An interesting symposium in the 2nd Quarter 2018 issue of Choices, published by the Agricultural and Applied Economics Association, deals with the impact of Chinese trade retaliation aimed against US agricultural exports.

Category Archives: Trade Policy

Guest Contribution: “Fall in US Trade Balance, Led by Ag. Exports”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers.

“Trade Wars Are Good, and Easy to Win”: Soybean Edition

I am dubious. End-market year soybean stocks at record highs.

Guest Contribution: “Trump Renews Charges of Chinese Currency Manipulation”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. A shorter version appeared in Project Syndicate.

Who Could’ve Known “Crash Brexit” Would Be Problematic?

In the aftermath of the Salzburg summit, where the Chequers plan was dismissed by the EU, and PM May demanded “respect”, the pound has plunged.

From the Front Lines of the (Soybean) Wars

Reuters has an interesting article, entitled “Inside China’s strategy in the soybean trade war”.

Mu Yan Kui … ticked off a six-part strategy to slash Chinese consumption and tap alternate supplies with little financial pain.

(Still) Waiting for Recovery in US Soybean Prices (Levels, Relative)

November soybean futures keep on going down. And the US-Brazil spread has proven durable.

Continue reading

New Tariffs on Chinese Imports

As part of the United States’ continuing response to China’s theft of American intellectual property and forced transfer of American technology, the Office of the United States Trade Representative (USTR) today released a list of approximately $200 billion worth of Chinese imports that will be subject to additional tariffs. In accordance with the direction of President Trump, the additional tariffs will be effective starting September 24, 2018, and initially will be in the amount of 10 percent. Starting January 1, 2019, the level of the additional tariffs will increase to 25 percent.

The list contains 5,745 full or partial lines of the original 6,031 tariff lines that were on a proposed list of Chinese imports announced on July 10, 2018. …

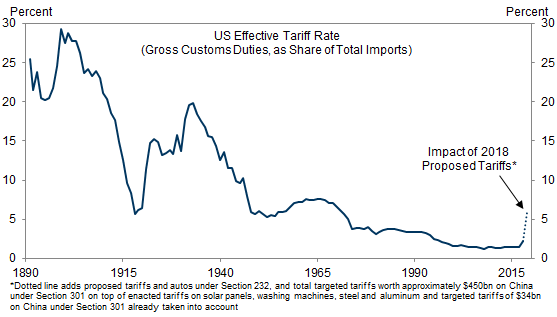

Implied US tariff overall tariff rates, from GS:

Source: Hatzius et al., “The Trade War: An Update,” Goldman Sachs June 25 2018.

Haven’t seen the Chinese back down so far, as some sanctions enthusiasts have predicted. If the demand is for China to give up on Made in China 2025, I’m guessing the Chinese are not going to back down in effect.

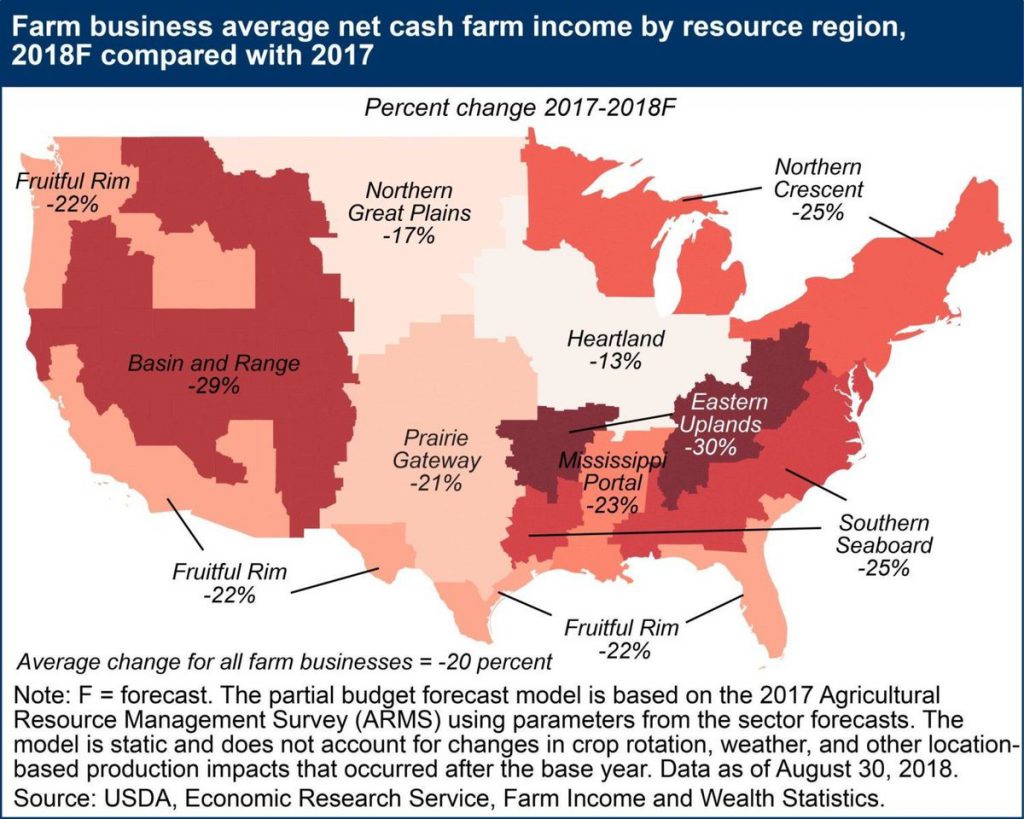

Farm Country Gets What It Voted For

From Yahoo Finance:

Tariffs imposed as retaliation for US tariffs worsen the US terms of trade (i.e., lower ag export prices), and a strong dollar lowers US ag prices. Rising interest rates due to the collision of monetary and fiscal policies worsens the debt service load of the ag sector, while reducing farmland prices.

Thanks, Trump!

Manufacturing Employment and Output

Today’s employment situation release depicted a picture of continuing recovery in the labor market. One interesting aspect is what is happening to the tradables sector, which I proxy with the manufacturing sector. There, the advance data indicate a slight decline.