Reader JohnH asks “is there a net US GDP forecast that includes the depreciation of defense capital?”. For what I think is being asked (commonly known as NDP, or net domestic product), the answer is de facto yes.

That’s because the two move in tandem for the US in peacetime.

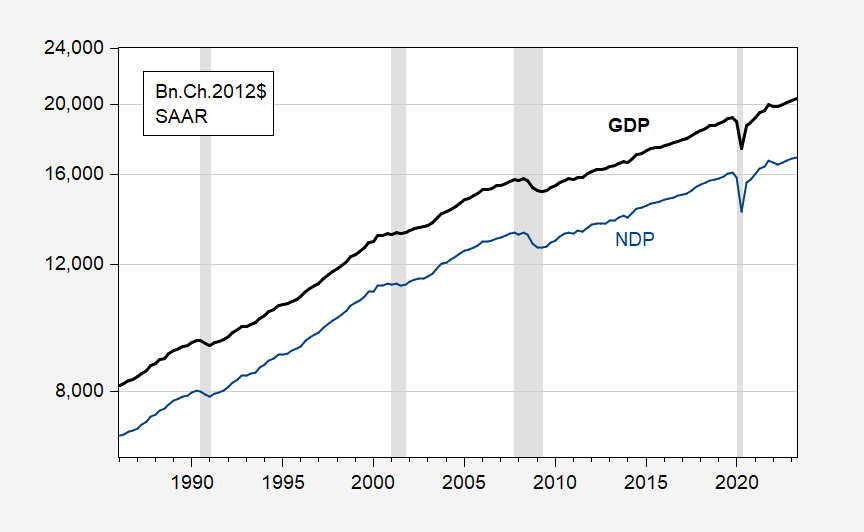

Figure 1: GDP (bold black), Net Domestic Product (blue), both deflated using GDP Deflator, in bn. Ch.2012$ SAAR. NDP is BEA series A362RC1Q027SBEA. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, 2023Q2 2nd release via FRED, NBER, and author’s calculations.

It’s difficult to see that the two series comove almost one-for-one, so I show the log first differences of the two series, 1986-2023.

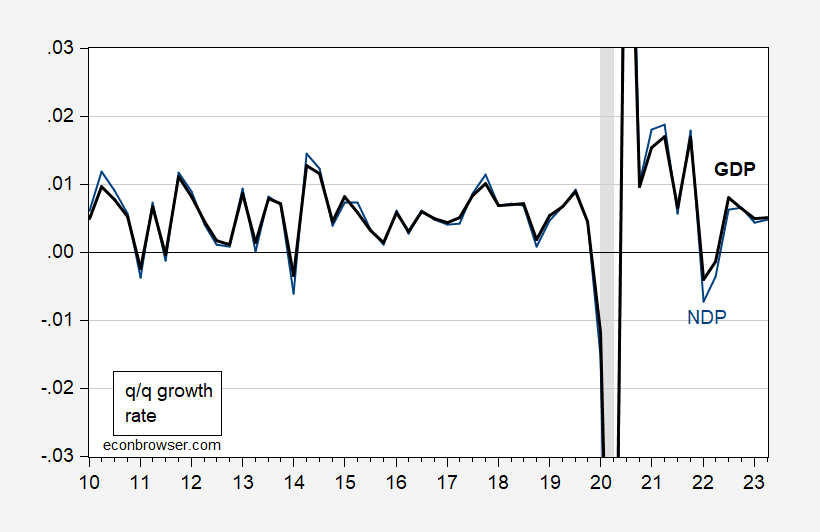

Figure 2: First log difference of GDP (bold black), Net Domestic Product (blue), both deflated using GDP Deflator, in bn. Ch.2012$ SAAR. NDP is BEA series A362RC1Q027SBEA. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, 2023Q2 2nd release via FRED, NBER, and author’s calculations.

Now, since consumption of defense equipment capital is much smaller than total consumption of fixed capital (public and private), then one can be confident that forecasts of GDP and NDP growth are essentially the same. 2021 consumption of defense equipment was Ch.2012$ 77.8 bn, while 2021 consumption of fixed investment was Ch.2012$ 3310.9 bn.

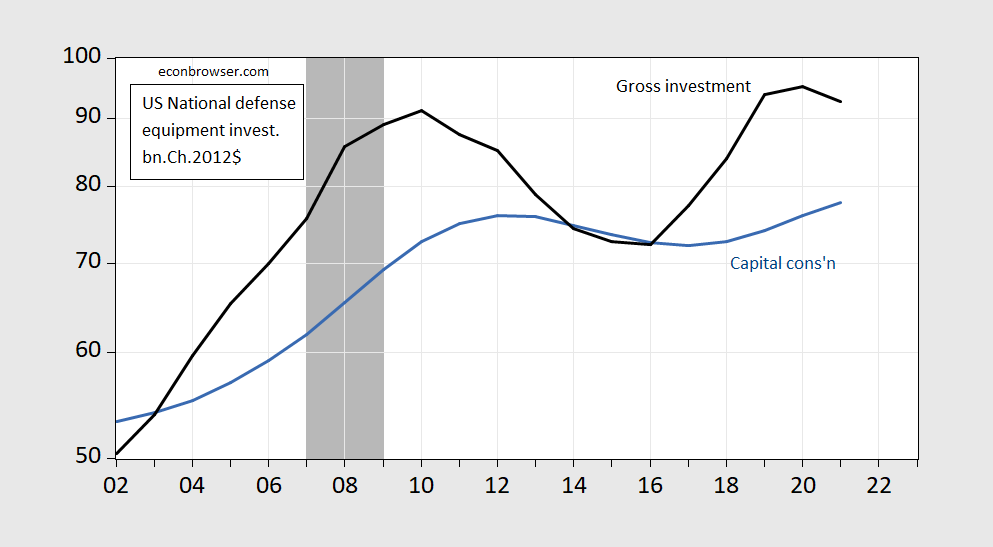

Here’s a picture of gross defense equipment investment and capital consumption.

Figure 3: Gross defense equipment investment (bold black), and capital consumption (blue), in bn.Ch.2012$.NBER defined peak-to-trough recession dates shaded gray. Source: BEA 2023Q2 2nd release, tables 5.2.6 and 5.9.6, NBER, author’s calculations.

JohnH’s query was prompted by my discussion of growth rates for Russia GDP ex-defense, and in particular my speculation regarding the depreciation component of defense spending. I would venture to say Russian depreciation of military equipment is much higher than that for the US (prorated to size of economy) because (1) the Russians are currently engaged in a full scale war, and (2) the US is not.

Addendum, 9/1:

For information on how BEA calculates depreciation (capital consumption) for the Federal government, including defense related assets, see BEA, Government Transactions, Methodology Papers: NIPAs, Sept. 2005, in particular pages 66 onward.

It would seem that using the term “depreciation” for military assets is a bit misleading, especially if the notion is that “depreciation” is much higher in war. Most people would call that “destruction of assets”. When it comes to military spending and assets, there are several paths that can be taken:

1. The assets are developed and then abandoned or repurposed because they simply don’t deliver against expectations. Example: US Navy Littoral ships which have a 20-year record of non-achievement.

https://www.forbes.com/sites/davidaxe/2021/05/20/the-littoral-combat-ship-cant-fight-the-us-navy-is-finally-coming-to-terms-with-it/?sh=7a2306d82587

2. The assets are developed and exceed expectations and life expectancy because, when upgraded, they are more capable than newly developed assets. Example: B-52 bombers.

https://www.19fortyfive.com/2023/06/b-52-bomber-with-enough-upgrades-it-could-fly-for-nearly-100-years/

3. The assets are developed and approximately meet expectations, but are much more expensive than projected and require significant modifications to meet required flexibility of mission. Example: F-35 fighter.

https://breakingdefense.com/2022/04/f-35-modernization-programs-costs-schedule-keeps-growing-gao/

4. The assets are developed and sustained with minimal upgrading for decades, then finally replaced (obsolescence). Example: Minuteman missiles.

https://breakingdefense.com/2023/01/usaf-to-begin-minuteman-iii-silo-conversion-to-house-sentinel-icbm-by-decades-end/

It would seem that number four comes closest to the idea of depreciation.

Dr. Chinn provided a link to a BEA document entitled “Government Transactions”. One can keyword search for depreciation. Read the relevant passages as they were clear whereas your comment was your usual babble speak. Anything you think was a “contribution” was already covered by this 2005 BEA discussion.

A more traditional definition: “Depreciation represents the decrease in the value of an asset due to its continuous deterioration through its useful life.”

The government approach in the linked article for military assets is “babble speak”. I gave 4 examples of how the valuation of a military asset changes and only one comes close to the traditional definition of “depreciation”.

YOU are accusing the BEA of babble speak? Well – you are the master at babble speak so hey!

How much faith would you have in the depreciation numbers of an agency that has never passed an audit and cannot account for 61% of its assets? Well, that’s exactly the case with DOD. https://wisconsinwatch.org/2023/08/in-its-latest-audit-did-the-defense-department-account-for-only-39-of-its-assets/

And we thought that Russian and Chinese numbers were opaque!!!

Of course, when it comes to DOD spending some people (hint: piggly and his doppelgänger Ducky) are willing to forgive and forget any transgression of commonly accepted norms of good governance. And let’s not forget that “SENATE DEMOCRATS BLOCKED WATCHDOG FOR UKRAINE AID — IGNORING LESSONS FROM AFGHANISTAN

The U.S. special inspector who monitored billions of dollars in U.S. waste in Afghanistan cautions about repeating the same mistakes in Ukraine.” https://theintercept.com/2023/08/02/ukraine-aid-special-inspector-afghanistan/

But you’ll never catch piggly and his doppelgänger Ducky complaining about waste, fraud, and abuse at the Pentagon

Smedlley Butler was right: “WAR is a racket. It always has been. It is possibly the oldest, easily the most profitable, surely the most vicious. It is the only one international in scope. It is the only one in which the profits are reckoned in dollars and the losses in lives.”

https://theintercept.com/2023/08/02/ukraine-aid-special-inspector-afghanistan/

“How much faith would you have in the depreciation numbers of an agency that has never passed an audit and cannot account for 61% of its assets?”

Jonny boy’s latest excuse for his own stupidity once again shows how stupid Jonny boy is. The agency that provides the NIPA figures is the BEA not the DoD.

Hey Jonny – keep digging. Maybe one day your hole will reach China.

“The push for a special inspector for Ukraine aid has been heralded by some of the Biden administration’s most vocal opponents, including Sens. Josh Hawley, R-Mo.; and J. D. Vance, R-Ohio; and Reps. Matt Gaetz, R-Fla.; and Marjorie Taylor Greene, R-Ga.”

Huh – so Jonny boy is teaming up with the most MAGA racists in Congress. Figures!

Now if Jonny boy actually read his little links, he might notice what a “clean audit” is supposed to be. Financial statements consistent with general accounting principles. Of course, Jonny boy does not even know what a financial statement even is or what is meant by general accounting principles. Yea – I bet Jonny boy’s only experience with accounting was working for Andersen on the Enron account.

https://www.gao.gov/products/gao-23-105198

DOD Financial Management: Greater Attention and Accountability Needed over Government-Furnished Property GAO-23-105198

Published: Jan 17, 2023. Publicly Released: Jan 17, 2023.

A link to the actual GAO document which has been publicly available for over 6 months. So why does Jonny boy cite some odd little dude from Wisconsin who cherry picked a few quotes only this week? Is Jonny boy THIS incompetent? Has Jonny boy read the entire GAO discussion? I doubt it. Even if little Jonny boy does read – he will not understand.

But for the adults in the room – you can read what the GAO wrote in its entirety.

Promises…promises…promises, The Pentagon has know about its financial management problems for years, probably decades…and has yet to fix the problem. But that probably doesn’t stop BEA from using DOD’s crappy data to gin up regular reports. GIGO!

We know you have written lies and worthless trash for years and it seems you haven’t cleaned up your pathetic act at all. At least the DoD is trying. You are not.

Your Wisconsin Jonny come lately did not say the DoD cannot measure 61% of its total assets. I gave you the GAO to see if you could read it. You couldn’t. The discussion was limited to:

Government Furnished Property (GFP) – is defined as property in the possession of or acquired by the Government and subsequently furnished to the Contractor for performance of a contract. It includes items like spares and property furnished for repair, maintenance, overhaul, or modification. It can be items taken or requisitioned from Government inventory or purchased by the Government specifically to be provided on a contract.

This is a subset of the assets owned by the DoD. AND a lot of the issue is not measuring what assets are involved but WHERE they are.

Now most people who learned basic reading skills would never make the false and inflated claim you made. But no worries – you may not know you are spreading lies as it is very very clear that Jonny boy never learned to read.

Interestingly enough, “ Russia is spending surprisingly little on its war on Ukraine… Russia’s spending remains opaque, but its war budget is about 3% of GDP,” slightly less than the United State (3.48%.) https://markets.businessinsider.com/news/commodities/russia-economy-spending-war-ukraine-defense-budget-gdp-europe-investing-2023-6?op=1

Russia’s spending amounts to $67 billion. Apparently, Russia gets a lot more bang for the buck.

Everytime you are caught in a lie or a really stupid statement, you change the subject. Everytime.

“Russia gets a lot more bang for the buck”. Translation – Russian soldiers are killing innocent Ukrainians which gets Jonny boy all excited.

Johnny, Johnny, Johnny! Go ahead and tell Menzie he moved the goal post!

You asked about a net gross figure, net gross domestic product. Menzie compared a net product to a gross product, GDP to NDP. See. No net gross domestic productin sight! And, and, and! You asked if depreciation were included in forecasts of net GDP. Menzie presented ACTUALS, not forecasts.

In fact, I think you have uncovered another scandal in economics, just like when you told us there is no data series for real median wages! (And now there is a series for real median wages, so congrats!) I’ve looked everywhere, and I find no evidence of a net gross domestic product data series. Not anywhere. Not even in Russia!

You’ve done it again, Johnny. What I don’t understand is why, when Menzie leaves himself, and in fact the entire enterprise of economics, wide open on this net gross domestic product issue, you attempt to change the subject. You trot out a long, meandering comment full of unsubstantiated assertions about a completely different issue, almost as if you are ducking the depreciation thingie. C’mon man, you’ve got another great scandal on your hands with this net gross debacle.

“Menzie presented ACTUALS, not forecasts.”

I think every adult agrees that Jonny is a worthless idiot. So let’s forget his incomprehensible babble and revisit those supply side claims that Trump’s 2017 would lead to faster long-term growth. As I recall the series forecasts suggested that the small bump up in investment demand would increase:

(a) GDP by 0.4% per year

(b) increase depreciation by 0.3% per year so NDP would rise by 0.1% per year

(c) decrease net income from abroad by 0.1% per year

All told the forecasted increase in potential NNP was ZERO.

Of course these papers were written by people who understand basic national income accounting, basic growth theory, and forecasting.

None of which are tools in Jonny boy’s pathetic little arsenal.

https://finance.yahoo.com/news/china-cuts-forex-ratio-bid-012500835.html

They talked to some British dude on Bloomberg and he said he didn’t think it would be enough by itself to stop the slide downward.

Instead of using official reserves, China has decided to support the yuan by using private reserves. Interesting choice.

In a number of currency runs against less developed economies over the years, intervention of this sort has simply meant that reserves left the country without benefiting imports. China has tons of official reserves. Not sure about private reserves.

It’s interesting to me, how two countries which believe themselves to be so different and in “stark contrasts” often are much more similar than they realize. I was reading in one of the better known business publications how Xi was very afraid/against following what they labeled “western style welfare”. But I notice Xi doesn’t mind cutting down payments and interest rates in the property sector. That’s not corporate welfare or policy benefiting the upper middle class of China?? That’s not like tax rebates and free land America offers to outfits like Foxconn, or tax deductions for mortgage interest that house renters don’t get??? How is that different from welfare?? The broad answer to that question is, it isn’t any different.

The article went on to say, that those inside Xi Jinping’s inner circle have heard him articulate that he thinks “Austerity is stimulative” because he spent time working in a cave as a young man (no joke). That mindset, that “austerity is stimulative” should be extremely frightening to mainland Chinese, when he keeps on handing out gifts to the property sector and government infrastructure projects that inevitably go to cronies. In fact the man has no design for his economic policies at all. It’s whack-a-mole.

If you can’t think systematically, it’s easy to miss stuff. Xi is probably not as strong on economics as the average Econbrowser commenter.

I’m not sure how meaningful that is, though, since there is an obvious bi-modal distribution among Econbrowser commenters.

“since consumption of defense equipment capital is much smaller than total consumption of fixed capital (public and private), then one can be confident that forecasts of GDP and NDP growth are essentially the same. 2021 consumption of defense equipment was Ch.2012$ 77.8 bn, while 2021 consumption of fixed investment was Ch.2012$ 3310.9 bn.”

The data is all provided by BEA in those NIPA tables. But little Jonny boy does not know that as he has never learned to do basic research. So little Jonny boy can assert that consumption of defense equipment was massive even if the clear facts show otherwise.

The whole question is inane. What useful insights would be in the GDP minus military depreciation?

The Western worlds high GDP is basically an indicator of buying and throwing away useless crap – whether in the private or public sector. The more waste and unnecessary consumption the bigger the GDP. If I buy a Toyota Avalon instead of a Corolla I don’t help myself or the environment, but I help the GDP. If I buy a 4500 sq ft house instead of a 1800 sq ft house, I don’t help myself any more with getting a roof over the head, but the GDP bean counters will be happy. If the military buy a big new tank, drive it around in circles 50 times, then 40 years later put it out to pasture in the Nevada desert, US will still be as safe/unsafe against invaders as if that tank had never been build, but the GDP bean counters will be happy.

The only thing more idiotic than what US is doing to “win” the GDP numbers game, is what China is doing. They work their buts off to produce all the useless crap and then get little pieces of paper (or computer entry equivalents) in return. At least the braindead consumer chumps in the US get some kind of endorphin rewards for the illusion of being “winners” or “richer”.

Ivan: Well, I guess you’re not a fan of hedonic measures.

You got me ;-(

At heart I am a Godless de-materialistic puritanian.

Anyway my point is that if we want to talk about waste we should not frame it in the context of GDP but directly discuss whether government funds should be spend on military equipment instead of some other “indulgence” (like civilized healthcare, education or public transportation).

Ivan: Well, I am all for research into measures like the Tobin-Nordhaus Measure of Economic Welfare (MEW), etc.

Goofball Moses says “You two seem to be largely in agreement”

In my best Sergeant Phil Esterhaus (actor Michael Conrad) voice imitation: “Hey!!!!……. let’s get back to bickering on here”

I had no positions in my time in usaf/ dod where i saw a depreciation account.

I agree with Bruce above that weapon systems get a lot of ‘sustainment’, get ‘preplanned improvements’, upgrades, and ‘life extensions’ so that depreciation is not accounted for from my experience.

The foundational goal for programs (i worked here later in my career) of maintaining a weapon/aircraft is to keep the systemin a state equal to the production specification, maintaining reliability puts resources in that keep the asset in a physically undepreciated state. the consumption and investment spending to do all that gets counted in gdp.

for example, we keep airplane running by replacing failed line replaceable units, the new unit is paid same price as a depot turned unit….. the intent in the depot repairs to good as new (or refitted to latest evolution of the part, requires extensive control of the item’s recorded configuration) state.

that said once the system reaches retirement it goes to depreciated by schedule not budget. one might say the dutch f-16’s are depreciated but while they were in the order of battle they were like new in performance and form.

there are classes of assets: ‘general support’ which are military assets, often commercial equipment for functions like base support, real estate maintenance and so forth. These assets are “booked”, but my experience i never saw depreciation. for general support assets depreciation may make sense, to budget or plan for replacements. i never worked in areas where that planning might occur, such as major command headquarters who manage a number of installations. expenditures to repair and sustain general support show up in defense consumption and investment in gdp.

all that said the dod has not passed a clean audit yet.

Anonymous: See this BEA document (pp 66+).

As this document notes:

Consumption of general government fixed capital consists of the depreciation of national defense structures, equipment, and software.

Barbara M. Fraumeni. “The Measurement of Depreciation in the U.S. National Income and Product Accounts,” (July 1997 Survey).

Maybe people like Anonymous, JohnH, and Bruce Hall should read Fraumeni before spouting off their usual BS.

my experience started keeping system in units up to specification, that was mostly maintenance and supply management. I did the general support budget, over common work not specific to the weapon system budgets which were managed at Air Force level.

that said, we handled a lot of expensive parts, sent repairables back to depot, and received full spec performance parts back… the money side handled at wright Patterson.

that observed if we spend a bunch of resources keeping a system up to spec, and we have an engineering activity to upgrade would charging depreciation be appropriate? not that I would expect accountants to understand how the systems are sustained, and the cost to avoid degarded system be double counted in depreciation?

pgl,

If you read a little farther……. in the link Prof sent. Your quote is contained there.

BEA document pg II-90. 91. https://apps.bea.gov/national/pdf/mp5.pdf

There are lists of consumption components for aircraft etc, none are fixed capital they are weapons. etc.

fixed capital is real property and real property installed equipment. they can be depreciated

the paragraph beyond your quote are not depreciated….

while you are reading lin k find the reports the dod sends in to bea that report the depreciation???

i could discuss defense industrial funds, stock funds working capital funds, and budget division that might help but you should google….

the quote you posed reminds of the general (‘general fixed capital’) support division of working capital funds to take care of base and post building and generals’ golf course.

This document’s discussion of depreciation notes:

Throughout the NIPAs, adjustments to this general procedure are made when assets are destroyed as a result of extraordinary disasters (such as Hurricane Katrina, the Loma Prieta earthquake of 1989, and the attack on the World Trade Center). For general government, disaster damage and war losses are directly subtracted from the stock of government assets and no further depreciation is recorded on these assets; CFC for the period of the disaster does not include anything extra for the assets destroyed. For government enterprises, the treatment of disaster damages follows the treatment in the business sector; CFC for the period including the extraordinary disaster includes the value of the assets destroyed. For all sectors, the value of such extraordinary destruction is shown as “other changes in volume of assets” in NIPA table 5.9, Changes in Net Stock of Produced Assets

Much clear than the above babble from Bruce Hall.

Thank you I will study this.

I had passing interest on occasion to reference the dod cost estimators guides, which at the time were 6000+ pages. I was usually concerned with types of deflator so we were correct in multi year forecasts

“all that said the dod has not passed a clean audit yet.”

Are you JohnH’s minnie me or what?

OK, it was a dirty audit but they got a B+. Not an A but certainly a higher grade than you ever received. BTW did you ever get better than a C- in anything.

“The Pentagon and the military industrial complex have been plagued by a massive amount of waste, fraud, and financial mismanagement for decades. That is absolutely unacceptable,” said Sanders. “If we are serious about spending taxpayer dollars wisely and effectively, we have got to end the absurdity of the Pentagon being the only agency in the federal government that has never passed an independent audit.”

https://www.sanders.senate.gov/press-releases/news-sanders-grassley-and-colleagues-make-bipartisan-push-to-audit-the-pentagon-and-end-wasteful-spending/

Of course, Congress, that model of moral righteousness and financial integrity, voted against any requirement that DOD pass an independent audit. Kleptocracy is not endemic just to Ukraine!

And then there’s piggly, who just fabricates stuff all the time…like his BS that the DOD got a B+ on its audit. How could it get anything but an F when it is unable to account for 61% of its assets? (piggly probably thought that his Fs in high school were really Bs.)

You gotta just love piggly and his doppelgänger Ducky’s lame attempts to justify and provide cover for massive amount of DOD waste, fraud, and financial mismanagement. [sarcasm] Well, at least Lockheed and Raytheon love the two of them, and apparently that’s all that counts…

Oh my – I’m being accused of fabricating stuff by a serial liar. What was my lie? Something about some DoD audit. Of course Jonny boy is too stupid to know that the NIPA data is produced by the BEA not the DoD.

Yea – my stalker is mentally retarded.

Just love it!!! “NIPA data is produced by the BEA not the DoD.”

But where does it BEA get its data? Given that the Pentagon can’t account for 61% of its assets, exactly how does it figure out how much the DOD’s assets have depreciated? Does it have spies inside the Pentagon? Or does BEA just accept whatever figures DOD has made up?

Unless BEA can prove that is has an independent, reliable source for DOD data, you have to believe that it is all smoke and mirrors.

But one thing we already know is that piggly is perfectly happy to believe pretty much any BS that the DOD says. What a rube!!!

“But where does it BEA get its data?”

Folks at the BEA have explained how it compiles their data. But has little Jonny boy read the publicly available documents. Of course not. I guess he is too busy rehashing his worthless trash.