Today, we are fortunate to present a guest contribution written by Paweł Skrzypczyński, economist at the National Bank of Poland. The views expressed herein are those of the author and should not be attributed to the National Bank of Poland.

We present an update of the jobs-workers gap discussed in these previous posts: [1], [2], [3], [4].

Recent BLS releases “The Employment Situation – March 2023” and “Job Openings and Labor Turnover – February 2023” allow us to update the jobs-workers gap and the business cycle indicator based on it. For March 2023 we assume that job openings level declined to 9.8 mn from February 2023 level of 9.9 mn, which would be in line what high-frequency data by Indeed suggests (https://www.hiringlab.org/data/).

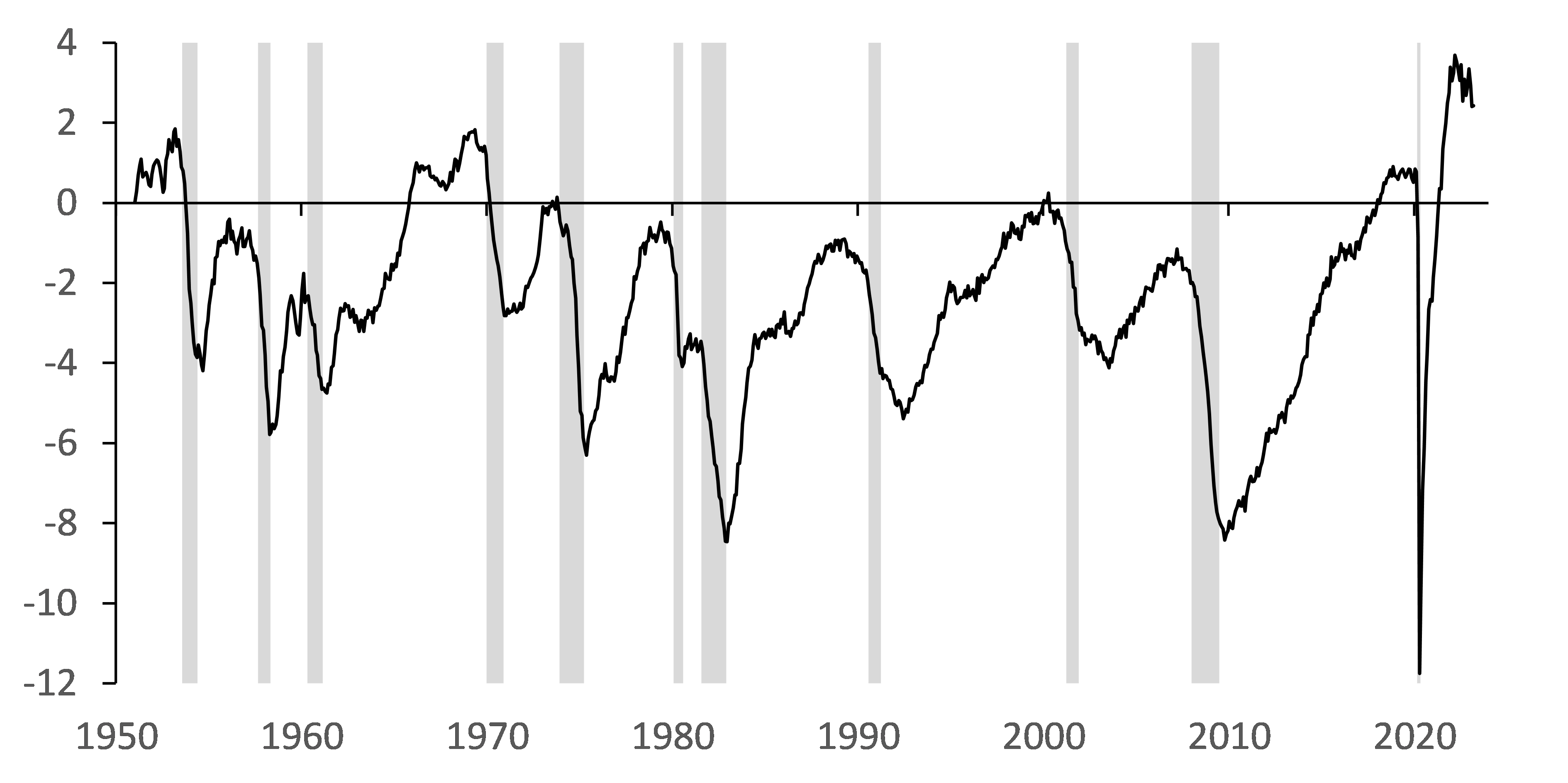

In March 2023 the jobs-workers gap was at 2.4% or 4.0 mn, unchanged from February 2023, however down by 0.5 pp or 0.9 mn from January 2023.

Figure 1. Jobs-Workers Gap (Percent)

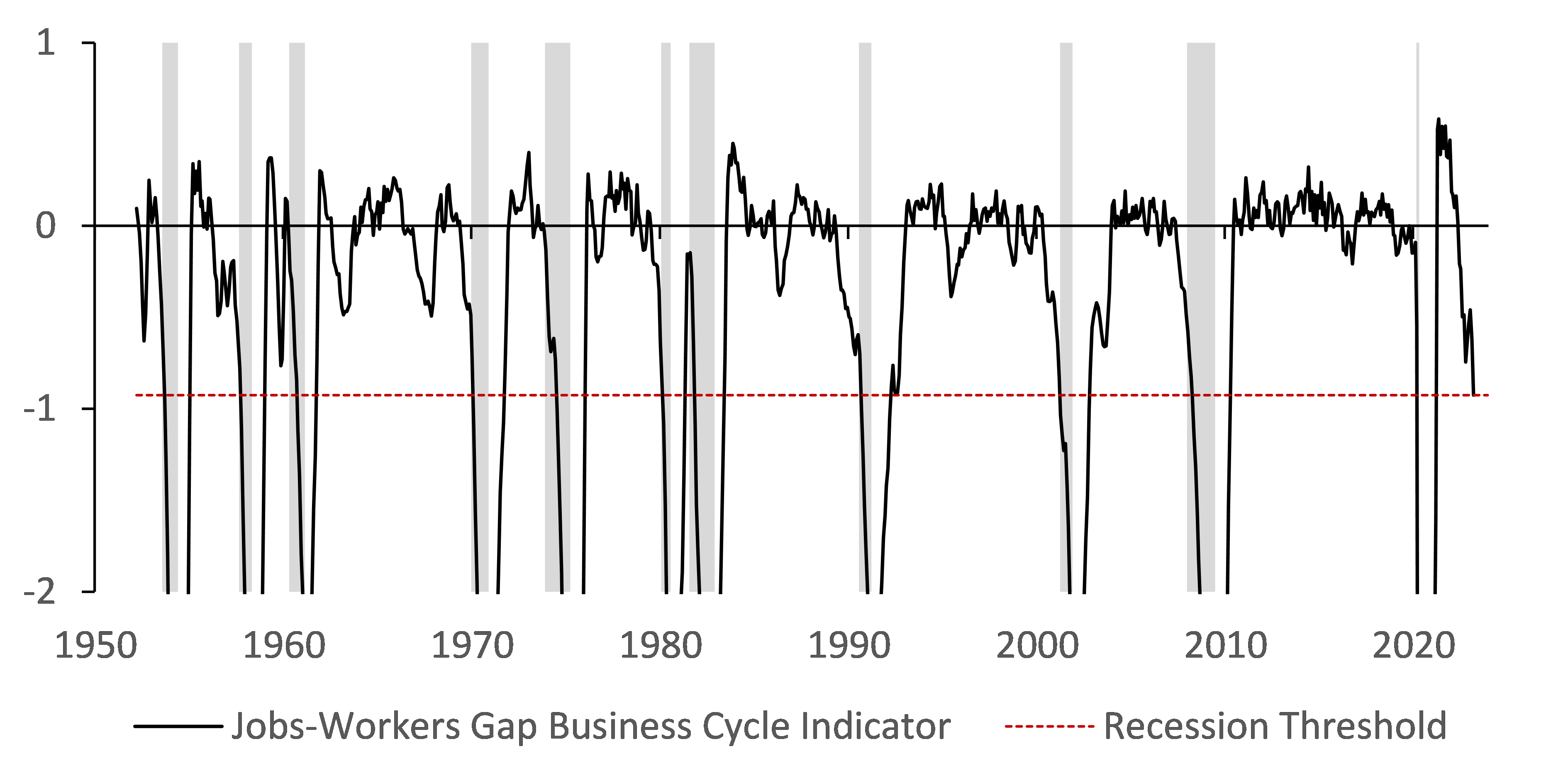

With this new data the jobs-workers gap business cycle indicator (JWGBCI) decreased to -0.93 pp in March 2023 from -0.62 pp in February 2023 and -0.46 pp in January 2023, hitting the recession threshold of -0.93 pp. Recall the indicator uses a smoothed gap, namely we calculate the change of the three-month moving average of the jobs-workers gap relative to its maximum during previous twelve months.

Figure 2. Jobs-Workers Gap Business Cycle Indicator (Percentage Points)

Conclusion of this update is as follows. Recent readings of the jobs-workers gap and the business cycle indicator based on it suggest that labor market conditions softened over the course of previous year to the degree that historically would be sufficient to make a recession call. Whether this case is a true or false positive remains to be answered with future data releases, not only referring to the labor market itself. Overall, recession watch is on, now also through the lens of labor market incoming data.

This post written by Paweł Skrzypczyński.

Way off topic again, the North American energy trade dispute is heating up. It doesn’t seem to represent an immediate threat to supply or prices.

The U.S. and Canada are engaged in a round of commercial diplomacy with Mexico regarding entry to Mexico’s energy sector. A couple of weeks ago, word was the U.S. is in the verge of escalating from talks to dispute settlement:

https://www.reuters.com/business/energy/us-plans-ultimatum-mexico-energy-dispute-raising-threat-tariffs-2023-03-27/

Probably a coincidence, but Mexico is in the process of taking over a number of Spanish-owned generating plants, in what President Lopez Obrador has described as “nationalization”. So that’ll probably be part of the next get-together between the parties to the energy talks.

https://www.reuters.com/markets/deals/mexico-buy-13-power-plants-spains-iberdrola-6-billion-2023-04-04/

Lopez Obrador is nearing the end of his term – Mexican presidents can only serve one – but his party is doing pretty well, so there’s a good chance for policy continuity in the next presidency. And energy policy is a big part of overall economic policy in Mexico.

Remember waaaaay back before the election, when the troll choir was adamant that we trust the household employment figure and Ignore the establishment survey, ’cause there had to be a Biden recession? What ever happened to their interest in household employment?

Maybe this is what happened:

https://fred.stlouisfed.org/graph/?g=12iwX

That’s over 500,000 jobs added per month, on average, in Q1. I guess that doesn’t matter anymore.

The troll choir pivoted to double digit INFLATION. Oh wait inflation is moderating. OK – time for the troll choir to pivot again.

Any data that doesn’t support the favorite narrative is bad/wrong/manipulated/lies – not by any evidence of rationale, by definition. SAD.

I really don’t find this useful because of the hiring distortions caused by lockdowns. They were not normal layoffs and frankly not really layoffs at all. If anything, your not measuring a jobs worker gap, but a distribution problem in jobs that is basically correcting. Creating a illusion of a “recession”.

Good point, that is why we should be taking these results with a grain of salt I guess. The measure shows that in historical terms the recent swing is enough to hit a recession trigger. Undoubtedly the pandemic distortions made it harder to analyze the data the way we used to. Nevertheless, worth tracking as other indicators.

We’ve run into a definiional problem. Yes, economic relationships are changed since the pandemic. But two of the features of the economy we have in mind when differentiating between expansion and recession are employment and consumption. So, yes, caution in interpreting you gap series is a good idea. Caution in interpreting consumption trends, as recently presented by NDD is a good idea. But we shouldn’t dismiss them. We should think harder about what they mean. The performance of the labor market and of demand are mostly what we mean when we talk about the business cycle.

We really do not find your sniping useful either.

Energy is not the only flash point with Mexico: “ Mexico declines to impose economic sanctions on Russia.” https://www.reuters.com/world/mexicos-president-says-will-not-take-any-economic-sanctions-against-russia-2022-03-01/

“ Mexican ban of GM white corn wins public support.” Glyphosate is being banned, too. https://www.chinadaily.com.cn/a/202304/02/WS64294a81a31057c47ebb7e68.html

“ A significant increase in Chinese influence over Mexico would have strong implications for U.S. security. Washington has, until now, maintained a “special relationship” with its southern neighbor in terms of security cooperation. Though the Mexican government has enjoyed autonomy in managing public order, it has kept the U.S. as its main — and practically its only — partner in domestic security matters. The development of a strong Mexican-Chinese relationship could change this equation, with Beijing emerging as an alternative source of equipment and advising to aid in Mexico’s escalating drug war.” https://americasquarterly.org/article/mexico-china-the-us-a-changing-dynamic/

AMLO is taking on some powerful US interests. The man has cojones! Would Washington stand idly buy if Mexico moves into China’s sphere of influence?

Eventual military intervention is not out of the question: “Mexico’s president rebukes GOP push to use U.S. military against cartels.”

https://www.washingtonpost.com/world/2023/03/10/mexico-amlo-drug-cartel-fentanyl/ We all know that drugs would be just a pretext for the camel to stick its nose into the tent. The mainstream media has already been publishing more articles identifying Mexico as Washington’s latest bogeyman, a critical step in paving the way for military action.

Would Ducky support intervention, should it come to that?

I doubt Macroduck advocates the kind of war crimes you do. No – the US is not invading Mexico as we have more respect for international law than your crew in the Kremlin.

Uh oh – – I just called out little Jonny. Getting ready for your next feeble little response. I’m sure the entire gang will have a good laugh at it.

Little Jonny boy is impressed that MEXICO is selling corn on the world market. Seriously Jonny boy – you should check what percentage of world corn is produced in little bity MEXICO:

https://www.statista.com/statistics/254292/global-corn-production-by-country/

Heck Ukraine produces as much corn as Mexico. We have told little Jonny boy that it would help if this moron learned to do basic research. It seems he has no clue how to do so.

Now I did have a tortilla with my lunch which was really good. I wonder if Putin is going to give little Jonny boy a bone for his dinner.

ISW has some interesting information in its April 7 report

https://www.understandingwar.org/backgrounder/russian-offensive-campaign-assessment-april-7-2023

“Russian budgetary revenues and expenditures for the first quarter of 2023 indicate mounting financial burdens on the Russian government. The Russian Finance Ministry released preliminary data on the Russian Federal Budget from January to March of 2023 on April 7, showing that Russian revenues decreased by 21 percent and expenditures increased by 34 percent compared to the first quarter of 2022.[54] The Finance Ministry claimed that the differences in first quarter budgetary revenues and expenditures between 2022 and 2023 is a result of a 45 percent reduction in oil and gas revenues between those two time periods, ignoring the impact of the war in Ukraine”

This is clearly showing how effective the sanctions have been at reducing oil and gas revenues for Russia and also how expensive this war is for them. Anybody thinking that Russia (with an economy about 5% the size of the west) can win by outlasting us, is not anchored in reality.

the currency of war is moral as well as material.

the side with more cannon fodder….

how are things at Bakhmut, and the reaper salvage?

your earlier 5:05 am post about cherry picking

and isw?