Answer: so-so.

Reader Erik Poole commenting on this figure (in this post) writes:

Assuming that the all the inflation forecasts are one-year forecasts in the above chart, do we have any kind of inflation expectations data for shorter time frames, such as 6 months?

The above is a fancy way of asking: are financial markets and professional forecastersb really that bad at forecasting inflation?

Glancing at the above chart, it appears to make a good argument for adaptive expectations driving economic agents inflation expectations.

I’m sympathetic to this view at the one year horizon. Adaptive expectations is what I learned as an undergrad in my first macro course in 1982 (with an autoregressive coefficient of unity, the adaptive approach underpins the accelerationist hypothesis). I also use this as the starting point for talking about dynamics in my macro course this semester, for pedagogical reasons. However, I soon move to more complicated approaches, for reasons laid out in Coibion et al. (JEL 2018).

In point of fact, if we are to evaluate these measures in terms of forecasting, rather than explaining behavior, then adaptive expectations do not appear to be the best, informally assessed. To see why, see this graph of forecast errors.

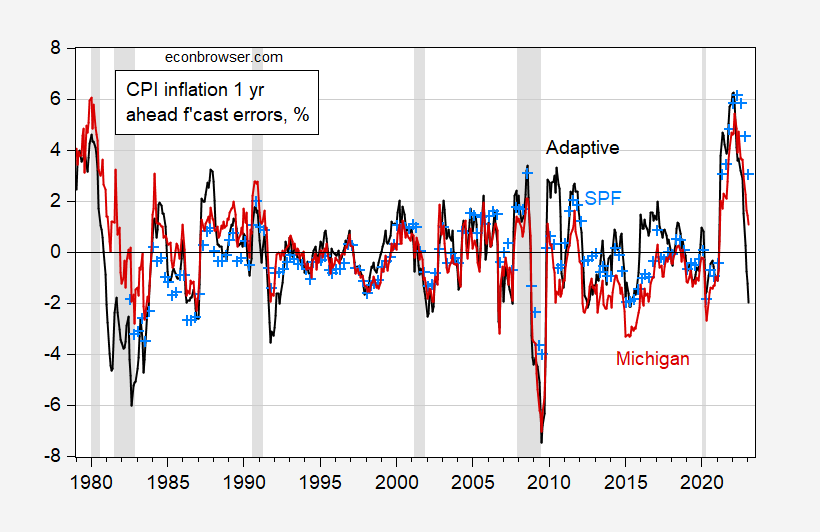

Figure 1: Year-on-year CPI inflation forecast errors from lagged year-on-year inflation (black), Survey of Professional Forecasters median (sky blue +), and Michigan Survey of Consumers (red), all in %. NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, Philadelphia Fed, University of Michigan Survey of Consumers via FRED, NBER, and author’s calculations.

Applying a common sample (SFP is reported once a quarter starting in 1982, and Michigan starts in 1979), one finds that the mean error is smaller for adaptive expectations, but the RMSFE is much larger – 1.86 vs. 1.59 for SPF and 1.54 for Michigan.

Note that this pattern of RMSFEs is accentuated if we omit the Biden period; then the adaptive approach yields a RMSFE of 1.68 vs. 1.19 for SPF and 1.37 for Michigan.

Nice post. JohnH keeps telling us we must use his forecasting approach because the other measures are not perfect. No forecasting method is perfect and his appears to be worst than the others. In fact, adaptive expectation appears to be overstating what inflation turned out to be of late.

Found this in a research paper I just looked up:

“Do we need new measures of expectations or new surveys? Information on the price expectations

of businesses–who are, after all, the price setters in the first instance–as well as information on

nominal wage expectations is particularly scarce.” Ben Bernanke, July 10, 2007

In other semi-related news there is “heart” to be taken from, or cause for better morale among us cynics of the current Fed Board, in that it appears that, just maybe, not all Fed FOMC members have gone batsh*t fruitcake loony:

https://www.ft.com/content/c6eae0a1-8ead-461c-a52b-dd785ece567d

Thanks Menzie.

To further clarify, if I am attempting to understand something, I will reach for a perfect foresight, rational expectations or Bayesian model, depending on the problem at hand.

That said, as an admittedly arrogant active investor, I often find myself often wondering if many economic agents, in particular other investors, rely instinctively on an adaptive expectations model for understanding macroeconomic fluctuations, inflation, macroeconomic policy, shocks to individual sectors, commodity prices and so on. Hence the interest in 6 month forecasts/expectations.

If one is going to play the active, market-timing game, I believe it is important to understand just how heterogenous economic agents in general and investors in particular can be. Example: the difference between bond fund managers and speculators who focus on precious metals.

To further clarify, for those interested in the investing aspect, I fully understand the theory and data supporting passive investment strategies. In recognition of that I attempt to diversity/hedge the portfolio with buy ‘n hold forever type assets.

The nominal interest rate on 10-year Chinese government bonds is just over 2.8%. Before JohnH starts yapping about negative real interest rates in China, maybe we should check this:

https://www.yahoo.com/finance/news/china-weak-inflation-fuels-calls-021434543.html

The consumer price index rose 0.7% last month from a year ago, the National Bureau of Statistics said Tuesday, weaker than the 1% forecast by economists in a Bloomberg survey. Producer price deflation worsened to 2.5%, the lowest since June 2020. Core inflation, which excludes volatile food and energy prices, climbed slightly to 0.7% from 0.6%. The “economic recovery is on track but not strong enough to push up prices,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd. “This suggests the economy is still running below its potential. There is room for fiscal and monetary policies to boost growth further.” While the economy has been recovering post-Covid, the figures indicate domestic demand remains weak, giving authorities space to roll out more supportive policies to bolster the consumption-led rebound. CPI has remained well below a government-set target of around 3% for the year.

https://english.news.cn/20230411/6202629dbbb74e6382b08b8282bfb0d6/c.html

April 11, 2023

China sees mild CPI growth in March

BEIJING — China’s consumer prices registered a mild growth in March, in sharp contrast to the persistent global inflation, official data showed.

The country’s consumer price index (CPI), a main gauge of inflation, rose 0.7 percent year on year in March, the National Bureau of Statistics (NBS) said Tuesday.

The figure was lower than the 1 percent increase in February. On a monthly basis, consumer prices edged down 0.3 percent, narrowing 0.2 percentage points from the month-on-month decline in the previous month, stated the NBS.

Dong Lijuan, a statistician with the NBS, attributed the mild inflation largely to the ample supply in the consumer market as the social production and living order continued to recover in March.

Data showed that food prices played a major role in dragging down the overall price level and went down 1.4 percent month on month. Specifically, the prices of vegetables and pork, a staple meat, went down by 7.2 percent and 4.2 percent month on month, respectively.

Non-food prices remained flat in March, up from the 0.2 percent decline in February, buoyed by the growing demand for travel and increased clothing expenses.

The country’s core CPI, deducting food and energy prices, climbed 0.7 percent from a year ago last month, up from 0.6 percent seen in February, Dong said.

The country targeted to keep the inflation rate or increase in CPI of around 3 percent for 2023. Its consumer prices grew 2 percent from a year earlier in 2022.

Tuesday’s data also showed that China’s producer price index, which measures costs for goods at the factory gate, went down 2.5 percent year on year in March.

The decrease expanded by 1.1 percentage points from that registered in February. On a monthly basis, China’s PPI remained flat in March, according to the bureau.

“Due to a quicker recovery in domestic economic activities and price changes of some commodities in the international market, the PPI remained flat month on month,” said Dong Lijuan. “But owing to a high comparison base in the same period last year, the year-on-year PPI declined.” …

China’s inflation is cooling because China’s economy is cooling:

https://www.reuters.com/world/china/chinas-march-consumer-inflation-lowest-since-sept-2021-2023-04-11/

https://english.news.cn/20230411/d893d97e368c4f97a16246fd6dc85a7d/c.html

April 11, 2023

China’s auto market picks up growth pace in March

BEIJING — China’s automobile market picked up its pace of growth in March, with industry insiders believing that it will continue to gather steam thanks to new supportive policies and the promise of more to come.

China’s auto sales expanded 9.7 percent year on year to about 2.45 million units in March, data from the China Association of Automobile Manufacturers showed Tuesday.

In March, the automobile output in China reached 2.58 million units, increasing by 15.3 percent year on year, said the association.

The new-energy vehicles (NEVs) market posted another stellar performance, driven by a sound policy environment.

China sold about 653,000 NEVs in March, increasing by 34.8 percent year on year, while NEV production surged by 44.8 percent from a year earlier to about 674,000 units.

In February, China pledged to roll out policies to support the purchase of NEVs, saying that measures will be taken to improve the NEV user experience from charging to license plate registration.

Thanks to the NEV boom, the market share of NEVs in China’s auto market reached 26.1 percent in the first quarter of the year.

China’s commercial vehicles market logged steady expansion. Sales of commercial vehicles stood at 434,000 units in March, representing a year-on-year increase of 17.4 percent.

China’s automobile exports witnessed a significant increase of 70.6 percent from a year earlier in the first quarter, making a positive contribution to the growth of the auto market….

This would be great news if it happens even though this will highly disappoint Putin poodle JohnH:

https://www.mirror.co.uk/news/us-news/kremlin-plans-sabotage-vladimir-putins-29685403

Kremlin plans to sabotage Vladimir Putin’s war while he has chemo, Pentagon docs claim

Classified documents from a Pentagon intelligence report have appeared on messaging app Discord since February with top Russian officials reportedly wanting to sabotage Vladimir Putin

The Kremlin plans to “throw” Vladimir Putin’s Ukraine war while he’s allegedly receiving chemotherapy, leaked Pentagon documents claim.

Classified documents from a Pentagon intelligence report have appeared on messaging app Discord since February and feature “top secret” plans which include a suggestion Russia’s top general could sabotage Putin’s war in Ukraine.

The documents, which have been printed out and photographed, contain daily intelligence briefings on troop fatalities in Ukraine along with other highly confidential information.

Many of them contain military acronyms and offer expert opinion on the war in Ukraine including critical information from the Kremlin on plans to ruin Putin’s war.

According to the leaked documents, which have since been removed from the platforms, Russian National Security Council Secretary Nikolay Patrushev and Russian Chief of the General Staff Valeriy Gerasimov want to “throw” the president’s war while he’s getting treatment for cancer.

The Ghost of the Self-Labeled Expert On Russia, once again calling out to us from the grave……..

“I do not have inside info on it, but I am skeptical of all these Putin-cancer stories”

https://econbrowser.com/archives/2022/05/guest-contribution-get-ready-for-reverse-currency-wars#comment-275749

Well folks it just goes to show, you can’t get good service at fast food outlets, and insiders in Russia just aren’t what they used to be. There’s no accounting for it. Like the spectacled guy in the film Chinatown said “Forget it Karen, it’s Nashville”.

Utter BS: “JohnH keeps telling us we must use his forecasting approach because the other measures are not perfect.” pgl just makes yet another logical fallacy, something that he is prone to do.

Just because I am willing to notice and point out poor forecasts does not mean that I could do any better…or that I would even would attempt something so foolish. Perhaps it’s time for some to eat humble pie and stop trying to be so presumptuous as to push the notion that estimated “real” forecasts have anything real about them…they creations of inherently fallible humans, just like the Keynes’ participants in beauty contests have more to say about group think than what is truly beautiful.

JohnH: Well you point out the poor performance of some of the standard measures, but fail to note the pretty poor performance of your preferred measure. This is why we don’t take anything you write seriously. By the way, (1) have you finally found all those measures of median income you said weren’t being reported, and (2) assessed the extent of Ukrainian advance since August 2022?

JohnH’s favorite economist blogger of late seems to be John Cochrane who did have a post sort of mocking inflation forecasts. But that was back on Oct. 22, 2022 and he used a yr/yr measure of inflation and not the month/month measure.

Cochrane’s Jan. 18, 2023 post did use month/month updated through the Dec. 2022 BLS release noting how inflation has indeed come down. Now JohnH for some reason forgot to tell us about this latter post. I wonder why.

I should apologize to Menzie, pgl, and yes even apologize posthumously to Barkley Rosser (genuinely). When JohnH first came to this blog I took him to be a “well-intentioned” person who just needed some further education and was “shapable” to receive that further education. But I got JohnH as badly wrong as I got Tulsi Gabbard. On this judgement of internal character, you three were right and I was wrong. For that I deserve the naive bozo award.

I still view myself as very perceptive about people overall. But when you get it wrong you get it wrong. I got it wrong.

logical fallacy must be your middle name. Since our host has already called you out – I’ll just spend myself watching the grass grow which is a lot more productive than reading your nonsense.

“Just because I am willing to notice and point out poor forecasts does not mean that I could do any better…or that I would even would attempt something so foolish.”

Why does Jonny boy remind me of the loud mouth in the gym mocking me as a struggled to bench 180 pounds. So I asked loud mouth to show us what he’s got. Off goes the heavy plates so loud mouth only has to bench 95 pounds and he still could not do it.

Yea – the ladies are all laughing at little Jonny boy.

Princeton’s Gregory Chow published a wealth of papers starting in 1956 and continuing for almost 60 years. A lot of these papers were on the Chinese economy but he was also a critic of rational expectations:

https://www.princeton.edu/~gchow/gccpublications.htm