All suggesting slowing growth…maybe

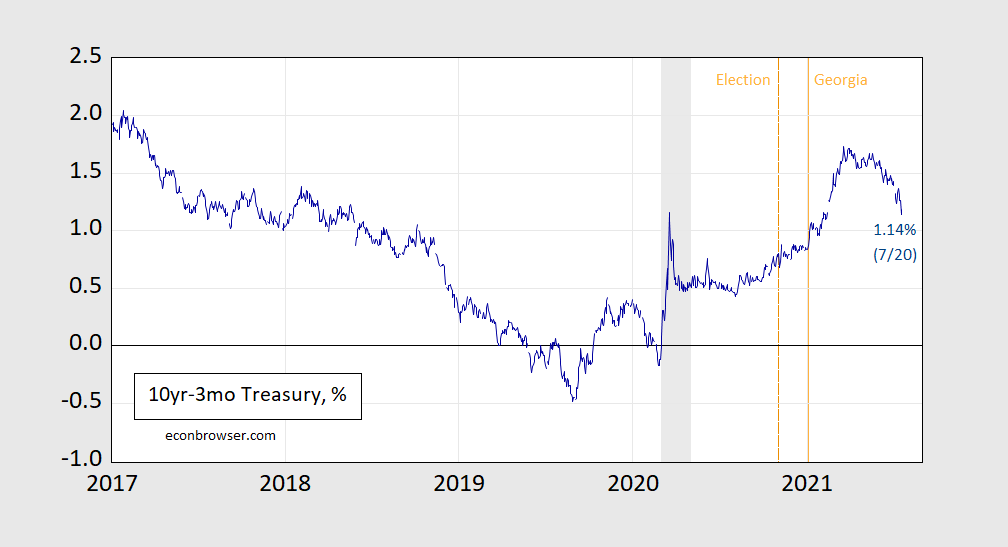

Figure 1: Treasury 10 year constant maturity yield minus 3 month yield, %. Source: Treasury via FRED, and author’s calculations.

Maybe we won’t get that red hot economy, bumping up and over full-employment GDP after all.

From Reuters:

“Equity markets were pricing an explosion of growth and margins over the next two to three years and it’s clear now we won’t have that,” said Ludovic Colin, senior portfolio manager at Vontobel Asset Management.

Colin said however bond markets appeared too pessimistic in starting to price recession.

“We don’t think we will have recession, just long-term growth that won’t be as beautiful as what was expected by investors in January-March period.”

Given the spread is still positive, predicting another recession seems uncalled for, especially given special factors affecting the term premium (e.g., flight to safety, Fed quantitative easing, etc.), as discussed before the last recession (e.g., here and here).

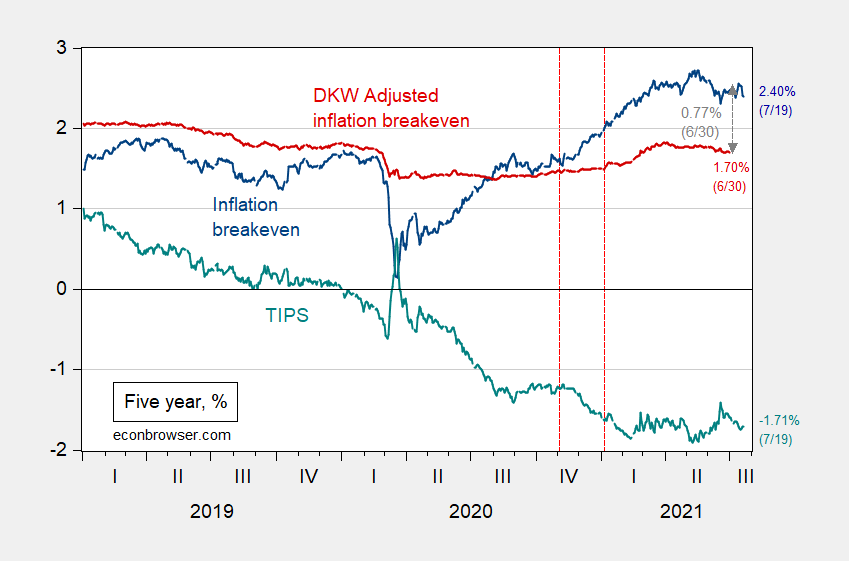

Declining inflation expectations (or at least breakeven calculations) and real rates similarly suggest cooling (relative to prior expectations).

Figure 2: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red),and TIPS five year yield (teal), all in %. Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW), and author’s calculations.

“Equity markets were pricing an explosion of growth and margins over the next two to three years and it’s clear now we won’t have that,” said Ludovic Colin, senior portfolio manager at Vontobel Asset Management.

It is “clear” that we will not have high growth rates? Like no one who does forecasting would put 100% certainty on anything of the sort. Does Mr. Colin have a track record of having near zero forecasts errors?

From the same Reuters article: “What appeared to be short covering in mid-curve Eurodollars pulled long end yields lower”, said Guy LeBas, chief fixed income strategist at Janney Montgomery Scott LLC.

There is a tendency in financial journalism, and among many market watchers, to attribute every market wobble to fundamentals even when there is no obvious change in fundamental conditions. Colin seems to suffer from that tendency, LeBas doesn’t.

In interpreting a change in market pricing, one ought to look at the trade (or price-action proxies for the trade) that drove the change in pricing. LeBas looks at the trade, and tells us it was short-covering in Eurodollars – a curve flattening trade.

Steepeners made money from last August to mid-March, but have not made money since then. Closing older steepeners to take profit would account for a Eurodollar short covering and curve flattening. Giving up on unprofitable steepeners put on since mid-March would also account for Eurodollar short covering and curve flattening. Neither case necessarily bespeaks a sudden change of heart about the economic outlook. The trade to clearly signal a change of view would be new flatteners, not lifting of old steepeners.

LeBas could have missed something, of course, but LeBas has been doing this for a very long time and is in a better position that the rest of us to see trades. He also bothered to look at trades before drawing a conclusion. There’s no evidence Colin did. I’ll put my money on LeBas. Market participant gave up on the reflation trade. No evidence they initiated a new recession trade.

By the way, it is entirely possible to trade Eurodollars against equities. Unwinding short ED/long SPY trades would help account for the dump in stocks earlier this week. Much of that sell-off has already been reversed – not a very convincing sign that market participants have undergone a profound change in thinking about the economy.

“There is a tendency in financial journalism, and among many market watchers, to attribute every market wobble to fundamentals even when there is no obvious change in fundamental conditions.”

A point Kevin Drum echoed in one of this latest blog posts!

You might enjoy Kevin Drum’s latest:

https://jabberwocking.com/please-just-stop-it-with-the-nonsense-explanations-for-daily-changes-in-the-stock-market/

https://www.moodysanalytics.com/-/media/article/2021/macroeconomic-consequences-infrastructure.pdf

Moody’s Analytics (Mark Zandi) analyzes the Biden infrastructure proposal noting they will enhance long-term growth and lead to a more equitable distribution of income. Worth the read even though the MAGA crowd will start shouting this former economic advisor to the 2008 McCain campaign is just being a partisan Democrat and Moody’s has been highjacked by Communists.

great link!

New analysis that suggest people who watch Faux News are less likely to get vaccinated:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3890340

It is indeed an odd business model that Faux News has. Lie to your viewers so they do not take the appropriate steps to protect themselves. Having a stupid audience that ends up killing itself cannot be good for the ratings in the long term.

“Moody’s has been highjacked by Communists.”

This doesn’t seem like something that Cuba would try, so I will ask: has North Korea notified us of its demands for releasing Moody’s yet?