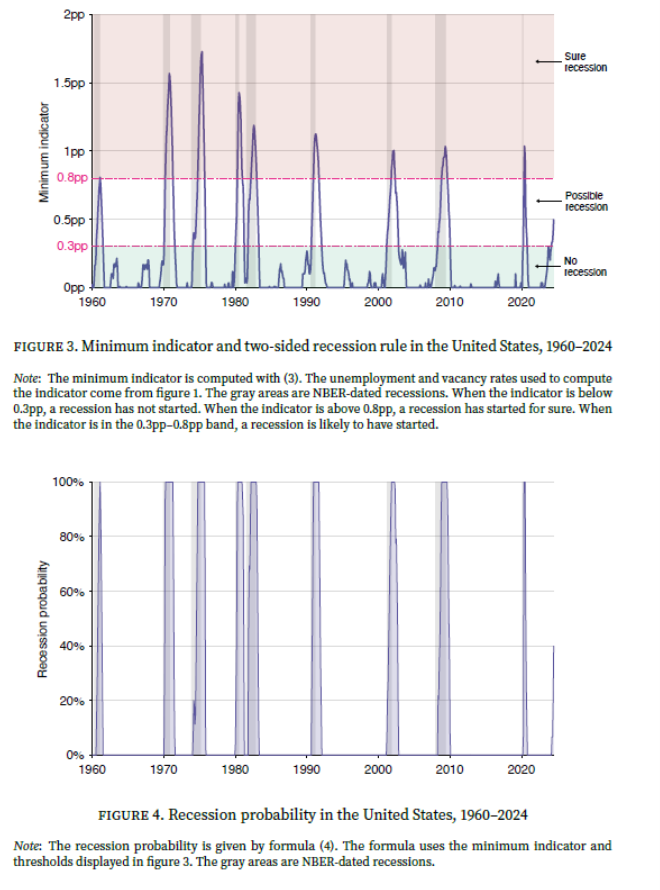

Pascal Michaillat (UCSC) and Emmanuel Saez (UC Berkeley) say 40% probability, yes. From the abstract to the paper:

To answer this question, we develop a new Sahm-type recession indicator that combines vacancy and unemployment data. The indicator is the minimum of the Sahm indicator— the difference between the 3-month trailing average of the unemployment rate and its minimum over the past 12 months—and a similar indicator constructed with the vacancy rate—the difference between the 3-month trailing average of the vacancy rate and its maximum over the past 12 months. We then propose a two-sided recession rule: When our indicator reaches 0.3pp, a recession may have started; when the indicator reaches 0.8pp, a recession has started for sure. This new rule is triggered earlier than the Sahm rule: on average it detects recessions 1.4 months after they have started, while the Sahm rule detects them 2.6 months after their start. The new rule also has a better historical track record: it perfectly identifies all recessions since 1930, while the Sahm rule breaks down before 1960. With July 2024 data, our indicator is at 0.5pp, so the probability that the US economy is now in recession is 40%. In fact, the recession may have started as early as March 2024.

Source: Michaillat and Saez (2024).

As far as I can tell, the authors use final revised data, not realtime. It would be good to see if the results were robust to the use of realtime data, given the big effect of population controls especially in recent years.

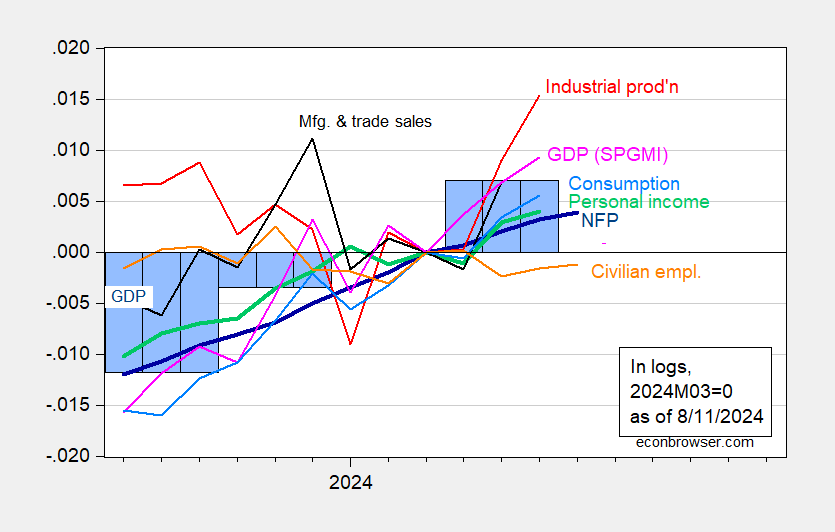

Normalizing NBER indicators to 2024M03 as a peak, we have Figure 1:

Figure 1 [corrected 8/13]: Nonfarm Payroll (NFP) employment from CES (bold blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2023M04=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (8/1/2024 release), and author’s calculations.

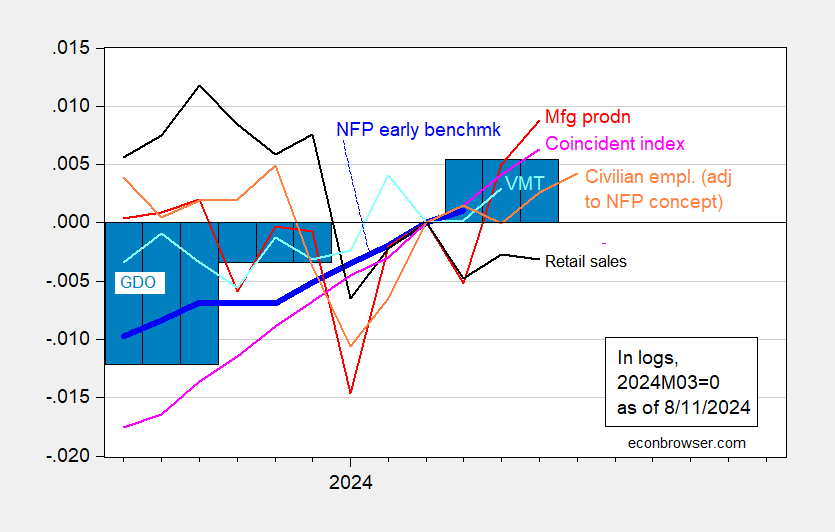

And alternative indicators:

Figure 2: Nonfarm Payroll (NFP) employment Philadelphia Fed early benchmark (bold blue), civilian employment adjusted to NFP concept (orange), manufacturing production (red), retail sales (black), vehicle miles traveled (light blue), and Coincident Index (light pink), GDO (blue bars), all log normalized to 2023M04=0. GDI used in calculating GDO for 2024Q2 estimated by predicting 2024Q2 net operating surplus using GDP, lagged surplus, lagged differenced surplus, 2021Q1-2024Q1.Source: BLS via FRED, Federal Reserve, BEA 2024Q2 advance release, Philadelphia Fed, and author’s calculations.

Of course, all these series will be revised to varying degrees, with GDP being the series at greatest risk — which is why NBER’s BCDC doesn’t put primary weight on it.

Isn’t it pretty widely thought that openings have run off the rails, that firms have been listing openings that don’t exist in large numbers? If the behavior of vacancies has changed, is an indicator based o historical performance reliable?

come on Chinny,

Trump said if he lost there would be a depression and he was right as usual wasn’t he!!!

Authors state in the footnote on page 2: “For some reason, the Sahm indicator provided by the St. Louis Fed is sometimes negative (Sahm 2024). This is strange given that—by definition—a variable cannot be lower than its minimum over the past 12 months. Our indicators are never negative.” This is not strange at all, they just do not calculate the same indicator as the one used in the Sahm rule. They provide an indicator of the form for the unemployment rate: uˆ(t) = u¯(t) − min_0≤s≤11_(u¯(t − s)), while the one for the Sahm rile is: uˆ(t) = u¯(t) − min_1≤s≤12_(u¯(t − s)).

Thanks. Nice of you to do that.

No problem. I thought for a long time that enhancing the Sahm rule with job openings (as shown a couple of times on this blog) will be useful this time around, however this idea was buried quite fast. Recall this post: https://econbrowser.com/archives/2023/12/guest-contribution-do-not-freak-out-about-the-jobs-workers-gap-or-the-sahm-rule.

Seems like other analysts are catching up to your thinking from last year.

I digged a bit more into this new indicator by Michaillat and Saez. Recall we got 0.53 pp from Sahm rule in July on unrounded data basis and 0.49 pp using more precise data (two decimal values). When you do the same with this new rule you land at 31% probability for July vs 40% reported in the paper (using rounded data). That results from the fact that their indicator is 0.50 pp for July due to the use of rounded data vs 0.46 pp when using unrounded data.

I have three comments/questions regarding this paper:

1. What is the “vacancy rate” being used? Housing vacancy rate? Residential or commercial rental vacancy rate? Job vacancy rate? I’m guessing the authors mean the last, and their graph seems to track with the job openings rate in JOLTS, but that series only goes back to 2001, and the authors’ graph goes back to 1959. Maybe I missed it in the paper, but I didn’t see this question answered.

2. If you are looking for a trigger that leads the Sahm rule (which as I understand it Sahm concedes is confirmatory rather than leading), why not just use initial jobless claims, which have a very long history of leading the unemployment rate? – except for this year, which is very interesting by itself.

3. And as to that final phrase just above, how does this paper handle immigration? Here is my hypothetical: At the start of period 1, the US labor force=100, with 4% unemployment. At the end of period 1, because of immigration the US labor force has increased to 105, but only 4 of the increase have found jobs. So jobs (and presumably income more or less) have increased 4%, but the unemployment rate has increased to 4.8%. If this increase has also reduced job openings by the same amount, is this paper’s indicator triggered? If so, it seems to me that is a problem, because what I see in this hypothetical is robust economic and job growth.

Note: I’m not in any way disparaging the work of the two well-known authors. I simply have questions based on my reading of the paper.

“t the start of period 1, the US labor force=100, with 4% unemployment. At the end of period 1, because of immigration the US labor force has increased to 105, but only 4 of the increase have found jobs. So jobs (and presumably income more or less) have increased 4%, but the unemployment rate has increased to 4.8%. If this increase has also reduced job openings by the same amount, is this paper’s indicator triggered? If so, it seems to me that is a problem, because what I see in this hypothetical is robust economic and job growth.”

Nice! My position. Heck is Sahm’s argument too. We saw this in the UK under Cameron as well.

As to the data, see “data sources” for Figure 1. “Vacancies” is constructed by the authors from various sources. There’s a downloadable spreadsheet.

This bothered me, too. I looked for a series, then went back to the paper and found the trick.

I agree that quirks in labor market activity in this cycle cast this indicator into question. The authors’ stated goal is to develop a Sahm-like rule that signals recession earlier. They may have succeeded, but haven’t addressed the issue of reliability that Sahm herself has raised.

A fine bit of work, perhaps more useful in future cycles than now. Of course, Sahm meant her rule to guide Congress to act earlier than it otherwise would, and that seems unlikely for now, so a new recession-signaling rule is mostly of academic interest.

You guys – I mean the authors – slept though their math course when the theory of probability was discussed. For 40% chance of a recession simply means that it is more likely than not, namely there is a probability of 60%, of no recession.

The recession bugs have been expecting recession for years, the economic data be damned. They will be right some day, whether in a year, in five years or in 20 years as our capitalist national economy is by definition cyclical.

The communists promised to us to eliminate the economics cycles of boom and bust. It made all of us poor (been there, lived through that).

Ivan, are you aware of the expression “teaching grandma to suck eggs”? No, the authors didn’t sleep through stats class. You imposed a reading on their text that isn’t in it. Grandma knows perfectly well how to suck eggs.

Was my comment erased by the moderator?

Ivan Orisek: No. Moderator was asleep at 7:39am CT, when you posted your comment. Your comment is now approved.

Asleep? You do know you were missing ESPN’s “Get Up”!

Off topic – “who do you trust”:

https://thehill.com/homenews/campaign/4823799-voters-trust-harris-economy/?tbref=hp

U Michigan and the FT asked which candidate voters trust most to handle the economy. Harris came out ahead by a small margin.

Oddly, a plurality of respondents see Harris as very liberal and trust Trump more than Harris to deal with China. These two results suggest voters are swallowing some parts of Trump’s campaign twaddle. Respondents also don’t like Biden’s handling of the economy, mostly because of inflation. Even so, they trust Harris on the economy more than Trump.

The GOP routinely gets higher marks than Democrats from voters for economic management (contrary to actual performance), do this might have some Republicans grinding their teeth. Maybe they should try to get Trump to drop out.

Off topic – governance:

https://www.propublica.org/article/inside-project-2025-secret-training-videos-trump-election

Pro Publica has gotten hold of Project 2025 training videos for Trump administration appointees. High on the list of things to learn: don’t leave a paper trail. The goal is to reduce accountability and limit oversight.

There are lots of other odious ideas, but this one stands out. A president with a criminal history, whose appointees, lawyers and advisors have a habit of ending up in jail, would lead an administration full of people instructed to keep no record of their actions. Failure to keep records is, itself, a violation of federal law in many cases.

We’re looking at a criminal conspiracy masquerading as a political movement. Bill Barr must be sooooo happy!

a number of years ago, we got to see the wonderfully accurate and intelligent assessment by rick stryker on the “big, big, huge” crowds at the trump inauguration (note the fields were mostly empty, but rick argued otherwise). so i am now waiting for rick stryker to present another wonderfully accurate and insightful assessment on how harris has been speaking to empty fields during her recent rallies. it must be true, because the senile old man trump claims that is the case. AI’d and everything! the orange abomination is becoming boring carnival act. the emperor has no clothes, but rick stryker believes otherwise. how is that short bet going ricky? weirdo.

The March on Washington for Jobs and Freedom was on August 28, 1963 and pictures of it show 250 thousand attendees or so. Of course Trump wants to laud the crowd he got to attack the Capital on January 6, 2021 as the biggest ever in history. So it has now been demonstrated on Faux News that those alleged people during the March on Washington for Jobs and Freedom was generated by a version of AI that existed over 60 years ago!

https://jabberwocking.com/how-are-hourly-workers-doing/

How are hourly workers doing?

Kevin Drum picks on how the WSJ leads by misleading (I know – easy target). But the WSJ story does get around to presenting some interesting comparisons of job openings over time. And it seems job openings today are where they were before the pandemic. Yep – Trump and Vance have been lying about this issue too (but you knew that).

Off topic – climate change and insurance:

https://archive.ph/TF0dp

Mostly detail, not so much big picture, which is fine.

I know, I know – it’s a pet issue of mine and I do go on about it. I just think access to insurance is an under-appreciated risk from climate change.

The world runs on credit, and creditors want insurance. No insurance? No mortgage. No insurance? Self insure, but that requires higher returns, which limits investment. Insurable yesterday, but not today? Loans get called, meaning capital gets stranded. Incomes fall, leading to positive feedback – a vicious cycle.

Neither private nor public institutions can price insurance correctly when the future is much different from the past, and pricing insurance correctly is critical to efficiency. Bad pricing means either under or over-investment; squandered opportunity or squandered resources. Perhaps on a grand scale.

Big insurers, such as allstate and farmers, have effectively stopped issuing new policies in houston. It is having a negative impact, although less known (but still reliable) carriers are stepping in. I had allstate for a couple decades, but a new policy’s had over $100k deductible. It was not reasonable. They lost home and auto as a result. Rates are almost double from about 6 years ago. Both auto and home. Due to natural disaster cost, not filed claims.

Lina Khan in the crosshairs? Let’s hope not. Matt Stoller isn’t reliable, bit that doesn’t mean he’s wrong about this:

https://www.thebignewsletter.com/p/monopoly-round-up-the-2024-cnbc-shadow

The gist is that Harris has received a lot of money and other support from a handful of people who want Khan gone from the FTC. Stoller isn’t the only one pointing this out.

Anyhow, those who care about the economic burden and political corruption that results from industrial concentration might want to speak up now, while there’s time.

“The subtext of my piece was that three Democratic billionaires – LinkedIn founder Reid Hoffman, IAC Chair Barry Diller, and Starwood’s Barry Sternlicht – publicly demanded that Harris fire Federal Trade Commission Chair Lina Khan.”

It is well known that Hoffman has made this offer. But Harris has not taken him up on it. She shouldn’t. That’s more like Trump’s MO. Now little JD Vance was asked about anti-trust. This two faced clown said he was all for reasonable anti-trust but does not agree with what Khan has been doing.

“On Bloomberg TV, Larry Summers made the same point as Altman, saying he wishes Lina Khan were fired but that doing so “at the behest of billionaires” is precisely the wrong way to do it.”

I listened to Summers little Twitter clip and was about to go eff you Larry but when he called Vance’s pretending to embrace anti-trust as phony as a $3 bill, I was so elated I almost pee’d in my pants!

Summers is explaining what was known as the Reagan Revolution re ant-trust which was to focus not on bigness but on protecting competition. Fine in theory I guess but Larry knows full well that this sort of economics based approach to anti-trust went too far and allowed a lot of oligopoly power to build up over the past 20 years.

The Rise, Survival, and Potential Fall of the Reagan-Era Antitrust Consensus

https://www.promarket.org/2022/03/13/the-rise-survival-and-potential-fall-of-the-reagan-era-antitrust-consensus/

From a couple of years ago related to the view of anti-trust that motivated that babbling by Larry Summers.

And now trump is using jeffrey epsteins jet. Cant make this sh!t up! Desperate and boring. This campaign is becoming a sad joke. Dude is simply too old to be running for president. Lacks stamina and good decision making. Vance. Enough said.

Team Trump is denying they knew it was once Epstein’s jet. Of course that did not stop them from trying out whether a couple of teenage prostitutes were aboard.

the slurring and confusion from trump during his rants is concerning. see his recent X rant with musk. the Republican Party is relying on a frail old man with memory and cognitive problems. his selection of vance, who he now despises, is indicative of poor decision making skills. another hallmark of a deteriorating cognitive condition.

hey rick Stryker, I would recommend you choose another nominee. but that would be anti-democratic and a coup. you are not allowed to change from dear leader trump. its against the constitution. he is yours until November. enjoy the beating.