Raw steel production is down, as is primary metal employment.

Category Archives: Trade Policy

An Event Study: Trade Truce-Part 1, or Not?

See if you can find when Trump makes his statement about trade negotiations with China. Winning!

Guest Contribution: “Let’s Go Back to Good Old Tariff-Cutting”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate.

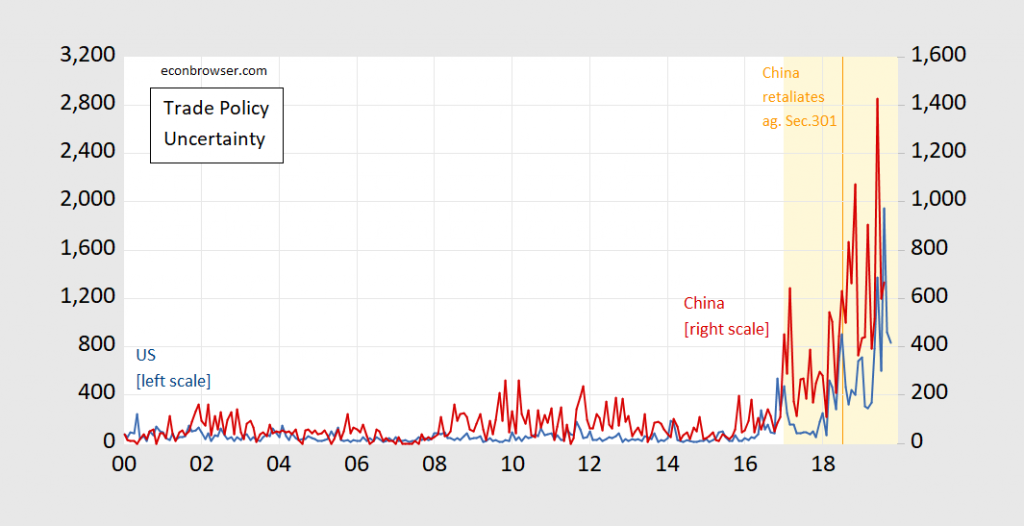

Trade Policy Uncertainty: US, China

The Trumpian World as Natural Experiment

The Trump economic policy regime (if it can be called that) has provided several “natural experiments”. Do corporate tax rate reductions “pay for themselves”? Does expansionary fiscal policy at full employment lead to large increases in output? Does increasing trade protection necessarily lead to an increase in the trade balance? Does a bellicose and confused trade negotiating stance accelerate fixed investment? I think the answers are No, No, No, and No. On this last point, see Altig et al. on Macroblog:

Presentation: “The Economic Consequences of Trump’s War on Multilateralism”

Here is a link to my October 18th Global Hot Spots talk, sponsored by the Wisconsin Foundation and Alumni Association.

Manufacturing Output under Last Obama Term, Now

So much misleading prose circulates these days:

“Manufacturing came back quickly after the recession as it has done in prior recessions, but then flattened out and declined during Obama’s second term.”

Victory at Sea: Soybeans heading to China (from Brazil)

Reuters: After trade talks in U.S., China ramps up Brazilian soy purchases:

Nearest month futures are about a dollar lower (at $9.34/bushel) than the nearest month futures on the day when Trump announced Section 301 action against China.

Is World Trade Volume a Leading Indicator?

The slowdown could be coming from tariffs, or from decelerating economic growth. You decide…

In Bizarro World

Bryan Riley at NTU brings my attention to this press release:

The Coalition for a Prosperous America (CPA) has won the prestigious Edmund A. Mennis Award from the National Association for Business Economics (NABE) for a study showing that a permanent tariff on China would benefit the US economy. The award from the nation’s leading association of business economists confirms a growing acceptance of pro-US trade policies needed to address the nation’s economic challenges.