On China, from the Report (page 4):

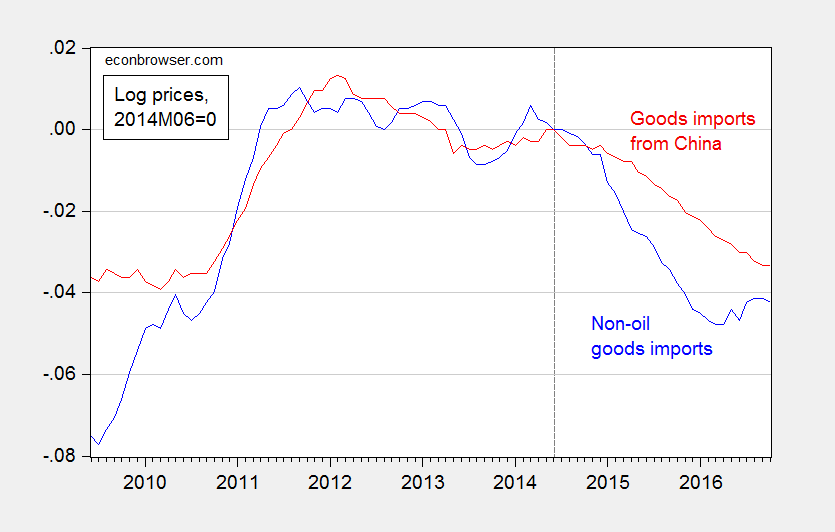

China has a significant bilateral trade surplus with the United States. The country’s current account surplus fell from 3.0 percent of GDP over the full year 2015 to 2.4 percent for the four quarters through June 2016, moving below the established threshold for that criterion. China’s intervention in foreign exchange markets has sought to prevent a rapid RMB depreciation that would have negative consequences for the Chinese and global economies. Treasury estimates that from August 2015 through August 2016, China sold more than $570 billion in foreign currency assets to prevent more rapid RMB depreciation. More transparency over exchange rate management and goals, and strong adherence to G‐20 commitments to refrain from competitive devaluation and not to target exchange rates for competitive purposes, will enhance the credibility of China’s exchange rate regime. At the same time, China has a very large bilateral goods trade surplus with the United States. This underscores the need for further implementation of reforms to rebalance the Chinese economy to household consumption. Fiscal policy can support structural reform and provide consumption‐friendly stimulus to support demand if growth slows more than expected.

Detailed discussion of China on pages 15-18.

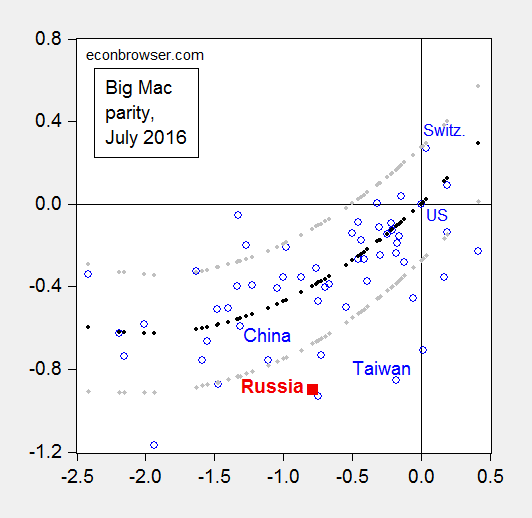

Here is the most recent Econbrowser post on the Chinese currency misalignment. See a more general discussion of the Penn effect at VoxEU. And on misalignment generally, see here.

Note that the Peterson Institute’s William Cline has recently taken issue with the Cheung-Chinn-Nong (2016) methodology; however, even there, based on the FEER methodology, they find neither under- nor overvaluation of the RMB.