Category Archives: international

The New Fama Puzzle, post-ZLB

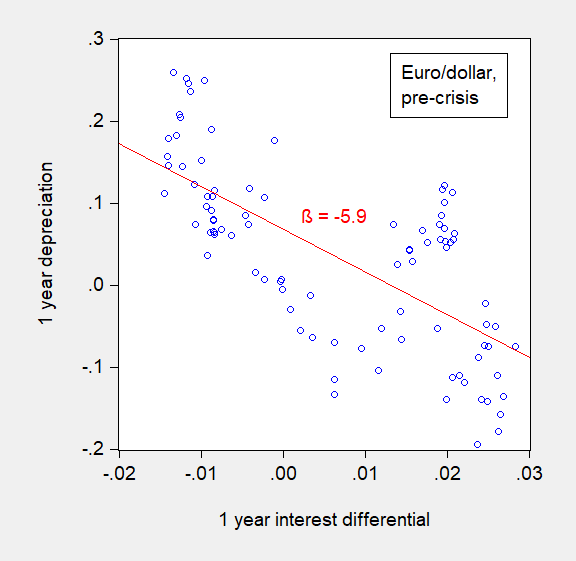

In a previous post, I documented the fact that the Fama puzzle had transformed post-global financial crisis, so that for most currency pairs, interest rate differentials pointed in the right direction for subsequent exchange rate depreciation, from 2006 through end-2015 (Bussiere, Chinn, Ferrara, Heipertz (2018)). Here I show that the new puzzle persists through the end of 2017, a period when US interest rates were rising.

Some Steel Sector Indicators

which should give you pause for thought about national-security-rationalized tariffs. Output stable, real prices up.

An Event Study: How Do Equity Markets View National Security-based Trade Protection?

Figure 1: Dow Jones, 15 minute increments. Source: TradingEconomics.

The World-Wide Fama Puzzle Reversal

In my previous post, I recounted “The New Fama Puzzle” as it applied to dollar exchange rates, with focus on the euro/dollar rate. A quick observation: the reversal also appears for non-US dollar based exchange rates (against euro, yen, pound).

Continue reading

Interest Differentials and Exchange Rate Changes Before and After the Global Crisis

If the joint hypothesis of uncovered interest rate parity (UIP) and rational expectations –- sometimes termed the unbiasedness hypothesis — held, then the slope of the regression lines (in red) would be indistinguishable from unity. In fact, they are significantly different from that value. This pattern of coefficient reversal holds up for other dollar-based exchange rates, as well as for other currency pairs (with a couple exceptions). The fact that the coefficient is positive in the post-global financial crisis period is what we term “the New Fama puzzle”.

World Economic Outlook Update: Upwardly Revised Growth, Rising Risks?

The IMF released an update to WEO today:

Continue reading

Guest Contribution: “Trump’s Tax Cut Will Worsen the US Current Account Deficit”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. This is an extended version of a column that appeared at Project Syndicate on January 15th.

Making Mexico Pay for the Wall (Redux)

So we’re back to this again? From CNN:

“They can pay for it indirectly through NAFTA,” Trump said Thursday in an interview with The Wall Street Journal. “We make a good deal on NAFTA, and, say, ‘I’m going to take a small percentage of that money and it’s going toward the wall.’ Guess what? Mexico’s paying.”

Guest Contribution: “Trade and Inequality Within Countries”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. This is an extended version of a column that appeared at Project Syndicate.