From CEPR-EABCN’s Euro Area Business Cycle Dating Committee (June 30 meeting), “Not Every Downturn Is a Recession”

Two quarters of very mildly negative growth has led to talk about a recession. The

Committee defines a recession as a significant decline in the level of economic activity, spread across the economy of the euro area, usually visible in two or more consecutive quarters of negative growth in GDP, employment and other measures of aggregate economic activity for the euro area as a whole. This is more than two quarters of negative growth. When trend growth is so close to zero, insignificant negative growth rates are to be observed with some regularity and may not by themselves constitute recessions. In this instance, particularly, the labour market is continuing to do well, with employment growing and euro area unemployment at its historically lowest level.

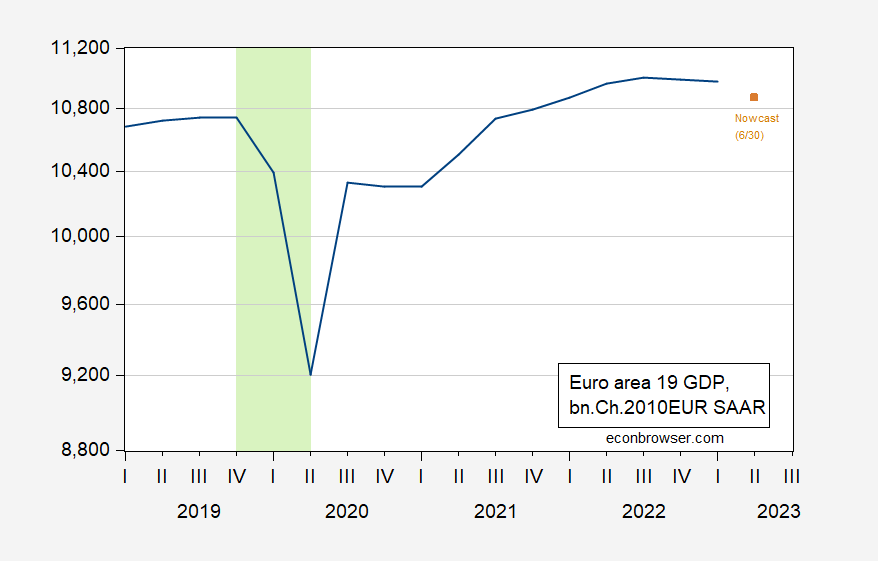

If one applied the 2 quarter rule slavishly to US data, there would be no US recession of 2001 right no (although there might have been for a few periods). Here’s Euro area GDP.

Figure 1: Euro area 19 GDP (blue), nowcast as of 6/30 (brown square), both in bn.Ch.2010EUR SAAR. CEPR-EABCN peak-to-trough recession dates shaded light green. 6/30 nowcast from Cascaldi-Garcia, Ferreira, Giannone and Modugno. Source: OECD via FRED, Cascaldi-Garcia, Ferreira, Giannone and Modugno, CEPR-EABCN, and author’s calculations.

Note that while GDP has flattened out in the last two quarters, employment has continued to rise.

Source: TradingEconomics.com.

While recession seems to be unlikely tobe applied to Q1, there is no guarantee that when Q2 data arrives, a recession is dated, perhaps as starting in Q1 or even Q4 (The 6/30 reading is for -1.0% q/q in Q2).

Why did this remind me of:

Steven Kopits

October 28, 2022 at 7:21 am

Menzie – Let me reiterate what I said:

No I am not going to reproduce the rest of this comment. There is already too much stupidity running rampant.

This series looks a bit different than the one from Trading Economics:

https://fred.stlouisfed.org/graph/?g=16LKL

Different total, too. TE appears to show an acceleration in hiring, FRED a deceleration.

But the point still holds – Eurozone officials do not count slight, brief declines in output, when all else is going well, as recession. Just like the NBER.

Employment lags and the Eurozone’s biggest economy is struggling, especially its manufacturing sector, so the odds of recession in the near term may be higher there than here. Eurozone factory employment fell in Q1. No Inflation Reduction Act in Europe to boost factory construction.

I agree but downunder that is how they define it. At least we do not use volatile annualised numbers!

Not Trampis: Well, maybe it’s the most common, but not universally acknowledged. Here’s the RBA on the subject.

Annualizing does not increase volatility in any meaningful sense. It’s just a mathematical transformation to allow for comparison to year-over-year growth.

The indicators of a looming recession seem to be variable. Is it or isn’t it?

https://www.yahoo.com/finance/news/explainer-u-yield-curve-hits-182731416.html

Bruce Hall: Or you could just read the blogpost, and/or this paper.

Note, there is no robust evidence that depth of inversion is correlated with the severity of the recession.

And let us not forget the debt-service ratio:

https://econbrowser.com/archives/2023/06/recession-probabilities-based-on-multiple-financial-measures

Term spreads may have lost predictive power, and the DSR says recession is unlikely.

Menzie, that was also indicated in the article:

“Concerns about the lagging economic impacts of the Fed’s aggressive path of rate hikes has kept the yield curve inverted for more than a year. Yet the recent push that has deepened the inversion may be a result of leveraged positions by hedge funds and other institutional investors as issuance by the Treasury Department surged since the passage in early June of a Congressional plan to raise the debt ceiling, analysts say.

Deeper inversions do not necessarily mean deeper or longer recessions, Jacobsen said.”

The article’s point was that the magnitude of the inversion seems to be a strong indicator of a recession (if you accept historical concomitancies).

Bruce Hall: Yes. That would go along with probit regression coefficients being statistically significant (regression of binary dependent variable on continuous variable, called a spread). Just so you know.

It is sort of stupid to try and categorize a continuous parameter – but maybe that is the only way to communicate to lay people.

Going from a growth rate of say 4% to one of 0.1% for two quarters is a lot worse than going from a rate of 0.1 to -0.1 for two quarters. Yet we have placed a big significance on passing that arbitrary growth number of zero.

At least the professionals insist that other things have to be taken into consideration – but the 2 quarters of negative growth have stuck with a lot of innumerate or ignorant people.

Wow! They’re at it again. The technical definition of recession seems to be a real red line for some economists!

What exactly is the big deal? Well, for one, vigorously defending the red line conveniently obscures the obvious–once you get to that point, then economic growth is poor enough to be characterized as anemic. Why not just acknowledge that? Who really cares if economic growth is +0.1 or -0.1%? But for economists, it appears to be an issue of life or death!

Maybe what we need to introduce some new nomenclature taken from quantum physics…like Schrödinger’s Cat, which can be considered both dead and alive.

Or maybe, just maybe we should introduce terminology which reflects how serious economists regard this. I suggest taking it from Dante: Hell is when there is currently no doubt that the economy is in recession; limbo when it’s debatable; and paradise when there is no doubt that it is growing.

Taking the present situation as a practical application for Schrödinger’s Cat, we see that real GDP is has grown 1.8% in the last year. https://fred.stlouisfed.org/series/GDPC1/

But if we look at real GDI, it’s down 0.9%.

https://fred.stlouisfed.org/series/a261rx1q020sbea

Then if we look at real factor income per adult over the last year, it’s zero for 90% of the population. Since January 2020, it’s been -1.1% for the middle 40% and -2.3% for the bottom 50%. (But having 90% of the workforce in recession doesn’t matter to mainstream economists, so we can just dispense with economic performance since January, 2020.)

https://www.realtimeinequality.org/

Schrödinger’s Cat? In limbo? Or just plain anemic? Being in recession or not is hardly an adequate description!

Seriously dude. Fix your ChatGPT as it is outdated. Oh wait – you are a gold bug who thinks periods of massive recessions are just wonderful as long as inflation is near zero.

“But if we look at real GDI, it’s down 0.9%.”

Over the last 2 quarters – yea that’s what Dr. Chinn said. But little Jonny boy is “moving the goal posts”. Since 2020QIV, real GDI is up 3.4%. Oh excuse me – did I move the goal posts on little Jonny boy. Hey Jonny boy – make like Charlie Brown and kick a field goal. I’ll make like Lucy and hold the football for you.

But wait – little Jonny boy is using REAL GDI. After this lying clown said we could only use nominal defense spending as Dr. Chinn’s reporting of real defense spending is abusing manipulated price indices provided by the BEA.

John A. Hofer – two faced worthless clown.

“you are a gold bug”…the usual drivel…pgl telling others what I think…and getting it totally wrong.

I’m reminding people of all that BS you wrote over at Mark Thoma’s place. But deny if you will as you lie about everything else.

pgl is “reminding people of all that BS [I] wrote over at Mark Thoma’s place.” But pgl can’t say what it was,,,because I never said anything about gold over at Mark Thoma’s place. pgl just makes things up.

Where did Dr. Chinn say in this post that real GDI, it’s down 0.9%?

pgl just makes it up as he goes along…then accuses others of lying!

JohnH: Reading pgl‘s comment, I don’t see where he asserted that I said real GDI was down. What is true is that GDP is less correlated with final vintage GDP than GDO (which barely budged in the last revision).

Then maybe you can figure out what pgl meant when he said, ““But if we look at real GDI, it’s down 0.9%.”

Over the last 2 quarters – yea that’s what Dr. Chinn said.” What would ‘that’ refer to but the above quote complemented with ‘over the last 2 quarters?’

“Maybe what we need to introduce some new nomenclature taken from quantum physics…like Schrödinger’s Cat, which can be considered both dead and alive.”

actually, what you are saying is incorrect. in quantum physics, schrodinger’s cat is not considered both dead and alive. it is in a superposition of states, but that wave function is not real. once a measurement is made, then it is real. so it cannot be both dead and alive, it only has a probability of one of those until it is actually measured. once it is measured, it is one or the other. it is not both.

“then economic growth is poor enough to be characterized as anemic. Why not just acknowledge that? Who really cares if economic growth is +0.1 or -0.1%? But for economists, it appears to be an issue of life or death!”

i don’t think any economists are trying to say that growth is not anemic at those levels. what they are saying is that, at those levels, it does not constitute what is categorized as a recession. anemic and recession are two completely different characterizations. but you, johnh, seem hell bent on telling everybody that those should be considered the same thing. they are not. why do you continue to raise a fuss? call it anemic, and you will not get an argument from most economists. why do you insist on categorizing something incorrectly, and then huff and puff when those who understand point out that you are wrong? unless you are a political hack with an agenda that is only supported by claiming a recession?

Schrödinger’s Cat is one of JohnH’s favorite pet words which he uses as a substitute for actual thinking – something little Jonny boy cannot do. Yea – he has no clue what this means but it sounds smart which is why a total moron uses to pretend he’s smart.

“unless you are a political hack with an agenda”.

Can we go back to the 1896 Presidential election which one source describes as:

Former Governor William McKinley, the Republican nominee, defeated former Representative William Jennings Bryan, the Democratic nominee. The 1896 campaign, which took place during an economic depression known as the Panic of 1893

JohnH is the kind of person who would have supported McKinley as McKinley was clearly a gold bug. JohnH over at Thoma’s place kept telling us how great the economy ran during the reign of people like McKinley. It is like this Know Nothing ever heard of the Panic of 1893.

Now William Jennings Bryan’s Cross of Gold speech rightfully condemned such policies. It was also a shining star among progressive thoughts for so many reasons.

Of course Jonny boy is not the kind of person who would have supported William Jennings Bryan.

There pgl goes again…”JohnH is the kind of person who would have supported…”

pgl just loves to make up what others stand for…and then accuses THEM of lying!

“i don’t think any economists are trying to say that growth is not anemic at those levels…” Well that’s probably a true statement…but only because they’re not characterizing the economy as anything but “not in a recession!” Of course, it could be in a recession…or it might not be. Measurements have been made, but the referees at NBER won’t declare for months whether the cat is dead or alive. Until then, pox on anyone who might have the chutzpah to suggest that the economy might be in recession.

Talk about a hilariously ridiculous situation!!! Economists claim to forecast with confidence what “real” interest rates will be for the next few years, but they are clueless as to whether the economy has been in a recession!!!

I get there are a lot of racists among American farmers but this is getting absurd:

https://www.cnn.com/2023/06/19/politics/chinese-land-purchases/index.html

A growing number of states are considering or have passed measures this legislative term to ban “foreign adversaries” and foreign entities – specifically China – from buying farmland. Proponents of the laws, mostly Republicans but some Democrats as well, have frequently cited concerns about food security and the need to protect military bases and other sensitive installations. But the moves have stoked anxieties among some experts on US-Chinese relations, including those who see echoes of past discriminatory laws in the United States like the Chinese Exclusion Act. Florida last month joined a list of at least seven other states – including Virginia, North Dakota, Montana and Arkansas – to pass variations of such bills this session, according to the National Agricultural Law Center (NALC), which is tracking the issue and conducts research on agricultural and food law. Similar measures are percolating in more than two dozen states and there’s a bill in Congress that seeks to federalize the issue, the NALC said. States have previously sought to limit foreign investment, said Micah Brown, a staff attorney at the NALC. What’s new, Brown says, is that some lawmakers are taking aim at specific countries and their governments. “2023 is really swinging for the fences here, with a majority of states having some kind of proposal, at least one proposal,” Brown told CNN. Of slightly more than 40 million acres of agricultural held by foreign investors in the United States, China held less than 1% of that land – or 383,935 acres – as of the end of 2021, according to a report from the US Department of Agriculture.

One supposed concern has to do with national security. After all if someone from the PRC grew oranges near a military base – that might threaten that base. So the racists behind this nonsense claim. Then again Ron DeSantis wants to dress up as Brad Pitt playing Achilles so he can practice his alleged fighting skills against a fake Bruce Lee. Cue the shirtless oiled up bodybuilders.

I see the concern. Maybe the Chinese owners would come to the US and start throwing oranges at our tanks and planes. How are you supposed to defend against that kind of powerful weapons. Or maybe they would tell their American workers to destroy the harvest and nobody in the US would hear about and stop that plan. There are many very very scary scenarios if you are a paranoid moron.

I was reading something on how sugar prices were going with a comparison to the spike in prices back in 2011. Now I started wondering if the $0.30 per pound price for raw sugar was the highest ever and Macrotrends noted this was not even close to the spike in the early 1970’s:

https://www.macrotrends.net/2537/sugar-prices-historical-chart-data

A little digging and up came this useful discussion:

https://moneyweek.com/1360/why-sugar-prices-have-soared

Sugar prices rose by more than 45 times between 1966 and 1974. Investment legend Jim Rogers explains why the price soared before giving way to a massive bear market – and also why sugar is now making a comeback….I reminded her that when sugar prices last made their all-time record run – soaring more than 45 times, from 1.4 cents in 1966 to 66.5 cents in 1974 – her countrymen were planting sugar all over France.

Now that’s volatility!

The clown show that makes up Putin’s army continues:

https://www.msn.com/en-us/news/world/russia-wants-to-send-more-kadyrovites-and-prisoners-to-ukraine-to-patch-up-holes-at-the-front-bloomberg/ar-AA1dqE0q?ocid=msedgdhp&pc=U531&cvid=61039b2ebf144195ac62b6b9a9df0c24&ei=11

Unnamed European officials say that while the departure of Wagnerites is not expected to change the course of the war, Vladimir Putin’s determination to avoid full military mobilisation means Russia is likely to send more Chechens and prisoners to the front line in the coming weeks. It is unclear how many additional troops the Republic of Chechnya can provide. Chechen leader Ramzan Kadyrov, who professes loyalty to Putin, in May stated on Telegram that 7,000 military personnel were already in Ukraine, and another 2,400 were being trained for two new regiments of the Ministry of Defence. Chechen militants haven’t yet been noticeably effective during the war. Some critics have dubbed them “TikTok battalions” for being more active on social media than in combat.

It doesn’t matter how much meat Russia sends to the trenches it will all get ground up, when the Ukrainians get cluster bombs. Russia used those to terrorise Syrian civilians. Ukraine will use them as the most effective ways to clear out enemy lines of foot soldiers. Replacing Wagnerites at the second and third line of defense, with prisoners that have had a 2 week course in how to assemble and clean a riffle, is not going to work out that well. I saw an unverified claim that in the first village taken back by Ukraine the defense forces had lost twice as many soldiers as the attacking Ukrainians. If that is true (its suppose to be the other way around in evenly equipped and staffed forces), then there is something very wrong with the Russian defenders or something very right about how the counteroffensive is being conducted at the tactical level.

in the usa the population growth rate is approaching zero, and probably will remain that way for a while unless immigration changes.

https://datacommons.org/tools/timeline#&place=country/USA&statsVar=GrowthRate_Count_Person

if a nation or region has near zero or negative population growth, one would expect the economic growth (ie GDP) to not be positive all of the time. using the negative gdp threshold, these regions could be under recession for years and still maintain full employment and other stable economic metrics. would somebody like kopits still want to call these areas in recession?

That depends on which party is in the white house.

And then there’s Depression: a prolonged period of decline in output and prices.

Why was 2008+ not a depression?

Princeton Stevie would remind you to use the term Suppression which I think means VMT declining.

in the usa, job growth continues

https://www.cnbc.com/2023/07/06/adp-jobs-report-private-sector-added-497000-workers-in-june.html

those hankering for a recession call in the usa, today, how do you square this circle? half a million new jobs, especially active in small firms. johnny, talking to you here. can you have a recession with a half million new jobs?