Reader Econned asks me for a critique of ecological monetarism. I don’t have one overall assessment, but I will say that I do not understand (1) how Cameron Harwick came up with the conclusion that the case for ecological monetarism was proven by inflation outcomes, and relatedly (2) how the below graph was constructed, which I believe is the basis for that conclusion.

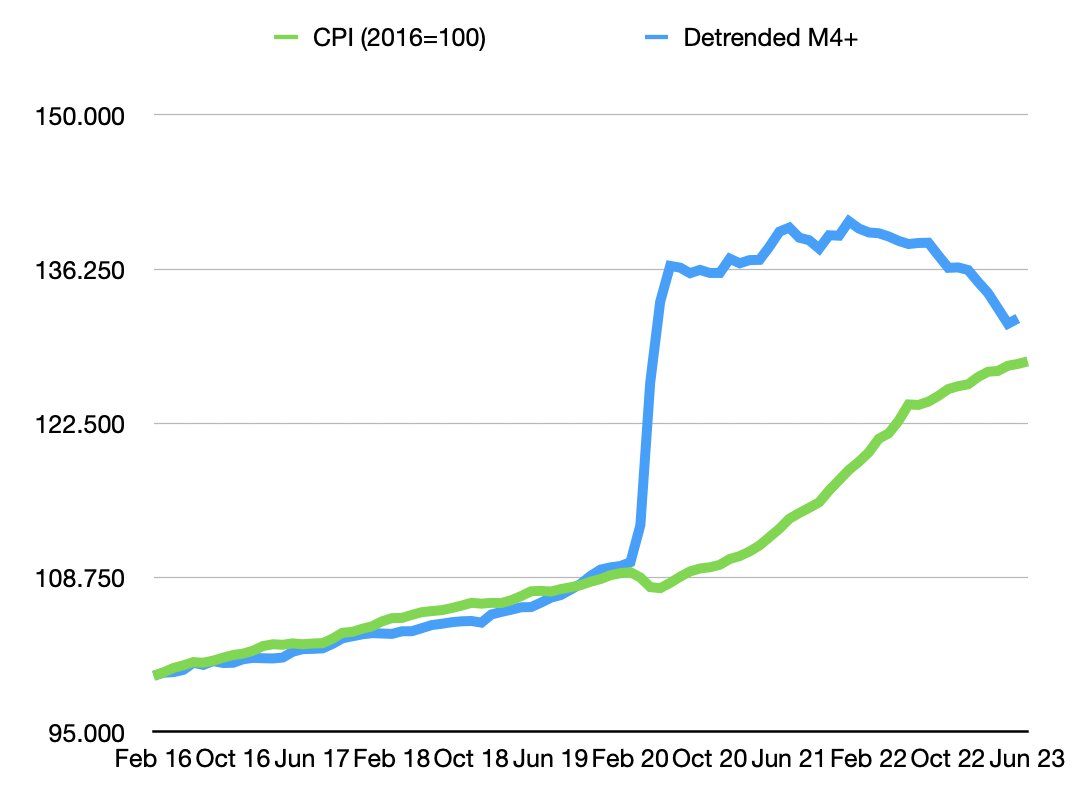

Here is Harwick’s graph.

Source: C. Harwick (2023).

Certainly, the graph seems to indicate the actual price level and money (detrended) match up pretty closely by June 2023.

Unfortunately, the article doesn’t say how M4+ is detrended. It was clearly not a Hodrick-Prescott filter that was used (I tried that).

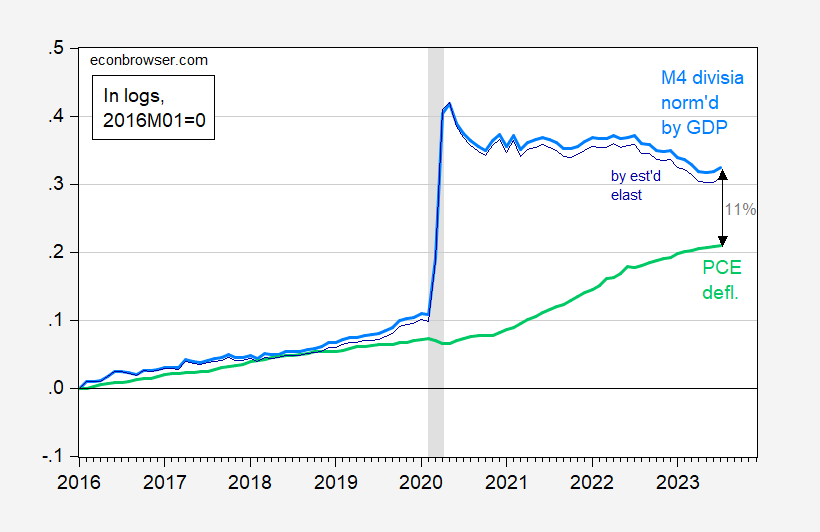

I detrended by dividing by GDP, which is consistent with some versions of the Quantity Theory. This yields the analogous picture (in logs):

Figure 1: PCE price deflator (light green), M4 divisia divided by real GDP (light blue), m4 divisia divided by GDP to the 1.1 power (dark blue), all in logs, 2016M01=0. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Cleveland Fed, SPGMI, CFS, NBER, and author’s calculations.

[Observations for 2023M07 for PCE deflator is the Cleveland Fed nowcast as of 8/29; for GDP is forecasted using lagged GDP and current NFP.]

The gap between the price level measured using the PCE deflator and normalized divisia M4 is 11% as of July. One might argue that detrending by GDP is inappropriate; maybe it’s better to use the income elasticity of real money demand, estimated from a money demand equation. Using Johansen over the 1967-2019 period yields an elasticity of about 1.1. Using this estimate leads to a gap of 10% (and widening!).

As an aside, if we were living in a flex-price monetarist world, the price level should’ve jumped at the same time divisia money increased, by about 30%. Obviously, that didn’t happen.

In the end, in order to differentiate between models, one could have to compare predictive power (e.g., here). I haven’t done that comparison recently, but I have estimated how an expectations and supply shock augmented Phillips curve does. If one thinks about how inflation has come down recently in line with measured cost-push shocks (e.g., the NY Fed GSCPI), then one might say the Phillips curve makes more sense than the quantity theory.

I said this from the beginning – Cameron Harwick’s is babbling BS. Econned has offered nothing to support this very broad money version of QTM. In fact the evidence you present to the contrary has been ignored by Econned and Cameron Harwick.

I said this from the beginning – Cameron Harwick’s blog post is babbling BS. Econned has offered nothing to support this very broad money version of QTM. In fact the evidence you present to the contrary has been ignored by Econned and Cameron Harwick.

It does roughly give you an idea of the intellectual “rigor” demanded to get posts up on “Econlib” [ snicker snicker ]

And Econned, Bruce Hall, and BlueStatesKopits start lavishing compliments to EconLib blog in 3….. 2….. 1…..

As to monetarism, if M2 doesn’t work out, try MZM. If MZM doesn’t work out, try M4 divisia + Treasuries. Now that M4 divisia + Treasuries hasn’t worked out, true believers will come up with another measure. Paradigms die fast or slow, but their ghosts can keep knocking on walls and blowing on candles forever so long a time. That’s what’s happening here.

Remember how this particular episode of ghost busters began in comments to here. Econned scolded Menzie for no good reason, because of some sad ego need – we’ve seen it before. Econned claimed “those who see value in QTM use a divisia index as the monetary aggregate”. What “those who see value in QTM” finally came down to is a blogger and associate prof at SUNY Brockport who touts a particular divisia index. That’s hardly “those who”.

So this is all looking like a bad habit (stalking Menzie) leading to bad judgement (aligning with a Hayek fanboy over a narrow dead-end line of enquiry) and to making specious claims about the state of monetarist thinking.

And Menzie is gracious enough to humor him.

Question for anyone but Econned:

Is “ecological monetarism” similar to MMT in that it isn’t a clearly defined sub-discipline of economics with original ideas, but its followers keep imagining that it is clearly defined and has original ideas? Broaden the question out to ecological economics if ecological monetarism is too narrow to actually exist.

Menzie Chinn,

Your first sentence is disingenuous at best.

As the link to my comment makes perfectly clear, I suggested that you have a conversation with Cameron Harwick where you tell him to “just look at the data” and provide all exchanges between you and Mr Harwick.

And you get ti assign homework to a tenured, PhD-holding former presidential advisor because…?

Your whole existence is disingenuous at best, you twit.

Your first sentence is a lie. The rest of your rant was your usual worthless rant. Once again – find another blog to pollute.

Menzie Chinn,

Maybe you’ll understand this better… my comment, QED.

The only thing to understand is that you are one arrogant idiot. Run away worthless troll.

and the professional jealousy by econned continues. here is a little more cheese for your whine, bumpkin.

This is off topic unless one considers debunking obscure math a related topic.

I am working on an appeal. An expert witness (actuary) developed a present value for a survivor annuity, which I believe to off by at least double. I need a lead for a good textbook which shows the proper formula for valuation. In this problem a survivor annuity is paid for by monthly contributions up to the death of person A. Then the annuity will pay person B for the rest of his/her life (about ten years according to mortality tables). The expert failed to discount the annuity by the stream of payments necessary to pay for the annuity among other problems.

I actually think this was a final exam problem in my Mathematics of Finance course in Madison 44 years ago. I know this is not economics, but I just need a reference book. If any of you know a good text, please let me know.

Not my area of expertise. Just taking a stab here:

https://www.amazon.com/Actuarial-Mathematics-Contingent-International-Science/dp/1108478085/ref=sr_1_7?crid=17LCJK4B2C06R&keywords=mathematics+life+annuities&qid=1693513156&s=books&sprefix=mathematics+life+annuities%2Cstripbooks%2C96&sr=1-7

The book also has a “Solutions Manual” which wouldn’t be too hard to find on Amazon.

https://assets.cambridge.org/97811084/78083/frontmatter/9781108478083_frontmatter.pdf

I found this table of contents to that interesting text. A lot of potential issues defining the structure of expected cash flows. Chapter 12 appears to deal with the discount rate issue.

Estimating the cash flows is the hard part which it seems you have down. Now the other side’s expert implicitly assumed a zero discount rate, then that is absurd. Brealey and Myers is one go to finance text. Something tells me Damodaran has written on something akin here. I hope this helps.

https://www.investopedia.com/ask/answers/070915/what-difference-between-present-value-annuity-and-future-value-annuity.asp

What investopedia says for what it is worth. This discussion strikes me as being rather obvious.