A reader takes issue with my post showing y/y and instantaneous core PCE deflator versus 2% target, noting (correctly) that as of 2020, the Fed’s new monetary strategy incorporates Flexible Average Inflation Targetting (FAIT). While I might have missed it, I don’t recall how one should operationalize FAIT in terms of graphs and rates of reversion to trend lines. The reader gives no guidance, merely a criticism, so I will update what I’ve posted before.

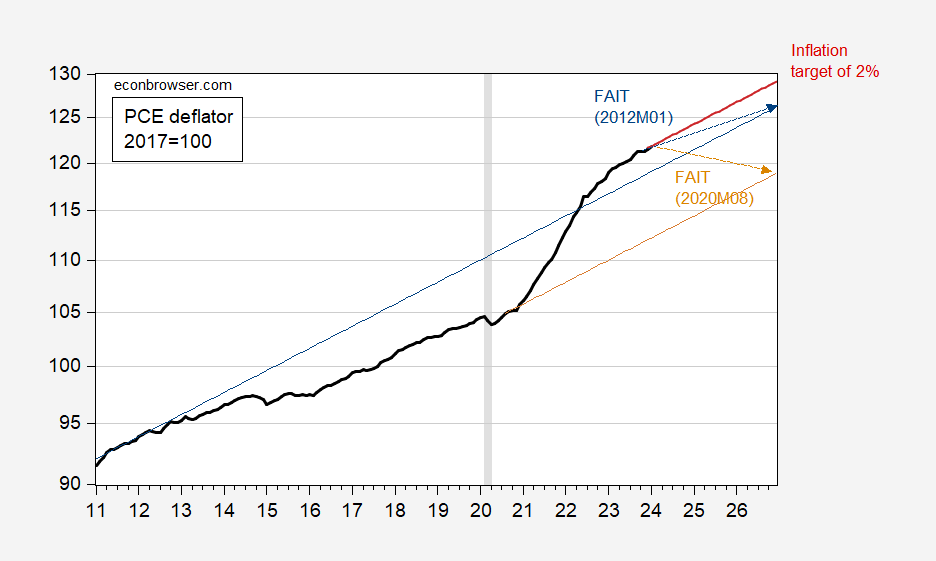

Figure 1 shows the actual PCE deflator (note that officially, the Fed is paying attention to the PCE deflator, not specifically the core PCE deflator).

Figure 1: PCE deflator (black), FAIT trend as of 2020M08 (tan), and as of 2012M01 (blue), and inflation target as of January 2024 (red line). Arrows denote what path of price deflator should be if reversion to be accomplished by December 2026. February observation is Cleveland Fed nowcast as of 3/15. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Cleveland Fed, NBER, and author’s calculations.

Note that in order to hit FAIT trend by end-2026, starting from when the new monetary strategy was published, the Fed would need to engineer deflation (of about 0.8% on an annual basis). To hit FAIT trend starting from 2012M01 (when Jeffry Frieden and I argued for conditional inflation now), inflation would have to run a bit less than 1.5% for the next three years. I have not seen anybody put forward these types of numbers. Of course, the amount of required deflation or disinflation, respectively, would alter if the target date was pushed further back, so 2040 or so.

Hence, I must confess to be somewhat puzzled by the reader’s criticism of plotting ex post PCE inflation against the 2% trend, as most FOMC members seem to be talking about inflation targeting as we used to know it, rather than FAIT.

Menzie Chinn,

1) My issue was your decision to reference a single month’s inflation point estimate as a way to asses if the FOMC is close to its “target” in the original post (i hope you’re able to recall what original post means – Google.com may help). The target isn’t yours to define. No, the FOMC does that for you. For us. And that target is not 2% for a month. Period.

2) I love the “booohooo, I just don’t know why Econned is so hard on me so I’ll try to save face by creating a new blog post by merely updating the data used in an even older blog post because in reality Econned is correct but I can’t let my ego show it – what’ll all of my fanboys on the chatroom I host think?!?!”

3) To answer your last sentence, I criticized your explicit reference to a single month’s point estimate as a way to determine if the commute is close to its target. You’re only “somewhat puzzled” because you choose to be… in this very blog post you went from observing that previously I was “noting (correctly) that as of 2020, the Fed’s new monetary strategy incorporates Flexible Average Inflation Targetting [sic] (FAIT)” and now you’re confused why I would reference the committee’s stated strategy as opposed to what you (erroneously and without reference) mention the words of members. Let us just go read the most recent speech posted on the Fed’s website. A 3/7/24 speech from Governor Bowman where she explicitly references “the current state of monetary policy appears to be at a restrictive level that will bring inflation down to 2 percent over time”. Again, it’s the Fed’s stated policy and it’s explicitly there in every MonPol statement, numerous speeches, and research.

Econned: Re: (1) The last observation of the tan line in the figure in this post is for instantaneous inflation, calculated per Eeckhout (2023). This is a weighted average of current and past inflation, so is not really “just one point”. Re: (2). I must’ve misunderstood your point, because you seemed to be stressing FAIT as the right way to assess how close we were to target. I merely accepted your alternative criterion, and showed what it implied. I don’t see why you object. Re: (3), once again, the number I stressed was instantaneous inflation, which is supposed to get at a trend inflation rate. Hence, it’s not “just one month’s data”.

Menzie Chinn,

FAIT is the committee’s regime. If that’s what their policy statements suggest as their goal (which they very clearly do), it must be the measuring stick to use. As I explicitly (yet obviously not clearly enough for you) stated to you in the chatroom of your prior thread on this discussion board, one problem is that the FOMC has not been clear on what they mean with the term “over time”. As such, you’re just hoping/wishing/thinking that the point estimate of instantaneous inflation (or any measure) that you decided to present is sufficient in judging if the committee achieves its target.

Econned: You missed my point. You seemed to assert that one month was not sufficient to determine whether one was hitting a 2% inflation target. I agree, and that’s why I included the instantaneous inflation rate in the graph. A separate point is whether the FOMC is following FAIT. That’s what this second post is about. I don’t think they are, at the moment.

Menzie Chinn,

You missed your own point. It’s one thing to ask if the FOMC is achieving its target under FAIT. It’s a separate issue to ask if the FOMC is actually pursuing its stated target under FAIT. This post doesn’t answer the latter despite what you believe you’ve achieved.

Econned: Looking at vintages of SEP, Papell and Molodtsova show that the Fed appears to be following a Taylor rule.

Menzie Chinn,

Okay. Good for Papell and Molodtsova. Is either your pseudonym? Their work is irrelevant to what you’ve done here. This is yet another one of your silly games – you link to old posts in the comments when you realize your commentary doesn’t fit the bill. And it’s all a last ditch effort to save face. The fragile ego games never end with you.

Econned: As indicated in the post (had you read it), David Papell is professor at U.Houston, Ruxandra Prodan is lecturer at Stanford. They are not pseudonyms (unlike “Econned”). If you had any acquaintance with modern empirical macro, you’d be familiar with at least one of the names. The point they make is that the Fed appears to be conducting a Taylor rule approach, not FAIT. Hence, it is completely relevant.

I noticed this in the discussion of the Taylor Rule by David Papell and Ruxandra Prodan-Boul:

rLRt is the ½ percent neutral real interest rate from the current SEP.

If r-star is really 0.5% then the FED should be lower interest rates. We have had a good discussion f r-star over the past few weeks – none of which trolls like JohnH remotely understood. Look at the comments under the post from Feb. 9. A lot of mumbling from little Jonny boy but not once did this know nothing troll mention this claim about r-star. Oh wait little Jonny boy has no clue what r-star even is.

‘Econned

March 19, 2024 at 3:42 am

Menzie Chinn,

Okay. Good for Papell and Molodtsova. Is either your pseudonym?’

I was going to stay out of Econned latest absurd rants but come on man – are you really THIS ignorant? Econned – total waste of time.

I gotta hand it you Menzie, you’re a better man than me, I would have banned the little SOB Stalker for “personal vendetta” issues or you name it. I guess he covets the professional rank/status you’ve attained?? I don’t know how you stomach him honestly.

Menzie Chinn,

First, I don’t believe anyone alive is so oblivious to social interactions to think I was serious about the pseudonym. However, it’s very on-brand for you to act as if it were a serious question and to followup with a suggestion that I do not have even an “acquaintance with modern empirical macro”. Second, “The point they make” is irrelevant to your post on your blog. Let me bring it all full circle for you, it’s not your research (which was my point in asking if those authors were your pseudonym and explicitly saying “their research”) and it does not support what you’ve posted on this chatroom of a blog where in this installment you (quite comically) confused achieving a target with pursuing a target.

Econned: If the query regarding use of pseudonym was supposed to be funny, I’ll have to admit I missed the humor. I suspect many others will have too, but I’ll let them answer for now. While Papell and Prodan’s work “is not my research”, they have convinced me, so if not my research, it’s at least my “view”.

Menzie Chinn,

So why didn’t you lead with their viewS as you view? Instead you posted trendlines from various start dates to be suggestive that the FOMC isn’t following FAIT.

And I’m not in the least bit surprised that your reading comprehension has again failed you given the numerous back-and-forths we’ve entertained. We all know that you either can’t comprehend written word or you’re grasping at straws while drowning acting as if you thought it was a genuine question. Your tricks only fool your fools.

Econned the Stalker is playing “school marm”. He insists that there’s a rule, and that all we need to know is the rule. That’s nonsense, of course. Analysis goes beyond the rule and looks at probabilities and processes.

Analysis might also, just maybe, look at goals. Flexible average inflation targeting was adopted in order to communicate the FOMC’s commitment to maintaining 2% inflation over time, and even that commitment was not, in itself, the ultimate goal of policy. The ultimate goal was to allow the FOMC to fulfill its price stability and growth mandates.

Stalker’s anal-retentive insistence on one element in the Fed’s monetary policy scheme, to the exclusion of knowledge about the actual performance of inflation and the outlook for inflation, growth and policy, is reductive and small minded.

By the way, since the adoption of FAIT is meant as a communication device, aimed at influencing inflation expectations (and leaving aside that most of the public is completely unaware of Fed communication efforts), we might want to ask whether inflation expectation are out of line with the target:

https://fred.stlouisfed.org/graph/?g=1iyN0

At 2.2% to 2.4%, not so much. And let’s not forget what the “F” in FAIT stands for; the FOMC has maintained flexibility in policy setting. That’s a pretty good reason to look beyond school-marmish insistence on one non-policy-making stalker’s anger issues and look at inflation performance through a number of measures and perspectives. That is, after all, what the big kids do.

It looks like economist Peter Navarro is headed for the hoosegow Tuesday morning. Chief Justice Roberts turned down his final plea to delay his imprisonment pending appeal. Roberts said that he saw “no basis to disagree with the determination that Navarro forfeited those arguments.”

It’s dumbfounding that Navarro has continued his utter devotion to his Dear Leader even as Trump has cast him aside, refusing to support Navarro’s claim of executive privilege. Something is broken in the brains of these people.

Aside from Navarro’s nervous breakdown, he follows a pattern of many high ranking MAGAs, willing to forfeit their own freedom and respect in order to sit in a jail cell. It seems to escape MAGAs that signing on with trump is a lose/lose proposition. trump gives lip-service about how he treasures “loyalty”. His followers have no idea what the word means. He encouraged Mike Pence to be slaughtered at the nation’s capitol while he watched it happen on TV. That’s what 4 years of doing bobblehead for trump got Mike Pence. The thread of violent death.

https://shorturl.at/lqLRX

Now Pence is DOA as a political candidate and writing editorials no one reads. Pence would be lucky to get elected to the school board for his grandchildren.

And today Trump is wailing that he has been turned down by more than 30 underwriters for the $464 million bond required for his appeal. He says they all want either cash or stocks and are refusing to take real estate as collateral — for a case in which Trump was convicted of inflating the value of his real estate. Who says irony is dead?

Try not to forget Joseph, the ugly orange thing is “a businessman”. If Professor Rosser was still with us, he could tell us at some bankers’ symposium (accommodations provided at large city travel destination for giving bankers’ happy talk) that trump wasn’t near default, he was only having “a liquidity problem”.

One sad fact, from the Orange point of view, is that most Orange assets are in a narrow sector. Now, an half a billion isn’t real money for the U.S. credit market, but half a billion in real assets, in a narrow segment of the commercial real estate market, with limited geographic distribution, looks like Filene’s basement to me; everything is marked down.

There was some happy talk three weeks ago that the Orange guy was going to sell Untruth Antisocial for oodles of money and that would take care of everything. Haven’t heard a peep since.

Not a bad breakdown as far as I can tell:

https://newrepublic.com/article/179879/trump-legal-debts-chubb-payment

Trump being unable to find an underwriter just means he hasn’t tried very hard. If he offered Mar-a-lago which he valued at $1 billion and is assessed at $37 million for taxes, I can see why an underwriter would balk. But if he really wanted a bond, he could put up real estate collateral at 200% or more to cover liquidity, like the Trump Tower plus a few golf courses. And then there is the non-refundable fee which might be 10%.

So I don’t believe for a minute that he can’t get a bond if he really wanted to. He just refuses to pay the terms required for underwriting. He’s just lying to the judge as usual, hoping to get a cheaper way out.

If a kid steals a car and can’t come up with $1,000 bond, he sits in jail until trial. He doesn’t get to whine to the judge that he can’t afford it.

He could sell Mar-a-logo for half his estimated value. Without the furniture but with Melanie. Problem solved, a lot of problems solved.