Reader rtd states “it is virtually guaranteed that after a nation’s business cycle trough, that same nation’s employment growth will display an upward trend.” I thought this an interesting enough assertion that it merited additional investigation.

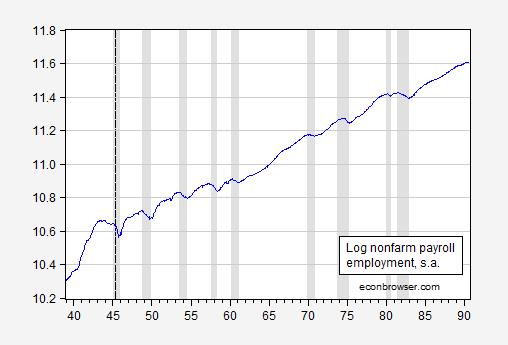

If one were looking at data in the US from the beginning of the nonfarm payroll series until the 1990-91 recession, this characterization would be apt, as shown in Figure 1.

Figure 1: Log nonfarm payroll employment (blue). NBER defined recession dates shaded gray. Long dashed line at end of WWII. Source: BLS via FRED, NBER and author’s calculations.

Employment rises almost immediately after the NBER defined troughs. Inspection of the recessions since 1990-91 exhibit a much different behavior. (On a side note, notice that employment declines with end of the war, with recession ending at 1945M10.)

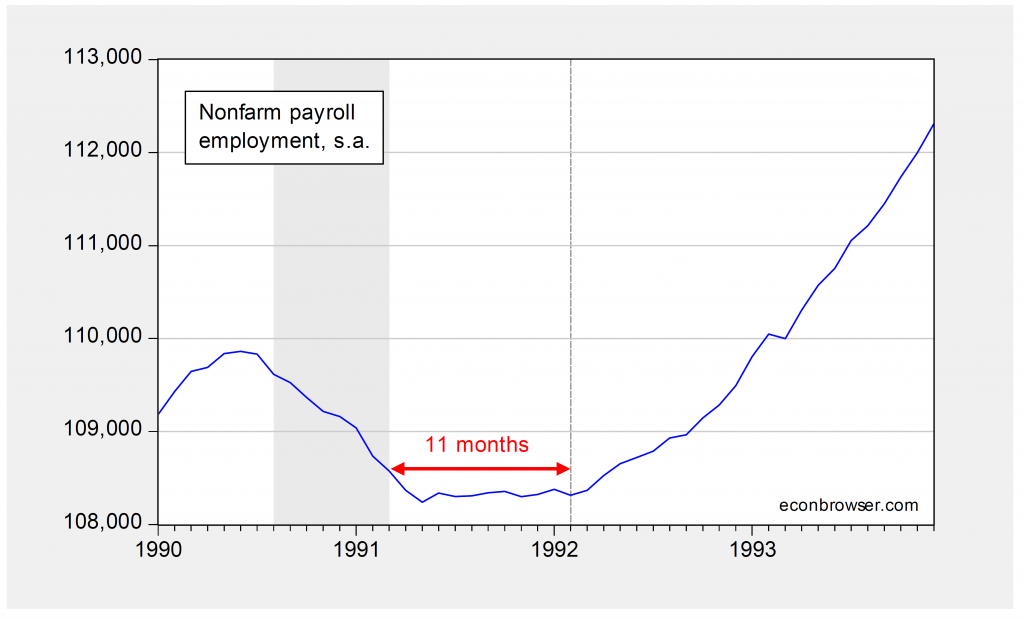

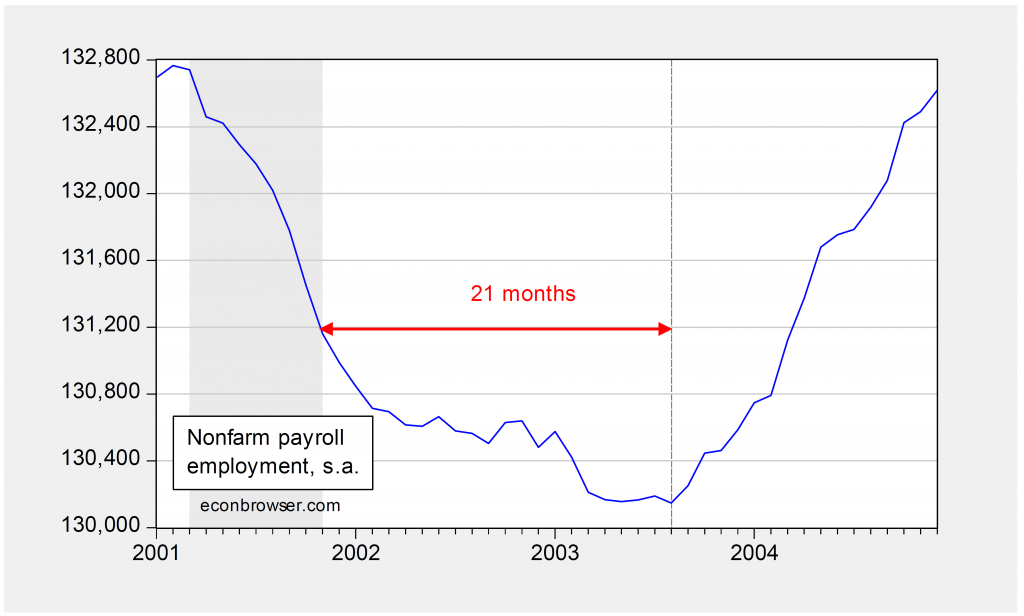

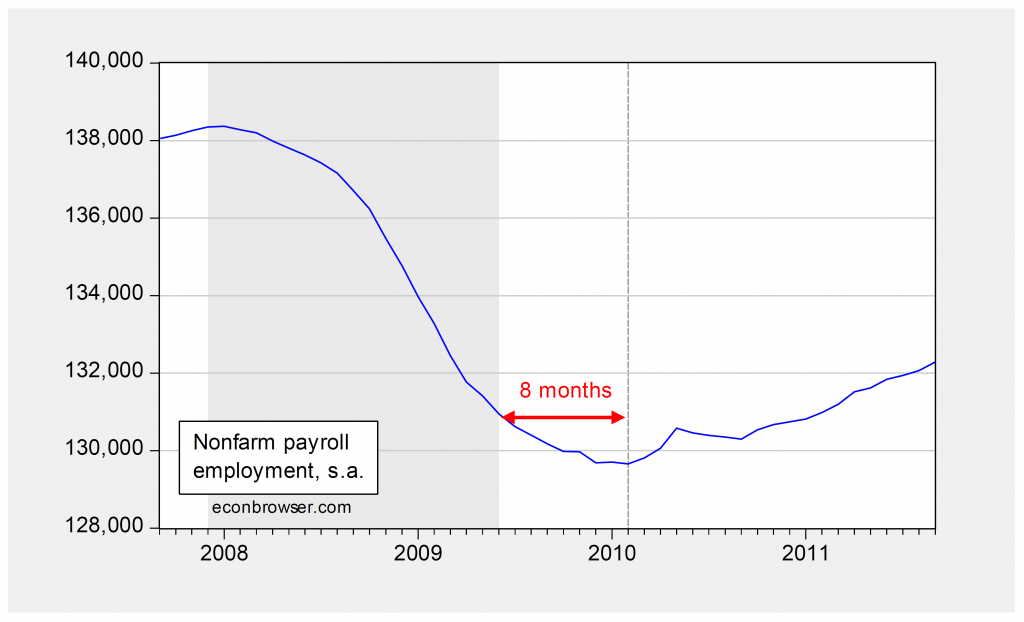

Now compare the behavior of nonfarm payroll employment after troughs of the last three recessions. There is a much delayed resumption of employment growth, as shown in Figures 2-4.

Figure 2: Nonfarm payroll employment, thousands, s.a., (blue). NBER defined recession dates shaded gray. Dashed line at employment trough. Red arrow indicates the 11 months between trough and increase in employment. Source: BLS and NBER.

Figure 3: Nonfarm payroll employment, thousands, s.a., (blue). NBER defined recession dates shaded gray. Dashed line at employment trough. Red arrow indicates the 21 months between trough and increase in employment. Source: BLS and NBER.

Figure 4: Nonfarm payroll employment, thousands, s.a., (blue). NBER defined recession dates shaded gray. Dashed line at employment trough. Red arrow indicates the 8 months between trough and increase in employment. Source: BLS and NBER.

On a side note, a similar delay (and smaller rebound) is apparent in Eurozone employment, as discussed in this post. In the UK, employment only exceeds the 2009Q3 level (end of the recession) in 2010Q2.

Menzi,

As you’re aware, my comment was based on a number of previously mentioned factors. Specifically that the two administrations that you were comparing each began in vastly different periods intra-business cycle in addition to differences in severity of downturn and monetary policies, among others. It’s also worth noting that with regards to employment growth trending upwards after recessions, I never once said anything about duration to trend. Moreover, and given this proper context, the subsequent graphs you’ve posted (also note the graph I linked to in the comment you’re referencing displayed the entire time series through the recent recession/recovery and didn’t cherry pick) don’t dispute my claim, that is unless you’re Presidents Harrison, Garfield, or Zachary Taylor – with a (current) maximum of 22 months from NBER trough to employment trough, my ‘characterization would be apt’ (as shown below).

Again, just for proper reference for those who weren’t following the blog post with my initial comment, here is my initial comment in its entirety:

“menzie, I can’t help but feel you are taking advantage of (some of) your readers with (constant) partisan posts such as this. Wether it is intentional or not, the ‘ceteris paribus’ implication in such graphs are misleading at worst and disingenuous at best. Someone with your credentials should know better than to compare job growth between theses two (or possibly any) administrations, unless there is an agenda. With one beginning near the trough of one of the worst economic downturns in modern history, it was virtually guaranteed an upward trend with the other administration experiencing the exact opposite – implying causation or relevance (to anything other than dogma) is absurd. On the other hand, maybe your implication is that central banks don’t matter at all.

This is Taylor, Cochrane, Krugman, Wolfers, DeLong-level myopic partisanship. IMO, you constantly taint the objective, rational, and meaningful conversations & analysis econbrowser is known for thanks to your upstanding co-blogger, Dr Hamilton.”

With regards to the Eurozone, my “characterization would be apt” would as well as properly quoted:

“…you’re taking Menzie’s approach assuming all else is equal. The Eurozone is a conglomerate of nations with varying fiscal policies, ideologies, cultures, and the list goes on and on. Please don’t compare apples with hand grenades.”

Thanks for the followup! Look forward to the continued dialogue.

I suppose it’ll take seeing another 10-15 years of data before economists of the advanced countries will finally admit : ” We’re all incompetent Japanese Keynesians now”.

http://www.washingtonpost.com/blogs/ezra-klein/files/2012/09/finanical-crises-employment-baseline.jpeg

Here’s an updated version of the graph you’ve linked to.

http://1.bp.blogspot.com/-rsrMgzyyBaQ/U5H_zyQIWVI/AAAAAAAAfTo/k4ULOB3Ir3c/s1600/finanacialcrises0514.png

My first impression of the reasons why for slower jobs recovery is the nanny-state policies making it easier and more comfortable to stay unemployed. When were unemployment benefit policies expanded? Is it the result or cause of slower recoveries? Dunno. Just asking.

CoRev: have you ever been unemployed? Have you ever spent any time with people who are? What role should government play to provide help to those who lose their jobs? How much comfort is there when benefits are far less than the wages earned before unemployment? Should a person who has a skill have his benefits cut if he or she has the opportunity for a non skilled job?

http://www.nber.org/papers/w20884

Robert Hurley: You ask these like they are rhetorical questions. My sister and my sister’s neice were both unemployed during the Great Recession. My sister remained unemployed for almost two years and enjoyed the time off as it gave her time to fix up her mom’s house and relax a little. She immediately got a job at Coca Cola (she lives in Little Rock, AR) almost down to the day that her UI benefits ran out. It was not a coincidence.

My sister’s neice, who is in her 20s and has a kid, was released from a bartending job and recieved UI for two years while working under the table at another resturaunt. She purchased a car and (and I am not making this up) a boob job during those two years.

Meanwhile, I was going in debt $75K and foregoing revenue from a job so that I could get a degree and get a job just to pay $15K in taxes each year, $15K that would be going to my wife’s law degree, which we will be taking on another $100K of debt for. So why do they deserve my money more than me and my wife? My wife and I started in the same position as them: broke with no help from anyone. So the real question is not “What role should government play to provide to those who lose their jobs?”, it is “Why do they deserve my money more than I do?” I personally don’t have problem with the taxes I pay, but I am not arrogant enough to believe that I should dictate how everyone else spends their money, unlike tax, tax, tax liberals.

anonymous, your first problem is your household acquired $175k in debt for education. were these degrees necessary? is the economic payoff real? but then again, years ago much of public education was actually subsidized by the states-for the economy’s benefit. unfortunately, many folks who received that benefit years ago do not feel the need to pay it forward. nevertheless, i have to question paying $100k for a law degree. there is a reason why so many law schools are struggling today-the future of law is not bright.

on a different note, it does appear certain members of your family never learned much about personal responsibility? i am sure folks such as ricardo and rick would have an opinion on them. but i am sure there are plenty of folks who use unemployment benefits responsibly, and shouldn’t be punished by the behavior of your family.

You asked “were these degrees necessary? is the economic payoff real?” in reference to two hard-working, motivated people using their own money and mortgaging their future to better themselves in the marketplace. The investment itself is tremendous motivation to succeed and they will continue to strive to achieve. On the other hand Obama wants to spend billions of tax dollars to GIVE away Community College AA degrees by the bushel; THAT is where it would be smart to demand “are these degrees necessary? is the economic payoff real? ” Do you think that the investment made by taxpayers is going to be respected and appreciated by the students engaged in taking classes that will provide them with a degree only useful to put on a wall? Or will it be just another give-away and opportunity to continue liberal indoctrination of students at the taxpayer expense? Liberals take note: this isn’t the sixties or seventies or eighties, we now have real data that giveaways and welfare inhibit job acquisition and slow or arrest departure from poverty; they were about 15% of Americans in poverty fifty years ago and about that today. The “Great Society” has failed miserably and the sooner we throttle down the spigot and reduce our spending, the faster the multi-generational welfare families can find jobs BECAUSE THEY HAVE TO.

baffling, So you are saying that I should ask myself whether or not a degree is a good investment, but that I should not ask myself if paying for someone else’s UI benefits for two years is a good investment. And liberals wonder why the average people think they are crazy. If someone takes my money, the impetus should be on them to prove to me that it is being spent well. Period. A lot of our money is spent well, but a lot of it is not spent well. I would love to have the money that is not spent well back in my pockets!

andre,

there exist many exceptionally talented individuals who will waste away that talent if not given the opportunity to at least start college. our economy loses when this potential is not tapped. that is a very important reason for opening up these gateways-knowledge and talent does not always reside in middle and upper class individuals-but those folks have natural pathways to college. many of the poor don’t have that opportunity. it would be a shame if the next bill gates never got out of his poor neighborhood because he could not afford to attend college-or even begin.

in addition, the talking points for the past number of years has leaned towards the need for a more educated work force. why would you not want to promote this need? it is what employers are asking for.

anonymous, i ask the question because you apparently are upset with your high debt burden, and consequently focus your outrage on others. you took on the burden. the question is, was it an economically good decision for you? i get the sense you have some buyers remorse. but you really need to understand, the unemployed are not the ones who gave you the high tuition for which you took out the loans. the high tuition results because some voters and politicians decided they no longer needed to subsidize your education-most likely after receiving their own subsidized education-think baby boomers. don’t get me wrong, i am in favor of obtaining higher education because of the multitude of benefits, socially and economically, it conveys to a person and community. but you really ought to reconsider who to “blame”.

“but that I should not ask myself if paying for someone else’s UI benefits for two years is a good investment. ”

absolutely in agreement you should ask that question. what did your sister and niece say when you explained to them how they were immoral for taking your tax money and wasting it away? i hope it was a serious and heartfelt discussion.

Anonymous: if you are laid off, would you apply for benefits? You made the statement that liberals dictate how everyone spends their money. Could you clarify ?

Liberals dictate that I, as a taxpayer, pay for two years of UI. Not sure what the confusion is.

Baffling, I am not unhappy with my debt burden, it was a good investment. I am unhappy that it would have been an even better investment if taxes were lower, which would be true on the margin if UI benefits did not reach two years. Again, liberals that support two years of UI, as you do, need to realize that is not free money and there are a lot of hardworking, debt-burdened people that have to pay for it.

anonymous, i think the burden is on you to show why your two irresponsible family members represent all of the long term unemployed, and as such policy should be written to address their behavior. on the other hand, we just went through a tremendous financial crisis lead by the financial geniuses of our country. there were many folks-i know them-who really had no options for employment for quite some time. now we can discuss if perhaps improvements can be made in the unemployment system-i agree improvements can be made-but to be honest your argument thus far is a bit selfish and immature with respect to a social community. someday you and your wife could be wearing the other shoe as well.

“Liberals dictate that I, as a taxpayer, pay for two years of UI. Not sure what the confusion is.”

i believe robert is asking if you would behave in the same manner as your sister and niece, if you too decided to accept unemployment benefits? because i am sure there would be somebody else out there upset at the way you were spending their tax money as well.

In my state the business pays into the unemployment fund – anywhere from 2% to around 9% of “base wages.” In good times the insurance fund is able to finance all the claims made and it is not “your” tax dollars that is funding the insurance payments. Of course this changed during the financial crisis as state UC funds ran short of money due to the nature of the crisis, and the feds put additional funds in state coffers. But the feds also gave out tax cuts, contracts for infrastructure projects, and other “stimulus” type measures.

I also have anecdotes. My sister as well. She was laid off late in the crisis. She did everything she could think of to get a job in her field. Her state was particularly bad but she had 2 kids in high school and one at the university so she did not feel like she could pick up and move. Eventually she maxed out. She took temp to hire jobs in customer service positions. I was a bit mad that she did not accept one offer for a full time job at $24K per year with no health benefits, but honestly she needed to earn more than that.

The family helped keep her home in the good school district, and her kids moving through their educations. Eventually she found a job in her field and is once again a productive taxpaying citizen. Now with one kid graduated and two at the state university.

Not only did she get some of “my” tax dollars, but her kids got some of my salary to keep them in school and we are lucky that our family is able to do this for each other.

The fact that your sister’s niece got her boobs fixed may not be the best optics, but hey, a plastic surgeon got paid, nurses were able to pay their mortgages, and the bra industry got a customer that needed a lot of new bras. It’s all stimulus, right?

Robert Hurley, the employment-population ratio is low and the number of part-time workers is high.

There’s too much unemployment and underemployment, for whatever reasons.

Right…

So we had a more than six year period where total jobs were lower than the previous high, ignoring population growth, yet it is the “nanny state” benefits that is keeping people out of jobs. Clearly, the economy would have been creating more jobs at a faster rate if unemployment benefits were eliminated.

Why did everyone duck the question?

Why do you think that is?

It looks like there may be an inverse relationship between the severity of the downturn (as represented in these three charts) and how it long it took for the NBER to announce a recession. The more severe = the faster the recession was announced.

I won’t argue with the calculations that define the “end of a recession”, but perhaps they are not inclusive enough. Just a thought.

Menzie, your post is just a lovely piece of work. Your appeals to reason and emotion are perfectly balanced and your writing is simple and clear.

BTW: Mitt Romney will try it one more time. This devil.

I guess Mitt Romney wasn’t simple and clear, Johnny.

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Yes Sully, thank god it will be against Jeb. This disgusting Romney could have been a real pain.

‘(On a side note, notice that employment declines with end of the war, with recession ending at 1945M10.)’

And then, with the drastic decrease in govt. spending, employment takes off! Why, you could almost call it a ‘boom’.

Patrick R. Sullivan: Except as government spending falls, the economy contracts…it does not immediately boom with private spending replacing government spending dollar for dollar, as you have implied in your various comments. If it had, one would have expected no deviation from the trend. Geez.

I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

‘Except as government spending falls, the economy contracts…’

Funny the NBER couldn’t find that in 1945.

Patrick R. Sullivan: The NBER indicates the contraction extended to 1945M10…

I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

Post 1945 also saw the ending of wage and price controls. Along with the baby boom wasn’t there an explosion of pent up demand?

This “I’m still waiting to hear you admit…” bit is like watching a two-year old throw a temper tantrum. You wait and think he’ll eventually tire himself out, but no, he just keeps crying and crying and crying.

Jeff, yup! It’s childish and boring.

CoRev Why did everyone duck the question?

I’m assuming you are referring to your question: “When were unemployment benefit policies expanded? Is it the result or cause of slower recoveries?”

Unemployment benefits were extended beyond the normal 26 weeks with the federal government picking up the extra cost after it became obvious that there were fewer jobs available than people looking for work. Any particular individual can increase his or her effort at finding a job, but it’s a zero sum game. Musical chairs. The alternative is crime, which most societies try to discourage. So extending benefits beyond the normal 26 week period makes sense morally. And it also makes sense as a macroeconomic matter. The goal is not just to shove people into jobs, it’s to use unemployment benefits as a way to maintain aggregate demand. When people are desperate to take a job that is far below their potential, that makes all of us worse off. It also reduces aggregate demand and slows the recovery. You need a balance. You don’t want people to stay out of the workforce too long because their skills diminish and they lose the discipline of the workplace. But you also don’t want carpenters, plumbers, welders and computer programmers accepting the first burger flipping job that comes along. That hurts both the longer run potential output curve and short run aggregate demand.

Keep in mind that the federal government’s extended unemployment benefits only apply to certain states that meet certain criteria. As economic conditions in a state improve, the federal government’s extended unemployment benefits come to an end.

There’s a new NBER paper that concludes the extended unemployment benefits increased unemployment because it discouraged people from looking for work after controlling for economic conditions. Some of this might be true, but I think the authors overstate their case. For one thing, their control is neighboring counties across state lines. Sounds reasonable, but they forgot that unemployment benefits are governed by the state in which you work and not the state in which you live. This is a problem in their study because many of the big county pairs are not as economically homogeneous as they assume. For example, they treat St. Louis and East St. Louis as economically the same. They’ve obviously never been to either city. They also misstate the goal. The purpose of the unemployment insurance program is not to reduce unemployment, but to give people the time to find the right job (a search problem) and to support aggregate demand. What the authors forget is a macroeconomic counterfactual. Suppose unemployment benefits did get cut off earlier. This may well have reduced unemployment, but it may also have slowed the recovery. Economic recovery is about recovering potential output, which is not quite the same thing as ensuring everyone finds a job in which that person earns less than his or her potential marginal product. The authors completely missed that point.

slug, i think many people who support shorter unemployment also support the resulting outcome in which lower wages occur. this is a primary driving force. as long as others are losing ground while the supporters maintain ground, relatively they have gained. at the end of the day it is these relative gains that drive this ideology.

Menzie,

This seems to be written (interestingly enough by another uberpartisan in econ) with you in mind.

“To make things worse, all the gladiators in this combat are looking at noisy time series data with very short samples, and making inferences about policy that might or might not operate with a lag, in an environment in which everything is changing at once. And the gladiators are free to pick out any data point that supports their thesis, and ignore the others.

A time-series econometrician would blanch if you presented her with that kind of analysis. She wouldn’t even give it the time of day. Instead, she’d do a historical study, using data as far back as she could go, instead of picking one or two recent points. She would have to use some theory to guide her along, too. And even then, her conclusions would come with huge uncertainty.”

rtd: The fact that you identify Noah Smith as an “uberpartisan” speaks volumes about your Weltanschauung.

Anyway, if you want conditioning, etc., let me refer you to this post, about relative economic performance under different presidential administrations. Recall that I did not say anything about the sources of differences in performance in my posts that you find so detestable.

The post you reference is (unsurprisingly) from your esteemed co-blogger, and not you. It’s amusing that you couldn’t find the time to at least reference this post in your initial “Private Employment under Obama and Bush” post. Instead, you purposefully ignore this and even worse, take a totally disingenuous approach. Your “Private Employment under Obama and Bush” post was sloppy and ideologically-driven.

However, it is interesting that you are now attributing employment under Obama as mostly good luck relative to BushII. Or, maybe you’re claiming it’s due to better oil shocks. Or possibly you’re attributing it to other (non-Presidential related) factors. However, I’m not betting on any of the above……………………….

rtd: As per your usual denseness, you miss my point; here are time series econometricians evaluating performance in presidential administrations, something you seemed to take issue with. You will note that the findings of Blinder and Watson are consistent with what I indicated in my post: a Democratic administration outperforms a Republican. Whatever causal interpretation you like is okay with me — I did not take a stand in my posts, and you projected your own views of what I meant. I would say you seem a little defensive, notwithstanding your protestations.

By the way, does Mark Watson (my first econometrics teacher!) count as a bona fide econometrician you book, despite evaluating performance during presidential administration, without conditioning?

First of all, what’s up with the personal attacks? You’ve again made my point re: your immaturity.

Second, you’re “I did not take a stand in my posts” is ridiculous. I stated in the past that you in fact, did not explicitly make a point but the implied points of your posts are crystal clear. And interestingly enough you’ve only now (that I can recall) stated this in our back and forth.

Regarding my being defensive: I think it is you, as someone who has devoted multiple blog postings to my calling you out (not to mention replying to nearly every comment), who is so defensive.

Another point, as I previously made clear, is the forum these data are introduced. The work by Watson & Blinder is an academic piece where their (capable) peers can evaluate their work. On the other hand, you are spewing your disingenuous ideology in a public forum with a greater likelihood of people taking it as meaningful or an honest analysis. Big difference.

Moreover, Blinder & Watson are clear:

“These three “luck” factors together (oil, productivity, and ICE) explain 46-62% of the 1.80 percentage point D-R growth gap. The rest remains, for now, a mystery of the still mostly- unexplored continent. The word “research,” taken literally, means search again. We invite other researchers to do so.”

Your rose-colored glasses would never allow you to mention ‘luck’ being attributed to the Obama administration. It should also be noted you aren’t following in the advice of your first econometrics teacher. Namely, actually taking their research further. But that wouldn’t fit your agenda(s).

Either way, your point here isn’t very relevant. It’s one thing to compare all administrations than just two. Anyone with basic stats realizes the biases that could arises in doing so. Plain and simple, you were being intellectually dishonest (akin to your recent post regarding the warmest year on record) in comparing two administrations facing drastically different environments, etc…….

Forgot to add link:

http://www.bloombergview.com/articles/2015-02-02/keynesians-market-monetarists-blog-for-economic-truth

I think this is a great display of my issue(s) with regards to your initial post (“Private Employment under Obama and Bush”).