I’ve got undergrad upper division and MSc level macro courses (latter w/Charles Engel) to teach this spring (also a stats course, where I use lots of examples from comments as cautionary notes, [1], [2], [3], [4]). Last year I added to the undergrad course climate change and r*. This year, I’m taking suggestions.

Right now, I’m considering, the macro implications of:

Tariffs of 10-20% universal tariffs plus 60% tariffs on Chinese imports.

Elevated policy uncertainty and investment.

Insurance disintermediation due to climate change

Addendum:

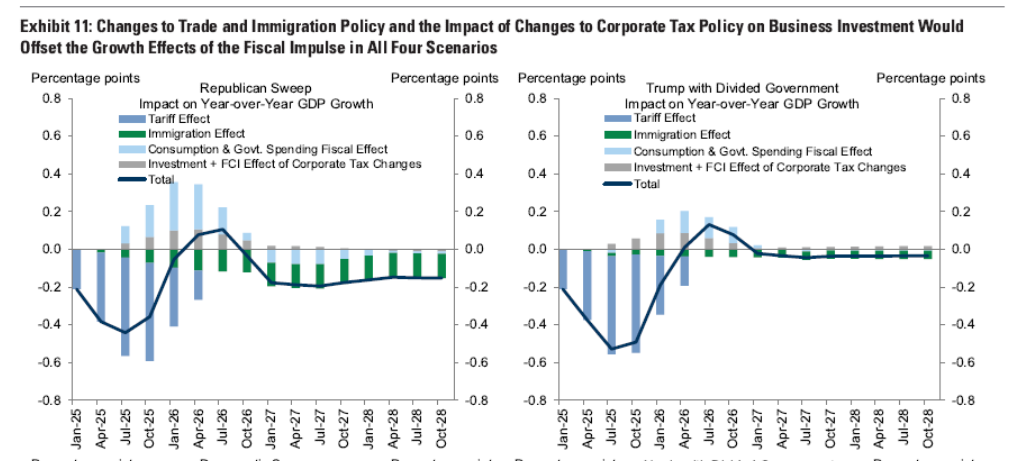

Incomplete Trump program, under R sweep and R Pres-divided govt, deviation from baseline.

Source: Alec Phillips, David Mericle and Tim Krupa (Goldman Sachs, 3 September 2024):

The first two items are timely and important. The climate issue is affecting households directly today, although most republicans are in denial over that fact. Even as their insurance premiums have doubled in recent years.

I like ‘Insurance Disintermediation due to climate change’ best as more market-driven than the others.

Maybe tack “rule of law” onto the policy uncertainty segment. Chief Justice Roberts seems to think this subject is timely.

Funny guy, Roberts. He has been in charge if the Supreme Court in the worst period of decline in the Court’s reputation, and now he sees a lack of respect for the courts as a problem.

Roubini is out with his look into 2025 over at Project Syndicate:

https://www.project-syndicate.org/commentary/trump-economy-good-and-bad-policies-may-cancel-out-in-2025-by-nouriel-roubini-2024-12

It is not like Nouriel to waffle, but but he certainly manages here. Intro paragraph:

“What impact will the next US administration have on economic growth and inflation? The answer is not yet clear, because while some of President-elect Donald Trump’s proposed policies would boost growth and reduce inflation over time, others will have the opposite effect.”

Aside from withholding judgement – not something Nouriel is known for – the interesting feature here is the structure of the second sentence. Open with the possibility that Trump’s policies will be good for the economy, rather than open with bad. “Sanewashing” is the term of art for this sort of thing.

In the body of his text Nouriel identifies potential benefits from extending tax cuts, but no risks. He takes Trump’s pledge of a 3-million-bpd increase in oil and gas production at face value, when domestic production is already historically high, and prices are fairly neutral for new investment. He takes happy-talk support for crypto and AI as support for technology in general, and looks for big benefits.

Nouriel eventually gets around to the risks of restrictive immigration policy, tariffs and decoupling from China, but keeps up the sanewashing, saying that it’s all a matter of degree and maybe Trump won’t, or can’t, go overboard.

“Thus, the Trump administration’s effects on growth and inflation will depend on the relative balance of positive and negative policies.”

Substitue the name of any president, and the same could be said – a bland nothing. All of this is in service of another blanf nothing, Nouriel’s 2025 prognosis:

“As long as Trump’s most radical policies are contained – and barring some unexpected development, such as a geopolitical shock – the coming year should be relatively benign for the US economy.”

Sometimes, tepid optimism is justified, even if it fails to warm the blood. Maybe Nouriel is still trying to shake the “Dr. Doom” label. Maybe he’s trying to preserve entre in Washington – after all, he recently co-author a piece praising tariffs. Whatever his motives here, this heap of equivocation is out of character.

Thanks for link.

I notice that Trump plans on a 3 million increase in crude/NG production.

The US now exports nearly 6 mbbl [equivalent] of LNG, a rise since Spring 2022 of ~ 3 mbbl (US imports into refineries about 3 mbbl of crude per day) a day to the export side!

Such a benefit would accrue to the US energy economy by letting Russia and Iran export to near their potential.

I guess we don’t get an end to the Ukraine or Iran adventures.