We’re roughly a month into Q3. Here’s a view, written a week ago:

…based on the indicators I track, yes, I think we are in continuing recession, and I expect a hard reset of the economy in H2.

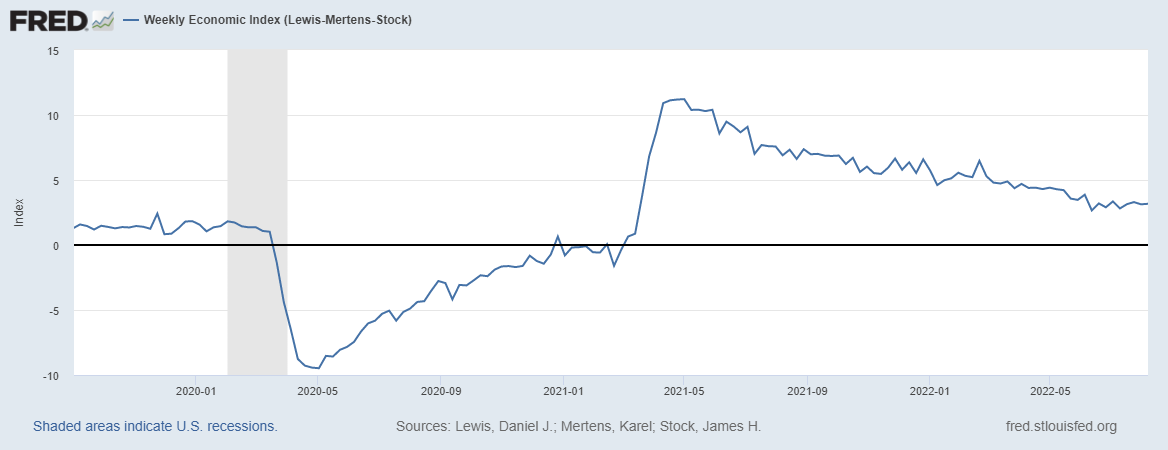

Here’s what the Merten-Stock-Watson Weekly Economic Index shows, for data for week ending on 6 August.

Source: NY Fed via FRED, accessed 8/11/2022.

From FRED:

The WEI is an index of real economic activity using timely and relevant high-frequency data. It represents the common component of ten different daily and weekly series covering consumer behavior, the labor market, and production. The WEI is scaled to the four-quarter GDP growth rate; for example, if the WEI reads -2 percent and the current level of the WEI persists for an entire quarter, one would expect, on average, GDP that quarter to be 2 percent lower than a year previously.

The last reading is 3.17%. That means, following the text above, “if the current level of the WEI persists for an entire quarter, one would expect, on average, GDP that quarter to be 3.17 percent higher than a year previously.”

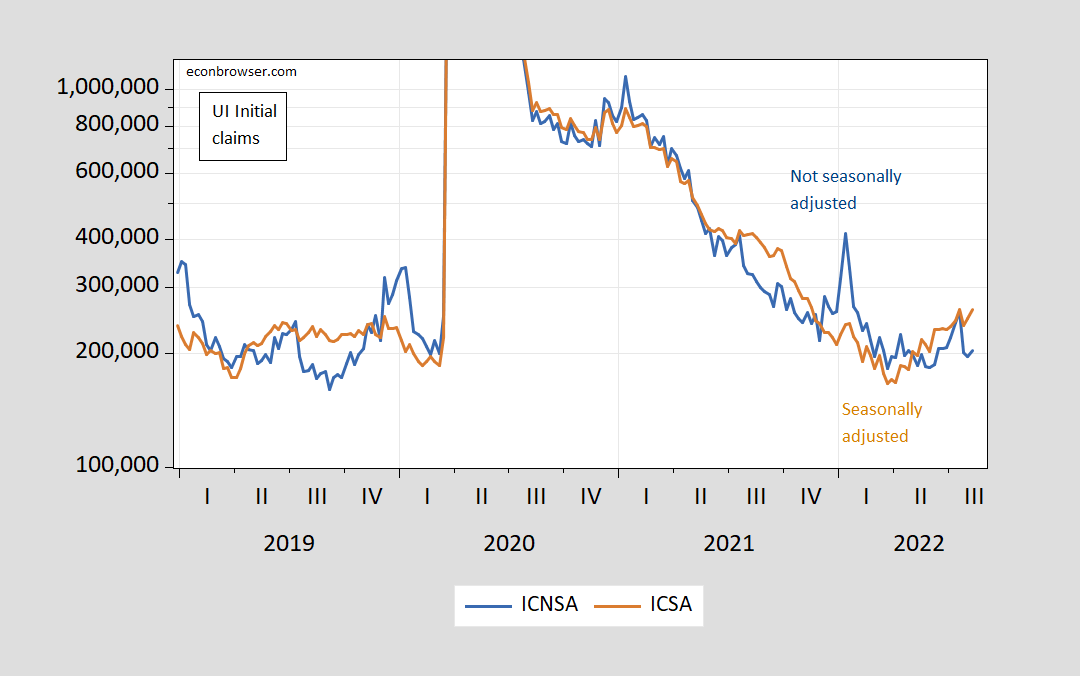

Some individuals have pointed to the rise in initial claims as evidence of an ongoing recession.

Figure 1: Unemployment insurance initial claims, n.s.a. (blue), seasonally adjusted (tan), both on log scale. Source: US Employment and Training Administration via FRED, accessed 8/11/2022.

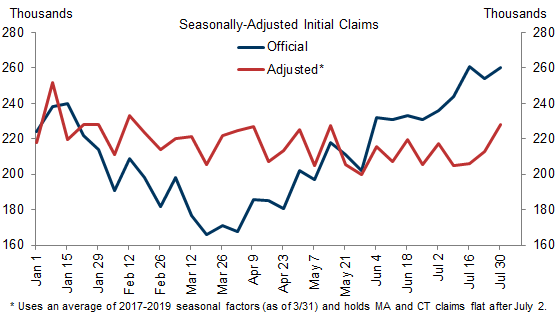

As noted in this post, the rise in initial claims seems to be a product of seasonal adjustment issues (the “shadow” from the 2020 recession) and misreporting in a couple states. Initial claims then seem to be rising much less remarkably.

Source: Ronnie Walker, “Explaining Away the Recent Rise in Initial Jobless Claims,” Goldman Sachs, August 10, 2022.

Cleveland FED’s 1-year expected inflation rate dropped from 4.2% to 3.3%.

https://fred.stlouisfed.org/graph/?g=SI3b

I’ve never been much of a “party games” kinda guy. I’m the socially awkward one who tries to find a corner of the room, hopefully with an adult drink in hand to calm social anxiety (TMI??). But I don’t care what Ricky Stryker says, this sure as hell beats pin the tail on the donkey. Wait….. is that what we just did??

Why is it that at parties, people seem to acquire social anxiety *around me*?

Guys? Where ya going …?

: )

I was afraid to post this, as it could send both Bruce Hall and Ricky Stryker into severe depression:

https://www.theguardian.com/us-news/2022/aug/11/democrats-midterms-win-projections-biden-republicans

It’s ok guys, if you’re feeling down you can go down to Florida and share a KFC bucket with the Orange Abomination. If you’re lucky he might even let you watch him smear ketchup on the wall as he discusses how he incited violence on the U.S. Capitol. Don’t worry about the clean-up, Mark Meadows always does hotel maid duty for the Orange One.

yep unemployment shows that as does employment growth. (sarc)

“the rise in initial claims seems to be a product of seasonal adjustment”

And yet Princeton Steve just said this has been rising every week (even though the recorded amount FELL the 3rd week of July). I guess if one repeats any assertion enough times some fools will think it is true.

Comes down to your faith in BLS. If you believe they can calculate seasonality correctly, then you use SA numbers. If not, use NSA. But pick one. If it’s NSA, then your view is that BLS cannot properly judge seasonality. I personally do not have a strong view about BLS’s competence in these matters and therefore defer to their analytics and judgement.

I would note, however, that I tend to prefer NSA numbers for VMT. Just too much chop in the data, as I have already noted, and the reason I prefer 12 mms.

Did you even bother to read Dr. Chinn’s post? I guess not. You abuse labor market data you do not even remotely understand. Nothing new here. Beveridge curve? HELLO? Like over 10 million job openings is a sure sign of a recession. You are indeed the dumbest troll ever. But please keep up your pathetic disinformation campaign.

Either IUCs are rising. or they are not. Which is it, in your opinion?

I will let the facts speak for themselves. That you choose to lie about the facts – that’s on you.

So are IUCs rising or not, in your view? You don’t even seem able to answer this simply question.

I think the ‘hard reset’ is underway and will continue. For example, the value of my home per Zillow is down 12% over the last six weeks. The hard resets include 1) job openings, currently rolling off at a 600k / month pace; 2) housing, mine rolling off 10% in the last month; and 3) the trade balance, reverting rapidly. I would note that we might also expect a hard reset at the SW border, pacing job openings.

Do we see these reversions without a recession? Don’t know, but I think it’s more likely than not.

As for other leading indicators: gasoline consumption this week continues low, but a bit better, same for diesel; total product supplied set a new low for the year. Initial unemployment claims continue to rise, albeit slowly and they remain at comparatively low levels.

So, we’ll see. If the US comes out of recession in Q3, that would tend to support the ‘technical recession’ thesis, that is, that the H1 downturn was the result of the stimulus rolling off. It is conceivable that inflation will also moderate accordingly. I have floated this notion before, and it’s conceivable.

However, if gasoline consumption remains where it is, I think it’s hard not to think we remain in some sort of recession. So, let’s see how it goes.

I would note that I expect Europe to be in recession in H2.

That, and similar sage advice, can be found here:

https://web.archive.org/web/20140106033827/http://granvilleletter.com/

https://en.wikipedia.org/wiki/Joseph_Granville#/media/File:Joseph_Granville_with_Reagan-by-Johanna_Granville.jpg

Your gibberish is getting more desperate by the day. Gasoline consumption? Your lies about initial unemployment compensation? Zillow? That is what you got?

Wow – we told you to sell your house a year ago. Of course you did not listen. You can’t listen as you spend the entire day bloviating BS.

Stevie did try to tell us Job Openings is a problem. Of course this incredibly dishonest troll cannot be bothered to provide a link to the actual data:

https://fred.stlouisfed.org/series/JTSJOL

The level of Job Openings is sky high. Now the last time this liar tried to pull data out of context, I provided references to something called the Beveridge Curve. Of course our bloviating BS artist could not be bothered to catch up on some basic labor economics.

Folks – Stevie does not know the basics. But that does not stop him for putting out disinformation to “support” his politically motivated claims of RECESSION.

Still waiting for a useful definition of “hard reset”. Without one, it looks like you are aiming at drama with deniability. Which would be par for the course.

It’s like hard lemonade, but even worse.

A hard reset is a reversion to mean or pre-pandemic level at historically rapid rates of changes.

For example, 30 year fixed mortgages rose from 3.22% on Jan. 6 to 5.81% in June 23rd (Freddie Mac Primary Mortgage Market Survey), a change of nearly 2.6% (pp) in less than six months. There aren’t too many periods with such a rapid rise in interest rates, certainly not as a percent of the initial rate.

Similarly, job openings declined by 600,000 last month, the biggest monthly decline in the series bar March and April 2020.

Finally, my house declined by 10% in value in one month. Can you find another time in history where US housing values fell by this much so quickly? (Albeit, this is one house, not an aggregate value).

I’ll let you do the trade deficit yourself.

These are all but unprecedented rates of reversion. Now, you may argue that US housing value can drop by 10, 15, 20% without an adverse effect on the real economy. And maybe they can. We’re coming off a truly screwed up stretch in monetary policy, so maybe things just normalize.

But that’s not the historical tendency. A steep drop in job openings and housing values are usually accompanied by a recession.

For example, on the 30 year fixed, you have to go back to 1981 to find a rise of 2.6% (pp) or more or the same time frame as seen this year. It’s not unusual, it is unprecedented in the last forty years.

https://fred.stlouisfed.org/series/MORTGAGE30US

I guess you choose not to saw the FRED graph on the 30-year mortgage rate because you did not want people to know it has declined in the last 3 weeks. Come on Steve – every time you LIE here, count on me exposing your dishonesty.

I just checked the history of this rate. It rose by 5% not less than 3% back in 1981. It rose by around 2% in 1987 and 1993. Come on dude – stop misrepresenting things so blatantly and start providing links to FRED so people can check out your totally bogus BS more easily.

So you claim to have a Vanderbilt PhD but don’t even have the guts to use your own name? You must not have a lot of confidence in your expertise.

Once again, you are demonstrating an inability to read and comprehend text. As I clearly stated in my comment, I used Freddie Mac’s Freddie Mac Primary Mortgage Market Survey, which posts weekly data.

I did not use annual data as I specifically stated the start and end dates as Jan. 6 and June 23rd. This is a period of 24 weeks. If you use a 24 week standard, then you have to go back to 1981 to find a similar period of such rapid rises. I was providing the Duckie an example of a ‘hard reset’ because he seems confused as to what that might mean. That’s an example.

As for declining interest rates, I made no comment on them at all. I was discussing rates of change, not levels. You do not seem to be able to distinguish between the two. What did they teach down there at Vanderbilt? How to hide your identity?

If you want to challenge my analysis, I suggest you consult the source data, which I clearly identified for you. You can find it here:

https://www.freddiemac.com/pmms

“Steven Kopits

August 13, 2022 at 8:28 am

So you claim to have a Vanderbilt PhD but don’t even have the guts to use your own name? You must not have a lot of confidence in your expertise.”

Rick Stryker pulled this pathetic stunt but had to back down when everyone else pointed out how absurd it was. Look Stevie – I am done just correcting your stupid statement and serial lies. Maybe it is time for me to tell you what I really think of the most arrogant bozo God ever invented. Then again I have too much respect for this blog. You have no respect for anything but your own bloviating.

Take your trolling somewhere else as EVERYONE here gets you are nothing more than an insulting clown.

“I did not use annual data”

If you knew how to READ the FRED graph I posted, it was WEEKLY data. And FRED puts its source in its notes.

Once again Princeton Steve completely blows a discussion as he is too lazy or stupid to notice what others are saying.

“For example, 30 year fixed mortgages rose from 3.22% on Jan. 6 to 5.81% in June 23rd ”

FRED shows this too but FRED shows that this rate fell after June 23 to less than 5% before rising to 5.2%.

An honest person would have told us that. You choose not to be honest. Go figure.

“I’ll let you do the trade deficit yourself.”

Thank you – I shall. Yes the current account has risen somewhat. WHY? Export ROSE which good macroeconomics would tell us should add to aggregate demand.

Yes imports rose more. WHY? That is what happens when aggregate demand is strong.

This is the most basic international macroeconomics that even freshmen in college learn. But not Princeton Steve. Dude – stop bloviating BS and take a freshman economics course.

Alright, trade deficit data. From March to June of this year, the deficit in goods and services compressed by $28 bn. The last time we saw comparable numbers were in Q4 2008 and Q1 2009, the worst of the Great Recession. And that’s just through June. Now, perhaps the deficit compresses without macro impact. It could. But historically, it hasn’t.

https://apps.bea.gov/iTable/iTable.cfm?ReqID=62&step=1#reqid=62&step=9&isuri=1&6210=4

https://www.census.gov/foreign-trade/Press-Release/current_press_release/ft900.pdf

“Steven Kopits

August 13, 2022 at 9:02 am

Alright, trade deficit data. From March to June of this year”

Did you read what I wrote? Short and in plain English but once again your feeble understanding of basic economics shows. Then again we all know you are BEYOND STUPID.

SK: If talking “zestimates,” how does that decline relate to overall increases for the past two years?

Over that time period, my house’s estimated value has increased about 24%, a decrease of 7% since the beginning of the year, yet still a considerable difference that has apparently outpaced the rate of inflation.

That (mythical?) increase certainly outpaces the losses incurred in my remaining index funds, though recent events have improved the gains in those too.

We are retracing. That’s the hard reset. The question is whether the retrace leads to the status quo ex-ante, or down a black hole. I don’t know, but historically, it has led down the black hole of recession.

Retracing. Hard reset. Suppression. The lying troll just makes it up as he goes!

Hard reset is the new way to say suppression.

A hard reset in the back side of excessive fiscal and monetary policy during, in this case, a suppression. A suppression can be considered an outage. The hard reset is the response to the exaggerated policies associated with misdiagnosing a suppression as a depression. For example, the end of the stimulus looks to see a hard reset in the trade balance, but we expect the balance to return to its pre-pandemic level about $30 bn below that of June. But I don’t know that we expect the balance to, say, go into surplus. My current expectation is merely that we reset to pre-pandemic levels, and that such a reset will occur — is occurring — with great speed. That may turn out to be a non-event, as it was in H1. There was no great unemployment, although very considerable pressure associated with inflation. Or maybe not. Maybe we see a recession. Such resets are historically associated with pretty brutal recessions.

Some of these hard resets, as you note, were also visible during the second oil shock of 1979-1983 and the depths of the Great Recession. Neither of those was a suppression; both had aspects of oil shocks, and in the case of 2008/9, financial crises.

In any event, a hard reset is not a suppression.

You do have this habit of making up your little pet terms. Dude – you are not doing macroeconomic analysis unless you count bloviating BS as the new macroeconomics. I would think you would grow tried of writing such nonsense since NO ONE takes your babbling seriously. Especially this know nothing garbage:

Some of these hard resets, as you note, were also visible during the second oil shock of 1979-1983 and the depths of the Great Recession. Neither of those was a suppression; both had aspects of oil shocks, and in the case of 2008/9, financial crises.

Oil did not cause the 1982 recession. The tug of war between Reagan’s fiscal stimulus and Volcker’s 2nd episode of tight money did. Oil certainly did not cause the 2008 recession. Only an idiot would make such claims. But you do repeatedly.

Sure, backside hard reset recession, depression.

But SK. Is your zestimate more or less than it was two years ago? If more, how much more?

From my comment above:

“A hard reset is a reversion to mean or pre-pandemic level>/i> at historically rapid rates of changes.”

SK: Simple question, more or less?

Above, YOU used the 12% zestimate decrease. Is it too much to ask that you follow up with the actual per cent increase or decrease?

Certainly not a technical question that requires any formula.

So, your home is currently down whereas since 2020 you are_____________________. One word and one number will do nicely.

Non –

Here are the numbers, index form.

Prior to the pandemic, let’s set the price of my house at 100. This value peaked at 166 this past June. The price fell to 150 (-10% from peak) in July, and currently stands at 145 (-13% down from the peak six weeks ago). The house, obviously, still has a Zillow value 45% higher than pre-pandemic, when interest rates were around 3.5%, as opposed to 5.25% now.

But a drop of your house value by 13% in six weeks, well, you don’t see that a lot in the historical data. That’s a hard reset. And it’s pretty clear the price is going to continue to fall rapidly in H2.

The question you are begging is whether it matters. For me, it doesn’t. I refi’d at a low rate, took no equity out, and don’t expect to sell the house anytime soon. So it’s all paper profits and losses. But I have two neighbors who bought houses in the last twelve months. Does it matter to them? It could.

Could we have a hard reset back to pre-pandemic levels without a recession? I don’t know. Maybe. But that’s not the historical tendency. Big declines in house values are typically consistent with not only recessions, but depressions. (You’ll recall that I define a depression as a balance sheet recession, where collateral values are impaired.) Further, if 30 year mortgage rates stay where they are, the value of the house should fall below its pre-pandemic value, simply as a matter of purchasers’ budget constraints and interest rates.

So we come back to the question of whether we can have a hard reset without a recession. I don’t know, but historically, hard resets happen in the context of recessions, indeed, depressions.

Steve,

I think you’re a smart guy and people here give you too hard a time.

But even I’m not taking your recession prognostication seriously. It’s like you’re going out of your way to completely ignore posts here written by a respected macroeconomist directed specifically at your claims about macroeconomics. At this point, why would you take your own word about growth seriously? You don’t even seem to be clear on what a recession is.

“I have floated this notion before, and it’s conceivable.”

That was after I explained to you how fiscal policy affects growth.

You are too smart to be fooled by Steve’s serial dishonesty. As in this nonsense:

Steven Kopits

August 12, 2022 at 12:41 pm

Check the FRED data to see why I think he is misleading people on this issue. He misleads on a lot of other matters too. Do I give him a hard time? YEA – I call out disinformation regardless of the source.

I haven’t made a recession prognosis. I called a negative GDP for Q2 based on IHS and Atlanta Fed forecasts. These proved correct, and combined with a negative print in Q1, would be sufficient to call a recession for H1 by the most commonly used standard.

As for Q3, I am agnostic on it. However, should oil consumption continue to decline — and total products did on a 4 wma basis in the past week — and should IUCs continue to rise, well, those are typically associated with recessions.

Nevertheless, as I have said before, we only have statistics for July, so let’s let some numbers roll in and see where we are. Moreover, I have stated that the technical recession may have been due to stimulus rolling off — that contractionary fiscal policy about which Menzie has written so many times before. On paper, before allowing for underlying growth, that would have amounted to a decline of about 4% of GDP, with the actual at 2.5% of GDP for Q1 and Q2 combined. So maybe the whole deal is a technical recession for Q1 similar to the downturn in 1947, ie, a decline of GDP associated with no material decline in employment and a quick recovery.

But this deal comes in two — in fact, three — different packages.

The second is an oil, and in Europe, natural gas, shock, and clearly that has taken some wind out of the US economy’s sails. As I have noted, the US in aggregate is in principal immune to an oil shock because we don’t import oil on a net basis. That is, losses in the consumer sector should be made up in gains in the oil sector, resulting in secular stagnation or stagflation in the case of the US. That, of course, is not true for Europe or the emerging economies which import most of their oil. For them, it’s the worst of all worlds, an oil shock in a commodity priced in dollars, with those dollars not devaluing because the US trade balance is not under pressure from high oil prices. This would lead to slow growth in the US and recession in a lot of the rest of the world. This is, for example, what we saw in 2011-2013 (2014), where the US saw secular stagnation and Europe suffered through a brutal five quarter recession.

For the moment, the oil sanctions story has ended with a Russian victory, with Russian output up again in July per the EIA’s August STEO, now only 3% below its pre-war level. I would note that the Urals discount — the difference between Brent and the Urals price received by Russia — has also narrowed slightly to $32 / barrel from $35 / barrel early in the war. That is, not only are the Russians producing at near-normal levels, they are also receiving slightly better per unit pricing.

Overall, however, increased Russian output reduces supply pressures and oil prices have fallen quite substantially. Is this enough to stem an oil shock recession? I don’t know. Let’s see if US gasoline consumption recovers materially. If it does, then by the metrics I use, we’re clear of recession risk for the moment. If not, well, I will tend to have a recessionary mindset.

Europe, however, will do down hard. Russian gas exports to Europe have fallen from around 16 bcf / day to around 3 bcf / day and natural gas prices there are consequently 10 times what they are here, and even here, they are about 2-3x what they were pre-pandemic. So it’s a big squeeze. Interestingly, the energy embargo on Europe from Russian is in fact working, while in the other direction is a failure. In any event, Europe is likely to go down hard. But those dynamics do not necessarily translate one-to-one to the US economy.

Finally, we are seeing a hard reset of the items I mentioned above. If you want to get a sense of what’s happening in real estate, see the yesterday’s output from Nick at Reventure. You might want to start at 1’50” (https://www.youtube.com/watch?v=6ZrFw4tPmC8&t=1350s)

Can the US do a hard reset without a recession? I don’t know. Maybe. Do I think it’s likely? Probably not. So when does that recession start? Q3? Q4? Next year? Don’t know. Sometimes you have to wait for more data to come in, and that’s what I am doing.

“I haven’t made a recession prognosis.”

Seriously? I get you are comfortable with lying but DAMN! Oh wait I guess someone has been posing as Steven Kopits. That would explain the incredible barrage of really dumb comments. You should ask this poser to stop.

Ole if he’s writing he’s lying, if you’re going to call someone a liar you MUST show and quote the source of your claim. Otherwise it is who is the liar. In your case too often you make the accusation without any evidence.

You still can’t understand how you achieved getting the name, Ole if he’s writing he’s lying,, because “Seriously? I get you are comfortable with lying but DAMN!” At least you can claim being a high level achiever.

Have I called Q3? I don’t think so.

Steven Kopits: You wrote two days ago:

.

That wording seems to indicate you believe we are in a recession now.

CoRev the mad barking dog chasing his own tail came to Stevie’s defense. Of course CoRev always steps in when the person he is defending has already gone in flames. CoRev is indeed THAT STUPID!

I think my comments, in part as you have quoted me, reflect my thinking, Menzie. I don’t make monthly recession calls, typically. How do I think August compares to, say, June or July? About the same, perhaps, based on what I can tell. Gasoline is cheaper, jobs are added, but IUCs continue to rise. Housing is beginning to implode in a big way, and I expect another big decline in job openings this month. I think it’s quite possible that we have a pause between two recessions, the first the stimulus roll off and the second the interest rate hikes. So maybe Q3 and Q4 are positive, but I think I still expect an interest-rate induced recession somewhere in the near future. As I have said, I don’t know, and will wait for more data to come in.

To add a bit more: If oil consumption, and in particular, gasoline consumption continues to fall, yes, I would be inclined to think we are still in recession. Total products were down last week; gasoline and distillate were up, but both are still weak on a 4 wma basis. With another three weeks of data or so, I would probably have enough to form an opinion.

https://www.census.gov/econ/bfs/pdf/bfs_current.pdf

Census released BUSINESS FORMATION STATISTICS, JULY 2022

It seems new business formations rose considerably.

Of course you will not hear about this from Princeton Steve who prefers to fish for just about anything to claim we must be in a recession/ Yea – his comments are not designed to inform as he really needs another invite by Fox and Friends.

Menzie

New Deal Democrat at Bonddad Blog is calling a recession starting late this year/early next year base on a number on long-leading indicators with a good track record. Take a look at his article and see what you think. http://bonddad.blogspot.com/2022/08/the-long-leading-outlook-through-mid.html

On a somewhat related note, was reading Greg Ip at WSJ on how recent legislation has added to the prospective deficit

https://www.wsj.com/articles/bidens-agenda-doesnt-give-priority-to-inflation-despite-rhetoric-11660233106?mod=hp_featst_pos4

but he didn’t discuss the current fiscal situation, which I recall as being somewhat on the contractionary/austerity side since ARPA benefits lapsed and weren’t renewed. Can you refer me to a source for ongoing estimates of the state of fiscal policy?

He tries too hard and overly real estate obsessed. This isn’t pre 2008 anymore.

I’m thinking the rise in initial unemployment claims might also be driven by the record low unemployment rates, which means employers are having to hire new or long-unemployed workers. Most of them will be fine, but I’d think there would be some that turn out unsuitable for their new jobs and end up getting laid off.

Interesting possibility. They’d have to be particularly terrible though. From what I hear from people working in Manhattan, companies are absolutely *desperate* keeping even people who are Donald Trump stable and Ted Cruz smart.

Someone gets labor economics. Good luck trying to convince the RECESSION cheerleaders.