More accurately, nowcasted using inbound container traffic. Two thirds of Chinese imports (by value) comes by sea freight. And sea freight from China doesn’t seem to be rebounding; from Torsten Slok:

Source: Slok, May 25, 2025.

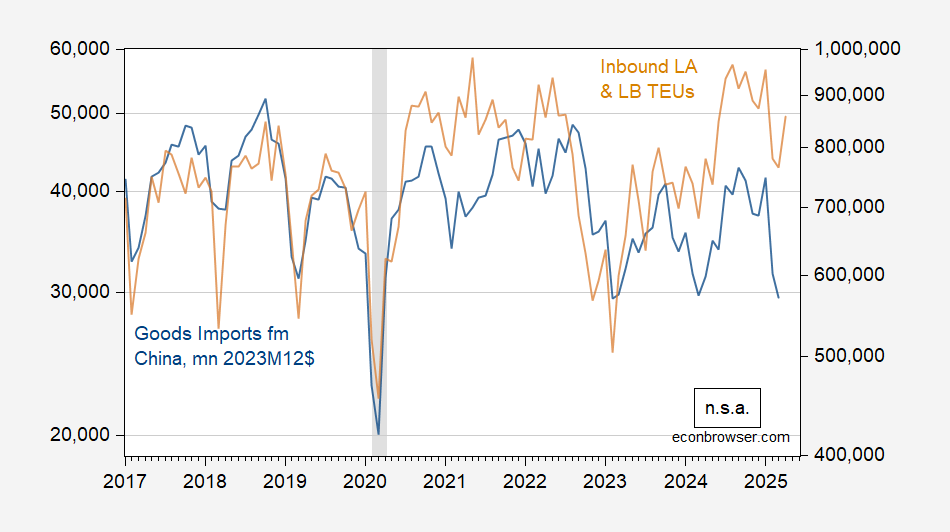

How are TEUs correlated with imports? Here’s total LA/Long Beach inbound TEUs and Chinese imports (deflated into 2003M12$)

Figure 1: Goods imports from China, mn 2003M12$, n.s.a (blue, left log scale), filled inbound TEUs to LA and Long Beach ports, n.s.a. (tan, right log scale). Nominal series deflated into real using deflator for imports of Chinese goods. NBER peak-to-trough recession dates shaded gray. Source: BEA , BLS via FRED, Ports of LA, Long Beach, NBER and author’s calculations.

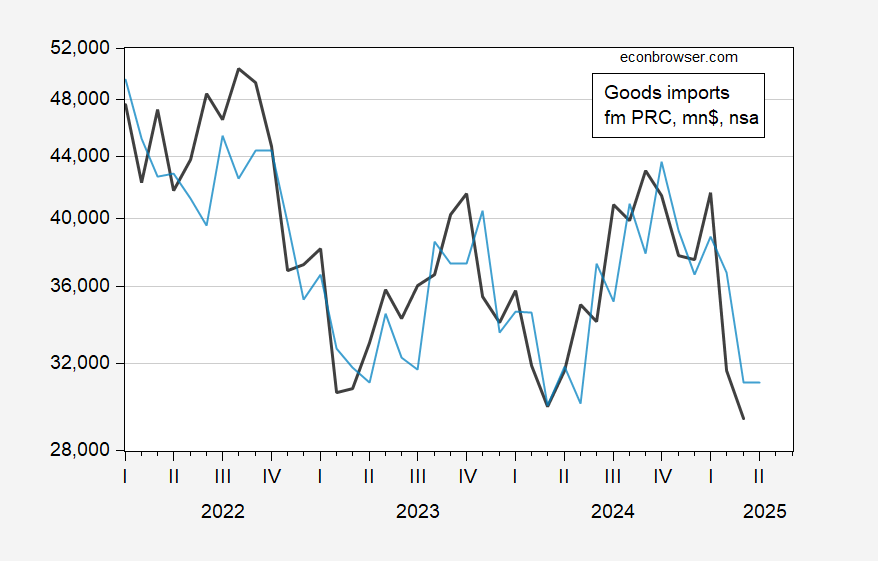

Can we predict April imports from China based on inbound TEU’s? Over the 2022M01-2025M03 period, I estimate in log first differences (using not seasonally adjusted data):

Δimpcht = -0.013 + 0.239 Δteu_LAt + 0.303Δteu_LBt + ut

Adj-R2 = 0.26, SER = 0.086, DW = 2.37, NObs = 39. Bold denotes significant at 10% msl, using Newey-West s.e.

Figure 2: Imports from China (black), and predicted imports using indicated equation (light blue), both in mn.2003M12$. Source: BEA, BLS via FRED, and author’s calculations.

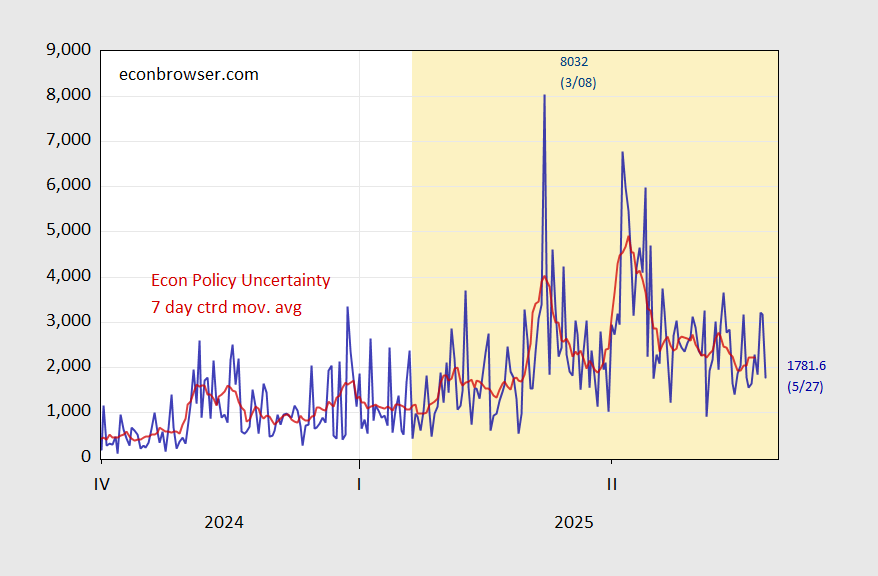

Should we expect a rebound now that there’s been an apparent pause in escalation in the trade war with China. The first figure provided by Slok suggests no. And given the incredibly fickle nature of Trump 2.0 trade policy, it’s understandable why this is the case.

Figure 3: EPU – trade category (blue), 7-day centered moving average (red). Light orange shading indicates second Trump 2.0 administration. Source: policyuncertainty.com.

For more on nowcasting trade using (in part) container traffic, see this blogpost.

Off topic – the U.S. Steel deal:

The notion of government controlling the “commanding heights” of the economy comes from Vladimir Lenin (so probably also fron Leon Trotsky). When famine threatened to topple the infant communist regime in Russia, Lenin instituted the New Economic Program (NEP) in 1921, essentially reverting to a market-based economy, but retaining control over coal, steel and railroads – the”commanding heights” of the economy:

https://www.marxists.org/archive/lenin/works/1922/nov/20.htm

In 2025, we have this in the U.S.:

“Sen. David McCormick said Tuesday that an arrangement that will allow Japan-based Nippon Steel to invest in U.S. Steel will guarantee an American CEO, a majority of board members from the United States and U.S. government approval over certain corporate functions.”

https://apnews.com/article/trump-us-steel-nippon-pittsburgh-34ce70dfee9f32cbebe4e13ea9af7ab7

Seems like the felon-in-chief’s economic theory is coming into focus; it’s the NEP.

trump seems to be following the work of mao rather closely. the red guard and cultural revolution are on display with trump. he really has no imagination.

by the way, attacking harvard because the trump family could not be admitted is a very sophomoric thing to do. middle school cafeteria behavior.

On topic – Gerbil Goods:

https://fred.stlouisfed.org/graph/?g=1JiNT

Not so good, very tariffy.

The decline in shipping has now hit the railroads.

The AAR reported this morning that intermodal loads were down -1.8% YoY last week, after being up only 0.3% the weeks before:

https://www.aar.org/wp-content/uploads/2025/05/2025-05-28-railtraffic.pdf

Cumulative 2025 traffic was up almost 9% YoY at the end of March, but the comparisons have been steadily declining since.

Since early April, the Port of LA has averaged -10% fewer TEUs in arriving traffic YoY. If that comparison holds for rail traffic, there is further downside to go.