Tax reform (DBCFT) will not pay for the wall. A remittances tax will not yield sufficient revenues, except perhaps over many years. What about a tariff?

Category Archives: Trade Policy

What Does Corporate Tax Reform and Paying for the Wall Have to Do with Each Other?

Maybe something, maybe nothing.

Two Trade Policy Terms to Remember: VER and ERP

Voluntary Export Restraint (VER)

With Robert Lighthizer going to USTR, it’s useful to remember that he was “implementer” of many VER’s, or “Voluntary Export Restraints” on steel imports, during his last stint at USTR during the Reagan Administration.

Continue reading

A 10% Across-the-Board Tariff?

Today the idea of a 10% across-the-board tariff rate increase was mooted. As Noland et al. (2016), pp.9-10 observe, the President has authority to undertake such measures. However, as a member of the WTO, other members have a right to dispute. More likely, they’ll retaliate.

Trade Policy with China

Since President-elect Trump has nominated Peter Navarro* to direct the newly formed Trade Policy Council, now seems a good time to review some trade data.

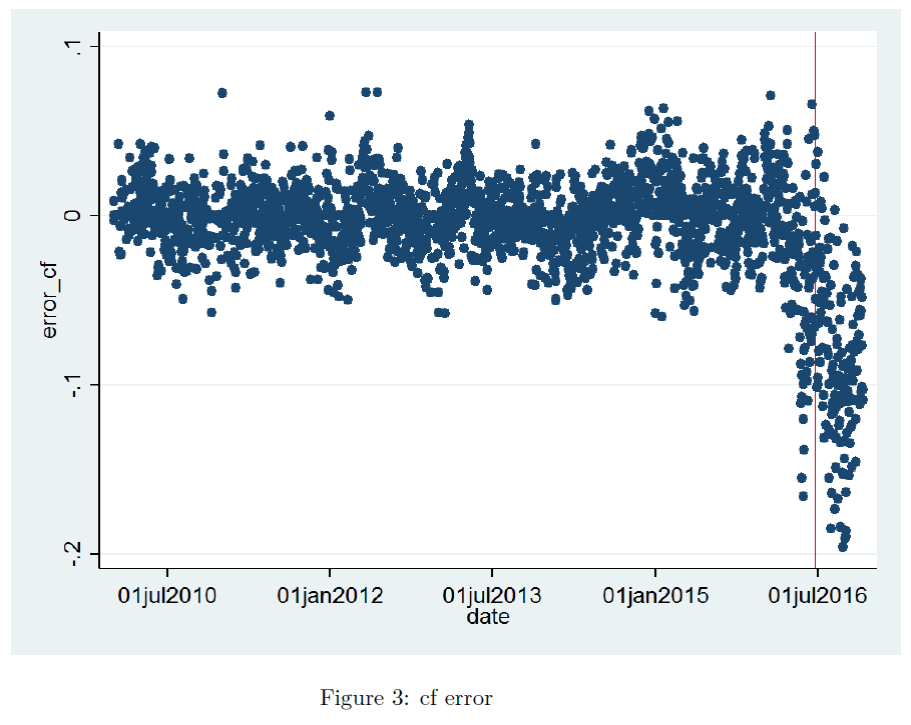

Post-Brexit Out-of-Sample Forecasted Electricity Consumption

Take England+Wales log daily electricity consumption, detrend using Christiano-Fitzgerald band pass filter, and then regress on seasonal (calendar) terms, and temperature/wind/rain factors (Kirchmaier and de Guana de Santiago, 2016, h/t Simon Kennedy at Bloomberg), through April 2016. Then forecast out of sample; the residual looks like this:

Figure 3 from Kirchmaier and de Guana de Santiago, (2016).

Electricity consumption is way under what would be expected from historical correlations, suggesting a decline in economic — particularly industrial — activity.

While monthly estimates of November GDP are up 1.1% relative to June, industrial output is down by 1.2%, according to NIESR (Dec. 7).

It is always useful to keep in mind that economic statistics are sometimes revised by large amounts.

Guest Contribution: “Five Key Factors for 2017”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers.

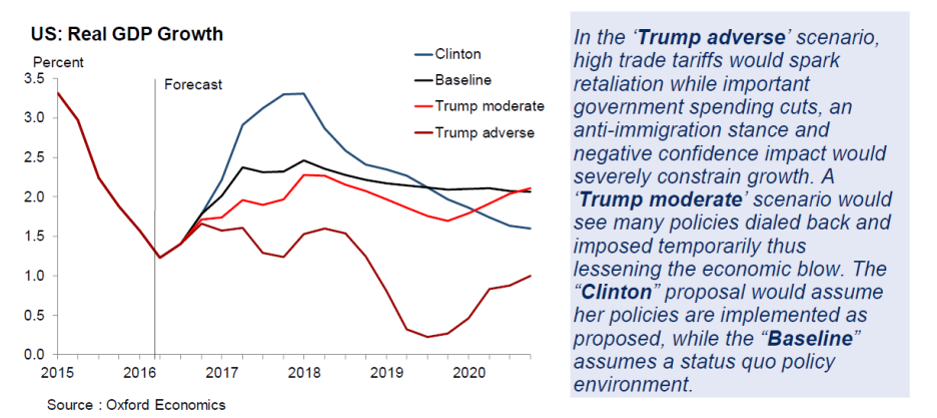

“The Election: Implications for Policy Change?”

That’s the title of an informal panel at the UW La Follette School of Public Affairs on Tuesday. Here are the slides that underpin my presentation.

For now, let the following figure summarize the choices.

Source: “Trump vs Clinton: Polarization & uncertainty,” Research Briefing (Oxford Economics, 19 Sept. 2016) [not online].

The other panelists are Pam Herd, Greg Nemet, Rourke O’Brien, and Tim Smeeding.

More Volatility in the Pound

From Bloomberg a few minutes ago:

The pound gained, halting a four-day slide against the dollar, after U.K. Prime Minister Theresa May accepted that Parliament should be allowed to vote on her plan for taking Britain out of the European Union, but asked lawmakers to do it in a way that gives her space to negotiate.

On Reading the Trump Economic Plan

At the beginning of the week (9/27), Bruce Bartlett forwarded me a link to a remarkable document, entitled “Scoring the Trump Economic Plan: Trade, Regulatory, & Energy Policy Impacts” (strangely, dated 9/29), coauthored by Peter Navarro* and Wilbur Ross. I’m way behind the curve, and there have been numerous examinations of the document, so I will not discuss the entire paper. Rather I’ll focus on the following specific question: would renegotiating trade agreements and slapping tariffs on China, conjoined with the Trump fiscal policy, induce a drastic change employment and trade flows? The short answer — yes, but probably in a direction opposite of that posited by the authors.