Michigan applies June mean forecast to May CPI. Source: BLS, CBO, Philadelphia Fed, Michigan via FRED.

Inflation rate forecasts are shown here. Keep in mind expectations drawn from surveys of consumers typically overpredict inflation. Longer term, market-based forecasts here.

It is interesting how the Michigan survey kept forecasting 3% inflation during the 7 years before the pandemic while actual inflation was generally less than 2%. Now this survey says 4%. I guess the Michigan survey is what you meant by ordinary people.

As opposed to our Usual Suspects who seem to think we will have double digit inflation. Yea – they are not ordinary in the least.

Well, news media hypes particularly large price increases, and we know that regular people also tend to focus a lot on certain items such as food and gasoline. There have been some large price hikes in these sectors as well as in housing, so not too surprising that average citizens may be overly weighting those larger price increases and not getting what the overall rate of inflation really is.

And over the years people tend to remember only memorable price events and tend to forget the periods when nothing remarkable happened with prices. For some folks it’s forever 1979 because they have vivid memories of that year. Mentally it’s like 1979 was just yesterday.

Funny story. One of my sisters told me that her investment manager suggested buying into Bitcoin in case we started seeing Venezuela like inflation. My jaw dropped.

2slugs, i hope that your sister dropped that investment manager. while i am a fan of some crypto exposure, it is certainly not because i fear venezuela like inflation! i don’t see that happening in the usa in my lifetime.

I posted something amusing but interesting from Kevin Drum in a comment under an earlier thread where Kevin noted overall food inflation has been less than 1% over the past 12 months. Yea Princeton Steve is paying more for his bagels and I paid a lot for my favorite chicken today but there are a lot of food items in my budget.

This ordinary person sees fuel prices as cyclical and relatively cheap even now. But this ordinary person also remembers making a dollar an hour and thinking that was a lot of money. It was for a 13 year old. Then the late 70s happened. We are not seeing that at all now.!

We also walked uphill both ways because downhills hadn’t been invented yet. There’s some ordinary crank perspective for you.

Well one thing that got a lot of peoples’ attention was the Colonial Pipeline hack. Where I live in Virginia indeed there were outright shortages with gas stations closed and lines at one open for a few days. I indeed had trouble getting my car refilled for gas during this, and it definitely reminded me of 1979.

Barkes is correct.

down under people such as my wife always focus on price increases and never the price decreases. Inflation has never been a peroblem for yonks yet pollies of either hue keep parroting on about the cost of living

biden appears to be doing some house cleaning on a friday night

https://www.cnbc.com/2021/07/09/biden-fires-social-security-boss-a-trump-appointee-who-refused-to-resign.html

‘Saul, 74, is a longtime Republican donor, a former vice chairman of New York’s Metropolitan Transportation Authority’

The MTA has been corrupt for years so it is no wonder why Trump put this clown in charge of SSA.

Just a weekend sort of thought: to what extent are inflation expectations/perceptions influenced by income growth?

Related: is there any significant variation in expectations among major different economic and demographic groups?

Of course, we hear about retiree’s complaints that the benchmark used for pension colas – notably SS – fails to capture the actual change in costs for them, and there obviously is a measure of truth in that. And, while not often mentioned, there is the rarely discussed difference in inflation for the 20% of the population that is not urban;.But what are the expectations and sensibilities of other substantial groups?

Not critiquing anyone in particular, but I really get saddened at times about the one size fits all inclination in a number of fields in a world with very large aggregate populations – which we don’t have to do. Modern information technology allows us to parse far more. We are quite a few decades past the days of Sir Arthur Lyon Bowley…

https://cepr.net/invented-inflation-a-big-part-of-the-real-inflation-of-the-1970s/

July 9, 2021

Invented Inflation: A Big Part of the Real Inflation of the 1970s

By Dean Baker

Jeanna Smialek and Ben Casselman had a good piece * in the New York Times on the inflation of the 1970s and the differences with the current situation. However, it left out one important part of the story.

In the 1970s, actually in the late 1960s also, the Consumer Price Index (CPI) had an error in its construction that led it to overstate the rate of inflation relative to the current measure. In some years, especially in the late 1970s, the error was especially large, peaking at 2.6 percentage points in 1979. Here’s the picture for the official CPI used at the time, compared with the Bureau of Labor Statistics CPI-U-RS, which calculates the inflation rate using the current methodology.

CPI CPI-U-RS

1978 ( 9.0%) ( 7.8%)

1979 ( 13.3%) ( 10.7%)

1980 ( 12.5%) ( 10.7%)

This mattered a lot in the 1970s because, as Smialek and Casselman point out, many wage contracts were directly indexed to the CPI. This means that an overstatement in the measured rate of inflation would show up directly in higher wages. Many rental contracts were also indexed to the CPI. This measurement error undoubtedly contributed to the wage-price spiral of the 1970s. Presumably we don’t have to worry about the same sort of measurement error today, and even if there were such an error, many fewer contracts are now indexed to the CPI. ( I wrote about this issue many years ago.)

* https://www.nytimes.com/2021/07/08/business/economy/inflation-redux.html

https://www.nytimes.com/2021/07/08/business/economy/inflation-redux.html

July 8, 2021

A Great Inflation Redux? Economists Point to Big Differences.

Prices climbed for years before the runaway inflation of the 1970s. Economists see parallels today, but the differences are just as important.

By Jeanna Smialek and Ben Casselman

The last time big government spending, supply chain shocks and rising wages threatened to keep inflation meaningfully higher, President Biden’s top economic adviser was in diapers.

Jump forward half a century, and some aspects of 2021 look a little bit like a do-over of the late 1960s and the 1970s, which many economists think laid the groundwork for the breakaway inflation that took hold and lasted into the 1980s. At a time when prices have popped and debate rages over how quickly they will moderate, those comparisons have become a hot topic.

Yet many inflation experts point out critical differences between this era and that one, from the decline of unionization to the ascent of globalization and shifting demographics, and say those discrepancies are part of the reason faster inflation is likely to be short-lived this time around. White House officials — including Brian Deese, Mr. Biden’s top economic adviser, who is 43 — say they expect price pressures to calm.

“We’re looking at the implications of an economy that comes out of a policy-induced coma and comes roaring back,” Mr. Deese said at a recent event, explaining why prices have moved up.

Inflation concerns may already be easing among investors. Yields on government debt rose earlier this year as investors demanded higher interest rates to compensate for the risk of higher inflation, among other factors. But yields have since fallen amid signs that the economic recovery is proceeding more slowly than initially expected.

The main certainty that emerges from the debate is this: Like half a century ago, the American economy is being rocked by big and unusual changes that have hit all at once. But those trends make it hard for analysts to guess what will happen, since their tools use the past to predict the future — and there’s no historical precedent for reopening from a global pandemic. This won’t be 1969 or 1978 again, but what it will look like is difficult to foresee.

“History doesn’t repeat itself,” said Rebecca L. Spang, a historian at Indiana University who has studied money and inflation. “Recognizing the complexity of any particular moment is something that economics, with its ahistorical models, is not very good at.” …

I notice Barkley says “regular people” and you say “ordinary people”. now…….. I KNOW you don’t mean it in a snobbish way, but how do you think many people will read that?? Mightn’t it just be better to say “non-economists vs. economists”?? Just one of my goofball thoughts. “Random Person X” even sounds better than “ordinary”.