As of today:

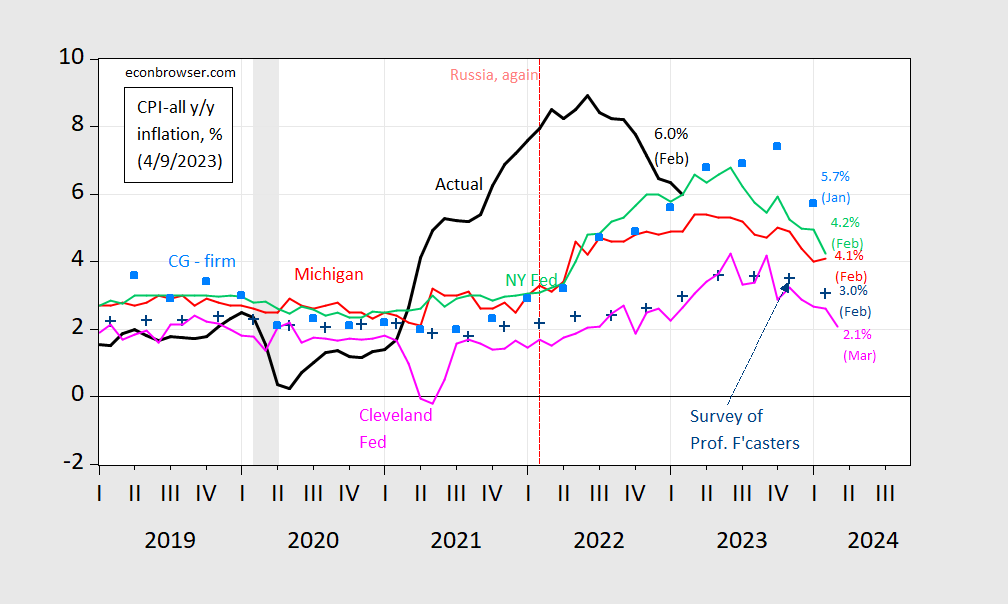

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected from Michigan Survey of Consumers FINAL (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares], all in %. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, University of Michigan via FRED and Investing.com, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and Coibion and Gorodnichenko, and NBER.

median expected from Survey of Professional Forecasters (blue +)

says expected inflation is 3% and not JohnH’s made up 6%? So what do they know because we have all learned Jonny boy is always right.

Yes, actual inflation is 6%. https://www.bls.gov/cpi/

Guesstimate inflation is 3%. And “real” returns are a function of guesstimates, whose track record has been pretty pathetic lately. IMO they’ve been more like Keynes’ beauty contest lately.

Reminds me of Karl Rove: “ “We’re an empire now, and when we act, we create our own reality. And while you’re studying that reality — judiciously, as you will — we’ll act again, creating other new realities, which you can study too, and that’s how things will sort out.” So sad that it didn’t turn out in Iraq…but reality has a way of biting the hand that created the fictional reality.

Your opinion is irrelevant. And is contradicted by evidence presented by the good professor just three posts ago:

https://econbrowser.com/archives/2023/04/is-the-lagged-one-year-inflation-rate-a-good-predictor-of-five-year-ahead-inflation

Johnny, you seem to be ignoring the work that Menzie has been doing for your benefit. Several of his recent posts have corrected errors in your thinking. Yet you seem unwilling to learn. Accept the kindness that’s being offered.

Jonny boy’s opinions are also malleable. He first decided to defend his BFF Princeton Steve screaming how high mortgage rates had become. But now they are very low? Which Jonny are we talking to today? We need a program.

See Jonny boy’s comment under the new blog post. Yea – Jonny boy is the dumbest troll God ever created.

Damn you dumb. One more time for the slow one – expected inflation is not the same thing as past inflation. And our host has already demonstrated that your adaptive expectations approach does a terrible job of forecasting future inflation,

https://jabberwocking.com/texas-governor-says-he-will-pardon-murderer/

Kevin Drum reports on how Daniel Perry will get pardoned for murder by the Governor of Texas simply because the victim was black and Perry is a MAGA hat wearing white dude with a gun. Only in Trump’s America.

Garrett Foster, the man Daniel Perry shot, was white. Race relations are bad enough without adding more lies and false accusations. Garret is also on video pointing a rifle at Daniel Perry, so there is some degree of FAFO there as well. Perry was convicted primarily because he made numerous social media posts talking about shooting protestors under the guise of self defense by creating a self-defense situation. Without those postings, I would have been in the “not guilty” camp. With the postings, the guilty verdict is fine with me.

In general though, if you want to live, don’t go around pointing rifles at people unless you are in an extreme self defense situation. Going up to a stopped car with a rifle in a highly emotional protest situation just isn’t a great idea.

Craig

https://www.reuters.com/markets/europe/russia-swings-29-bln-first-quarter-budget-deficit-2023-04-07/

Russia’s deficit for the 1st 3 months of 2023 as oil revenues are down and military spending is up.

Wait – Princeton Steve was predicting a $30 billion deficit per month while his BFF JohnH kept telling us that the deficit would not be very large. You know – these two goofballs should collaborate and get their lies straight.

It’s not a big deal, I’m not upset or anything, but there’s been some bugaboos with your blog server, I would say within the last 16 hours. I’m pretty certain it’s not on my end because I even tested to see if I could get in with a more updated browser. Just an FYI. I should have copy/pasted the error message for you but I didn’t, so I apologize for that.

Off topic, China’s crack-down on finance –

China’s anti-corruption drive is focusing on the financial sector so far this year:

https://www.cnn.com/2023/04/05/economy/china-financial-industry-crackdown-intl-hnk/index.html

https://www.scmp.com/economy/china-economy/article/3216331/why-has-china-launched-anti-corruption-probe-its-finance-industry-and-how-will-it-defuse-risk

As noted in the CNN piece, there are two likely reasons for the focus on finance. One is that it’s a good idea to keep a close eye on a critical sector, plagued with troubles. The other is that control of finance gives the Party more power and ready access to money.

What we’ve seen, though, with the change from a dedication to good economic management under Xi’s recent predecessors to a dedication to personal power under Xi, is a series of economic missteps. Finance always needs strict supervision, but a ham-handed increase in control is likely to cause problems. This is a bad time for yet another big financial risk.

When they’re finished rooting out corruption in China’s financial system, maybe they’ll lend a hand to the Fed, the Treasury, and the aDOJ to show how it’s done.

“Honey, I shrunk the financial system.” Oh, no!

But Jesus would have appreciated it!

Speaking of China’s stepped-up control of the financial sector, an investment banker involved in tech (another target for China’s anti-corruption effort) has disappeared:

https://www.cnn.com/2023/04/03/investing/china-renaissance-delays-results-missing-ceo-intl-hnk/index.html

I stand by “ham-handed”.

Oh no….. another one of the 1950s “sent down youth” gone bad?!?!?!?! Say it ain’t so Joe.

And I thought all that time on village farms, with a plow, had cleansed their souls. Huh, go figure. But my Ex’s mother thought they were “joyous times”. What a deep and sophisticated woman…… always “guiding” her province teacher’s university math major daughter. Good times……

The thing that seems so hard for dictators/authoritarians to understand is that “the best can leave, and then you get left behind with “the rest””

Speaking of authoritarians, the Speaker of the Tennessee House may occupy his legislative seat illegally:

https://popular.info/p/where-does-the-tennessee-house-speaker

These category of stories just tend to aggravate me. Not because they aren’t true, and not because they shouldn’t be discussed and shared, but because I know almost before I even read the story that there will be no consequences for this bastard. He will just go on, the same as donald trump. Like he has magical pixie dust on his shoulders, there will be no punishment for breaking the law/rules.

I get where I don’t even want to click on them, because In know what will happen to Sexton: NOTHING AT ALL

Based on the latest from Kevin Drum, it seems CoRev has a new job – research assistant for the pro-life Charlotte Lozier Institute, the research arm of Susan B. Anthony Pro-Life America:

https://jabberwocking.com/pro-life-group-shows-that-mifepristone-is-safe/

‘National Review’s Michael New takes a different approach: instead of trying to defend Kacsmaryk’s ruling on legal grounds, he claims that mifeprestone is, in fact, more dangerous than you think’

Read for yourself the torturing of the evidence on the use of mifeprest. But hey – we are talking about the National Review.

Ole Bark, bark, it’s so comfortable living in your head. You really should clean this place up, but aft the 20+ years of watching you in action, expectations are minimal. My hope is that the ugly, irrational hatred doesn’t stick to me. 😉

Take your meds.

Do you really think nootropics work??

I have some reading material for the COREV:

https://tax.kpmg.us/articles/2023/carbon-trading-transfer-pricing-next-frontier.html

Carbon Trading and Transfer Pricing: The Next Frontier?

Exploring the transfer pricing issues related to carbon trading that will impact multinational enterprises for years to come

Not that CoRev will have a clue what these KPMG kids mean by transfer pricing but it seems they have accepted the need to address climate change.

I just hope this gets COREV so angry he starts chasing his own tail barking all day.

Good you believe you’re living in someone’s head because yours has been vacant and unoccupied for some time.

Everything has been moved out with condemnation completed.

What you call irrational hatred, others see as simple truth.

Noneconmist: “What you call irrational hatred, others see as simple truth.”

Of course those living with the irrational hatred can not discern life without it. 😉

On-line prices were down 1.7% y/y in March:

“Today, Adobe (Nasdaq:ADBE) announced the latest online inflation data from the Adobe Digital Price Index (DPI), powered by Adobe Analytics. Online prices in March 2023 fell 1.7% year-over-year (YoY), marking the seventh consecutive month of YoY price decreases with over half of the categories (10 of 18) tracked by Adobe seeing falling prices on an annual basis. On a monthly basis, online prices in March remained flat (up 0.03%). ”

Here’s the press release.

https://news.adobe.com/news/news-details/2023/Media-Alert-Adobe-Digital-Price-Index-Online-Prices-Fall-1.7-In-March/default.aspx

Data presentation:

https://business.adobe.com/resources/digital-price-index.html

Note that electronics account for most of the y/y decline in online prices.

Regarding two days away inflation, I see that as of today, Bloomberg consensus shows Core CPI at 0.4% and CPI All at 0.2% for March 2023. The latest weights for CPI All are: food, 13.521%; energy, 7.076%; and core, 79.403%. 79.403×0.4% = 0.32%, so the weighted sum of food and energy must be about negative 0.08% for the resultant sum to be about 0.24% rounded to 0.2% for March.

20.597% x (-various)= -0.08% rounded

79.403% x 0.40%*** = 0.32% rounded

Total ************=0.24% or 0.20% rounded

I was looking for food to be up about 0.21%, energy to be down about 1.1% and Core CPI to be up about 0.44%, with the weighted average being about 0.3% for CPI All. Looks like below my weighted sum of food and energy is about – 0.5% and above Bloomberg needs -0.8% for the sum.

13.521% x 0.21% ****= 0.028%

7.076% x -1.1% ******= – 0.078%

79.403% x 0.44% *****= 0.350%

Total ************** =0.30%

The biggest problem keeping Core CPI elevated is the services portion of Core CPI. And the biggest part of Core CPI Services is the disparaged home owners’ equivalent rent of residences.

Core CPI and Owners’ Equivalent Rent of Residences

https://fred.stlouisfed.org/graph/?g=12nDk

https://www.bls.gov/web/cpi.supp.toc.htm

https://www.bloomberg.com/markets/economic-calendar

I note that the Econoday consensus shows 0.4% for Core CPI and 0.3% for CPI All.

https://us.econoday.com/byshoweventfull.aspx?fid=559228&cust=us&year=2023&lid=0&prev=/byweek.asp#top

Are the Cleveland Fed inflation expectations one year or 10-year?

Erik Poole: In this specific graph, all expectations are one year ahead.

Following up in a way. It seems JohnH is trying to justify his backwards looking approach by appealing to something Cochrane posted back in Oct. 2022 when the latest CPI release was from Sept. 2022. The theme was that inflation has not come down in line with expectations. Of course one little JohnH trick was to exclude the new data we have seen since Cochrane’s post.

But the chart they were relying on was using yr on yr changes which we know disguise the recent declines in m/m inflation rates.

Thanks Menzie.

I asked because I hunted around the Cleveland Fed website and could not find one year ahead expectations data. Just 10-year average expectations data.

Erik Poole: Go to this website: https://www.clevelandfed.org/indicators-and-data/inflation-expectations

There are four icons on top of the page. The second from the right is labeled “downloads” in orange letters. Click on that, and you will get a spreadsheet for all inflation expectations from year 1 to 30.

Got it.

Assuming that the all the inflation forecasts are one-year forecasts in the above chart, do we have any kind of inflation expectations data for shorter time frames, such as 6 months?

The above is a fancy way of asking: are financial markets and professional forecasters really that bad at forecasting inflation?

Glancing at the above chart, it appears to make a good argument for adaptive expectations driving economic agents inflation expectations.

A simple linear extrapolation of the measured Y/Y CPI suggests that it should be near the 4% threshold by Q4 2023 when I expect the USA to be in recession, a recession that will be confirmed by the NBER many months later. Assuming coincident indicators are worse by then, broader equity markets could be bottoming by then.

IS-LM, AD-AS, but you should know by now, none of the “cool kids” use that anymore. They just look to Powell for FFR (and all the Fed Board since Brainard left go “Yeah, what he said”) and see what the C Suite is spoon-feeding Larry Summers to say. Try to get with the program, would yeh??

If guys like Larry Summers can’t decipher obvious supply chain issues, war created shortages, and flat out corporate profiteering while he’s been screaming demand side and domestic USA wages for months, how much more do you think the pretentious PhDs have to say to us?? This is the guy Bloomberg TV thinks walks on water. Is it Larry’s continual upper body bobbing like his afternoon enema just kicked in??~~or Larry’s connection to Jeffrey Epstein that makes David Westin think Larry is an oracle?? Only Davey can tell us.

fwiw, yesterday at Zero Hedge:

Fed Survey Shows Inflation Expectations Re-Accelerated In March, Credit Access Worst Ever – As the labor market starts to finally crack (the most lagged economic signal), and consumer credit growth slows (at their limits), The Fed has a problem as, according to the New York Fed’s March Survey of Consumer Expectations, inflation expectations are on the rise once again, especially the short-term. Median inflation expectations increased by 0.5 percentage point at the one-year-ahead timeframe to 4.7%, the first increase in the series since October 2022. Median inflation expectations for the three-year-ahead horizon edged up 0.1 pp to 2.8%. The oldest cohorts among the respondents were the ones expecting the highest inflation ahead… Perhaps even more notably, the share of households reporting that it’s harder to get credit than a year ago rose, reaching a series high.

‘New York Fed’s March Survey of Consumer Expectations, inflation expectations’ rose a bit to 4.7% but this survey has always shown an upward bias. Of course Zero Hedge exists to rile up people not inform people.

Missed inflation on the way up? Well, compensate by missing it on the way down!