Today, we are fortunate to present a guest contribution written by Paweł Skrzypczyński, economist at the National Bank of Poland. The views expressed herein are those of the author and should not be attributed to the National Bank of Poland.

We present an update of the jobs-workers gap discussed in these previous posts: [1], [2], [3], [4], [5].

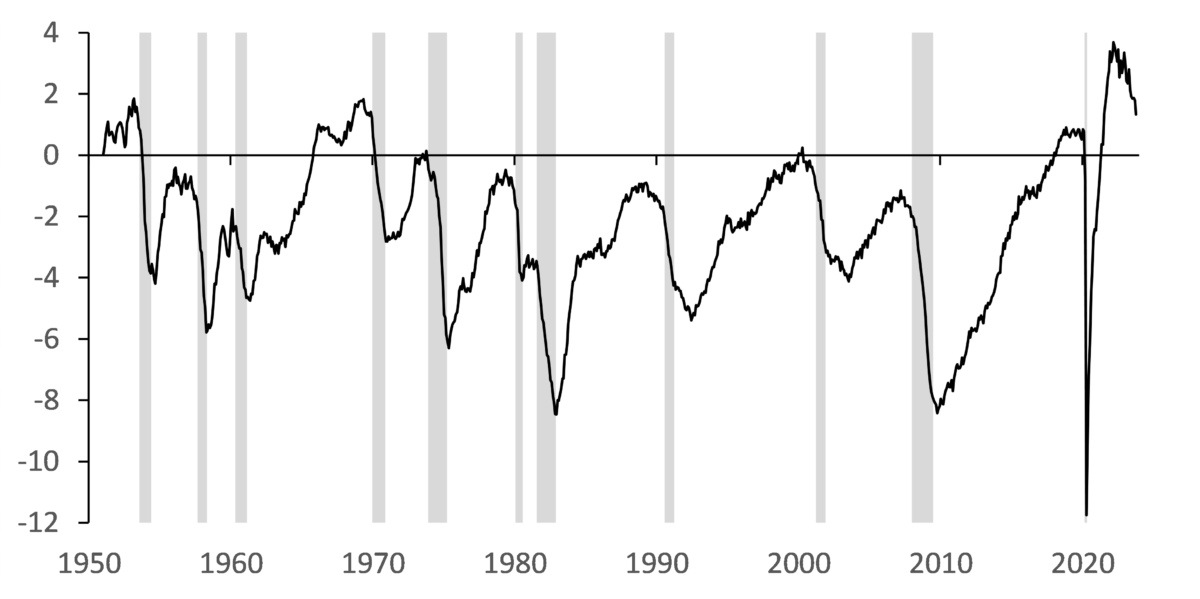

Recall that our update in April 2023 that was based on data up to March 2023 suggested that the jobs-workers gap business cycle indicator (JWGBCI) hit the recession threshold of -0.9 pp. Since than the indicator contracted further. Recent BLS releases allow us to update the jobs-workers gap and the business cycle indicator based on it for October 2023. The jobs-workers gap was at 1.3% (2.3 mn) in October 2023, visibly lower than in March 2023 as well as way lower relative to a historical high of 3.7% (6.1 mn) reached in March 2022.

Figure 1. Jobs-Workers Gap (Percent)

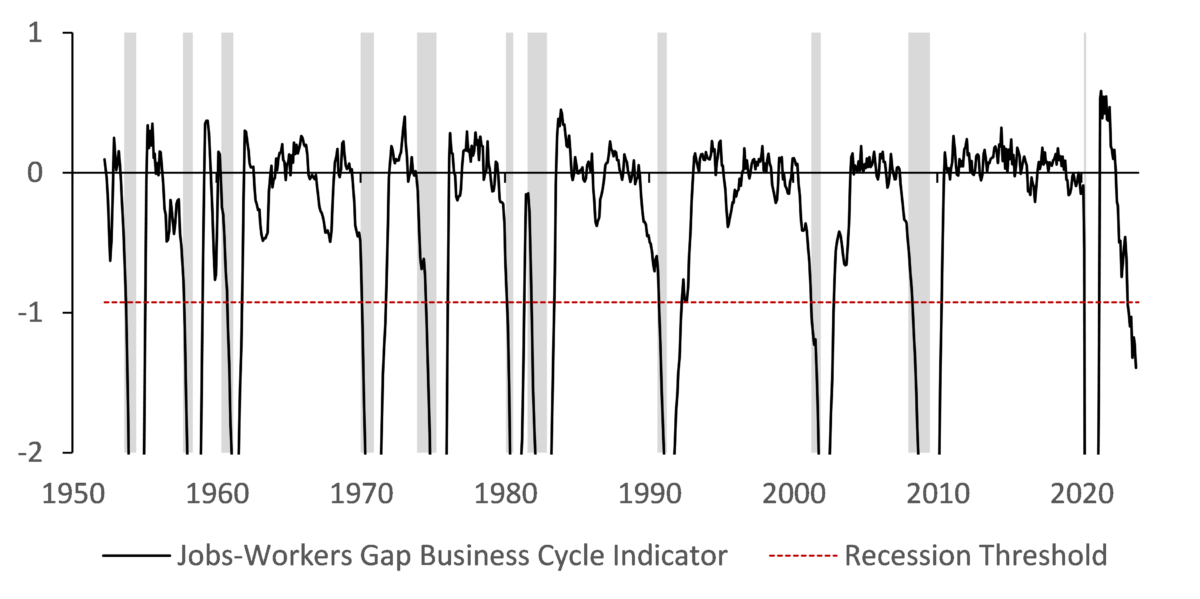

At the same time the jobs-workers gap business cycle indicator (JWGBCI) decreased to -1.4 pp in October 2023, further deepening below the recession threshold of -0.9 pp. Recall the indicator uses a smoothed gap, namely we calculate the change of the three-month moving average of the jobs-workers gap relative to its maximum during previous twelve months.

Figure 2. Jobs-Workers Gap Business Cycle Indicator (Percentage Points)

Formally, using recent readings of the jobs-workers gap and the business cycle indicator based on it we conclude that labor market conditions softened to the degree that historically would be sufficient to declare a recession already started. The caveat is that it would be a huge mistake to do so. Why? The level of job openings during this expansion skyrocketed, which drove the jobs-workers gap to new historical highs. Notice that as of October the level of jobs-workers gap was still far above the pre-pandemic values. This translates to the dynamics of the JWGBCI we observe now, which suggest recessionary tendencies, but in fact reflect moderation of labor market conditions. Furthermore, turn to other economic data that NBER uses do track the business cycle. Overall, this data says definitely “no worries” as of now.

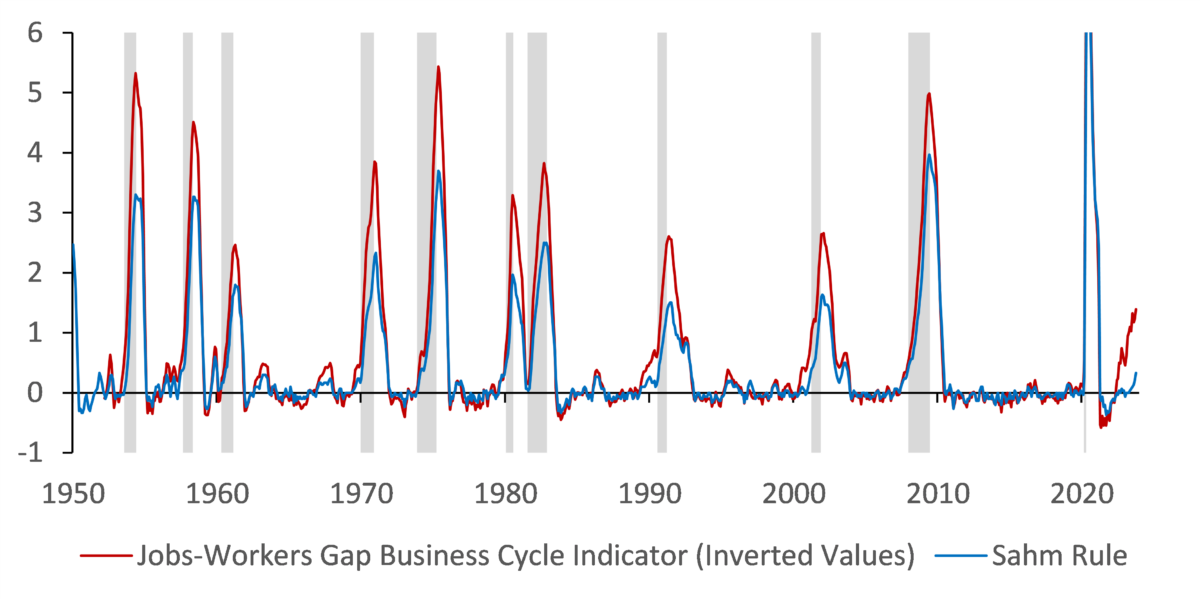

One very important thing to mention in terms of recession calls and the labor market data is the Sahm Rule, developed by Claudia Sahm. The JWGBCI presented here is very similar to the Sahm Rule which is based on the smoothed unemployment rate. In order to derive the Sahm Rule indicator we calculate the change of the three-month moving average of the unemployment rate relative to its minimum during previous twelve months. The threshold for triggering the Sahm Rule is 0.5 pp. Notice that during this expansion the JWGBCI started to move much faster than the Sahm Rule indicator, which is fully related to job openings data that does not feed into the latter indicator.

Figure 3. Jobs-Workers Gap Business Cycle Indicator and the Sahm Rule (Percentage Points)

Upcoming labor market reports, including the one we get this Friday, will reveal how conditions evolve but it is important not to freak out about any type of indicator that tries to track the cycle through the lens of historical linkages. In fact Claudia Sahm wrote a very good piece on this issue not long ago (Why might this time be different?). Keep in mind that this expansion proved many times to be different from past experiences and that is why you should take all current recession calls with a much larger grain of salt than usual. In normal times we didn’t perform well in tracking the business cycle in real-time, in these post-pandemic times which are far from being “the normal we knew” we might be doing it even worse.

This post written by Paweł Skrzypczyński.

Big result from a basic income experiment:

https://www.vox.com/future-perfect/2023/12/1/23981194/givedirectly-basic-income-experiment-abhijit-banerjee-tavneet-suri

Lump sum is better. I wonder whether the result is translatable to other cultures. Are the recipients in an economy in which much of the population engages in small business and few work for wages? Dunno.

ADP says the private sector added 103,000 jobs in November, with hiring qute mixed across sectors.

https://www.bls.gov/news.release/empsit.a.htm

THE EMPLOYMENT SITUATION — NOVEMBER 2023

Total nonfarm payroll employment increased by 199,000 in November, and the unemployment rate edged down to 3.7 percent, the U.S. Bureau of Labor Statistics reported today.

The unemployment rate fell even as the labor force participation rate rose. Employment to population rose from 60.2% to 60.5%.

Speaking of freaking out over jobs…nice report.

There may be some counting problems in recent months, but nothing outrageous. For instance:

https://fred.stlouisfed.org/graph/?g=1cprj