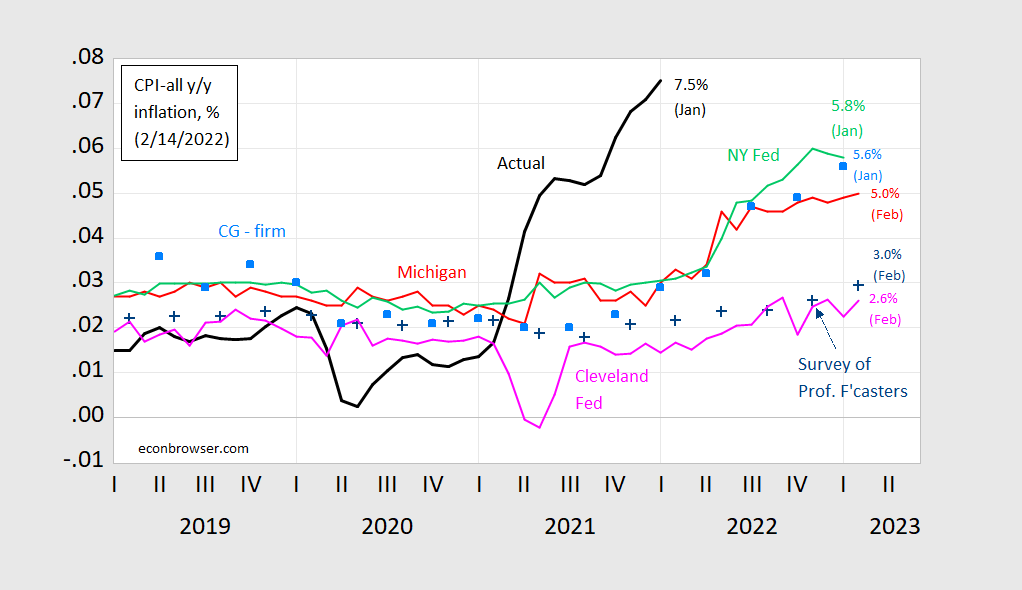

Paul Krugman notes research out of NY Fed (analysis here) suggesting sensitivity of household inflation expectations to current actual is lower than in the past. As a reminder, here’re household expectations (Michigan, NY Fed) vs. others (economists) at the 1 year horizon.

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected (preliminary) from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares]. Source: BLS, University of Michigan via FRED and Investing.com, Reuters, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and Coibion and Gorodnichenko.

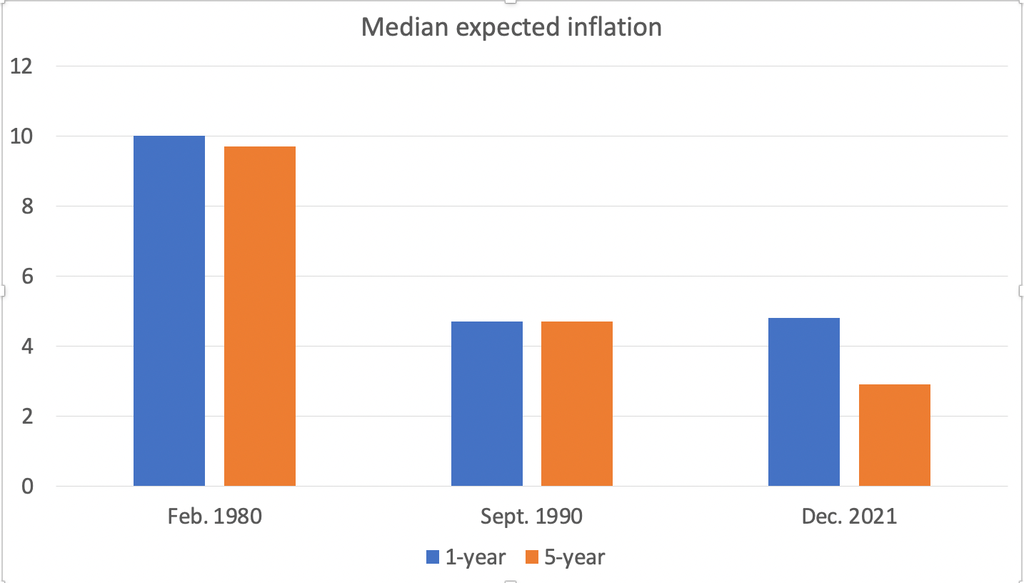

Krugman’s main point is that the current episode drastically differs from past episodes (as measured by the MIchigan survey), in that longer term expected inflation has not moved in one-for-one tandem with short term. Rather, it’s moved less. Here’s Krugman’s graph comparing the current episode to the February 1980 and Sept 1990 episodes.

Source: Krugman (2022).

If expected inflation is 3% on average over the next 5 years, and 1 year expected inflation is 3.1%, then implied expected inflation over the years between 1 and 5 is going to average 3% (= (3×5 – 3.1)/4 ).

Note that consumer/household based expectations have been on average higher than those from economists and other forecasters, and (as discussed here), before the ongoing inflation surge upwardly biased. Currently, household expectations are about two and a quarter percentage points higher than economists’ expectations – so don’t rely on these household forecasts for accuracy. However, they might be more relevant to thinking about how inflation responds to expectations (see Coibion and Gorodnichenko (2015).

A nice analysis that should be good news for the current Administration as the research neither confirms the Mitch McConnell spin nor having to resort to the latest JohnH soap box

https://www.nytimes.com/2022/02/18/opinion/inflation-us-consumer-surveys.html

February 18, 2022

Wonking Out: What to Expect When You’re Expecting Inflation

By Paul Krugman

Good news on inflation has been hard to come by lately. But this week we got two encouraging reports from the Federal Reserve Bank of New York — results from its latest Survey of Consumer Expectations, and an analysis of the recent behavior of inflation expectations by New York Fed economists.

Neither report had any bearing on the inflation we’re actually seeing, which continues (so far) to run hotter than it has for decades. Instead, they were all about the hypothetical future. Consumers, it turns out, don’t expect inflation to stay hot. Rather, they appear to believe it will continue for a while, then fade away. In fact, expected inflation over the medium term has actually come down over the past couple of months.

Furthermore, it’s unlikely that a few more bad numbers will create an inflation panic: Consumers appear much less likely to revise up their expectations of future inflation than they were in the past.

Why do we care? It’s not because consumers have some special wisdom, but because expected inflation can feed actual inflation. Actually, it can do that in two ways — although only one is relevant to our current situation. And the apparent fact that medium-term expectations of inflation aren’t rising greatly improves our chance of getting past this difficult episode without a lot of pain.

The irrelevant way expected inflation can matter, by the way, is through demand. When inflation is running high, consumers may rush to spend money before it loses its value. According to legend, when Germany experienced hyperinflation in the 1920s, patrons at beer halls would buy two beers at a time, because they expected the price of the second to rise while they were still drinking the first. When a government can’t stop inflationary money-printing, this urge to spend can lead to even higher inflation.

As I said, this isn’t relevant to the current U.S. situation; no, we don’t need to print money to pay our bills. But we do need to keep an eye out for the possibility that inflation will become entrenched in the economy. What do we mean by that?

Some readers may want to avert their eyes: I’m about to write down an equation. For the past half-century, most policy-oriented macroeconomists have accepted the idea that the inflation rate is determined by a relationship that looks something like this:

Inflation = a – b × unemployment rate + expected inflation + other factors

Why is expected inflation in there? Because in an economy in which everyone expects persistent inflation, companies setting prices or deciding what wages to offer will engage in a process of leapfrogging, raising their prices in the belief that other companies will also be raising their prices. I wrote more about that process here. And this in turn means that once people have come to expect persistent inflation, getting back to sustainably low inflation typically requires going through an extended period of high unemployment during which people keep seeing inflation lower than they expected, and gradually revise their expectations down.

For the past two decades or so, this hasn’t really been a concern, because expectations of inflation have become “anchored”: the public has come to expect low inflation as normal, and doesn’t react much to temporary ups and downs due to things like oil price fluctuations. The big concern about the inflation spike between 2021 and 2022 has been that inflation expectations might lose their anchor, making it much harder to get inflation back down once supply chains and all that are back to normal.

So is that happening? …

https://fred.stlouisfed.org/graph/?g=nBRv

January 30, 2018

Producer Price Index for all commodities and Personal Consumption Expenditures excluding food & energy, 1980-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=Me0d

January 30, 2018

Personal Consumption Expenditures excluding food & energy, 1980-2021

(Percent change)

“Furthermore, it’s unlikely that a few more bad numbers will create an inflation panic: Consumers appear much less likely to revise up their expectations of future inflation than they were in the past.”

OK – everything Mitch McConnell has said of late is pure and utter BS. But you knew that already.

“Inflation = a – b × unemployment rate + expected inflation + other factors”

Thanks for getting us past that NYTimes firewall as it seems that Krugman does recognize “other factors” in his modeling of inflation. After all JohnH keeps telling us that prominent economists never mention this – at least not at the NYTimes. It is good to know that Paul Krugman is just a run of the mill economist!

https://fred.stlouisfed.org/graph/?g=r5Wn

January 15, 2020

5-Year, 5-Year Forward Inflation Expectation Rate, 2020-2022

https://fred.stlouisfed.org/graph/?g=r5Wc

January 15, 2018

5-Year, 5-Year Forward Inflation Expectation Rate, 2017-2022

For all this we thank President Biden.

You mean Biden has caused householdsto realize that long-term inflation is likely to be lower than inflation in the near term? oK, if you say so.

Or are you suggesting thhat Biden is responsible for the rise of inflation…in Europe, Asian, Latin America, Afira, Canada, Mexico, the Caribbean…?

I was under the impression Covid was the culprit, either way. You know something the rest of us don’t?

That line was inspired by reading Rick Atkinson’s third WWII ETO book.

It was a Nazi propaganda poster still legible on a bombed out wall in Koln.

In three years, you will not recognize America.

The war has begun.

I presume you are celebrating this invasion as it further increase the price of oil. And your supposed economic solution was tossed out the door by Putin as what we suggested is of no interest to him.

@ CapeCodKopits~~formerly “SmellyJerseySteve”

Did you tell Steve Bannon when oil is going to cross $100?? Your prediction is at least 7 weeks late, and counting.

Oh yeah, and when are Chinese villagers going to throw Xi Jinping off the 8th floor terrace?? You said sometime between 2 years ago and the year 3010, right?? I still can’t figure out how you calculated the violent overthrow of Xi Jinping inside such a narrow time frame. You are amazing.

This disinformation from Russia over its manufacturer crisis in Ukraine is in high gear:

https://www.latimes.com/world-nation/story/2022-02-17/russia-ukraine-disinformation-campaign

Kevin Drum likens this to the lies we routinely get from Fox News – which BTW aided Trump’s attempt to overthrow our government.

The sad reality is that Putin is gearing up this dishonesty to justify an invasion of Ukraine. One would think no American would repeat Putin’s disinformation besides Fox News own Tucker Carlson. The pathetic reality is this is the kind of sick garbage we have to endure from ltr and JohnH.

The Fed is highly invested in the idea that anchored expectations (or not-so-anchored) matter a lot in prospects for inflation. The divergence in longer from shorter term inflation expectations should make Fed folk happy.

Well said. Now if we can also get more research into what Krugman briefly dubbed “other factors”.

I also learned from the readers of Kevin Drum that Faux News had only 23 seconds of coverage of the Mazars dropping of Trump ala Bret Baier:

https://crooksandliars.com/2022/02/fox-news-buries-news-trumps-long-time

Something tells me that Mr. Baier will need to find another job as Faux News is determined to make sure their viewers do not see this news.

John Durham wants you to know that Faux News and Trump has been lying about what his latest court filing said:

https://news.yahoo.com/john-durham-distances-himself-wing-124812065.html?fr=sycsrp_catchall

While that is quite true – what Durham put into that filing was to “dirty up” an innocent person and how Durham realizes his entire political charade might be in a little trouble before the court. It is time for this clown to end his joke of an investigation.

“Krugman’s main point is that the current episode drastically differs from past episodes (as measured by the MIchigan survey), in that longer term expected inflation has not moved in one-for-one tandem with short term. Rather, it’s moved less. Here’s Krugman’s graph comparing the current episode to the February 1980 and Sept 1990 episodes.”

His chart has “median expected inflation” near 10% back in Feb. 1980 and near 4.5% in Sept. 1990. Forgive me for asking as I’m running up against that NYTimes firewall (OK, I’m a cheapo) but this the median of the Michigan survey or something else?

I had to find a non-war thread to put this in, or somehow I would feel like a shallow person (which I probably am anyway) mentioning this under a war post. But I got a Large D-1 college T-shirt today made out of cotton for $1 at Wal Mart (the irony being I rarely go there). The only reason I’m mentioning this is when I get something super-cheap I always feel like I have “accomplished” something, so I had to brag. It was actually listed at $12, and then when I ran the bar code over the automatic checkout it read $1. SWEEEEEEEET!!!!!

I love squirting 1/4 lime into my rip-off copycat cheapo Mountain Dew that I get. And I try super hard to get them under 25cents and preferably under 20cents. It’s gotten harder lately and I’ve tried to get more creative (there’s a bottled type of “lime juice” I can get for less than $3 that has 36% actual lime juice, 32 fluid ounces). I heard this story on NPR and thought others may take an interest.

https://www.npr.org/2022/02/19/1081948884/mexican-drug-cartels-are-getting-into-the-avocado-and-lime-business

I love lime juice in my drinks (ironically usually when I’m not drinking alcohol) and it’s going to take a lot of willpower on my part, but I think I may have to give up on the limes. I don’t think it’s gonna be pretty for Mexican farmers longterm. “The Jimmy Hoffas” of the world, that actually semi-care about labor don’t exist anymore (certainly not in Mexico and really anywhere) So…… I think I’m gonna have to give up the limes. That’s painful kids.

If Krugman put confidence intervals on his bar graphs, would all significance disappear in a sea of noise?