Mr. Trump has stated his intention of raising tariffs on steel and aluminum, based on national security grounds. See this post on the specious aspects of this argument, and this recent EconoFact column on the hits to the economy that would result from steel tariffs. The EU has hinted at striking at Wisconsin cheese in retaliation (Wisconsin is the second largest state exporter). This makes perfect sense from a strategic perspective – agriculture is America’s comparative advantage, and Wisconsin’s Representative Paul Ryan is Speaker.

Category Archives: recession

California in Recession? (Part III)

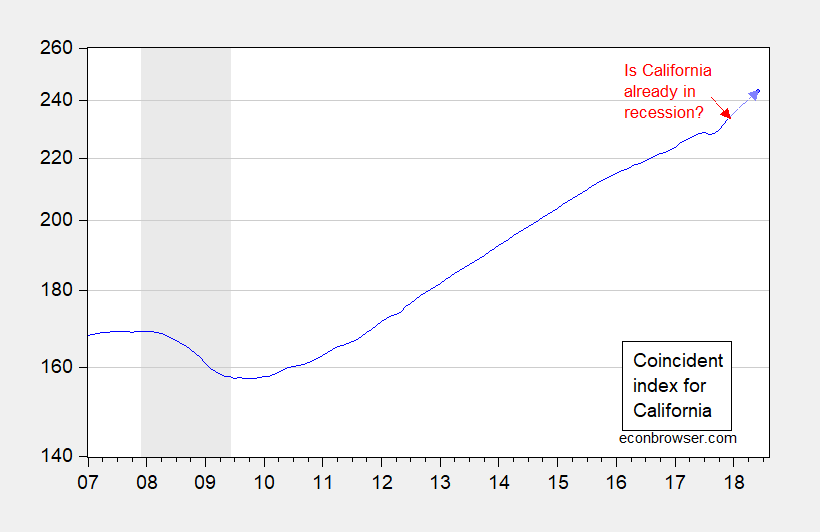

Back in mid-December, Political Calculations asked if California was in recession. Data released by the Philadelphia Fed suggests the answer is no.

Figure 1: Coincident index for California (blue), and implied index value for June 2018 using leading index (light blue arrow, blue dot) against log scale. NBER defined national recession dates shaded gray. Red arrow at date of Political Calculations post. Source: Philadelphia Fed [1], [2], and author’s calculations.

Wisconsin in Recession?

I doubt it, but it’s more likely than an ongoing recession in California. Wisconsin year-on-year GDP growth lags, personal income and wages/salaries growth are both bouncing around zero.

California in Recession?

That’s what Ironman asks at Political Calculations, and he answers his question thusly:

Going by these [household survey based labor market] measures, it would appear that recession has arrived in California, which is partially borne out by state level GDP data from the U.S. Bureau of Economic Analysis.

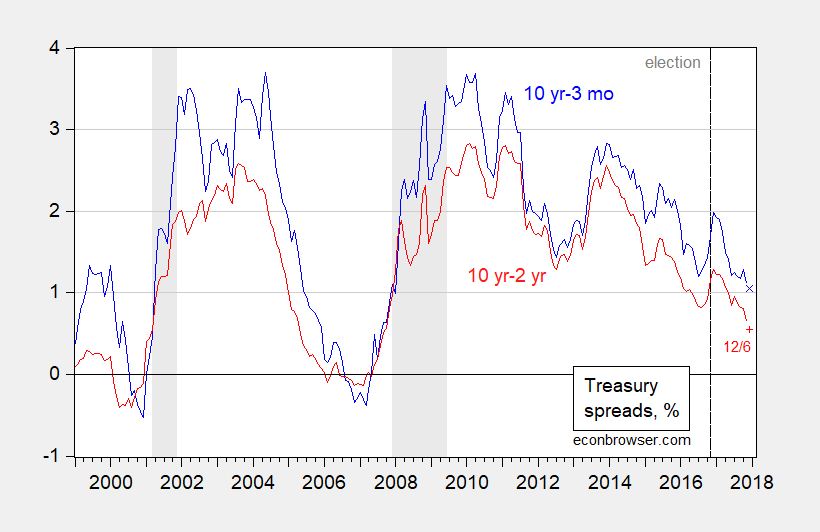

Post-War, How Many Times Has the 10yr-3mo Spread Fallen below 1% Without a Recession Following?

Recession Watch, October 2017

Where do we stand?

Business Cycle Indicators as of May 2, 2017

Reader Steve Kopits writes “I am thinking the business cycle rolls over right here.” Here are five key indicators that the NBER Business Cycle Dating Committee have consulted in the past, as of today.

Guest Contribution: “Battling Unemployment: A Clear Win for the ‘Cycs'”

Today we are fortunate to have a guest contribution written by Zidong An (American University) and Prakash Loungani (IMF).

Recession Watch, October 2016

The 2016Q3 GDP advance figures were released today, indicating a 2.9% growth rate (SAAR), exceeding consensus (Bloomberg 2.5%). Tomorrow, Jim will report on the recession probabilities based upon the advance release (see last quarter’s analysis here). Until then, given all the discussion of recession (e.g. [0], [1]), it seems useful to show a few pictures of where we stand today, and the outlook going forward, given some standard and non-standard indicators.

The Recovery in Perspective (Again)

In tonight’s Presidential debate, the moderator Chris Wallace stated:

Secretary Clinton, I want to pursue your [economic] plan, because in many ways it is similar to the Obama stimulus plan in 2009, which has led to the slowest GDP growth since 1949.