The November unemployment rate came in at 4.6% v. 4.5% Bloomberg consensus. What does the Sahm rule say about whether we’re in a recession or not? Nothing, as we don’t have an October reading (thanks to the wisdom of OMB declaring BLS employees non-essential).

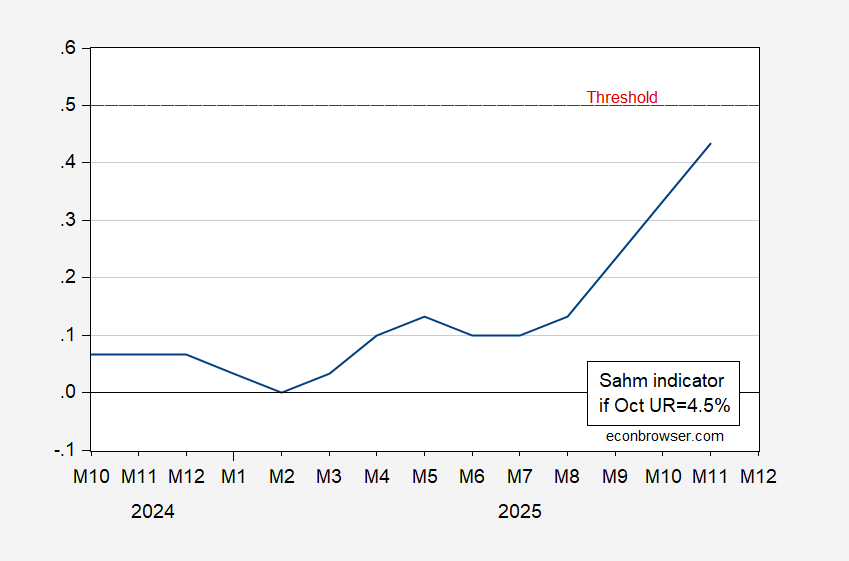

But suppose we linearly interpolated September and November unemployment rates, so October is assumed to be 4.5%. Then the 3 month trailing average of the unemployment rate (4.5%) is 0.5 0.43 above the minimum 3 month moving average unemployment rate (4% 4.07%) over the preceding 12 months. [Thanks to Pawel Skrzypczynski for catching my mistake!]

Figure 1 [CORRECTED]: Sahm indicator (blue). November observation assumes October unemployment rate is 4.5%. Source: BLS, and author’s calculations.

A cautionary note: the Sahm realtime indicator also breached the threshold in August-September 2024. On the other hand, Michaillat-Saez argue for a recession since March 2024.

I have read that the simplicity of the Sahm calculation contributes to its reliability. If but one data point is missing – BLS employees via the OMB – is the simplicity/reliability factor compromised?

Your students need a practicum in conjectural economics.

Off topic – When first our military began murdering sailors off the coast(s) of Latin America, the felon administration dragged out the “war on drugs” chestnut. Pure nonsense, of course. More recently, the felon himself has made clear that he really wants Venezuela’s oil. (Who’d have guessed?) Problem is, grabbing Venezuela’s oil requires the participation of oil companies, and they aren’t interested:

https://www.politico.com/news/2025/12/17/trump-oil-venezuela-return-00695292

Now, it makes perfect imperialist sense that we’d go to war to grab oil fields; we’re suffering through an oil emergency, for goodness sake! Just look at those prices!:

https://fred.stlouisfed.org/graph/?g=1OWvf

Which also explains the stunning demand for oil field equipment:

https://ycharts.com/indicators/us_rotary_rigs

What idiot thought that grabbing up a bunch of decrepit oil fields would be a good idea? Probably some idiot who thought he’d enrich himself through “deals” with oil companies.

Off topic? – Claudia Sahm on affordability:

https://substack.com/home/post/p-181156971

Trust Claudia to see a little more clearly than most. Her latest has a lot in it, but I was most struck by a chart which includes the 5-year average of median wage growth. The intuition behind using a 5-year average is that today’s real wage, and people’s perception of their financial situation, is an accumulation of wage gains and price inflation over a period of years, not just a y/y change. The 5-year rise in real wages is just 3%, and has been around that pace since around 2022. That’s toward the low end of the range for at least the past 2 decades.

By the way, you can see a pretty clear track of presidential approval in the 5-year real wage gain, with the exception of the felon-in-chief’s weak approval numbers in his first term.

Sahm relates this longer-term element of affordability to Powell’s recent statement that it will take “some years” of persistent real wage growth to undo the harm of Covid/tariff era inflation. That’s accomplished by supporting job growth despite above-target inflation, as long as inflation can reasonably be expected to slow toward target; a Greenspan/Rivlin/Blinder “growth experiment” under stressful conditions.