Video via WisconsinEye, event on April 10th.

Sponsored by WisBusiness. Summary from WisconsinEye:

The annual Wisconsin Economic Forecast Luncheon, set for April 10, 2024 at the Madison Sheraton, is co-organized by WisPolitics-WisBusiness and the Wisconsin Bankers Association. This year a focus is the housing market and interest rates. Mark Eppli, director of the James A. Graaskamp Center for Real Estate at the University of Wisconsin-Madison Business School, gave a keynote presentation at the luncheon and was followed by a panel on other key issues such as workforce, wages and prospects for growth.

Agenda:

11:30 AM – 12:30 PM | State of the Wisconsin housing market

Real estate expert Mark Eppli provides insights into where the housing market and interest rates are going, gives remarks and answers questions.

12:30 PM – 1:15 PM | State of the Wisconsin economyA question-and-answer session with a panel featuring two economists and a local banker. The economists are: Dale Knapp, of Forward Analytics, a division of the Wisconsin Counties Association; and Romina Soria, a senior economist at the Wisconsin Department of Revenue.

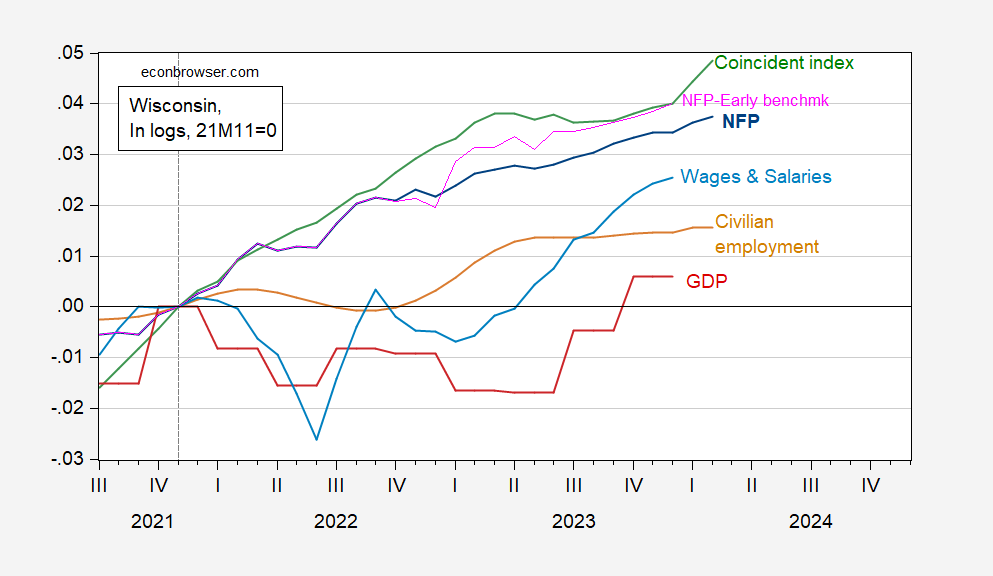

My discussion of DoR’s Economic Outlook forecast, and the Wisconsin macro outlook. Here’s the relevant picture incorporating latest macro indicators.

Figure 1: Wisconsin Nonfarm Payroll Employment (dark blue), Philadelphia Fed early benchmark measure of NFP (pink), Civilian Employment (tan), real wages and salaries linearly interpolated, deflated by national chained CPI (sky blue), GDP (red), coincident index (green), all in logs 2021M11=0. Source: BLS, BEA, Philadelphia Fed [1], [2], and author’s calculations.

Note that no recession (as alleged by the WisGOP) is apparent in the latest data (although these estimates are sure to be revised).