The FT-Booth Macroeconomist Survey was released today. GDP is slated to grow 2.1% in 2024, q4/q4.

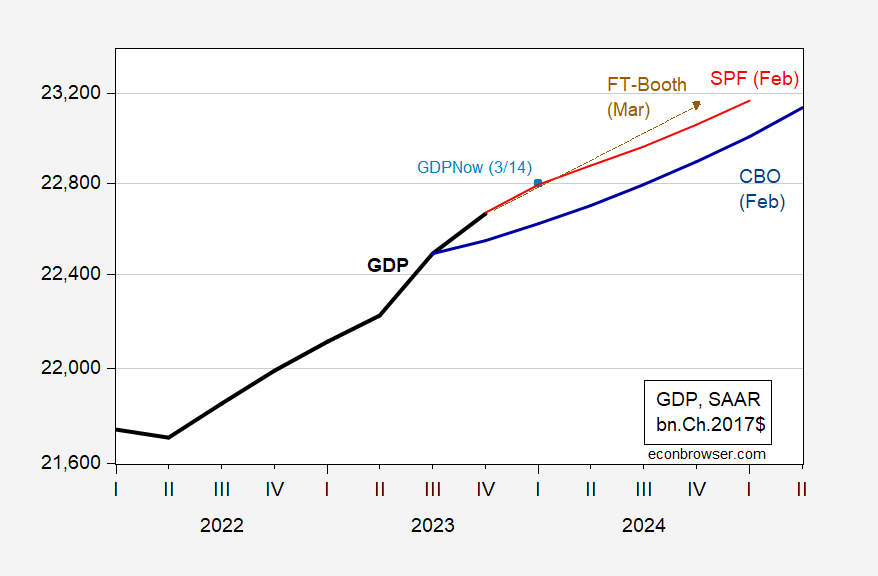

Figure 1: GDP (bold black), CBO projection (blue), Survey of Professional Forecasters (red), FT-Booth median forecast (brown inverted triangle), GDPNow of 3/14 (light blue square), all in bn.Ch.2017$. Source: BEA 2024Q4 2nd release, CBO Budget and Economic Outlook (February), Philadelphia Fed SPF, Booth School, Atlanta Fed (3/14), and author’s calculations.

The median growth rate is 2.1%, with 10% lower/upper bounds at 1.6% and 2.5%. This growth rate is faster than the 1.7% median rate in the February SPF. (I’m apparently more pessimistic than the median, with my point estimate at 1.7%.)

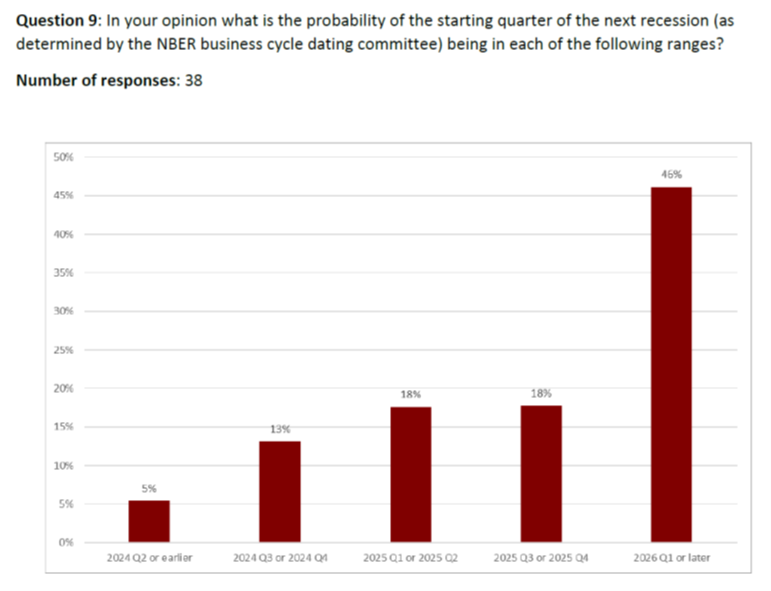

What about recession? The modal response is now pushed to 2026 or later.

Source: Booth School.

The recession start date has yet again been deferred, with modal response moved to 2026 or beyond. In the December survey, 42% indicated a start in 2025Q3 or beyond.

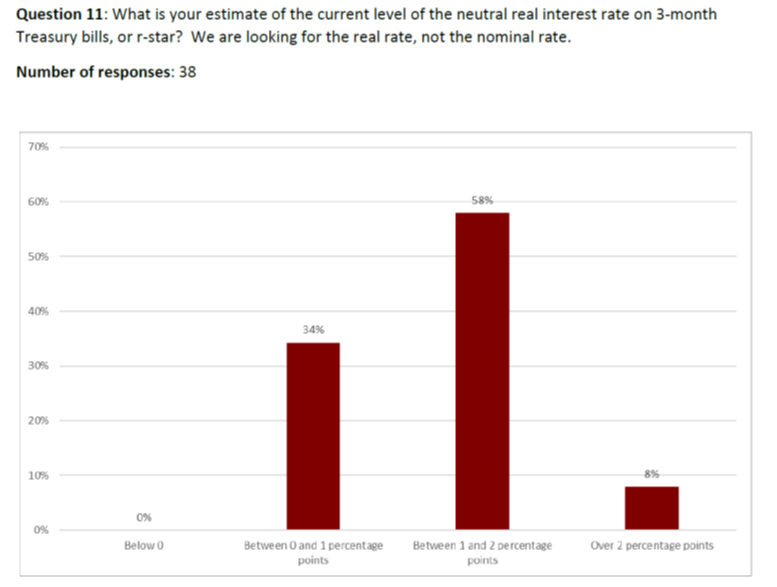

Finally, the respondents weighted in on r*:

Source: Booth School.

The modal response is for r* to between 1%-2%, which is consistent with the estimates shown in this post, and this post. Only 3 people (out of 38) believed r* > 2% (which only the Lubik-Matthes estimate matches).

“Fed will have to keep rates high for longer than markets anticipate, say economists,” in FT highlights other aspects of the survey.

Kristalina Georgieva, head of the IMF: “We have an obligation to correct what has been most seriously wrong over the last 100 years – the persistence of high economic inequality. IMF research shows that lower income inequality can be associated with higher and more durable growth,” she said.

“We simply cannot get to the ‘high ambition scenario’ for growth unless we foster a fairer global economy.”

https://www.theguardian.com/business/2024/mar/14/imf-kristalina-georgieva-inequality-growth-living-standards-john-maynard-keynes

Interesting, isn’t it, how high interest rates get all the attention when it comes to assigning blame for slow economic growth?

There Jonny.boy goes again telling us recessions foster income equality. Oh wait ..Jon y boy thinks the natural rate is over 5 percent

” isn’t it, how high interest rates get all the attention when it comes to assigning blame for slow economic growth?”

Can you be more dishonest? After all – many of us noted that Cameron’s fiscal austerity delayed the UK’s recovery from the Great Recession. Now who was it that was Cameron’s fiscal austerity cheerleaders? Oh yea – little two faced Jonny boy.

Did those 3 say r star is between 2.5 and 3 percent

I wonder if those surveyed were the same eminent economists who assured us two years ago that Corporate America was not a significant factor in driving inflation…

https://www.kentclarkcenter.org/surveys/inflation-market-power-and-price-controls/

JohnH: No, they’re not the same. You can see the list of macro forecasters at the end of the pdf for results, while the survey you linked to has the list of respondents. In other words, you could’ve answered your own question quite easily had you had just a little diligence.

Not to belabor the point, I am actually relatively neutral (no pun intended) on this portion of the argument, but sometimes economists go “on the record” (I believe you have at least once before) even though they do not have to go on the record. Do we know who the three are?? I’m guessing not but happy to be told by anyone that my guess is wrong.

Another disgusting allegation from Jonny Know Nothing