“He’s definitely a great pick, probably the best of all the ones that were under consideration” said EJ Antoni, economist with the Heritage Foundation, “He’s somebody who understands that economic growth is not what causes inflation. The government spending, borrowing, and printing too much money is what causes inflation and he gets that.”

…

“In other words, he’s exactly the opposite of Jerome Powell, and that makes me very optimistic because I think we’ll get exactly the opposite results, which is good” Antoni told KTRH.

I’m not surprised that this is Dr. Antoni’s views, given his assessment of the “…so called economists” on the Fed staff, who presumably provided input into policy under Powell. Just to reiterate, this is the person who thought we have been (and with no recession end-call, still in) a recession since 2022. He also wrote that we were likely in recession as of July/August 2024.

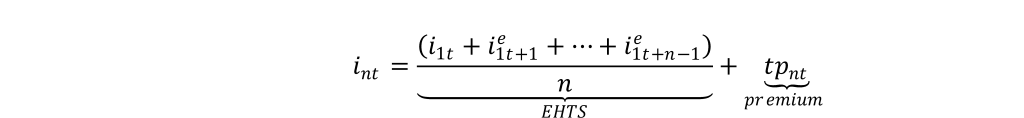

I wish I understood Antoni’s reasoning here. By most variants of the Taylor rule, the Fed funds rate, which Warsh has indicated he thinks might need reduction, is at about the right level. Reduction of the Fed’s balance sheet will likely put upward pressure on long term rates, which is more closely linked to private borrowing costs. To see this, consider this decomposition of the long term rate.

In this context, Warsh proposes reducing iit , and presumably the path of expected future short rates, while also increasing tpnt (to the extent that quantitative (aka credit) easing decreased it). The net effect is ambiguous, depending on the extent of Fed funds decrease, perceived autoregressivity in short rates, and the size and impact of quantitative tightening.

Of course, lowering short nominal rates today does not necessarily reduce long nominal rates, even if there is minimal impact on the term premium from quantitative tightening, if in fact low short rates exacerbate inflationary pressures…

James recently pointed out the term-premium problem the Mad King* is causing:

https://econbrowser.com/archives/2026/01/import-trends-output-policy-uncertainty-and-or-tariffs#comment-322111

Here’s a look at both term premium and inflation premium on 10-year notes since the election:

https://fred.stlouisfed.org/graph/?g=1Ra1O

Each has risen about 15 basis points so far during the felon-II administration.

* Time to give “felon-in-chief” a rest though it’ll be back. I’m thinking of Ludwig here, not George; what with the Kennedy Center now due for a dose of brothel decor, just like the White House.

Little EJ is now doing his “economics” on talk radio? I guess getting “publications” on the Twitter had standards too high for little EJ.