Some observations on the employment situation and other economic indicators: (1) Not only is nonfarm payroll employment slowing its rate of descent, so is private employment; (2) but perhaps more dramatically the decline of aggregate hours halted last month; (3) the rate of decrease has diminished even faster for civilian employment measured by the household survey, and indeed; (4) the household (research) series adjusted to conform to the payroll series is now improving; and (5) a first “estimate” of July GDP supports the case for stabilization of output.

Category Archives: employment

Links for 2009-07-17

Some quick remarks about the evidence for economic recovery, central bank independence, and Goldman Sachs.

Back where we started

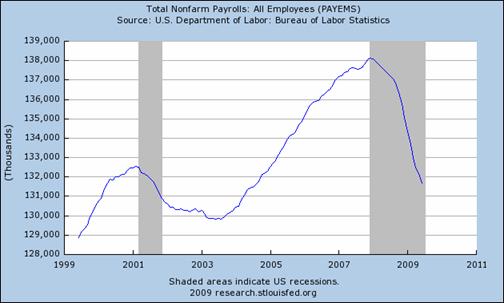

BLS reported that the total number of Americans employed in June on nonfarm payrolls came to 131.7 million workers on a seasonally adjusted basis. That’s below the June 2000 figure of 131.8 million with which we started the decade.

|

Not a robust recovery

Often after a sharp economic downturn we observe an equally dramatic recovery. But nobody can claim to be seeing that so far in the currently available data.

James Pethokoukis: “An improving job market”

Hmm. I’m not sure about this statement.

Where’s my recovery, dude?

A couple of disappointments in this week’s data.

Three Pictures from the April Employment Situation

Revisions are downward (but getting smaller over time), the growth rate becomes less negative, but hours continue to decline rapidly.

This shoot is definitely growing bigger and greener

The Labor Department reported today that seasonally adjusted new claims for unemployment insurance fell by 34,000 to 601,000 for the most recent available week, resulting in a reduction of the 4-week average for this series for the fourth consecutive week in a row.

Further progress for initial claims for unemployment insurance

The Labor Department reported today that initial claims for unemployment insurance fell by 14,000 during the most recent available week. That brings the 4-week average down for the third consecutive week and puts it 3.3% below the peak reached April 9.

Oil shocks and recessions

Here I provide some more background on the relation between oil price increases and economic recessions.