At the beginning of the week (9/27), Bruce Bartlett forwarded me a link to a remarkable document, entitled “Scoring the Trump Economic Plan: Trade, Regulatory, & Energy Policy Impacts” (strangely, dated 9/29), coauthored by Peter Navarro* and Wilbur Ross. I’m way behind the curve, and there have been numerous examinations of the document, so I will not discuss the entire paper. Rather I’ll focus on the following specific question: would renegotiating trade agreements and slapping tariffs on China, conjoined with the Trump fiscal policy, induce a drastic change employment and trade flows? The short answer — yes, but probably in a direction opposite of that posited by the authors.

Category Archives: China

More Drumpfarmegeddon Tabulation

Earlier on, Moody’s Analytics took on the task of determining the likely impact of implementing the Trump economic pronouncements (tax cuts for the wealthy, massive deficit spending, increased defense spending, spending cuts on other discretionary components, and revocation of free trade agreements). Oxford Economics has taken up the task of evaluating the more recent incarnations of his pronouncements (to call it a “plan” is giving it too much credence).

“Policy Challenges in a Diverging Global Economy”

That’s the title of the volume of proceedings of the 2015 Asia Economic Policy Conference, edited Reuven Glick and Mark M. Spiegel.

Currency Casus Belli?

Is a current undervaluation of the Chinese yuan plausible?

Guest Contribution: “China Should Rebalance by Following the Fed”

Today we are pleased to present a guest contribution written by Gunther Schnabl, Professor of Economics and Business Administration at Leipzig University.

Currency Misalignment, 2016: FEER vs. Penn Effect

The Peterson Institute for International Economics’ William Cline has just published estimates of equilibrium exchange rates for May 2016; the USD is 7% overvalued, while the Chinese yuan (CNY) is at its “FEER level”.

Guest Contribution: “Exports, Exchange Rates, and the Return on China’s Investments”

Today, we’re fortunate to have Willem Thorbecke, Senior Fellow at Japan’s Research Institute of Economy, Trade and Industry (RIETI) as a guest contributor. The views expressed represent those of the author himself, and do not necessarily represent those of RIETI, or any other institutions the author is affiliated with.

Chinese leaders are determined to rebalance their economy away from an overdependence on exports. How are they progressing?

Causes and consequences of the oil price decline of 2014-2015

At the NBER Annual Conference on Macroeconomics in Cambridge last week I participated with Steven Kamin of the Federal Reserve Board and Steven Strongin of Goldman Sachs in a discussion on commodity prices. You can watch a video of our discussion at the NBER web site.

Thinking about The Great Leap Forward

When Technocrats Are Pushed Aside

US-China Trade Policies: the Nuclear — and Near-nuclear — Options

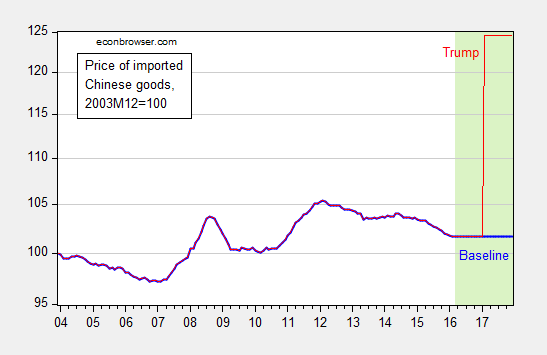

Substantial attention has been devoted to the disasterous effects of implementing a Donald Trump agenda of imposing 45% tariffs on imports of goods from China. To gain some perspective, consider the implications for prices of goods imported from China if such a tariff were imposed (and a large country assumption used, so that only half of the tariff increase manifested in increased prices).

Figure 1: Price of Chinese commodity imports, 2003M12=100, with 2016M03 values at 2016M02 values (bold blue), and a 22.5% higher price level as of 2017M02 assuming the half of incidence falls on the US (red). Light green shaded area denotes projection period. Vertical axis is logarithmic. Source: BLS, and author’s calculations.

Obviously, drop the large country assumption, and the resulting price increase can be up to 45%.