Month-on-month vs year-on-year, and headline, chained, sticky price, 16% trimmed, and (for April) PCE deflator.

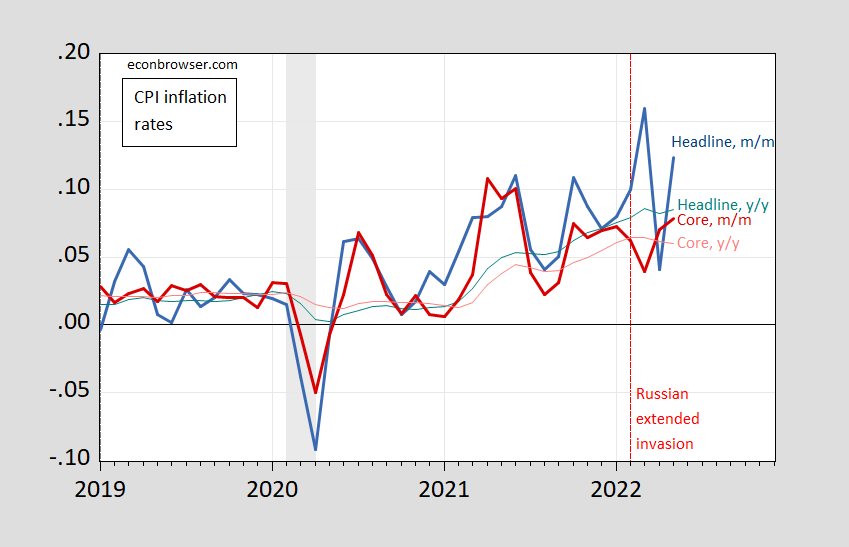

First, remember the distinction between m/m (which is more informative regarding contemporaneous conditions), and y/y (which is more backward looking).

Figure 1: Month-on-month inflation of headline CPI (blue), year-on-year of headline CPI (teal), month-on-month inflation of core CPI (dark red), year-on-year of core CPI (pink). NBER defined recession dates (peak-to-trough) shaded gray. Dashed red line at Russian expanded invasion of Ukraine. Source: BLS, NBER, and author’s calculations.

Note that while y/y headline hit a high (since 1981), m/m is down (though not as much as one would’ve hoped). On the other hand, m/m core inflation rose, which bodes ill trend inflation.

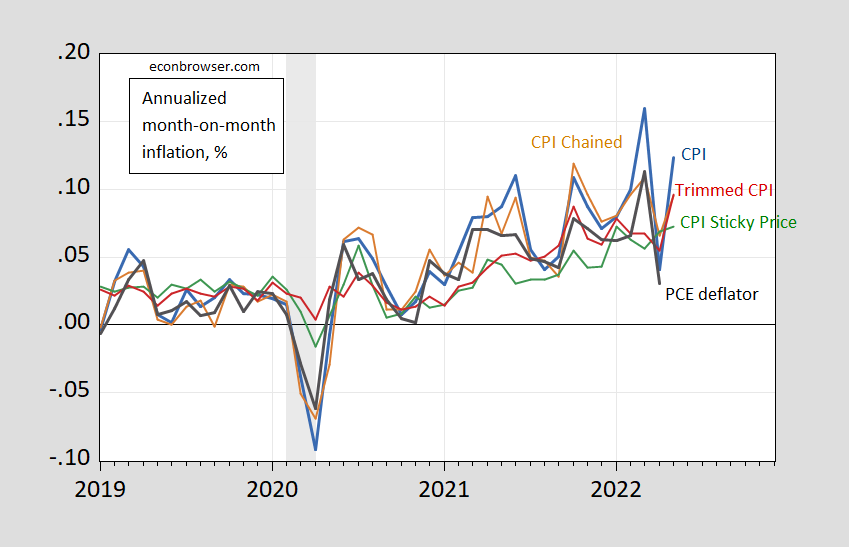

Second, different estimates of month-on month headline inflation, shown in Figure 2, shows some hopeful signs.

Figure 2: Month-on-month inflation of CPI (blue), chained CPI (brown), 16% trimmed CPI inflation (red), sticky price CPI inflation (green), personal consumption expenditure deflator inflation (black), all in decimal form (i.e., 0.05 means 5%). Chained CPI seasonally adjusted using geometric Census X13 (brown). NBER defined recession dates (peak-to-trough) shaded gray. Source: BLS, BEA, NBER, and author’s calculations.

The Cleveland Fed’s nowcast for May m/m annualized PCE inflation as of 6/11 is 8.9%, rebounding from the actual preliminary 3.0% in April.

Over the last month, trimmed and sticky price CPI inflation has been less that headline. Trimmed < headline suggests price increases are concentrated in certain rapidly rising categories. Sticky < headline suggests flexible prices are doing the bulk of the price changes.

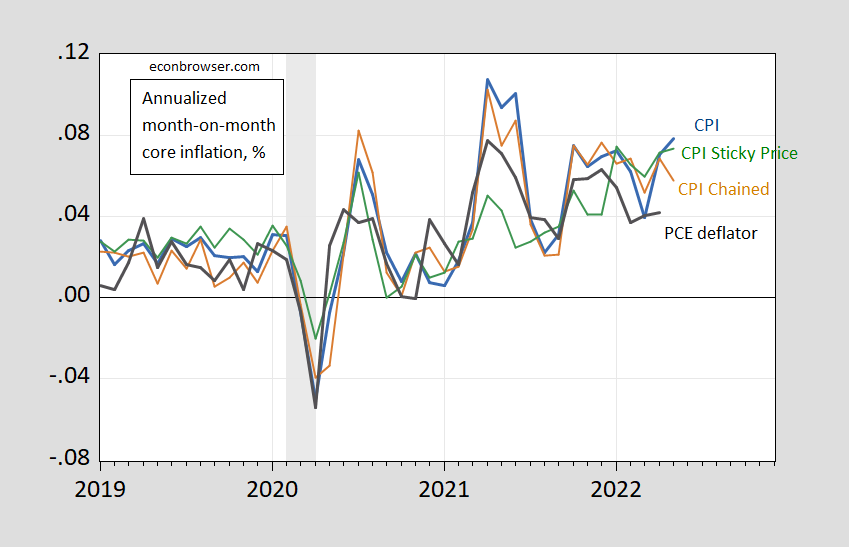

Third, for core measures, the rise in May is not good news (even if the rate is lower than in April of last year):

Figure 3: Month-on-month inflation of core CPI (blue), chained core CPI (brown), sticky price core CPI inflation (green), personal consumption expenditure core deflator inflation (black), all in decimal form (i.e., 0.05 means 5%). Chained CPI seasonally adjusted using geometric Census X13 (brown). NBER defined recession dates (peak-to-trough) shaded gray. Source: BLS, BEA, NBER, and author’s calculations.

The Cleveland Fed nowcast for May core PCE inflation is 5.7%, up from preliminary 4.2% in April.

A good rundown on the implications of the CPI release is provided by this Brookings piece (including views of Furman, Edelberg, and Wolfers). See CEA twitter thread as well. The contribution of housing costs is notable, since this factor is likely to be persistent:

Together these housing cost measures contributed about 24 basis points to monthly core CPI inflation, versus 11 basis points on average pre-pandemic, reflecting challenges in the housing market.

The 5 year inflation breakeven rose from 3.08% to 3.15%, still below the March 25th level of 3.59%. The 5 year 5 year forward breakeven stayed essentially constant (dropping 3 bps).

“The 5 year inflation breakeven rose from 3.08% to 3.15%, still below the March 25th level of 3.59%.”

But Summers decides to change the weights for CPI and then declares we need a Volcker style 1982 recession to lower expected inflation to 2%. It seems the market disagrees. Ah yes Bruce Hall never read this poor excuse for an analysis ala Summers as he is content reading the headline of some dumb Yahoo account instead. And yet this dumb barking dog claims I agreed with whatever meaningless rant he fired off. Yes Bruce Hall is THAT STUPID.

That’s nice to talk about 5-year inflation breakeven in the 3%+ range, but it doesn’t convince anyone that there isn’t a problem now. Still having a problem with that Harvard professor and former Secretary of the Treasury? Your tune is getting stale. Perhaps a good run with a bunny will cure that.

Jared Bernstein (these Jareds certainly get around) did not say it was all Trump’s fault; he said it is all Putin’s fault (invasion of Ukraine in 2021?), yeah? He said, other than the minor annoyance of inflation, all is good and we should trust the Fed, work with Congress, and bring down budget deficit (a deficit hawk?). Hmmm. Well, I guess inflation really isn’t a problem.

https://www.cbsnews.com/video/white-house-economist-addresses-concerns-over-accelerating-inflation/#x

btw, I never did quite get your credentials. Meager? Now is your chance to impress.

“Still having a problem with that Harvard professor and former Secretary of the Treasury? Your tune is getting stale.”

That is really rich from someone who never read his latest paper. I did and I provided a critique. Oh wait – you have no idea what this debate is about. Run along little chirping birdie.

“Wolfers noted higher wage pressure hasn’t proven to be a major factor in recent inflation. “The wage numbers, which, really we do think of as the important medium-run driver of inflation, aren’t that threatening, but the price numbers really are kind of miserable. So how those two end up getting squared is an open question.”

Furman agreed: “If you want to forecast inflation, you don’t just want to take the CPI report, and look at these numbers and figure out the past way to extrapolate them forward, there’s a lot of other things and a lot of other data we know about the economy. I think that data, taken as a totality, says the underlying inflation rate may be around 4 percent, rather than the 8 percent headline CPI we’ve had over the last year.”

Agreeing with Furman’s 4 percent estimate of underlying inflation, Wolfer’s noted that, “I agree that that’s worrying, but it’s dramatically different than the headlines you’re going to read tomorrow. So the Fed has work to do, but it’s not quite the crisis you’re going to see in 72-point font in the morning.”

But Bruce Hall never reads past the 72 point font headline. This discussion of how wage inflation is not above 4% is what Krugman has been saying. So maybe Summers is a decent economist but a lot of other very smart people are not sounding the alarm bells just yet. Then again his latest paper really did not do much but look at the weights of some CPI index. Not exactly one of the better NBER papers. Oh wait – Bruce Hall did not read that paper either.

This discussion of how wage inflation is not above 4% is what Krugman has been saying. Yaaay! So wages are rising less than half of inflation. You’re a real champion of the working person. Do you get a commission from the Biden Administration for each crappy “good news” point you try to spin?

And you are a champion of the average Joe? I bet you even support the Rich Scott plan to eliminate Social Security and Medicare. Of course understanding long term financing issue is never going to be your forte since you have to take your shoes off to count past 10.

Keep pretending it’s only five-years in the future that matters.

Of course, Biden won’t be POTUS then.

You get dumber by the way and I did not think someone’s IQ could drop below zero but yours has. Track the price of food, oil, and other such commodities and you might notice a lot of volatility. Now if you have some reliable forecast that oil in 2027 will hit $200 a barrel – produce it. But be careful to READ your link for the 1st time in your pathetic trolling life as it might just be forecasting $50 a barrel.

Come on Bruce – we know you are incompetent. We know you are a serial liar. So don’t even try to tell us what the price of oil will be in 2027.

BTW Trump will not be President in 2027. And in fact he is likely to be dead. Which will make the world a better place even if it will leave you no reason to live in anymore.

pgl is a notorious partisan hack. For years he denied that deficit hawks Pelosi and Obama had promoted austerity ten years ago. Of course, Biden’s stimulus in 2021 was a reaction to Democrats’ underwhelming economic performance back then…something that pgl could never acknowledge.

You are such the crybaby. What you wrote there is dishonest as it gets and pointless as well. Grow up little troll.

Any inflation jumping ahead of wages is bound to be rather short lived. If people cannot afford to purchase things they will cut spending. That change in supply/demand will bring prices down.

“Any inflation jumping ahead of wages is bound to be rather short lived.”

That was Krugman’s simple point. But catch the latest stupid chirping from the Village Idiot Bruce Hall.

Okay, Ivan, what is your definition of “short lived”? Is that like pgl’s definition of “temporary inflation” last year?

https://www.bls.gov/news.release/realer.nr0.htm

…And if we go back a year ago, real wages were losing ground then.

https://www.bls.gov/opub/ted/2021/real-average-hourly-earnings-down-1-7-percent-over-the-12-months-ending-june-2021.htm

When do employers start to pay out those catch-up wage increases?

Oh, and labor participation rate is still 1pp lower than pre-pandemic Trump times. Where have all the workers gone? But as Jared Bernstein says, everything is great except for a little annoying inflation.

“temporary inflation” You have been lying a lot about what I allegedly said. I’m calling you on the carpet – produce the comment where I said this term./ I didn’t and until you either produce the comment or fess up that you are lying your rear end off – it is time for you to STFU.

“if we go back a year ago, real wages were losing ground then.”

Our host has noted the sharp increase in real wages at the start of the pandemic. I’m sure you actually read some of these posts so your little cherry picking of the data here is blatantly dishonest. OK maybe you did not know how you were being blatantly misleading as we have seen your propensiry not to read informative discussions and/or not understand their simple points.

So which is it Bruce? Are you a blatant liar or just the dumbest troll ever?

OK the rest of you – I get he is both.

FRED Blog has an informative discussion of real wages that goes back more than just the last 12 months:

https://fredblog.stlouisfed.org/2018/02/are-wages-increasing-or-decreasing/

Another Bruce Hall LIE so easily exposed?

Look – this troll might think he is clever but it takes about 5 seconds to find reliable data to expose his serial dishonesty. So no – Bruce Hall is both a liar and the dumbest troll ever (besides his BFF CoRev).

You earlier said we should take a longer term view. OK, over the past 3 years, nominal wages rose by 14.72% while CPI rose by 14.14%. But you are claiming real wages are down. Yep – you cherry pick data for a living. Now who is paying you for all these really stupid lies?

I’ll simply point to your comment: https://econbrowser.com/archives/2022/04/financial-market-responses-to-the-march-cpi-release#comment-272327

Ivan

April 13, 2022 at 4:45 am

It seems pretty obvious that the drivers of current headline inflation are temporary.

I am not Ivan – and yes you lied once again. I know – you have some weird primal need to lie 24/7 so continue to do so. We would not want you to lose your manhood firing off your AR 15.

One account of who watched and who did not watch the 1/6 hearings Thursday evening:

https://www.msn.com/en-us/news/politics/20-million-people-watched-jan-6-hearings-in-prime-time-nielsen-says/ar-AAYlLRS?ocid=msedgdhp&pc=U531&cvid=1d0b47ef81a4484982dbb81fec155621

Of course the usual domestic terrorists did not watch as they were busy getting their assault weapons ready for the next attempt to overthrow our government. MAGA!

https://www.nytimes.com/2022/06/10/opinion/federal-reserve-policy-ecb.html

June 10, 2022

Wonking Out: Why Monetary Policy Has Gotten So Hard

By Paul Krugman

Today’s newsletter isn’t about what the Federal Reserve or its counterpart the European Central Bank should be doing. I have views, of course: For what it’s worth, I think the Fed is getting it roughly right and the E.C.B. is overreacting. But that’s a debate both huge and inconclusive; in fact, it may never be resolved, since people are so good at convincing themselves that they were right.

What I want to focus on, instead, is why the job of each both central bank seems so challenging right now — why each institution seems to be facing agonizing trade-offs.

The background: For a while, inflation seemed to be largely an American problem. Yes, prices were rising in Europe too, but not as much as in the United States, and the E.C.B., unlike the Fed, wasn’t talking about raising interest rates. Recently, however, European inflation has surged, to the point that it’s basically as high as U.S. inflation.

This has led to some odd twists in the inflation debate. Some economists point to European inflation as evidence that U.S. deficit spending was never the culprit, that inflation is being driven by global forces outside the Biden administration’s control. In response, those who do blame excess spending for U.S. inflation are making exactly the same arguments about Europe that Team Transitory used to make about America: Underlying inflation remains low, it’s all about temporary shocks from pandemic recovery, the Ukraine war and so on.

This is not, by the way, a gotcha. Economic models should reach different conclusions in different circumstances. But it’s still kind of funny.

I doubt, however, that either Jerome Powell, chairman of the Fed, or Christine Lagarde, president of the E.C.B., finds the situation funny. Both face agonizing choices. Neither knows, with any confidence, how serious an inflationary threat he or she faces, and therefore how much is needed to cool down the respective economies. Nor do Powell or Lagarde have reliable estimates of how much is needed to raise interest rates, the main policy tool, to achieve a given amount of cooling.

To explain it, I keep thinking of “fine motor skills” — the hand-eye coordination that lets people tie their shoelaces and button their shirts. Well, both Powell and Lagarde are, in effect, trying to tie their shoelaces in the dark — while wearing mittens.

But here’s my question: Why wasn’t it always like this? …

https://fred.stlouisfed.org/graph/?g=MN2G

January 15, 2018

Consumer Price Index for Food and Energy, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=MN3g

January 15, 2018

Consumer Price Index for Food and Energy, 2017-2022

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=Fn2j

January 15, 2018

Consumer Price Index for Rent and Owners’ Equivalent Rent, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=MO8n

January 15, 2018

Consumer Price Index for Rent and Owners’ Equivalent Rent, 2017-2022

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=E0Qp

January 30, 2018

Consumer Price Indexes for New and Used cars & trucks, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=KPT0

January 30, 2018

Consumer Price Indexes for New and Used cars & trucks, 2017-2022

(Indexed to 2017)

Fingers crossed, the peak in energy and food prices will be in September. Set government COLAs and the let the cost of living fall.

Odds aren’t great, but one can dream.

The cost of living will fall? Wow! Dream on!

Do you really want to go down the road that Bruce Hall is going? He is indeed the biggest Trump liar and a total village moron. Now if you want to be his new BFF – be our guest.

Happens for some folk every time gasoline prices fall sharply. I realize you don’t care about facts, but that is one.

Its all energy concentrated now. End that bubble, you end inflation.

On an economics blog they can not understand or more likely can not admit the impact of CURRENT energy policies on inflation in the economy.

CoRev: Seriously? The current price of oil and gasoline has to depend in part on regulatory policies, as well as macroeconomic policies. What serious economist denies that. Now, whether a change in regulatory policy (say drilling permit sales) today can affect in a substantive manner gasoline prices today is a different matter, given essentially a world price of oil (after accounting for oil type differences). Geez.

Menzie, “The current price of oil and gasoline has to depend in part on regulatory policies, as well as macroeconomic policies. What serious economist denies that. ” So you agree that policies and their regulations/administrative implementations DO IMPACT “The current price of oil and gasoline..”?

Did I get that correct?

If that is correct would you say that Presidential candidates and then Presidents jaw boning and promising voters of future actions can also impact prices?

The reason I seek clarification is because so many commenters here can/will not admit so.

We have a new winner for the dumbest comment ever. Way to NOT address his question. Oh wait – you have Bruce Hall disease and you do not understand even a simple question.

Remember “the good ol’ days” CoRev??~~“way back” in Spring 2020, when nations’ leaders worked together in open collusion to keep oil prices higher?? i.e. when donald trump was trying to raise the price you/CoRev paid at the gas station??

https://www.nytimes.com/2020/04/12/business/energy-environment/opec-russia-saudi-arabia-oil-coronavirus.html

I bet you’re feeling like bawling, now that donald trump couldn’t get gasoline prices even higher for you, don’t you CoRev?? Never mind how that added to a war-chest for Putin’s invasion of Ukraine. Oh wait, that last part is also “good policy” in your mind, isn’t it CoRev???

The most interesting thing to me about these stories about Republican collusion to raise prices on consumers, is when a Republican President F*cks over the middle class, you never hear a single person on FOX news discuss it, or label it as “big government” or “government intervention”. Somehow when a Republican President openly colludes to f*ck over the American consumer at the gas station, and f*ck over businesses that consume oil as a cost/input, that Republican collusion transforms magically into “sweetness and heavenly light”.

CoRev is just trying to help Bruce Hall out here. Now why anyone would want to help out an economic know nothing that lies 24/7 is beyond me.

Bierka -The NYC Jerk, The reason I seek clarification is because so many commenters here can/will not admit so.

I see that discussion went way over your head.

CoRev

June 12, 2022 at 4:46 pm

More pointless barking from our favorite rapid dog.

Bierka the NYC Jerk says: “More pointless barking from our favorite rapid dog.” I thank you for your description, but how rapid do you think I am?

I’d be curious to know (maybe with some WSJ numbers (??) how private economists’ Average forecast on inflation compares to the Fed’s forecasts on inflation. We got the old host/lawyer placating Larry Summers at the old people’s nursery on Bloomberg (you notice Larry can’t spit out the words “war in Eastern Ukraine” “Global shortages” “start/stop Covid shutdowns” or “global value chain” but Larry can talk about inflation all day long.

If Larry is going to blather on about “how bad the Fed’s inflation forecasts were”, let’s see what the private economists were saying in the same time frame. Larry was on TV saying “that’s not Linda Kohn’s job”. Really Larry?? Was it “your” job at Harvard to mansplain to women they “weren’t good at math”?? Was that “your job” Larry?? Was it “your job” to “mansplain” to Brooksley Born, and attempt to intimidate Brooksley Born that she wasn’t supposed to regulate TBTF bankers before the 2007–2008 derivatives and swaps crisis?? Was that “your job” Larry??~~because no one else thought that Brooksley Born was there to to coddle TBTF bankers while they risked regular depositors’ savings—only you thought that was “your job” Larry.

https://www.thenation.com/article/archive/woman-greenspan-rubin-summers-silenced/

Everyone paying attention knows you’re a corporate and richest 1% lapdog Larry, And if you were on the REAL W$W when Louis Rukeyser was host, he would have taken your sorry A$$ behind the woodshed with a paddle with holes in it and taught you what fiduciary responsibility is Larry. You’re in essence pissing on Rukeyser’s grave and you make me SICK Larry. You make me SICK

Why couldn’t the Fed predict the complete shutdown of Shanghai exports like Larry Summers did last year?? Only Larry knows. But Larry knew Shanghai would shutdown, Larry knew there’d be war in Ukraine (nearly as soon as Barkley Rosser, about 48 after the first artillery rounds). Larry knew all those things. If you yank the pacifier out of Larry’s mouth when he’s done crying he’s not a policy adviser anymore he’ll tell you anything you want to know that came out of last week’s newspaper~~unless the topic you bring up just doesn’t jive with fiscal policy being the bane of humanity. That’s when Larry shoves the pacifier back into his mouth.

I believe this is an important number to pay attention to. If this number is dropping, and inflation is still rising, depending on the specific industry, I think it could be an indication that a lot of what we are seeing is panic buying, or inflation that is just driven by fear alone. Not what I would term a “real” shortage. Again, depending on the industry and taken together with other economic statistics.

https://ycharts.com/indicators/us_ism_manufacturing_supplier_deliveries_index

For whatever it’s worth I was out driving around this Saturday night. It was after 7pm and the traffic seemed much lower to what you would see typically this time of the week. It’s my personal opinion that the American consumer can “beat” this inflation IF they make intelligent choices. CAN and WILL are different things. The latter, the “will” part, I am more pessimistic on. I do think inflation will lower before the end of December though. Beyond that I don’t have enough confidence to make a definitive statement. All of this assumes war doesn’t extend west of Ukraine.

As our RBA points out it is the trimmed mean rate which you should be looking out and at 6.5% it is way too high. Central Banks have bee caught out and are playing catch up.

And private economists weren’t surprised at the level of inflation as well?? (i.e. they didn’t know there would be war in Ukraine, they didn’t know Xi Jinping would shutdown all of Shanghai when Grandma Zhang sneezed while cleaning dust mites, etc) Give me a quote from a non-Mises person or American Republican who doesn’t start screaming “Inflation!!! Inflation!!!” 5 seconds after a Democrat takes the White House. YES, we know “Grumpy Economist” John Cuckrant has been screaming inflation for the last 30 years consecutive, and now Cuckrant is “right”. Of course you’ll hear very little discussion on economic growth, jobs growth, “tight” labor market (I don’t buy that it’s “tight”, but better than under donald trump). American financial media discusses a “tight” labor market in the same tones they would discuss a mass shooting. Gee, I wonder why CNBC would do that ?? Because the subtext is directed to what audience that put a salary payment in the TV anchor’s bank account?? Joe Kernen is representing Mr. and Mrs Average American?? Only to the MyPillow illiterates who get an erection when they hear Kernen has private phone conversations with a criminal U.S. President.

https://news.cgtn.com/news/2022-06-11/Chinese-mainland-records-79-new-confirmed-COVID-19-cases-1aLOLsrstag/index.html

June 11, 2022

Chinese mainland records 79 new confirmed COVID-19 cases

The Chinese mainland recorded 79 confirmed COVID-19 cases on Friday, with 65 linked to local transmissions and 14 from overseas, data from the National Health Commission showed on Saturday.

A total of 131 asymptomatic cases were also recorded on Friday, and 2,798 asymptomatic patients remain under medical observation.

The cumulative number of confirmed cases on the Chinese mainland is 224,659, with the death toll from COVID-19 standing at 5,226.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-06-11/Chinese-mainland-records-79-new-confirmed-COVID-19-cases-1aLOLsrstag/img/ccea98de57454d83af3c923d922d5369/ccea98de57454d83af3c923d922d5369.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-06-11/Chinese-mainland-records-79-new-confirmed-COVID-19-cases-1aLOLsrstag/img/b63f77fc4f8d41ddb80b4ce2e30918cc/b63f77fc4f8d41ddb80b4ce2e30918cc.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-06-11/Chinese-mainland-records-79-new-confirmed-COVID-19-cases-1aLOLsrstag/img/8e02e5dfdca94939b10791adda67d0d0/8e02e5dfdca94939b10791adda67d0d0.jpeg

https://www.worldometers.info/coronavirus/

June 11, 2022

Coronavirus

United States

Cases ( 87,305,419)

Deaths ( 1,035,828)

Deaths per million ( 3,094)

China

Cases ( 224,659)

Deaths ( 5,226)

Deaths per million ( 4)

I perceive three Democratic over arching and interconnected polices with their supporting implementations which are detrimental to the country and driving the polling.

1) Climate Change fight – leads to inflation

2) Politicization of every issue – leads to dividing the populace

3) Selective enforcement of laws to support the above. Leads to poor support of unpopular implementations.

CoRev,

1) Climate Change fight – leads to inflation

And…high oil prices don’t ? Go on, pull the other one.

2) Politicization of every issue – leads to dividing the populace

Let me be sure I’ve got this right.

Democrats, not GOPers, politicize every issue.

Democrats not GOPers, divide the populace.

Is that what you’re saying?

I just want to be sure I clearly understand the level of your confusion.

3) Selective enforcement of laws to support the above. Leads to poor support of unpopular implementations.

Did you have any specific laws in mind, like say, the peaceful transfer of political power?

Inquiring minds want to know.

David, “And…high oil prices don’t ? Go on, pull the other one.”

Since you asked. On January 27 2021 Biden’s White house released this: https://www.whitehouse.gov/briefing-room/statements-releases/2021/01/27/fact-sheet-president-biden-takes-executive-actions-to-tackle-the-climate-crisis-at-home-and-abroad-create-jobs-and-restore-scientific-integrity-across-federal-government/ which started the leasing issue and de-emphasizing fossil fuel as an energy source. For want of a better term started his war on fossil fuels.

Even Menzie admits that policies do impact oil/energy prices. The above reference shows how they are implemented.

“Democrats, not GOPers, politicize every issue. Democrats not GOPers, divide the populace.” Indeed! Dems have a name for it, Identity Politics.

“Did you have any specific laws in mind, like say, …?” Indeed, again. Crime, illegal immigration, and yes there are examples of election shenanigans.

These things are obvious to the average US voter who have a good comparison between two administrations policies. What’s not surprising is that liberals/dems will not admit it yet.

“Even Menzie admits that policies do impact oil/energy prices. The above reference shows how they are implemented.”

My you do have Bruce Hall disease. Menzie had a couple of terrific posts with lots of solid research that showed your little drill baby drill stick would have almost no current impact on oil disease. Thanks once again for letting us know you are incapable of following this or any isssue.

“Today, President Biden will take executive action to tackle the climate crisis at home and abroad while creating good-paying union jobs and equitable clean energy future, building modern and sustainable infrastructure, restoring scientific integrity and evidence-based policymaking across the federal government, and re-establishing the President’s Council of Advisors on Science and Technology.”

Maybe the point about integrity is what has CoRev riles up. We know Trump lied about everything. I guess CoRev’s economic model has blatant Presidential lying leading to lower oil prices. After all – he and Bruce Hall are doing their best to lower oil prices by writing their slew of dishonest comments. Thanks fellows!

I thought David Brooks and FOX news were the ones obsessed with “identity politics”. I never even heard the word before David Brooks had mentioned it every damned week he did the Friday rundown on PBS NewsHour. Brooks mentioned “identity politics” so many damned times I thought the dumb bastard had even coined the term. Once again CoRev telling me new things I never heard from any other source. How does he do it??

I personally think David Brooks is scared of Black people. He talked about personal meetings with President Obama before he became President that sounded more like he thought he was Roy Neary in Close Encounters of the Third Kind and the first time Brooks shared the TV screen with Jonathan Capehart the look on his face made me wonder if Brooks was peeing himself under the anchor desk.

“For want of a better term started his war on fossil fuels.”

if that leads to higher fossil fuel prices and the faster adoption of cheaper renewables, sign me up. since people like corev want to drag their feet, then war it can be. we know which side will win in the long run. the electrification of the usa is underway. fossil fuels are not part of that future.

Baffled – coward confirms they are a fossil fuel warrior. You are to blame for a portion of the inflation. How large is that portion????

And you are proud of your success in causing so much economic harm and pain.

corev, if you would get out of the way, we could implement renewables even faster and cheaper. your feet dragging is contributing to higher than necessary energy prices. are you proud of the economic pain your are creating?

and let us be very clear here. right now, higher energy costs are a direct result of fossil fuels, not renewables. fossil fuels are a tax on society. time to move on to a better and cheaper energy source. renewable energy costs have consistently gone down in cost over the years. that is what you should be rooting for, corev, if you are interested in reducing economic pain. but my guess is you are still in favor of the fossil fuel tax.

Baffled – coward claims: “corev, if you would get out of the way, we could implement renewables even faster and cheaper.” My foot dragging is solely responsible for the delaying implementation of renewables. Wow! How delusional you are, about me and the future of fossil fuels.

To be sure this is the most nonsensical statement you have made in recent commenting: “and let us be very clear here. right now, higher energy costs are a direct result of fossil fuels,” How could it be otherwise? Fossil fuels are still the primary component of energy. If their costs go up then so will energy costs. Fossil fuel costs are going up due to the War on their production and use.

BTW, where’s that example of where adding renewables to the electric grid does not raise costs to the grid? You’re who claims it is false. Must be many examples. Show us!

Failure to answer this challenge and others is how you gained the name coward.

“Fossil fuel costs are going up due to the War”

finally, corev got something right.

perhaps you can come up with something more original than coward. or are you incapable of an original thought yourself?

People keep wondering what Trump was doing the afternoon of 1/6/2021. I think I know but describing the act of pleasing oneself might get me banned from the internet. But I suspect CoRev was joining Trump that day.

1) Climate Change fight – leads to inflation? This sounds like moronic partisan garbage from Bruce Hall. CoRev – I never imagined you could be so incredibly dumb but maybe so.

2) Politicization of every issue – leads to dividing the populace – this politicization lays at the feet of your master … Donald Trump

3) Selective enforcement of laws to support the above. Leads to poor support of unpopular implementations. Funny you forgot to mention which laws are not being enforced. #1 on my list is how the Justice Department has not brought Trump to trial for what he led on 1/6/2021.

Bierka – the NYC Jerk, “1) Climate Change fight – leads to inflation? This sounds like moronic partisan garbage from Bruce Hall. CoRev – I never imagined you could be so incredibly dumb but maybe so.”

Here’s my solution to climate change.

/sarc Why are we trying to limit the growth of CO2 or better still remove it from the atmosphere when limiting the growth or removal of H2O would be more effective? We even have the technology readily available. We use it nearly everywhere there is the energy to do so. Dehumidifiers and air conditioners are and would be very effective.

Yeah, that idea is as asinine as removing CO2 from the atmosphere and/or keeping it from entering it.

Using GREEN ENERGY would make this as cheap as renewable electricity generation. As a bonus doing this would lower temps in the locale of the devices proving without a doubt that GHGs are the culprit for warming. Or would it? /sarc

I just had to add the /sarc note to assure you and the other astute readers here would actually understand it was sarcasm aimed at your CO2 solution. After all CO2 is the control switch for climate/warming/??? just as this graph shows: https://www.woodfortrees.org/plot/hadcrut4gl/from:1950/plot/esrl-co2/normalise/plot/hadcrut4gl/from:2014/trend/plot/esrl-co2/normalise/from:2014/offset:-0.1/trend

Here’s my solution to climate change.

Foilowed by a lot of words that prove only one thing – CoRev has no effing clue what he is babbling about. None at all.

Bierka- the NYC Jerk, on another blog and other thread I left off the /sarc tags knowing those readers would see the sarcasm.

Here, however, I deliberately added them and even pointed them out: “I just had to add the /sarc note to assure you and the other astute readers here would actually understand it was sarcasm aimed at your CO2 solution. ” Still you missed the sarcasm.

Slavering, dumb out of control responses are why you gained the name Bierka. The value of the responses are why I also include your own descriptor of the NYC Jerk.

Your latest comment just re-confirms their validity.

CoRev’s own link writes this:

These tools could in theory be used for any time series but the main rationale for their existence is for analysis of historical climate data. The idea is to allow you to go to the source data and look for answers to questions like:

Has the Earth got warmer recently?

Is it still getting warmer?

Is CO2 the only explanation for what has happened?

Are there solar cycles involved?

Are there other influences we don’t understand yet?

If so, how much do they account for?

What is likely to happen next?

It’s not the place of this Web site (or anyone else) to tell you the answers, even if I could! This is just a tool to help you dig into the data to help you form your own opinions. Whatever you decide the most important thing is that you learned what the issues in analysis are and how to test your ideas against real data.

Sorry CoRev – your little plot proves nothing about any of the above questions. But nice try.

Bierka – the NYC Jerk, are you that clueless? It’s a tool from which visualizations can be made. Y’ano like this one: https://econbrowser.com/wp-content/uploads/2022/06/inflationrates_core_may22a1.png

It nicely answers this claim: After all CO2 is the control switch for climate/warming/??? just as this graph shows: https://www.woodfortrees.org/plot/hadcrut4gl/from:1950/plot/esrl-co2/normalise/plot/hadcrut4gl/from:2014/trend/plot/esrl-co2/normalise/from:2014/offset:-0.1/trend

BTW that’s not my claim. That is the understanding of some of the Eco-(fill in the blank): “Climate: Why CO2 Is the “Control Knob” for Global Climate Change” https://science.time.com/2010/10/14/climate-why-co2-is-the-control-knob-for-global-climate-change/

You do amaze.

My, CoRev, you are really quadrupling down on this infantile “Bierka” stuff. Well, bow wow wow wow again. Time to go to your doghouse.

If I understand the FRED series, T5YIE, this inflation breakeven series represents the expected average inflation rate over the next five years. And according to FRED, the FRED series, T5YIFR “is a measure of expected inflation (on average) over the five-year period that begins five years from today.” Looking at each data series (using monthly averages), T5YIE for June 2022 is 3.04% and T5YIFR is 2.41% for June 2022. The respective May 2022 values (using monthly averages) are: 3.03% and 2.35%.

If we look back five years, T5YIE was shown as 1.75% for May 2017 and T5IFR was shown as 2.06% for May 2017.

According to FRED, the inflation measure is the all-item CPI.

https://fredblog.stlouisfed.org/2021/12/measuring-expected-inflation-with-breakevens/#:~:text=For%20this%20reason%2C%20this%20market-based%20measure%20of%20inflation,5%20years%20has%20risen%20steadily%20to%20about%203%25

The all-items CPI for May 2017 was 244.004 and for May 2022 was 291.474. Computing the average compound five-year CPI growth: (((291.474/244.193)^(1/60)^12)-1)*100 = 3.6%.

How should the accuracy be considered? If the T5YIE forecast of 1.75% shown for May 2017 is compared to the past five-year CPI inflation of 3.6%, there is a difference of about 1.8 percentage points, however the forecast is also off by (3.6%-1.8%)/1.8% or by 100%.

Regarding the potential accuracy of T5YIE for the next five years, the five-year compound annual average inflation rate from 2017M04 to 2022m04 ranged between 1.3% and 3.4%. The subset period of 2017m04 to 2020m12 was somewhat stable ranging between 1.3% to 1.9%. So, it seems if the current CPI 5-year rate of 3.6% continues for about 40% of the time, then we need CPI 5-year inflation to be about 2.6% for about 60% of the time over the next 5 years. If the CPI 5-year rate continues for about 20% of the time, then we can endure CPI 5 Year inflation to be about 2.9% for 80% of the next five years.

3.6 x .4 + 2.6 x .6 = 3.0

3.6 x .2 + 2.9 x .8 = 3.0

What may concern seasoned citizens is looking at the CPI from 1969 to 1995. Maybe it is different this time, but the CPI-all index rose from 35.7 as of January 1969 to 93.8 as of November 1981 or a compound increase of about 7.8% per year. During this time, the 5-year average compound CPI increase rose from 2.9% to 10.1%. It was not until August 1995 that the 5-year inflation rate declined to 3.0%. The compound average annual increase from 1969 to 1995 was about 5.6%.

Back to the current day, although there are several measures of inflation, the measure that most folks hear about on the news is the CPI. The annualized inflation for May is what they experience daily shopping for food and buying gas. The CPI-all showed a May annualized increase of about 12.3%. CPI excluding food and energy increased by an annualized 7.8%, food increased by an annualized 14.5% and energy increased by 58.4% annualized. The weights used for the May CPI report are: CPI excluding food and energy, 78.3%, food, 13.4% and energy, 8.3%. https://www.bls.gov/web/cpi.supp.toc.htm , see table 1 for weights.

Here’s hoping that economists are better able to analyze and better able to help guide the economy today compared with the past.

https://english.news.cn/20220612/78742ca3ad9b43f1bd2100357f139fd1/c.html

June 12, 2022

China’s installed power battery capacity logs strong May growth

BEIJING — China’s installed capacity of power batteries saw steady growth in May amid the boom of the country’s new energy vehicle (NEV) market, industry data showed.

Last month, the installed capacity of power batteries for NEVs rose by 90.3 percent, year on year, to a total of 18.6 gigawatt-hours (GWh), according to the China Association of Automobile Manufacturers.

Specifically, about 10.2 GWh of the lithium-ion batteries were installed in NEVs, up 126.5 percent from a year earlier, accounting for 55.1 percent of the monthly total.

According to the association, China’s NEV market maintained rapid growth momentum in May, with sales skyrocketing by 105.2 percent year on year to 447,000 units.

[ China’s new energy vehicle market is now running above 400,000 monthly. ]

Reading noisy tea leaves, amirite?

Amirite: noun; a mineral which, when applied to human speech, leads to a loss of cognitive function. Plural: no, you’re as wrong as ever.

https://www.msn.com/en-us/news/politics/senate-group-agrees-on-broad-outline-of-new-gun-law-after-uvalde-massacre/ar-AAYncoY?ocid=msedgdhp&pc=U531&cvid=f98bda60a73d4ae486bc75adefb8d85c

It seems we may have a bipartisan deal in the Senate to have a very minor improvement in gun safety laws. I know this is far from having an effective Brady bill and an assault weapons ban so we have more to campaign for.

But it is a little progress which is likely to set off CoRev even further.

I remember back in that freshman econ lecture when the difference between positive and normative analysis was presented. The wise one presenting the lecture emphasized that all decisions are normative, but that even normative decisions should be based on positive analysis. Unintended consequences can’t always be avoided, but positive analysis sure helps.

I have a real sense of nostalgia for that lecture whenever Brucie, Covid, Johnny and anony clutter up comments.

Five-year inflation expectations matter vastly more than short-term expectations for the purpose of making policy. Short-term expectations matter for politics. So here’s Brucey demanding that we focus on the short term, because everything should be about politics – normative – with no attention to good policy – positive.

CoRev is so clearly part of the right-wing propaganda mechanism, with his insistence on hyperbolic rhetoric like “war on fossil fuels. Oh, and “for want of a better term” as the bloviatoring cherry on top. Better terms might include “CO2-reducing” or “environmental policy”, since those are both factual statements of purpose, while war is hyperbole. And then to say Democrats politicize everything – every accusation a confession with you guys.

Menzie does economics. Start with positive analysis. When he posts, the political howls begin, because the implication of positive analysis (if you’ve lost the thread, that means fact-based analysis that attempts to avoid bias) don’t suit your masters’ interests.

I do enjoy a bit of positive economic analysis.

Menzie’s posts are often very political in nature. Since we are in the topic of inflation, I will point out that, on multiple occasions, Menzie asserted or inflation projections by Kevin Hassett were not “plausible” (which was an absolutely ridiculous claim by Menzie even before the inflation numbers proved Menzie to be wrong). Menzie called out Hassett only because it suited Menzie’s political biases. At that time, Hassett was a former CEA Chair of a former POTUS of whom Menzie doesn’t like. Menzie’s blog posts are as focused on normative economics just as much as they focus on positive economics. For better or worse – but the views!!!! It’s all about the pageviews!!!!

Econned: If you go to the post, I wrote of Hassett’s prediction “not particularly plausible”. I don’t think I wrote “implausible” as you assert.

Why do I care about pageviews? It’s not like I get paid for them.

DOW 36000 written in 1999 was certainly implausible. The underlying assumptions were absurd. Zero risk premium was one oddity but the really dum thing was asserting cash flows = profits ignoring the fact that growing companies need new investment in tangible assets.

But yea – it seems Econned flunked reading 101.

You also wrote in the preceding sentence:

“This doesn’t mean there aren’t possible surprises far on the upside of inflation (say, due to supply shocks).”

I guess Econned had no idea what this meant since his trolling forgot to mention this.

Last time I checked politics and economics were intertwined. But I’m sure commenter “Econned” has gone over to Mankiw’s blog and complained about this, especially since Mankiw’s politicization got so bad inside the university classroom that large numbers of students boycotted his class.

And God knows, when you get your PhD in Economics you have to sign a form promising never to discuss or write about politics again and turn it into the Provost before anyone gets his/her doctorate. All the rednecks like “Econned” know that, they heard it from high school grad Glenn Beck.

“But I’m sure commenter “Econned” has gone over to Mankiw’s blog and complained about this”

No comments from Econned there. But of course Mankiw disallowed comments a long time ago. He got tired of us correcting his spin on the progressitivity of the tax system.

Moses Herzog,

You aren’t comprehending the issue. My reply was to macroduck who asserted “Menzie does economics. Start with positive analysis. When he posts, the political howls begin, because the implication of positive analysis (if you’ve lost the thread, that means fact-based analysis that attempts to avoid bias) don’t suit your masters’ interests.”

I agree politics and economics are intertwined. I never suggested that they weren’t. Mankiw doesn’t have a comment section. I don’t know why you are name calling. I don’t know why you are suggesting I’m a “redneck”. I don’t know why you think Glenn Beck is relevant.

there goes econned, putting untrue words in people’s mouths so he can go off on a tirade. his entire paragraph was simply inaccurate, but fodder for his bias against prof. chinn. one wonders why he spends so much time on this blog if he has such a low opinion of it.

Baffling,

There was nothing inaccurate about my comment. Thanks for playing so poorly.

econned, your reply did nothing to change the fact your original comments were inaccurate. nice try though.

baffling,

and you’ve done nothing to show where my original comments were inaccurate. It’s because my original comments were accurate. Horrible try though.

Econned, prof chinn clearly demonstrates the inaccuracies i his comment. I need not repeat those. Quit squirming.

Econned

June 13, 2022 at 4:29 pm

baffling,

and you’ve done nothing to show where my original comments were inaccurate. It’s because my original comments were accurate.

Oh brother – your original comments were CLEARLY inaccurate. But you are too much of a troll to admit it.

First, to steal your comment… I don’t think I wrote “implausible” as you assert.

Second, Your ego is why you care. But your ego prevents you from acknowledge it. Interesting how that works, isn’t it?

Third, at least you aren’t trying to deny the overtly political nature of your Hassett critique.

Baffling nailed your pathetic little rear end. Run along and pester some other blog as everyone here knows your stupid game.

“Menzie asserted or inflation projections by Kevin Hassett were not “plausible””

Gee there is some big difference between not plausible v implausible? I guess we are back to Guide for a Married Man (1963) and the Deny, Deny, Deny scene!

You are either wrapped up in the “alternative facts” universe in which ideas you disagree with must be lies, or you are simply dishonest. How many times have you mentioned Hassett? What other instances of supposed politically motivated posts from Menzie can you cite?

Hey, wait a minute… Are you actually Hassett? Is this a Mary Rosh thing? That would explain why you keep jumping on Menzie about Hassett. C’mon, fess up. Is that you?

Hassett has shown himself to be an exceptionally poor economist. that is not from political bias. it is from a look at his economic assessments and predictions throughout the years. which is probably why trump welcomed him into the fold. his economic and infectous disease models during the covid pandemic were not even wrong, they were so bad.

Hassett is marginally better than Lawrence Kudlow. Of course the Three Stooges are better economists that Larry, Mo (Stephen Moore), or Donald Luskin (Curly).

baffling,

I agree 100% with each of your sentences here. But absolutely none of that is relevant. The point is that Menzie went out of his way to single out that exceptionally poor economist’s inflation forecast and Menzie was wrong. Menzie only called out that exceptionally poor economist because Menzie doesn’t like that exceptionally poor economist. And that’s true despite Menzie being in err about that exceptionally poor economist’s inflation forecast.

It’s pretty simple.

Hassett is not an innocent target. He was an economist who had the ear and influence of potus. He was wrong about the economy and covid. Exceptionally wrong. And it cost americans their lives. It takes an ignorant world view that hassett is being unfairly targeted by prof chinn. Your defense of hassett, in light of his impactful failures, is what is the bias here, econned. Criticism for failure in a politically appointed position should be expected here. Or does he get a pass for those failures?

Baffling,

Hassett had the ear of an ex-POTUS. Hassett being wrong about COVID is irrelevant to Menzie being wrong about Hassett’s inflation projection. I’m not defending Hassett but you’re to biased to see that. The real bias is that you and others are unable/unwilling to separate feelings from rational discussion.

” I’m not defending Hassett but you’re to biased to see that.”

that is exactly what you are doing.

“Hassett had the ear of an ex-POTUS.”

exactly what kind of mental gymnastics are you trying to pull here? he worked for trump while trump was in office. the fact that trump lost the next election, and was removed from office to make him exPOTUS, has no bearing on our conversation here. he was with trump while the administration had a covid meltdown. don’t try to minimize the impact of both trump and hassett here.

baffling,

You’re wrong. On so many levels.

Regarding defending Hassett. Wrong. I’m pointing out Menzie makes politically-driven posts. Just because I use Hassett as an example is in no way a defense of Hassett. Talk about mental gymnastics.

Regarding Hassett having the ear of an ex-POTUS is relevant because the issue at hand (Menzie calling out Hassett’s inflation projection) occurred when Trump was no longer in office. So it absolutely has bearing on our conversation.

You can’t see your biases because your glasses are Menzie-tinted.

What alternative fact? Menzie’s posts and comments regarding Hassett’s inflation forecast were politically motivated. And wrong. I thought I already said that.

Was Hassett’s forecast incorporating ex ante the ex post supply side shocks? I doubt it. He was putting forth a suspect model of the aggregate demand effects. Simply because one gets lucky using a terrible and perhaps incomplete model does not make one a good forecaster.

Now I thought anyone who ever took an econometrics course would get my simple point. But something tells me you do not.

I feel it’s such a shame the Uvalde Police Dept wasn’t nearby this event in Idaho. If the Uvalde “good guys with guns” police dept had been there people wouldn’t have been “hassled” too much. The Uvalde police chief could have offered “Patriot Losers” free donuts, a key to the city, and given them a police escort to the nearest daycare center or gay bar. Pete Arredondo: Which place did you “Patriot Losers” say you’d rather do target practice at?? The daycare center or the gay bar?? Don’t worry guys, the township pays for ALL my gas”.

“Good Guys With Guns Protecting the Local Donut Shops” is an oath Uvalde police take as sacred to their hearts.

https://www.vanityfair.com/news/2022/06/white-supremacists-pride-event-arrested-in-idaho

MD as a freshman you were easily led, and your understanding was seriously limited. Cluttering up comments is what is guaranteed by Amendment 1. This comment is perhaps the most insensitive I’ve read in a long time, especially this portion: “Five-year inflation expectations matter vastly more than short-term expectations for the purpose of making policy. Short-term expectations matter for politics…. with no attention to good policy – positive. ”

The short term expectations? Why not impacts? Expectations move polls and elections, but impacts move expectations. We the vast majority of voters can see the LACK of merit in the current policies and have been VERY BADLY impacted by them.

What amazes is that you can not see these policy impacts. I guess through your eyes 5 years of this inflation and continuation of the polices causing it are just an unintended consequence of those good policies. Breaking all the records are good!

Most voters perceive that: “CO2-reducing” or “environmental policy” are just two policy examples resulting in BAD impacts. Their positive fact-based analyses of these impacts are showing up in the polls and the big one will be in the next election.

Your comment confirms how far from reality is your thinking and understanding of conditions. Denial and ideology are not enough this time.

“MD as a freshman you were easily led, and your understanding was seriously limited. Cluttering up comments is what is guaranteed by Amendment 1.”

CoRev pretends to be some Constitutional lawyer! Look – we are saying you do not have the right to make a fool out of yourself. You do so daily.

And Macroduck knew more economics during the 1st week of his freshman year than you learned over your entire worthless life.

BTW – this short-term v. longer term issue goes to something John Taylor (Republican economist) wrote in his youth (before he drank the Bush Kool Aid). It had something to do with overlapping long-term wage contracts. We would ask you to read his excellent writings but they are all way over your little incompetent brain.

“Cluttering up comments is what is guaranteed by Amendment 1.”

corev, the first amendment does not guarantee your right to clutter up comments on this blog. your response simply shows ignorance of the constitution. let me provide a refresher for you.

First Amendment:

Congress shall make no law respecting an establishment of religion, or prohibiting the free exercise thereof; or abridging the freedom of speech, or of the press; or the right of the people peaceably to assemble, and to petition the Government for a redress of grievances.

Baffled – coward, yup, that’s the amendment and this is the appropriate portion: ” or abridging the freedom of speech, ”

I don’t see where “cluttering comments” is constitutionally defined. Maybe you can help us here.

seriously, corev, are you just this dumb? or did you forget that the first amendment applies to the government and abridging the freedom of speech? it does not apply to private entities. that is why workers can be fired for criticizing their employer. prof chinn has given you the courtesy of a voice on this blog. he is under no obligation to do so, according to the law. your freedom of speech is not protected HERE. that is NOT what the constitution says. my guess is you never took a civics course in high school or college. you are welcome for the help. idiot.

Stuck on definitions still? Damn it – your parents should really buy poor little CoRev a dictionary.

Baffled – coward, relevancy? None to “cluttering comments here”.

corev believes the first amendment protects his rights to clutter the comments on this blog. and when shown he is wrong, he simply doubles down, in true trumpian fashion. just admit you are wrong in your understanding of the constitution, and walk away with your tail between your legs. your comments on this site are becoming utterly foolish in nature. you seem to be living in an alternate reality.

Baffled – coward, relevancy? None to “cluttering comments here”. And even again a deflection.

corev, i very clearly addressed the cluttering comments item. why do you persist in denial? very clearly, there is nothing in the constitution that protects your cluttering of the comments section on this blog. you are asserting a right you do not have. you should be THANKFUL that prof chinn PERMITS you to place your garbage on this blog. it is a PRIVILAGE he has granted to you corev. you should tell him thank you and that you appreciate his kindness. i would have banned you a long time ago.

Let me take this time, CoRev, to personally offer regrets for my policies that caused Slovenia’s inflation rate to exceed that of the United States in May. They’re now looking at an annualized 8.7% after a 2.0% jump in May.

As you previously noted, you as spokesman for “citizens of the world”, have had enough of my reckless disregard for prudent economic policies.

That the citizens of Melania Trump’s homeland should suffer because of what I’ve done here is indeed both wrong and cruel.

This I promise: you can address those pictures of Melania (the ones from GQ on your bedroom wall) and assure her that I will do everything I can to end this misery in her beloved country.

Thank you.

“Noneconomist

June 14, 2022 at 4:01 pm

Let me take this time, CoRev, to personally offer regrets for my policies that caused Slovenia’s inflation rate to exceed that of the United States in May.”

Would you please list your policies that have caused this terrible condition? No one here has been able to define a list of economic policies either good or bad that have affected any economy.

Kinda funny for an economics blog. Don’cha think?

CoRev: Memory fading? You’re employing a ghost writer? You previously insisted I was responsible for Europe’s average May inflation rate (annualized 8.1%). Or did you forget you wrote this?

“We warned you for years that your policy goals were inflationary. Now we, citizens of the world, have to live with your poor policy judgment…”

Pretty clear you believe I have something to do with inflation here and elsewhere. In another post, I noted the inflationary and supply chain problems that have shuttered 18 of Russia’s 20 auto factories, offering my condolences for my part in causing widespread unemployment for Russian auto workers. I’m sure you’re very concerned about them, knowing I’ve put so many of them out of work.

Of course, I did ask you to explain how that $8.79 gallon of gas in Germany was Biden’s fault, but either you couldn’t or simply had no answer and didn’t. But you did, heroically, proclaim yourself a “citizen of the world” while accusing me of, among bad deeds, ruining economies large and small. Sorry, Luxembourg.. Mea culpa, mea culpa.

Sadly, I must be to blame for any increase in Belgian chocolates (Belgium 9.9% annualized in May) my apologies, Antwerp.

Not to worry. Citizen CoRev has your back.

Nonecon, so you can/will not list your policies causing these price increases. I already listed those I believe are behind it, both in the over arching policy or policy agenda, the fight against ?climate? change, and I’ve also listed the war against fossil fuels, an implementation of that arching policy or policy agenda, as a primary policy cause. I have also included just a few examples of policy implementations via regulations or administrative acts, of this war on fossil fuels, that have impacted prices.

Your denial of these examples leads to your failure to understand them.

When you say: “Let me take this time, CoRev, to personally offer regrets for my policies that caused Slovenia’s inflation rate to exceed that of the United States in May. ” I would like to see an equivalent policy list from you

Aw, is that the best you’ve got? Babble?

You’re just feeling insecure because I actually remember the stuff from economics classes and you don’t. Which is understandable, because actual analysis doesn’t serve your purpose. Starting from evidence and working toward conclusions is sooooo limiting. Starting with the political interests of your masters and working backward leaves you free to say pretty much anything, as lon as it suits your masters’ interests.

Market-based estimates of uure inflation are evidence. Evidence of that you are trying to explain away with yout “impacts move expectations” babble.

Nice to know I hit a nerve, though.

MD, two points. 1) Would you please identify to whom you are responding

2) Would you please rewrite your comment correcting the typos.

Rapid dogs do not babble. CoRev is barking as he chases how own tail.

Rudy Giuliani facing ethic charges! Of course Rudy never had an ounce of ethics in the first place. But hey – he will never practice law again. Now he might want to hire a good defense attorney as their traitor will need one.

https://www.msn.com/en-us/news/politics/giuliani-faces-ethics-charges-over-trump-election-role/ar-AAYnO7o?ocid=msedgdhp&pc=U531&cvid=8bb37274a1b640a9b1018f51c2caea1f

McDonald’s decided not to run its 850 Russian franchises. But Russians who really want a heart attack eat junk food can go back to the same establishments under new management. Not that I ever eat at McDonald’s in the 1st place but I would not trust the food here:

https://www.msn.com/en-us/money/companies/burgers-are-back-russia-reopens-rebranded-mcdonald-e2-80-99s-restaurants/ar-AAYnLE5?ocid=uxbndlbing

So the right wing media will not air the 1/6 hearings but they are pushing this lie (line)

Jim Jordan: January 6 Committee ‘Has Altered Evidence and Lied to the American People About It’

Of course Jim Jordan is blatantly lying here. Same way he lied when he denied any knowledge of the Ohio State coaches raping their male wrestlers.

I assume this will be StevenKopits’ new posterboy for immigration policy:

https://www.yahoo.com/news/dr-oz-says-hell-fight-015735153.html

Remind you of any other former TV stars Kopits worships??

“Dr. Oz says he’ll fight to end illegal immigration. A business owned by his family, in which he is a shareholder, faced the largest fine in ICE history for hiring unauthorized workers.”

Now that is a title. Real doctors are insulted this clown claims to be one of them.

Legalize-and-tax, my friend. That’s the only way to end illegal immigration.

@ Kopits

Hope you remember to mention that on your next FOX or OAN appearance. Somehow I’m doubtful you manage to spit that one out of your mouth on TV. Since you can’t get blood out of a turnip I’m curious which parties you propose to tax?? (this one’s going to be good folks, wait for this doozy of an answer).

No answer from Kopits, just as I thought. The sure way to get Kopits to STFU is to ask him if big deep pocket employers should be punished for hiring illegal immigrants. Kopits instantly vanishes from any blog thread when this topic is brought up. Like asking Barkley Junior if he has ever been a member of NBER. Poof!!!! He’s gone like a fart in the wind.

Moses Herzog: I don’t know why you keep on mentioning as relevant whether somebody is a member of the NBER. I’m a member, but I’m not on the Business Cycle Dating Committee, which makes the determination. In fact they’re only 8 members currently (out of 1700 affiliated members of NBER overall).

I noticed that the price of Bitcoin has fallen by more than 50% this year, and wonder at the real economic effect. My sense is to be concerned given how widespread holding of Bitcoin appeared to be last year, but I know too little of the matter:

https://www.nytimes.com/2022/05/17/opinion/crypto-crash-bitcoin.html

May 17, 2022

Crashing Crypto: Is This Time Different?

By Paul Krugman

Last week TerraUSD, a stablecoin — a system that was supposed to perform a lot like a conventional bank account but was backed only by a cryptocurrency called Luna — collapsed. Luna lost 97 percent of its value over the course of just 24 hours, apparently destroying some investors’ life savings.

The event shook the crypto world in general, but the truth is that this world was looking pretty shaky even before the Terra disaster. Bitcoin, the original cryptocurrency, peaked last November and has since declined by more than 50 percent.

Here’s one way to think about that decline. Almost everyone is concerned about the rising cost of living; the Consumer Price Index — the cost of a representative basket of goods and services — has gone up about 4 percent over the past six months. But the cost of the same basket in Bitcoin has risen around 120 percent, which means inflation at an annualized rate of about 380 percent.

And other cryptocurrencies have performed far worse. Two cities — Miami and New York — have introduced their own cryptocurrencies, with enthusiastic support from their mayors. MiamiCoin is down more than 90 percent from its peak, and NewYorkCityCoin is down more than 80 percent.

By now, we’ve all heard of them, but what exactly are cryptocurrencies? Many people — including, I fear, many people who have invested in them — probably still don’t fully understand them. Saying that they’re digital assets doesn’t really get at it. My bank account, which I mainly reach online, is also a digital asset, for all practical purposes….

https://www.nytimes.com/2022/06/06/opinion/cryptocurrency-bubble-fraud.html

June 6, 2022

From the Big Short to the Big Scam

By Paul Krugman

Remember “The Big Short”? The 2010 book by Michael Lewis, made into a 2015 film, told the story of the 2008 global financial crisis by following a handful of investors who were willing to bet on the unthinkable — the proposition that the huge rise in housing prices in the years before the crisis was a bubble, and that many of the seemingly sophisticated financial instruments that helped inflate housing would eventually be revealed as worthless junk.

Why were so few willing to bet against the bubble? A large part of the answer, I’d suggest, was what we might call the incredulity factor — the sheer scale of the mispricing the skeptics claimed to see. Even though there was clear evidence that housing prices were out of line, it was hard to believe they could be that far out of line — that $6 trillion in real estate wealth would evaporate, that investors in mortgage-backed securities would lose around $1 trillion. It just didn’t seem plausible that markets, and the conventional wisdom saying that markets were OK, could be that wrong.

But they were. Which brings us to the current state of crypto….

The same mispricing just recently occurred with gas futures. Market failure is more the normal state of things.

https://www.msn.com/en-us/news/politics/former-trump-strategist-steve-bannon-explodes-at-the-idea-of-trump-being-indicted-over-january-6th-riot/vi-AAYplJN?ocid=msedgdhp&pc=U531&cvid=874a70f67da3497a9648a37833e0d468

Steve Bannon claims Trump is still President? Bannon is angry that we want Trump prosecuted? Bannon wants AG Garland to be impeached? Seriously how drunk is this blow hard?

Rudy Giuliani was inebriated on election night?

https://www.msn.com/en-us/news/politics/apparently-inebriated-rudy-giuliani-cited-by-jan-6-vice-chair-liz-cheney-people-react/ar-AAYpyzH?ocid=msedgntp&cvid=73c0531225e04a0a941040ef7d1de127

Why is this news? RUDY is drunk 24/7.

https://cnsnews.com/index.php/article/washington/susan-jones/economist-larry-summers-banana-republicans-who-minimize-jan-6-attack

Bruce Hall reads a dumbass Yahoo News headline rather than the latest paper from Lawrence Summers and now pretends Summers is the sainted guru on inflation. Well I hate to break this to Brucie but Larry is now blaming the “Banana Republicans” who dismiss Trump’s treason on 1/6/2021 are feeding inflation. Hey Brucie – you are a Banana Republican and your new BFF says YOU are responsible for this inflation.

More from this story ala Bruce Hall’s new BFF Larry Summers:

Summers said rising gasoline prices are “driven by the geopolitical developments around Ukraine,” something President Biden has been saying ever since Putin’s invasion, even though prices were rising before that. “It’s hypocrisy in the extreme when people…say we need to stand strongly with Ukraine, and then blame the administration for the fact that gas prices are higher than they were a year ago. I have been disappointed by some of the almost demagogic statements that have been made in that regard,” Summers said.

It is like Summers has been reading the dumbass comments from Bruce Hall and decided to sell Brucie out completely!

Good grief. Do we even have a Federal Reserve or, possibly, Treasury any longer?

https://www.nytimes.com/2022/06/13/technology/bitcoin-ether-price.html

June 13, 2022

Bitcoin drops 18 percent to lowest price since 2020.

By David Yaffe-Bellany

The price tumble was accelerated over the weekend by an announcement from Celsius, an experimental crypto bank, that it was halting withdrawals “due to extreme market conditions.” At one point this year, Celsius held nearly $20 billion in assets, attracting depositors with a promise of yields as high as 18 percent if they entrusted their cryptocurrency to the project.

Celsius is one of a number of start-ups in the murky world of decentralized finance that are coming under intense scrutiny as crypto prices drop….

ltr,

Not the job of either the Fed or the Treasury to prop up values of speculative assets when they crash.

Menzie’s comments section has a sort of rhythm. Sometimes, comments are light and mostly substantive. Other times, heavy and full of Faux News-derived bombast.

I don’t have a general theory of comments-section bombast. I do, however, have a special theory of bombast. The January 6th hearings have begun, so Trump-puppies need to create a distraction. Faux News viewers will be protected from learning the facts of Trump’s attempted coup, but swing voters who don’t live in the echo chamber have to be distracted.

Inflation! That’ll do it! Just look at all the effort in comments here to turn inflation into a purely political issue. Economics? Menzie, how dare you???? Inflation is politics, noying but politics, and don’t you forget it. And it’s all Biden’s fault! Not Covid, not Russia, not extended supply chains. Except maybe we should have let Russiw have Ukraine. And Moldova. And maybe Estonia, if everything works out right.

So please, let’s all ignore actual politics, like an effort to overturn a democratic election, and ignore actual economics, like longer-term inflation expectations. Only the inflation that can’t be fixed, today’s inflation, is worth your attention.

Don’t think. Just blame. Come on everybody, Blame Biden. That’s it. No insurrection to see here. Just…blame…Biden.

Our unofficial non-licensed Econbrowser panelists label this a 5-star comment.

MD, speaking of comment rhythms, there is a consistent issue of denying reality in the comments. That’s DENIAL s a single word description. You claim: ” Only the inflation that can’t be fixed, today’s inflation, is worth your attention. ” Can’t be fixed? Its cause is obvious to the voters. Your denial is showing. Inflation can be fixed if you can recognize its cause(s).

You’ve in the past claimed there was no war on fossil fuels. That’s just another example of your denial of reality.

If you actually believe these are causes for inflation: “Not Covid, not Russia, not extended supply chains. Except maybe we should have let Russiw have Ukraine. And Moldova. And maybe Estonia…” then show us the policy(s) promulgated to reduce their impacts.

I’ve made the case that the war on fossil fuels is a primary driver of energy price rises. Mucking with this fundamental set of commodities is seldom good. Setting policies to slow/limit their production and implementations are just plain dumb. Make a case for that being wrong.

It’s all political theater. We’ve gone from Russia, Russia, Russia now to Jan 6. Remember my comment about politicizing everything? You’re about to find out how wrong you are about voter gullibility.

there is not an honest statement in your entire comment.

Baffled – coward claims: “there is not an honest statement in your entire comment.” Show us what is not honest. Don’t lie nor deflect. The comment is in front of us. Show its dishonesty sentence by sentence. I especially want you to attack the sentence that quotes MD.

I’ll wait.

CoRev: I must apologize again for my policies shaping inflation and supply problems. Seems I’ve caused severe disruptions in the Russian auto industry with my thoughtlessness. God knows why you, “citizens of the world” find my actions reprehensible.

As Bloomberg reported last week “Russian Car Sales Collapse as IsolationHits Once Hot Industry”

What was I thinking?

Slapping myself when I read that “Only two of Russia’s more than twenty auto plants, onlytwo are open now…” To think that my policies were the root of such a disaster is indeed more than I can bear.

I promise to do everything in my power to correct my mistakes so that your friends in Russia can get back on the assembly line. You, as self-appointed spokesman for “citizens of the world”, deserve no less.

Some commenters may remember one form of unnecessary trump caused inflation that made Brazilian farmers wealthier that didn’t seem to bother you much—-SOYBEANS Kinda similar to how when Summers was on President Obama’s staff fiscal stimulus just didn’t seem to bother him alot. Funny how one’s seat in the room seems to effect how they feel about things.

Noneconomist,

Heck, I am guilty too. I do not know why I failed to cure Covid in China so that they did not have these lockdowns in Shanghai and other major cities that disrupted global supply chains. But then, maybe it is not my fault after all since CoRev assures us that it is all Biden’s fault because the entire problem is due to his war on fossil fuels. So, I guess we can sleep at night after all.

Nonecon, “CoRev: I must apologize again for my policies shaping inflation and supply problems.”

See my previous comment to you.

Barkley, you too could provide that list of policies that caused the current economic problems. I’ve asked the question multiple times.

One more time. (CoRev, is it possible you’re mixing your memory pills with little blue pills and some sort of testosterone booster?)

When asked how Bidencould be responsible for high inflation rates in Europe, you had NO answer.

Instead, you proclaimed yourself a “citizen of the world, and wrote , “Now we citizens of the world have to live with your poor policy judgments.”

By that, you are speaking for Slovenians, Slovakians, Russians, Brits, Germans, Greeks, et.al., are you not? And you (or your, uh, ghost writer) are blamingthe world’s inflation (supply chain disruptions, materials shortages, etc) problems directly on Biden and me.

What’s your problem then with me apologizing for my part in causing your fellow citizens in Greece to be facing the most expensive gasoline in Europe? You (or Casper your ghost writer) wrote about warning me “for years.”

Please. Check the medicine cabinet and make sure your meds are lined up properly. The NRA is now working to make mental health professionals more readily available. We all know you make little enough sense when you’re not over medicating.

And don’t worry. We’ll get those Russian workers back on the assembly line soon. My policies have hurt them dreadfully,I know.

CoRev,

You do not deserve a reply between your complete descent into infantilism here along with your history of lying and misrepresentation along with massive amounts of goal post moving even worse than the notorious Econned. However, I shall mention two where both Trump and Biden have been guilty.

One of the most important was Trump’s utterly unjustified withdrawal from the JCPOA nuclear agreement with Iran. He said he would get a better agreement, but that did not happen. Biden said he would rejoin the agreement, but messed up by listening to hawks who got him to demand more from Iran on missiles, so we are still not in the agreement. Now Iran has far more enriched uranium, including some that is weapons grade, than it ever had.

But the economic bottom line is that sanctions on Iran are probably responsible for it producing about 2 million barrels of oil per day less than it would be otherwise. This is way more than the slight increase that might have happened to US oil production if Biden had imitated Trump. Very bad policy voth in terms of nuclear weapons as well as inflation.

Then we have the Trump tariffs, which Biden has so far kept most of, although there are reports he might relax them. I remember you were a big supporter of those. Anyway, Biden has kept them because organized labor and lots of white workers in rust belt states support them, even when they are against their own interests, with the bizarre case of autoworkers at the closed Lordstown GM plant in Ohio supporting the very steel tariffs that helped lead to them getting laid off.

Barkley, so today’s inflation all Trump’s fault? Wow! I look back at the numbers and see fossil fuel prices rising right around the election and then Biden’s swearing in. I remember Biden’s claims of removing fossil fuels as a source for energy. I do agree that Biden has failed to remove most of the tariffs, and in your prior comment that was a cause of lower soybean prices. What’s today’s soybean price?

If Trump’s withdrawal form the JCPOA was a cause of today’s oil prices and therfore inflation, then we should see that starting early inTrujmp’s term. Macrotrends has a nice chart of oil prices by president: https://www.macrotrends.net/1369/crude-oil-price-history-chart

Wow how wrong can you be? Under Biden and Obama both we saw higher oil prices. Not Trump.

The hatred and desperation are palpable. We are living with the policies you fold have for years called for. Voters can feel the difference caused by policies in this and the past president;s terms.

CoRev’s brain has been haunted by trump propaganda for a long time now. All of it makes sense now.

A look inside CoRev’s haunted house:

https://www.youtube.com/watch?v=9NzQ05PhlMU

https://www.youtube.com/watch?v=Zo_mpwmashg

https://www.youtube.com/watch?v=wNk3LwaVkbQ