Since 2017Q1. By Mr. Trump’s own metric, we’re losing. But it’s a stoopid metric for evaluating “unfair”-ness.

Category Archives: economic growth

Guest Contribution: “The ECB’s Strong Euro Problem”

Today, we are fortunate to present a guest contribution written by Ashoka Mody, Charles and Marie Visiting Professor in International Economic Policy, Woodrow Wilson School, Princeton University. Previously, he was Deputy Director in the International Monetary Fund’s Research and European Departments.

The euro has appreciated 10 percent against the Swiss franc (CHF) over the past year. The U.S. dollar and the Japanese yen have not made similar gains vis-à-vis the franc. Tracking the franc’s movements relative to the major currencies gives an unusual window onto the deflation-fighting credentials of the world’s major central banks. It illustrates, in particular, the European Central Bank’s half-hearted efforts to fight the risk of price deflation. Financial markets have come to believe that the ECB will prematurely tighten monetary policy: hence, despite brief episodes of depreciation, the euro will tend to stay strong, hurting economic prospects in several eurozone member countries.

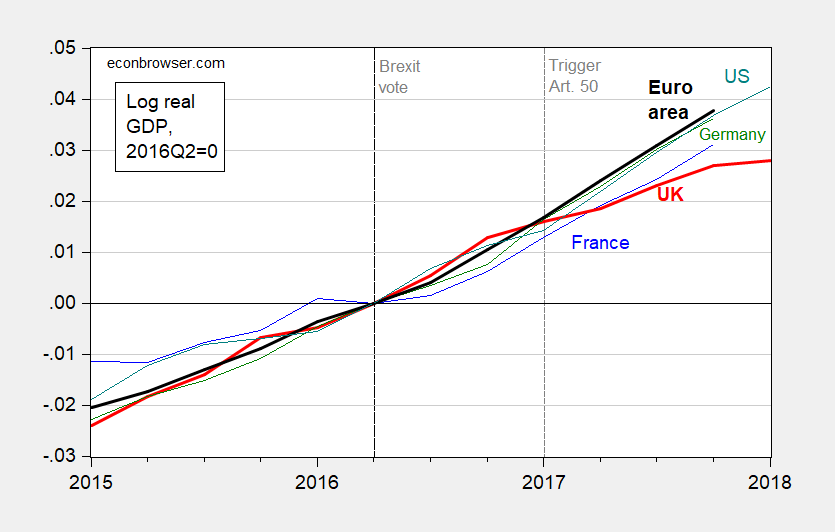

Comparative Performance of the UK Economy

There was no recession after Brexit. But a slowdown looks like it’s here now…

Figure 1: Log real GDP for France (blue), UK (bold red), Germany (green), US (bold blackteal), and euro area (tealbold black), all normalized to 2016Q2. Source: OECD, BEA, author’s calculations.

Continue reading

Six Pictures of the US Macroeconomy

As I prepped for final lectures in my macro policy course, I generated these graphs.

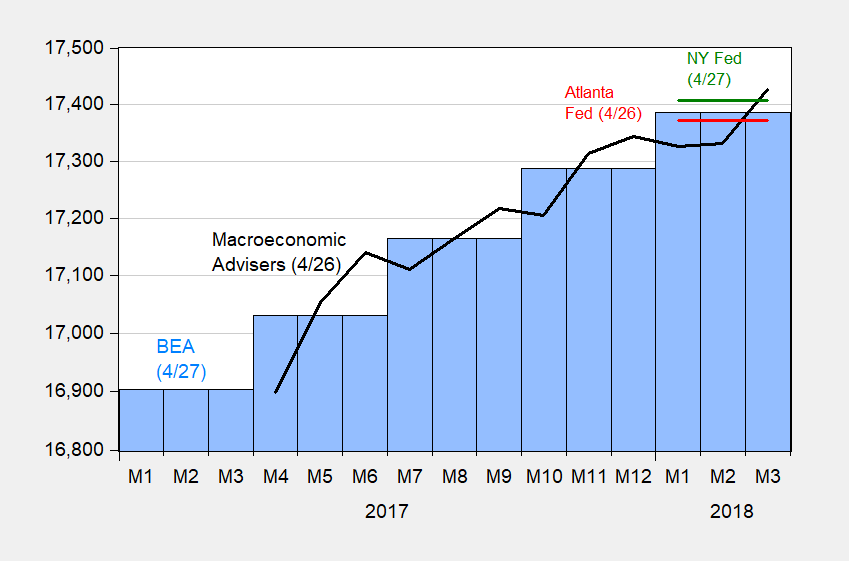

Nowcasting the US Economy:

Figure 1: Reported GDP (blue bars), Atlanta Fed GDPNow (red), NY Fed nowcast (green), and Macroeconomic Advisers (black), all in billions Ch.2009$ SAAR, on log scale. Source: BEA 2018Q1 advance; Atlanta Fed (4/26), NY Fed (4/27), Macroeconomic Advisers (4/26).

Annual, Annualized, q4/q4 Growth Rates: A Graphical Depiction

Why do reported growth rates differ for the same variable? Refer to the last three years of GDP data to see…

Figure 1: Quarterly GDP, SAAR, FRED series GDPC1 (dark red line), annual, FRED series GDPCA (green bars), in billions of Chained 2009$. 2017 q4/q4 growth rate (red arrow); annual 2017 y/y growth rate (green arrow); 2017Q4 q/q SAAR growth rate (blue arrow); 2016Q1 y/y SAAR growth rate (black arrow). Source: BEA, 2017Q4 3rd release via FRED, and author’s calculations.

So, there are several ways to calculate the growth rate over the course of the year. They will almost invariably differ, perhaps substantially, when GDP is either growing very rapidly or shrinking very rapidly. And there is no “right” way. If one wants to calculate the most recent growth experience, one might stress q/q. If one wants to look at a longer horizon, then one might want to use the quarterly y/y. If one thinks quarterly series are very noisy, one might want to look at annual y/y.

Note: SAAR denotes Seasonally Adjusted at Annual Rates.

Additional Note: One could average the q/q annualized growth rates over the four quarters of 2017 to try to get 2017 q4/q4 growth rate. This calculation leads to an approximation, which gets worse the more variable growth rates are (unless growth rates are calculated as log-differences — which is part of the reason economists like to express variables in logs and log differences…).

Nearly Two Decades of US-Canada Trade Balance Data

There seems to be some confusion regarding the distinction between trade balance in goods and services (a typical macro variable of interest) and trade balance in goods (more commonly reported, but less and less relevant on its own as countries become more service intenstive). In order help remedy this confusion, I plot below freely and easily accessible data, for those willing to expend a few calories to click.

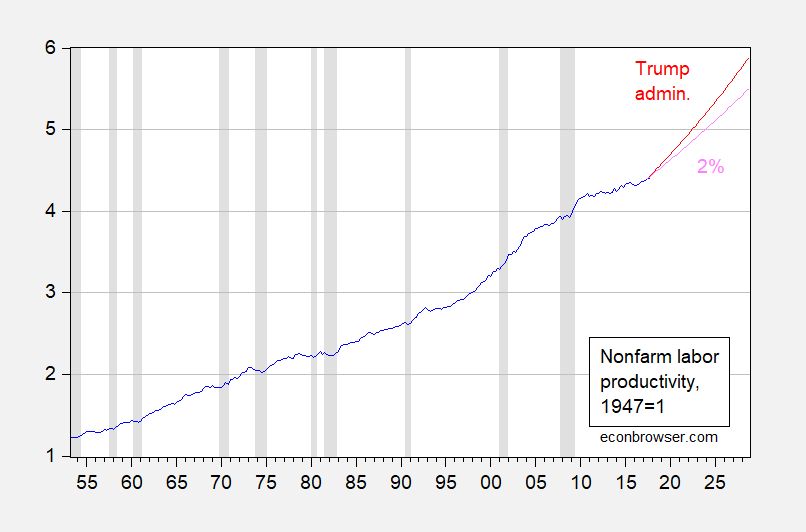

Economic Report of the President, Table 8-2: Projected Productivity Illustrated

Jason Furman points us out to his favorite Table 8-2 in the Economic Report of the President, 2018, released yesterday, with particular reference to the productivity assumption.

Figure 1: Nonfarm real output per hour, 1947Q1=1 (blue), Trump Administration forecast of 2.6% (red), historical average (1953Q2-2017Q3) growth rate of 2% (pink). NBER defined recession dates shaded gray. Source: BLS via FRED, NBER, CEA and author’s calculations.

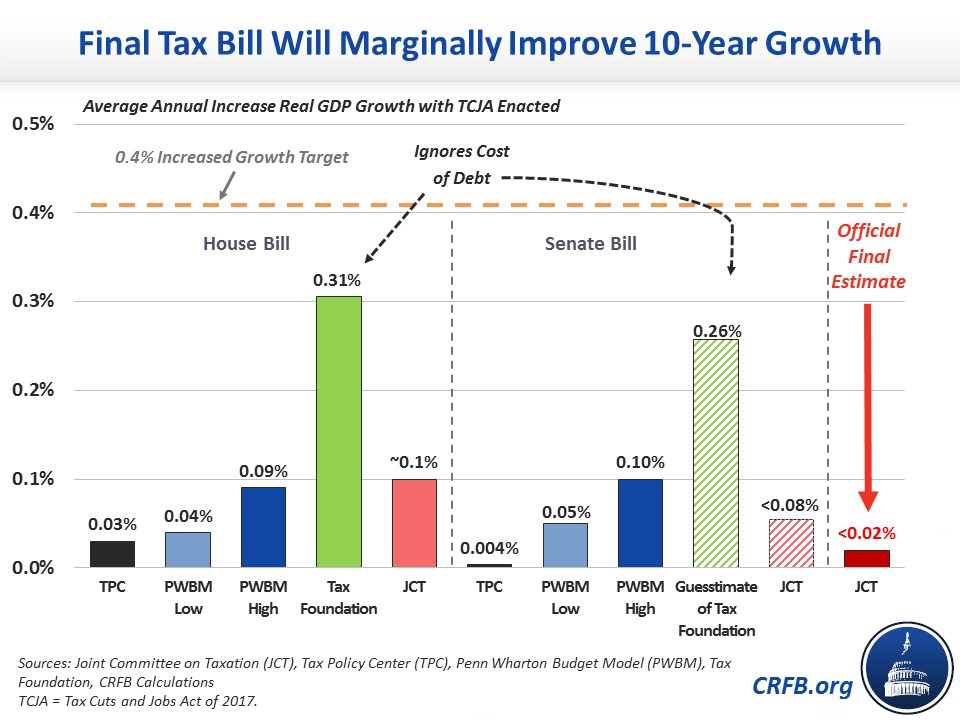

No Retraction: TCJA Average Growth Acceleration = 0.01-0.02%

In response to my quote of CRFB’s assertion that average growth acceleration under the Tax Cuts and Jobs Act relative to baseline will be only between 0.01-0.02 percent (shown below),

Source: Committee for a Responsible Federal Budget (Jan. 3, 2018).

Reader Vivian Darkbloom writes:

I’m asking myself how an average increase of only 0.01 percent to 0.02 percent in GDP growth over a decade could result in an average of increase in the level of GDP output of 0.7 percent of that same ten-year period as reported by the CFRB and Menzie.

and continues:

Either you need to justify it (and the related text regarding the assertion that it is 1/20th to 1/40th of the McConnell estimate), or retract it.

Leontiev Lives! In Wisconsin

The MacIver Institute has released new projections of the impact of the Tax Cuts and Jobs Act on Wisconsin:

Continue reading

No Second Thoughts: Sustained 3.5% Growth Is Unlikely

Reader Arthurian writes in the wake of the 3% growth rate (SAAR) reported for 2017Q3:

Back in January Menzie Chinn said he thought growth in the 3.5-4% range was “unlikely”. I wonder if he is having second thoughts now.

I’m going to show two pictures deploying at most undergraduate statistics to show why I — like most numerically literate people — still think sustained 3.5% growth is unlikely.

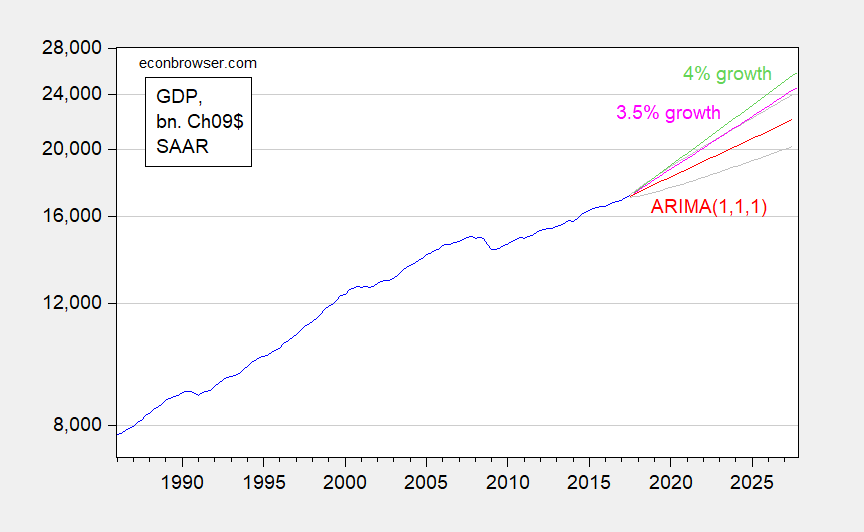

First, consider what a naive statistical model — an ARIMA(1,1,1) estimated over the 1986-2017Q3 period — says, as compared to a 3.5% or 4% growth rate.

Figure 1: Reported GDP (blue), ARIMA(1,1,1) dynamic forecast (red) and 64% prediction interval (gray lines), implied path for 3.5% sustained growth (pink) and for 4% (light green), all billions Ch.2009$ SAAR. Source: BEA 2017Q3 advance release, author’s calculations.

Note that by estimating the regression starting in 1986 when the trend growth rate was relatively high, I am slanting the results toward projecting faster growth. Even then, the 3.5% growth rate is at the uppermost edge of the 64% prediction interval. 4% growth is even more laughable.

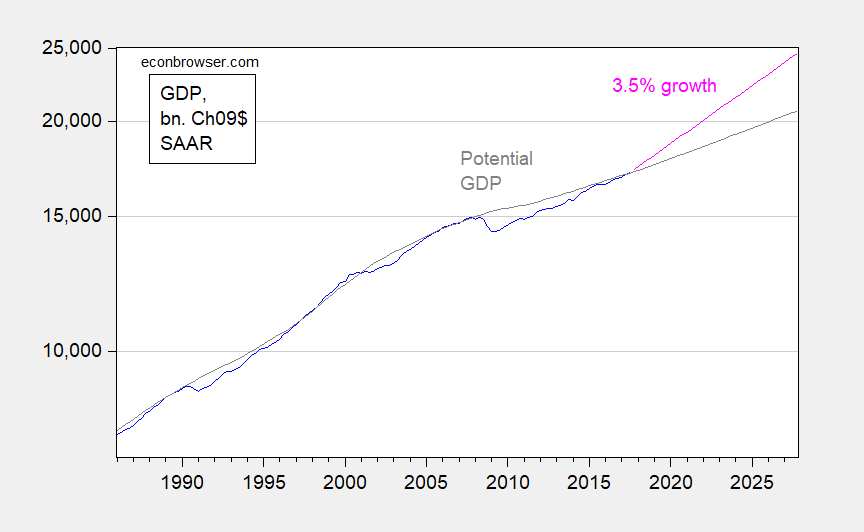

Second, now consider what sustained 3.5% growth implies for the output gap. For that calculation, one needs an estimate of potential GDP; for want of a better measure, I use CBO’s estimate. This is shown in Figure 2.

Figure 2: Reported GDP (blue), implied path for 3.5% sustained growth (pink) and potential GDP (gray), all billions Ch.2009$ SAAR. Source: BEA 2017Q3 advance release, CBO (June 2017), author’s calculations.

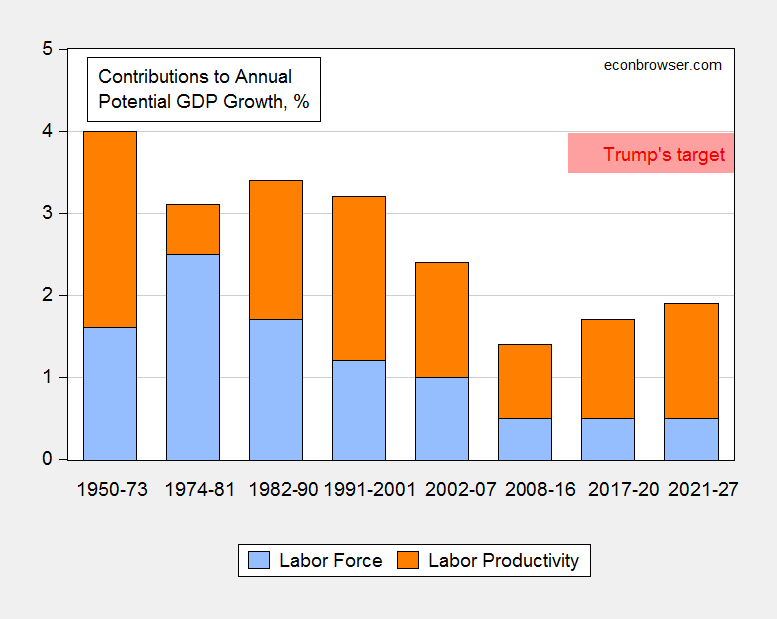

Assuming sustained 3.5% growth, the output gap by end-2019 would be 4.2%, 5.9% by end-2020. Of course, CBO could be terribly misguided about the trajectory of potential GDP. But in order to believe potential GDP can grow at 3.5%, I really do believe that it can only be done by adherence to Spaceology. Refer to Figure 3, reproduced from my January post, and look at what the orange bar — labor productivity — has to do in order to hit 3.5% potential growth.

Figure 3: Contributions to annual growth in potential GDP growth, from labor force augmentation (blue bar), and from labor productivity growth (orange bar). DJT’s target of 3.5-4% shown as pink range. Source: CBO, Budget and Economic Outlook, January 24, 2017, Table 2-3; and Trump-Pence website