Mr. Steven Kopits asserted that the Philadelphia Fed’s early preliminary benchmark supported a recession in 2022H1, to wit:

You, Menzie, held the Est Survey was more likely right. You wrote: So: (1) I put more weight on the establishment series, and (2) the gap between the two series is more likely due to increasing, and biased, measurement error in the household series, rather than, for instance, primarily increases in multiple-job holders. https://econbrowser.com/archives/2022/12/the-household-establishment-job-creation-conundrum

Dead wrong, as it turned. And predictably so.

You were wrong because you did not consider the statistics more holistically. That’s the learning point for your students. Cross check your indicators if you have dials which are telling you different things. If jobs are increasingly rapidly, then GDP should also be up. If jobs are increasing rapidly, then mobility and gasoline consumption should also be up, because so many people need to drive to work in this country. Finally, if productivity is imploding when jobs are up, you really need to take a pause and put together some sort of narrative as to why that might be happening. It suggests something anomalous in the data which requires closer inspection.

Had you done that, Menzie, you might have concluded as did the Philly Fed…

What remains of that hypothesis? Well, on March 16th, the Philly Fed released this update.

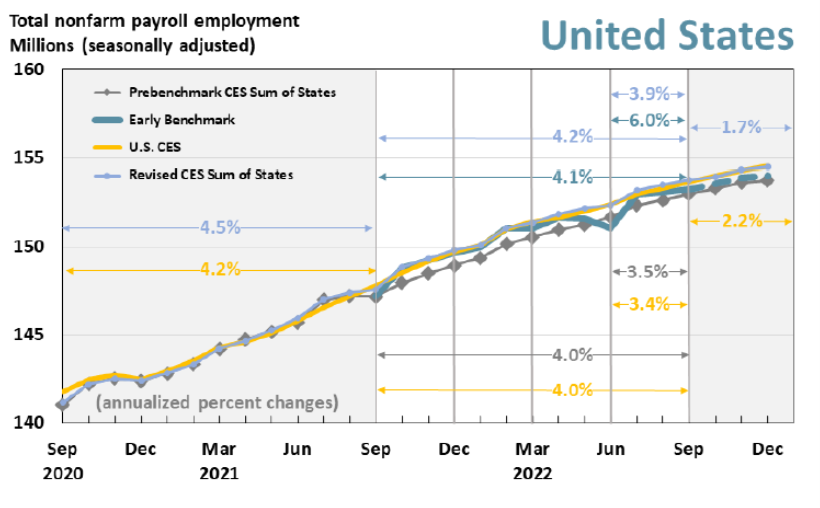

Source: Philadelphia Fed.

From the report:

Over the full year ending with this 2022 Q3 vintage — which includes additional QCEW data changes affecting the prior three quarters — payroll jobs in the 50 states and the District of Columbia grew 4.1 percent.

• Based on the prebenchmark CES sum of states and the U.S. CES, payroll jobs grew 4.0 percent.

• The revised CES sum-of-states growth rate is 4.2 percent.

This EB estimate corresponds to 6,072,000 net new jobs added during the period rather than the 5,825,500 jobs estimated by the sum of states; the U.S. CES estimated net growth of 5,904,000 jobs for the period.For 2022 Q3, payroll jobs in the 50 states and the District of Columbia rose 6.0 percent, after adjusting for QCEW data.

• Based on the prebenchmark CES sum of states and the U.S. CES, payroll jobs grew 3.4 percent and 3.5 percent, respectively.

• The revised CES sum-of-states growth rate is 3.9 percent.

• This EB estimate corresponds to 2,203,200 net new jobs added during the period rather than the 1,322,100 jobs estimated by the sum of states; the U.S. CES estimated net growth of 1,270,000 jobs for the period. [bold italics added – MDC]

I argued in my previous rebuattal of the Kopits 2022H1 labor market recession hypothesis that these estimates were likely to be revised. And indeed they have been, so much so that (1) the previously estimated downturn is essentially erased, and (2) employment growth continues through 2022Q3.

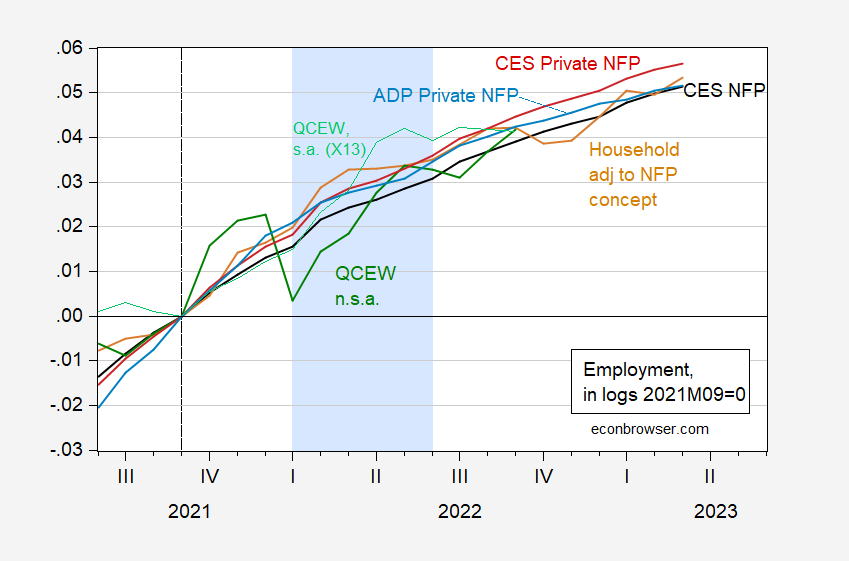

I think it ill-advised to rely upon just one series, and so in Figure 1, I present in the CES, CPS, and ADP estimates of either NFP or private NFP, or QCEW tabulation of covered employment.

Figure 1: Cumulative percent change in CES nonfarm payroll employment (bold black), CPS civilian employment adjusted to NFP concept (tan), CES private nonfarm payroll employment (red), ADP private nonfarm payroll employment (light blue), Quarterly Census of Employment and Wages (QCEW) total employment, seasonally adjusted using log X-13 (light green), and QCEW total employment, not seasonally adjusted (dark green), all since 2021M09. Light blue shading denotes a recession hypothesized by Steven Kopits. Source: BLS, ADP via FRED, and author’s calculations.

All the foregoing suggests to me no recession in 2022H1 (although the data will be revised further). However, momentum in 2022 is no guarantee of no recession in 2023, as discussed here.

I love how little Stevie wrote:

‘Dead wrong, as it turned. And predictably so.’

Actually this is applicable to little Stevie’s forecast that oil prices would hit $180 a barrel. Dead wrong – and predictably so.

Revisions are the bane of forecasters.

For example, everything that I and everyone else wrote about initial jobless claims for the past two years got tossed in the trash can by major revisions this past Thursday. Those new all-time record lows last spring? Gone. All of those under 200,000 reports for the past several months? Gone. Initial claims were a positive in almost everyone’s basket of data until Thursday. And in one fell swoop, they retroactively turned into a negative.

Similarly, the really poor QCEW for Q2 2022 was mainly based on an awful June month, that caused the YoY% change in jobs to be only 4.0%, after ending Q1 at +5.1% YoY. In the last set of revisions, May and June 2022 were both revised, and June in particular, which now shows a 4.4% YoY gain – an increase of over 500,000 jobs!

While the QCEW in my opinion remains the gold standard ultimately, because it is not a survey but rather a census of over 95% of all establishments, it is really dismaying that *all* of 2022’s data remains preliminary. It makes me wonder if there is another day like Thursday lurking out there in the next 12 months for the Establishment Survey.

There was no surprise Thursday. It was back loaded into 2 weeks. Come back in a couple of weeks. Pre recession??? Give me a break.

Stevie has a tone problem. I’ve called it his “consultant tone” – my assumption is that he was faced with questions from clients for which he had no fact-based answer and got in the habit of making up answers rather than admitting to ignorance. The habit metastasized. Now, this assumes Stevie has clients. It also assumes that his “I’m right, you’re wrong, because I very disdainfully say so” shtick is something that developed over time – due to a weakness of character, make no mistake – rather than something acquired at birth. Either assumption could be mistaken.

In just the past few comments sections, NDD has acknowledged that jobless claims revisions have undercut some of his earlier thinking and Paweł Skrzypczyński has acknowledged that the relationship behind his employment gap measure may have changed in the aftermath of the Covid shock. These are real economists, doing real work, and they show no sign of ego-need getting in the way of their thinking. Stevie has no such humility, and no such claim to knowledge.

There he is, talking smack about Menzie, a real live actual economist, only to be served up a big plate of crow. And not for the first time.

Rehab, Stevie. Lots of rehab.

Stevie claims to have worked for Deloitte-Hungary. I have never been to Hungary but the American version of Deloitte consists of a lot of incompetents who make lots of money by lying for their clients. One would think competition would weed out incompetent lying consultants but it’s called the Big Four for a reason.

Wow, calling out the banned is a particularly slick move. Do your thing, Menzie. Hahahaha

Econned: Mr. Steven Kopits has not been banned on this website. He is free to comment, but he has chosen not to do so since March 26, at which time he argued that M2 velocity was mean stationary.

Menzie Chinn,

So who you were referencing here? I though the convo was regarding Steven Kopits. https://econbrowser.com/archives/2023/04/a-statistical-analysis-of-implications-of-using-the-china-virus-phrase#comment-296571

Remember, that this was when you publicly asserted that your view that the usage of ‘Kung Flu’ or ‘China Virus’ isn’t intrinsically bad, but rather just “since there was already a widely known term for the virus”. So the ‘ban’ is because you want to be a lexicographer? It isn’t because the terms are inherently bad? Weird stuff.

Econned: Please try to keep up. Reader Peak Trader used the term (in addition to other derogatory terms, not aimed at Asian Americans) and was banned. Mr. Kopits defended the use of the term in question, but did not keep on using it once apprised of the policy. Hence, he was not been banned for a single transgression.

Menzie Chinn,

My asking is trying to keep. Apologies if you found it a burdensome request to clarify your unclear comment – I do not follow the never-ending tabloid-worthy gossip and pettiness that you foster here on Econbrowser.

No, really, these must be truly dark times for Stevie Kopits. He’s gone a full three months without Barkley Rosser telling him he’s “actually” a great oil price forecaster and all-around swell guy.

The struggle, and the void, is real.

/sarc

it was obvious to me the banned comment was not directed towards steven kopits, as kopits has made comments on this site. it seems that econned was simply eager to jump on prof chinn, and made a stooopid mistake. probably out of professional jealousy, yet AGAIN. or econned is simply a very slow learner. take your pick.

baffling (and Baffling and all baffled variations thereof),

Your repeated replies of emptiness combined with unsupported claims have finally lead me to a very easy decision… it’s time to include you on my list of econbrowser commenters to completely ignore. Maybe you will take this courtesy notice as a heads-up to not be one of the embarrassing unrequited interlocutors who remain obsessed with my comments despite receiving zero acknowledgment from me (the comment section on Econbrowser is a strange place – seems to be a lot of comments/diary sessions/random unrelated musings/etc, but I digress). Here’s hoping, for your ego’s sake, that you don’t follow in the footsteps of others and you allow your infatuation with me to wane with time. As for me, my comments and interactions regarding the posts on this site will continue, only with the additional ease of having one additional commenter to cease all interaction with. It’s a win-win for me and do I hope you’re able to find a silver lining in your internet crush treating you as a non-existent item.

All the ‘best’… or whatever.

” Apologies if you found it a burdensome request to clarify your unclear comment”

econned, nice hackery. apologies for prof chinn’s mistake eh? why not apologize directly to prof chinn for making a stooopid comment to begin with. prof chinn did not make a mistake or unclear comment. if you had not been so hell bent on criticizing him, you would not have made such an incorrect statement to begin with. as i have said before, the professional jealousy leads you to say stooopid things.

“it’s time to include you on my list of econbrowser commenters to completely ignore.”

fine with me. but each time you make false or misleading statements, i will still call you out on it. if you don’t want to hear from me, then don’t be a hack. your choice.