One major question posed by recent events is whether the issues SVB faced would’ve been caught had EGRRCPA not been passed (which raised the threshold for what qualifies as a SIFI). Bill Nelson at the Bank Policy Institute has an illuminating post arguing that the liquidity coverage ratio (LCR), which would have applied to SVB had it been classified an SIFI, would not have been triggered. People like former Senator Toomey (a cosponsor of the 2018 act) have asserted that the LCR wouldn’t have caught SVB. Here’s the logic I think he, and others, is relying on.

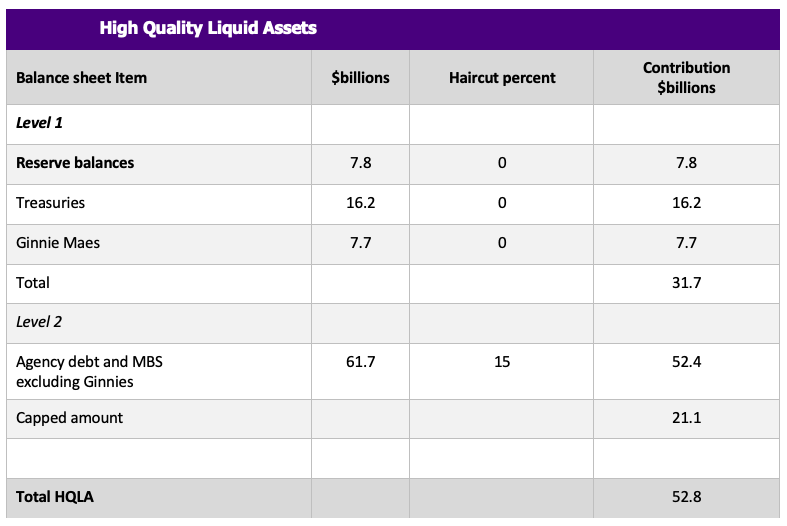

The LCR for the largest institutions is designed to cover 30 days of stress. For smaller and less complex institutions, the LCR’s stress assumptions are relaxed by multiplying projected net cash outflows by 70 percent. Absent S. 2155, SVB would have been subject to this reduced LCR requirement. To estimate SVB’s LCR, it is necessary to estimate the two components, [High Quality Liquid Assets] HQLA and net cash outflows. All data are as of Dec. 31, 2022, and are from SVB’s 10-K and call report. The results are summarized in table 1.

High-quality liquid assets consist of reserve balances (deposits at a Federal Reserve Bank), Treasuries, agency debt and agency MBS, and a few other things. The securities are marked to market. Reserve balances, Treasury securities and Ginnie Maes (which are fully guaranteed by the U.S. government) are included in level 1 HQLA, which must be at least 60 percent of HQLA. Agency debt and agency MBS are included in level 2a and are subject to a 15 percent haircut. SVB had $7.8 billion in reserve balances, $16.2 billion in Treasury securities at fair value and $7.7 billion in Ginnie Maes at fair value, so $31.7 billion in level 1 HQLA. SVB had $61.7 billion in agency debt and agency MBS (excluding Ginnie Maes) at fair value; after the 15 percent haircut, that’s $52.4 billion in level 2 HQLA. Because level 1 HQLA must equal at least 60 percent of HQLA, SVB’s holdings of level 2a HQLA are capped at $21.1 billion. In sum, SVB would have had $52.8 billion in HQLA for LCR purposes.

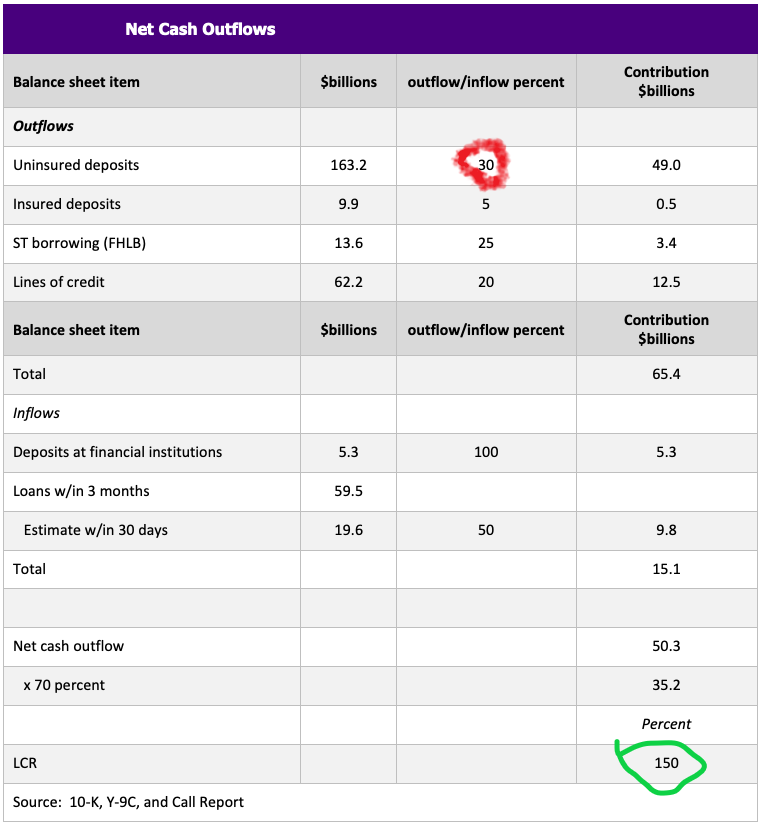

Net cash outflows are more complicated. They are calculated by applying pre-specified factors to various balance sheet and off-balance-sheet items. The factors are chosen to replicate the situation during the GFC, with significant idiosyncratic and market-wide stress. In many cases, the precise factor to apply depends on information that is not contained in the 10-K. An additional restriction in the LCR is that projected inflows cannot exceed 75 percent of projected outflows. As noted, for a bank of SVB’s size and other characteristics, net cash outflows are then multiplied by 70 percent.

First, outflows. SVB has $173.1 billion in deposits, of which $161.5 were domestic. Of domestic deposits, $151.6 billion were uninsured, indicating $9.9 billion were insured. We therefore estimate that $163.2 billion of total deposits were uninsured (total – domestic insured). The outflow rate on uninsured deposits of retail and nonfinancial business customers varies between 10 and 40 percent depending on the characteristics of the depositor and deposit, with the lower outflow rate applied to retail customers including those small businesses that are treated like retail customers. The outflow rate on uninsured deposits of financial business customers varies between 25 percent for operational deposits and 100 percent for non-operational deposits. If we assume a 30 percent outflow rate, that’s a $49.0 billion outflow.[1] The outflow rates on insured deposits are 3-40 percent, where 3 percent is for a stable retail deposit. Assuming an outflow rate of 5 percent results in a $0.5 billion outflow. SVB had $13.6 billion in short-term borrowings, which are almost entirely FHLB advances. The rollover rate on FHLB advances is 75 percent so the outflow from the short-term borrowing is $3.4 billion. SVB had $62.2 billion in lines of credit and letters of credit. The drawdown rate assumption on lines of credit is between 0-30 percent depending on the type and the counterparty. If the drawdown rate is 20 percent, the outflow would be $12.5 billion. Total estimated outflows are $65.4 billion.

Second, inflows. SVB had $5.3 billion in deposits at other financial institutions, all of which are assumed to be an inflow. It had $73.6 billion in loans of which $59.4 billion mature within three months. Half of scheduled repayments on most loans are treated as an inflow. If we assume, conservatively, that one third of the loans that mature within three months mature within one month, the inflow would be $9.8 billion. Total estimated inflows are $15.1 billion.

Estimated net cash inflows is $50.3 billion, or $35.2 billion after multiplying by 70 percent.

SVB’s LCR would therefore have been 150 percent ($52.8 billion/$35.2 billion) on Dec. 31, 2022. The requirement is that the LCR be equal to or above 100 percent.

Table 1 in the article cleary lays out the simple math.

Divide Total HQLA by estimated net outflow leads to the LCR of 150% (circled in green below).

The LCR = 150% depends on a outflows of 30% on uninsured deposits.

Given the rapidity with which SVB lost uninsured deposits, I wondered about the assumption of only a 30% outflow rate on the sum of operational and nonoperational deposits. Taking all the other assumptions Mr. Nelson used, I varied the 30% outflow rate to search for what would yield a LCR less than 100%. The answer is 46%.

In one day (Thursday last week), depositors took out $42 billion according to journalistic accounts, so in a single day, 24% of deposits left. I don’t know what the regulators would’ve assumed in their stress tests, but in any case I’m not sure 30% would’ve been the right number.

So, in my book (taking into account I’m not a regulator, and have no such experience), it’s not clear-cut that having SVB listed as a SIFI wouldn’t have at least made supervisors look at SVB a bit harder. By the way, having 76% of total debt as being held to maturity (i.e., 2.2% securities available for sale) means that the typical LCR based on a calculation based on all high quality liquid assets would have needed a footnote.

None of this is to deny the fact that concentrating assets in Treasurys and agency debt without hedging interest rate risk seems to have been a dumb idea, given the telegraphing of rising rate.

As someone with only his Bachelor’s, not a Master’s degree in Finance, I don’t see anything wrong with your analysis or breakdown here.

Also, I should say, as someone with 3+ years past experience in the semi truck industry, semi drivers have a common saying for what Mr. Toomey is doing. It was a “code of conduct” mentioned frequently, night and day, by drivers~~~”CYA”. What else is Toomey going to say?? “Boy…… I sure screwed the pooch on that EGRRCPA bill, didn’t I??” He’s operating as any politician would and does.

Some related links, worthy of perusing:

https://www.creditslips.org/creditslips/2023/03/oops-how-the-fdic-guaranteed-the-deposits-of-svb-financial-group.html

https://www.creditslips.org/creditslips/2023/03/who-knew-silicon-valley-was-on-park-avenue-manhattan.html

https://www.creditslips.org/creditslips/2023/03/whats-going-on-with-first-republic-bank.html

https://www.creditslips.org/creditslips/2023/03/why-werent-silicon-valley-bank-depositors-using-cdars-.html

https://www.creditslips.org/creditslips/2023/03/what-could-go-wrong-when-a-dip-maintains-a-large-uninsured-deposit-account-at-silicon-valley-bank.html

https://jentaub.substack.com/p/friday-fiascos-bank-bailouts-are

https://bettermarkets.org/newsroom/silicon-valley-bank-accountability-now-for-failed-federal-reserve-regulators-reckless-bank-executives-negligent-board-members/

https://bettermarkets.org/newsroom/the-federal-reserve-cannot-investigate-itself-for-its-failure-to-properly-supervise-silicon-valley-bank-an-independent-ig-needs-to-be-appointed-asap/

https://bettermarkets.org/newsroom/white-house-call-for-accountability-for-reckless-bank-executives-is-excellent-but-reversing-trumps-vast-broad-deep-and-dangerous-deregulation-is-also-required-asap/

Catherine Rampell is also on Al Franken’s latest podcast. She does discuss SVB in her visit with Franken and I assume makes mostly broad strokes on the topic.

I thought this article (I read it 13 years ago and still remember it to this day) by Yadav Gopalan, is very informative, and if you are looking for a “shorthand” way to evaluate a commercial bank’s “soundness” looking at Gopalan’s breakdown is useful. You’re looking for page 1 and then jump over to page 5 of the Fed Res pamphlet:

https://www.stlouisfed.org/-/media/project/frbstl/stlouisfed/Files/PDFs/publications/pub_assets/pdf/cb/2010/CB_Spr_10.pdf

Kids, Uncle Moses got that by “snail mail” when it first came out.

Acronyms can be a very useful memory trick, not just a way to be snobbish, or keep things “for insiders only” or “insiders lingo”. CAMELS is a great memory trick to use when looking at banks’ financial solidity or even as a personal investment.

Menzie, your conclusions are so true. “Surely, had interest rates not risen so much over the past year, the SVB collapse might not have occurred so soon. But given the downturn in the tech sector, SVB (given not subject to annual stress tests, and liquidity requirements) would have probably encountered a run (Toomey’s assurances notwithstanding).” From here: https://econbrowser.com/archives/2023/03/banking-turmoil-deregulation-vs-monetary-profligacy-vs-unanticipated-events

and

“By the way, none of this is to deny the fact that concentrating assets in Treasurys and agency debt without hedging interest rate risk seems to have been a dumb idea, given the telegraphing of rising rate.” From this article.

But they both miss the underlying causes: Biden’s inflation and Biden’s Fed response to it.

No amount of bank regulation would have altered their impact. Some reports show ~50% of today’s banks are in similar maturation/interest rates mismatch. Only the ignorant believe this is not systemic.

CoRev: If you haven’t noticed, inflation rose all around the world. Are you saying Biden caused all that inflation too. I’ll have to tell (using your logic) that Lagarde is off the hook. Also BoE’s Bailey. And…

I don’t think most banks were/are as bad at matching maturity, and/or managing interest rate risk. And managing diversity of their depositors. It’s very stupid to think this is “systemic”. It’s only systemic in the sense of the drastic rises exposing which individual banks did a poor job on managing different types of risk. It’s very ironic that bankers and finance types who constantly wave the naughty finger at the federal government on possible debt crises cannot effectively manage money literally handed over to them on a silver platter by depositors. And again, the real idiot here (as usual) is CoRev, who thinks the depositors at SVB were the “typical” depositors (or as diversified in jobs/industries) you would see at the average American bank.

Again, Warren Buffett has made the analogy that when the tide washes back out to sea, you see who is wearing their swimming trunks. Most banks were/are wearing their swimming trunks. This is NOT “systemic”. Credit Suisse was having issues long before the rate hikes, as were SVB and First Republic. Macroduck and I, along with many financial journalists, were discussing Credit Suisse months ago. (Shall I pull up the links for our learning disabled Cali resident CoRev??? Happy to, just give the word. The rate hikes exposed problems in risk management already there over a period of years.

SVB was a case of particularly poor bank managing. Their risk manager resigned. The bank deserved to be dissolved. The people in charge of the mess deserve to lose their money and any future employment in banking. We need to change the law so that actually will happen in the future.

However, the problem was that they were big enough to precipitate a crisis for the rest of the banking system and the economy. A lot of people, who had nothing to do with this, would have ended up without a paycheck if the “free” market forces had been allowed to do their thing. If you have the ability to do that kind of damage to others you should be forced to be cautious (regulation) and also to have insurance (enhanced FDIC). That is why I am subject to all kinds of traffic laws and also must carry liability insurance on my car. The idea that regular folks need to be restricted and held accountable but bankers don’t is absurd and has been proven wrong again and again.

Menzie, now you are describing inflation globalism? I think this EU chart clearly shows what caused inflation there: https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Inflation_in_the_euro_area The cause here and in the EU is the same, and Biden jumped onto the same band wagon with both feet.

Energy prices started rising here and in the EU with Biden’s inauguration, just as he promised to halt climate change. For the Biden supporters/apologists, that was a year before Russia invaded Ukrania.

Actually, in answer to your question: “Are you saying Biden caused all that inflation too.” Yes, by following the same foolish Net Zero policies. Y’ano, SVB’s failure is only one fall out from those policies. Inflation

Biden, a liberal Democrat, is implementing your and your fellow liberals preferred policies. How are they working out?

Thanks Biden and his apologists.

Biden’s Fed? When you decide to lie, as you are doing here, you need to try harder. This isn’t even a challenge.

Powell was appointed by Trump. Regional presidents are appointed by regional Fed banks’ boards. Governors have lengthy terms to avoided letting Presidents influence monetary policy.

C’mon! If you insist on lying, at least put some effort into it.

This is like all those time right wing bloviators said “Democrats are in control! Why don’t they (fill in the blank)” while Republican Senators were threatening filibuster of every bill Democrats offered. It’s not Biden’s Fed and it’s not Biden’s inflation. CoRev is lying.

MD, tries to deny the results of his own preferred policy implementations by his President.

Tsk, tsk, you can do better.

I forgot the link to Reports: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4387676

Monetary Tightening and U.S. Bank Fragility in 2023: Mark-to-Market Losses and Uninsured Depositor Runs?

Interesting paper but nowhere does it say Biden caused inflation. Now maybe you think Powell’s tight monetary policy was inflationary. Yea – CoRev is that stupid.

I don’t understand why US laws are both so massive and so lacking at the same time. An internal model (principle based) like approach with sensible baselines (rule based) for regulators would have caught this? SVB was a bank twice the size of a mid-sized European insurer. At that size they all run internal models for Solvency II. Heavily regulated, heavily staffed, high in cost and usually high in saving compared to the baseline regulatory models. But easily attainable for a firm with 9k personnel. For SVB the regulators on the local firm should have understood the local portfolio of customers, recognized the company specific nature of volatily in outflows and relation to IRR and adjusted the regulatory nature of the internal models accordingly. This might sound like EU-hubris and bias, but it is the way it works on the ground here. I’m critical of the say 40 million an insurer here pays in yearly regulatory fees, but in this case the principle based approach to regulations sounds and feels more efficient.

Willem: Well, ask Senator Crapo.

I’m getting dozens of facial images in my head now, most with an R to the right of their name.

This is not a regulatory problem. This is a cost of deposits problem. The 3 mo t-bill rate, as of Friday, was 4.57%. The smaller banks committed their balance sheets when cost of funds was all but 0%, often in the form of 30 year mortgages, at 3% or less. If we add 1.5% of assets to cover bank operating costs, then the breakeven operating cost for the smaller banks is about 6% versus 3% income from mortgages. Again, this is not hard math and the reason why all the mid-sized banks collectively are begging for a backstop.

As I have said, the Fed better get the FFR back to 2.5-2.75% promptly, or else it will bring down the entire mid-tier banking sector.

https://www.axios.com/2023/03/19/svb-fdic-signature-bank-midsize-banks

https://ycharts.com/indicators/3_month_t_bill#:~:text=3%20Month%20Treasury%20Bill%20Rate%20is%20at%204.57%25%2C%20compared%20to,long%20term%20average%20of%204.17%25.

Steven Kopits: Hmm. Well, I’m glad you finally figured out how to read a balance sheet. But I’m not sure you understand that if banks adequately addressed interest rate risk (as in a basic money & banking textbook) matched interest sensitive assets and liabilities, they wouldn’t necessarily be in this situation.

Would it kill you to read (1) a money and banking textbook, (2) a macro textbook, (3) a basic stats textbook, before pontificating further?

By the way, do you finally admit you misunderstood my post on SVB, to wit [1], my response,[2], my response, [3], my response?

Stevie seems to miss a lot of things. I guess he really believes banks are incapable of holding assets with expected returns greater than 2%. I guess I missed reading the Hungarian version of Money and Banking that Steve apparently learned from.

@ pgl

Hey, if your stratospheric forecasts on oil price increases was getting beaten into smithereens on each and every subsequent oil price forecast made, you’d be screaming to the world “we need 2.5% FFR!!!!” too. Yes?? Come on now, play ball with the perennial forecasting failure or Kopits is taking his football and go home this instant.

Folks, this nutjob narcissist Kopits, is saying he’s melancholy that the Fed Res did not do more stress tests, at the same time he’s saying regulation is “bad”. He can’t go a single blog thread without contradicting his own statements. Is this someone you want to argue with everyday?? I’ll pass on that.

Did Stevie first tell us the regulators “botched” this. Oh wait – he now says it is not a regulation issue. No – it is the downside of having tight monetary policies. Of course it was not long ago when little Stevie was complaining that monetary growth was way too high.

I have been noting for a while Stevie has very malleable opinions.

I am glad you finally understood what I was trying to tell you.

Kopits says: “I am glad you finally understood what I was trying to tell you.”

This is the same exact style of narcissistic behavior we regularly saw from Barkley Rosser Jr. Presenting imaginary statements made by people he argues with, with the sole intent of misrepresenting reality. It’s very common among narcissists. It’s literally a clinical red flag for diagnosis of possible narcissism.

Remember when Barkley Rosser Jr said, because I was correct that war in Ukraine was no doubt about to happen because of many reasons, including, but not limited to, Russian troops on the southern border of Belarus, that mean I was “happy” about war. Being “happy” about war is a serious and dark accusation. In this specific case it is TRUE libel and slander. (BTW, something Rosser cried wolf about roughly every even numbered day on this blog.) This is what mentally ill people do. It’s an attempt to make honest, conscientious, inward looking people doubt themselves or appear guilty about things not bearing in fact/reality.

WTF? YOU do not understand your own babble.

“Midsize banks plead for unlimited FDIC backstop for two years”

It seems they are worried about a liquidity issue. You on the other hand seem to be saying these banks are insolvent. But who knows given how your bombastic writing only shows you never learned basic Money and Banking.

Oh wait – you do not know the difference between liquidity issues v. solvency issues – do you? If so, could you please stop writing these utterly stupid comments?

Stevie is pretending to be qualified to say what is and is not a regulatory problem. Stevie the consultant is doing the consultant shuffle again, pretending to know things that clients might ask about.

Stevie does the consultant shuffle just about all the time. He also does the right-wign suck-up all the time. Now imagine a sime Venn diagram, two circles which partially overlap. One circle is Stevie’s consultant shuffle. The other is the right-wing suck-up. Stevie lives in the intersection of those two circles. Now, imagine a third circle which represents truth. Only where truth overlaps both the suck-up circle and the shuffle circle will Stevie ever speak the truth. It’s a tiny sliver on the best of days.

Last July, we had a debate about interest rates going forward per a solid analysis by David Papell and Ruxandra Prodan, “The Fed Fell Behind the Curve by Not Following its Own Policy Rules”

This is worth re-reading in its entirely, and I dare say, my comments proved prescient.

https://econbrowser.com/archives/2022/07/guest-contribution-the-fed-fell-behind-the-curve-by-not-following-its-own-policy-rules

Steven Kopits: But in that Papell/Prodan piece, the actual FFR was less than the prescribed as of 2022Q4, or even 2023Q1, except in one case (balanced approach-consistent), which is not the most apt description of stated policy framework. If we are talking about impact on asset valuations, it should be the levels of rates, not the pace, that matters. In the case of SVB, they didn’t seem to alter business model even as the long interest rate moved, so what does pace have to do it?

And yet, Menzie, there are now 200 banks at risk.

Nearly 200 banks at risk for same fate as SVB: study

https://nypost.com/2023/03/18/nearly-200-banks-could-fail-the-same-way-svb-did-study/

So tell me, Menzie, do we have a systemic problem, or was it poor management at SVB?

And if it’s a systemic problem, what should the Fed/Treasury do, in your opinion?

The NYPost is a rag that most New Yorkers use only to line the bottom of their bird cage. Take a look at the 1st two paragraphs of this stupid discussion. Oh no – midsized banks may be insolvent. Oh wait – I meant to say there is a liquidity. Hey Stevie – you found someone almost as stupid as you are.

Let’s review the premise of this claim that neatly 200 banks could fail. The circumstance under which the authors say this could happen is that half of all depositors withdraw their deposits from those banks.

Now let’s ask ourselves how likely that is. The discount window is taking in Treasury and Agency debt and Agency MBS at par, no questions asked. Deposits under $250,000 were insured prior to the run. And now? C’mon, even you know this one, Stevie.

A refresher on risk analysis in the absolute simplest terms – You assess risk by multiplying the expected loss in an event by the probability of that event to get the probable loss from that event.

So, what are the odds that 200 banks will lose half their deposits under current regulatory and market conditions? Show of hands, and don’t say something dumb, based on some editor making a grab for readership.

Oh, in case it isn’t obvious, from the fact that two banks failed and the other 4,145 didn’t, it was poor management at SVB. Thanks for asking.

P&P’s analysis was right on the money. Were the banks stress tested at 4.5%? Could you find me the page on the Fed website where they tell us that the Fed did that?

“Were the banks stress tested at 4.5%?”

What a moronic question. Do you even know what a stress test is? Oh that’s right – you do not know the difference between solviency issues v. liquidity issues.

Until you do – SHUT UP. You are nothing more than a complete waste of time.

Why Econbrowser has become so devalued in recent years. What serious people comment here anymore? Or is it just a place that cranky, crazy old men come to complain? Is Econbrowser now the crank site?

The posts are solid macro, one after another. The comments make this place a cesspit.

Steven Kopits: Many people do not feel free to comment because they are employed by agencies that take a dim view of social media activity of that sort. You can infer what degree of readership Econbrowser has by who is does guest posts.

If you think that’s your problem, I pity you.

Kopits happily spouts lies to appeal to the MAGA and FOX crowd, then wants to complain about the comments section of a blog. Is Kopits the guy who takes his wife to Costco to queue up for a hotdog and while waiting in line mumbles to her about how insufferable the better steakhouses in Boston are??

It’s also interesting Kopits says the posts are “solid macro” while 75% of his endless b*tching is spent arguing with the blog host about things Kopits should have learned from any undergrad course on macro.

The pace of the rate increase has everything to do with it.

A bank can’t reprice the asset side of the balance sheet by 5% (pp) in 14 months, because banks typically lend long, and particularly so for smaller regional banks, which tend to issue a lot of mortgages.

On the other hand, the liability side of the balance sheet — deposits — can in theory reprice overnight. Depositors can take out demand deposits whenever they choose. That means that the bank will have a mismatch on the asset and liability sides of the pricing equation.

In most bank failures and runs, we are talking about balance sheet issues, that is, repayment risk. In this case, we are speaking of price risk, not repayment risk. The price risk comes straight from the Fed.

And why is that, Menzie? Because Fed and Treasury mistook a suppression for a depression. The Fed tanked interest rates, blew up assets value, led to a historic rush for refinancing — particularly on mortgages — and in the process discounted QTM, which promptly created some pretty durable inflation. To counter that, the Fed raised interest rates pretty much right along the lines of P&P from July last year.

But no one rans the numbers to check of the banks could actually handle that rate increase at that pace. Clearly, they cannot, which even a pretty basic stress test (scenario analysis) should have told them. In fact, if you check, I would guess the banks did actually warn the Fed about this several times.

Steven Kopits: If you look at Papell & Prodan’s most recent February post, you will see that the “balanced approach – shortfalls” prescription for 2023Q1 is only slightly below current levels. As far as I can tell from their graph, the Fed moved rates up 425 bps in 5 quarters vs 400 bps in 7 quarters. This is the definitive reason for SVB’s collapse. By the way, if you read the Jiang et al. (2023) paper, and/or the Economist discussion, you’ll note that capital losses on the asset side were partially if not fully offset by capital gains on the (sticky) deposits side.

Let me remind you that (1) the extent of fiscal impulse in the rest-of-OECD was much smaller, and yet (2) inflation surged there as well, and (3) surged yet more after Russia’s expanded invasion of the Ukraine. Or are you asserting (a) that it’s all Joe Biden’s and Jay Powell’s fault, and/or (b) fiscal and monetary policies in the US caused Putin to expand his invasion of the Ukraine?

Inquiring minds would like to know what stupid propositions you are forwarding.

“you’ll note that capital losses on the asset side were partially if not fully offset by capital gains on the (sticky) deposits side.”

But Stevie does not realize that loan margins consider both loan rates and deposit rates as he also does not consider hedging may involve having a portfolio where the value of assets is correlated with the value of liabilities. Am I being unfair? No – just read his hyperbolic comments which are all over the map.

Menzie and the other policy apologists, how do you stop this: “In response, deposits worth $42bn were withdrawn, a quarter of the bank’s total. ” (From your Economist reference)

How many banks are in similar financial condition and would survive such a run? 100s? Or as some studies say ~50%?

CoRev: The $42 bn figure is from CNN/Business.

Yes, Powell and Yellen. Nothing new there.

And, yes, the US can export inflation. If a US fiscal impulse goes into a full employment (or upwardly constrained employment) economy, then the difference will show up in imports. We would expect to see a blow-out in the trade deficit and clogging of ports. Which we did. And we would expect that supply chains across the world would be under pressure with price increases across the globe. Which we did. So, yes, best I can tell, the US is able to export inflation.

Steven Kopits: Wow. Thank you for your continued comments; they are par excellence fodder for my macro and stats courses as examples of extreme stupidity. Look for a post on SVAR estimates of exported inflation.

Putin’s invasion was driven by his expansionist impulses. As I have said before, dictators have a liberal objective function, ie, more is always better. ‘More’ will be defined as more money, more power, more longevity, and more people and land under their domains. This war was going to happen covid or not. Covid may have altered the timing, but I think it unlikely that the pandemic would have changed the ultimate situation.

Of course, Biden could have prevented the war. He chose not to do that, and is still playing for a tie, best I can tell, and bleeding out the Ukrainians in the process.

Inquiring minds also want to know, Menzie, if we have systemic risk. If we do, what is the nature of that risk? What should the Fed do about it, in your opinion?

The point I was making, Menzie, was when did the prospect of 5% 3 mo Treas rates become apparent? It was not later than last July, now almost 9 months ago. Therefore, the banks were modeling with 5% by early H2 last year, and it was apparent to them that the banking sector would be in big trouble if the Fed raised interest rates per a Taylor model or something similar.

As this is a life-and-death issue to the banks, they no doubt brought it to the attention of Yellen and Powell not once, but many times. Similarly, if you check the emails of Fed and Treas staff involved in these matters, I would bet that Powell and Yellen were cautioned not once, but several times, by staff that the banks could not sustain 5% interest rates on deposits.

“As I have said before, dictators have a liberal objective function, ie, more is always better. ‘More’ will be defined as more money, more power, more longevity, and more people and land under their domains. “,

This statement from the man who said that if only Ukraine had sold a huge portion of its land, resources, and sovereignty off for a dollar figure to Putin, all of their troubles and the war would have evaporated into the ether. You can’t get policy prescriptions like this from “just any consultant” you know. This level of genius is special to Kopits alone.

Moses –

I think both Ukraine and Russia would be vastly better off if Ukraine had agreed to sell Crimea to Russia for $625 billion. I appreciate you think they are better off as is, but I whole-heartedly disagree.

“because banks typically lend long”

Gee Stevie figured out maturity risk which Dr. Chinn already noted over and over. Then again – maturity risk has been noted in the parlance of Money and Banking well before anyone of us were born.

But little Stevie thinks he has another AHA moment. Yea – Stevie is really clueless.

If a bank lends long, then their pricing is also long, at least in many cases. When did the banks issue new mortgages or refi’s? During the pandemic at 3% or less. What is their cost of funding? Around 5%. Numbers are straightforward.

Mortgages are issued by banks but mostly not held by them. Mortgages are bundled and turned into MBS. Banks turn the proceeds into more mortgages, and hold very few whole mortgages on their books. I recall the world got an education in the workings of the mortgage market a few years back. Maybe Stevie missed it?

Let’s consider some of Stevie’s other declarations. Nobody ran stress tests at current interest rates? A few comments earlier Stevie was asking if the Fed had, now he’s insisting nobody has. Whence comes this new certainty? From the pile of bull plop under Stevie’s desk. Stevie sys it, so we just have to accept it.

“Clearly” banks cannot survive the “pace” of interest rate rise because blah, blah, blah. “Clearly” is consultant-speak for “I have no evidence.” Here’s some evidence – as of last September, the FDIC insured 4,157 banks. “Clearly” none of them have been able to survive the Fed’s rate increases.

Rate increases “at that pace” mind you. Why is “pace” in there? Because Stevie claimed it matters, Menzie said maybe not, so now Stevie is repeating his claim because repetition is the same thing as proof, right?

Stevie finishes up with a classic bit of rhetorical mischief: “In fact, if you check, I would guess the banks did actually warn the Fed about this several times.”

“I would guess”? There’s a winner for you. And in this case, “I would guess” is the evidence used to assert “In fact..” This is how Stevie does consulting. He guesses. He repeats assertions when he lacks evidence. He asserts that things must have happened because that supports his argument. And he claims that two banks failing (are we up to three yet?) means that “banks” – all 4,157 of them – are unable to survive Fed rate hikes.

Is this the worst thing Stevie has ever tried to sell us? The density of distortion, dishonesty and broken logic is hard to beat, but then, if anyone could do worse, Stevie could.

A lot of regional bank hold their own mortgages. Mine does, for example.

https://www.fdic.gov/analysis/quarterly-banking-profile/fdic-quarterly/2019-vol13-4/fdic-v13n4-3q2019-article3.pdf

The data is slightly dated, but not enough to make a difference as far as getting a pretty accurate picture of now.

“Steven Kopits

March 20, 2023 at 9:37 am

If a bank lends long, then their pricing is also long, at least in many cases.”

My God – this troll has to be the dumbest person I have ever encountered. Stevie – do you you even know what a bank does?

Of course the rate of change mattered; it is foolish to contend otherwise.

However, as is almost always the case, this is not the result of a single thing. It is a collision of several factors and no single one of them would likely have caused this. Slower Fed increases – the bank has more time to adjust long positions. Different mix of deposits – less likelihood of a concerted run. No social media – ditto. Fed increases stopping at a lower level… competent risk management at the bank… more awareness by the Fed… better oversight by regulators: any of these might have changes the outcome favorably. But…

I dare say, my comments proved prescient.”

Gee – when did Urban Dictionary define prescient to be long winded and utterly incoherent?

The same folks who complained the fed was too slow to raise interest rates are now the same folks complaining about the problems arising from higher interest rates. Astounding. And every day we here them say “i told you so”.

UBS buys trouble Credit Suisse:

https://www.msn.com/en-us/money/personalfinance/ubs-buys-credit-suisse-for-3-2-billion-as-regulators-look-to-shore-up-the-global-banking-system/ar-AA18OCCm?ocid=msedgdhp&pc=U531&cvid=85b15562996d47fd8c56d56d988bf10e&ei=13

UBS agreed to buy its embattled rival Credit Suisse for 3 billion Swiss francs ($3.2 billion) Sunday, with Swiss regulators playing a key part in the deal as governments looked to stem a contagion threatening the global banking system. “With the takeover of Credit Suisse by UBS, a solution has been found to secure financial stability and protect the Swiss economy in this exceptional situation,” read a statement from the Swiss National Bank, which noted the central bank worked with the Swiss government and the Swiss Financial Market Supervisory Authority to bring about the combination of the country’s two largest banks.

So Credit Suisse was still quite solvent but may have been facing liquidity issues. I guess little Princeton Stevie got this one wrong as well (even if he is too dumb to get the point).

…and then UBS fired all of the Credit Suisse management? Please, please, please…

Speaking of which, what’s going on with Deutsche Bank these days?… No, no, no! This can’t be good:

https://www.bloomberg.com/news/articles/2023-03-18/deutsche-bank-is-said-to-study-opening-for-credit-suisse-assets#xj4y7vzkg

This is a big improvement in the financial outlook. Happened over the weekend, just like it does in the States. If we ever see a bank taken over during the week, that’ll mean regulators were blindsided. Doors opening on Monday is critical.

I think that just having been subject to those reviews on a regular basis is likely to have made the bank more cautious.

However, if Toomey suggest that the current reviews need to be tightened up even further to ensure that SVB style problems in all banks with over 100 billion would be discovered – then I agree. However, I am not sure why he loosened stress tests, if they were already too lose to identify the problems that destroyed SVB. Should he not have tightened them instead?

the idiocy of the arguments is astounding. for instance, conservatives argue that it was not deregulation that caused the problem. but then they turn around and want to blame the regulators for the failure. come on, pick a gripe for crying out loud.

i posit that the core problem is that bankers are not infallible. some of them are complete idiots. i know, have met a few. that is why we have regulations, to keep the idiots from doing damage to the entire industry. medicine, law and engineering have rules in place to eliminate those who break ethical and business rules. if the financial field cannot discipline itself, then the government should come in and discipline the field with regulations. you need to protect your discipline against the few rules breakers who bring harm to the entire discipline. this is necessary if you discipline impacts the public welfare.

Embarrassed to admit I had somehow missed the passing away of Pat Schroeder. A great and unique lady. Classy and filled with a surplus of empathy for her fellow man. She contributed greatly to democracy and the public dialogue. She will be missed.

https://www.politico.com/news/magazine/2023/03/17/pat-schroeder-remembrance-00087429