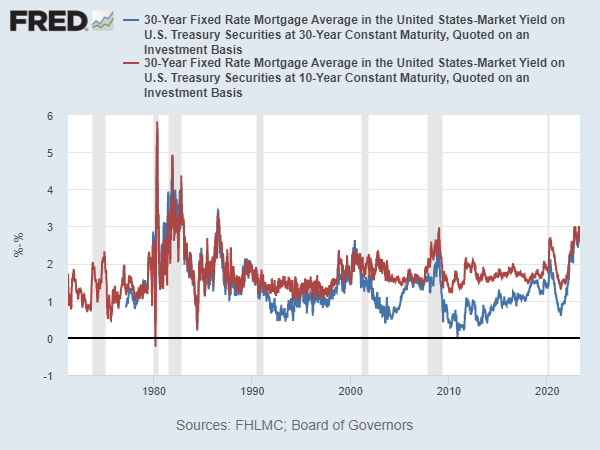

From FRED, a maturity matched spread (as well as 30 yr -10 yr Trsy).

Source: Freddie Mac, Treasury via FRED. Data are weekly averages of daily rates. [added 30yr-10yr spread 10pm]

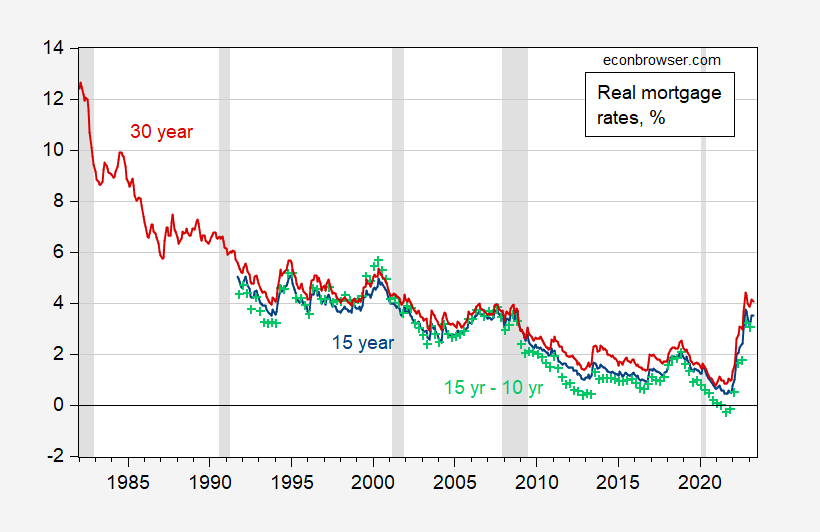

And here’s an update on real (ex ante) mortgage rates.

Figure 1: 15 year mortgage minus 15 year expected inflation (blue), 15 year mortgage minus 10 year SPF expected inflation (green +), 30 year mortgage minus 30 year expected inflation (red), all in %. NBER defined peak-to-trough recession dates shaded gray. Source: Fannie Mae via FRED, Cleveland Fed, Philadelphia Fed Survey of Professional Forecasters (SPF), NBER, and author’s calculations.

I am only an amateur at correcting the JohnH clown show. You are the master!

Our host showed two spreads without taking a position on which one is the mortgage spread. Wise choice! Best not to advise the mortgage industry how to run its business!

Once again you prove you do not know how to read.

‘a maturity matched spread (as well as 30 yr -10 yr Trsy).’

I guess you still have no clue what maturity match means.

Where was the mention of the mortgage spread?

I guess I’ll have to bookmark this quote from the St. Louis Fed and repeat it until it finally sinks into pgl’s impermeable brain—“ Total mortgage spread is the difference between the Freddie Mac Survey 30-year mortgage rate and the 10-year Treasury yield.”

https://www.stlouisfed.org/on-the-economy/2020/july/mortgage-rates-not-matching-declines-in-treasury-yields

I could find that same definition in lots of places…but His Majesty pgl is convinced that the mortgage industry is doing it all wrong!!!

JohnH: That’s one spread. It might even be a favorite spread. But, just like there are many term spreads, you can imagine others wanting to cite other spreads.

“That’s one spread.” And it so happens that it’s called the mortgage spread. There are obviously other spreads. Since a traditional role of banking is to borrow short and lend long, short term rates may well be part of the calculus.

“it so happens that it’s called the mortgage spread.”

One person called it that. Come on Jonny boy – get real. After all you coined the stupid term wage recession. Now if you are expecting a Nobel Prize – keep waiting.

“Best not to advise the mortgage industry how to run its business!”

Have you interviewed bankers? I have not. I guess Jonny boy knows how Wall Street bankers make decisions as his job is to mob the floors and take out the trash.

Now I get financial economics. You don’t.

I worked for a while in the mortgage department in the Park Avenue HQ of a money center bank.

Pgl continues to embarrass himself by showing us how little he knows about mortgages.

I think I know the address. The current occupants are still laughing at how your incompetence bankrupted your former firm!

Let’s see if JohnH can tell us why the blue line is generally below the red line. Hint – something called the term structure. Now I gave it away to most people but I kind of doubt JohnH will figure it out.

One of Jonny boy’s defenses for his maturity mismatched measure of the credit spread is some claim (without evidence) that households only hold onto their 30 year mortgages for 10 years. One has to wonder how stupid Jonny boy thinks borrowers are. Let’s imagine someone just bought a house today and was given the choice between a 30 year mortgage at an interest rate = 6.43% v. a 15 year mortgage at a rate = 5.71%.

Now if this borrower wanted to borrow money for only 10 years – I would imagine he would got for the lower rate. But not little Jonny boy who says people are willing to pay an extra 71 basis points because …. because …. because they are just as dumb as little Jonny boy!

Rocket Mortgage: “What Is The Average Home Loan Length?

A mortgage allows a borrower a certain amount of time to pay off the loan. The most common amount of time, or “mortgage term,” is 30 years in the U.S., but some mortgage terms can be as short as 10 years.

Most people with a 30-year mortgage won’t keep the original loan for 30 years. In fact, the average mortgage length is under 10 years.”

https://www.rocketmortgage.com/learn/average-mortgage-length

I just love it when pgl puts his ignorance of the mortgage industry on full display…sometimes I even hold off on my substantiation so that I can delight in pgl’s ignorance.

JohnH: Why is the 10 year Trsy used as a benchmark? I think in principle one would want to use the 30 year Treasury, so one would compare the yield to maturity on both instruments. However, the 30 year is a thinner market, and the constant yield to maturity has to be estimated, relying on the 20 year (at least for the series on FRED). I would say the argument that a typical mortgage is held for ten years is not a particularly convincing argument for using the 10 year Treasury YTM, as one is comparing a holding period return to a yield to maturity. It’s done for expediency, mostly.

We don’t typically compare a 10 year holding period return to a 3 month yield to maturity, for instance, when doing a term premium calculation, for instance.

There is also the consideration that since mortgages are amortized, the duration of a 30 year mortgage is closer to the duration of a 20 year government bond.

I sort of made this suggestion earlier as a defense of comparing the interest rate on 15 year mortgages to the 10 year government bond rate.

But the total ignoring of the term structure is just silly as you note.

Yep.

If you compare duration between mortgages (and MBS) to Treasuries, there is usually a closer match between tens and mortgages than bonds. The point to this spread is to think about substitutes within a portfolio. Liquidity and duration are both important portfolio metrics.

And for investors for whom yield-to-maturity is the main consideration, the spread at 30 years is an appropriate metric.

Why wouldn’t the effective maturity be as acceptable for calculating a NPV for mortgage as for a treasury? The main difference is practicality vs. Theoretical purity.

JohnH: What is “effective maturity”?

My best guess is by “effective maturity” JohnH means the average mortgage length he was quoting. My thought on it is many of these things became trash the day “we” decided it was ok for those financial services companies who originated the loan could sell off the loan.

@ Menzie

You know how I enjoy asking questions “straight out of left field” right?? You know one thing I was wondering right now?? I think your Dad must have been a pretty cool guy (I mean that 100%, no facetiousness, I say it with 100% respect based on his blue collar job, and what you have said about your siblings being in the health care industry). My Dad was literally a “bastard child” (or had strong reason to believe he was) and went on to get his Masters in education in a family with no one holding college degrees. And I take, in some ways, your Dad and mine to be pieces off the same block (in mentality). You probably think what I am saying is very strange, but maybe you “kinda” get what I’m trying to say~~~but all of that leads up to the question I wanted to ask you. My Dad thought banks being able to sell off residential mortgages to “mortgage servicing companies” in basically any location under the sun was really unethical and immoral. I’m not as extreme in my views on that as my father, but actually pretty well agree with my Dad’s thoughts. I’m very curious what your Dad (or even what you would guess your Dad’s) thoughts were on that matter. I bet he would agree with my Dad.

Effective maturity is the average length of time mortgagees hold their mortgages before refinancing or selling.

Net present value is based on the expected stream of payments. Nowhere in the calculation is there an “effective maturity” term, even if there were such a thing as “effective maturity.” (What, exactly, did you do in that mortgage department?)

Duration is also calculated from the expected stream of payments. Prepayment affects the expected stream of payments, so affects duration.

Now, here’s a point which I haven’t seen mentioned by our former mortgage department employee, but which drives a pretty big wedge between mortgage and Treasury duration: mortgage principal is paid back in little dabs over the maturity of the mortgage, while Treasury principal is paid back in a lump on the maturity date. Huge difference in payment streams.

Liquidity is not part of the payment stream, but is a critical issue in portfolio management.

Does duration affect spreads? Why, yes. Yes it does. Liquidity? Yes, again. Cost of carry? Yep.

And anyone who did anything worth mentioning in mortgage finance shouldn’t need me to explain that to them. Anyone who did substantive work in mortgage finance should have been able to explain the behavior of mortgage spreads, instead of insisting that others explain it.

Rocket Mortgage? DAMN!

Yeah, Rocket Mortgage, the nation’s largest mortgage originator, doesn’t know anything about mortgages! But pgl, who doesn’t even know what the mortgage spread is, is someone we should take seriously! Such arrogance!

originator means broker which means they take no position as to yields or risk taking. And you claim you know banking? No – you’re an idiot. But we all knew that.

‘What, exactly, did you do in that mortgage department?’

You never answered Macroduck’s question but that’s OK as we know you took out the trash and mopped the floors in that fancy Park Avenue office.

https://fred.stlouisfed.org/graph/?g=o5t6

January 15, 2018

Thirty- & Fifteen-Year Fixed Rate Mortgage Average and 10-Year Treasury Rate, 2007-2023

https://fred.stlouisfed.org/graph/?g=137Pa

January 15, 2018

Thirty-Year Fixed Rate Mortgage Average minus 10-Year Treasury Rate, 2007-2023

https://fred.stlouisfed.org/graph/?g=138JM

January 15, 2018

Thirty- & Fifteen-Year Fixed Rate Mortgage Average and 10-Year Treasury Rate, 2000-2023

https://fred.stlouisfed.org/graph/?g=138IX

January 15, 2018

Thirty-Year Fixed Rate Mortgage Average minus 10-Year Treasury Rate, 2000-2023

https://fred.stlouisfed.org/graph/?g=YcwR

January 30, 2018

Case-Shiller Real Home Price Index, 1992-2023

(Indexed to 1992)

https://fred.stlouisfed.org/graph/?g=QKkV

January 30, 2018

Case-Shiller Real Home Price Index and 30-Year Mortgage Rate, 1992-2023

(Indexed to 1992)

Back in November 2022 when JohnH started going off about how economists ignore and do not understand mortgage spreads, I put up a link to this paper:

https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr674.pdf?sc_lang=en&hash=FB45B7D738A1D31622F190B4543DC431

Federal Reserve Bank of New York Staff Reports “Understanding Mortgage Spreads”

Nina Boyarchenko / Andreas Fuster /David O. Lucca

It appears little Jonny boy never read it. I say this because I noted how prepayment risk may have something to do with this spread last night and it was clear little Jonny boy had no clue what I said. But read the abstract from this paper:

Most mortgages in the U.S. are securitized in agency mortgage-backed securities (MBS). Yield spreads on these securities are thus a key determinant of homeowners’ funding costs. We study variation in MBS spreads over time and across securities, and document a cross-sectional smile pattern in MBS spreads with respect to the securities’ coupon rates. We propose non-interest- rate prepayment risk as a candidate driver of MBS spread variation and present a new pricing model

that uses “stripped” MBS prices to identify the contribution of this prepayment risk to the spread. The pricing model finds that the smile can be explained by prepayment risk, while the time-series variation is mostly accounted for by a non-prepayment risk factor that co-moves with MBS supply and credit risk in other fixed income markets. We use the pricing model to study the MBS market response to the Fed’s large-scale asset purchase program and to interpret the post announcement divergence of spreads across MBS.

As I and others have noted many times, JohnH is not interested in a real discussion of any economic topic. No – little Jonny boy wants to pretend he is the only one that knows things even if little Jonny boy clearly knows nothing and refuses to read actual economics.

How exactly do the factors suggested in the Fed’s paper explain the unusually high mortgage spreads we are currently seeing? What changes in specific data should we be following to be forewarned of a drop in the mortgage spread?

pgl doesn’t have a clue. He still can’t explain why the mortgage spread is so high!

“How exactly do the factors suggested in the Fed’s paper explain the unusually high mortgage spreads we are currently seeing?”

One more thing moron. It is called the pricing of options. When the probability of interest rates going down is low (as in when mortgage rate were less than 4%) then the value of the option is low. When mortgage rates are high, the probability of interest rates going down is higher, the value of the option is higher.

This is very basic stuff. That I have to explain the basics of option pricing to you does show you are the dumbest little troll ever.

Kudos! pgl could name ONE of the reasons for a high mortgage spread!

I named it back in November. But Jonny boy was too stupid then to get it. And it took 3 Cliff Notes versions this time for the dumbest troll God ever created to get it this time.

‘He still can’t explain why the mortgage spread is so high!’

The NYFED paper explained it. OK – you are too stupid to get what it said so I gave you the Finance for Dummies yesterday and I just laid it out for you again.

But yea – even the Finance for Dummies version is way over your head. Like we have all said – YOU ARE DUMB!

LOL! Pgl says that the Fed paper explained it, but he can’t tell how their explanation pertains to the current situation or what data should be used to identify a changing situation.

Months ago, pgl attributed the high mortgage spread to volatility. The only problem is that the MOVE index is somewhat higher than a year ago, but the mortgage spread is significantly higher.

For a know-it-all who sits in judgement of every comments, pgl sure exposes himself as an emperor with no clothes!!!

” Pgl says that the Fed paper explained it, but he can’t tell how their explanation pertains to the current situation or what data should be used to identify a changing situation.”

My Lord – most two year olds have better reading skills than little Jonny boy. I have often give you the Finance for Dummies explanation but one more time for the mentally retarded.

The value of the prepayment option rises with mortgage rates (more scope for these rates to fall later) and current mortgage rates are rather high (something Jonny boy mentions a lot).

Jonnny boy – stop chirping and start THINKING. Oh wait – your brain is incapable of thinking. Never mind.

Yep, pgl can’t explain why the mortgage spread is so high, as I concluded long ago.

“The NYFED paper explained it. OK – pgl is too stupid to get what it said so I gave him the Finance for Dummies yesterday and I just laid it out for him again.

But yea – even the Finance for Dummies version is way over pgl’s head. Like we have all said – PGL ARE DUMB!”

[one of pgl’s favorite tactics is to throw out a paper that he doesn’t understand well enough to summarize the salient points and then accuse someone of not understanding it.] Well, pgl, if you can’t explain something yourself, you don’t understand it.

And we keep accusing CoRev of losing his marbles. You seriously need to take your meds.

“one of pgl’s favorite tactics is to throw out a paper that he doesn’t understand well enough to summarize the salient points and then accuse someone of not understanding it.”

I clearly explained what this paper said back in November and repeated my clear explanation. The fact that you are too stupid to understand how to tie your own shoes is not my fault.

30 year mortgage minus 30 year expected inflation (red) is now 4%. Now we had one JohnH telling us that this was not a high real interest rate.

Then again we have another JohnH telling us mortgage rates are too high.

Which JohnH decided to get out of bed this morning?

Interesting, isn’t it, that there was no information provided about the recent predictive accuracy of the SPF-10 inflation forecast used to determine real (ex ante) mortgage rates . (I must admit that I thought at first that SPF-10 was referring to a sunscreen protective factor, which come to think of it, would have about the same predictive accuracy!

In any case, Wolfgang Münchau says it better than I could ever hope to: “Inflation models are worse then useless. They make central banks complancent.

If anyone wonders why the pandemic models have been hopelessly wrong, just take a look at inflation models. Pandemic models are actually not too bad by comparison. Sure, they are wrong most of the time, but they are wrong in the normal sense in which models are wrong. They are sometimes too pessimistic, sometimes too optimistic.

Macroeconomic inflation models have the unique distinction of being wrong and biased. They perform worse than all of the following: a random number generator, a soothsayer with big ball, and a monkey with a dartboard. I am not suggesting that central banks should replace staff economists with monkeys. But if they did, the first thing we would note is a measurable reduction in forecasting bias. Wrong and unbiased is better than wrong and biased.”

https://www.eurointelligence.com/column/the-porcupine-flips

I’m amazed that there is a market for bad information markets…but then again, I guess it’s not to amazing, given that there is also a market for people forecasting the date of the end of the world!

“I must admit that I thought at first that SPF-10 was referring to a sunscreen protective factor”

That explains a lot. You have been out in the hot sun for so long your excuse for a brain dried up.

Wolfgang Münchau is a journalist. Hey Jonny boy – Lawrence Kudlow used to write for the National Review. So why not ask that clown about this.

Wolfgang Münchau is not just any journalist: “Wolfgang Munchau, 49, is associate editor and European economic columnist of the Financial Times. Together with his wife, the economist Susanne Mundschenk, he runs eurointelligence.com, an internet service that provides daily comment and analysis of the euro area, targeted at investors, academics and policy makers.” https://www.ineteconomics.org/research/experts/wmunchau;

https://ces.fas.harvard.edu/people/002175-wolfgang-münchau

You were caught lying about what Cochrane had said on this issue back in November. And now you return to your dishonesty? Yep – Jonny boy lies more than the other Trumpian trolls here. Then again – one has to be a liar to continue as a Putin poodle.

24 October 2021

Hey Jonny boy – you did it again. You used something written a one and a half ago to tell us that our current forecasts are all biased. But even a retarded monkey would realize the high inflation back then has come down consistent with those forecasts you continue to mock.

Now which is it Jonny boy – are you too STUPID to read the date of your own link? Or are you doing what you do best – LYING.

BTW – you did this with some old John Cochrane piece which Cochrane later updated. And you forgot to tell us about his most recent blog post?

YEA – you are one very dishonest troll.

pgl is trying to gloss over all the bad inflation forecasts of the past five years!!!

And he totally misses what Münchau calls “policy bias” whereby the forecasts tend toward the Fed’s target rate of 2%!!! If you look at the SPF forecasts, they were pretty much stuck on 2% for months as inflation raged. Finally, they deferred a bit to reality.

And economists base real (ex-ante) interest rates on an inflation forecasting outfit like that? Caveat emptor!

JohnH: You’re missing the point about ex ante forecasts. It’s not whether they’re good or bad (which is important from a statistical point), but to the extent you’re measuring expectations, these are the expectations that agents make their decisions based on.

So, the Michigan survey inflation forecast is biased. But since agents make their decisions based on their (perhaps biased) expectations, these matter.

You have clearly not taken a macro course in the past 40 years…

So essentially the “inflation expectations” game is nothing more than Keynes’ beauty contest, as I have suggested before.

It has nothing to do with real present value, only what other investors think that other investors are thinking about what price to pay–an illusion.

And, as we can see, investor expectations on TIPS breakeven have been virtually delusional for the past few years, as has the SPF forecast.

So what exactly is the value in macroeconomics of bad inflation expectations? Is it assumed that expectations somehow become reality, as in the Michigan survey debunked by Claudia Sahm and Jeremy Rudd?

JohnH: The SPF and Trsy-TIPS breakeven have not been as delusional as the one year lagged CPI inflation rate that you have argued for using. There’s a whole post on this, by the way.

That old Cochrane post you put forth as fresh evidence based its trash on Wolfgang Münchau. So you knew you just rehashed something we already debunked. Johnny boy has lied and lied again.

Now a real man would own up to his serial lies. But not little Jonny boy. He just double downs on his discredited lies. But that is who you have been for many years. A serial liar.

Dr. Chinn had to remind dishonest little John that we covered this before.

Cochrane who you quoted citing Wolfgang Münchau back in October 2021 later admitted that actual inflation had declined in the last year in line with expectations.

That you try to rehash the Oct. 2021 gibberish from Cochrane and Münchau now is the most dishonest garbage I have ever read. It’s so bad that Dr. Chinn should ban your lying rear end from this blog. You are truly the most pathetic troll EVER!

pgl sure loves to make unsubstantiated claims about what others said…with absolutely no proof.

We also know that pgl loves to misrepresent what others say and even fabricate their views, so without citations, you can totally disregard pgl’s nonsense.

JohnH

May 5, 2023 at 3:13 pm

Little Jonny boy does not like it when others catch him lying. Little Jonny boy throws a temper tantrum screaming that others lied because little Jonnny boy is all upset that his lies have been called out.

Yea – little Jonny boy is one worthless troll.

in the first figure, there seems to be a break in behavior before and after about 1990. prior to, the spreads were about the same. they differed afterwards. any reason for this change?

The break is simply the 30-year government bond rate v. the 10-year government bond rate.

Maybe we can get Alan Greenspan to rehash his Great Bond Conundrum. I always laughed when Max Sawicky would refer to Greenspan as Yoda.

Somewhere in this damned messy computer room, I gotta book published by Wiley written by some dude with a MidEast sounding name on rates and what they mean. I think I actually got it before I went to China. I always thought this was just a pretty “standard” quoted rate and there wasn’t much “debate” circulating around it, but I’m gonna find that book sometime before I get sauced on Friday (apparently this confounded rain has cancelled my Friday lawn mowing plans) under this mess of NYT newspapers, library receipts, “graphic novels” (I always just call them comic books) and cans of alcoholic fruit drink and find out what the hell he has to say about this damned rate.

Geez Louise, we gonna argue savings deposit rates vs checking account rates next??

I guess one can say that Clarence Thomas and Harlan Crow made sure this young man got a good education!

https://www.propublica.org/article/clarence-thomas-harlan-crow-private-school-tuition-scotus

In 2008, Supreme Court Justice Clarence Thomas decided to send his teenage grandnephew to Hidden Lake Academy, a private boarding school in the foothills of northern Georgia. The boy, Mark Martin, was far from home. For the previous decade, he had lived with the justice and his wife in the suburbs of Washington, D.C. Thomas had taken legal custody of Martin when he was 6 years old and had recently told an interviewer he was “raising him as a son.” Tuition at the boarding school ran more than $6,000 a month. But Thomas did not cover the bill. A bank statement for the school from July 2009, buried in unrelated court filings, shows the source of Martin’s tuition payment for that month: the company of billionaire real estate magnate Harlan Crow.

Clarence Thomas is one of the most corrupt judicial figures in our history. It is simply amazing that a sitting Supreme Court justice feels that rules and laws do not apply to him personally. They only apply to other people.

Off topic: Two new papers out of Berkeley look at the effect of minimum wage increases on employment:

https://irle.berkeley.edu/publications/working-papers/high-minimum-wages-and-the-monopsony-puzzle/

https://irle.berkeley.edu/publications/working-papers/small-businesses-and-the-minimum-wage/

The gist is that, overall, minimum wage hikes don’t cost jobs except for teens working at small firms. Averages wages rise and inequality declines with higher minimum wages. The results are consistent with the presence of monopsony.

Michael Reich is listed last on both papers, which suggests that he’s a nice man.

Thanks. It’s too bad that it takes a pandemic for people to realize they’re being underpaid in reference to the value they add to firms/businesses. And that has never been rocket science. And frankly, has never taken an equation to understand. Nothing personal to mathematical equations.

It would be nice if we saw more orthodox economists speaking out strongly for this, instead of thinking about tenure career path and keeping options open for corporate jobs. I guess they think being the milquetoast recordkeeper of events gives them a more scholarly appearance. Like watching a large building burning down, not interested in the barrels of gasoline that were kept in storage for 15 years, they want to measure the ex-post height of the flames.

What drove up wages for the 10% percentile–labor market tightness or higher minimum wages? Or both?

Ernie Tedeschi, an economist at Evercore ISI:

“Right now, the economy is doing something extraordinary,” he says. “People at the bottom of the distribution have actually seen higher wage growth than people at the top and in the middle.”

Crunching census data, Tedeschi finds workers in the bottom third of the income ladder have enjoyed pay raises of about 4.1% in each of the last two years, compared with 3.6% raises for the top third and 3.9% for all workers.

Minimum wages aren’t the only factor. Low-wage workers also have more bargaining power, as employers scramble to fill job openings when unemployment is just 3.5%.

Right now, the economy is doing something extraordinary. People at the bottom of the distribution have actually seen higher wage growth than people at the top and in the middle.

But without the upward pressure of rising minimum wages, Tedeschi estimates the bottom third would have received raises averaging just 3.3% (below average for all workers and for workers in the top one-third.)

“Minimum wages probably are the difference that are kicking up wage growth at the bottom to higher levels than other groups in America,” he says. https://www.npr.org/2020/01/09/794280616/minimum-wage-hikes-fuel-higher-pay-growth-for-those-at-the-bottom

Thirteen states already index minimum wages to inflation. https://www.epi.org/blog/tying-minimum-wage-increases-to-inflation-as-12-states-do-will-lift-up-low-wage-workers-and-their-families-across-the-country/

Do you think January of 2020, 3 years and four months ago is a good place to be grabbing your data at this stage?? Tedeschi now works in the White House if it makes any difference to you John.

Autor grubbed his data from many years before that. And, as I noted, many states, including many of the most populous ones, index their minimum wage to inflation, which would help the effective minimum wage for the country as a whole. Together with tight labor markets, minimum wage increases had to help.

The problem is that real wages since 2019 have been stagnating, except for those of the top 10%, who take home almost of factor income…a basic fact that is outside the Overton Window.

“The problem is that real wages since 2019 have been stagnating,”

john, just curious, on what basis do you believe those wages should be increasing? and if they do indeed increase, what are the ramifications? meaning if something (real wages) increases, then all else constant, something else needs to decrease. what do you assume should decrease, or what then should no longer remain constant if no other decrease is to occur?

“Low-wage workers also have more bargaining power”

The point of the paper Dr. Chinn gave us. But did little Jonny boy READ it before he started misrepresenting it. Of course not.

Hungary has its own CPAC?

https://abcnews.go.com/International/wireStory/hungarys-orban-bemoans-liberal-virus-cpac-conference-99070058

At CPAC, Hungary’s Orban decries LGBTQ+ rights, migration

Hungary’s populist prime minister has likened liberalism to a “virus” in an opening speech at the Conservative Political Action Conference in the Hungarian capital on Thursday

Hungary’s populist prime minister likened liberalism to a “virus” in an opening speech at the Conservative Political Action Conference in the Hungarian capital on Thursday, painting a picture of a global right-wing movement mobilizing to defeat “progressive elites.” Viktor Orban’s speech at CPAC Hungary centered around battling what he frequently described as “woke culture,” and delved primarily into hot-button cultural topics such as transgender and LGBTQ+ rights, migration and the content of education for children. The two-day conference, the second in Hungary in as many years, featured segments titled “Make Kids Not War” and “No Country for Woke Men.” A sign over the entrance to the venue, a conference hall on the Danube River, read, “No Woke Zone.” After receiving a standing ovation, Orban said Hungary had become “world-famous” for its hard-line migration and cultural policies, and offered those in attendance a recipe for implementing a similar right-wing agenda at home. “No migration, no gender, no war,” Orban said, urging his international audience to focus on these issues in their own countries.

Orban may be more homophobic and racist than even Donald Trump. Princeton Steve’s kind of guy!

Considering Orbans ethnic background, his own homosexuality, maybe you need to rethink this post.

Mortgage delinquencies do not explain the increase in the mortgage spread. Delinquencies are up, but remain low:

https://www.mba.org/news-and-research/newsroom/news/2023/02/16/mortgage-delinquencies-increase-in-the-fourth-quarter-of-2022

As noted in the MBA article, delinquency tracks job loss. As of March, the average unemployment rate forecasts of CBO, Blue Chip, and Federal Reserve over the 2023-2025 period were 3.7%, 4.3% and 4.4%, respectively – not all that high. So neither the current unemployment rate (3.5%) nor expected unemployment explain the current mortgage spread.

Cost of funding, on the other hand, explains the current mortgage spread pretty well:

https://fred.stlouisfed.org/graph/?g=138Ca

You’ll notice that the funds rate doesn’t always match the mortgage spread very well, but toss in expected delinquencies, as proxied by the jobless rate, and you get a pretty good explanation for much of the performance of the mortgage spread. Add in the current expectation for a rise in joblessness in your imagination, ’cause FRED doesn’t have a series for that.

‘The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.96 percent of all loans outstanding at the end of the fourth quarter of 2022, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey. The delinquency rate was up 51 basis points from the third quarter of 2022 but still down 69 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the fourth quarter fell by 1 basis point to 0.14 percent.’

Interesting historical data. But the real issue is projected delinquency and expected losses from default. Markets are after all forward looking.

I have provided over and over a NYFED paper that talks about prepayment risk. Now Jonny boy does not understand that mortgage holders have an option that increases in value when the possibility that mortgage rates could fall in the future. Low current mortgage rates mean low option value. High mortgage rates mean higher option value.

I would have thought even a Village Idiot would get this but not our little Jonny boy. I have tried many times to explain the basics to Jonny boy with no success. Maybe you could help this fool out.

Congrats, pgl…you finally identified ONE of the factors behind the high mortgage spread. But even after having read the Fed paper, that’s the best you can do?

Hey dumba$$$. I cited this back in Nov. 2020. Of course little Jonny boy never read the paper back then either. Thanks for reminding us of how STOOOPID you are.

I already gave little Jonny boy Finance for Dummies. Oh wait – that too went over this little retarded head. Yea it is the best I can do trying to explain the basics to the dumbest troll God ever created. Then again your preK teacher had tried her best to teach little Jonny boy how to read and even she failed. You are truly the dumbest person I have ever met.

https://news.cgtn.com/news/2023-05-04/Scientists-predict-CO2-mitigation-of-China-s-RPVs-in-2030–1jwI4M6oywo/index.html

May 4, 2023

Rooftop photovoltaic power: Scientists predict CO2 mitigation of China’s RPVs in 2030

Chinese scientists and their international counterparts have published an assessment of the carbon mitigation potential of rooftop photovoltaics (RPVs) in China, noting that they could be offsetting about 2.72 billion tonnes CO2 in 2030.

The rooftop photovoltaic is a solar system with electricity-generating solar panels installed on a building’s roof. According to the study, * published recently in the journal Nature Communications, RPVs are important in achieving energy transition and climate goals, especially in cities with high building density and energy consumption.

Estimating RPV carbon mitigation potential at the city level of an entire large country is challenging given the difficulties in assessing a rooftop area.

Researchers from Nanjing Normal University and other institutions in China, as well as those from the United States and Singapore, used multi-source geospatial data and machine learning regression to identify a rooftop area of nearly 66,000 square kilometers for 354 Chinese cities in 2020, representing about 3.63 billion tonnes of CO2 mitigation.

Considering urban land expansion and power mix transformation, the researchers estimated a potential CO2 mitigation of about 2.72 to 3.63 billion tonnes in 2030, when China plans to reach its carbon peak.

The study also suggested that it is necessary to further explore how to improve the flexibility of RPV energy production, such as combining RPVs with energy storage technology to achieve continuous power supply at night and reduce any fluctuation on the power grid.

* https://www.nature.com/articles/s41467-023-38079-3

https://www.nytimes.com/2023/05/03/us/politics/senate-tariffs-chinese-solar-panels.html

May 3, 2023

Congress Clashes With Biden Over Tariffs on Illegal Chinese Solar Panels

In a rebuke to the Biden administration, the Senate approved a measure to reinstate tariffs on solar panels found to violate U.S. trade rules.

By Ana Swanson

The Senate voted on Wednesday to reinstate tariffs on solar panels from Chinese companies in Southeast Asia that had been found to be coming into the United States in violation of trade rules.

The measure, which passed by a vote of 56 to 41, had already been approved by the House. It sets up a showdown with the Biden administration, which had temporarily halted the tariffs to try to ensure that the country had an adequate supply of solar panels in the fight against climate change….

I would have thought Trump’s stupid trade war with China would have been thrown in the dust heap by now. China makes better and cheaper solar panels, which we should be purchasing.

Considering how low the tariff is, it’s irrelevant.

25% is not low. Could someone update your remedial version of ChatGPT. Damn!

Your not getting it. The so called tariff is a very weak and useless attempt at supporting the coal to China industry. The U.S. doesn’t use enough China made panels to matter. The lame fig leaf is about slowing solarization in Asia.

Menzie, you are 20 years out of date. It’s not protectionist vs free trade, but global company vs global company. Just think if coal was banned to China in the name of America. JohnH, you probably don’t have the brain power to get it.

The female version of the original remedial ChatGPT is not any better than the male version.

Where have all the free trade fundamentalists gone? Such protectionism would have been booted out of Congress only a few years ago!!!

Funny how all those economists making careers out of supporting free trade have suddenly gone silent! How quickly the tide changes!

JohnH: The pro-free-trade economists are still around. Many of the pro-free-trade politicians have disappeared, particularly in the Republican party.

Eh, nope. China is a large buyer of U.S. coal. Something you forget. Tariffs that small are simply irrelevant over time.

Maybe you were trying to articulate the old the foreigner will pay argument but it seems your ChatGPT is very rusty.

It is odd that Jonny boy can defend Trump’s idiotic trade war but gets all mocking when Biden tries to have a somewhat smarter Industrial Policy. I guess he likes his MAGA hat.

https://www.nature.com/articles/s41467-023-38079-3

April 24, 2023

Carbon mitigation potential afforded by rooftop photovoltaic in China

By Zhixin Zhang, Min Chen, Teng Zhong, Rui Zhu, Zhen Qian, Fan Zhang, Yue Yang, Kai Zhang, Paolo Santi, Kaicun Wang, Yingxia Pu, Lixin Tian, Guonian Lü & Jinyue Yan

Abstract

Rooftop photovoltaics (RPVs) are crucial in achieving energy transition and climate goals, especially in cities with high building density and substantial energy consumption. Estimating RPV carbon mitigation potential at the city level of an entire large country is challenging given difficulties in assessing rooftop area. Here, using multi-source heterogeneous geospatial data and machine learning regression, we identify a total of 65,962 km2 rooftop area in 2020 for 354 Chinese cities, which represents 4 billion tons of carbon mitigation under ideal assumptions. Considering urban land expansion and power mix transformation, the potential remains at 3-4 billion tons in 2030, when China plans to reach its carbon peak. However, most cities have exploited less than 1% of their potential. We provide analysis of geographical endowment to better support future practice. Our study provides critical insights for targeted RPV development in China and can serve as a foundation for similar work in other countries.

pgl was recently bleating concern about corporate margins falling, though they’ve been in record, nose-bleed territory for the past few years. So far margins are beating the 4Q22 results as well as 1Q23 estimates, even though they’re in severe, horrifying, concern-bleating danger of moving out of record territory. At this rate they may not get to the 24% that pgl was hoping for anytime soon.

Oligopoly has its perks…which may well explain why inflation isn’t dropping faster. Those with the means, motive, and opportunity to drive greedflation are not known for their hesitancy for exploiting an opportunity when it presents itself.

“pgl was recently bleating concern about corporate margins falling”

Awww – I must have hurt little Jonny boy’s feelings. I noted profit margins as coming down a bit as a good thing and little cry baby claims I had “bleating concern”.

Look Jonny boy – it is not my fault you write the dumbest things ever. What is one to do? Repeat you stupidity and lies? Try growing up little baby.

The lamest excuse JohnH uses for his weird maturity mismatched measure of mortgage spreads is that other fools abuse the 10-year rate.

Now as smart as the FRED folks are they take this series compared to the 10-year government bond rate as some proxy for the BAA credit spread:

https://fred.stlouisfed.org/series/DBAA/

But the legend states:

‘These instruments are based on bonds with maturities 20 years and above.’

So if the corporate bond has a maturity of 20 years or more, why are we not subtracting the 20-year rate?

My point is simply that if some clown does something stupid, you’d be a fool just to follow suit. But Jonny boy follows some of the dumbest clowns ever and he takes great pride in doing so!

pgl really needs to talk to anyone in real estate to get an understanding of industry practice as it pertains to the mortgage spread. Instead he keeps spouting economic theory, insisting that theory trumps reality!!!

Go ahead, pgl, get out of your ivory tower. The fresh air will do you good, even if it is Brooklyn.

JohnH: As a person who claimed the real mortgage rate was still negative in 2023, you are hardly in a position to criticize anybody else’s understanding.

Odd – my comment was about measuring corporate bond spreads. And JohnH thinks I was referring to the real estate market? Seriously?

Actually the ones who should be taken to task are those who repeatedly published those overly optimistic inflation forecasts used to determine ex-ante real interest rates…as well as those who, having been fooled over and over by them, still put a lot of credence in them.

JohnH: So if U. Michigan stopped publishing the survey of consumer expectations, they would disappear?

Hey little pet poodle. We get that life is hard in the Kremlin when Putin refuses to feed you. But damn – your comments of late are beyond stupid, beyond totally dishonest, and simply a total embarrassment to your poor mother. Suck it up troll and demand that your Russian masters to feed the poodles.

BTW – even John Cochrane gets that inflation in the past 10 months has come down. I guess life in the Kremlin has caught little Jonny boy off from the real world. Hope Putin at least finally feeds his pet poodle.

I guess you have to talk to the janitor for Rocket Mortgage since you are lost when the grown ups talk financial economics. But seriously – do you even know the difference between corporate bonds and mortgages? DAMN!

“pgl really needs to talk to anyone in real estate to get an understanding of industry practice as it pertains to the mortgage spread.”

that mortgage spread is fine for discussion purposes. the real question is, does the industry actually respond directly to that spread? or is it more of a general talking point, to avoid more detailed discussion? my guess it serves more as a general talking point, and the financial decision making is much more complex.

Jonny boy actually thinks his Park Avenue banker friends have some sophisticated model for calculating some “mortgage spread”. No – they set mortgage rates. Researchers may try some tortured definitions but that is not how mortgage rates are set in the market place. Then again little Jonny boy has no clue what the mortgage market is. He is too busy mopping the floors in those fancy Park Avenue buildings.

AS,

Thanks for the info in comments to the previous post. I’ve responded further there.

As the gentleman on twitter said, mark your calendars. One week from today:

https://www.finance.senate.gov/hearings/cross-border-rx-pharmaceutical-manufacturers-and-us-international-tax-policy

Oh, boy. This is going to be disgusting. If you look up “mendacity” in the dictionary…

William Morris

PwC

Washington , DC

Mendacity is his middle name which is how he made partner.

https://www.pwc.com/gx/en/news-room/press-releases/2023/pwc-names-william-morris-new-global-tax-policy-leader.html

Doesn’t his grin just tell you how he is about to rip off the public fisc?

@ Macroduck

I mean, I get what you’re saying, but surely the pearls and gems of Setser outweigh the other.

Would I attend a co-lecture by Menzie Chinn and Peter J Wallison?? Well, Wallison ranks high on my go ballistic “does anyone have a handgun handy??” list, so I’d have to think about it to be honest. Maybe if I brought music headphones for when Wallison was moving his mouth??

Yep, you get what I’m saying.

Brad Setser!

I’ll probably take a nap when that PwC clown testifies.