My nowcast of BLS private nonfarm payroll employment was for a decreaes of 78K, but with a very wide prediction interval. This is an aggregate number; however, we can infer certain trends from the disaggregate (by firm size) numbers from ADP.

The financial accelerator approach (e.g., BBG, 1996)implies that smaller firms (with less collateral) will evidence a slowdown sooner than larger firms. Using the 500 employee cutoff, can we see the differential trends in the data?

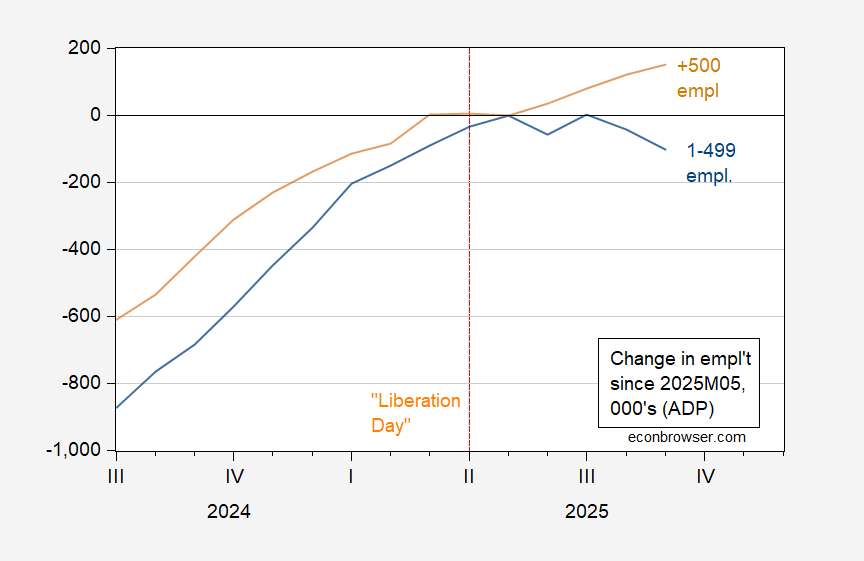

Figure 1: Change in employment from May 2025 in firms with less than 500 employees (blue), in firms with 500 and more employees (tan), both in 000’s, s.a. Source: ADP via FRED, and author’s calculations.

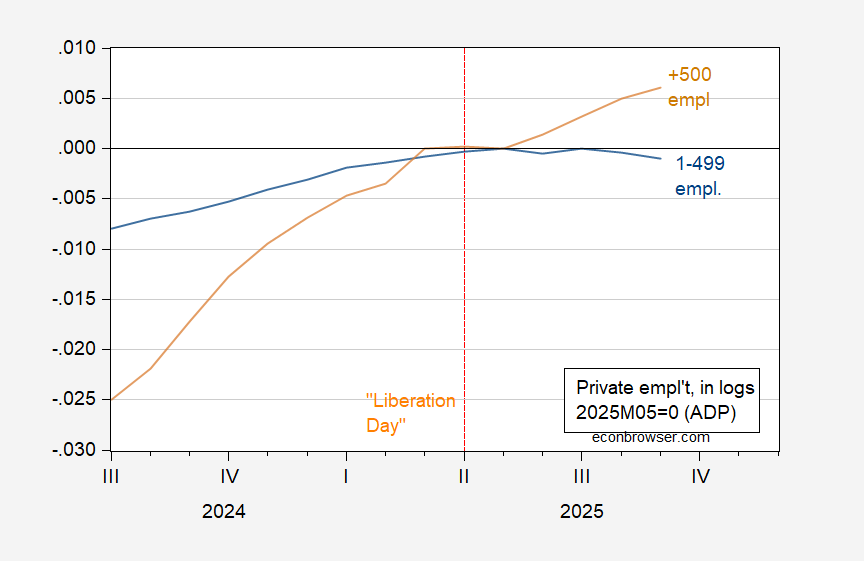

Figure 2: Employment in firms with less than 500 employees (blue), in firms with 500 and more employees (tan), in logs 2025M05=0. Source: ADP via FRED, and author’s calculations.

Private employment in firms with 1-499 employees constitutes about 80% of employment.

Seen either way, employment growth has essentially disappeared for “small” firms.

Addendum:

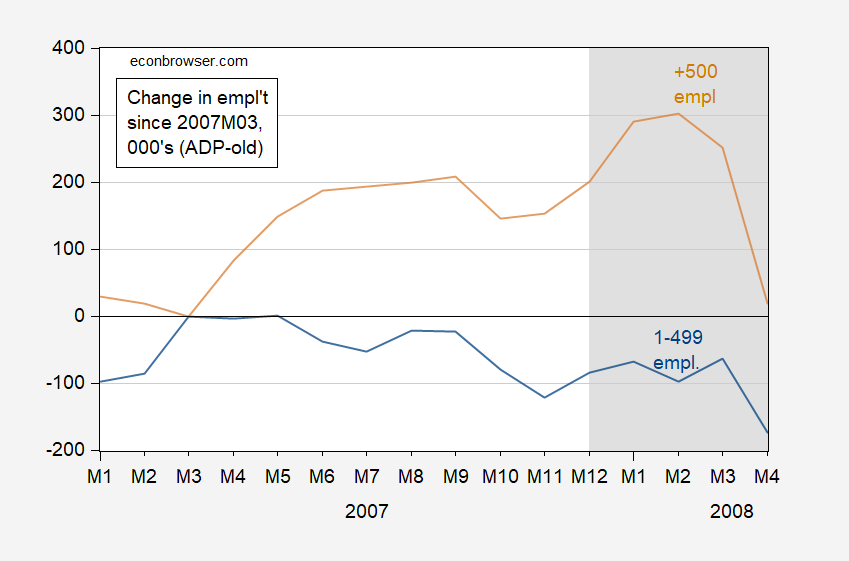

Note that in the runup to the 2007-09 recession, small firm employment declines led large firm by nearly a year.

Figure 3: Change in employment from May 2025 in firms with less than 500 employees (blue), in firms with 500 and more employees (tan), both in 000’s, s.a. NBER defined peak-to-trough recession dates shaded gray. Source: ADP (discontinued series) via FRED, and author’s calculations.

Justin Wolfers makes the good point that the unrevised ADP numbers do not track nonfarm payrolls as closely as the revised numbers do. But the three month moving average of even the unrevised numbers looks like a good estimate. It’s also worth noting that ADP has already incorporated the preliminary QCEW benchmark.

In addition to the ADP, the weighted average of the ISM manufacturing and services sub-indexes have indicated consistent contraction beginning in June.

And the average of the employment components of the 5 regional Feds that report manufacturing and services also indicated slight contraction in November.

Finally, since the data had all been collected before October 1, I suspect that if the official report were going to be good, the T—-p Administration would not have furloughed every single BLS employee but 1, to make sure the report wasn’t released.

The same acccess to capital problem that leads small firms to cut back on hiring in response to stress also means they have less flexibility in dealing with sudden cost increases – like higher tariffs. Small firms are often contractors to larger firms; large firms may cut contracts in preference to cuttinng internal headcounts.

So, yeah, keep a really close eye on small-firm performance.