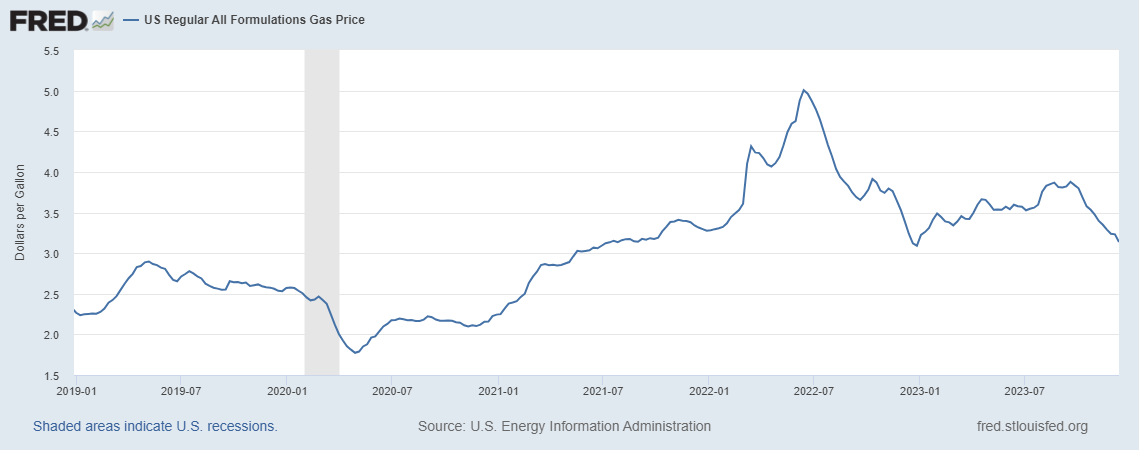

Last week, I was asked about the likely future trajectory. As of the week ending today, prices still falling (from $3.23 to $3.14).

On WPR, I noted that we should enjoy it while we can:

Falling gas prices also help bring down inflation.

“If oil prices are going to stay at the levels that they are, then we can continue to see at least not an upward movement in gasoline prices, and that’s gonna allow us to have inflation continue to fall,” said Menzie Chinn, a professor of economics at the University of Wisconsin-Madison.

But Chinn warns that world events could cause the price of oil to spike quickly.

“For instance, if you saw the conflict in and around Israel expand to a more region-wide conflict which draws in Iran,” he said. “You can imagine that would drive up oil prices, even if outright hostilities didn’t occur, the uncertainty and the risk would drive up prices.”

The weight of gasoline in the CPI (2020) was about 2.6%, which doesn’t sound like a lot, but since gasoline prices are highly volatile, they can be a big contribution to inflation variation, just in a mechanical sense (see this post).

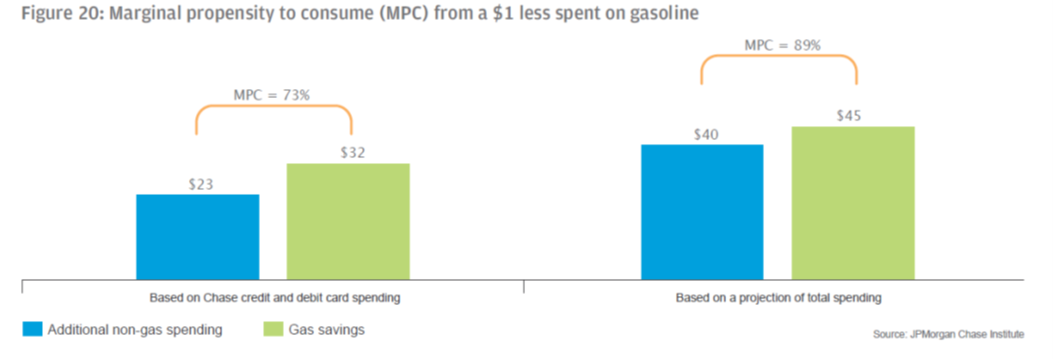

The gasoline price drop, at least the nonseasonal component, is providing a boost to the economy. Back in 2015, JP Morgan Chase estimated each dollar decline in gasoline prices increased spending on other goods and services by 80 cents. So dropping gas prices have helped sustain spending (see Jim Hamilton’s post from back then).

Source: JPMC (2015).

Makes the Christmas time more cheerful at the gas station. Just make sure to resist the overpriced candy bars, until you get to the supermarket. Lately my go to junk food is two fig bars with a small cup of coffee late at night. Just really seems like a nice way to end the day.

https://fred.stlouisfed.org/series/DCOILWTICO

It helps that oil prices have fallen by about $20 a barrel since late September. And to think Princeton Steve assured us that oil prices would soar way past $100 a barrel!

It’s getting to the point you can’t even trust consultants anymore. Next it’ll be lawyers and used car salesmen, the cornerstones of a civilized America.

My man Michael Wilborn would add marketing types to your list. Yea marketing people are even worse than lawyers.

I’ve always been an advocate of privacy, even literally since I was a little boy. I think these things are dangerous, and what really bothers me, is how young people today have nearly zero sensitivity to the issue.

https://www.npr.org/2023/12/19/1219984002/artificial-intelligence-can-find-your-location-in-photos-worrying-privacy-expert

Here’s a thought experiment that scares me. I went for a run in the rain yesterday morning which means I left my smart phone at home. Now suppose some creep without a phone decided to rape and murder my neighbor. The cops would not have his phone being near my place but they would have mine. Maybe I should get a lawyer just in case. Damn!

Yeah, what are they always talking about–“pinging” the phones? Or they can “triangulate” the location with the towers?? I know they are getting better at it, but I would be mildly shocked if they can specify the location that well. But, it is something to be concerned about, I would agree,

Oil prices appear to have fallen due to an unexpected reversal in global oil balances. This appears to have reached its near term limit, and I think oil prices will likely rise from here.

The EIA continues to show US oil production reaching a plateau in the last three months and declining in the last two weeks, notwithstanding a continued gap between Brent and WTI, in recent years consistent with US production growth in the 600-800 kbpd / year range. Rig counts have begun to roll off again, supporting the notion that US operators require $90 WTI to add incremental rigs, that is, by some measure, we can say that the ‘breakeven’ for marginal barrel of US oil is $90 / barrel. (This is not the measure that, say, Goldman Sachs would use.)

US shales have set the global price of oil since August 2014. If the marginal cost of US oil rise to $90, then it stands to reason that the global price of oil should reflect this situation, that is, WTI should exceed $90 on average, and Brent perhaps a few dollars more.

The potential for oil prices to exceed $100, perhaps by a good margin, remains intact. For the moment, the US economy looks resilient, but we will see.

Meanwhile, Xi seems to be taking China into the kind of hell Chavez and Maduro effected in Venezuela, Castro produced in Cuba, and Stalin inflicted across the Soviet Bloc, including eastern Europe. One can posit a range of potential outcomes, but at least one of these sees the progress unwind of the Chinese economy, with weak resulting oil demand growth and downward pressure on oil prices.

Thus, on the supply side, the structural bullish story remains intact. The demand side, however, is murky, and a range of quite different outcomes seems plausible.

“This appears to have reached its near term limit, and I think oil prices will likely rise from here.”

Does anyone know of a a single time on this blog when Kopits said he thought oil prices would drop?? Just a single time when Kopits said that?

Good to have you back. Everyone well?

Doing better, Yes in much better spirits now. Not 100%, but much better. Thank you for asking. I have a lot of mixed feelings about the whole two week ordeal. It’s basically a close relative who thinks nothing bad ensues from stuffing your face with carbs half the day long and getting zero exercise outside of walking 15 feet to the toilet. It’s the way she was raised. Her mother was the same. OBSESSED with food. You can’t choose your relatives.

Noneconomist must be in California as he is complained about $4.50 a gallon for gasoline. I’m in Cali too and gasoline can be over $5 a gallon here. Damn – I might as well be in France!

I’m glad Moses is back too.

: )

Thanks. It makes me feel good you guys say that. I get angry and blather here a good deal, but I still like to think my overall contribution is positive, so it means something to me on a personal level you guys say that,

i for one enjoyed the peace and tranquility for a while 🙂

This will definitely make you feel better: just paid $4.49/gallon for Chevron, and that’s down considerably from recent weeks. If I’d been in Sacramento, would have paid $3.99.

But I’ll still take the foothills, Temps hit 65 last weekend, low 50’s at night. Good rain the past three days. Looks like mid 50’s for the weekend.

Unfortunately for ski resorts, snow remains 7000’.

Glad you’re feeling and doing better.

That is exactly the problem. Broken clocks are right twice a day and someone who want to conclude that a commodity price will go up, will be right every now and then, but not worth betting your own money on. Prices of commodities are extremely difficult to predict because they depends on dozens of factors on both demand and supply side. So I would not blame someone for getting it wrong more often than the flip of a coin. However, if someone constantly try argue for a specific direction, then they are not trying to understand – they are just peddling their shit.

The most critical flaw in what Steven is saying above is the complete lack of accounting for the most critical “treat” to demand for oil – alternative energy. He has gotten stuck in his previous wild and erroneous arguments against conversions to electrical transportation and alternative energy. In contrast to real economists like Krugman, he cannot admit his errors, so he cannot correct his models, so he keeps getting it wrong.

“I think oil prices will likely rise from here.”

No one cares what you think. Get a clue troll – Moses is tracking your forecast record and it is dismal.

Hey, it turns out that Clarence Thomas wasn’t just a passive actor engaging in a little petty bribery. Now it turns out he was actively extorting Republican billionaires to give him more money. He threatened Republican billionaires to quit during Bill Clinton’s term unless they figured out some way to make him more financially comfortable. So they did.

Donald must be in awe!

Republicans aren’t racist. Not against Uncle Toms anyway.

Note: See Who’s Who Encyclopedia of Uncle Toms, Tim Scott and J.C. Watts

Filled with regular at the local Costco.

Regular

$2.559

Premium

$3.319

Merry Christmas and thanks, Costco. Of course, I usually only have to fill up once every 3-4 weeks, but my wife drives her car twice the distance per week than I do so she makes up for it. Heading back to Florida this January to take care of my wife’s 102-year old mother for a few weeks, but flying because even with cheap gasoline the airfares are so low during that time. Still AAA expects more miles driven during the holidays this year than last.

Kelly Anne Conway is not happy with you reporting that Uncle Joe brought down gasoline prices. Oh well the governor of Texas needs your talents supporting his abuse of Hispanics in his state. Cheers!

Merry Christmas, pgl.

I’m not sure just how “Uncle Joe brought down gasoline prices” given his general antipathy toward fossil fuels, (https://www.axios.com/2023/12/06/oil-production-biden)

but I’m happy that traders are not driving up the prices of oil right now and that refining capacity seems to be sufficient for current national demand and, hopefully, will stay sufficient when normal seasonal demand increases.

https://www.eia.gov/petroleum/weekly/gasoline.php

maybe the war on fossil fuels is not as dramatic as some of you claim. recored production. but it goes with the push towards EV, which reduces the demand for oil as well. that helps to drive down cost. it is simple economics. those that are anti renewables simply strive for higher energy prices, if you believe in supply and demand economics.

Marry Christmas Baffling. A couple of studies indicate that the actual reduction of gasoline demand because of EVs is much less than many people presume:

• https://www.motorbiscuit.com/evs-reduce-gas-usage-america-less-might-think/

As detailed by Ars Technica, between 2010 and the end of 2021, Americans bought over 2.1 million plug-in electric vehicles. This includes 1.3 million fully electric cars.

That’s a huge number of electric vehicles, right? You would think that would make a big difference in reducing gas consumption. Not so much, says the Argonne National Lab. Despite all of these plug-in electric vehicles, gas usage in America was reduced by a paltry 0.54%.

• https://www.scientificamerican.com/article/electric-vehicle-owners-are-not-driving-enough-and-thats-bad/

Studies have consistently found people are driving their EVs less than their gas cars. In our most recent one, my co-authors and I conducted an extensive analysis of odometer readings from 12.5 million used cars and 11.4 million used SUVs listed between 2016 and 2022. We found that EVs averaged just 7,165 annual miles driven, compared to 11,642 for gas vehicles. A 2021 study found similar results when it examined the increase in household electricity usage after purchase of an EV to estimate mileage, as did a similar analysis of used vehicle listings by iSeeCars.com this June.

It would seem the current low prices are more a seasonal phenomenon than anything else. You can expect gasoline prices to start ratcheting up again in March.

https://www.convenience.org/Topics/Fuels/Changing-Seasons-Changing-Gas-Prices

it is not surprising that EV vehicles have less miles right now. most of them are in the city, where people drive less to begin with. until we fill out the recharge stations on the highways, this will continue to be the case. part of the reason people like you oppose the expansion of recharge stations is that it will enhance the use of EV, undermining your arguments. but we know that an electric future is inevitable.

the reduction in gas prices is a result of both the decrease in demand and an increase in supply. the decrease in demand is not trivial, the way you try to lay it out. and in combination with increase supply, it is impactful. gas pump prices don’t lie.

as more and more EV get on the road, the impact will be significant. only around 1% of autos on the road are electric, so a 1/2% reduction in gas consumption due to EV should not be a surprise to anyone. I have no worries bruce. merry Christmas.

Why does the Trump plea to dismiss his NY fraud case remind me of your standard JohnH rant. Well read what the judge had to say!

https://www.msn.com/en-us/news/politics/judge-engoron-tears-donald-trump-to-shreds/ar-AA1lIK3c?ocid=msedgdhp&pc=U531&cvid=514ec593a2e647f485912b742b646d29&ei=5

Judge Engoron Tears Donald Trump to Shreds

The judge ruling over Donald Trump’s civil fraud trial wrote a scathing rebuttal of the former president’s defense while rejecting the Republican’s latest attempt to have the case decided in his favor.

Judge Arthur Engoron, who is overseeing the case in which Trump is accused by New York Attorney General Letitia James of fraudulently inflating the value of his properties and assets in financial statements, dismissed the former president’s appeal for a directed ruling to clear him of any wrongdoing for the fifth time on Monday.

Engoron has already ruled that Trump committed fraud while filing financial statements for years, and is expected to decide on the size of the punishment against the former president sometime around late January or early February. Trump, the frontrunner in the GOP presidential primary, denies all wrongdoing and says the case is a politically motivated “witch hunt” that aims to stop him from winning the 2024 election.

Trump faces being banned from doing business in New York state, having his properties removed from his control, or being forced to pay a fine totaling hundreds of millions of dollars.

While rejecting Trump’s argument to rule in his favor, Engorn highlighted some of the “fatal flaws” in the former president’s defense, including the testimony from one of their expert witnesses in the trial, New York University Stern School of Business research professor Eli Bartov.

During his testimony, Bartov told the New York court that there is “no evidence whatsoever” that Trump or his family committed fraud with their financial statements. It was later revealed that Bartov was paid $1,350 an hour for his services to defend the former president, putting his total at $877,500.

Engoron said Trump and his legal team were wrong to assume that the court would accept Bertov’s testimony as “true and accurate,” adding: “Bartov is a tenured professor, but the only thing his testimony proves is that for a million or so dollars, some experts will say whatever you want them to say.”

Engoron added that Bartov had “lost all credibility” by “doggedly attempting to justify every misstatement” from the former president during his testimony.

In a series of posts on Truth Social, Trump lashed out at Engoron for having “mocked and excoriated” Bartov for “telling the Truth” in the judge’s latest ruling.

“The ignorant Judge did not even try to listen to the Expert Witness. This is a great insult to a man of impeccable character and qualifications,” Trump wrote. “The Judge ignores the Law!”

Engoron also dismissed one of the key arguments from Trump that valuations on his properties such as Mar-a-Lago, his triplex apartment at Trump Tower in Manhattan, or his golf courses are subjective, or that their value is based on what people are willing to pay, as a “lie is still a lie.”

“Valuing occupied residences as if vacant, valuing restricted land as if unrestricted, valuing an apartment as if it were triple its actual size, valuing property many times the amount of concealed appraisals, valuing planned buildings as if completed and ready to rent, valuing golf courses with brand premium while claiming not to, and valuing restricted funds as cash, are not subjective differences of opinion, they are misstatements at best and fraud at worst,” the judge wrote.

“Bartov was paid $1,350 an hour for his services to defend the former president, putting his total at $877,500.”

Now, are we sure the reporter has his verb tense right? Sure hope so, for the Bartov’s sake. Trump may see the payment for services as “contingent”.

R. Glenn Hubbard was paid a mere $1200 an hour to defend Medtronic’s transfer pricing. What R. Glenn wrote is being roundly bashed by actual transfer pricing people as the worst “analysis” ever concucted. Some call his “model” Frankenstein. They are being too kind.

Yea – sometimes these “expert” witnesses actually make Princeton Steve look good.

I’m not one to cite the WSJ editorial board but this is a hot topic:

U.S. Steel’s Sale Is Industrial Policy Boomerang

https://www.msn.com/en-us/money/markets/u-s-steel-s-sale-is-industrial-policy-boomerang/ar-AA1lLeJN?ocid=msedgdhp&pc=U531&cvid=e22065c3ccc24492abe265924eb43f30&ei=13

We have to admit to a smile as Washington’s protectionists howl about Japanese steel manufacturer Nippon Steel’s $14.1 billion deal to buy U.S. Steel. They apparently miss the irony that their tariffs and industrial policy have resulted in the foreign takeover of an iconic U.S. manufacturer. U.S. Steel put itself on the auction block this summer and sought to strike a deal while the irony is hot. Trillions of dollars in Washington spending on public works and green energy are goosing domestic demand for steel while tariffs protect U.S. manufacturers against foreign competition. U.S. Steel’s best assets are political creations.

President Trump in 2018 slapped 25% tariffs on foreign steel under the pretense of protecting national security. Domestic steel producers lobbied for the tariffs, which they said would protect American workers from cheap foreign imports. Yet U.S. Steel’s workforce had shrunk to 22,740 at the end of 2022 from 29,000 in 2018. The evidence shows that the tariffs have resulted in fewer downstream manufacturing jobs and raised prices for consumers, all while padding the bottom line of domestic steel makers. Washington’s industrial policy is also helping to boost demand for domestic steel and U.S. manufacturers’ profits.

Federal spending in the 2021 infrastructure bill includes conditions requiring contractors to use U.S.-made steel. The Inflation Reduction Act provides additional tax credits for wind producers that use domestic steel. Both laws are also spurring construction of new factories, at least for a time. The U.S. ir on-and-steel-mill order backlog is currently at a 15-year high. Because U.S. steel makers can’t meet demand, projects will be delayed or contractors will have to pay higher prices for foreign steel. That’s bad for consumers. But the cosseted U.S. steel makers will benefit from higher prices and profits.

You can understand why Nippon wanted to get in on the Washington spending action, especially as manufacturing flags in Europe and much of the world. Nippon’s $14.1 billion bid is roughly double what Cleveland-Cliffs offered to pay for U.S. Steel this summer, which underscores the economic value of tariff avoidance. The U.S. Steel Workers supported Cleveland-Cliffs’ courtship, but it was opposed by auto makers worried about the potential behemoth’s pricing power. The combined company would have controlled 100% of blast furnace production in the U.S. and 65% to 90% of domestic steel used in vehicles.

U.S. Steel rejected Cleveland-Cliffs’ offer, and it may have been smart to hold out for a better deal. Nippon’s offer doesn’t appear to present antitrust concerns. Although the acquisition would make Nippon the world’s second largest steel maker after China’s Baowu, it has a relatively small footprint in the U.S. The deal could even provide an American-Japanese counterweight to China’s steel powerhouse. Yet the same politicians who support higher tariffs and industrial policy to counter China now are raising abouts about the deal for purported national security reasons.

“Steel is always about security,” Pennsylvania Democratic Sen. John Fetterman declared. Ohio Sen. J.D. Vance chimed in: “Rest assured that I will interrogate the long-term implications for the American people, and I will do everything in my power to protect the future of our nation’s security, industry, and workers.” Do they think the Japanese are going to bomb Pearl Harbor?

U.S. steel making has been declining for decades owing to the higher labor costs of unionized production. American human and financial capital have been put to better work elsewhere such as advanced manufacturing. There are nearly one million more U.S. manufacturing jobs than a decade ago, and there probably would be more if not for Mr. Trump’s tariffs. Some politicians, including presidential front-runners from both parties, want to take the U.S. back to the days of 1930s protectionism and industrial policy. But if the Japanese want to invest in the U.S., shouldn’t Washington welcome them with open arms?

Lots of different policy issues. Maybe another Econbrowser post could weigh in.

As I understand it (which isn’t saying much) U.S. Steels acquisition of Big River Steel made it a prime take-over target. Big River is the cleanest steel plant in North America. Nippon wants Big River more than any other U.S. Steel asset. It doesn’t hurt that U.S. has recently expqnded into Europe.

I’m not sure what to think about this. I would actually bet the Japanese will run it much more efficiently than American executives/management would. So it’s a win in the sense of use of resources and efficiency. But I still think it presents national security issues when you forfeit some amount of control over local resources/ local manufacturing.