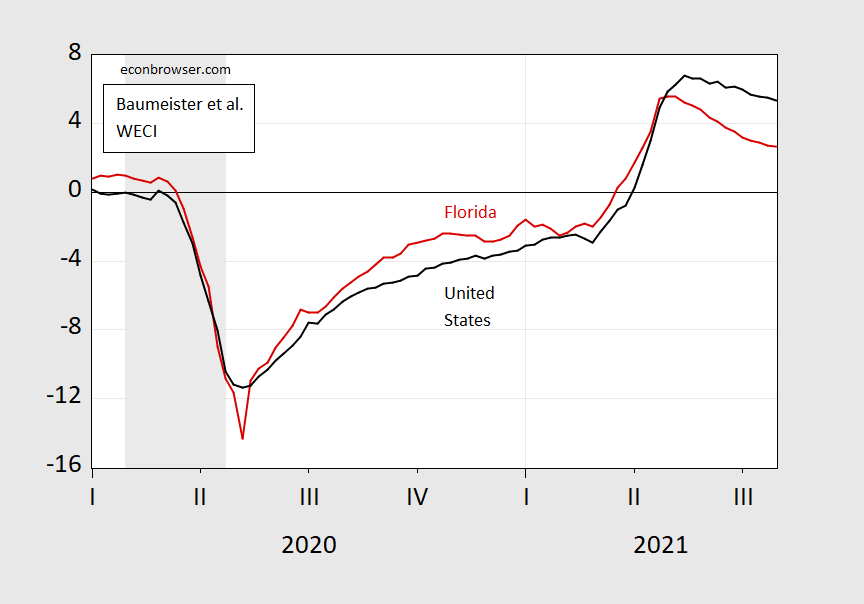

Florida is decelerating faster than the US, according to the Baumeister et al. Weekly Economic Conditions Index (discussed in this post) just released today.

Figure 1: Baumeister et al. Weekly Economic Conditions Indicators for US (black) and Florida (red), percentage point deviation from annualized trend national growth rate. NBER recession dates shaded gray, from beginning of February to end of April. Source: Weekly State Level Economic Conditions, accessed 8/6, NBER.

The Baumeister et al. measure is noteworthy because it provides a reading on the Florida economy through the end of July. The latest conventional indicator for the state is from June. Even when the employment figures for July are released by BLS on August 20th, those figures will pertain to the reference week before mid-July, and before the delta variant surge.

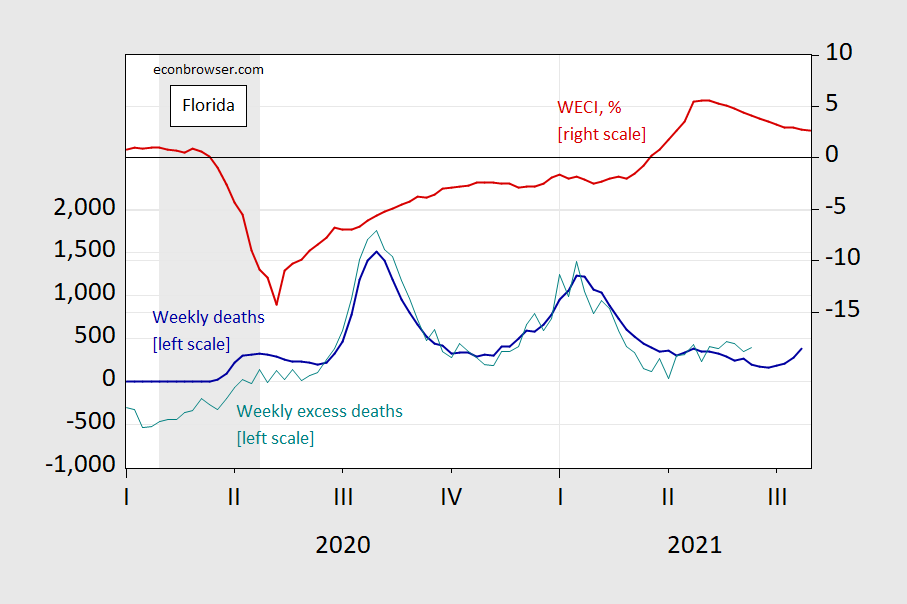

One can see that weekly deaths in Florida are now rising strongly (as tabulated by CDC). Although Florida’s economy is decelerating faster than the nation, it’s hard to see economic activity taking a nose dive in response, so far.

Figure 2: Florida weekly Covid-19 deaths (blue, left scale), excess deaths calculated as actual minus expected (teal, left scale), and Florida WECI, % (red, right scale). Source: NBER recession dates shaded gray, from beginning of February to end of April. Source: CDC, accessed 8/4, Weekly State Level Economic Conditions, accessed 8/6, NBER, and author’s calculations.

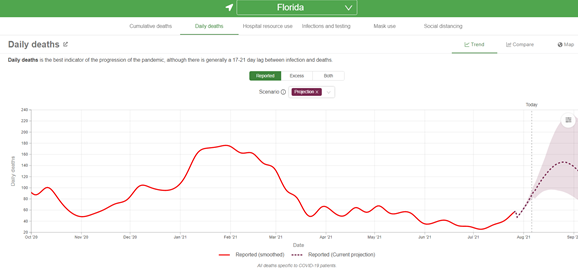

However, as has been amply documented, the CDC ensemble model has just raised its forecasted deaths as more data comes in. The most recent IHME forecast of 8/5 (which is not included in the released CDC ensemble model) is here.

Source: IHME forecast of 8/5/2021, accessed 8/6/2021.

Forecasted reported deaths peaks on 8/25, at about 146 deaths per day, or 1022 per week. Corresponding figures for excess deaths (which are typically considered more accurate) is 203 deaths per day, or 1423 per week. Deaths reported today (not 7 day moving average) was 199; current hospitalizations due to Covid-19 were at 13427, exceeding the prior peak level of 12282 recorded for July 23, 2020.

IHME’s latest forecasts indicate that over the next two months, an effective mask mandate would be expected to decrease reported deaths by 1250.

As a social scientist, I am curious to see Governor DeSantis’s tolerance level – i.e., how many fatalities/day will induce him to take emergency public health measures. For me, it’s conceivable that he never does, and tries to hang on until fatalities decrease as behavioral changes take hold.

who would have thunked that

Their governor wants to be Trump II. He is. Arrogant, loud, and very STUPID.

http://www.xinhuanet.com/english/2021-08/07/c_1310114008.htm

August 7, 2021

Nearly 1.76 bln doses of COVID-19 vaccines administered in China

BEIJING — Nearly 1.76 billion doses of COVID-19 vaccines had been administered in China by Friday, the National Health Commission said Saturday.

[ Chinese coronavirus vaccine yearly production capacity is over 5 billion doses. Along with more than 1.757 billion doses of Chinese vaccines administered domestically, another 750 million doses have been distributed internationally. A number of countries are now producing Chinese vaccines from delivered raw materials. ]

It’s a shame Chinese vaccines work so poorly. If Chinese leaders would stop using their vaccine as a bragging tool and focus on the welfare of China’s people, much could be done. As it is, China’s leaders are acting, in their own way, a lot like Florida’s governor.

https://www.yahoo.com/news/anti-vaxxer-florida-radio-host-191433478.html

chinese vaccines are working fine. there are fewer deaths in china due to coronavirus than uigher deaths in the chinese detention camps. this is a point of pride by the ccp.

https://www.msn.com/en-us/news/other/marjorie-taylor-greene-encouraged-alabama-residents-to-greet-vaccination-promoters-with-guns/ar-AAN2KGN?ocid=uxbndlbing

Marjorie Taylor Greene aka the ugly witch with a B tells an Alabama crowd that low vaccination rates are to be applauded AND encourages anyone who comes over the house to help you get vaccinated should be greeted with a gun.

People applaud this ugly witch? Sick.

Every front porch in northern Georgia where inbred banjo players strum out “Dueling Banjos” is a place where Mad Marge speaks the truth, the whole truth, and nothin’ but the truth. Ain’t nobuddy stickin’ them with none of that Fauchee poison.

Kids growing up in Atlanta are warned by their parents not to venture too far north.

“As a social scientist, I am curious to see Governor DeSantis’s tolerance level – i.e., how many fatalities/day will induce him to take emergency public health measures.”

Right now there are people slowly suffocating to death in Florida because hospitals can’t keep up with the oxygen supplies. There’s plenty of oxygen to go around but the specialized delivery drivers can’t keep up because of trucking restrictions on hours worked per day. Earlier in the pandemic a declaration of a public heath emergency allowed these restrictions to be eased. But Desantis has refused to do this again now because it would require him to admit that he has a public health emergency.

So Desantis is needlessly allowing people to suffer excruciating deaths without oxygen because to do otherwise would be politically embarrassing.

https://www.bloomberg.com/news/articles/2021-08-04/florida-hospitals-fighting-to-get-oxygen-with-hand-tied

August 5, 2021

Florida Hospitals Fighting to Get Oxygen With ‘Hand Tied’

By Shira Stein – Bloomberg

Florida hospitals are struggling to get oxygen due to a rise in Covid-19 cases attributable to the delta variant and Florida Gov. Ron DeSantis’s decision not to declare another state of emergency.

A shortage of drivers who are qualified to transport oxygen, as well as restrictions around how long truck drivers can be on the road—which went back into effect following the expiration of the public health emergency in the state—means that the supply isn’t getting to the hospitals that need it most….

Desantis is denying this issue – much the same Trump did.

https://www.nytimes.com/2021/08/07/us/covid-kindergarten-enrollment.html

August 8, 2021

The Kindergarten Exodus

As the pandemic took hold, more than 1 million children did not enroll in local schools. Many of them were the most vulnerable: 5-year-olds in low-income neighborhoods

By Dana Goldstein and Alicia Parlapiano

PHILADELPHIA — On a sweltering July afternoon, Solomon Carson, 6, jumped off the stoop of his family’s tidy rowhouse in West Philadelphia, full of what his father, David, called “unspent energy.”

When a stranger asked his name, he answered brightly, but added that he couldn’t spell it. “I can help you with that,” his father said, patiently pronouncing each letter, with Solomon repeating after him.

Solomon was supposed to have learned the basics in kindergarten this past year, but his first year of formal education was anything but.

When Covid-19 closed classrooms, his parents chose not to enroll him in city schools that they already had doubts about. As they were not working, they decided to teach him at home along with his two older brothers. And they signed him up for a virtual charter school that advertised in-person tutoring — and failed to provide it.

Now, as Solomon heads to first grade, Mr. Carson is cleareyed about where his son stands academically. “I really think we can improve,” he said.

Solomon is part of a vast exodus from local public schools….

https://www.nytimes.com/2021/08/06/opinion/covid-vaccine-supply-chain-bown-bollyky.html

August 6, 2021

Wonking Out: What Vaccine Supply Tells Us About International Trade

By Paul Krugman

For many of us, Chad Bown of the Peterson Institute for International Economics — a boutique think tank specializing in, duh, international economics — has become the go-to guy for current developments in trade policy. His work tracking the evolution of Donald Trump’s trade war was invaluable.

Now he has a highly informative new paper * with Thomas Bollyky on the vaccine supply chain. I won’t lie: There’s a lot of detail, and the paper is fairly heavy going. But it’s full of useful details, and it also, I’d argue, tells us some interesting things about the nature of world trade in the 21st century.

One thing that caught my eye — probably not the most important thing, but one close to my heart — is that the story of global vaccine production demonstrates the continuing relevance of the so-called New Trade Theory, or as some now call it, the “old New Trade Theory.”

Background: Here’s a sample graphic from Bown and Bollyky, showing what’s involved in the production of the Pfizer vaccine:

https://static01.nyt.com/images/2021/08/06/opinion/krugman060821_1/krugman060821_1-jumbo.png?quality=90&auto=webp

The shots made round the world.

Producing these vaccines is evidently a complicated process, involving facilities in many locations, presumably implying a lot of cross-border shipments of vaccine ingredients. Notably, in Pfizer’s case all these facilities are in the United States and Western Europe, which is typical across pharma firms, although other companies have a few facilities in Brazil and India.

So where do vaccine supply chains fit into the theory of international trade? …

* https://www.piie.com/publications/working-papers/how-covid-19-vaccine-supply-chains-emerged-midst-pandemic

https://www.piie.com/blogs/trade-and-investment-policy-watch/how-trumps-export-curbs-semiconductors-and-equipment-hurt-us

Chad Bown has authored or co-authored 334 discussions on various aspects of trade including the one you provided. I have linked to something on semiconductors from Sept. 2020 which I earlier asked Bruce Hall to read given his obsession with this sector. Something tells me Bruce never read it but this discussion was first rate. Lots of excellent reading on so many important topics.

His recent Foreign Affairs piece on the semiconductor sector was interesting. A small sample:

‘The supply crunch has hit a range of sectors. Automotive plants have idled as they await delivery of chips used in their cars. Makers of microwaves, refrigerators, and washing machines have been unable to fill their orders. Long the obscure concern of experts in the technology sector, semiconductor supply chains have now been thrust into the spotlight.

But the supply of semiconductors was at risk long before the pandemic, and the virus is only partly to blame for today’s shortages. One of the biggest culprits was a sudden shift in U.S. trade policy. In 2018, motivated by national security concerns, the Trump administration launched a trade and tech war with China that jolted the entire globalized semiconductor supply chain. The fiasco contributed to the current shortages, hurting American businesses and workers. Now, the Biden administration must pick up the pieces.’

Huh – no wonder Bruce Hall does not read Chad Bown. The 1st paragraph notes it was the auto sector that got hit hard which is likely because it was dumb enough to follow Bruce Hall’s just in time inventory model. The 2nd paragraph notes a lot of the blame goes to Trump’s stupid trade war which Bruce was required to defend over and over.

pgl: Bruce Hall only reads stuff like this.

Bruce Just in Time Inventories Hall should read this:

https://www.supplychaindive.com/news/nxp-semiconductors-automakers-just-in-time-shortage-chip/604424/

The automobile manufacturers have finally realized they need to hold inventories of things like semiconductors. After all the benefits of holding inventories are now rather obvious. The cost of holding inventories is the interest rate on working capital, which currently is incredibly low.

Of course Bruce “no relationship to Robert” Hall does not do benefit/cost analysis.

…does not do benefit/cost analysis.

Doing the cost part is relatively straightforward and I imagine that even Bruce Hall could manage the arithmetic. The cost of holding inventory is basically some discount (or interest) rate plus some storage cost plus some loss risk and an obsolescence risk. It’s estimating the benefits of holding safety level stocks that gets messy. For starters you need to know how to estimate a shadow price of not being able to satisfy an order, which is something about which I’m pretty sure Bruce Hall is quite clueless.

https://www.foreignaffairs.com/articles/2021-07-06/missing-chips

July 6, 2021

The Missing Chips

How to Protect the Semiconductor Supply Chain

By Chad P. Bown

Maintaining large inventories is a waste when the real problem is bad government policies. But I guess when industrialists’ only concern about government policy is tax cuts for the rich, I guess they’re are going to need a backup plan and that is wasteful inventories.

http://pubs.aeaweb.org/doi/pdfplus/10.1257/aer.101.1.1

December, 1980

Scale Economies, Product Differentiation, and the Pattern of Trade

The classical theory that foreign trade is determined by comparative advantage fails to explain some important observations, for example, that there is considerable trade in both directions within what is usually regarded as a single industry, and that countries tend to export goods for which the domestic demand is higher. Paul Krugman investigates the determination of foreign trade under increasing returns; he assumes no difference in production conditions between countries. Prices are determined by imperfect competition with costless product differentiation. Using simple models, he formalizes foreign trade. When transport costs are introduced, he shows that each country will specialize, so no two will produce the same goods. The larger country will have terms of trade turned in its favor, and wages will be higher there. Some extensions of the model allow varieties within a single industry. It can then be shown that intra-industry trade can emerge and that countries will tend to export those commodities for which the domestic demand is highest. *

* https://www.aeaweb.org/aer/top20/70.5.950-959.pdf

WTF does this have to do with the automobile sector’s failure to secure getting semiconductors? Not a thing.

Interesting that Krugman, as always, paints a glowing picture of globalization and of the relatively “random” distribution of scale producers. I see no particular to this distribution nor does Krugman, other than to look upon it as rather cool. Moreover, if he were to scratch just a bit below the surface, I suspect that he would have found that the distribution was hardly random but rather the result of a corporate “race to the bottom” strategy whereby sites were actually selected on the strength of local incentives and inducements.

Has Krugman forgotten Ireland’s notorious status as a corporate tax haven? Or Amazon’s cynical plan to pit American cities against each other to get the best deal for Amazon, but, as it turned out, not for the people of New York City, who organized to drive them ? Does he now think that the race to the bottom is cool?

All of this is vintage Krugman…singing the praises of globalization even when the benefits aren’t all that apparent…and glossing over any costs and disadvantages, which of course he might acknowledge in his textbooks but certainly never in a place where he actually has a readership as wide as at The NY Times.

Such utter dishonesty. I guess Krugman is still kicking your dog.

So now pgl is denying the important role of local incentives and inducements in multi-nationals’ siting of facilities!!! What a rube!

Has he conveniently forgotten the whole saga of Amazon’s bidding war for a second corporate headquarters? The list of such corporate site selection bidding wars is long. Another blatant example was Boeing’s move of much production to South Carolina. And the exodus of American and European manufacturing to China had little to do with some “random historical accident.” much as Krugman might like to claim otherwise.

When I worked in the corporate world, it was an inside joke that corporations selected their headquarters to be in close proximity to where the CEO lived in his gated mansion, replete with low taxes. Think Stamford and Greenwich. My first boss moved his division headquarters to be within walking distance of his house. Random historical accident? Hardly!

While geography might help explain part of country and local site selection in globalization (yes, chip manufacturers need plenty of water to dilute their noxious chemicals enough to discharge them into the environment), it clearly does not explain much of it. As the auto industry’s migration from Detroit to the South to the Mexican border and then to China, a lot of cross-border trade is simply due to corporations being foot loose and fancy free in search of incentives and inducements. And to gloss over that fact while praising the distribution of corporate facilities, many of which are not dependent on any particular site, is simply to engage in telling of half truths in service of an agenda of globalization.

“So now pgl is denying the important role of local incentives and inducements in multi-nationals’ siting of facilities!!! What a rube!”

I have never denied that but continue to lie. You may thing this worthless drivel makes you sound smart but it doesn’t.

Funny thing – you brag about working for some Fortune 200 company but you never tell us which one. Oh – maybe it went bankrupt thanks to your utter incompetence.

“

Would pgl deign to reveal who he works for?

“JohnH

August 9, 2021 at 8:20 pm

Would pgl deign to reveal who he works for?”

Me. Gone independent with the consulting. But of course you still refuse to tell us which Fortune 200 company went bankrupt because they relied on your “expertise”.

Um…no. Krugman, who won a Nobel prize for his work on trade theory, does not believe the distribution of production is random. In fact, a good bit of his work on trade focused on the geography of trade — which, almost by definition, studies why production is not randomly distributed.

Yes, Krugman has a lot of “Clinton Democrat” (DLC) in him, including a fondness for global trade. There have been dozens, maybe hundreds of comments here at Econbrowser alone over the years, complaining that he is an apologist for globalization. We get it. But acting like a Monty Python peasant shouting “Burn him! He’s a globalist!” every time he’s quoted misses the rather interesting things a rather well informed man has to say.

How about we all take as given that Krugman is Old Scratch himself. No need to repeat it any more.

Behind Pfizer’s move to Chesterfield, MO: “County Executive Steve Stenger sent County Councilmembers a letter asking them to pass legislation authorizing the issuance of $248.5 million in federal Chapter 100 bonds needed for Pfizer to lease, occupy and equip the new facility.

The measures will provide a 50 percent abatement of real and personal property taxes on the project for 10 years and a sales tax exemption on construction materials. The county and Missouri offered Pfizer economic incentives if it meets specific job creation criteria, a county news release said.”

Anybody remember Scott Walker’s beloved FoxConn deal?

[But hush, hush, let’s not tell anyone. We must issue only glowing reports about the positive aspects of the distribution of multi-nationals sites!]

Totally nonresponsive to what macroduck wrote. But hey continue your lies as you are now outdoing even ltr as the #1 troll!

Pfizer in Chesterfield rang a bell and look at what I found by an advanced research tool called Google (JohnH refuses to use it):

https://www.pfizer.com/news/hot-topics/new_r_d_facility_opens_in_chesterfield_missouri

R&D on things like vaccines. Huh – that Pfizer COVID-19 vaccine was quite the break through. But of course someone who flunked basic research skills would never have known that.

Of course I have NEVER advocated local supply-side economics even if the serial liar called JohnH claims I have.

“Totally nonresponsive to what macroduck wrote. ” Uh, no. My response was to point out that there is a clear pattern to Pfizer’s global investments. And that pattern has absolutely nothing to do with economics. And it is not at all random.

The same investments could be in many countries and in any one of a large number of localities. What is probably the decisive factor has more to to with the richness of the incentive package than the economic advantages of the site.

Bottom line, Pfizers “marvelous” supply chain is a largely reflection of corporate greed. Globalization has broadened the range of choices for corporations like Pfizer as well as providing them with more localities desperate to compete with each other for the privilege of being ripped off.

Naturally, Krugman mentions nothing about the seamy side of globalization, only its glories and wonders. An impartial academic should do better, offering a more objective perspective.

Sadly Krugman has changed over the years from a leading edge academic into a huckster single mindedly using his bully pulpit to promote the wonders of a system designed for big, multi-national corporations like Pfizer, who take advantage of it to profiteer. I am sure that they are quietly grateful to him for providing intellectual cover for their exploits.

JohnH has no clue what Krugman has written as evidence by these utterly worthless rants of his.

“JohnH

August 9, 2021 at 6:27 pm

“Totally nonresponsive to what macroduck wrote. ” Uh, no. My response was to point out that there is a clear pattern to Pfizer’s global investments. And that pattern has absolutely nothing to do with economics.”

WTF? If you are correct, then they would be tanking their corporate value. Call the lawyers as I smell a shareholder lawsuit if you are correct. But of course you are not as this is just another one of your patented really stupid claims.

“Has Krugman forgotten Ireland’s notorious status as a corporate tax haven?”

This is an incredibly STOOOPID question for multiple reasons. First of all it is about international taxation and transfer pricing which some would say is a different issue from international trade protection. Of course anyone who has read Brad Setser knows there are ties. Brad has often cited some of my blog posts on this topic where I have talked about this transfer pricing issue. But of course I do not write for the NYTimes so I guess I do not count. Brad does not write for the NYTimes either but he is a trade advisor for the Biden Administration.

And better – Brad has noted where Krugman has indeed contributed to this discussion. Google Leprechaun Economics and one would see lots of excellent discussions written by Krugman who coined this term.

Of course JohnH cannot be bothered as he is too busy bashing Krugman with some of the most dishonest and stupid comments ever.

https://www.irishtimes.com/news/ireland/irish-news/irish-ambassador-condemns-leprechaun-economics-term-as-derogatory-1.4591943

Oh my! Some Irish ambassador is mad at Paul Krugman for coining the term Leprechaun Economics. But this ambassador needs to check with JohnH who claims Krugman has never addressed this type of transfer pricing abuse (even though Krugman has quite often).

“Has Krugman forgotten Ireland’s notorious status as a corporate tax haven?”

this was a bean counter move. it had nothing to do with production of product.

“Or Amazon’s cynical plan to pit American cities against each other to get the best deal for Amazon, but, as it turned out, not for the people of New York City, who organized to drive them ?”

i would argue new york city was the fool here. perhaps we need to revamp how localities can produce tax incentives, i would agree. but considering the world we live in today, not the imaginary world of some progressives, this was a poor move. lots of money in those jobs, going elsewhere.

Ummm—Ireland was clearly identified as one of the sites in the chart showing Pfizer’s widespread distribution of facilities.

And your point is??? Ireland does produce a lot of pharma products. It is part of their transfer pricing games per Brad Setser. But what does he know?

NYC may celebrate St. Patrick’s Day but it is not Dublin Ireland. And Amazon is not doing vaccine research. Chesterfield, MO is. Do try to keep things straight in your utterly warped little brain!

https://www.cnbc.com/2020/03/06/amazon-is-secretly-working-on-a-cure-for-the-common-cold.html

It appears Amazon is doing research on more than just one type of vaccine. Apparently neither “Grand Challenge” or “1492” sent commenter pgl the memo.

This is…… “shocking”……

i stand corrected. pfizer never was able to complete their reverse merger to take advantage of the lower taxes in ireland. they tried and failed. but pfizer was not trying to relocate to ireland because of product. it was because of taxes.

I opposed this hand out for Amazon. Like Google is not bringing the city a lot more jobs with no hand outs? The real beneficiary would have been a bunch of slum lords in Long Island City. An area I avoid like the plague.

But of course JohnH thinks I supported Amazon in this because he is truly a worthless idiot.

Did Krugman oppose Amazon in NYC?

Krugman’s position: “So Amazon isn’t coming to New York. Is this a good thing or a bad thing? Let me tell you a secret: NOBODY KNOWS.:”

An artful dodge from a master of the artful dodge.

Interesting piece from the Council on Foreign Relations article on how taxation, not economics, drives the wondrous distribution of Pfizer’s supply chain.

https://www.cfr.org/blog/irish-shock-us-manufacturing

I guess you are so stupid that you did not see that Brad Setser wrote this. It is the same transfer pricing analysis that I noted earlier. I guess you are so dumb you did not realize that. Guess who wrote the seminal discussions of what Brad so ably detailed? PAUL KRUGMAN. The same person you keep bashing because – well because you are STOOPID. But we have covered that already.

BTW – after-tax returns is a key concept in financial economics. But again – this kind of stuff is way over your limited little head. Damn!

“Here’s a sample graphic from Bown and Bollyky, showing what’s involved in the production of the Pfizer vaccine”

Interesting diagram that shows it all starts with producing lipids. Which happen to be made in 3 states – CT, NY, and ALABAMA. One would think ALABAMA would be ahead of the rest of the US in getting vaccines in the arms of their citizens but thinks to ugly old witch Marjorie Taylor Greene – people are now advised to shoot people who are helping get the citizens vaccinated. Distribution is a key part of international trade flows but in ALABAMA this part of the value chain is being shut down.

Putting that graphic into the Krugman piece in such a prominent place, makes it apparent that Pfizer is poster child for globalization à l Krugman.

https://static01.nyt.com/images/2021/08/06/opinion/krugman060821_1/krugman060821_1-jumbo.png?quality=90&auto=webp

Interesting that Pfizer’s corporate rap sheet is never mentioned… It is so egregious that it would make Trump green with envy.

https://www.corp-research.org/pfizer

What a wonderful poster child for Krugman celebrate!!! [sarcasm]

This is beyond your usual stupidity. Krugman never said what Pfizer is doing is some wonderful thing. He is just describing the reality of a situation – not endorsing it. But of course JohnH would not recognize the real world if it landed on his house.

In florida, conservatives are conducting an assault on children. Abbott and fellow conservatives are ramping up a similar assault on children in texas. As a society, we should do everything possible to protect the most vulnerable-our children. Instead, we have governors willing to sacrifice our children in the name of politics. It’s disgusting and appalling.

Fewer kids means less future Democratic voters. It is all in the grand scheme of GOP voter suppression.

Importantly, Paul Krugman wrote a short essay on vaccine supply and international trade, and Krugman suggested reading an essay written on trade in 1980 and considered among the finest of essays of the last century by the American Economic Review. I think the essay completely germane as well as brilliant and posted an abstract by the AER and open link to the text:

https://www.aeaweb.org/aer/top20/70.5.950-959.pdf

December, 1980

Scale Economies, Product Differentiation, and the Pattern of Trade

By PAUL KRUGMAN

For some time now there has been considerable skepticism about the ability of comparative cost theory to explain the actual pattern of international trade. Neither the extensive trade among the industrial countries, nor the prevalence in this trade of two-way exchanges of differentiated products, make much sense in terms of standard theory. As a result, many people have concluded that a new framework for analyzing trade is needed.’ The main elements of such a framework-economies of scale, the possibility of product differentiation, and imperfect competition-have been discussed by such authors as Bela Balassa, Herbert Grubel, and Irving Kravis, and have been “in the air” for many years. In this paper I present a simple formal analysis which incorporates these elements, and show how it can be used to shed some light on some issues which cannot be handled in more conventional models. These include, in particular, the causes of trade between economies with similar factor endowments, and the role of a large domestic market in encouraging exports.

The basic model of this paper is one in which there are economies of scale in production and firms can costlessly differentiate their products. In this model, which is derived from recent work by Avinash Dixit and Joseph Stiglitz, equilibrium takes the form of Chamberlinian monopolistic competition: * each firm has some monopoly power, but entry drives monopoly profits to zero. When two imperfectly competitive economies of this kind are allowed to trade, increasing returns produce trade and gains from trade even if the economies have identical tastes, technology, and factor endowments. This basic model of trade is presented in Section I. It is closely related to a model I have developed elsewhere; in this paper a somewhat more restrictive formulation of demand is used to make the analysis in later sections easier.

The rest of the paper is concerned with two extensions of the basic model. In Section II, I examine the effect of transportation costs, and show that countries with larger domestic markets will, other things equal, have higher wage rates. Section III then deals with “home market” effects on trade patterns. It provides a formal justification for the commonly made argument that countries will tend to export those goods for which they have relatively large domestic markets.

This paper makes no pretense of generality. The models presented rely on extremely restrictive assumptions about cost and utility. Nonetheless, it is to be hoped that the paper provides some useful insights into those aspects of international trade which simply cannot be treated in our usual models….

* https://en.wikipedia.org/wiki/Edward_Chamberlin

Too bad Avinash Dixit still has not gotten a Nobel for his work on the model that Krugman used here to get his all by himself.

https://voxeu.org/article/why-krugman-got-nobel-prize-economics-not-polemics

Dixit himself noted the work of Krugman (and others) in his 2008 tribute to Krugman getting the Nobel Prize.

Avinash is a class act. He was Dept Chair at Princeton when Krugman got the prize all by himself and was in the same department. I have commented previously on how not only Dixit byt Masahisa Fujita deserved to share that prize with Krugman, but will not dig into that any further right now.

For the record, Paul deserved the prize, but it should have been shared with those two guys, as many besides me have obsrved. However, I would say that both Akerlof and Stiglitz deserved to get it by themselves, but they were made to share it with each other and with Michael Spence.

To be honest, I didn’t realize Dixit is still living. I agree, he richly deserves a Prize, for this and other things. During my studies, I don’t think we were assigned a single Dixit paper. My instructors favored younger authors with whom, quelle surprise, they had studied or published. I had to discover those I’d missed, including Dixit, on my own. I know I missed some great ones.

Referenced by Paul Krugman in December 1980:

A. Dixit and J. Stiglitz, “Monopolistic Competition and Optimum Product Diversity,”

Amer. Econ. Rev., June 1977, 67, 297-308.

This paper is one of the 20 most cited papers in the history of the AER. Stiglitiz got the prize, shared with Akerlof and Spence, but not for this paper, and Dixit has not gotten it and probably never will.

https://www.aeaweb.org/aer/top20/70.5.950-959.pdf

December, 1980

Scale Economies, Product Differentiation, and the Pattern of Trade

By PAUL KRUGMAN

Generalizations and Extensions

The analysis we have just gone through shows that there is some justification for the idea that countries export what they have home markets for. The results were arrived at, however, only for a special case designed to make matters as simple as possible. Our next question must be the extent to which these results generalize.

One way in which generalization might be pursued is by abandoning the “mirror image” assumption: we can let the countries have arbitrary populations and demand patterns, while retaining all the other assumptions of the model. It can be shown that in that case, although the derivations become more complicated, the basic home market result is unchanged. Each country will be a net exporter in the industry for whose goods it has a relatively larger demand. The difference is that wages will in general not be equal; in particular, smaller countries with absolutely smaller markets for both kinds of goods will have to compensate for this disadvantage with lower wages.

Another, perhaps more interesting, generalization would be to abandon the assumed symmetry between the industries. Again, we would like to be able to make sense of some arguments made by practical men. For example, is it true that large countries will have an advantage in the production and export of goods whose production is characterized by sizeable economies of scale? This is an explanation which is sometimes given for the United States’ position as an exporter of aircraft….

https://www.econlib.org/jagdish-bhagwati-for-nobel-prize/

And of course Jagdish Bhagwati deserves a Nobel Prize for his work on international trade.

Of course he does. I think we were assigned one(!) of his papers. Found, and read, others on my own.

Dixit deserves it more than Bhagwati.

Currently on vacation in a state with below average Covid cases. Florida was just completely off the list due to the risk of Covid. It will be a long time before I would plan to go to Florida several month out. You just cannot trust that their government will act appropriately to a spike in infections – and I would not want to go there and then just have to isolate from the crazy natives the whole time. It appears that even though the lack of restrictions are a selling point for some people, they are also scaring away a lot. So all those lost lives and long (permanent?) Covid sacrifices didn’t help the economy at all.

And your point is??? Ireland does produce a lot of pharma products. It is part of their transfer pricing games per Brad Setser. But what does he know?

Interesting, isn’t it, that Krugman would make Pfizer his poster child for globalization? Particularly since Pfizer is notorious for ripping off governments around the world both on taxes and on the prices of drugs it sells. (Not to mention extorting good deals from local governments for siting of new facilities.)

https://www.theguardian.com/business/2021/aug/05/pfizer-flynn-overcharged-nhs-anti-epilepsy-drugs-cma

https://tfiglobalnews.com/2021/07/28/pfizer-has-hit-the-goldmine-during-covid-crisis-leaked-contract-shows-appalling-terms-and-conditions/

https://www.wsj.com/articles/big-pharma-quietly-pushes-back-on-global-tax-deal-citing-covid-19-role-11627378146

https://ahrp.org/pfizers-2-3-billion-settlement-leaves-victims-in-the-lurch/

https://www.corporatecrimereporter.com/news/200/pfizer-doesnt-want-known-pfizer/

Of course, we know that globalization opened the doors wide to all sorts of evasion of taxes and regulations as well as crime and corruption. But to unabashedly celebrate a notorious violator? What has Krugman become, a publicist for bad actors, whose behavior he gladly overlooks and even celebrates simply because they have a global supply chain? And why are so many so in thrall to someone who celebrates such a bad actor?

“Interesting, isn’t it, that Krugman would make Pfizer his poster child for globalization? Particularly since Pfizer is notorious for ripping off governments around the world both on taxes and on the prices of drugs it sells.”

Maybe you have not figured this out but EVERYONE who reads this blog knows you are a pathetic little liar. Krugman did not endorse Pfizer or globalization. He just noted some excellent writing from Chad Brown. And I noted above Krugman literally wrote the book on Irish transfer pricing games. Of course a little liar like you cannot even knowledge that.

I guess my pleas for you to stop polluting his blog the way you did to Economist View will go unheeded. But do know that the rest of you are either laughing at your stupid garbage or have just given up.

Gee a Big Pharma company charges obscene prices. Of course they do – they all do. And Krugman has noted this abusive monopoly power quite a lot. Of course a lying know nothing like JohnH thinks he is bringing to our attention something new? What’s next – the Taliban are nasty warlords. Who knew?

AND … the Pope is Catholic! Oh my!

Gee a Big Pharma company charges obscene prices. Of course they do – they all do. And Krugman has noted this abusive monopoly power quite a lot. Of course a lying know nothing like JohnH thinks he is bringing to our attention something new? What’s next – the Taliban are nasty warlords. Who knew?

AND … the Pope is Catholic! Oh my!

“Pfizer has hit the goldmine during Covid Crisis, alleged leaked contract shows appalling terms and conditions”

Quoting Gomer Pyle – “surprise, surprise, surprise”. Of course an intelligent person could have checked the 10-K filing for Moderna to see how low production costs are relative to revenue and how little selling expenses are. http://www.sec.gov makes this SO easy but again the research impaired JohnH has never figured this out either.

In the first 6 months of 2021 Moderna has generated $6.3 billion in vaccine revenue with production costs less than $950 million and selling costs less than $200 million. Yes obscene profits for any one to see if one knows how to check http://www.sec.gov.

But JohnH needs some leaked document to realize the obvious. He is indeed that stupid!

pgl,

For the record, while I remain critical that PK got the Nobel without Dixit or Fujita, I am not remotely supporting or endorsing this string of nonsensical drivel that JohnH is spouting about him. Clearly JohnH is just this die hard protectionist scrambling to justify his poor arguments and trying to slam Krugman as a prominent defender of global free trade, although he has long offered exceptions and doubts and exceptions to that case, generally reasonable, a fact that JohnH fails to admit or recognize, just repeating indefensible nonsense about this.

There are some economists who are die hard defenders of free trade and we never hear JohnH going after them. Of course Greg Mankiw did not support Hillary Clinton for President as he is a George W. Bush kind of guy. And something tells me that Greg has never kicked JohnH’s dog either.

Krugman’s piece that monopoly power was pointed out to JohnH but of course this troll dismissed it because it was written for the Irish Times. OK, here is a 2018 piece he wrote for the NYTimes that specifically addressed pharmaceutical pricing:

https://www.nytimes.com/2018/05/12/opinion/whats-good-for-pharma-isnt-good-for-america-wonkish.html

Krugman is crystal clear that high pharma prices is not good for America. But of course JohnH will find some way of dismissing this too. He always does as JohnH has zero integrity.

Funny, I didn’t see Krugman linking to this article in his unabashed praise for Pfizer’s supply chain. But balanced analysis was not his goal here.

“JohnH

August 9, 2021 at 7:21 pm

Funny, I didn’t see Krugman linking to this article in his unabashed praise for Pfizer’s supply chain.”

Yes – JohnH is defending his indefensible nonsense with garbage like this. Whaty an idiot!

“i would argue new york city was the fool here. perhaps we need to revamp how localities can produce tax incentives.”

There is a simple solution for the destructive race to the bottom as cities compete to provide handouts to corporations. Congress can’t stop states and cities from doing stupid stuff. But they can simply tax all of these local incentives as income for federal corporate taxes.

Just as debt forgiveness is currently taxed as income, local tax forgiveness could be taxed as income. Just as local tax payments are treated as a federal tax deduction, their opposite, local tax incentives can be treated as federal taxable income. And the tax rate could be up to 100% if necessary.

Good luck getting Republicans to agree to tax increases for corporations, but there is nothing preventing tax increases from being included in a budget reconciliation bill.

https://pubs.aeaweb.org/doi/pdfplus/10.1257/aer.101.1.1

1977

Monopolistic Competition and Optimum Product Diversity

By Avinash K. Dixit and Joseph E. Stiglitz

Under monopolistic competition with differentiated goods and increasing returns to scale in each good, is there too much or too little product differentiation? This paper uses classical tools of microeconomics to answer this question, and in doing so, provides the foundation for an entire literature in which products are endogenous in number and attributes, and general equilibrium welfare analysis can be used to examine the consequences of tastes for variety. *

* https://www.aeaweb.org/aer/top20/67.3.297-308.pdf