as of 10PM Eastern:

Continue reading“International Spillovers of Monetary Policy: Conventional Policy vs. Quantitative Easing”

That’s the title of a fascinating new paper with important policy implications.

Continue reading“A Third of a Century of Currency Expectations Data: The Carry Trade and the Risk Premium”

That’s the title of a new paper, coauthored with Jeffrey Frankel, using data extending back to August 1986.

Continue readingJindal-nomics Illustrated

In response to my graph of Louisiana GDP, Manfred asks:

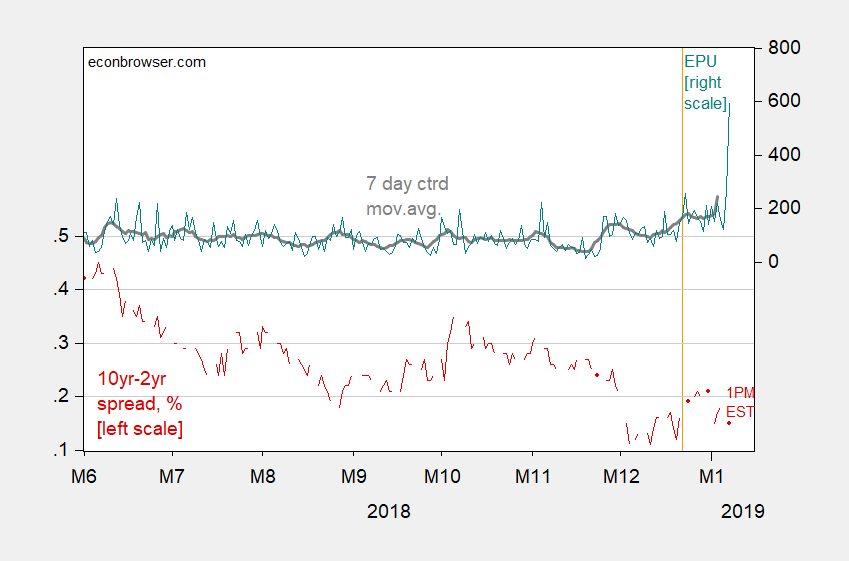

Continue readingMeasured Uncertainty and Treasury Spreads, 1/7/19

We Can Make Mexico Pay for the Wall

Just declare an International Emergency. From US Treasury,

U.S.C. annotated, Title 50. War and National Defense Chapter 35. International Emergency Economic Powers :

Treasury Spreads and Measured Policy Uncertainty

Do they matter?

Continue readingEmployment Estimates in the Run-up to the 2001 Recession

Employment Release: We Are Now Back to the 2016 Stochastic Trend

Louisiana’s Economic Progress since 2005

It’s striking. GDP correlates with oil in recent years, but not always, so why didn’t the magic of Jindalnomics work?

Continue reading