Source: ino.com.

Category Archives: China

John Bolton on Tariffs on Imports of Chinese Goods

From The Hill:

President Trump’s incoming national security adviser John Bolton said Sunday he hopes impending economic tariffs against China could be “a little shock therapy” for the country.

Some Thoughts on the Art of (Trade) War

夫未戰而庙算胜者,得算多也;未戰而庙算不勝者,得算少也。

The general who wins the battle makes many calculations in his temple before the battle is fought. The general who loses makes but few calculations beforehand. — Sun Tzu

Guess which sentence applies to which side in the incipient struggle?

A Declaration of Trade War on China?

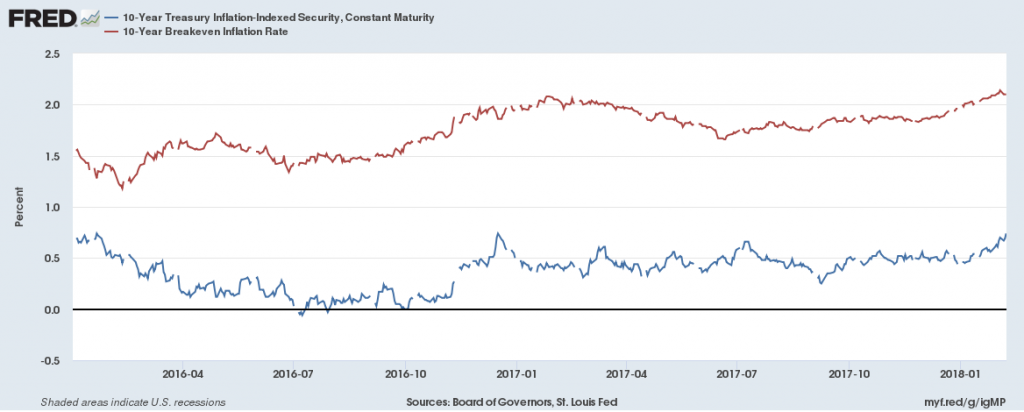

A Fisherian Decomposition of the Recent Interest Rate Increase

How much of the increase in the 10 year constant maturity Treasury yield is from higher real rates, and from higher expected inflation?

Source: Federal Reserve Board via FRED.

Recalling the Fisherian identity:

it = rt + πet

One can take the total differential:

Δit = Δrt + Δπet

Hence, of the 0.49 percentage point change from December 15 to February 7 in ten year Treasury yields, 0.27 percentage points is accounted for by a real interest rate increase, and 0.22 percentage point by inflation expectations boost (abstracting from liquidity premia, etc.).

Over the five year horizon, of the 0.41 percentage point change, 0.28 percentage points is accounted for by the real rate change, and 0.21 percentage point from higher expected inflation.

All about why nominal rates are rising, in interview with Marketplace (Stan Collender comments too). We talk about the standard things — tax cuts, spending increases, Fed QE unwinding and rate increases, and (my contribution) the deceleration of foreign central bank Treasury purchases (graphical depiction here on page 6). Discussion of the last point with respect to China here.

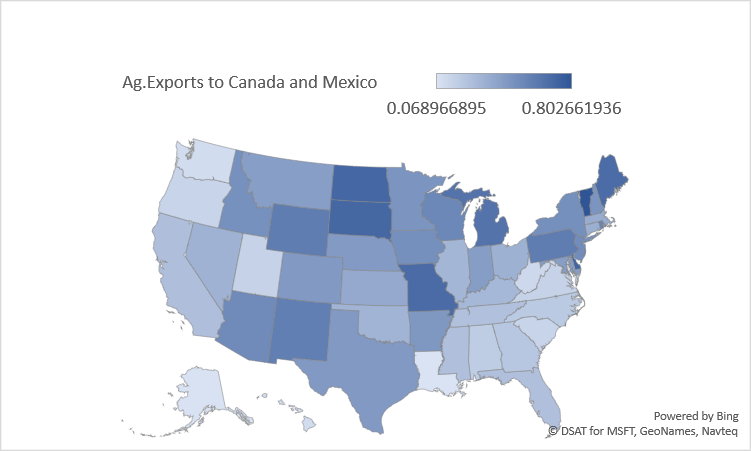

EconoFact: “Threats to U.S. Agriculture from U.S. Trade Policies”

Or, Does Mr. Trump feel lucky?

From EconoFact:

The agriculture sector in the United States depends upon exports for its vitality. Sales of U.S. agricultural products abroad are responsible for 20 percent of U.S. farm income, supporting more than one million American jobs on and off the farm, according to the U.S. Department of Agriculture. The three biggest buyers of American agricultural products are China, Canada, and Mexico. Yet trade with these three countries faces heightened uncertainty. The Trump Administration initiated a process of renegotiating the North American Free Trade Agreement (NAFTA) with Canada and Mexico, which includes the option of exiting the deal altogether. In addition, the United States has started a series of investigations of unfair practices leveled against China, some of which have already resulted in the imposition of new tariffs. These trade policy initiatives threaten agricultural exports both because of the potential increase of tariffs on exports to Canada and Mexico that would result from a withdrawal from NAFTA as well as the very real threat of retaliation in response to other proposed policies.

Figure 1: Share of total agricultural exports going to Mexico and Canada, by state. Agricultural exports defined as NAICS 111+112+311 (crops, livestock, and processed food). Source: Census via ITA and author’s calculations.

The entire article is here. More on agricultural sector fortunes here.

Guest Contribution: “10 Lessons for China 10 years after the subprime financial crisis “

Today we are fortunate to present a guest contribution written by Alessandro Rebucci, Associate Professor, and Jiatao Liu, at the Carey School of Business at Johns Hopkins University.

Continue reading

Thoughts on Trade, Growth and Inequality from “Fostering a Dynamic Global Economy”

The Kansas City Fed’s Jackson Hole symposium this year focused on the causes, implications and remedies for the slowdown in economic growth. Major themes revolved around productivity, fiscal policy, and international trade. Here I discuss some of the major points relating to international trade and inequality, encompassing a paper by Nina Pavcnik (Dartmouth), comments by David Dorn (Zurich), and panel remarks by Ann Harrison (UPenn), Catherine Mann (OECD), Peter Schott (Yale), and John Van Reenen (MIT).

Guest Contribution: “The Signal/Noise Ratio in US North Korea Policy”

Today, we present part two of a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. An earlier version appeared as “Can Trump Deal with North Korea and China?” in Project Syndicate.

Guest Contribution: “Deal-maker Trump Can’t Deal”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. An earlier version appeared as “Can Trump Deal with North Korea and China?” in Project Syndicate.