EU officials attack Joe Biden over sky-high gas prices, weapons sales and trade as Vladimir Putin’s war threatens to destroy Western unity.

…“The fact is, if you look at it soberly, the country that is most profiting from this war is the U.S. because they are selling more gas and at higher prices, and because they are selling more weapons,” one senior official told POLITICO. ”

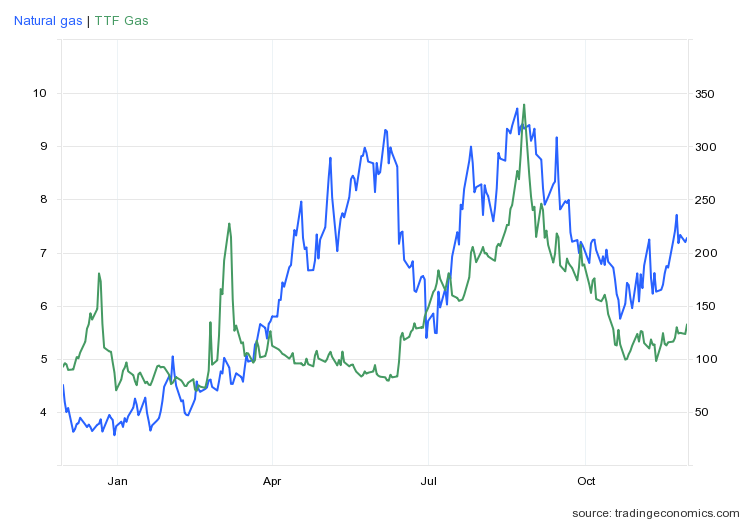

While the quote is taken verbatim from Politico, it is not clear to me that natural gas prices are sky-high in the European context. Here are data for US natural gas futures (blue line) vs. Dutch TFF futures (green line).

Figure 1: US natural gas, USD/MMbtu, (blue, left scale), and TTF natural gas, EUR/MWh (green, right axis). Source: Tradingeconomics.com, accessed 11/29/2022.

Prices are quoted in different units (Eur/MWh for TTF, USD/MMbtu for US), so a direct comparison is not possible. Still one can see TTF prices are much below what they were earlier in the year (although much higher than they were two years ago).

What about LNG. Here, as I’ve noted, markets are segmented because of capacity for transport and for conversion from liquid to gas form. EIA notes for the week ending 11/16:

International natural gas futures price movements were mixed this report week. According to Bloomberg Finance, L.P., weekly average futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased 85 cents to a weekly average of $27.06/MMBtu, and natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased 15 cents to a weekly average of $34.10/MMBtu.

Is this to be expected (as opposed to whether this is a “good” or “fair” outcome)? I’d say yes, given what we know about the market (see this post). The quote in the post is from Loureiro et al. (2022):

…[T]his study conducts growth convergence testing and clustering analysis on a panel comprised of four established gas price benchmarks and two emerging ones that expand up to the pre-Covid-19 period. The most significant finding is that no gas price convergence can be found outside Europe. This is despite the existence of episodes of partial convergence that are identified in the literature, and replicated and explained here. Importantly, the results strongly reject the postulate that increased LNG flows serve as a price-levelling arbitrage mechanism.

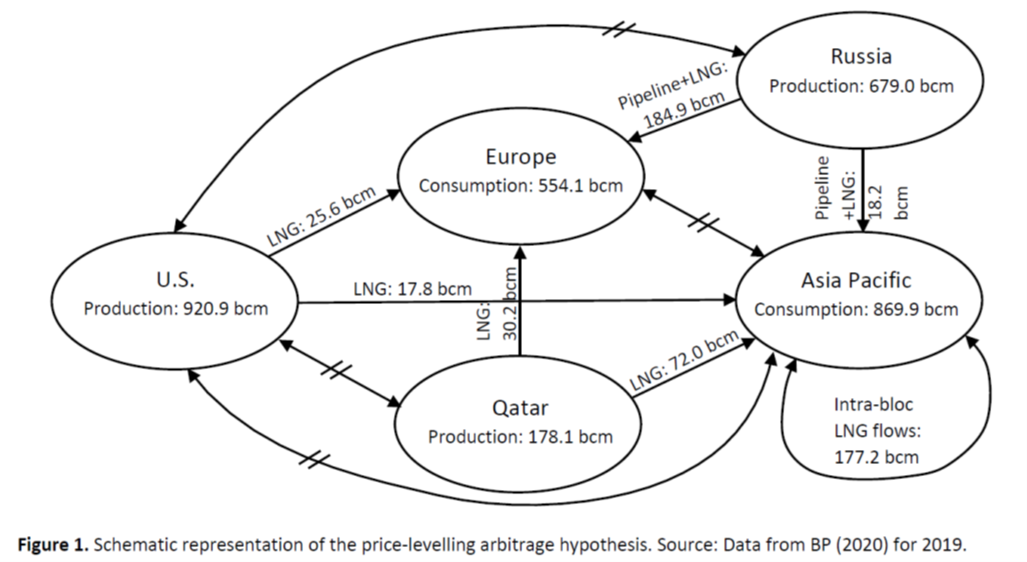

Once one sees the relative magnitudes of flows a few years earlier, one can see why price equalization would be unlikely.

Source: Loureiro et al. (2022)

* If you were wondering, yes, this is the same JohnH who has trouble determining where median real earnings data are located, what ONS data is reported, and doubts Ukrainian moves to take Kherson.

You have covered these markets before and we still see Bruce Hall getting just about everything wrong about what is happening and why. So why would we expect JohnH to get any of this right as JohnH’s Ph.D. is centered around getting everything wrong.

BTW I checked the financials for the largest US producer of LNG and it seems to be incurring losses of late. OK – neither Jonny boy nor Bruce Hall ever learned to read a 10K filing.

Fortune: “Energy profits soar

On Friday, Exxon Mobil and Chevron, the largest U.S. oil and gas companies, raced past analyst expectations with their quarterly profits.

Chevron posted $11.2 billion in third-quarter earnings, nearly double from the same period last year. Meanwhile, Exxon’s profit of $19.7 billion represented an even bigger 191% gain.

Shares in both companies are up at least 40% this year.

U.S. companies have benefited from Europe’s worsening energy crisis, sparked by the Ukraine War and Russian energy companies limiting natural gas flows to the continent, causing gas prices to hit all-time highs at one point. The U.S. has exported record amounts of liquefied natural gas (LNG) to Europe, with 70% of its LNG export capacity headed for the continent last month, up from 23% a year ago.

In Europe, TotalEnergies and Shell have also been able to rake in big profits, posting quarterly earnings of nearly $10 billion each on Thursday. For both companies, those profits were more than double over the same period last year.'”

https://fortune.com/2022/10/28/energy-crisis-big-oil-gas-profits-tech-meta-amazon-exxon-chevron-shell/

Yet pgl found one, single company that didn’t do so well…because of accounting losses related to futures contracts. Then he wants us to believe that Cheniere’s loss is indicative of an industry which to the contrary is actually making out like bandits! Just more of the usual BS from pgl…

Oil profits are high indeed. But dumbass – the topic was natural gas. I guess you do not know the difference between the two. Then again – you have proven you know nothing about everything.

Cheniere just happens to be the 2nd largest producer of natural gas in the entire world and the largest US company. But of course our lying troll disses it as just one little company. You’re an IDIOT.

JohnH recently claimed his preferred original sources but once again this lying troll relies on some incomplete Fortune article rather going to the published financials for companies like Exxon. His good buddy CoRev knows how to go to http://www.sec.gov even if he cannot be bothered to tell us what the financials of any company say.

Jonny boy – I went to the financials for Exxon which provides all sorts of nice details. Have you buddy CoRev help you out here.

Now for the latest full year, it seems that the sale of oil was five times the sale of natural gas.

Here is a little homework assignment. Check out their latest 10-Q and tell everyone how much of their operating profits came from oil versus natural gas. We’ll wait as this sound be a laugh riot.

‘because of accounting losses related to futures contracts’. Copying off other’s homework. Hey Jonny – I documented the overall operating loss for Cheniere for both 2021 and the 1st 9 months of 2022,

Your buddies did not tell you how much of this overall loss came from this particular factor. Be a good little boy and go read their financials and report on the segmented details. Oh wait – you do not know how to do so. Never mind. MORON!

Cheniere Energy sold $15,864 million of LNG in its last fiscal year (2021) but it incurred 16,565 million in operating costs for a loss just over $700 million. I went beyond their 10-K to examine their most recent 10-Q which shows for the first 9 months of 2022, its revenues were $ 24,343 million but its operating costs were 26,495 million for the same period. I guess the reporters that JohnH and Bruce Hall rely on for their stupid comments do not know how to check with http://www.sec.gov either. If they did – they might get supplying LNG to Europe costs a lot.

We can;pt trust Ole Bark, bark, since he lies so often. This time his lies is the “hide the pea” type. He could have provided the actual link: https://www.sec.gov/ix?doc=/Archives/edgar/data/3570/000000357022000024/lng-20211231.htm#icba087f137704406bcb0653c9cd6d8ea_328 or even: https://www.sec.gov/ix?doc=/Archives/edgar/data/3570/000000357022000106/lng-20220930.htm

But no! What he consistently does is: their stupid comments do not know how to check with http://www.sec.gov either. What level of inferiority requires him to act so stupidly/arrogantly?

And yet he is allowed to continue to comment here?

Did you have a point CoRev? Oh wow – you copied and pasted my reference to the ‘SEC but could not be bothered to tell us a single thing about this company. I said JohnH is an idiot – now he is but Barkley is right – you are the dumbest troll God ever created.

And yet he is allowed to continue to comment here?

I do see you are trying to get people who you do not agree with banned. Hey little CoRev – start your own blog. You will not have to ban me as I would not waste my time with something you posted.

@ pgl

Why not?? PhD Barkley has I am sure, nearly successfully, tried the same discussion killing stunt over two dozen times here. Apparently all tenure at james madison U gets a prof is power trips of “you disagree with me, you should be banned”. I bet it proves for very “open” and insightful discussion in a certain someone’s classroom.

https://www.aap.org/en/pages/2019-novel-coronavirus-covid-19-infections/children-and-covid-19-state-level-data-report/

November 24, 2022

Cumulative Number of Child COVID-19 Cases

As of November 24th, over 15 million children are reported to have tested positive for COVID-19 since the onset of the pandemic according to available state reports. About 115,200 of these cases have been added in the past 4 weeks. This week 29,400 child COVID-19 cases were reported. Over the past 7 weeks, weekly reported child cases have plateaued at an average of about 27,000 cases.

15,008,059 total child COVID-19 cases reported, and children represented 18.3% ( 15,008,059 / 82,129,310 ) of all cases

Overall rate: 19,940 cases per 100,000 children in the population

American Academy of Pediatrics

Children’s Hospital Association

https://www.worldometers.info/coronavirus/

November 28, 2022

Coronavirus

United States

Cases ( 100,507,928)

Deaths ( 1,104,879)

Deaths per million ( 3,300)

China

Cases ( 311,624)

Deaths ( 5,233)

Deaths per million ( 3.6)

Repeating –

ltr insists on planting the same stupid data about Covid deaths in comments here, day after day, along with off-topic stories about Chinese rainbows and lollipops. And unicorns – can’t forget the unicorns. China’s death rate from Covid is two orders of magnitude lower than the U.S. rate. Right. Sure.

It is obvious enough why Chinese and U.S. data show such different death rates from Covid. Worldometer, whence ltr derives data, relies on official sources. That means China’s government provides data on China, worldometer repeats it and ltr repeats that. Using a common data “source” gives the impression that data are comparable, but that’s not true.

Y’all remember when information about Covid was first becoming available? One thing we learned about was “co-morbidity”, medical conditions which increase the harm caused by some other medical condition. Covid is mostly not a solitary killer. Obesity, geriatric conditions, heart disease, black-lung, asbestosis…y’all know the list. China simply attributes death to other causes than Covid to an in order to claim that so-called zero Covid policies work. I submit that China cooking the data is the most parsimonious explanation for the steaming pile of nonsense ltr relentlessly dumps here.

Or we could say “The heck with persimmons! Never liked ’em, anyway.” We could assume that Chinese folk are so genetically different from everyone else that they just naturally survive Covid is greater than everyone elses. But that would be racist. Heaven knows, we wouldn’t want to be racist. So, to avoid racism, we have to conclude that China lies, day after day, about Covid deaths. Which means we must also conclude that ltr lies day after day.

But we already knew that.

Are you able to contribute something relevant to the topic under discussion?

Or are you simply fullfilling your daily quota for spam?

BTW Have you got already instructions how to handle the Covi issue in China? Or are you still flying blind?

There were 5,226 coronavirus deaths in China on May 26, 2022.

There were no deaths from May 26 for nearly 6 months till November 20.

From November 20 through November 30, there were 7 deaths, bringing the total from 5,226 to 5,233.

During the nearly 6 months of no coronavirus deaths in China, there were 300 to 500 coronavirus deaths each day in the United States.

“There were no deaths from May 26 for nearly 6 months till November 20.”

i know for a fact of at least one death in china caused by covid19. this makes the assertions from ltr false. they are incorrect.

ltr,

40,000 cases a day now, but no deaths? Sorry this is not remotely credible.

Of course, if it is true, then the current version of Covid attacking China is not a problem and the lockdown policies that are killing lots of people for other reasons and are clearly extremely unpopular in the nation should be ended.

The November 24th data on children was published on November 29; delayed because of the Thanksgiving holiday and celebration.

“Prices are quoted in different units (Eur/MWh for TTF, USD/MMbtu for US), so a direct comparison is not possible.”

It’s possible. See the graph. https://www.princetonpolicy.com/ppa-blog/2022/11/29/dutch-ttf-gas-prices-in-dollars-per-mmbtu

The TTF price is currently around $37 / mmbtu, compared to the 2018-2021 average of just over $5. The US HH Nymex price is $6.70 compared to about $2.50 / mmbtu from 2015-2021.

Now, gas prices started rising in Q3 of last year, but they really took off with the start of the war. I think we can conclude that the war has indeed made gas prices

‘sky high’ for most of the year and continue to do so to a lesser extent today.

It is fair to claim that gas suppliers, including both Russia and the US, have seen considerable profits during this period. If Russia reduces supply, then obviously prices will go up and alternate suppliers will see bigger profits. That’s straight forward.

Similarly, wars are fought with weapons and ammunition. These must be purchased at a time when supplies may be limited, again ensuring high profits for suppliers.

On the other hand, for the US as a whole, it is out about $100 bn financing the war to date, and budget 2-3x that over the next few years. So it’s not a cheap venture for either the Federal budget or taxpayers.

But wars are typically not fought in traditional cost-benefit terms. If Russia is defeated, the money will have been well worth it. If not, then the effort was arguably not worth a cent.

I don’t see how the US could have stood by while Russia invaded Ukraine.

Steven Kopits: Thanks for the calculation. What I meant was that one couldn’t directly compare using the graph I posted.

You’re welcome. It’s a bit of a pain to do TTF to Nymex. I’m doing a piece on the Russian oil sanctions and had to suffer through the conversion, so I happened to have it handy.

Doesn’t FRED report EU v, Henry Hub prices in the same dimension?

They do, on a monthly basis. But as of today, the latest data is as of Oct. 1, which is effectively two months out of date.

“It is fair to claim that gas suppliers, including both Russia and the US, have seen considerable profits during this period.”

I noted the financials for the largest US exporter of LNG and this company has been reporting operating losses. I noted Bruce Hall and JohnH never learned to read financials at http://www.sec.gov but I thought an energy consultant could do so. Maybe not.

I believe the company to which you refer is Cheniere. Their revenues doubled in the nine months to Sept. 30, but the company did in fact report a large loss. Here’s how they explain it:

Our consolidated net loss was $3.5 billion and $4.8 billion for the three and nine months ended September 30, 2022, respectively, compared to net loss of $523 million and $263 million for the three and nine months ended September 30, 2021, respectively. Substantially all of the increase in net loss of $3.0 billion and $4.5 billion during the three and nine month comparable periods, respectively, was due to an increase in commodity derivatives losses from unfavorable changes in fair value and settlements of $3.2 billion and $4.8 billion between the periods, respectively…

They found themselves on the wrong side of some hedges, if I understand the situation correctly. Otherwise, they should have been making money hand over fist.

https://www.sec.gov/ix?doc=/Archives/edgar/data/1693317/000169331722000008/cch-20220930.htm#i099fb2dc19f14ec18f760699129e5f91_139

Well by golly. Some one here knows how to read SEC financial filings. I get you do not really want to be JohnH’s BFF but could you please do the poor boy a favor and teach him how to do so.

I have actually written parts of a few prospectuses and ran the legal teams doing the work on others.

“They found themselves on the wrong side of some hedges”

Well – hedging contracts are a major part of this business. Just ask Glencore (which BTW tell boy little JohnH they do not file with the SEC but their Annual Reports are publicly available).

if you want to ignore quarterly losses due to derivative hedges, then the same applies to profits. if there were any profits driven by those derivatives in other quarters, that should be ignored as well?

the fact is, they were not making money hand over fist. as a market investor, it raises a flag as to how competent management really is at the firm. they are paid good money to not be on the wrong side of a trade.

You are expecting JohnH to be consistent? You do not know Jonny boy very well!

Otherwise – an important point but remember Jonny boy is a professional liar.

BTW – this particular company has been reporting losses for all of 2021 and the first nine months of 2022. I asked CoRev and Jonny boy to identify the amount of the losses they wish to sweep under the table but neither one of these trolls can read a 10-K or a 10-Q.

I am not ignoring hedging losses, Baffs, only saying that these did not have anything to do with the underlying economics of the business, best I understand it. And, yes, oil companies can make and lose lots of money with hedges.

Steven Kopits

December 1, 2022 at 3:12 pm

I am not ignoring hedging losses, Baffs, only saying that these did not have anything to do with the underlying economics of the business

What a dodge. Look if you can do what I asked JohnH to do – take their financials and segment out the hedging losses from the operational side of their income statements, then maybe you might show us what this underlying economics looks like. But Jonny boy is incapable of even basic financial accounting. Now maybe you might take a shot using their 2021 10-K and 2022 10-Q but until you do – you have nothing but your usual smoke.

Quite arguing with Baffling and do some real analytical work – assuming you have a clue how to do so.

“only saying that these did not have anything to do with the underlying economics of the business”

I would disagree. these hedges were based on the current and future anticipated economics of the business. perhaps those changed, and it impacted the hedges. but people hedge because current economic conditions appear problematic. oil companies do not hedge as simply a financial investment. they do so in response to economics.

Tks, Steven.

As for the carping Europeans:

The only expenditure that [Germany] is increasing massively is military spending. A total of €58.6bn is budgeted for 2023—an increase of €8.2bn compared to last year;

Wow. €8.2bn! That’s almost as much as the US spends in Ukraine every month. The Germans are totally useless.

https://www.wsws.org/en/articles/2022/11/28/ovtr-n28.html

Could it be that your source is crap? 🙂

I do not dispute his source. But it should be noted that Stevie horribly misrepresented what his own link said. Of course this misreading of one’s own link is par for the course for both Bruce Hall and JohnH so Stevie has to join their little “game”.

Could it be that Germany is not pulling its weight? Germany should be able to whip the Russians with one hand tied behind its back. And Germany should be leading on the continent. Instead, it is hiding. It’s absolutely clear that Putin owns Orban. It I think the evidence suggests he owns Trump. And increasingly, it looks like he owns Scholz.

So where is Germany, Ulen? Germany should be taking the view that it is Europe’s leading power and therefore the primary driver for safety and security there. And yet it is so very weak, so feeble and indecisive. Britain, not Germany, is leading Europe. If not for Britain and the US, Ukraine would have fallen.

That’s the reality. To me, it’s pathetic. But not unique, alas.

Do you not know how to READ? You certainly suck at basic research. I guess you do not realize that US GDP is FIVE times that of Germany. But the dumbest consultant ever compares what we spend in defense to what Germany spends in a set of really STUPID comments about pulling their own weight? There is dumb but this is incredibly dumber than a rock.

To my point: Ben Hodges:

Need to find a source for Gepard ammunition. Swiss block delivery so far…but RheinMetall can produce it if German govt provides the necessary will, authority and funding.

https://twitter.com/general_ben/status/1597991464038170626

Stevie gets his information from some self important bozo on the Twitter? Damn – what a clown.

Former Commanding General USArmyEurope, Senior Advisor for @humanrights1st

, loves the Army Team, FSU football and the Atlanta Braves!

OK Ben Hodges is a Braves fan so he can’t be all that bad! But FSU football – yuck.

Of course being into sports in the neck of the woods I grew up in does not make one an expert on Putin’s invasion of Ukraine.

“Could it be that Germany is not pulling its weight? Germany should be able to whip the Russians with one hand tied behind its back. And Germany should be leading on the continent.”

Look, it may be a surprise for you but germany contributes to EU money, therefore, a decent discussion covers this.

Re German leadership: One day after the announcement of 100 billion EUR for the Bundeswehr you could find a comment by a member of RUSI which stated that Germany may need coaching. And the Oder floodings with assistance of the Bundeswehr in Polen was less than 20 years ago.

Did you learn anything?

It is always “funny” that people who obviously do not understand the situation in Europe make broad insulting suggestions.

I agree totally. But hey Ben Hodges is a Braves fan and so am I. Not that has a damn thing to do with Ukraine.

You are comparing an increase to a level? Dumb even for you.

“The 2023 budget passed in the German parliament on Friday is a declaration of war on working people. At its centre is a massive increase in military spending and extreme cuts in the areas of health, education, and social welfare.”

Stevie pooh dismisses this Reaganesque fiscal policy as having too little defense spending? Maybe he is too dumb to realize what the kiddies in preschool have already calculated. Defense spending will be around 6% of Germany’s GDP. Yes – Stevie pooh is the world’s most incompetent consultant.

https://www.statista.com/statistics/1303432/total-bilateral-aid-to-ukraine/

Why would anyone hire a “consultant” who is incapable of doing even basic research. The US may be sending a lot of military aid to Ukraine but it is not €8.2 billion. Germany is sending a fair amount of aid – in fact more per capita than the US.

And Germany’s 2023 annual budget (level not Stevie’s dumb rate of increase) for defense spending is more in absolute terms than what the US has sent in military aid so far. In fact, the German defense budget for 2023 is around 6% of its GDP.

So as usual Stevie goes off on a rant that proves only one thing – he cannot do even basic arithmetic.

US GDP on a PPP basis is 4.8x that of Germany. US military support is 23x that of Germany. British military support is 3.2x that of Germany.

…the German Economic Institute, a Cologne-based think tank, said that Berlin isn’t on course to hit the 2 percent benchmark [for 2023] despite the boost in funding. In a report, the institute notes that no extra cash has been committed for this year. Meanwhile in 2023, it sees a near-€18 billion shortfall despite an increase in outlays.

Government spending will continue to come just below target until 2027. At that point the special fund will be either used up, and defense spending will fall back to around 1.2 percent of GDP. If it’s still not all spent, then the preceding years will come in even further below target.

Pathetic.

https://www.politico.eu/article/germany-to-miss-2-percent-nato-defense-spending-target-think-tank/

‘US military support is 23x that of Germany.’

Source for this weirdly stated bloated claim. The US does spend 3.5% of GDP versus what Germany intends to which is 2% of GDP. WTF does you pull this 23x nonsense?

BTW – China’s defense spending is only 1.5% of its GDP so by your stupid standard – they are wimps.

Stevie “Steven Kopits

December 1, 2022 at 5:34 am

I am thrilled that China’s defense spending is 1.5% of GDP.”

Not the counter rebuttal from someone who gets it:

Look, the 2% argument or derivatives is usually used by stupid people for a stupid audience. The issue is about capabilities, if the spending efficiency is low, more money does not change this. Or from another POV: Germany should have a very decent force for less than 1.5% of GDP. Hint: This is even supported by US generals

Ulenspiegel

December 1, 2022 at 12:37 am

I guess Stevie is too dumb to get why the US military is concerned about China’s advancing abilities to use its research. Of course Stevie has shown himself totally incapable of basic 1st grade arithmetic so why should we expect the most incompetent consultant ever to get something like defense capabilities?

“Germany will fall short of its pledge to spend 2 percent of its GDP on its military, a leading economic think tank warned on Monday.”

And Japan’s ratio is only 1% but not a peep out of the troll you thinks Xi is a far greater threat than Putin. Oh wait – China

spends only 1.5% of GDP on defense. Wimps.

“Government spending will continue to come just below target until 2027. At that point the special fund will be either used up, and defense spending will fall back to around 1.2 percent of GDP. ”

Look, the 2% argument or derivatives is usually used by stupid people for a stupid audience. The issue is about capabilities, if the spending efficiency is low, more money does not change this. Or from another POV: Germany should have a very decent force for less than 1.5% of GDP. Hint: This is even supported by US generals. :-)))

Suggestions for you and others with your mindset: The internet provides high quality education, use it, you do not have to die stupid.

A few hours of youtube by the Australian Perun gives you enough hard data and basic understandings.

“Could it be that Germany is not pulling its weight? Germany should be able to whip the Russians with one hand tied behind its back. And Germany should be leading on the continent.”

Look, it may be a surprise for you but germany contributes to EU money, therefore, a decent discussion covers this.

Re German leadership: One day after the announcement of 100 billion EUR for the Bundeswehr you could find a comment by a member of RUSI which stated that Germany may need coaching. And the Oder floodings with assistance of the Bundeswehr in Polen was less than 20 years ago.

Did you learn anything?

It is always “funny” that people who obviously do not understand the situation in Europe make broad insulting suggestions.

Well, we could start with a little Gepard ammo. You think Germany could manage that little, itty bit? Or is even that too much for Deutschland?

I lived in Europe for 15 years, not that far from Germany and within the German orbit. So what? Germany is not pulling its weight. Germany should be leading on the continent, and it is not.

Btw, an announcement is not a disbursement. In the US , we have actually disbursed tens of billions. The Baltics and Poland are making huge efforts. But Germany? Not so much.

Wee correction. I was relying on a less than clear account for Germany’s GDP which is just under one billion Euros PER QUARTER. On an annualized basis, its GDP is closer to 4 billion Euros per quarter. Now the Germans are actually planning to spend 80 billion Euros per year (not Stevie’s stupid 8.2 billion) which would be 2% of GDP.

Now compare that to Japan which has a defense spending to GDP ratio of only 1%. Given how Stevie has told us what a monster Xi is – one would think he would be criticizing Japan not Germany. But he doesn’t which is beyond odd.

I am happy to criticize Japan, if you like.

Actually we have had enough of your bloviating. Unless you want to comment on China spending only 1.5% of its GDP on defense. I guess they are wimps by your idiotic reasoning.

I am thrilled that China’s defense spending is 1.5% of GDP. Now if they would only convert into a democracy…

pgl,

I believe that should be “trillions” rather than “billions,” a wee difference, regarding Germany’s GDP. You are correct, however, that with its boost in defense spending Germany will be spending about 2 percent of its GDP on defense in the coming several years.

The cold weather brings out the Dr. Evil in me.

About the pricing of liquid gas, the price of the gas as such seems to be less a problem than the infrastructure necessary to ship, store and deliver the gas. German home and business consumers of gas complain repeatedly about gas prices they pay but gas coming to Germany seems to be less of a price problem than storing and getting the gas to consumers. China has been building infrastructure for liquid gas and the effort necessary is impressive. Possibly then, gas pricing is more complex than simple price charts show.

https://news.cgtn.com/news/2022-11-29/Qatar-announces-first-major-gas-deal-with-Germany-1fmoPiW900E/index.html

November 29, 2022

Qatar announces first major gas deal with Germany

Qatar on Tuesday announced its first major deal to send liquefied natural gas to Germany as Europe scrambles to find alternatives to Russian energy sources.

Qatar’s Energy Minister Saad Sherida al-Kaabi said up to 2 million tonnes of gas a year would be sent for at least 15 years from 2026, and that state-run QatarEnergy was discussing other possible deals for Europe’s biggest economy.

Kaabi, who is also QatarEnergy’s chief executive, said so many European and Asian countries now wanted natural gas that he did not have enough negotiators to cope.

The talks for the latest deal took several months as Germany resisted the long-term contracts that Qatar typically demands to justify its massive investment in the industry.

The German government has been looking for new energy sources to ease energy pressure, and the latest deal will not help the country get through the looming winter.

The gas will be bought through U.S. firm ConocoPhillips, a long-term partner with QatarEnergy, and sent to a new terminal that Germany is hurrying to finish at Brunsbuttel.

“We are committed to contribute to the energy security of Germany and Europe at large,” Kaabi told a press conference after the signing ceremony with ConocoPhillips CEO Ryan Lance.

Lance hailed the accord as “a vital contribution to world energy security.”

Qatari officials would not discuss prices, but industry analysts have said Germany will have to pay a premium for the shorter contract and the hurried start to deliveries.

https://newseu.cgtn.com/news/2022-11-30/Germany-introduces-fuel-price-caps-as-some-struggle-to-cope-with-bills-1fmktiut0Ck/index.html

November 30, 2022

Germany introduces fuel price caps, as some struggle to cope with bills

By Peter Oliver

Berlin – Germany is set to introduce a cap on the cost of gas and electricity for households and businesses. The plan, which will cost Berlin just under $56 billion, will come into effect from March 2023 and subsidies will be paid retrospectively for January and February.

The German state will also pay a one-off subsidy covering gas bills for December. Despite the promised aid, some consumers have already been hit with price rises for their power.

It’s the letter many people in Germany have feared….

“Qatari officials would not discuss prices, but industry analysts have said Germany will have to pay a premium for the shorter contract and the hurried start to deliveries.”

Sounds reasonable to me but I guess JohnH will have to start a whole discussion of why we are attending their World Cup.

i was surprised when i looked up how long germany had been buying russia natural gas, it has been 50 years.

i read somewhere, maybe john kemp, that europe natural gas storage is about full, that might lower spot prices for a while. i do not think storage is as big part of natural gas supply than piping pressure.

today, api reported a larger than expected draw on crude stocks, but a modest increase in gasoline and distillate stocks

i prefer the eia weekly, tomorrow.

germany inked a deal for qatari lng, it commences in 2026 bc receiving and distribution infrastructure needs to be developed.

replacing russia natural gas will be investment intense and net higher recurring costs….

i doubt near term that significantly more usa lng will get to europe, a us terminal has been down as well.

I’d love to be a fly on the wall if and when Menzie explains his analysis to European leaders…or when those leaders try to explain sky high natural gas prices to their constituents.

I suspect that Europeans would do a very straightforward analysis and take historical prices as their base line. And from that reference point, prices are indeed sky high.

Worse, futures markets don’t show prices remaining at current levels until 2024. How much European industry will move offshore by then as a result? How high will unemployment go?

“We are really at a historic juncture,” the senior EU official said, arguing that the double hit of trade disruption from U.S. subsidies and high energy prices risks turning public opinion against both the war effort and the transatlantic alliance. “America needs to realize that public opinion is shifting in many EU countries.”

Another top official, the EU’s chief diplomat Josep Borrell, called on Washington to respond to European concerns. “Americans — our friends — take decisions which have an economic impact on us,” he said in an interview with POLITICO.

The U.S. rejected Europe’s complaints. “ [The usual tone-deaf response from the “diplomats” at the State Department.]

https://www.politico.eu/article/vladimir-putin-war-europe-ukraine-gas-inflation-reduction-act-ira-joe-biden-rift-west-eu-accuses-us-of-profiting-from-war/?mibextid=BUZLm6

Is blowback finally happening? The very thought that Politico would frame the article in terms of US war profiteering should send shivers down the backs of the borg.

You of all people should refrain from questioning our host’s presentation of data since you get just about everything wrong. Deliberate misrepresentation in some cases but in most cases attributable to the fact that you are dumber than a rock.

Since you have repeated that stupid political story about high profits for LNG companies, let me remind you of the FACTS:

pgl

November 29, 2022 at 2:01 pm

Cheniere Energy sold $15,864 million of LNG in its last fiscal year (2021) but it incurred 16,565 million in operating costs for a loss just over $700 million. I went beyond their 10-K to examine their most recent 10-Q which shows for the first 9 months of 2022, its revenues were $ 24,343 million but its operating costs were 26,495 million for the same period. I guess the reporters that JohnH and Bruce Hall rely on for their stupid comments do not know how to check with http://www.sec.gov either. If they did – they might get supplying LNG to Europe costs a lot.

Poor little Jonny – never learned to read financial filings.

EuroIntelligence: “Industry is really worried about IRA

“Whether you talk to European industrialists in Brussels or German industrialists in Berlin, you get the same message these days. They are really worried about the US inflation reduction act. At the BDI conference in Berlin, it was the dominant subject. FAZ quotes the president of the German federation of industry as saying that more than a fifth of German medium-sized companies they had polled were considering packing up and leaving the country. We cannot recall ever seeing such a figure. The main reason he cites are the high energy costs. Despite recent market moves, end user energy prices will not revert to the pre-war times on a sustained level. Many privately-owned industrial companies are operating at the limits of their pain thresholds with low profit margins. But it is one thing for a company to pull through a recession, with their owners forgoing income for a year, or for the owners to conclude that the business model is no longer viable in its current form. The German government’s gas price break is not going to make the difference between viability and non-viability. It will help struggling, but viable businesses to tide themselves over. The time horizon when cheap renewable energies will shift the viability calculations for companies is still outside all planning horizons, even for long-term oriented private company owners.”

https://www.eurointelligence.com/

Finger pointing has begun…and culprits beyond Putin are being identified…

Macroduck has already pointed out that normal trade disputes cannot be a justification for Putin’s war crimes. But nice job of ducking his excellent points so you can continue to excuse the genocide of innocent Ukranians.

“I suspect that Europeans would do a very straightforward analysis and take historical prices as their base line.”

Jonny boy thinks he is making a point but does he have a clue what a “very straightforward analysis” using historical prices as the base line even means. First of all, the general price level now is 2.33 times what it was back in 1990 when FRED’s EU natural gas series starts. So we must consider inflation adjusted terms.

And the idea that any commodity price has some historical base line is about as absurd an idea as it gets. Commodity prices are volatile and anyone who knows anything about commodity prices realizes a commodity boom started a generation ago.

But none of this comes to Jonny boy’s little brain as he suggests someone should do a “very straightforward analysis”. Yea – Jonny is as clueless as it gets!

“I suspect that Europeans would do a very straightforward analysis and take historical prices as their base line.”

Well Jonny several days later has not informed us how to do his “very straightforward analysis and take historical prices as their base line.”

Maybe he should do this for the Henry Hub price of natural gas:

https://fred.stlouisfed.org/series/mhhngsp

I provide this data to show my point about the volatility of commodity prices. Here in the US the price of natural gas is less than half of its nominal price back 17 years ago. If we inflation adjust this series, the situation gets even more dramatic.

So Jonny boy – please show us how you would do this “very straightforward analysis and take historical prices as their base line.”

Oh wait – you have no clue. Do you?

JohnH,

You have already told us about these quotes. Previously you described the Europeans making them as being “furious.” These do not look like that, troll.

Putin has taught his pet poodle to repeat the same lie over and over ignoring all else. The old Repeated Assertion trick.

Actually, futures markets DO show prices remaining at current levels until 2024.

Jonny boy thinks he has said something important about future markets but this lying troll cannot tell us what that price might be or WTF he has used as a source. It seem Goldman Sachs can and it ain’t consistent with the usual intellectual garbage from Jonny boy:

https://www.cnbc.com/2022/11/02/goldman-sachs-expects-european-gas-prices-to-tumble-30percent.html

The Dutch Title Transfer Facility (TTF) is Europe’s main benchmark for natural gas prices.

It traded at around 120 euros per megawatt hour on Tuesday.

Goldman Sachs expects that price to fall to 85 euros per megawatt hour in the first quarter of 2023.

This is how one writes when one wants to inform. Jonny boy writes unclear gibberish as his goal is to mislead.

“futures markets DO show prices remaining at current levels until 2024.”

Did you or did you not notice our host’s graph which shows that ‘current levels’ represent a 65% decrease since late summer of this year? I would ask you to learn to WRITE but I’m told by your preK teacher that you never learned to READ.

This should send shivers down the backs of the borg, too: “Less Than Half of U.S. Voters See Defense and Protection of Ukraine as America’s Responsibility”

https://morningconsult.com/tracking-the-russia-ukraine-crisis/

Apparently the gung-ho adventurism of most commenters here is not representative of American public opinion. So sad.

Lying about what you own link said (again):

Americans Remain Divided Over the U.S. Obligation to Ukraine: Roughly 2 in 5 U.S. voters (43%) say their government has a responsibility to protect and defend Ukraine from Russia, while 38% say it does not. There are stark partisan divisions on the question: 55% of Democrats believe America is obligated to protect Ukraine, compared with 33% of Republicans.

More people say it is our responsibility than said it was not. JohnH – serial liar.

JohnH,

But mote see it as US responsibility than do not, 43 to 38%. So there are some who are not sure. You really like to misrepresent things on this matter every chance you get, don’t you?

BTW, ever going to be any recognition out of you that Moscow is completely in violtion of international law with this invasion and that it has committed massive war crimes between thousands of civilians killed not to mention many people tortured and now many apparently kidnapped?

Thanks – JohnH tells so many blatant lies, it takes a Village to keep up.

pgl,

I have double checked on this matter, and I have to say that the link JohnH uses is really somewhat misleading. The poll on which the report is based is subtly skewed in its verbiage, with JohnH of course not informing us of this.

So the question the poll posed to people uses the word “responsible.” People are asked if the US is “responsible” for defending Ukraine from Russian invasion. It occurs to me that this is much stronger than asking if people “support” US helping Ukraine defend itself from Russian invasion. That use of “responsible” hints at a much stronger commitment than simply being willing to “support” such defense.

And indeed, googling found multiple sources reporting that the percent of the US population that at least as of mid-to-late October was willing to “support” Ukraine in defending itself from the Russian invasion exceeeded 70 percent, way more than the 43 percent figure JohnH reports that one gets when one asks if the US should be “responsible” for this.

So, some pretty serious misrepresentation here, yet again, by JohnH.

Thanks for the due diligence. We can take it as given – any claim by JohnH is either a total misrepresentation of his own source or some misleading garbage from someone employed by the Kremlin. JohnH has less integrity than even Tucker Carlson.

“So the question the poll posed to people uses the word “responsible.” People are asked if the US is “responsible” for defending Ukraine from Russian invasion. It occurs to me that this is much stronger than asking if people “support” US helping Ukraine defend itself from Russian invasion. That use of “responsible” hints at a much stronger commitment than simply being willing to “support” such defense.”

Permit me to expand on this but in a different direction. Princeton Steve is off on some strange tirade that Germany is “not pulling its weight”, which seems to come down to the premise that Germany is responsible for the defense of Ukraine. But as we all know – the reason why NATO was created was so its members can jointly participate in the defense of European nations from the potential aggression of the former Soviet Union or the current head of the Kremlin.

The US is one of many nations sending assistance to Ukraine. JohnH is peddling some garbage that the US does not support this by peddling off of questions that would suggest the US is the sole member of NATO expected to step up. Stevie on the other hand is criticizing Germany for not be solely responsible for the defense of Ukraine. Both propositions are utter garbage and an insult to NATO.

https://english.news.cn/20221130/bc48900deb024015a4f40f40033f6427/c.html

November 30, 2022

China launches Shenzhou-15 manned spaceship, realizing historic crew gathering in orbit

* China launched Shenzhou-15 on Tuesday night. The manned spaceship, atop the Long March-2F Y15 carrier rocket, blasted off from the Jiuquan Satellite Launch Center in northwest China at 11:08 p.m. (Beijing Time).

* The three astronauts aboard Shenzhou-15 entered the country’s space station and met with another astronaut trio on Wednesday, a historic gathering that added the manpower at the in-orbit space lab to six for the first time.

* The Shenzhou-15 mission will wrap up the last stage of the space station construction and kick off the first stage of its application and development.

By Liu Yiwei, Zhou Zhou and Quan Xiaoshu

JIUQUAN — The three astronauts aboard China’s Shenzhou-15 spaceship entered the country’s space station and met with another astronaut trio on Wednesday, a historic gathering that added the manpower at the in-orbit space lab to six for the first time.

China launched Shenzhou-15 on Tuesday night. The manned spaceship, atop the Long March-2F Y15 carrier rocket, blasted off from the Jiuquan Satellite Launch Center in northwest China at 11:08 p.m. (Beijing Time), according to the China Manned Space Agency (CMSA).

About 10 minutes after the launch, Shenzhou-15 separated from the rocket and entered its designated orbit.

At 5:42 a.m. Wednesday, the Shenzhou-15 spaceship conducted a fast automated rendezvous and docked with the front port of the space station’s Tianhe module. The space station was expanded to its largest configuration with three modules and three spaceships, having a total mass of nearly 100 tonnes.

At 7:33 a.m., Chen Dong, the commander of the Shenzhou-14 crew, opened the hatch. The three space station occupants greeted the new arrivals Fei Junlong, Deng Qingming and Zhang Lu with warm hugs and then they took a group picture with their thumbs up, shouting in chorus — “China’s space station is always worth looking forward to.”

The space reunion has kicked off the first in-orbit crew rotation in China’s space history, said the CMSA.

The rotation can verify the feasibility of the regular rotation mode that will follow, according to Gao Xu, a senior spaceship designer at the China Academy of Space Technology.

SIX ASTRONAUTS IN ORBIT

The Shenzhou-14 astronauts, who were sent to the space station in June, plan to complete the in-orbit work handover in about five days, and then return to the Dongfeng landing site in north China’s Inner Mongolia Autonomous Region.

During the rotation of the two groups, they will complete a work handover concerning the status of the space station combination and materials, as well as the experimental projects. Meanwhile, the Shenzhou-14 crew will continue to make preparations for their return, said Ji Qiming, assistant to the CMSA director, at a press conference on Monday….

Prices in Europe went crazy when it looked like they actually could end up with “running out” of gas and/or needing to rationing it this winter. However it was soon recognized that this kind of disaster would not materialize. In the US prices went up because companies found it to be more profitable to convert our NG to LNG and ship it to Europe. If Europe get a better balance in needs and supply, they may not be willing to pay as much for US LNG and our prices may fall back further.

All true to a point. But note the Henry Hub price for natural gas never rose all that dramatically. I get Bruce Hall was all freaking out over this but we all know Kelly Anne Conway peddles Brucie all sorts of lies and Brucie does not seem to be bright enough to do his own research.

I’ve been reading Professors Chinn’s and Hamilton’s informative blog for a long time, and occasionally commenting as Left Coast Bernard. I especially enjoy when Prof. Chinn does real time estimating and analysis right before our eyes.

Most of the opinionated, argumentative, and knowledgeable commenters post anonymously, and few tell us about themselves.

I wonder if you would tell us something about yourselves to help other readers judge the source of the information and views that you confidently express. This could be done while remaining anonymous.

Something like this: I’m a retired physicist and lifelong amateur student of economics, history, and current events. Cornell Prof. Alfred Kahn taught my econ 101 course, which used Samuelson’s text. These days I live near Tampa, and I’ve been teaching physics part-time at the U of Tampa and next semester at the U of South Florida. Most of my comments on this site are questions addressed to Prof. Chinn and Prof. Hamilton, but I appreciated that I also received replies from some commenters.

I think that the experience of reading this blog would be improved if commenters would spend less effort insulting one another.

BL rightly says: “I think that the experience of reading this blog would be improved if commenters would spend less effort insulting one another.” And yet those most hateful and derogatory comments continue.

Why?

Do you know what is the most insulting thing in this comment section? Your incessant lies. Now I get you want the rest of us banned so you can lie with impunity but you are the one who would be banned by most economist blogs.

But do continue with your tirade of incessant insulting our intelligence.

https://www.worldometers.info/coronavirus/

November 29, 2022

Coronavirus

New York

Cases ( 6,546,944)

Deaths ( 74,125)

Deaths per million ( 3,810)

China

Cases ( 315,248)

Deaths ( 5,233)

Deaths per million ( 3.6)

https://www.worldometers.info/coronavirus/

November 29, 2022

Coronavirus

Germany

Cases ( 36,463,485)

Deaths ( 157,791)

Deaths per million ( 1,881)

China

Cases ( 315,248)

Deaths ( 5,233)

Deaths per million ( 3.6)

There were 5,226 coronavirus deaths in China on May 26, 2022.

There were no deaths from May 26 for nearly 6 months till November 20.

From November 20 through November 30, there were 7 deaths in China, bringing the total from 5,226 to 5,233.

During the nearly 6 months of no coronavirus deaths in China, there were 300 to 500 coronavirus deaths each day in the United States.

There have been 1,105,049 coronavirus deaths in the US through November 29.

https://news.cgtn.com/news/2022-05-27/Chinese-mainland-records-102-new-confirmed-COVID-19-cases-1amUW6S96Bq/index.html

May 27, 2022

Chinese mainland records 102 new confirmed COVID-19 cases

The cumulative number of confirmed cases on the Chinese mainland is 223,837, with the death toll from COVID-19 standing at 5,226.

https://news.cgtn.com/news/2022-11-20/Chinese-mainland-records-2-267-new-confirmed-COVID-19-cases-1f6H3qEMe7m/index.html

November 20, 2022

Chinese mainland records 2,267 new confirmed COVID-19 cases

The cumulative number of confirmed cases on the Chinese mainland is 286,197, with the death toll from COVID-19 standing at 5,227.

https://news.cgtn.com/news/2022-11-29/Chinese-mainland-records-3-624-new-confirmed-COVID-19-cases-1flCEinU5XO/index.html

November 30, 2022

Chinese mainland records 4,288 new confirmed COVID-19 cases

The cumulative number of confirmed cases on the Chinese mainland is 319,536, with the death toll from COVID-19 at 5,233.

https://www.worldometers.info/coronavirus/

November 29, 2022

Coronavirus

France

Cases ( 37,778,417)

Deaths ( 158,859)

Deaths per million ( 2,422)

China

Cases ( 315,248)

Deaths ( 5,233)

Deaths per million ( 3.6)

If you can buy futures low and sell them high as they rise to spot, why do future prices indicate anything but psychological noise?

Are you taking financial economics from the same drunk homeless moron that has taught Econned all he knows?

rsm,

Well, you cannot always do that, as often the futures price ends up being higher than the realized actual future spot price when it arrives. Indeed there is probability involved in all this, although calling it “noise” overstates what is going on. Indeed, curiously, if it were always the case that realized future spot prices exceed current futures (or “forward”) prices, this would be far less “noisy” than what we see where such future spot prices are often below current futures prices.

What is seriously noisy are your comments about “noise,” rsm.

Do you know what is the most insulting thing in this comment section? Your incessant lies. Now I get you want the rest of us banned so you can lie with impunity but you are the one who would be banned by most economist blogs.

But do continue with your tirade of incessant insulting our intelligence.

Judging by the latest garbage from Econned, it strikes me that rsm has been trying to teach JohnH financial economics. Now I get rsm is incompetent at financial economics but Econned seems to have “learned” from him.

Natural gas tends to be extremely regional. Once LNG export capacity is filled, it doesn’t matter how much more the TTF increases, since the offtake is fixed. This is a very familiar concept to anyone who works in this industry. And a microeconomic insight. You can see this effect other places like with full pipelines creating persisent diffs between Waha and Henry Hub.

Another key (basic) insight in this industry is that it takes about 5 years (and several billions, but $$ are fluid) to build a liquefaction plant. Yet, I still Groundhog Day hear commenters wonder why plants aren’t FIDing, when spreads are momentarily high (as they are now). Basic economic insight is instead to look at the 5-10 futures market. Today is like looking 5 years in the past, from the standpoint of first sales!

Oil is global. Gas is regional. (In general, in general…pedants.) See here from minute 4:00 to 10:00:

https://www.csis.org/events/global-lng-market-outlook-too-many-sellers-not-enough-buyers

which is why the Freeport lng outage has tended to drive natural gas prices down since this summer. looks like perhaps January, the plant will be back in operation. if we have a cold winter, that could have some negative impacts on domestic natural gas prices.

FWIW, one of the major drivers of low gas prices in the US, last few years has been “associated gas”. This is gas that is essentially “free” from an oil project (which justifies its investment regardless of gas recovery). Lot of gas was being dumped based on oil production. If we were doing 15MM bopd, there’d be a lot of “ass gas” right now also. Of course, if you don’t like fossil fuels and want to keep it in the ground, fine. But markets are markets. Supply and demand function and dumping ass gas, lowers prices.

“and because they are selling more weapons,”

last I saw, the USA was giving billions of $$ to Ukraine for the war effort. I did not see them selling those weapons. now, there are some nations selling weapons to Russia. but that is not USA profiteering.

Thanks for noting this. I noticed this little lie from JohnH as well. I would love to see how the government accounting for how these weapons were paid for. I doubt the funding is coming from Ukrainians especially since Congress has to approve the appropriations. This point would seem rather obvious but that is not going to get in the way of JohnH from flat out lying about this. He lies about everything else.

maybe state and commerce book the aid as exports?

weapons: himars, m777, 120mm mortars, nasams, Nike… ‘stockpile release per blinken’. sent to Ukraine are sent from the army, or marine corps assets, either possessed by units in garrison, or propositioned at the units planned forward operating base. no money changed hands until the congress appropriates and the dod buys replacements.

note some units may no longer be combat ready, for years,

for ammunition: arty rounds, anti aircraft missiles and all those ‘pods’ containing himars and anti tank rockets, they come from different appropriations and usual stored forward or in national stores separate from individual unit readiness measures.

an accounting entry might be made to take the weapons off unit to&e books, and a budget may be assembled to get $$ to replace the weapons, and go thru the appropriation process.

some weapons and pods are not currently in production, and some components, I.e. bill of material listed microcircuitry may be obsolete……

there are limits to provisioning an Industrial Age war……

“maybe state and commerce book the aid as exports?”

Maybe? You are guessing – which is not exactly an answer. If we sold equipment, it would be exports. But my understanding is that it is American taxpayers not Ukrainians who will pay for much of this equipment.

Ukraine cannot pay for a dimes worth of any gift. zelenski and the Kiev literal nationalists want the skim off a trillion of your bucks

guessing u pay taxes

if Americans are giving weapons to Ukraine, and then the us government is paying to replace those weapons in the usa arsenal, that is not profiteering by the usa.

Anonymous,

Wow, you really are into spelling the capital of Ukraine the Russian way, arent’ you, even after it has been pointed out to you that this is incorrect and inappropriate, essentially amounting to ongoing Russian propaganda here.

If you want anybody here to think you are anything other than out and out Putin troll like JohnH is, you will spell it “Kyiv,” not “Kiev.” But I gather from other comments of yours, you support the jihaidic invasion of Ukraine by Russia because Patriarch (not “metropol”) Kirill does so against those “schismatic orthodox” Greek Catholics in western Ukraine, whom, I guess, you as a Catholic do not like. Sheesh.