First time teaching undergrad macro (elective, after intermediate macro) in three years, so I thought time to revise the syllabus (Econ 442) to account for new issues (compare against Fall 2001).

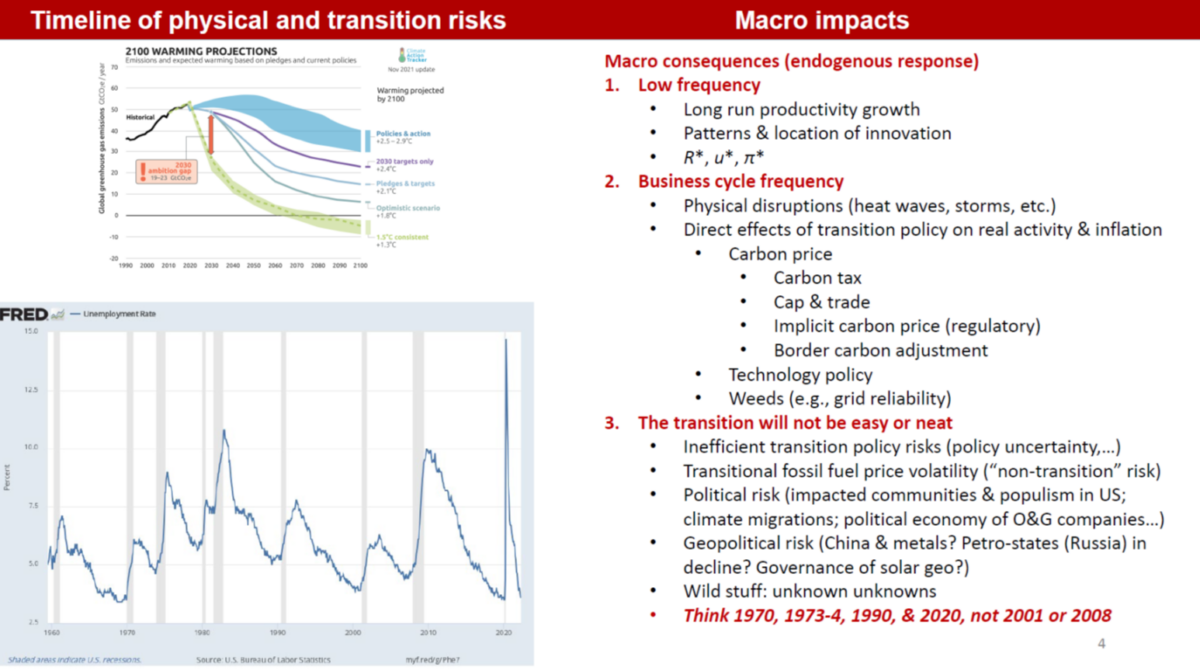

First, climate change and macro implications.

Source: Stock (2022).

Will be focusing on climate shocks complicating macro stabilization (consider hurricanes, droughts, heat waves, disaster insurance crises), consequences of reliance on fossil fuels, implications of carbon taxes and cap & trade.

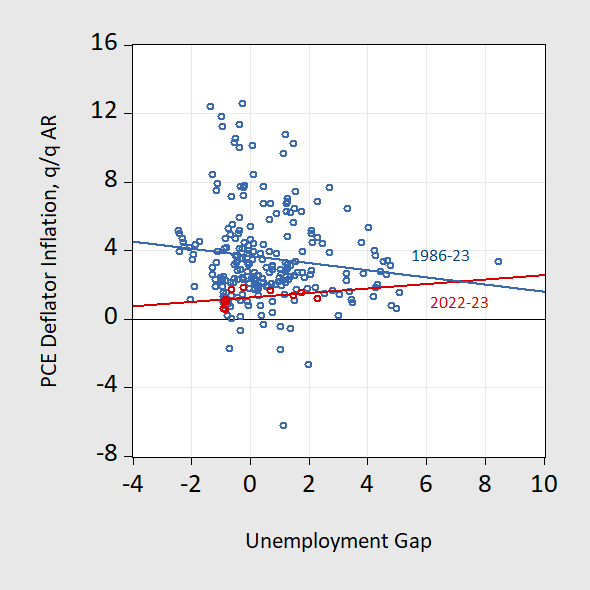

Is the Phillips Curve still relevant?

Figure 1: PCE deflator q/q Annualized inflation against unemployment gap, lagged one quarter, 1986-2023Q3. Bivariate regression line for 1986-2023 (blue), for 2021-2023 (red). Unemployment gap calculated as unemployment rate minus noncyclical unemployment rate from CBO. Source: BEA, BLS, CBO via FRED, and author’s calculations.

The rapid runup and decline is taken by some as an indictment of the conventional Phillips curve approach. Figure 1 is suggestive. However, even a basic textbook version of the Phillips curve incorporates more than 2 variables…

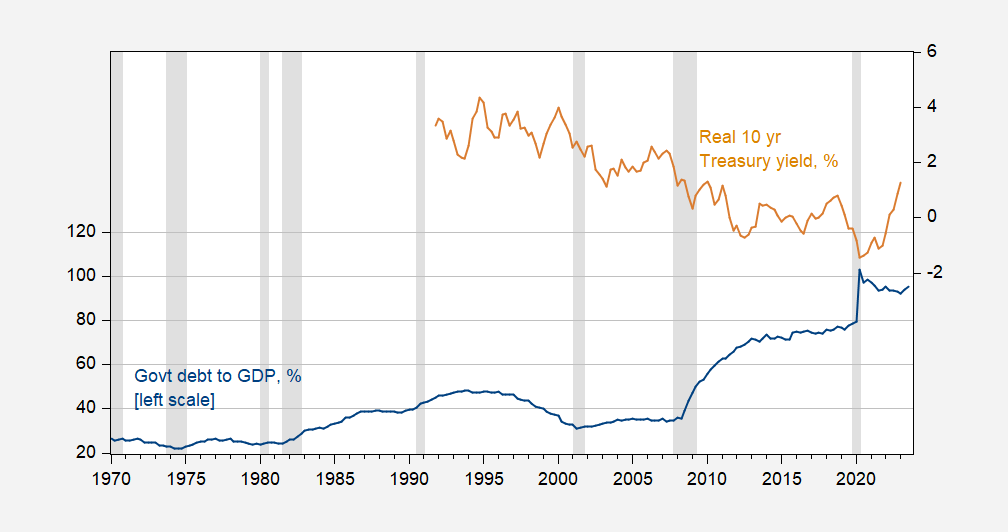

Is it government debt: why have real yields risen?

Figure 2: Government debt held by public divided by GDP, % (blue, left scale), and real 10 year Treasury yield, % (tan, right scale). Real yield is nominal 10 year subtracting SPF expected 10 year inflation rate. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury, BEA, via FRED, Philadelphia Fed, NBER, and author’s calculations.

The switch from declining debt-to-GDP to rising in 2001, accompanied by fall real yields posed a challenge to conventional wisdom. Did the 2020 jump in debt-to-GDP result in a long-standing break in that association.

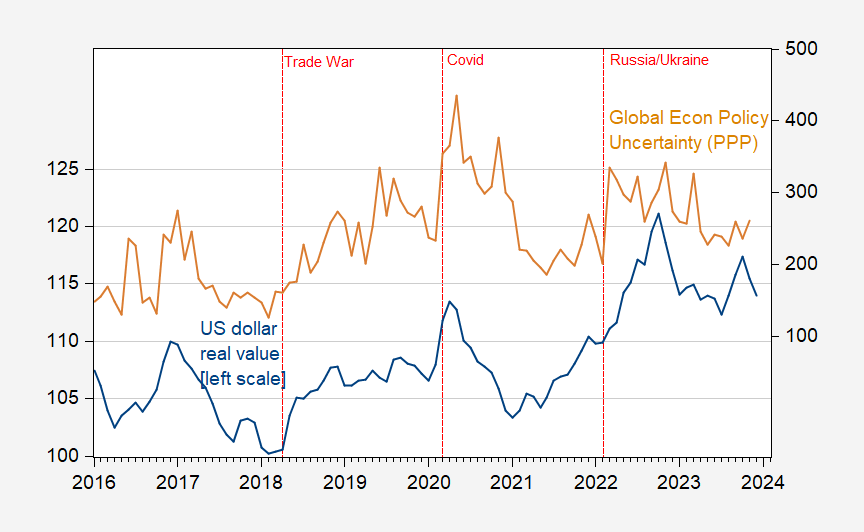

Will the dollar remain a safe-haven currency (and what does it imply for interest rates)?

Figure 3: US dollar (broad) real value (blue, left scale), and Global Economic Policy Uncertainty, PPP weighted (tan, right scale). Real exchange rate spliced at 2006M01 – goods weights pre-2006, goods and services weights thereafter. Source: Federal Reserve Board, policyuncertainty.com, and author’s calculations.

In times of uncertainty, the dollar rises in value. This is even true when when shock emanates from the US (think Covid and bleach; and in September 2008).

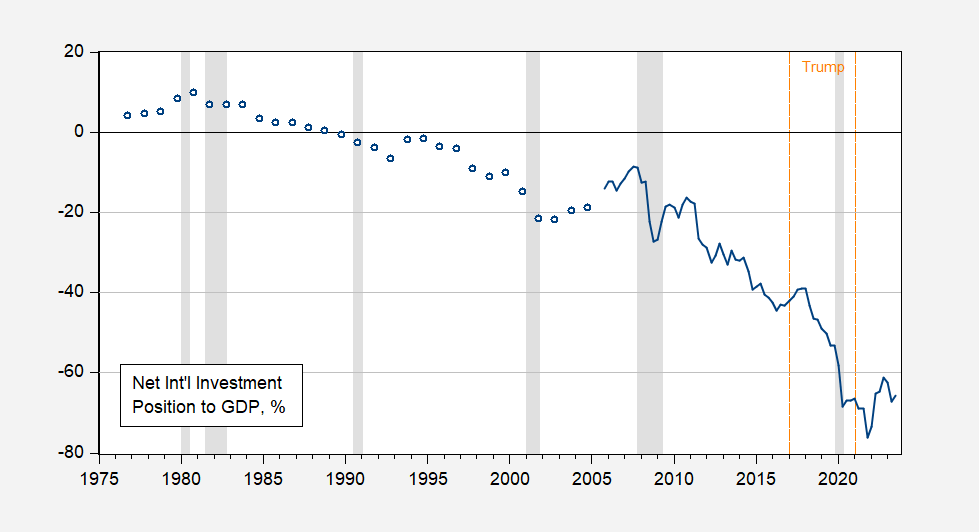

And what does reserve currency status (related but different from being a safe have currency) imply for continuation of this trend in the US Net International Investment Position?

Figure 4: Net international investment of the United States (ex-derivatives) as a share of US GDP, %. NBER defined peak-to-trough recession date shaded gray. Source: BEA, NBER and author’s calculations.

Interestingly, the US became increasingly a net debtor (by about 30 ppts of GDP) over the Trump administration. Winning!

The textbook for the class is Olivier Blanchard’s Macroeconomics. I know some people will ask “what the he** do you teach your students, Menzie?” (That question is asked by the same person who argued that a recession occurred in 2022H1). Now you know.

By the way, for the first time in three years, I don’t get to teach MSc. macro. But here’s the syllabus for last year’s Econ 702 (textbook by Garin, Lester, and Sims).

Menzie Chinn,

To what extent do you cover monetary policy in this into course? Will you show the FOMC regime changes?

@ Menzie’s stalker

I’m sure the day that Prof Chinn wants Mark Levin or some other wack job to write his lesson plans/ syllabus, he’ll give them a phone call.

You know Menzie, outside of you adding new words to my lexicon such as atavistic (nothing offends a former pretend teacher who taught ESL in China more than a danged durned Asian American teaching him them thars newfangled words), I’d say 3/4ths of the reason I tune in here to the blog is for the dry-humor like you exhibit near the tail end of the post there.

You didn’t think I was here to learn macro or review macro or that my ears picked up when you said you were teaching undergrad macro and there might be a few stuff for me I can actually grasp, did you?? And I thought you knew/understood me Prof Chinn.

…….. and don’t be mentoring any of those, what JMK called “educated bourgeoisie” type students either, ‘cuz that’s what really offends me. I had a student when I taught in China, from the countryside, if my memory doesn’t fail me (as it so often does) her English name was “Connie” and her Chinese name was Kang Xiao Jie. She wore the same red long-sleeved pullover top the entire term. Out of hundreds, was one of my top three students of that term.

‘What the hell do you teach your students, Menzie? “Well, you know, here’s the theory, but let’s not get carried away with it in real life.”? Why would anyone want to be an economist when the bulk of your views seem to revolve around exceptions to the rule, about presumptions that you are smarter than the market or that markets don’t work?’

Anyone who thinks the free market theory offered up in basic principles classes is all there is to economics has to be dumber than a rock. Then again Stupid Steve never learned even the basic free market principles. Then again the same troll actually thinks M*V = P*Y is advanced macroeconomics and there is something called the “suppression” model.

“Exceptions to the rule” are, in many cases, exceptions to simplifying assumption. Say “market structure” or “rule of law” and you’ve tacitly recognized that fact. Anyone who thinks simplifying assumptions are “the rule” has no business spouting opinions.

This is not just the case in economics. There are basic models in geology which are nearly always off the mark when it’s time to explain the results of field work. “Models” of history? Clio preserve us!

Simplifying assumptions are claimed to

represent reality only in Chicago and at Heritage and maybe not even in Chicago these days.

Although large segments of GLS go above my head, I still think it’s super super awesome the authors’ provide the text for free for the time being. That’s quite generous and kindly in the 2024 world.

“Figure 1: PCE deflator q/q Annualized inflation”

PCE deflator ala the Biden socialists at the BEA? Expect another childish tirade ala JohnH! Never mind that excellent paper from the folks at the Cleveland FED. After all – they are all Commies!

Nice reading list. I’m starting here:

The Long-Term Budget Outlook Under Alternative Scenarios for the Economy and the Budget

https://www.cbo.gov/publication/59406

I want to see what the CBO has to say about Biden’s proposal to shore up Social Security with higher taxes on the rich as opposed to the Nikki Lightweight “solution” which is basically tell seniors to eff off.

Is the Phillips Curve relevant? Define relevant. Is there information in the Phillips Curve? Yes. It was sloped and is now relatively flat. Has there been a structural change (OK, that one’s obvious) and what is the nature of that change?

Same question for Figure 2: What change has occurred to raise interest rates, real and nominal?

I think it would be fun to list all the factors which might have been important in lowering interest rates in the era of low term premia, and see which have weakened. The idea of term premium still makes sense, but it hard to claim that such a thing exists since around 2015. Even now, with sharply higher rates, term premium is about the same for all maturities, near zero:

https://fred.stlouisfed.org/graph/?g=1evi3

Other than a preference for higher interest rates among Fed folk, is there a case to be made for persistently higher interest rate when the market premium for holding duration is zero?

Scary stuff. Incited by MAGA??

https://www.theguardian.com/world/2024/jan/21/germany-afd-party-deportation-masterplan-protests

“The mix of proven neo-Nazis and notionally respectable business people at the meeting was instructive. Invitations to the Düsseldorf forum were issued by Gernot Mörig, a retired dentist who once led the rightwing extremist Association of Homeland Faithful Youth (BHTJ), and Hans-Christian Limmer, co-founder of high-street bakery BackWerk and a major shareholder in popular burger chain Hans im Glück and health food delivery service Pottsalat. Limmer, who did not attend the meeting, has left the latter two companies’ boards since the report was published.”

And in Davos CEOs of certain US companies have declared that a 2nd Trump Presidency could be a good thing for them.

It is not an “into” course. Nor is it an intro course.

I guess it is progress that Econned did not go off on a childish tirade asking if monetary policy would be covered. Maybe Econned should read the syllabus as the answer is yes. Of course we should give this Know Nothing troll as he did not insist on a discussion of the Quantity “Theory” of Money asking instead about regime changes. Again this Know Nothing troll has not read this paper, which is assigned for this course:

https://users.ssc.wisc.edu/~mchinn/Coibion_jel.20171300.pdf

As expected, inequality and real wages don’t make the cut. Nonetheless they are huge issues and impact economic growth and should be an integral part of public policy debate.

https://www.imf.org/en/News/Podcasts/All-Podcasts/2020/12/22/binyamin-appelbaum

JohnH: You are an idiot. Maybe you should read the textbook that’s assigned. Maybe you’d see how wages fit into a macro textbook.

As a matter of fact, I dare you to read a (modern) macro textbook. It would do you a world of good to actually read what you are critiquing.

Do you think someone external to the course could “sort of, kind of” follow along with the course with the 6th edition?? The chapters follow the same topics pattern??

Excuse me, did anyone provide a link to the textbook? Neither wages nor inequality show up on the syllabus, which supposedly highlights the topics that get focused on. This suggests that real wages and inequality are at best an afterthought, something which is consistent with what I’ve been observing here for a long time.

In an unmentioned recent development, BEA is actually providing data on income distribution, something which should be of interest to macro students.

“ Gross Domestic Product, or GDP, is the constant go-to economic indicator that news anchors and U.S. Members of Congress alike love to dissect. Reading quarterly reports from the U.S. Department of Commerce’s Bureau of Economic Analysis on GDP growth is a form of divination that, in popular imagination, tells us whether the economic fortunes of the United States are trending up or down. Strong GDP growth is considered evidence of good fortune for all Americans under the presumption that “a rising tide lifts all boats.”

This presumption is mistaken. Aggregate GDP growth may once have indicated good fortune for most Americans, but over the past several decades many Americans have been left behind as growth increasingly tilted toward the rich. This reality makes GDP a misleading statistic for the opinion leaders and politicians who rely on it. The consequence is that policymakers’ diagnoses of the U.S. economy, and their prescriptions for what ails it, are based on the wrong metric. “ https://equitablegrowth.org/gdp-2-0-measuring-who-prospers-when-the-u-s-economy-grows/

JohnH: Blanchard is one of the most popular macro textbooks around. There are 8 editions, a 9th one about to come out. I thought 5 seconds on Amazon would’ve got you what you wanted.

Darn, you are one lazy person. If only you spent 1/100th of your time you spend typing nonsense and claiming conspiracy on actually reading a mainstream macro textbook, you would be an immeasurably more interesting interlocutor.

Jonny is relying on BEA after trashing its reporting of the PCE deflator

JohnH: You actually commented on a 2021 post on this subject. Are you memory-deficient? Or are you a bot?

Since you are unable to recollect things, I will repost the blogpost in question.

Sincerely, you are the laziest commenter. I am thankful however you did not claim a vast government conspiracy of suppression of distributional data in this case.

Johnny just can’t help but commit the “burden of proof” fallacy. Johnny incorrectly claimed that income distribution was not part of the course material. When corrected, he has complained that he wasn’t spoon-fed the information he should have checked before making his claim.

Ready, fire, aim! That’s Johnny.

“Excuse me, did anyone provide a link to the textbook? Neither wages nor inequality show up on the syllabus, which supposedly highlights the topics that get focused on.”

We get you are stupid. We get you are cheap. But lazy too? If you Google you might find a FREE PDF of the entire text. Chapter 7 is one of the best discussions of labor economics I have ever seen in a macro text. But little Jonny boy claims it does not exist because little Jonny boy is an IDIOT.

“In an unmentioned recent development, BEA is actually providing data on income distribution”

I guess you did not read this link either as it clearly notes that BEA started reported this data in 2020.

Also the Washington Center for Equitable Growth is made up of those mainstream economists who you claimed never mention income distribution. But here they are very focused on an issue which you claim mainstream economists do not care about.

I have a copy of Blanchard’s Macroeconomics 8th edition. Chapter 7 is an excellent discussion of the Labor Market. JohnH’s insistence that Dr. Chinn’s course will not cover real wages has to be the dumbest claim I have ever seen.

Come on Jonny boy – we ALL get you are a lazy idiot. Please stop inflicting this blog with your stupid trash.

It is odd… Here’s Johnny claiming something has been left unsaid that really ought to ve said. He was wrong, but that’s almost always true for Johnny.

But Johnny has never said that Russia should end its war in Ukraine and withdraw from the land it has stolen from Ukraine.

It’s odd that Johnny refuses to live up to the standard he demands of others.

I got Stephanie Kelton’s latest book at a used bookstore for $3 the other day. I’m guessing Menzie and pgl will tell me I overpaid. : )

$3 is a bargain compared to Mankiw’s $300 text. Yea she is a bit left of me but then someone has to counter Mankiw’s love for rich people.

My new favorite Jonnyism. Accusing Dr. Frankel of never advocating reduced tariffs. Oh wait – he called for reduced tariffs on mere washing machines but not on his precious electric vehicles EVEN AFTER we reminding this lying clown where Dr. Frankel said we should remove those tariffs on household appliances (washing machines) and autos. After all EVs are not automobiles according to little Jonny boy.

“Appelbaum says while there has been a surge of interest among economists to study the inequities of distribution, some still question the importance of it.”

Well a few right wing economists might not care about income distribution but this topic has been part of the mainstream for as long as I have been alive. And yea I am a bit older than little baby Jonny boy.

BTW had little Jonny boy checked – he might have noticed that Binyamin Appelbaum got a BA in history and has been a reporter for his entire career. But Jonny boy thought Binyamin Appelbaum was the expert on economics. OK – Binyamin Appelbaum knows about a thousand times more than little Jonny boy but last I checked 1000 times zero = zero.

I might call this battle between Elise Stefanik and Liz Cheney a battle of wits except Elise Stefanik is dumber than JohnH:

Liz Cheney Fires Back at ‘Crackpot’ Elise Stefanik

https://www.msn.com/en-us/news/politics/liz-cheney-fires-back-at-crackpot-elise-stefanik/ar-BB1h8T1R?ocid=msedgntp&pc=U531&cvid=fb8a785d41104cab81548b55629eee3e&ei=11

If you hurry you can catch Rich Lowry on NBC’s coverage of New Hampshire tonight. Could effect digestion of your evening meal.

Fortunately I skipped Lowry preferring to watch the Knicks visiting Barkley Center. The 4th quarter play of the Nets made me sick enough.

Heh, wise decision. I didn’t watch much more than half a minute of Lowry. Although I do confess to the weird habit (not a lot, but occasionally) watching people who talk nonsense just so I can sit there and fume at them with my arms crossed. Lowry used to just about make my head explode in anger on the old McLaughlin Group shows. But I loved Jack Germond. Germond was not telegenic in looks but he was as erudite as they come. Even bought Germond’s book. One of the great American journalists in my view. I’ll have to catch up on the Knicks so we can share thoughts here. I mostly just watch Phoenix because I’m a Durant fanboy.

Yes, “dated”, but still highly recommended:

https://www.goodreads.com/en/book/show/261278

Sadly, they don’t make journalists like Jack Germond anymore. Wish I could have sat next to his bar stool just to chat two hours. He would have felt robbed by the experience, but I sure as hell would’ve had a blast listening to him.

Completely off topic – Tagasschau reports a sharp drop in German exports to both the U.S. and China in December:

https://www-tagesschau-de.translate.goog/wirtschaft/weltwirtschaft/deutsche-exporte-ex-eu-100.html?_x_tr_sl=de&_x_tr_tl=en&_x_tr_hl=en&_x_tr_pto=wapp

Moses, the German is for you. Others can hit the translation button, as needed.

The U.S. hasn’t yet publshed data for December, but what is clear is that German exports to the U.S. had caught down to the rest of the world in September through November:

https://fred.stlouisfed.org/graph/?g=1eypX

That decline appears to have worsened in December. In November, the value of all German exports was down 0.8% y/y in December, while exports to the U.S. were down 4.7%.

https://fred.stlouisfed.org/graph/?g=1eys7

Germany doesn’t ship to the U.S. through the Suez, nor through the Panama Canal, and anyway the September drop is too early for any disruption due to the Suez, certain not for the export of goods made from Asian inputs coming through Suez. Energy shortage doesn’t jump out either, given the timing, but who know what lagged effects might have shown up?

Italian exports, which face the same basic energy and logistics issues as do Germany’s, are holding up considerably better:

https://fred.stlouisfed.org/graph/?g=1eyuy

I’m too lazy to find data for bilateral trade between Germany and China, but the decline in exports to China was reportedly already underway in H1 of 2023:

https://www.reuters.com/markets/chinas-importance-german-exporters-wane-2023-08-04/

China’s economic problems could explain that weakness. The U.S., on the other hand, had a pretty good year and a strong currency. Anybody? Except the troll choir, of course.

German public policy of “de-risking”??

https://www.reuters.com/technology/german-exports-china-hit-by-slow-customs-processing-tech-firms-warn-2023-10-26/

I cheated and tapped Mr. Google on the shoulder. I don’t doubt there are other factors but this has to play some part in it.

Makes sense. There is also an on-again-off-again train strike which begain in November. That could have cut into December exports. Looks like an accumulation of problems, maybe?

I don’t know how to do the math on effects on trade volume, but Euro has increased in value to RMB also. Which would increase prices for Chinese importers of German products if my brain is working today. But Euro USD exchange rate hasn’t varied enough to change trade that much, to my very currency effects ignorant eyes.

But if I got something wrong here I am sincerely happy to be enlightened. Perhaps even 1/2 percentage point change in currency value to the country concerned has a big effect?? I don’t think so, but……..

JohnH whines that macroeconomics does not cover things like wages which is weird as the Solow long-rum growth model says a lot about wages. But economics from over 60 years ago is too current for little Jonny boy. So you have to forgive this worthless troll for missing the tons of discussions since then.

Now Jonny boy cites an IMF podcast from some writer at the NYTimes that at first says economists have been addressing these issues but said little of substance after that. But I guess little Jonny boy missed this from the IMF:

https://www.imf.org/en/Topics/Inequality/introduction-to-inequality

‘While some inequality is inevitable in a market-based economic system as a result of differences in talent, effort, and luck, excessive inequality could erode social cohesion, lead to political polarization, and ultimately lower economic growth (Berg and Ostry, 2011; Rodrik 1999).’

Two more papers that little Jonny boy failed to read. Our host suggests Jonny boy is an idiot which is probably the nicest thing one can honestly say about this worthless troll.

Trade theory has a great deal to say about factor payments. And there’s Johnny, claiming repeatedly that the guy who most recently got a Nobel for trade theory doesn’t care about income distribution. Johnny’s argument? Johnny hasn’t noticed Krugman saying anything Johnny’s wants Krugman to say, so Krugman does care.

But the reality is, Johnny wants to sew disaffection for the benefit of his master, Putin. This is an economic blog, so Johnny spews nonsense about economics.

Raw data: US energy production

https://jabberwocking.com/raw-data-us-energy-production/

Kevin Drums graphs the nearly 15% increase in energy production over the past 3 years exploding the parade of LIES from the likes of Bruce Hall and the former CoRev. He did this by source where solar almost double while wind grew by 26.5%. And yes oil grew by 26.4%. Gas, coal, and nuclear have also grown.

Now we know CoRev never admitted to his dishonesty and how this banned troll can’t even if he had the courage. Bruce Hall is not banned but Brucie has even less integrity than CoRev ever did.