Following up on Jim’s post, some additional comments on the Q1 GDP growth surprise of -1.4% SAAR; GDPNow was 0.4%, while IHS-Markit was -0.6% (and was way below Bloomberg consensus of 1.1%). What to take from this?

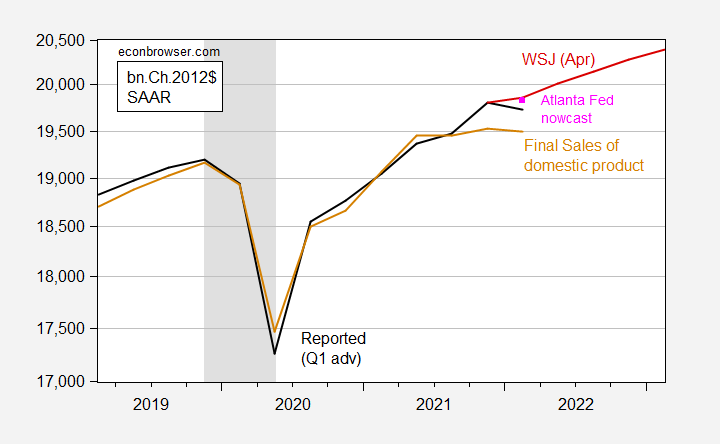

Figure 1: GDP (black), Atlanta Fed nowcast as of 4/27 (pink square), WSJ April survey mean forecast (red line), and final sales of domestic product (brown), all in billions of Ch.2012$, SAAR. NBER defined recession dates peak-to-trough shaded gray. Source: BEA 2022Q1 advance release, Atlanta Fed, WSJ April survey, and author’s calculations.

Jim’s post on the GDP release noted that imports were a big mover, and that there was some question regarding oil exports. It’s important to recall that there are a lot of estimated components in the advance GDP figure; for instance, March trade figures are finalized after the advance GDP release. Hence, the release taking place at the end of May will show revisions for GDP and components.

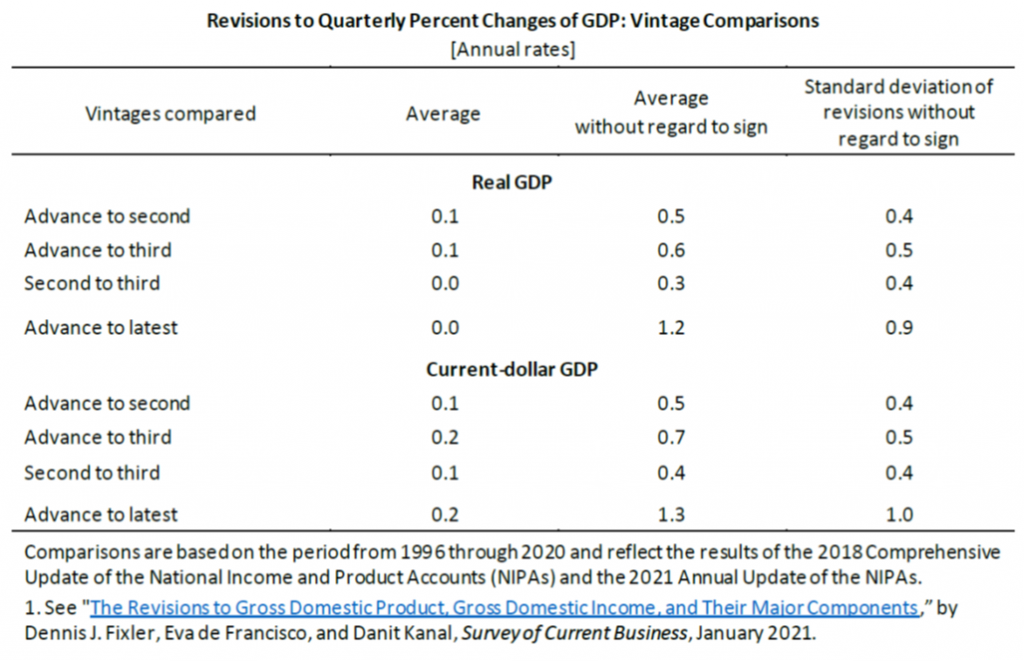

Source: BEA (2021).

The mean absolute revision (MAR) going from advance to second release is 0.5 ppts, and from advance to third (in this case coming out in June) is 0.6 ppts. When the dust finally settles years from the advance release, the MAR is 1.2 ppts… For now, however, we can be reasonably sure that GDP growth was negative in Q1.

While we care about total production (which is GDP), we are perhaps even more interested in aggregate demand (expenditures taking out inventory). On the other hand, as shown in Figure 1, final sales of domestic product (that GDP is taking out inventory changes) was down only 0.6 ppts (SAAR). CEA stresses final sales to domestic purchasers (C+I+G-inventory change) as a measure of domestic momentum; that grew 3.7% SAAR. This is what some observers are taking comfort from (including consumption growth, which continued into March):

Figure 2: Nonfarm payroll employment (dark blue), Bloomberg consensus for April NFP (blue +), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. NBER defined recession dates, peak-to-trough, shaded gray. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (4/1/2022 release), NBER, and author’s calculations.

Most tracking estimates for Q2 are around 2% (IHS-Markit, GDPNow), based on data available now.

Menzie,

I assume that the numbers released are preliminary. It is my memory that trade figures are those that are most frequently revised and revised by the largest amounts later. So it is possible that both the export and import numbers may yet be revised sufficiently to end up with growth being a net positive, if probably not by much. Right?

Barkley Rosser: Ordinarily I’d say the trade number revisions wouldn’t be big enough to overturn a -1.4% growth rate — but this time around March goods numbers (we have advance on goods, not on services) were a big enough downside surprise, and the unique pre-stocking in advance of Ukrainian associated commodity shocks might mean big enough revisions.

Heh, I’m not gonna say it…… what I’m thinking….. that is to say….. never mind.

“CEA stresses final sales to domestic purchasers (C+I+G-inventory change) as a measure of domestic momentum; that grew 3.7% SAAR.”

Now if net export demand magically reverses course – fine. But I drop in net exports on a more sustained basis is not good news.

“CEA stresses final sales to domestic purchasers (C+I+G-inventory change) as a measure of domestic momentum; that grew 3.7% SAAR.”

Now if net export demand magically reverses course – fine. But I drop in net exports on a more sustained basis is not good news.

Are we really looking a a 5.9% drop in labor productivity?

Annualized, of course.

“What are we to take from this?” Well, aside from the blog host’s usual cerebral rundown, this goofball (me) is “taking from this” that although Fed regional banks do a respectable (maybe admirable, I say maybe) job with their NowCasts, IHS-Markit is much better at this GDP forecast game (and probably other numbers) than they are.

Just a reminder, it’s not net exports that are important to GDP. It’s exports – period – that are important.

Imports are not a component of GDP so can neither increase nor decrease GDP, at least not in any direct way implied by the GDP accounting identity.

Recall that is was Peter Navarro, one of the dumbest economists alive, who wrote a white paper using the GDP accounting identity to argue that imports decrease GDP and to support Trump’s tariffs.

Yes Sir

“Not everything that counts can be counted, and not everything that can be counted counts.”

Attributed to Einstein and stolen off of a Fed Res website.

This is the second time you’ve made this assertion. The prior time, you accused rjs of confusing an accounting identity with causality, when GDP accounting was precisely the issue being discussed.

GDP is a data series. A very particular data series. That data series is the result of an accounting process. If you do not treat imports as a drag on GDP growth, but treat every other input to GDP in the usual way, you get the wrong answer.

If your point is that imports aren’t bad, that they don’t hurt the economy, that’s fine. But you are mistaken to argue that imports don’t subtract from GDP. You’re simply getting the math wrong.

Navarro is a nutcase and that paper was STUPID but …

Imports are not a component of GDP so can neither increase nor decrease GDP, at least not in any direct way implied by the GDP accounting identity.

Consumption includes products made abroad so we do need to account for that fact.

https://news.cgtn.com/news/2022-05-01/Chinese-mainland-records-920-new-confirmed-COVID-19-cases-19FLcWbopa0/index.html

May 1, 2022

Chinese mainland records 920 new confirmed COVID-19 cases

The Chinese mainland recorded 920 new confirmed COVID-19 cases on Saturday with 916 linked to local transmissions and four from overseas, data from the National Health Commission showed on Sunday.

A total of 7,409 new asymptomatic cases were also recorded on Saturday, and 180,362 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 216,587, with the death toll at 5,060.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-05-01/Chinese-mainland-records-920-new-confirmed-COVID-19-cases-19FLcWbopa0/img/f7d949ff454b4f879ff7628b4a19cbce/f7d949ff454b4f879ff7628b4a19cbce.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-05-01/Chinese-mainland-records-920-new-confirmed-COVID-19-cases-19FLcWbopa0/img/1d068f91d61e4b26806f6d2ba522c81d/1d068f91d61e4b26806f6d2ba522c81d.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-05-01/Chinese-mainland-records-920-new-confirmed-COVID-19-cases-19FLcWbopa0/img/28fdba2b824c4b098bb073846fd64152/28fdba2b824c4b098bb073846fd64152.jpeg

https://www.worldometers.info/coronavirus/

April 30, 2022

Coronavirus

United States

Cases ( 83,066,907)

Deaths ( 1,020,833)

Deaths per million ( 3,051)

China

Cases ( 215,667)

Deaths ( 5,022)

Deaths per million ( 3)

Dean Baker gets it: “ It is amazing how frequently policy types talk about “free trade” as though it is actually a policy anyone is interested in promoting. The reality is that what passes for free trade is a policy of removing barriers to allow low cost manufactured goods to enter the United States without restrictions. This puts downward pressure on the pay of manufacturing workers. Since manufacturing had historically been a source of high paying jobs for workers without college degrees (it is no longer), the loss of these jobs out downward pressure on the pay of non-college educated workers more generally.”

https://rwer.wordpress.com/2022/04/29/there-is-no-political-constituency-for-free-trade-its-just-a-term-used-to-justify-screwing-workers/

Actually, Baker is wrong, there is a constituency promoting “free trade.” It consists of banks and international corporations who profit from exploiting lower wages and fewer regulations, and managing offshore profits. And the secondary beneficiaries consist of corrupt politicians, who economists mysteriously aligned with to create a pro-free trade narrative that all but drowned out a serious discussion of the real costs and benefits of a corporate-designed trade policy and cleverly branded it as “free trade.”

“It consists of banks and international corporations who profit from exploiting lower wages and fewer regulations, and managing offshore profits. ”

It also consists of poor consumers who like their household goods cheap, because prices (as anyone who has bothered to look at polling regarding inflation knows) is a major factor in the standard of living.

The rest of your argument is a conspiracy theory, of course.

Me thinks you misunderstood what Dean was saying with the sentence you objected to. Try reading this over and over:

A policy of genuine free trade would mean eliminating barriers that limit trade in physicians’ services as well as the services of highly paid professionals more generally. It would also mean weakening or eliminating patent and copyright monopolies, which can raise the price of protected items by many thousand percent above the free market price. There is no political constituency for removing these protectionist barriers, as can be clearly seen by the fact that no major political figure is advocating this pa

I advocate removing these barriers to competition as do a lot of economists such as Dean Baker. I trust you are not saying we should continue to protect those darn oligopolists, multinationals, and the doctor cartel.

Yes, pgl, the abuses stemming from protection of physicians and patent monopolies are different from what Dean Baker criticized in the opening paragraph. And he has been complaining about them for years, unlike you, pgl. And Baker is wrong that there is no constituency. There is in fact a very well heeled constituency—physicians and drug companies. And politicians are in their pocket, while economists, unlike Baker, have done little to challenge that constituency.

But that still contradicts nothing Baker said in his opening paragraph, which is a well articulated condemnation of corporate friendly “free trade” in general.

“And he has been complaining about them for years, unlike you, pgl.”

You are such a little crybaby who lies whenever questioned. I have complained about the doctor’s cartel for over 45 years. That is when I read something Milton Friedman wrote in 1962 called Occupational Licensing. Something you never read or at least would never understand. That’s right troll – conservative economist like Friedman and Greg Mankiw oppose the doctor’s cartel. AND they have the mental abilities to understand what Dean wrote. You clearly do not.

Look – we get you think you are the only smart person in the room but you are not. And you garbage writing points out to EVERYONE that you truly are an utter moron.

So, pgl, instead of snarking and insulting, why not just prove to us that you actually approve of what Dean Baker said about protected physicians and drug patents? (Links please.)

And while you’re at it, why not show us that you understand what Baker wrote in his first paragraph, condemning corporate friendly free trade in general? Oh, no! Pgl can’t go that! He’s too much of a tribalism suck-up to prominent liberal economists and their corporatist trade policies to ever acknowledge the self-evident truth of what Baker wrote.

Macroduck: “If you do not treat imports as a drag on GDP growth, but treat every other input to GDP in the usual way, you get the wrong answer.”

But imports are not an input to GDP. GDP is Gross Domestic Product. Imports are not domestic. Imports are not included in GDP.

pgl: “Consumption includes products made abroad so we do need to account for that fact.”

Well, you are halfway to the correct answer. Consumption includes imported products and that is exactly why you subtract imported products at the end. They exactly zero out. If you increase imports, you increase the consumption by exactly the same amount. The two cancel out. If you decrease imports, you decrease consumption by exactly the same amount. Whether you increase or decrease imports, GDP does not change. You simply put the same imports on the plus side and the minus side of the GDP equation.

“If you increase imports, you increase the consumption by exactly the same amount. The two cancel out.”

Does it always happen this way? Let’s imagine a situation where domestic demand does not change but the relative price of imported goods falls so consumers buy more imported goods and less domestically produced goods.

Look you are right about Navarro’s real dumb paper but please do not start writing things almost as absurd.

Accounting wise you are right. However, in the real world the consumer has a certain amount of money to consume. If that money is “consumed” on imported products that consumption doesn’t add to GDP, if it is “consumed” on domestic products it does.

You can take a look at that reality from one angle or another, describing it with one word salat or another – defining words like “import” and “included” one way or another. But in the real world it does make a difference for our GDP whether I purchase an imported appliance or a domestically produced one. It makes a difference for the GDP and for employment in US

Very well said.

Um, you need to go and re-read your intro to macro textbook.

Read about how GNP and GDP differ.

Read about how trade factors in, and how imports can be (wait for it) consumed.

Here’s a toy model.

Assume an island that consumes 5 avocados. There are no imports. Obviously the GDP is 5 avocados.

Now assume the island consumes 10 avocados and 5 are imported. The GDP is still 5 avocados.

Now assume the island consumes 15 avocados and 10 are imported. The GDP is still 5 avocados.

Imports neither increased nor decreased GDP because the only thing that counts is the number of avocados produced domestically. Imports don’t count.

Or assume the economy consumes 10 avocados with 7 imported. Please stop this as you are beginning to sound like Peter Navarro.

Ron Varra maybe?

Are you saying that the import of 7 avocados instead of 5 avocados reduced GDP? Seriously, you are making a mercantilist argument? That’s embarrassing.

GDP is what is produced domestically. It may go up or down for lots of reasons, but imports do not directly add or subtract from GDP, unless you are a mercantilist.

When someone says “three-quarters of the trade hit to GDP was from higher imports …”, that’s a mercantilist talking.

I’m certainly no globalist, but to find myself having to debunk mercantilism and defend basic math is kind of staggering.

No – I’m just pointing out that your little toys are not the only possibility.

“Seriously, you are making a mercantilist argument? That’s embarrassing.”

Now you have gone full blown trolling. I made no such argument and you have become a total waste of time. Move on.

GDP is gross domestic product. C is consumption, not production. We can consume without producing. If we use C in calculating GDP, and we do, then we have to have a way of determining how much of consumption is domestically produced. Keeping track of imports and exports is part of makin sure we know how much of consumption is domestic produced. Similarly, we can produce in any given period without consuming or exporting in that period. So we track inventories.

Your own toy model shows the point you think you are disproving. Fifteen consumed minus ten imported equals five produced. In your toy model, C-M=GDP

We do not track production as production. We track consumption and then calculate from consumption to production.

“We do not track production as production. We track consumption and then calculate from consumption to production.”

Joseph is telling BEA how to do their jobs even if he has no clue how difficult their jobs are.

Turns out those Chechnyan forces volunteering to fight for Russia didn’t go there to fight.

https://www.cnn.com/2022/05/01/europe/russia-farm-vehicles-ukraine-disabled-melitopol-intl/index.html

When Uncle Vlad finds out his military progress has stalled because his little helpers were too busy looting to do any fighting, will we see a mysterious pandemic of Polonium poisoning among the the commanders of those forces ?

And here’s a more detailed derivation.

Start with:

(1) GDP = C + I + G + (X – M)

Now the reason you subtract iMports at the end is because you haven’t distinguished between domestic and import consumption on the left. So you could instead write the equation as:

(2) GDP = domestic Consumption + iMported Consumption + domestic Investment + iMported investment + domestic Government + iMported Government + eXports – iMports

Since imports on the plus side equal imports on the minus side, they simply cancel out. What you are left with is:

(3) GDP = domestic Consumption + domestic Investment + domestic Government + eXports

As equation 3 demonstrates, there are no imports in GDP. They neither increase nor decrease GDP.

There are a couple of reasons people have this misperception about imports. First is that the data collectors don’t separate out domestic and imported consumption. It’s difficult to determine if people are eating California or Mexican avocados at the point of consumption. So they just count all avocados consumed and then subtract the number of avocados imported at the Mexican border as in equation 1 above. But note that this is just an accounting convenience. With some extra effort, they could have figured out how many domestic and foreign avocados were consumed and then the import term in equation 1 wouldn’t even be necessary and the object of confusion about imports. Instead you would have equation 3 which has no imports in it.

But it gets worse. Note the parentheses around (X –M). They aren’t necessary. They don’t change the equation. But they give the illusion that net eXports are what are important. So you get bogus stuff from Navarro and Trump about the trade imbalance reducing GDP. What is important for GDP is exports, not imports.

So when someone says “three-quarters of the trade hit to GDP was from higher imports …”, that’s just wrong. It’s wrong on the math and it’s wrong on the economics. It’s statements like that which give the public wrong ideas about trade. That statement tells people that imports are reducing GDP.

(3) GDP = domestic Consumption + domestic Investment + domestic Government + eXports

As equation 3 demonstrates, there are no imports in GDP. They neither increase nor decrease GDP.

OK but tell BEA to collect the data this way. They will likely give you a lecture about the immense effort they have to endure to get to the traditional presentation wich is mathmatically equivalent to your version.

Please stop as you are wasting everyone’s time with such incredible trivia.

It’s not trivial when someone says “three-quarters of the trade hit to GDP was from higher imports …”. That’s stating a causal relationship and it is false. Higher imports did not decrease GDP, at least not in any way that is easily measurable. Certainly not measurable from the GDP identity.

Instead, if you look at the data, GDP took a hit from lower exports. This isn’t trivial. If you want to increase GDP, one way to do it is to increase exports, not cut imports. If you don’t recognize that difference, you’re in real trouble.

Isn’t the argument among free traders — not that I believe many real free traders exist — but isn’t the argument that through comparative advantage that imports can increase GDP? Why would you be comfortable with saying that higher imports decreased GDP?

In the accounting for GDP, there is no assertion of causality. You have wrongly insisted there is an assertion of causality, and so you have also insisted that we do GDP math in a way which doesn’t reflect how our national accounts are tabulated. You’re confusing poliics with math. You are reading somethig into the quote which isn’t there.

“It’s not trivial when someone says “three-quarters of the trade hit to GDP was from higher imports …”.

I never said anything of the sort. Come on dude – you have turned into a troll. Move on.

it sounds like you’re quoting me here: “three-quarters of the trade hit to GDP was from higher imports …” and i’ll take it as a fair criticism, that was a lousy way of expressing what happened…..i was responding to Barkley’s question, which made it appear that the negative print was due to lower exports…and i agree, we should be measuring domestic output…but that’s not what we do…

on another site, i just tried a simplistic to explain what happened to first quarter GDP: see if you agree with what i wrote here, obvious omissions notwithstanding:

macroduck: “there is no assertion of causality.”

“three-quarters of the trade hit to GDP was from higher imports …” English is my native tongue. I think I have a reasonable grasp of the language. How can imports hit GDP if there is no causality? It sure sounds like an assertion of causality to me. And it would certainly sound like an assertion of causality to the general public.

pgl: “I never said anything of the sort.” Nobody said you did. That quote was from a different person and was the origin of this entire dispute, but apparently you think this is all about you. If you can’t keep up, perhaps you should just step back. If you agree that the statement is misleading and incorrect, then why are you wasting your time arguing to defend it?

This blog is supposed to help educate and inform the public about economics. I made what I considered a mild criticism of sloppy language that could misinform the public, hoping we could do better in the future. And the result was a rabid dog pile trying to defend the indefensible.

I will note that the originator of the quote seems to have taken my suggestion in good grace, which I appreciate. They aren’t fighting here. It is you guys who have gone on a total freakout.

“This blog is supposed to help educate and inform the public about economics. I made what I considered a mild criticism of sloppy language that could misinform the public, hoping we could do better in the future. And the result was a rabid dog pile trying to defend the indefensible.”

Rapid dog? OK – but you are the dog chasing its own tail. This has turned into a food fight which is not helping to educate. Move on.

this morning’s construction spending report shows that annualized construction spending for January was revised $23.6 billion higher, and annualized construction spending for February was revised $24.2 billion higher….in reporting 1st quarter GDP, the BEA’s key source data and assumptions (xls) indicated that they had estimated March residential construction would be $10.0 billion more (at an annual rate) than that of the previously reported February figure, that March nonresidential construction would be valued $5.5 billion more than that of the reported February figure, and that March public construction would increase by $0.5 billion from previously reported February levels…totaling those figures, the 1st quarter GDP report showed March construction spending to be at an annual rate $16.0 billion higher than previously reported February levels…since this report shows that March construction spending was up at an $1.9 billion annual rate from February figures that were revised $24.2 billion higher, that means the total annualized construction figure used for March in the GDP report was $10.1 billion too low…averaging that understatement with the the understatements in the annual rates of construction spending used for January and February in the GDP report, we find that this report shows that construction spending was underestimated by $19.3 million (at an annual rate) in the 1st quarter GDP report, implying an upward revision to the related GDP components at a rate that would result in a addition of about 0.28 percentage points to first quarter GDP when the 2nd estimate is released at the end of May…however, since that estimate is based on the aggregate change spending, an imbalance of inflation adjustments among the revised components might also have a material impact on the final revision…

rjs, I have absolutely no problem with your explanations which are always well thought and intelligent. Which is why the one statement that you call “a lousy way of expressing what happened” stuck out to me. So I suggested it would be better not directly invoking imports as an explanation. Which was all fine. I’ve have no beef with you.

But a couple of other commenters went totally bonkers crazy tying themselves in knots trying to prove that there was absolutely nothing inaccurate about the original statement. Which is sad. Oh, well.

joseph, i just realized that my response to Barkley has been battered around through two threads here (i don’t usually read all the comments on each thread but i’ve now gone back to see what’s been going on…)

anyhow, i’ve been writing about the monthly GDP reports for about a dozen years now, give or take…when i write about the same subject over a long period of time like that, my thinking about it gets into a rut, & i tend to use the same explanations month in and month out, without ever questioning what i think i know…so i’m going to copy the relevant section about what i wrote on 1st quarter exports and imports below, and you tell me what i have right or wrong, ok?

Just to show I’m not alone in this, here is an article published by the Economic Research Department of the Federal Reserve St. Louis. The author is making the same points as I did.

https://research.stlouisfed.org/publications/page1-econ/2018/09/04/how-do-imports-affect-gdp

If you aren’t up to reading the whole thing here are some selected excerpts:

“the current textbook and classroom treatment of how international trade is measured as part of GDP can lead to misconceptions if not properly explained. This essay intends to correct misconceptions and provide clear instruction.”

GDP = C + I + G + (X – M)

“The Misleading Aspects of Net Exports

because imports are subtracted (i.e., “– M”), the equation seems to imply that $30,000 should be subtracted from GDP (Table 2). However, this cannot be correct because GDP measures domestic production, so imports (foreign production) should have no impact on GDP.”

“Correcting Misconceptions

As such, the imports variable (M) functions as an accounting variable rather than an expenditure variable. To be clear, the purchase of domestic goods and services increases GDP because it increases domestic production, but the purchase of imported goods and services has no direct impact on GDP.”

“Conclusion

in nearly every quarter since 1976, net exports (X – M) have been negative (see the graph and Table 1), which seems to imply that trade reduces domestic output and growth. This can influence people’s perspective on trade. This essay explains that the imports variable (M) corrects for the value of imports that have already been counted as personal consumption (C), gross private investment (I), or government purchases (G). And remember, the purchase of domestic goods and services should increase GDP, but the purchase of imported goods and services should have no direct impact on GDP.”

In all, the article makes the same point I did that the “minus imports” term in the GDP identity can give the wrong impression about trade affecting GDP if one is not careful in their explanations. That’s how you end up with Peter Navarro and Trump tariffs. That’s why it’s important to be clear.

rjs: “on the other hand, real increases in imports subtract from GDP because they are either consumption or investment that was added to another GDP component that shouldn’t have been”

Ah, now I see where the confusion is coming in. You are conflating gross spending, which is used to compute GDP, with GDP itself. But not all spending is GDP. Only domestic spending is GDP. Imports are a part of spending but were and are never a part of GDP so don’t have to be subtracted from GDP. Imports have to be subtracted from spending to compute GDP. It isn’t the case that “imports were added to another GDP component that shouldn’t have been.” Imports are a part of spending and have to be removed.

The problem with saying you have to subtract imports from GDP, rather than from spending, is that it implies to the average reader that imports cause a reduction of GDP. You can get away from that confusion by simply not doing it. Why state something is a way that causes confusion. Imports never are part of GDP. They are a part of spending. You subtract imports from spending, not GDP. You can’t subtract imports from a quantity they were never in to begin with. Imports do not reduce GDP.

And be careful of saying something like “spending on imports reduced GDP.” While more accurate than saying imports subtracted from GDP, you are implying a causal relationship that would appeal to protectionists.

rjs: “hence, the 17.7% increase in real imports in the 1st quarter subtracted 2.53 more percentage points from 1st quarter GDP… “

And that right there is the confusion. Imports did not reduce GDP. Imports cannot change GDP. Imports can go up and down from month to month but they do not change GDP by one whit. Because imports are never a part of GDP, how could they possibly change GDP? Imports going up or down is totally irrelevant to GDP so, frankly, why even mention imports in the context of GDP. (Of course imports can have secondary effects on GDP but they have absolutely nothing to do with the reported GDP.) Whenever you say that “imports reduced GDP” you are implying that GDP would have been higher if imports had been less. That is not true. It confuses the public, so don’t say it.

rjs: “hence our worsening trade imbalance subtracted a rounded net of 3.20 percentage points from 1st quarter GDP …”

And that is the punchline that causes the damage in confusing the public. Trade deficit is a political punching bag so you have to be very careful what you say about it. The trade deficit didn’t decrease GDP. A decline in exports decreased GDP. Imports neither increased nor decreased GDP because they cannot. When you say that the trade deficit decreased GDP, the first thing people think is that we somehow have to cut back imports. But that won’t help at all because imports don’t change GDP. Reducing the trade deficit does nothing for GDP if you don’t increase exports.

Please read the paper from the Federal Reserve that I linked and see what you think. It directly addresses the issue of confusing the public about GDP and imports.

https://research.stlouisfed.org/publications/page1-econ/2018/09/04/how-do-imports-affect-gdp

the problem is that imports are already included in the components that GDP is calculated from…for instance, PCE starts with data from monthly retail sales reports; no one at Walmart is reporting what part of their retail sales were from imported goods….so to get those non-GDP imports out of gross spending, they must be subtracted somewhere during the calculation…

i would rewrite your historical GDP formula (ie, GDP = C + I + G + (X – M)) to show GDP = C -MC + I – MI+ G + X, where MC is consumer spending on imports and MI is investment in imports, such as capital equipment… that way you’d at least get rid of that highly misleading (X – M) component…for GDP, exports have nothing to do with imports…

it seems that the idea that imports are a gross subtraction comes from the BEA itself; for instance, the press release says:

https://www.bea.gov/news/2022/gross-domestic-product-first-quarter-2022-advance-estimate

and if you look at the full release and tables, imports are included as a negative in each of the BEA’s tables:

https://www.bea.gov/sites/default/files/2022-04/gdp1q22_adv.pdf

BEA: “The decrease in real GDP reflected decreases in private inventory investment, exports, federal government spending, and state and local government spending, while imports, which are a subtraction in the calculation of GDP, increased. Personal consumption expenditures (PCE), nonresidential fixed investment, and residential fixed investment increased (table 2).”

Well, for sure the BEA didn’t say “imports reduced GDP”. They did not say “imports subtracted from GDP”. They did not say “imports were a hit to GDP.” These imply causality. I think everyone should agree that causality between imports and GDP is complicated and certainly not all negative.

Instead the BEA said that imports are subtracted from spending to calculate GDP. That is an accounting convenience to make the identity correct.