Reader Bruce Hall comments in his defense of calculating an 18 month change using not seasonally adjusted CPI data, and then 6 months of seasonally adjusted data:

…pgl insists on using 13.3% which is what I wrote on my initial comment regarding this “price level change” based on data not seasonally adjusted. After his “correction of my thinking” I used the Fed’s seasonally adjusted data which was 12.6% from January 2021 to June 2022. Of course, we all know that the end points of seasonally adjusted data are subject to revision as the seasonal factors are recalculated over time. So maybe after several months that number may be 12.4% or 12.8%. But the issue is not the exact percentage change but the general magnitude of that change and how that relates to subsequent (June-December) change. June appears to be the point of discontinuity which is not generally featured in the yr/yr numbers, but has to be gleaned.

Well, I’ve pointed out the hazards of doing 18 month changes on nsa data here; but what about adding nsa and sa data?

Well, here’s an example (from the Scott Walker campaign, in a post of 2016) of adding not only different series, but differently seasonally adjusted (or unadjusted) data.

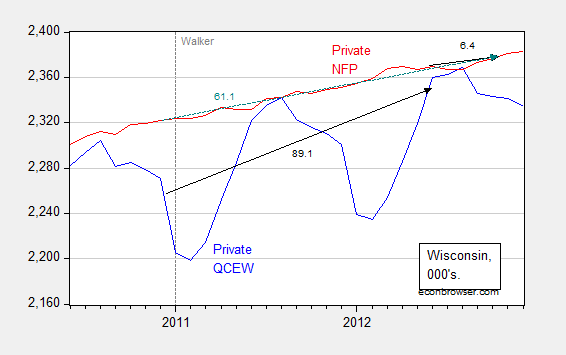

In particular Wisconsin Governor Walker’s campaign got into trouble when they touted job creation numbers obtained by adding together seasonally unadjusted jobs figures (from what is called the Quarterly Census of Employment and Wages) with seasonally adjusted jobs figures (from the establishment survey) to get a cumulative change in employment. (They did this because QCEW figures lag by many months, while the establishment survey data are more timely). This is shown in Figure 3.

Figure 3: Wisconsin nonfarm private employment from Quarterly Census of Employment and Wages, not seasonally adjusted (blue), private nonfarm private employment from establishment survey, seasonally adjusted (red). Black arrows denote changes over QCEW and establishment survey figures; teal arrows over establishment survey. Source: BLS.

Notice that one can calculate the changes from December 2010 (just before Walker takes office) to March 2012 (the latest QCEW figures available as of December 12, 2012), and then add to the change from March 2012 to October 2012 (the latest establishment figure available as of December 12, 2012). That is, add 89.1 to 6.4 to get 95.5 thousand, close to the 100 thousand figure cited by Governor Walker’s campaign. You can see why Governor Walker’s campaign officials did so – the correct calculation using the change in the establishment survey from December 2010 to October 2012 was only 61.1 thousand.

So, Bruce Hall is, if not in “good” company, in the company of the likes of the Scott Walker campaign.

It is sad that Bruce Hall decided to accuse me of using NSA data when it was me that pointed out that the use of SA data gave a 12.6% increase over his odd 17 month “year”.

Getting something wrong over and over again is bad enough. But now Brucie is taking a page from JohnH and just flat out lying.

“But the issue is not the exact percentage change but the general magnitude of that change and how that relates to subsequent (June-December) change.”

Oh Brucie gets fancy with his language designed to deflect from what he originally tried to tell us. Let’s put this in plain English. Inflation was high way back then but in the last 6 months has been really low.

Of course when Bruce started us down this rabbit hole – he was echoing the GOP line that inflation was out of control. A partisan lie Bruce was happy to parrot back then but he wants us to believe he never said that.

Brucie is not an honest fellow.

I don’t suppose it would hurt to point out that the use of y/y comparisons of non-seasonally adjusted data is common, while nsa comparison over any other period is uncommon, for a particular reason. The same seasonal effects felt in, let’s say, April of 2021, will also be in effect in April of 2022. A y/y change over in NSA data is likely to be very nearly the same as a y/y change in SA data. The same cannot be said for any other time span. Comparing NSA data over any other span is bad practice. Adding SA and NSA data…well…Menzie has handled that.

I had assumed that this is common knowledge, especially among those who regularly discuss economic data, and would till now have felt silly bringing it up. Recent events suggest common knowledge isn’t as common as I’d have thought. Sorry to bother the rest of you.

Menzie, I recall that you know the Arthur Laffer NSA story.

Macroduck: Yes, discussed in this post, along with a recounting of Casey Mulligan’s tangle with seasonals (amazing he subsequently became chief economist for Trump’s CEA).

Twelve years ago, there were more regulars in comments. Smart regulars. I miss ’em.

Alan Blinder made this point (among other key points) in the oped I linked to. Bruce Hall followed up with one of his usual snide but retarded comments which told me that Brucie decided not to read what Dr. Blinder sensibly wrote.

You may have heard that House Republicans are floating a bill to replace the income tax with a national sales tax. Well it seems those Socialists at the WSJ think this is not a good idea:

https://www.msn.com/en-us/news/other/masochist-republicans-are-poised-to-hand-democrats-a-gift-wsj-editors/ar-AA16AOMg

Calling the GOP caucus “masochists,” the editors cautioned House Republicans to kill Carter’s bill that would create national sales tax among other changes before it reaches a floor vote or suffer the consequences later.

Beginning, “Rule No. 1 in the legislative handbook is to make your opponent take the tough votes, but House Republicans may be reading it backwards. They’re set to vote on a national sales tax that won’t become law but will give Democrats a potent campaign issue,” the editors added, “The point is that a consumption tax might make sense if Congress were writing the tax code from scratch. But it isn’t, and we could end up with both a national income and sales tax, the later of which could evolve over time into a value-added tax.”

Maybe someone should tell the WSJ that both Japan and most European nations have VAT taxes and income taxes.

Off topic, supply trouble –

Peru is a copper exporter. Peru is in upheaval*. Here’s the story:

https://www.mining.com/web/peru-unrest-threatens-to-choke-off-almost-2-of-global-copper-supply/

Couple of things: almost 2% isn’t 2% and “threaten” isn’t the same as “gone”. Still, copper futures are up over 12% in the past month:

https://www.marketwatch.com/investing/future/hg00

Mining.com vaguely credits the lifting of lockdown in China with some effects, but commodities in general are upfar less than copper over the past month:

https://www.spglobal.com/spdji/en/indices/commodities/dow-jones-commodity-index/#overview

*Obviously, this is all Biden’s fault.

Chile is the main copper ore exporter but Peru is not far behind:

https://www.worldstopexports.com/copper-ore-exports-by-country/

The 5 biggest exporters of copper ore are Chile, Peru, Australia, Indonesia and Canada. Collectively, that concentrated group of suppliers shipped almost two-thirds (64.6%) of the total value for exported copper ore during 2021.

Copper Ore Exports by Country

Below are the 25 countries that exported the highest dollar value worth of copper ore during 2021.

Chile: US$26.7 billion (30.1% of exported copper ore)

Peru: $15.2 billion (17.2%)

Australia: $5.8 billion (6.6%)

Indonesia: $5.4 billion (6.1%)

Canada: $4.1 billion (4.7%)

Mexico: $3.42 billion (3.9%)

Brazil: $3.37 billion (3.8%)

Mongolia: $2.98 billion (3.4%)

United States: $2.92 billion (3.3%)

Panama: $2.8 billion (3.2%)

Kazakhstan: $1.8 billion (2.1%)

Taiwan: $1.31 billion (1.5%)

Russia: $1.25 billion (1.4%)

South Korea: $1.19 billion (1.3%)

Spain: $1.11 billion (1.3%)

Papua New Guinea: $884.4 million (1%)

Serbia: $855.1 million (1%)

Georgia: $817.7 million (0.9%)

Armenia: $769.3 million (0.9%)

Saudi Arabia: $673.8 million (0.8%)

Democr. Rep. Congo: $601.7 million (0.7%)

Ecuador: $490.1 million (0.6%)

Turkey: $454.7 million (0.5%)

Bulgaria: $426.1 million (0.5%)

Portugal: $325.2 million (0.4%)

https://www.macrotrends.net/1476/copper-prices-historical-chart-data

Copper priced almost reached $5 a pound back in March but the current price being near $4.30 per pound is really high.

MD, instead of looking at the yearly commodity index, look at the 10 year to actually see performance at presidential cycles. Yes, “Obviously, this is all Biden’s fault.”

The troll who flunked the economics of soybeans now pretends he is an expert on copper prices? Dude – most copper trade goes from places like Chile and Australia to China. And that’s Bidens doing? Yea – your are an idiot.

I’m not sure why the fixation on NSA data. I did use that once, many, many comments ago, but quickly changed to SA data. Yes, for things like employment in Wisconsin, SA data certainly is important for understand true changes in employment.

Your Figure 3 above is not similar to the relationship of SA versus NSA for the CPI, but I understand it is for example purposes where there is significant seasonality. I used to use the old Census software for seasonality back in the 90s for analyzing replacement parts sales for Ford Motor Co so the concept is not foreign

https://www.bls.gov/cpi/tables/seasonal-adjustment/seasonal-factors-2022.xlsx

With the exception of travel related and luxury related items, the monthly adjustments tend to be relatively minor, not at all like Wisconsin employment.

However, the links and data I have been providing and to which incessant comments about “convention” and “seasonality” have been SA data for CPI (admittedly I just used the the index for All Urban Consumers: All Items in U.S. City Average (https://fred.stlouisfed.org/series/CPIAUCSL) and probably should have used for the total US, but I got tired looking for those monthly values rather than just the published percent changes. So I used a fairly decent surrogate. That was not the important issue; the issue was that between 1/21 and 6/22 inflation (prices) was increasing rapidly (approximately 13% for the period) and then from 6/22 to 12/22 it was fairly flat (abated). Yes, different length of time, but so what? Isn’t that the same argument made by climate worriers who say temperatures rose slowly for 100 years and then quickly for 30? Should they be waiting another 70 years?

From my recent comment:

Menzie, I repeat, I used the seasonally adjusted data from the Fed for the calculations.

https://fred.stlouisfed.org/series/CPIAUCSL

January 2021 = 262.2

… rapid inflation

June 2022 = 295.3 (rapid upward trend stops)

July 2022 = 295.3

… low inflation

November 2022 = 298.3

December 2022 = 298.1 (low increase since June)

https://econbrowser.com/archives/2023/01/services-inflation-some-data#comment-293025

Your comment to me regarding the use of 3-month smoothing is appropriate. It can eliminate a lot of “noise” if the monthly values are gyrating. However, in the case of the CPI, the monthly values (not percent change) were trending fairly smoothly from 1/21 to 6/22. Then from 6/22 to 12/22 they flattened out fairly smoothly. In this case using 3-month smoothing would have meant needing 5 months of data to get 3 smoothed points which were not much different from 3 single months of data.

btw, 1/21 through 6/22 are 18 data points. 12 in ’21 and 6 in ’22; count ’em.

All of this is to say that the 6.5% yr/yr inflation rate for December is completely misleading and should not be the basis for current Fed economic policy. That inflation water already spilled over the dam six months ago.

I understand, from your perspective, why you want to button everything down “perfectly”, but sometimes in the quest for perfection we miss the bigger picture.

https://www.goodreads.com/quotes/108491-perfect-is-the-enemy-of-good

Bruce Hall: I do not understand your remark: “(admittedly I just used the the index for All Urban Consumers: All Items in U.S. City Average (https://fred.stlouisfed.org/series/CPIAUCSL) and probably should have used for the total US”. CPIAUCSL pertains to all US, but cities. There is no rural counterpart or a CPI that encompasses rural areas as well as cities, published by the BLS as an official series. (There is an HICP; you might want to check that out.)

Okay, perhaps I misunderstood this:

https://fred.stlouisfed.org/series/CPALTT01USA661S

I could not find a current version through 12/22. I’ll presume there is one, but I don’t follow all of the various report to know exactly where to look. So I used what I thought was the next best series. I wasn’t looking for a complementary rural series, just a US total. Regardless, the All Urban Consumers: All Items in U.S. City Average should be reasonably good enough to tell the story of what has happened.

I responded to pgl here: https://econbrowser.com/archives/2023/01/services-inflation-some-data#comment-293071 and that is still my point. If you disagree, I’d rather have your reasoning rather than being pointed to another dataset. Do you agree or disagree with my response to pgl that…

That bigger picture is that the “conventional” way of reporting inflation (yr/yr) is not a good tool for identifying a discontinuity in the momentum of inflation and certainly is not what the Fed should have been looking at since October which led to rate hikes of 0.75 and 0.50 pp. and may push the US unnecessarily into a recession.

https://finance.yahoo.com/news/federal-reserve-raises-interest-rates-to-highest-since-2007-sees-higher-rates-in-23-190034046.html

Bruce Hall: You downloaded a series from FRED that is clearly identified as coming from OECD’s Main Economic Indicators (only at annual frequency). Now, if you download BLS series for CPIAUCSL, aggregate to annual (or download directly from BLS website CPI all urban), you will see that it is exactly the same series as the one you downloaded from. So…in point of fact, the series you are citing is total for *all US cities*. Sorry. Try again.

Bruce Hall

January 21, 2023 at 7:53 pm

This is when you started using SA data?

Your original comments on this were back in early Nov. 2020. Waiting for over two months is not exactly quickly correcting your error. Bruce – for someone who LIES routinely, you are not very good at it.

Brucie is lying about how the conversation before the election went down. But yea Republicans do lie a lot and later claim they did not say what they really said.

No Brucie first claimed his NSA series differed from the SA series I noted back then was my omission of the price of cannibus. I guess he smokes a lot of that stuff.

Sorry for the misplace bold. Dislike the old html code.

How did we miss this?

‘Bruce Hall

January 20, 2023 at 6:49 pm

pgl, I know what’s bothering you and Menzie. You want everything expressed as either an annual or monthly change rate. I don’t feel constrained by that arbitrary limitation. If there was 12.6% or 12.5% inflation over 18 months, that’s clearly understandable. I don’t have to take that and divide by 18 and multiply by 12 to make it an “annualized” figure.’

Kids in pre-school know 12/18 = two thirds. Kids in pre-school know how to quickly multiply 2/3 times 12.6, But Brucie finds such simple calculations time consuming and diffcult? Hey Brucie – get a copy of Microsoft Excel and it can do these advanced calculus exercises for you.