A lot of chatter about a sugar high coming from the passage of the American Rescue Plan, previous fiscal and monetary measures, combined with the increase in CPI inflation. Time to step back and assess.

First, the chatter:

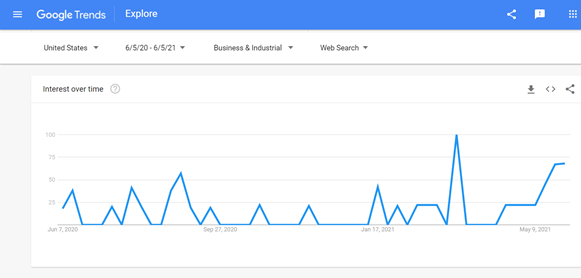

Figure 1: Google Trends count for “Sugar High”, accessed 6/13/2021.

Will the economy overheat? Will the overheating cause inflation? Will this cause the Fed to over-react so as to crash the economy (or will the financial imbalances cause a crash a la 2008?).

On the overheating question, one can look to the forecasts of GDP, and estimates of potential GDP.

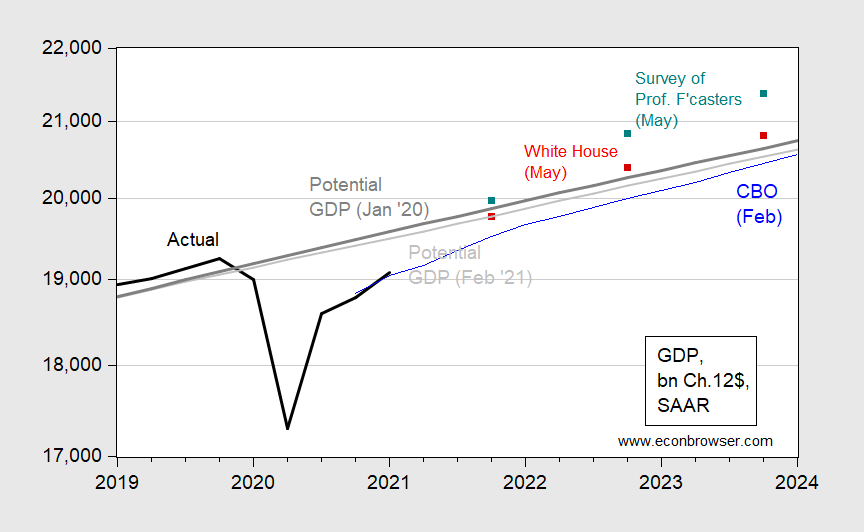

Figure 2: GDP as reported (black), CBO projection from February 2021 (blue), Survey of Professional Forecasters median (teal squares), White House forecast (red square), potential GDP from January 2020 CBO (dark gray), from February 2021 (light gray), all in billions of Ch.2012$, SAAR. Source: BEA 2021Q1 2nd release, CBO Budget and Economic Outlook (January 2020 and February 2021), Survey of Professional Forecasters (May 2021), White House (May 2021), and author’s calculations.

By Q4 of 2021, the White House is predicting output 1.2% above potential GDP as estimated by the CBO earlier this year (February). The Survey of Professional Forecasters (SPF) median predicts output slightly higher, 2.3%. Now, the implied output gap (actual minus potential GDP) depends critically on the estimate of potential GDP. The CBO’s February 2021 estimate incorporated less scarring of the economy than the July 2020, but more than January 2020. Using the January 2020 estimate, we have a -1.1% gap according to the White House, and a -1.0% according to the SPF.

The foregoing is not to argue that one estimate of the output gap is preferred to the other. Rather, it’s to note that a big surge in actual output (a “sugar high”) has different implications depending on the path of potential GDP, which is unobserved. As Coibion, Gorodnichenko and Ulate (2018) note, conventional accounting approaches tend to understate potential output in real time. Hence, for instance, Goldman Sachs predicts rapid growth, but also sees potential output as being substantially higher than does the CBO, so that the implied output gap is more negative at the moment than the above graph suggest, and output less likely to overshoot potential substantially going forward (see Hatzius, “Why the Economy Won’t Overheat,” Goldman Sachs, June 7, 2021).

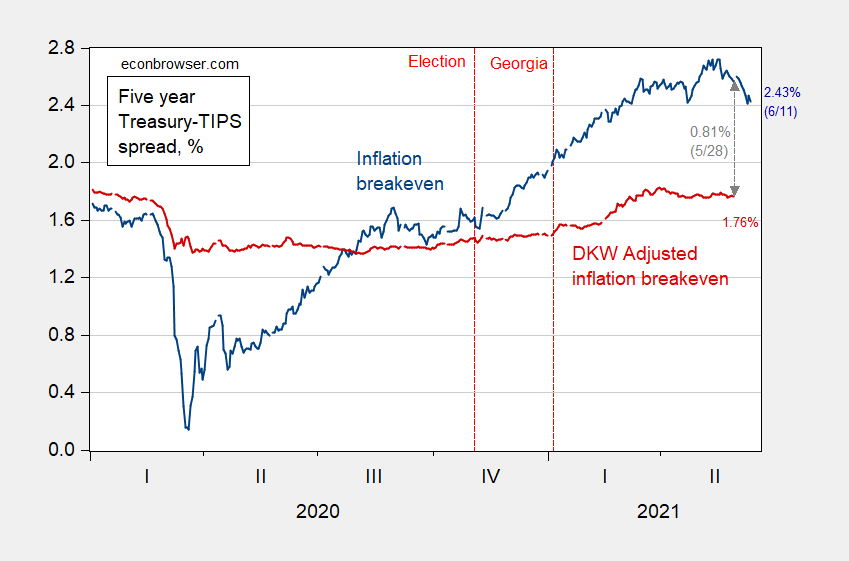

Even if output rises above potential, other key issues include (1) the slope of the Phillips curve, and (2) long term expected inflation (see this post for a graphical framework in which to put (1), (2) and the projected output gap in). I will point out that long term (5 year) expected inflation as implied by financial markets (the 5 year Treasury-TIPS breakeven) seems to not have surged much, despite the CPI surprise a few days ago, as shown in Figure 3.

Figure 3: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW, all in %. Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) accessed 6/4, and author’s calculations.

Survey and market based data seem to ascribe only a slight increase in year-on-year inflation, at the mean, suggesting that none of the fears are part of the central scenarios contemplated by markets and forecasters.

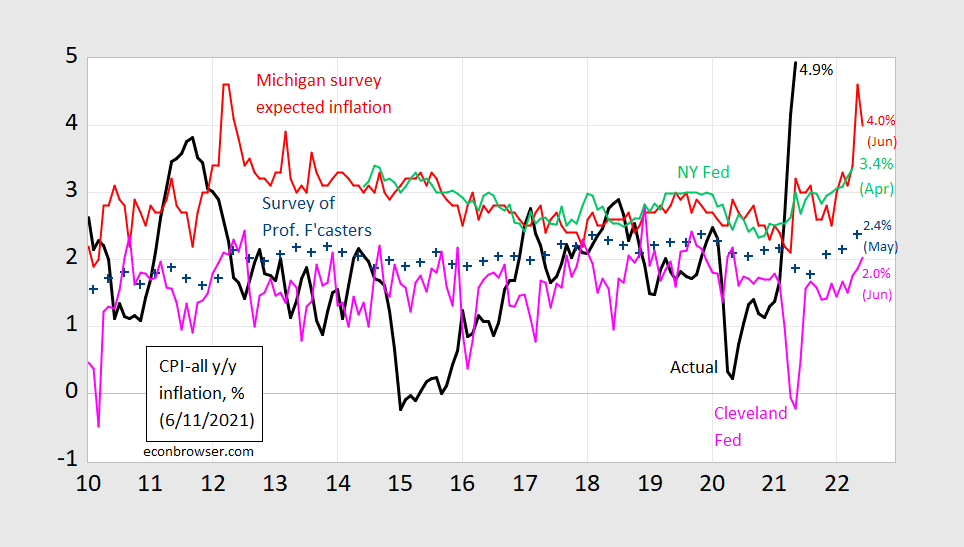

Figure 4: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink). Source: BLS, University of Michigan via FRED, Reuters, Philadelphia Fed Survey of Professional Forecasters, NY Fed, and Cleveland Fed.

While the Michigan survey implies pretty high year-on-year inflation (4% as of June), we know that such consumer/household based estimates are usually upwardly biased; perhaps better to focus on the changes. From November 2020 to June 2021, the Michigan (survey) measure has risen 1.2 percentage points, while the Cleveland Fed (hybrid market/survey) measure has risen only 0.6 percentage points.

This doesn’t mean there aren’t possible surprises far on the upside of inflation (say, due to supply shocks). However, my view is that the 7% y/y inflation forecasted by for instance former CEA Chair Kevin Hassett is not particularly plausible.

Finally, I think the “sugar high” analogy is meant to suggest we will have a financial crash a la 2008. With the origins of the boom cycle not being driven by overleveraging (thank you higher capital standards!), I don’t think this is the right place to look for a crash. That doesn’t mean we won’t see one elsewhere, but I think the crash-in-finance scenario seems low probability.

I wonder why the inflationistas weren’t shouting “sugar high” when then passed their $2 trillion tax cuts for the rich. Perhaps “sugar high” only applies to money for poor people. Money for the rich is a “caviar high.”

The one sure indicator of an overheating economy is what we call down under a wages breakout.

I saw Mr. Lawrence Summers on a recent episode (no I do not usually watch it) of the contemporary version of “Firing Line” on PBS. He was playing his new role in the Biden White House as Senior Inflation Alarmist Cackling Hen. It’s an unpaid internship, and if Larry’s act wins over TV audiences he advances up to Special Adviser to Andrew Cuomo on Interaction of Genders at the Workplace. His long term plan is to eventually do a “modern” vaudevillian sockpuppet act where his left hand plays the part of a Harvard PhD mathematics professor who wants to know what is the exact grudge he has against her.

https://www.cnn.com/2021/06/08/politics/andrew-cuomo-book-pandemic-investigation/index.html

No one on planet Earth is going to believe me (that’s fine, I probably wouldn’t believe it if I heard it from someone else either) But when I really started to get a whiff of something stinky going on with Andrew Cuomo on the nursing homes (aside from the death counts looking funny) is when this story below ran:

https://www.news10.com/news/gov-cuomo-returns-ventilators-to-schenectady-county-nursing-home/

I watched it originally on Youtube, and there was something VERY unnatural or staged about how Andrew Cuomo presented this info. One’s first inclination was to be emotionally moved by the Niskayuna gesture, but the more you watched it, and looked into Cuomo’s eyes, it just seemed like there was something seriously wrong that Cuomo wasn’t verbalizing but he was screaming with “a tell” from his eyes. And I’m not talking about the Niskayuna ventilators gesture itself, but more like the discussion of the Niskayuna ventilators was some kind of “Three-card Monte” game Cuomo was playing to take our eyes off of something else that was going on. I know it sounds like BS, but I’m telling you when I watched that press conference that day, everything in me was saying “something else we don’t know about is going on here, and something is seriously seriously wrong with this picture”.

Was there another reason Niskayuna did that?? Or was it nothing to do with Niskayuna AT ALL, but a simple PR ploy to get journalists’ eyes away from something bad?? My best guess is it had nothing to do with Niskayuna, from Niskayuna’s side of things. Still…… something was there with Cuomo’s weird weird facial expression.

The 10 yr T-Bond yield has dropped 17% over the past 12 weeks to the same level it was in Feb. 2020 despite all the massive deficit spending, money creation and this year’s exploding inflation. https://fred.stlouisfed.org/series/DGS10

Prof. Summers admits he is baffled. https://www.bloombergquint.com/global-economics/summers-surprised-by-bond-yields-falling-even-as-inflation-jumps

He recently called the Fed’s current interest rate policy “the edge of absurd” and added, “The Fed’s idea used to be that it removed the punch bowl before the party got good. Now the Fed’s doctrine is that it will only remove the punch bowl after it sees some people staggering around drunk.”

https://www.coindesk.com/consensus-summers-inflation-fiscal-monetary-policy-fed-punch-bowl-staggering

So Jay Powell and the crew are not just on a sugar high, they are staggering drunk. Don’t think so Larry.

John B. Taylor of Stanford has been saying interest rates have been held too low for too long for the past 11 years. Yes the former star in macroeconomics lost his marbles when he worked for Bush43.

“The yield on the key 10-year Treasury note fell to a three-month low of 1.43% on Thursday even after the government reported the consumer price index surged 5% in May from the previous year, the most since 2008. It ended Friday at 1.45%. Borrowing costs typically rise when inflation fears mount.”

I would have thought Summers was smart enough to realize nominal interest rates incorporate expectations of prices increases in the future rather than some temporary blip in prices over the past year. It is basic economics.

So Prof. Summers is admitting to be baffled – that is a good first step. For a real professor the first step is admitting that your models/narratives are not in line with real world observations. Next step is to ask why – and carefully evaluate the presumptions that went into the models/narratives, and may explain the deviation of outcomes from predictions. The final step is to reject or modify your models/narratives such that they get aligned with all previous and current factual observations. Look out for the potholes of rejecting objective facts rather than false narratives – and good luck Mr. Summers.

Summers says 4% inflation. Hassett says 7%. Surely Kudlow isn’t going to let these pikers show him up. How about 10%? You know he can do it.

When Glassman and Hassett published DOW 36000 back in 1999 rumor has it that Kudlow was working on his book DOW 50000. Alas, he consumed a little too much coke and never finished the draft.

What happens when this variant “Delta” (do you feel like you’re in some super cheesy Chuck Norris film now??) gets to America, where we still have lots of rural morons (or even urban morons all over the deep south USA) who don’t want to get vaccinated?? I don’t know what happens, but I think it’s a question worth asking, when we have been warned over-and-over-and-over again by public health experts that when you don’t get vaccinated it encourages the creation of more variants or “mutations”.

https://www.yahoo.com/news/chinas-latest-outbreak-doctors-infected-154327292.html

Just wait for some sad sad sad individual in desperate need of attention, to tell us all “Delta” variant started in a science lab somewhere in Mumbai, and some secret agents whispered this “top secret spy info” into his ear. Wait…… I’m getting an update from “Q Barkley” who is friends with agent 007 (not related to QAnon but roughly the same intelligence level), “Q Barkley” (again, personal friends with CIA agent 007) says it came from a lab, but we will now never know if it came from a lab, because too much time has gone by, and hiding info, and there’s no way we can know it came from a lab—but he knows “it came from a lab”. Even though now, we can never know it came from a lab, he knows it came from a lab. Understand?? And if it didn’t come from that lab, then he knows it came from another lab, even though, now, we can never know that, then it came from another lab, even though we can now never know that. Understand??? OK, if you understand that, sign up for “Mathematical Economist 101” at JMU for the next semester, hurry, before you learn what personal credibility means.

Is anyone getting any “vibes” about what the discussion is on trade inside the White House?? We all seem to agree Biden has been a little slow on taking down tariffs etc. But I just can’t believe he’s not getting internal pushback, unless they agree with me that they should wait for China to blink first. Normally I look to places like Politico to know what is going on inside, but I haven’t seen anything there. I read a Chetan Ahya speech on ZH blog that said he didn’t see much movement on changing trade policy under Biden (certainly as it related to China.

Again, I am super curious if anyone out there is hearing/reading anything about internal talk inside the Biden administration about where they are going on that??

The optics of calling off Trump’s tariffs would be bad, very bad. Biden just got NATO to agree that China is a security risk (I.e. enemy). Now, you can’t just call off doing something stupid and ineffective when you have just declared a country an enemy. I mean, we have a long, proud tradition of Vietnam, Iraq and Afghanistan to maintain.

And the military contractors wouldn’t be happy if Biden went soft and got reasonable!

JohnH: There are Section 301 tariffs and there are Section 232 tariffs (as well as others). The Section 232 tariffs were mostly levied on US allies, so your argument does not pertain to those tariffs (on steel, aluminum).

I’ll save you the video link because it’s pretty easy to find using key word search on YT, but another thing that has me feeling pretty confident on this being mostly reflation is that Lael Brainard gave very recent remarks to the New York Economics Club, in which she basically stated she doesn’t see a problem on inflation (for 2021–2022, I’m paraphrasing). She gives very precise numbers in the speech and which ones she puts more weight on as it relates to the inflation question. I know you take in most of your knowledge by reading, but if you ever care to watch speeches, I think this would be one of the ones you might watch. I have high high respect for Brainard, and when people I hold in high regard keep saying the same thing on inflation, I feel like I’m on good ground that this is transitory reflation. Now, just so I don’t mis-quote, Brainard doesn’t seem to be as avid on using the term reflation as I do, but she does say transitory inflation more than once in the NY Economics Club speech.

Sometimes I’m a little slow in the head, and I have to shamefully confess I had almost completely forgotten about the 232 ones (or tariffs related to our allies). That is quintuply as bewildering on why the Biden team haven’t moved on that. I mean they must have some still up on Canada, yes?? Who the hell has been a better friend to America than Canada over the last 50 years??

We’re going to spit on Canada’s shirt after they went to bat for us on the Huawei/MengWanzhou deal??? What benefits did Canada get out of that arrest/detainment??? And correct me if I’m wrong, but my understanding was the arrest/detainment of Meng would not have gone down if America hadn’t requested it. But who bore the brunt of the retribution from China have they arrested her?? Among two dozen other things we could list Canada has done for us~~~and we’re going to mess them around with tariffs?? Hey Biden!!!!—Biden’s trade staff!!!!—get your head out of your A– !!!!

*after they arrested her.

@ Menzie

Our prior disagreement related to the Federal Reserve not doing more on regulation is generally settled as far as I’m concerned (with you the winner by technical knockout).

Still, I can’t resist picking at an itchy blood scab (my white trash bringing up??) and am honestly curious~~~

Let’s say an outfit like the OCC is not doing their job on regulation enforcement. Do you think Janet Yellen and/or Jerome Powell have any moral obligation to the American people to discuss this at congressional hearings or use their own bully pulpit to discuss how low and middle income Americans are paying what amounts to an illegal tax to big bankers for the usage of their own money~~and that the OCC is doing nothing about it??

https://www.propublica.org/article/jpmorgan-chase-bank-wrongly-charged-170-000-customers-overdraft-fees-federal-regulators-refused-to-penalize-it

I’ve asked this question before, but how do these “errors” always end up, in the banks’ favor ????

Moses Herzog: OCC is part of the executive branch of Federal government. Fed has some say on regulation of banks in terms of financial stability, and then those pertaining to consumers by way of the Consumer Financial Protection Bureau. I have a suspicion you are talking about the latter aspect – so yes, Yellen could talk about OCC, Powell could talk about financial stability regulation and consumer finance regulation.

@ Menzie

Appreciate the reply.

Just kinda “thinking out loud” here or writing “semi ad lib”. I mean I watch this “space” of financial regulation pretty closely, related to things my dad went through, natural interest etc. Maybe not as closely as I did 2008–2010, but still my eyes gravitate to headlines related to banks and regulation. Yet I literally by happenstance ran into that story on OCC, Chase and a multitude of large banks listed in the ProPublica story. Now, I don’t expect you or most people to take this topic as personally as I do, but I pretty much did the internet version of “walking upon” that story, it was under the trump national debt story. How is it that a story discussing 170,000 average Americans getting reamed by large banks, mostly committed on the weakest members of society, which raises $11 Billion (including the legit fees) for banks runs in the news in December~~6 months ago, and I’m just finding out about it NOW???

Just imagine you can’t hardly buy your groceries, can’t pay your rent, wake up one day to find you got charged $100 on a bogus overdraft charge. And how exactly are depositors gonna pay the legal fees to fight the bogus charge?? The banks know those depositors don’t have the money to fight the bogus overdraft charge, so what does the OCC do?? “Well, let’s keep this on the low down for these poor bankers. Let’s “punish” (or in this case NOT punish) them. I mean, gosh, we can’t give them a bad rep or something”. Don’t any economists working at the Fed get tired of this Cr__ ??? Even just the research economists if Yellen and Georgetown Jerome want to look up into the sky while these people get reamed?!?!?!?!?!

Gee – continuing really stupid trade policy in lieu of declaring actual war? Then again an actual war would be a very bad idea even if Princeton Steve is doing his best to gin one up.

I guess if one has to have some form negative sum game avoiding massive deaths is a good idea.

“I think the “sugar high” analogy is meant to suggest we will have a financial crash a la 2008.”

Where have we heard this recently? Oh yea Princeton Steve has been beating the drum with his claim of a housing bubble. Of course he cannot respond to the facts that the financial fundamentals predict rising housing prices as he flunked Fin 101.

Remember back in 2009 when Obama’s own Treas. Sec. was talking about “sugar, sugar” like he was a member of the Archies? Obama should have fired this clown as we needed more fiscal stimulus not less.

That Townhall Finance piece by Peter Morici struck me as something co-authored by Kevin DOW 36000 Hassett and Bruce “no relationship to Robert” Hall. Morici apparently got a Ph.D. back in 1974 from SUNY-Albany. Nothing against the SUNY system but this ain’t exactly MIT or Berkeley. So yea he tossed in a few terms that would impress the Fox and Friends crowd even if the general thrust of what he wrote was Trumpian BS.

The WSJ title “Secular Stagnation” has me wondering if these supply-side cranks even knows what the term even means. Before the firewall cut me off, I was able to read this:

‘In a phrase, the President’s economists are predicting the return of “secular stagnation.” Readers may recall that unfortunate term from the Obama Presidency, when leftish economists sought to explain why growth seemed stuck at 2% or so despite unprecedented monetary stimulus. The fault, they said, was in our stars and not in their policies. The Biden budget says we’re likely to stagnate again after the Keynesian spending flood of 2021 and 2022—though at even lower growth rates than the slow-growth Obama years. The White House predicts a two-year growth boom of 5.2% in 2021 and 4.3% in 2022, as the country returns to normal after the pandemic and record amounts of government spending flood the economy to goose consumer demand. But the White House says growth will sink to 2.2% in 2023, and then average below 1.9% for the next eight years. That’s striking for a couple of reasons.’

Mother of God – do these WSJ idiots think potential output is growing by 4% per year or what? If they get basically reality, this passage is beyond dishonest.

I would like to know what these lying clowns wrote as there couple of reasons for finding having aggregate demand growth match potential output growth is striking. So if anyone can get past the firewall, please let us know. We all need a good laugh!

I’ve been noting how iron ore prices have surged. Mark Draper of the Australian Financial Review provides an excellent discussion of this global market as he notes why one would expect the iron ore boom to turn downward a bit:

https://www.afr.com/wealth/personal-finance/five-triggers-that-will-force-iron-ore-price-down-20210614-p580xw

His reporting is really good. One would hope US business reporters would write as well. Of course iron mining is a big deal in Australia as well as Brazil.

U.S. car manufacturing is up 20% from March to April (May numbers aren’t in yet). With car manufacturing expanding that quickly, does anyone still believe that new and used car prices are going to continue to increase? For every new car sold there is generally one used car added to the market. When car prices start to decline they will be a drag on inflation.

Likewise lumber futures have declined over 30% in just the last month.

Biden could also remove steel and aluminum tariffs on Canada and the EU. We could see rapid deceleration of inflation by the end of the summer.

Could the real goal of threatening all those honest election officials be to have them quit and to replace them with MAGA hat wearing partisans? It looks like the plan is working:

https://www.latimes.com/world-nation/story/2021-06-13/exodus-elections-officials-raises-concerns-partisanship

I sort of binged out on Star War movies on Saturday and kept thinking Trump and the Emperor have a lot in common. After all – this evil plan seems to be working perfectly.

I bet you missed the very tail end of the saga where Kathleen Kennedy jumps out from behind a hair salon, huge lightning bolts emanate from Kennedy’s fingers that turn Luke Skywalker into a nonbinary person, and then does a mic drop.

Headline:

“Jamie Dimon says JPMorgan is hoarding cash because ‘very good chance’ inflation is here to stay'”

Um, Jamie… what “inflation” means is that the value of cash goes down.

Welcome back to the Obama economy. Where any indication of economic improvement drives up commodity prices, cost-of-living and uncertainty to the point that savings must be increased and capital investment is canceled. Where monetary easing causes disinflation instead of inflation.

The good news is with less people commuting and working from home instead, there won’t be such a congestion feedback.

https://cumulativemodel.blogspot.com/2008/06/high-gas-prices-drive-down-fuel.html

@ aaron

I’m sorry, pgl’s “FemaleNoSpeak” blog already fulfills the infomercial function of the blog. Post over at “Princeton”Kopits’ blog and see what he can do for you. He can also hide death counts in your region, depending on minority demographics.