With July in, it’s interesting to note that elevated probabilities of recession in 12 months come not from spreads, nor financial conditions, but oil prices.

Figure 1: Probability of recession from probit regression on 10yr-2yr spread (blue), on 10yr-3mo spread (green), and 10yr-2yr spread plus Chicago Fed Financial Conditions Index (tan), for 12 month horizon, estimated 1976M06-2022M07. NBER defined peak-to-trough recession dates shaded gray. Red horizontal line at 33%. Source: Authors calculations based on data in Figure 2.

While the probability for recession in 23M07 is now higher for the 10yr-3mo (due to the drop in this spread), it still remains below the 28.8% coming from the 10yr-2yr (see this article regarding 2s10s vs 3m10s). Notice including the Financial Conditions Index reduces the probability.

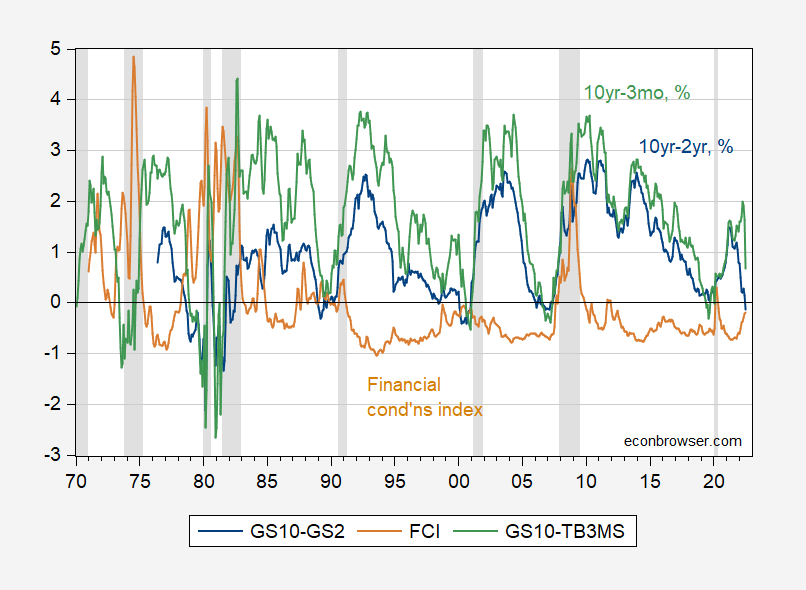

Figure 2: 10yr-2yr Treasury spread (blue), 10yr-3mo Treasury spread (green), both in %, and Chicago Fed National Financial Conditions Index (tan). Three month Treasury is yield on secondary market, FRED series TB3MS. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury, Chicago Fed both via FRED, NBER, and author’s calculations.

Why then are many forecasters indicating a high likelihood of recession. In some it’s foreign yield curves, inflation or unemployment configurations. One big determinant is oil prices; if one adds to the 10yr-2yr specification the relative price of oil (WTI to core CPI), then one adds to the forecasts the red line below.

Figure 3: Probability of recession from probit regression on 10yr-2yr spread (blue), on 10yr-3mo spread (green), 10yr-2yr spread plus Chicago Fed Financial Conditions Index (tan), 10yr-2yr spread plus relative price of oil (bold red), for 12 month horizon, estimated 1976M06-2022M07. July WTI oil price thru 7/23 and July core CPI is Cleveland Fed nowcast. NBER defined peak-to-trough recession dates shaded gray. Red horizontal line at 33%. Source: Authors calculations based on data in Figure 2.

Using a 33% threshold, this specification would miss the 1990, 2001 and 2020 recessions, but capture the others. Surely a wider search would yield a specification that captures the other recessions — a 3 month change in nominal oil prices captures 1990, 2001, but misses the 2007 and 2020 recessions (and comes close to predicting a recession in 2021M03).

The bottom line is that term spreads and financial conditions are not currently the reason that most are saying there’s a high likelihood of recession; oil prices are key to pushing probability estimates over the threshold.

(By way of contrast, note that I was getting over 40% probability of recession by 2020M06, back in 2019, using only 10yr-3mo term spread).

“The bottom line is that term spreads and financial conditions are not currently the reason that most are saying there’s a high likelihood of recession; oil prices are key to pushing probability estimates over the threshold.”

So if we manage to materially lower oil prices, then these models will not be giving a high likelihood of recession. One can only hope (even if our usual RECESSION CHEERLEADERS get mad at me for saying so).

The bottom line is that term spreads and financial conditions are not currently the reason that most are saying there’s a high likelihood of recession; oil prices are key to pushing probability estimates over the threshold.

[ The analysis is excellent and the conclusion seems obvious, the rhetorical question that comes to mind as before is why America has not been working directly with Venezuela on dramatically increasing oil production and refining capability. After all, there is no American hesitation to ask for assistance from Saudi Arabia. Why has Venezuela been treated so differently, seemingly to our economic disadvantage? The oil reserves of Venezuela are after all vast, even if differing in nature from those of Saudi Arabia. ]

Not to mention getting back into the JCPOA with Iran and ending sanctions on it, a good 2 mbpd out of there possible. Still needs to undo Trump’s worst foreign policy blunder of them all, which is now an economic problem.

https://www.nytimes.com/2022/08/01/opinion/can-inflation-reduction-save-the-planet.html

August 1, 2022

Can Inflation Reduction Save the Planet?

By Paul Krugman

After all the false starts and dashed hopes of the past two years, I’m reluctant to count my chickens before they’ve actually been signed in the Oval Office. Still, it appears that Democrats have finally agreed on another major piece of legislation, the Inflation Reduction Act. And if it does become law, it will be a very big deal.

First, would the law, in fact, reduce inflation? Yes, probably — or at least it would reduce inflationary pressures. That’s because the legislation’s increased spending, mainly on clean energy but also on health care, would be more than offset through its tax provisions; so it would be a deficit reduction act, which other things being equal would make it disinflationary.

But you want to think of the Inflation Reduction Act as being like the National Interstate and Defense Highways Act of 1956, which probably did strengthen national defense a bit but mainly benefited America by investing in the nation’s future. This bill would do the same, and maybe even more so.

To understand why this bill inspires so much hope, it’s helpful to understand what has changed since Democrats’ last big effort to deal with climate change, the 2009 Waxman-Markey bill, which passed the House but died in the Senate.

The core of Waxman-Markey was a “cap and trade” system that would, in practice, have operated a lot like a carbon tax. There were and are good arguments for such a system, which would give companies and individuals an incentive to cut emissions in multiple ways. But politically, it was easy to portray it as an eat-your-spinach plan, one demanding sacrifices from ordinary workers.

With the failure of Waxman-Markey, the Obama administration was reduced to a much more limited agenda, one that relied on carrots rather than sticks — tax breaks for clean energy, loan guarantees for companies investing in renewables. I think it’s fair to say that most economists didn’t expect these measures to achieve much.

But a funny thing happened on the way to the climate apocalypse: There was revolutionary progress in renewable energy technology, probably jump-started, at least in part, by those Obama-era policies. In 2009, electricity generated by wind power was still more expensive than electricity generated by burning coal, and solar power was more expensive still. But over the next decade wind power costs fell 70 percent, solar costs 89 percent.

Add in plunging battery prices and it has become possible to see the outlines of an economy that achieves drastic reductions in carbon emissions with little if any sacrifice, using electricity generated by renewable energy — as opposed to burning fossil fuels — to heat and cool our buildings, run our factories, power our cars and more….

I am saddened that Paul Krugman did not properly credit China for the huge gains in green energy productivity and cost reduction made all through this last decade. Chinese efforts on greening have been and are essential for all of us and we need to applaud the Chinese efforts and work with China from here. Rather, Congress with administration approval has been making it harder for America and allies to work on ecology matters with China:

https://news.cgtn.com/news/2022-05-26/China-builds-largest-pumped-storage-power-plant-in-Israel-1alRBy5ybte/index.html

May 26, 2022

Chinese-built lowest-altitude power plant in Israel enters final construction stage

A large-scale pumped storage power plant in northeastern Israel reached the final stage of construction on Wednesday, as a 200-ton rotor, crucial to turning water into electricity, was smoothly installed on a generating unit.

The 344-MW Kokhav Hayarden pumped storage hydropower plant, located near the city of Beit She’an and some 120 km away from Tel Aviv, is expected to be operational in early 2023.

The project is the largest of its kind in Israel, as well as the lowest of its kind in the world, as its powerhouse lies 275 meters below sea level, according to building contractor Power Construction Corporation of China (PCCC).

Featuring two reservoirs at different heights, both with 3.1 million cubic meters, the hydropower plant can operate at a water head of 500 meters.

The facility, usually connected to a grid, uses the off-peak power to pump water to its upper reservoir, and release the water to the lower one whenever it needs to generate electricity to help relieve peak demand on the grid.

“During off-peak hours, it pumps water from the lower reservoir to the upper and stores it, and generates electricity with gravitational energy when needed,” PCCC project manager Han Hongwei told Xinhua….

You’ll notice Krugman also did not write about Canada, Switzerland, Malta or Taiwan. Krugman isn’t obliged to write propaganda for a China.

Like someone who lives in NYC is going to be focused on India, China, South Africa. Heck I have become rather NY centric too. But OK – if China is doing its part, we should too.

Prof. Chinn:

Here is a graph of the Chicago Financial, Adjusted Financial, and Leverage Indexes, plus the Senior Loan Officer survey of lending conditions to large firms, all normed to zero as of their most recent values:

https://fred.stlouisfed.org/graph/?g=SpgJ

While none of them are perfect (see 1987 and 1998), their current values have most often occurred within one year of an oncoming recession.

The Chicago Fed itself is on record that the Leverage subindex is valuable as a leading indicator.

Respectfully, I do not think they support a sanguine case at all.

I do agree that gas prices are central to the idea that a recession is either imminent, or has already started (vs. is likely next year).

Similarly, the Office of Financial Research (OFR) financial stress index and most of it’s components are now positive (showing increased stress). Timing makes the connection to Fed policy pretty obvious:

https://www.financialresearch.gov/financial-stress-index/

… if we can only shift enough money from the private sector to government spending….

Your boy Donald Trump did his best. BTW I still see you do not know the difference between government expenditure v. government purchases.

Come on Brucie – an important and simple distinction. Are you really so stupid you do not get it by now?

Ole Bark bark show’s his ignorance even again. “BTW I still see you do not know the difference between government expenditure v. government purchases.”

His comment was about government spending. BTW, purchases are expenditures and expenditures are how governments spend. So enlighten us about the differences between each.

Come on Bark bark – an important and simple distinction. Are you really so stupid you do not get it by now?

It seems we are that ole fossil fuel externalities issue of which only liberals know what they are, ans that they are only negative.

“purchases are expenditures and expenditures are how governments spend.”

Even 18 year freshmen realize how utterly stupid this retort is. Look CoRev – the entire neighborhood has gotten tired of your rapid barking. Econned suggested you find a new hobby. Take his advice for your own good before the neighbors put you down for endangering their kids.

Ole Bark bark, show us where it’s wrong.

Check out this graph of real government purchases over time as clear evidence the Bruce Hall is indeed the dumbest troll ever:

https://fred.stlouisfed.org/series/GCEC1

Yea he thinks he is getting a little dig on President Biden but of course this MAGA moron does not know the difference between nominal government spending v. real government purchases. This MAGA moron once again fails to do a lick of economic research.

But wait real government purchases exploded under Trump but has been coming down since this horrific excuse of a President left office.

Bark bark woof woof, you are so clueless on this subject it is impossible to find a starting point. Read your own damned references to get a clue.