Some individuals keep on asserting that because something affects the growth rate of a variable for only one period that the impact on the variable in question lasts only one period [1] [2]. Here is an extremely simple exposition on why this belief is misguided.

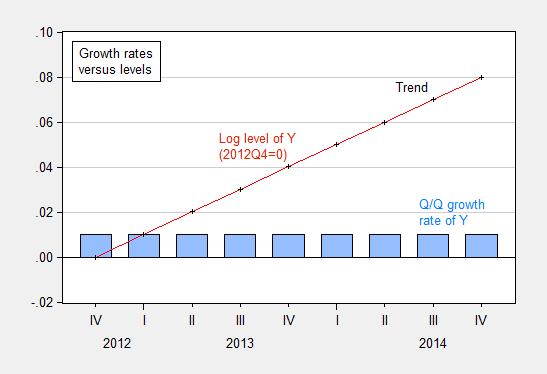

Suppose the growth rate (in log terms) is constant at 1% q/q (4% on an annualized basis); then the log level of the variable rises on a trend, as in Figure 1.

Figure 1: Growth rate q/q (blue bar), and log level (red), and trend (black +).

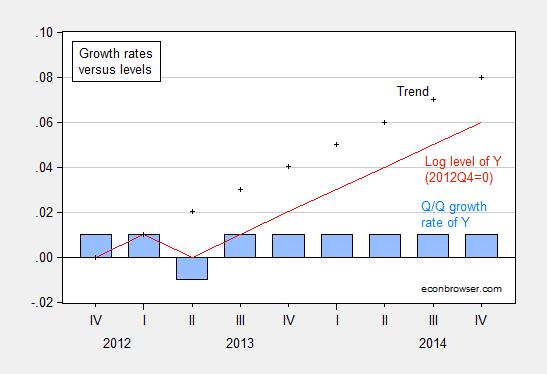

Suppose the growth rate drops by 2% q/q for one period, 2013Q2, but then reverts to 1%, thereafter, as in Figure 2. Notice then that output never reverts to pre-shock trend.

Figure 2: Growth rate q/q (blue bar), and log level (red), and trend (black +).

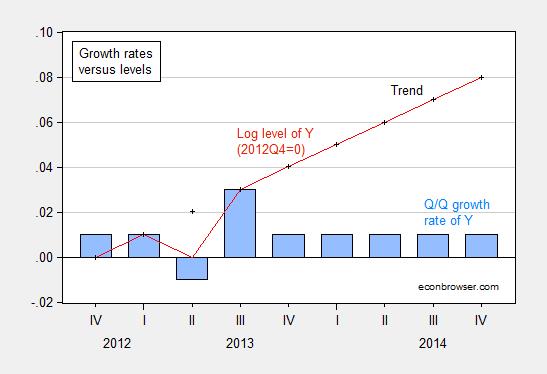

Only if the growth rate drops by 2% q/q one period and then rises by 2% one period, before reverting back to 1% growth rate, will the log level revert to trend, as in Figure 3.

Figure 3: Growth rate q/q (blue bar), and log level (red), and trend (black +).

So, what’s the relevance of this really simple exposition? Well, if one observes a large drop in the growth rate for one period, and then return to pre-shock growth rates, that does not mean that the impact on the level of the variable only lasts one period. In point, of fact, in this example, it is a permanent impact. Let the variable be real GDP, and the shock the sequester, and one has the real-world analogue.

If you feel like you have seen this distinction drawn in the past, you are correct; here is the relevant post from 5 years ago.

If the value falls 50% (e.g. 100 to 50), it has to rise 100% (i.e. 50 to 100) to get back.

Peak Trader: Not true for log levels, as indicated in paragraph 2, and legends to Figures 1, 2, and 3.

A very common example is reported profits on the stock exchange. The goal so often stated is an increasing trend of profits making a curve upward. But that can’t be sustained – unless you’re GE and for years manipulated GE Finance results to fake it – so you report a loss or even a significant drop in profits. You then build upwards from that lower mark and all is right with the stock. That loss is a restart of sort. It has amused me for decades that you can read “x periods of increasing profits except for a loss in y period” when that loss acted as a reset to lower the glowing trendline of increasing profits.

Right.

Now if you take Fig. 1 from your last post, you can see the GDP line close right back up on trend two Qs later.

As I understand it, in general, it is assumed that there will be catch-up growth after a recession, stimulus or not. This time around, there wasn’t such a catch-up, prompting the whole secular stagnation cottage industry (and yes, I read that wretched VoxEU piece). And then, even with the deficit falling in the US and the end of QEx, the US economy starts putting up serial 4% GDP growth quarters. So now we’re closing the potential GDP gap.

And why is that? Well, I think we all know, don’t we? If that’s true, then US shale oil is driving global GDP. And that’s a big deal. A very big deal.

Steven Kopits Uh-oh, I think we’re coming perilously close to that old unit root (stochastic trend) versus deterministic trend argument from Nelson-Plosser daze. I think the consensus view is that over the long run potential GDP is driven by population growth and technology (broadly understood). And over the long run the economy is in equilibrium more often than it’s not, so observed GDP growth tracks with trend. But over the short run aggregate demand can sometimes fall below potential output; i.e., sometimes the economy experiences demand shocks. I don’t know of any economic theory that says the economy must endogenously generate offsetting positive demand shocks for every negative demand shocks. (Well, okay, I suppose some crackpot Austrian views might qualify, but I’m talking mainstream macro.) There may well be offsetting demand shocks, but they are almost universally seen as exogenous and not part of an endogenous growth process. And this is where your argument goes off the rails and, in fact, contradicts itself. On the one hand you’ve posited a theory that says the economy will naturally return to trend…and not just a return to trend growth rates, but a recovery of projected growth levels. In order to return to projected growth levels, there must be a positive shock that exceeds the trend growth rate. Then In your last paragraph you tell us that it is US shale oil that is driving global GDP; i.e., you are telling us that the recent above trend GDP growth rates are due to bountiful oil supplies. As I said, this contradicts your earlier argument that the economy endogenously recovers growth levels. Surplus oil is a positive exogenous shock. Sorry, but those two views are completely contradictory. You cannot simultaneously argue that the economy will recover growth levels on its own and then point to an exogenous oil shock as the reason why growth levels have recovered.

BTW, I think youmisunderstand the concept of “secular stagnation.” In the current context “secular stagnation” refers to chronically weak aggregate demand despite interest rates being at the zero lower bound. It’s a demand side problem, not a supply side problem.

The U.S. shale oil boom is endogenous growth – private sector technology meeting or anticipating “Peak Oil.”

It benefited U.S. producers and consumers, along with reducing oil imports, to raise U.S. GDP, ceteris paribus.

Of course, foreign oil producers and economies also influence oil prices.

OK, Anon, let’s take them one by one. I was thinking of GDP and population growth, and it occurred to me that I have a post on that, here: http://www.prienga.com/blog/2014/11/25/us-population-growth

You’ll see that population growth very much is a function of economic cycles. Any population will tend to expand until it reaches some binding constraint. GDP is one of those, as you can see pretty clearly on the associated graph.

Consequently, it is possible to consider population an endogenous variable even in the medium term. Culture, governance and technology can be considered exogenous, if you like.

“And this is where your argument goes off the rails and, in fact, contradicts itself. On the one hand you’ve posited a theory that says the economy will naturally return to trend…and not just a return to trend growth rates, but a recovery of projected growth levels. In order to return to projected growth levels, there must be a positive shock that exceeds the trend growth rate. ”

Yes, that’s correct. I think there is a typical expectation that there will be a recovery to GDP trend after a recession. There is normally a period of catch-up, and many–for instance, the Fed–had lamented a lack of such catch-up following the Great Recession. That’s why we had this whole ‘worst recovery ever’ debate.

“Then In your last paragraph you tell us that it is US shale oil that is driving global GDP; i.e., you are telling us that the recent above trend GDP growth rates are due to bountiful oil supplies. As I said, this contradicts your earlier argument that the economy endogenously recovers growth levels. Surplus oil is a positive exogenous shock.”

The global economy had not recovered earlier growth levels. Indeed, Europe still hasn’t (but it’s going to look a lot better). As I have stated before, a supply-constrained oil markets model is a binding constraint model. While the oil supply is a binding constraint, it will restrain GDP growth. And we’ve seen that. The IMF, Fed, OECD, pretty much everyone has seen GDP come in under their expectations since at least 2011, and no one really knows why. If you use a supply-constrained model, then the reason is oil.

Now, if the economy experiences a positive supply shock and the oil supply increases to unconstrained levels, then oil as a constraint goes away and the economy is able to catch-up until it hits another constraint, which could be labor, capital or something else. If it is a ‘normal’ constraint (eg, labor pool, cost of capital, etc.), then we would expect the economy to regain trend and grow at trend from thereon out. Hence, my assertion that the 2007 potential GDP trend line remains the correct one (barring future problems in the oil supply and assuming that one believes in the notion of potential GDP as a useful tool).

This is an important debate. If you believe Scott Sumner, low GDP growth is due to insufficient monetary accommodation. (I look at that argument here:

http://www.prienga.com/blog/2014/10/17/did-the-ecb-tank-the-euro-zone)

If you believe Menzie, it’s a lack of fiscal stimulus. (I consider that argument here: http://www.prienga.com/blog/2014/11/28/deficit-spending-and-gdp-growth)

If you believe me, it’s a lack of oil. (I haven’t really published on that. Well, buy the book.)

So, Scott is bemoaning a lack of aggression by the ECB. If that’s true, expect Euro problems to linger. On the other hand, if it’s oil, expect Europe to look much better, and in particular the PIGS to look really unexpectedly better. I have already stated that I expect the PIGS to out-perform the US in 2015, and the US just posted a 5.0% GDP quarter.

Now if you believe Menzie’s thesis in this very post, he’s saying that the effects of the sequester are lasting more than two quarters because it affects growth all the way out the curve (see Fig. 2 above). That could be, but it’s not compatible with a potential GDP model, because a potential GDP model is also a binding constraint model, ie, it is subject to some sort of natural speed limit which cannot be exceeded. And the data also says Menzie is wrong. Last two quarters have averaged over 4% GDP, so unless Menzie is going to say that potential GDP has increased, all we’re doing is catching up to the potential GDP trend line, and we’re doing it in a hurry.

If you believe me, we’re going to have 2-3 years of rapid catch-up, assuming no further problems with the oil supply (not a given). And we can do that without fiscal accommodation and without monetary accommodation—which we have already achieved, in fact. And that’s a huge difference in policy perspective between me and either Menzie or Scott.

Moreover, I have put on paper a prospective path by which we close up on potential GDP. In the linked post, I posit the form of trend recovery using, as a proxy, airline data with a forecast based on the 1986-1989 recovery following the collapse of oil prices in 1985, here: http://www.prienga.com/blog/2014/12/22/the-recovery-of-potential-gdp-for-menzie

To date, I think I am the only one to plot a path back to the 2007 potential GDP trend line.

So, if an increase in the minimum wage decreased economic mobility among low skilled workers, that could have tragic longer term consequences?

@Anonymous: “I think you misunderstand the concept of “secular stagnation.” In the current context “secular stagnation” refers to chronically weak aggregate demand despite interest rates being at the zero lower bound. It’s a demand side problem, not a supply side problem.”

Indeed, which is the characteristic of the current phase of the Long Wave, i.e., debt-deflationary regime or Schumpeterian depression, which central banks are leaning against desperately to avoid debt deflation that is required for a new demand-side inflationary LW Upwave to commence, which in turn requires an increase in the rate of growth of labor’s share of GDP vs. capital’s share, most particularly financial capital’s share. In fact, total net annual flows to the US financial sector equal or exceed annual growth of US nominal GDP, resulting in all future US output being pledged to the financial sector and, in turn, the rentier top 0.01-0.1% to 1%.

However, the problem is that developed countries’ labor share must compete in the so-called “tradable sectors” with (1) relative slave labor in Asia, the Americas, and now Africa and (2) accelerating automation, digitization, and virtualization of service labor, including eventually highly skilled service occupations, such as engineers, programmers, lawyers, doctors, and, one can hope, economists and economics professors, CEOs, hedge fund managers, and private equity plunderers.

If you read that VoxEU thing, you’ll see half a dozen or more definitions of secular stagnation. Coen Teulings and Richard Baldwin, who edited the aforementioned Secular Stagnation: Facts, Causes and Cures, write “Secular stagnation, we have learned, is an economist’s Rorschach Test. It means different things to different people.”

Tim Taylor has more here: http://conversableeconomist.blogspot.com/2014/08/the-secular-stagnation-controversy.html

By the way, it seems to me that Summers recanted his whole secular stagnation argument.

He writes in the FT (Sept. 2014, did I miss this?):

“[With 200k months job growth in the US], the unemployment rate would then fall to about 4 per cent by the end of 2016. While such a low unemployment rate is conceivable, it seems much more likely that employment growth would slow at some point, because of rising wage costs or policy actions, or because employers have difficulty finding workers. Then, the economy would be held back not by lack of demand but lack of supply potential.”

So which is the binding constraint? Supply or demand? If it is the supply of labor, then wages should rise, and Slugs will be happy. And if we have 4% GDP growth and a non-responsive labor supply, then all sorts of things could start to happen. But I think Summers is wrong (again). Labor force participation will pick up nicely.

http://www.ft.com/intl/cms/s/2/4be87390-352a-11e4-aa47-00144feabdc0.html#axzz3Ci7K7QKp

Patrick, we could consider cutting the minimum wage if we also dramatically cut or eliminate the regressive SS payroll tax on earned income, including self-employment, and devise an alternative progressive funding source for SS, as well as tax energy consumption and non-productive land resource rents progressively on the basis of net energy consumption per household(s) and non-productive holdings of financialized assets.

Taxing regressively earned income of the bottom 90%+ while favoring unearned income, including rentier hoarding of financial assets at no velocity and non-productive financial speculation, financial engineering, etc., is a disincentive to innovation, efficiency, investment, production, and labor product, including self-employment, and is bad economics for the bottom 90-99% AND for “capitalism”.

BC, how is this an answer to my question, which was, ‘So, if an increase in the minimum wage decreased economic mobility among low skilled workers, that could have tragic longer term consequences?’?

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

i guess you need to better qualify how the increase in minimum wage decreased economic mobility among low skilled workers. pretty strong statement there without proof. plenty of low skilled workers will gain from an increase in the minimum wage patrick. seems a straw man argument to me.

Patrick R. Sullivan: I’m making a distinction between growth rates and levels, in the context of the math, with stated assumptions. You’ve posited a hypothetical, wherein I do not know the assumptions regarding the data generating process.

By the way, I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Menzie

It is nice to see a simplified representation of the economy as you make in this post, but by implication, you are saying that somehow, someway, sometime, the real economy can be represented accurately by pure mathematics, which is just a fiction of hope and desire. It will not and can not happen.

To demonstrate, here is an alternative assumption, not greatly different from yours. Because of expectations that the increase in debt would continue to rise without check (no sequester), change Figure 1 above to q/q to .05% starting with the fourth period. But because the sequester does happen, Figure 2 remains the same. The trend in Figure 2 soon rises above the revised trend of Figure 1. This completely changes the consequence of the sequester you later allude to, that it has a permanent effect of lowering GDP.

It is all in the assumptions.

Ed

Ed Hanson: Trust me when I say no one in the academy thinks of me as being overly-mathematical. Only those who have little familiarity with math would think it so. So, to paraphrase, let me say: Those who cannot remember high school math are condemned to repeat their math errors…

So Menzie,

Is it all in the assumptions?

The US economy has “suffered” a sequester and two years of decreasing Federal budgets (austerity? oh the humanity). But the latest quarters of GDP have been rather good. Perhaps you should revisit your theories (or at least your assumptions) of the sequester. Just perhaps, even if it causes a short term dip in GDP growth rate, the resulting improvement of growth rate beyond expectations make it a good thing. Maybe, just maybe, less government is a very good thing.

Ed

Well Menzie, as I’ve pointed out to before, you’ve mastered the ‘red herring fallacy’. That’s not in dispute. Of course, I’ve given up on you ever answering the substantive question from lo those many months ago. Why do you keep embarrassing yourself by calling attention to that?

For today’s lump of coal in your stocking, Clemens and Wither deliver this;

http://econweb.ucsd.edu/~mwither/pdfs/Effects%20of%20Min%20Wage%20on%20Wages%20Employment%20and%20Earnings.pdf

‘… [federal] minimum wage increases reduced the national employment-to-population ratio by 0.7 percentage point between December 2006 and December 2012. …this accounts for 14 percent of the national decline in the employment-to population ratio over this period.

The severity of the recession accounting for the balance. Even more ominous;

‘ We also present evidence of the minimum wage’s effects on low-skilled workers’ economic mobility. We find that binding minimum wage increases significantly reduced the likelihood that low-skilled workers rose to what we characterize as lower middle class earnings. This curtailment of transitions into lower middle class earnings began to emerge roughly one year following initial declines in low wage employment. Reductions in upward mobility thus appear to follow reductions in access to opportunities for accumulating work experience.’

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Don’t ever change, Menzie. I’d have a lot less fun if you ever manned up and actually addressed a substantive question.

Patrick R. Sullivan: Thank you for your comment.

So…I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Patrick R. Sullivan The Clemens & Wither paper is a bit off topic and JDH has already had a post on it, but I’m wondering if you actually read the full paper and not just the abstract. I think Clemens & Wither are on pretty safe ground in claiming that a national minimum wage likely increased unemployment during the recession; however, their follow-on conclusion that low wage workers were also made worse off is pretty flimsy…and even they admit that it has some problems. For one thing, they implicitly make the rather implausible assumption that unemployed people in their late teens and early twenties just sit around all day vegetating and living in the parents’ basements. No doubt some do, but one hell of a lot of them use this period of involuntary unemployment to return to school and gain new skills. There is a very strong counter-cyclical relationship between unemployment and enrollment in higher education…particularly enrollment at community colleges. So Clemens & Wither are asking us to believe that an additional 2-4 years of education does not overcome the income losses due to lost accumulated work experience flipping burgers. Seriously? This is laughable on its face. Their extrapolation based on empirical evidence is unconvincing because it does not account for a shift dummy in education gains while people are unemployed. Their data set isn’t really long enough to capture all of this, so they just make some very strong (and implausible) assumptions and extrapolations. The hard truth is that teens finding low wage employment is one of the surest ways to derail a kid from going on to higher education. There’s a big difference between finding a minimum wage job after you start college and getting a minimum wage job as a teenager before starting college. The first experience is liberating; the latter is oftentimes an economic trap that dooms kids to permanent poverty.

Well, since I’ve quoted from the paper, and not the abstract, I’d think there would have been a clue there for you, Sluggo.

But, what’s your evidence for your belief that kids who can’t find a minimum wage job, instead go to college?

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Plenty of evidence. If you actually read the paper (as opposed to just cutting and pasting), then you should know that the authors were not talking about the unconditional effects of a minimum wage; they were talking about the effects of a national minimum wage conditioned on a deep recession. And we have long known that college enrollments are strongly counter-cyclical. That is, the availability of jobs right out of high school plays a big role in a young person’s decision of whether or not to enter the workforce versus going to school. For example, according to the US Census, college enrollments have fallen by about 1 million since 2011, with 463,000 of that in the last year. Anecdotally, I have a couple of brothers in academia who hire and fire adjunct professors and teaching assistants at a couple of large public universities, and the sharp drop in enrollments due to an improving economy was the subject of holiday dinner tables. Here’s a table that shows college enrollments for those between 18-24 up to year 2012. Remember, you have to subtract about another half-million since then to get to today’s estimated number.

http://nces.ed.gov/programs/digest/d13/tables/dt13_303.10.asp

Any fool can see that there is a strong counter-cyclical relationship, especially at 2-year community colleges. For example, college enrollments virtually flatlined in the go-go 1990s. It wasn’t until the first Bush recession that enrollments started to pick up again. And then things flattened out as the business cycle hit its peak in the mid-2000s. Along comes the Great Recession and enrollments surged again. Now enrollments are plunging. Obviously, many people who cannot find jobs right out of high school decide to go to school instead. Having a job increases the opportunity cost of going to school. Not having a job lowers the opportunity cost of going to school. This is well understood. A rise in the minimum wage that results in unemployment during a recession also lowers the opportunity cost of going to school. Most people young people who are unemployed because of structural or cyclical reasons don’t just disappear. Eventually they figure out that going back to school makes sense, if for no other reason than it will get their parents off their backs.

Actually it’s not at all easy to see a ‘strong counter-cyclical relationship’, in the table you provided, sluggo. Instead, I noticed a consist increase in college enrollment throughout the booming years of the 1980s and 90s. From 12.2 million in 1985 to 13.8 million in 1990 (prior to the recession that hit in the latter part of that year)

True, enrollment did continue to increase through the brief, mild recession. However after a slight decline in the early 90s it started increasing during the dot.com boom years. While the unemployment rate dropped to 4%, college enrollment hit 15.3 million in 2000 (the last year of the economic expansion that began way back in 1991).

Which doesn’t seem to support your narrative. Nor does the increase in enrollment from 16.6 million in 2002 (the first year of the Bush Boom) to 18.2 million in 2007 (before the Great Recession began).

Though I suppose it is progress to get someone here to acknowledge that raises in the minimum wage, do in fact decrease employment.

And, another thing, sluggo, did you notice footnote #17 in the Wither-Clemens paper?

My latest article in the UAE’s National:

http://www.thenational.ae/business/energy/past-has-lessons-for-turbulent-oil-market#full

Steven Kopits A couple of points need some clearing up. First, your neo-Malthusian theory about short-run population dynamics and the business cycle doesn’t quite work. For example, see Germany. And you forgot to account for a biological 9-month lag term in your analysis. The only plausible relationship has to do with immigration. A strong economy will tend to increase the population because of immigration, but of course that means some other country will be losing population.

Second, nothing in the Larry Summers article recants the “secular stagnation” hypothesis. “Secular stagnation” is not about persistent unemployment; it’s about the inability of the private economy to generate adequate aggregate demand on its own. Summers’ view is that we’ve been living in a world of “secular stagnation” since the first Bush recession. Summers argues that given all of the fiscal and monetary stimulus over the last 14 years, we should have seen a red hot economy teetering on 1979 style inflation. But that’s not what we see. Instead we see inflation that consistently falls below target despite Herculean efforts on the part of central banks. Also, Summers and Krugman have never argued that “secular stagnation” must be permanent. Their argument is simply that it is something that might last a generation or so, as in the case of Japan. As to “secular stagnation” being a Rorschach test, well, I think Larry Summers is entitled to define it his way since he’s the one who resurrected the concept. Being first does entitle him to some consideration.

Finally, I don’t think you’re quite getting this whole endogenous/exogenous thing. Oil shocks are exogenous. Technology shocks are exogenous. They are also random. When economists talk about an economy returning to trend, they usually mean something along the lines of an endogenous movement that returns the economy to some equilibrium path. And they are usually talking about returning to trend rates, not levels. If you want to return to some ex ante trend in terms of levels, then at some point the economy must exceed the trend growth rate. Now it is certainly possible for an economy to experience periods in which it exceeds its trend growth rate, but the point is that it’s very hard to cobble together a coherent model that does this endogenously. You almost always need some kind of exogenous positive shock. That shock could be a change in fiscal policy, or a regime change in monetary policy (e.g., a willingness to tolerate a higher inflation rate). Or it could be a drop in oil prices that has the effect of increasing net exports. My point is that in your arguments you keep slipping in these exogenous shocks through the back door and then having slipped them in, you try and argue that the economy returns to trend levels all on its own and without any need for exogenous shocks like fiscal policy.