The Wall Street Journal’s July survey results are out. The forecasted level of GDP is higher despite the deteriorating Covid-19 infection and fatality numbers.

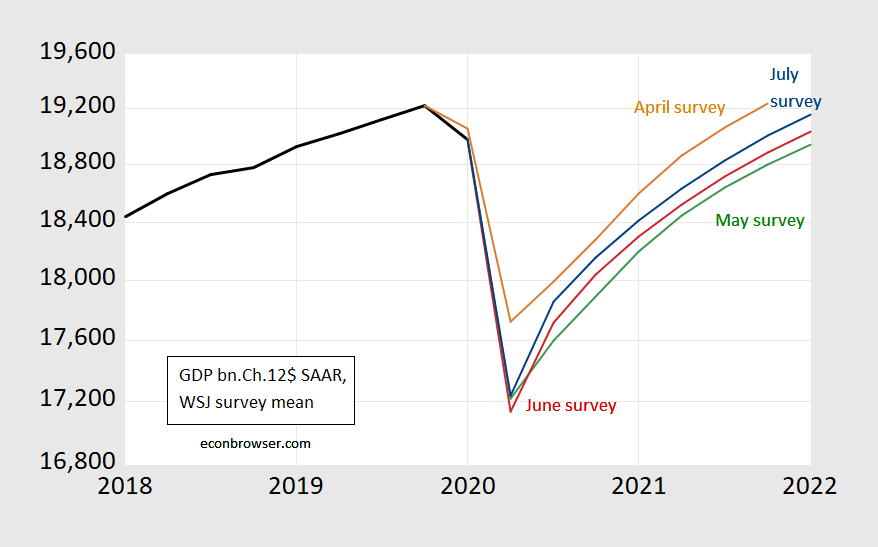

Figure 1: GDP, bn. Ch.2012$ SAAR (black), mean, from WSJ April survey (tan), May (green), June (red), and July survey (blue), all on log scale. Source: BEA, WSJ, various vintages, and author’s calculations.

It’s still the case that recovery to 2019Q4 levels – the prior peak — is not attained by 2022Q1 according to the mean response. This prediction is broadly consistent with the IGM/538 survey, which has a modal response for catchup taking place in 2021H2 (see here.)

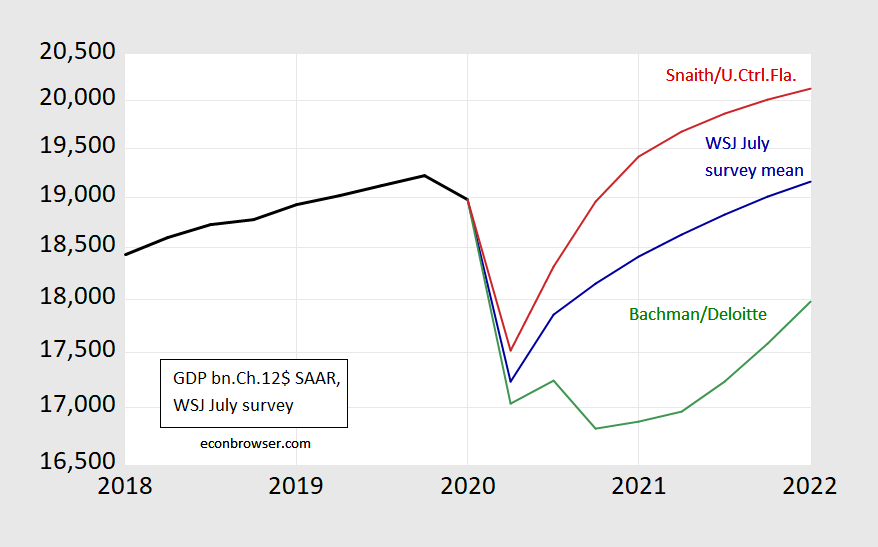

Despite the worsening outlook, there are few seeing a “W” in output; and the optimistic are pretty optimistic.

Figure 2: GDP in billions of Ch.2012$, SAAR, reported (black bold), WSJ July survey mean (blue), most “W” from Daniel Bachman at Deloitte (green), and one year most optimistic from Sean Snaith at University of Central Florida (red). Source: WSJ July survey, BEA, and author’s calculations.

Daniel Bachmann is also the most pessimistic for the outlook over the next year (through 2022Q1).

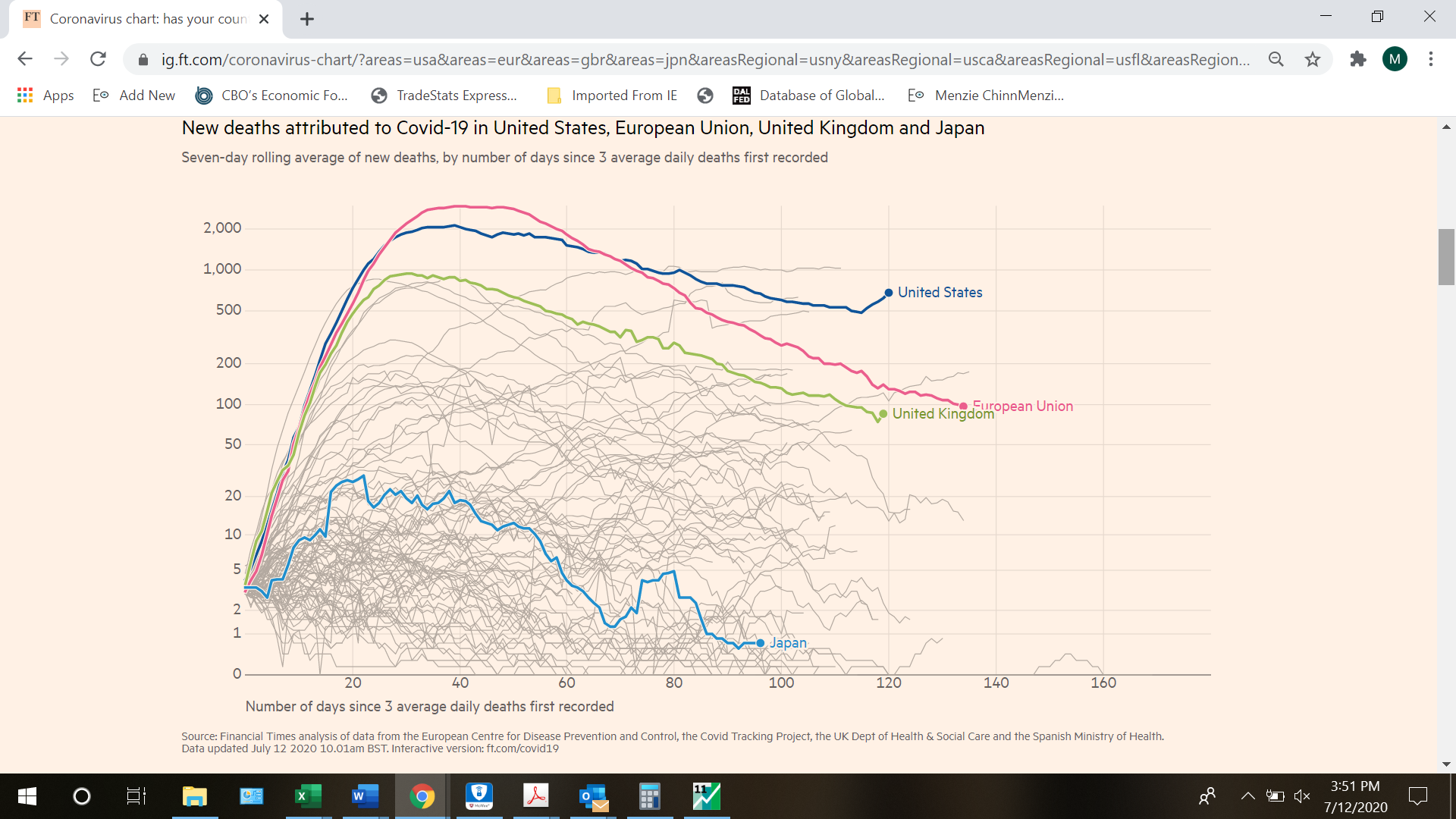

Here is a graph of fatalities through July 10, for the US as compared to other major economies.

Source: FT, accessed 7/12/2020.

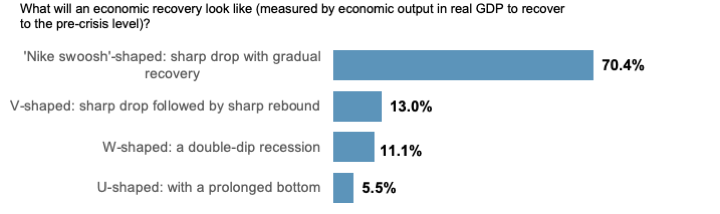

Addendum: Note that contra Kudlow, most economists are not anticipating a “V” recovery…

Kinda makes you wonder who the 13% are that are expecting a “V” shaped recovery.

Early on the V-recovery proponents had some jackasses in the Virginia region, thanks for asking. They dropped off a couple weeks after it was patently ridiculous. Sorry for using the word ridiculous.

Are you still calling for an “L” shaped pattern as you once were, Moses? I do not remember anybody else supporting you on that one. And I originally was supporting the “swoosh” or whatever that posited a slow initial bounceback to be followed by a pickup later, but now it looks like we are seeing a short-term near V bounceback to be followed by a slowdown, although nobody seems to have a letter or a math symbol or a logo or anything else to describe that pattern, which is clearly visible in all the figures Menzie shows here, although that latter slowdown part is still a forecast. We have not seen it yet.

So, when will you admit that you were more wrong than anybody else here with your “L” forecasr?

@ Barkley Junior

Why don’t you show the link, where I forecast an L-shaped recovery?? You’re going to be looking a long time for that link, because there is none on this blog. What I stated was, there had been more than one L shaped recovery in the past, with links to those periods—after you falsely said none had ever occurred in the past.

Let’s revisit the record of the forecasting impotence of Barkley Junior, shall we?? This gem from the great Barkley Rosser on June 17, a full 26 days prior:

“If this continues even somewhat, we may see what I had pompously dismissed numerous times here, that V-shaped recovery pattern, with most of the economics profession also being skeptical on this point. At the top of this surge are some sectors that may represent one-time buying, such as furniture. But other sectors may continue to see strong sales increases. This is the largest part of consumption, which is the largest part of GDP. It may well end up that growth in May and June will offset the sharp decline in April, leading to a situation of net positive GDP growth in the second quarter, and thus no recession in the journalistic sense of two consecutive quarters of net economic decline. “

https://econbrowser.com/archives/2020/06/business-cycle-indicators-june-16-2020#comment-237508

These permalinks make things so awkward for some people, don’t they??

Now, who would we guess on this blog (a blowhard perhaps??) has made multiple vague comments on macro issues before, to turn around and tell everyone that they were “the only one “ who “predicted” such and such would occur?? Who would make it in the high school yearbook for “most likely to…..” under that category who comments on this blog?? I think I hear the Final Jeopardy jingle in the background, can anyone else hear that?? But it’s not done playing yet and I already know the answer.

But wait, it gets better:

“This recession may amount to only two months, March and April, although the declines in both those months so were so great they will offset the growth in the other two months of each quarter,”

https://econbrowser.com/archives/2020/06/business-cycle-indicators-june-16-2020#comment-237507

[ In my best Leo Getz ] OK, OK, OK, OK OK, another on, it’s just too tempting, OK, OK, OK, OK, another one, from 26 days ago:

“While we know first quarter was overall negative in its growth rate, that remains uncertain for the second quarter. “

https://econbrowser.com/archives/2020/06/business-cycle-indicators-june-16-2020#comment-237508

Junior and permalinks. The gift that keeps giving. Oh wait, just one more doozy, From June 27th, 16 days ago:

” ‘Possibility’ it might be as high as -20% for second quarter? It now looks like consumption is highly likely to be positive for the second quarter kills any chance of overall GDP growth for the second quarter being -20% or lower. Heck, I would be very surprised if it is lower than -10%.”

https://econbrowser.com/archives/2020/06/gdp-nowcasts-june-26th#comment-237778

Moses,

Quite a bit of what you quote from me looks to be correct. It looks to be correct that so far the only two months with negative GDP growth have been March and April. We may yet still have a “W” pattern with some future month having negative growth, but it will not be May or June, and probably not July either. The decline in April may exceed the turnaround in May and June, but I did not say definitely that May and June would offset April. I said they might, although I know you really do not like it when I make hedged statements like that. They are cause for ridicule.

And, again, the rates of growth I posed were quarterly rates, not annualized ones. Those a re completely reasonable and not inconsistent with your own “beer gut” 28.88% annualized rate.

I am not going to go searching through past messages here. I actually have a lot of other things to do, and this blog is not the end all and be all of my life. Maybe you did not ever really hang your hat hard on the L pattern, but I remember you tending to favor it over others at some point. You certainly sneered at the V, the swoosh, and the checkmark, and some others, And that has turned out to be dead wrong.

As it is, however, the near term bonceback does look more like a V than any of the others, and I was the first to call that here, along with the note that it was probably going to slow down after that initial bounceback. And that looks to be exactly what has happened. Look at the June and July surveys in the first figure provided above by Menzie. That is exactly what I said.

California, Oregon and Tennessee have all just reversed course, restricting openings. Don’t think that is reflected in the estimates reported here.

2slug,

We did have something looking more like a V at the front end there,, but now it is flattening out, by ow much we shall have to wait and see.

This seems like the appropriate time to make my “Joe Beer Gut” copy-cat off the Weisenheimers, non-modeled prediction for 2nd Quarter SAAR GDP (which is not exactly where I may or may not think SAAR GDP is, but with an aim to predict the 2nd Quarter BEA number as near as possible).

My prediction is…….. negative 28.88%

Thanks for attending the “Joe Beer Gut” virtual press conference. We’re not taking questions at this time, but will entertain them at a near future date. I attempted to get at least one paid sponsorship for this virtual event, but no adult beverage vendors or garbage food makers seemed to think this would be helpful to their products’ sales. Thanks once again.

Is that annualized or per quarter rate?

@ Junior

Your reading comprehension ability explains at least some of your problems (but not all). Tell me, as a child, how many retellings of Goldilocks and the Three Bears did you need to realize there were three bears in the story??

Barkley, I advise you never to watch the film “Rashomon” or your head could possibly explode.

Moses,

My question is not an attempt at a cheap shot. It is for clarification, even as I realize this is a number you are pulling from your “beer gut,” or wherever. It makes a big difference.

This is an areas where i have already publicly apologized for bungling and getting confused. When I decided to respond with a number to your request for one from me, and I was looking at various data, I became confused regarding which numbers were annualized, which are quarterly, and which are monthly (that consumption number was monthly).

.

As it is, I intended my 20% to be a maximum quarterly rate This turns out to be probably trivially true. Most of the numbers being thrown arounnd, all those -37% and -45% rates were annualized. As it is, my -20% quarterly rate would be about a -120% annualized rate, or something like that, far beyond what anybody is predicting.

Anyway, I do see that your number is SAAR so iit is annualized. That would certainly be within my 20% quarterly rate limit, not at all unreasonable.

Anyway, if your -28.88

@ Barkley Junior

You have now officially and without a doubt reached CoRev, Bruce Hall, “Princeton”Kopits, Ed Hanson level self-parody. There is nothing I can comment here, that you haven’t made abundantly clear on your own.

This has now reached a point where even throwing the occasional clown joke your way isn’t fun anymore. I never got the point in jousting with the PeakTrader types.

The last joke I am wasting on you: Do not dare blasphemy my Joe Beer Gut negative 28.88% 2nd Quarter SAAR GDP forecast. It is an untenable position to be anti-science.

I have a hard time sharing the optimism. For a lot of reasons I think have been stated over time.

I share your view Willie. I think there are two main problems going on here (that are in my limited range of purview anyway) 1) There’s not enough communication going on between epidemiologists and economists, because if there was, I think the upturn would be more gradual (as in Bachman’s numbers). 2) there is a kind of “negative money multiplier” that I think economists are failing to account for here. Those jobs that are disappearing, aren’t going to be able to be turned back on “like the flick of a light switch”. Which is one of the reasons I have pushed back against Barkley Junior, and apparently against Menzie, on the contention that an 8% May consumption number “record” after a gargantuan drop off, is really “a big deal”. The consumption long-term, is not going to be able to keep up with the blackhole or meteorite crevice of job losses.

BTW, a lot of regular readers of this blog probably think I just parrot Menzie on economics issues. Well, Menzie’s thoughts mean a lot to me, and have shifted my views on some things. And I think we agree on 85%+ of things. But I try to have my own mind and not parrot. That 8% May consumption number being referred to as a “record”, though, yes technically true, is one topic Menzie and I might have significant “friction” on.

Although I think it was subtextually clear in my comment, I still want to make clear, at the very top of my above comment, I was referring to the aggregated forecasts of the upturn, would be more gradual.

Moses Herzog: I am not saying 8% is fantastic. I’m just validating (1) m/m real consumption growth *was* 8%, and (2) it *was* a record, given the available time series on real consumption.

And just to be clear, I did not know it was a record for consumption when I put that in quotations in the other thread. So I was wrong on that aspect of it, and I should have been more careful before spreading misinformation, which I was unintentionally doing. But I should have had my facts straight, which I didn’t.

Actually the number was 8.2%. I do not know how far back one has to go to find such a large increase.

That is the monthly rate. As an annualized rate it exceeds 150%.

Gee whiz Barkley, I thought after you F’d-up your 2nd quarter SAAR GDP forecast you’d gone and retroactively sworn off quoting annual rates, and you only focused on Q-to-Q even though the GDP numbers you were criticizing as too low were SAAR. I’m so terribly confused now Junior. Please, Junior, set the heavenly stars back into alignment for all of us, would you??

I know, Moses, that you do not like to dwell on errors you have made that even Menzie has had to point out to you unequivocally. But the fact is that the 8.3% number is the monthly rate of growth of consumption in May. I am not for going strictly with one base or another, simply noting that one sees different bases being used in different places, which can be confusing. I have been confused by it.

It is you who insist on the SAAR annualized rates. So I think it is a bit surprising that you have a cow having it pointed out how dramatically large that consumption increase in May really was, given how many comments you made here dismissing it and diminsihing it. When pushed by Menzie you will admit that you may have screwed up. But it just is impossible for you to actually admit I am right about something, and I have been about what has been going on in May and June in general form.

But, clearly I have gone off the farm here and fallen back into petty wrangling with Moses. This really is a waste of time, and I apologize to others,

I thought this was an interesting little gem in a WSJ article by Russell Gold and Melanie Evans:

“University of Illinois Hospital, while separating Covid-19 patients from others, allows physicians, nurses, technicians and custodial staff to float in and out of Covid-care zones, employees said. Nurses from both sections of the hospital change in shared locker rooms before and after shifts. A spokeswoman for the hospital said it tried to have a dedicated staff for Covid units but didn’t dispute that some personnel floated from a Covid unit to a non-Covid one.

Dr. Bleasdale told others as early as the end of March that the virus seemed to be spreading inside University of Illinois Hospital. In an email to other infection-control doctors, she wrote: ‘We have gone to universal masking and not due to pressure but due to nosocomial transmission’—meaning spread inside a hospital.”

This is why I have never gotten tested for the Virus, even though I was very ill near to Valentine’s Day. I think there is about a 15%–25% chance that is what I had because I rarely get ill, and it was one of the worst bouts with flu-like symptoms I have EVER had. I have seen footage on TV of nurses at testing stations, literally putting their hands up to their face and hair while testing people at stations outside of hospitals. And you know that the number of infected that nurses interact with is going to be much higher than the general population’s “exposure”. So—You think I am going to risk infection at a testing station to find out if I had the virus back in February?? Not in this lifetime friends.

Reading what Kudlow was saying a few days ago reminded me of how he early on said we had this virus contained. If Kudlow advised someone to buy a particular stock, that person should massively short sell the same stock. Kudlow has a real talent for getting everything wrong.

“People are starting to quit their jobs again, which is extraordinary, in order to shop around for better jobs and wages.” – Kudlow

I’ll leave it to those who are better at analyzing BLS data than I am but where on earth did Kudlow come up with this idea? I know Trump wants his people to tell whatever lie it takes and we know Kudlow has a long history of lying for his political masters. Is this just another flat lie from Kudlow the Klown?

actually people are quitting their jobs in industries that force them to go back to work with high chances of becoming covid positive. that is the reason people are quitting jobs today.

PGL, I assume that Ludlow was referring to the May JOLTS. Quits went up 190,000. Of course, Loopy Lyin’ Larry, along with all the other RWNJs, neglect to mention that people who voluntarily quit are ineligible for unemployment compensation, so they can’t blame the $600/wk supplement.

It’s possible that some people were changing jobs for higher wages. I currently work for a large retailer that includes grocery, and some of our new hires came from a pork processing plant. Even with how crazy things were in the initial weeks of the pandemic, they said there was less stress than in the packing house, and they wouldn’t go back for the higher wages paid there. I think we also lost some workers who went to employers who were paying a wage premium for a few months.

“I think we also lost some workers who went to employers who were paying a wage premium for a few months.”

So MSNBC reported on some jobs seeing wages increased from $13/hour to $14/hour for a couple of months but now wages are $13 again even though the workers face the same hazards.

I had to do it – listen to all 7.5 minutes of Kudlow lying on Fox and Friends. If you want a good laugh – take a listen. But for those who want to do something more productive with your time, two highlights.

They asked Kudlow about Biden and he went off on how any reversal of Trump’s tax cuts for the rich would be a massive job killing. Of course slashing and burning government spending is AOK for Kudlow the Klown.

Kudlow was chopping at the bit to tell us how NAFTA 1.1 would be the most incredible trade policy ever. He even suggested it would somehow lead to a surge in productivity. NAFTA 1.1 is basically a rehash to what Trump called the worst trade deal ever.

pgl,

One of the more striking things about the current US economy, and one of the reasons it is so hard to make any reasonable forecasts and leading forecasters keep falling on their faces, is that there are massive intersectoral shifts going on that we are having a great deal of trouble tracking and keeping up with. A sign of this is that even as employment has been growing quite sharply from its very low level, we continue to have a very high rate of layoffs. Some sectors are growing, with some doing better than before the pandemic hit because they are favored by it, such as online marketing. But others are taking huge hits, some of them probably permanent.

So, it is quite possible that wages are going up in some selected sectors. But this is almost certainly a pretty isolated and minor phenomenon in the broader labor market where the double digit unemployment rate we are ecperiencing is almost certainly exerting downward pressure on wages in the vast majrority of sectors. of course Kudlow is so out of it he may have just made up his claim, even if there are some rising wages out there is some isolated parts of the economy.

The shape of the recovery will also depend on what shape the consumer class is in. If congress were to continue the $600 addition to unemployment checks (or even $300) consumption may recover faster. Same goes with help to state and local government – if they get enough help to prevent job loses, the economy will recover much faster. Another question is how they will resolve all the zombie businesses – if they are put through regular bankruptcy (with firesafe of assets) the recovery will take a lot longer.

when the country shut down in march, it was apparent that we would have a significant drop. as the economy reopened, it was also apparent, compared to the original drop, that we should get a significant jump in economic activity. this will necessarily happen when you restart from a very low point. in the background, many people overlooked the fact that a large majority of people continued to work (and collect a paycheck) throughout the shutdown and pandemic. the term shutdown is a bit of a misnomer, in that the economy did not completely shut down. it simply changed. obviously retail, hospitality and food services were probably impacted the most. and this was also some of the most visual effect, as people saw the restaurants and shops physically closed for a time. household spending did decline, but it did not quit. it simply shifted to other spending patterns. grocery stores with food delivery, amazon and other retail delivery picked up quite a bit of market share. anybody wonder why amazon stock is at an all time high?

trying to estimate economic activity in may and june will be quite difficult, due to the changes in how the economy functions. but june and july will begin to give us the framework of how the economy will work going forward over the next 6 months. retail and restaurants will ebb and flow depending upon outbreaks. however, i think the average consumer has shown they will operate much differently than prior to the outbreak. they are still spending, but they are not going out. it is all delivery based consumption. this will not change over the next 6 months. therefore, i do not think you see much economic improvement over the level we have seen in june and july. at least through the end of the year-unless we get a breaththrough in therapeutic or vaccine.

the elephant in the room right now is daycare and schools. the economy cannot grow substantially without those two items safely reopening. however, it seems until now the federal government has done absolutely no work addressing how to safely reopen those on a large scale this fall. the administration thinks its work is done with the proclamation schools will reopen in the fall. but they have done absolutely nothing to help the nation prepare for a safe reopening. we have wasted valuable time, ONCE AGAIN, while trump talks and takes no real action. that is a shame. another wasted opportunity.

also, unless the feds provide support to state and local governments, the upcoming belt tightening by local governments will inhibit any additional growth at least through the election. if trump and republicans do not provide state and local relief, their will be no economic story to help them stay in office.

The reason for a sharp uptick, as Barkley Rosser pointed out in an earlier discussion about construction and that I managed to argue with him about while agreeing, is the apparent rebound caused by resumption of certain industries, including construction, that usually do not stop on a dime. The V will not continue for a number of reasons.

1. State and local governments must balance budgets and will curtail spending in response to falling tax revenues.

2. Hospitality and travel will come back only slowly and with high expenses.

3. People working from home will reduce demand for everything from office space to fuel.

4. Other industries, especially service industries that are not COVID related medical services will face reduced demand or, in some cases, be mostly shut down for the duration (how many orchestras will be playing?)

5. Demand is demand, and the reduction in demand from affected industries will radiate out, just as increased demand has a multiplier effect.

Some contributors to the downturn may be small, but the economy was dying of a thousand cuts before COVID. Now, the thousand cuts just got deeper. The steep drop and then steep rebound to a much lower level will be followed by a long, lazy curve that may have a downward slope if we don’t get the pandemic under control and do that soon. I’m normally a pathological optimist, but I’m not at all optimistic now.

don’t discount the fact that trump will return to his tariffs and economic assault on china before the election. and this will in turn affect our economic performance. soybean farmers have already seen the result. he weakend them greatly prior to the pandemic.

I don’t like the fact that recently Biden has started to flirt with some of those same anti-trade sentiments, although you can tell that his heart isn’t really in it.

I saw that too. But we should be fair – smart trade policy is not exactly what Greg Mankiw preaches. Smart trade policy, however, would stay far away from what Wilbur Ross and Peter Navarro spoon feed our Idiot-in-Chief.

What is the latest time a presidential nominee has ever chosen his VP?? I have beaten this dead horse to an unrecognizable pulp~~~and I will keep beating it on the tiniest chance anyone out there is listening. Susan Rice was made for that job. She has it engrained in her DNA. She hits all the SJW check boxes (unimportant to me, but should make many others happy) and she is incredibly cerebral, an expert on national security, international relations, would be a great “war time president” (something people have pecked at female candidates on in the past). And with the right economic team I have strong faith she would at minimum be a B+ on domestic affairs. Why aren’t more people screaming this woman’s name from the hill tops???

Biden was “tight” with President Obama, Rice was “tight” with President Obama.

There isn’t another black female woman as a presidential candidate that can reach their hands up to this woman’s heels in the capability department. It’s not even close.

“black female woman”, hmmmm, uuuuhh, yeah see, she double checks that box. AMAZING……

Susan Rice is indeed highly qualified. Now some in the party might wonder who is best politically. But by now – Biden should be able to beat Trump even if he were stupid enough to run with Sarah Palin. So why not go with the most qualified. Beside the VP debate would be fun as Rice would make Pence look like the fool he really is.

I have thought Kamala Harris would be a good VP candidate, but Rice would be a good one, too. The right would get all wound up over Rice, but then some people get all wound up just by getting out of bed.

Almost always VPs are selected or at least announced during conventions. This year is different, so Biden will probably be announcing earlier than usually happens except for the cases where this is an incumbent VP like Pence in place already. So this will not be somehow awfully late, as you seem to suggest, Moses, but instead record early, assuming it comes before the convention as promised.

That’s the Hillary model. Sentiment regarding trade is very different because of Trump’s trade spectacle. Maybe not more positive, but certainly more aware. Biden may be honoring commitments to particular supporters.

@ macroduck

One of the ways (many ways) Hillary lost the race and knifed herself, was going into manufacturing base (or maybe the better way to express it is prior manufacturing base) states and pounding the big bass drum that she was a big proponent of NAFTA. Now, whatever your feelings about the substance of the NAFTA policy, good or bad, that one wasn’t flying politically. And for the woman we were always being told was supposedly the “behind the scenes” political genius of the Clinton family she showed she had ZERO barometer on people”s feeling on certain topics when she ran around the Midwest screaming that one at the top of her lungs. If Biden could shake the early stage dementia clouds from his head, he needs to stress he would enact policies. which would open Chinese markets for sales, and lessen the amount of Tariffs on USA agriculture, and basically leave it at that. Biden doesn’t need to show the fine print, because most people don’t care to see the details anyway. He doesn’t have to “spell it out” like sh*t-for-brains Hillary did, broad strokes are good enough.

“Biden doesn’t need to show the fine print, because most people don’t care to see the details anyway. ”

biden needs to say as little as possible and still remain a horse in the race. i agree, few details. simply state we are going to enact policies that bring back manufacturing employment and improve trade. period. do not give any details that can be used as ammo. stay quiet and simply let trump implode. if i were biden, i would behave as though i am ignoring trump. let my surrogates attack trump when he says ridiculous things, but treat him like a toddler who needs a timeout. the less you react to trump, the angrier he gets. and reacting to trump plays into his hands. just don’t do it.

There’s never a candidate whose policy proposals are things I completely agree with. I’ll take what we get with Biden, who may be flawed but is a pragmatist and has the country’s benefit in mind, over bunker boy, who is out for his own benefit at the expense of all else.

2slug,

I do not like this either, but I hate to say it that he is doing this to counter Trump in the ultimate cote swing states of PA, MI, and WI on the one issue where Trump still seems to poll well, and where Biden also has background and connections, namely with the industrial, male, white working class of those states, with him a native of Scranton, PA, which state he does not have all that much of a lead over Trump now, amazingly enough. Last time I checked, the really ultimate swing states are PA and WI. Remember: he who takes Prairie du Chien, Wisconsin, takes the White House.

Also, remember that in 2016, Hillary caved to the longrunning protectionist sentiment among the Dems and the AFL-CIO by opposing the PPT that Obama had negotiated. But that did not give her much cred among the protectionists who went for Trump and who indeed did off the PPT, one of the first things he did in office. As it turns out, it might have been handy to have had around, given his current anti-China push, not to mentiion that it would have given him most of what was new in his USMCA deal, although, of course, that would have denied him the propaganda of having this great new super-improved deal over the old NAFTA, which was, of course, the worst trade deal ever, except for the others he described that way.

If Trump’s big concern with China is that they “steal our IP” then Obama’s much derided trans Pacific deal was a really good idea. Of course Trump thought a destructive trade war was a better approach. Which of course has done a lot of damage but little good.

Trade is irrelevant. I think more people are finally getting it. The future is self sufficiency vs consumption. Manufacturing died out in 1924 ex-DOD(1948 with DOD).

Trump could care less who steals what’s IP. The U.S. has stolen its share.

He failed on infrastructure, which was larger than trade nonsense. I reject your point.

“Last time I checked, the really ultimate swing states are PA and WI.”

https://www.cnn.com/2020/07/12/politics/texas-swing-state-2020-election-polls/index.html

i pointed out many months ago that texas is changing. this was seen in 2018 with beto’s performance. now we are seeing polls indicate texas is in play. will it go democrat in 2020? probably not, but it will be close. and for republicans to keep texas, they will need to SPEND in a state they did not plan to worry about a couple of years ago. i think biden has a chance in texas, assuming he does not alienate the population. most texans would not vote for hillary, just because. but many texans are NOT a big fan of trump. if somebody offers an alternative that is not too extreme on the other end, that might be enough to change the vote. especially if they know that person is only running for one term. the texas governor is already opening the door to acceptable anti-trump decision making. if trump loses texas, no other state really matters.

baffling,

TX may be in play, but it is not remotely a swing state and certainly not an ultimate crucial one like PA and WI. If Biden wins TX, he will alteady have taken not only PA and WI, but MI, FL, NC, AZ, and will be seriouslyi playing for several others as well. In short, if he takes TX, it will be the big icing on a landslide, not the marginal showdown state that puts him over.

So, sorry, it remains that he who wins Prairie du Chien, Wisconsin, wins the White House.

https://www.houstonchronicle.com/politics/texas/article/Trump-derides-phony-polls-in-Texas-claims-15405247.php

barkley, texas has two big issues for trump to contend with. covid19 and oil. oil in particular sets it apart from the other swing states. oil has been punished as a result of trump policies, especially in texas. if biden can clearly articulate this situation and provide a solution, he wins texas. then it does not matter what happens in the other states. that said, saving oil in texas does not help the green movement, so i don’t think biden will make a big push on this front. unless he can build on wind and solar in a way that texas can embrace. texas wind is world leading in energy production-that can go a long way in replacing oil. if biden can convince texas that wind is a legitimate replacement for the oil industry, he may have a chance. but you need to convince roughnecks of this change, and that won’t be easy. i don’t think he has a plan at this time.

You are not getting it, baffling. I completely agree that it looks like Texas is in play and for the reasons you mention, and that is great.

But the question you dragged this point in to address was what are the key swing states whose outcomes will determine the election, and that is not remotely Texas. It is places like Wisconsin and Pennsylvania. Again, if Biden wins Texas, he will have already taken those crucial swing states probably by mush larger margins, and Texas will simply help make it a landlslide, not a cliffhanger, which it will be if Biden is scraping it in PA and WI (and getting MI) without getting any of the other states Trump took in 2016.

barkley, if biden were to take texas, then does it really matter who takes pennsylvania or wisconsin? if a swing state is supposed to impact the outcome of the election, those results would be meaningless with a texas win. texas is no longer a lock for republicans, or at least it continues to drift that way. pandering in the state can affect the national outcome.

baffling,

I guess we are talking at cross purposes. I doubt you are questioning that Biden’s chances in core swing states like PA and WI are a lot better than they are in TX, so that if he takes TX, he has those others and a lot more as well.

Heck, if you want to focus on just one state, another big one that will pretty much give it to Biden by itself and where his chances are also stronger than in Texas is Florida.

I think the more important point about Texas is not what happens this year or its role, which, again, if it goes for Biden it will not be what put him over but what makes it a landslide in the electoral college, is the long run pattern in Texas. The demographics are heading in the Dem direction with the steadily rising Latinx population and with it becoming less pro-GOP, which traditionally the Texas Hispanic population was more so compared to those in other states (except for the Cubans in Florida). Traditionally the GOP in Texas was aware of the importance of that population and went out of its way to appeal to it. George W. Buish was a good examples, who speaks Spanish and did relatively well with that population when he was Gov of TX. But with Trump and the current Tex GOP going with him hard, the trend towards the Dems is really strong now and will probably continue.

I wish to remain neutral in this friendly disagreement between two other commenters here, but I thought this article over at “The Intercept” is worth reading for those who enjoy “reading the political tea leaves”

https://theintercept.com/2020/07/14/texas-democratic-primaries-progressives/ <<—–Enjoy!!!!!

Tariffs on French imports too:

https://econospeak.blogspot.com/2020/07/favoring-hi-tech-tax-cheats-over.html

My analysis is in line with what Willie has written. Does anyone thing we could call this a ‘recovery’ if unemployment is at 10–12% by end of this year? A lot of these job losses will be permanent and it is difficult for me to figure out how to reduce this number. We have not even seen the layoffs from airlines, banks, and other industry segments that will be downsizing over the next six months. This will get uglier before it gets better.

Alan Goldhammer: “Recovery” in the lexicon of business cycle chronology denotes a period of sustained and broad increase in economic activity. It is different from having a negative output gap (i.e., where the economy is operating below the levels it would if all factors were being used at normal rates). See this post.

Thanks for reminding us of this excellent post. I always like Krugman’s term: PLOG. Prolonged Large Output Gap.

We will see a slow increase in output. Maybe starting in late Q3, maybe in Q4. I don’t have high hopes for Q3 because there’s all the downsizing and fallout that hasn’t worked its way through yet. We will get months of growth and months of shrinkage in a choppy, messy pattern. It will be like that until all the pandemic response missteps and their consequences have worked through the system. I don’t see much way that Florida, Texas, California, and Arizona avoid stepping back from reopening. There are probably other areas that will have problems as well.

The US passport doesn’t work much of anywhere any more, either. That’s going to leave a long-term psychological dent. It could have and effect on the dollar’s role as the world’s reserve currency. I don’t see the dollar losing that status quickly, but this will accelerate efforts to dethrone it. That’s a 20 year or longer effect that failed COVID response policies will have.

The Krugman PLOG will be with us for all of 2021 and most likely longer.

This is pretty shocking. When I lived in China I had a Canadian friend, and I was kinda stuck at his apartment for awhile, and he had a satellite feed of some of the better western cable channels (I think you had to either get a state issued permit or a few people would do it illegally). And one of the few things other than getting drunk semi-regular that we could agree on and enjoy was watching Mythbusters. Probably at least half the reason I watched was just to perv out on Kari Byron, but Grant Imahara made an indelible impression as well. 49…….. unbelievable. He always had so much light that seemed to emit out of his eyes. There has to be a way to stop this. Aspirin to bring down blood pressure?? How could there be no hint on this stuff??

https://twitter.com/KariByron/status/1282820309783994369/photo/1

What a fun group with a lot of chemistry. If they all didn’t get along well they sure put on a good front for the viewers.

There was a very nice article at CNN about why we will never get natural herd immunity. We better prepare for a new normal. This also hint at why there has so far never been a vaccine for any Coronaviruses. This virus elicits a short-lived and ineffective immunity. Does the economist have a plan for that scenario – perpetual lock down and isolation?

https://www.cnn.com/2020/07/13/opinions/herd-immunity-covid-19-uncomfortable-reality-haseltine/index.html

ivan, this is why i have been a greater advocate for better therapeutics. and acceptance that the world has changed. there will be more viruses like this as well. they occur every 10 years or so. the more interconnected the world is, and the more blind we are to the threat, the harder it will be to deal with. travel and other elective social interaction activities will either need to change or go away for the next few years. other activities will take their place. it does not look as though long term immunity will occur in the population. in fact, it appears those that are reinfected have it worse the second time around. other viruses, like dengue fever, behave in a similar manner. we need to quit this fantasy of reopening and returning to january 2020, and figure out how to better our lives moving on to january 2021.

Herd immunity is one of the more interesting “open questions” related to COVID-19. The realism or pragmatism of herd immunity. It was roughly a week ago a WSJ editorial board member was implying herd immunity could be very near. I’ll let you decide how reliable a WSJ editorial board member’s thoughts on epidemiology is. Allyssia Finley played basketball in middle school, dreamed of playing pro tennis and likes kicking a soccer ball around. Also her very fluffy WSJ bio says her Mommy taught her never to use the word stupid. She has worked in a Frozen Yoghurt shop also. So I guess Alyssia Finley is like the Bari Weiss of WSJ. So, you can decide from that what you think Alyssia Finley knows about herd immunity.

https://opinion.wsj.com/wsj_author/allysia-finley/

I think, on a serious note, I am in the middle ground on this one. I do think most of the time if you get infected with COVID-19, it probably is going to give you like a year’s worth of immunity. But I think most of the arguments on this relate to the short term, and if we don’t have a vaccine until late 2021 it’s a pretty dumb wager for people to count on herd immunity to “save” us between now and then. And when we have a vaccine, at that point the importance of herd immunity becomes miniscule. So as this goes on, I think that for most individuals 1-3 year immunity can be achieved after having acquired the virus. As far as herd immunity I think most of this debate is a sideshow and not really relevant to the problem.

“As far as herd immunity I think most of this debate is a sideshow and not really relevant to the problem.”

the herd immunity is important in that there are many people arguing to reopen the economy because we are on the threshold of herd immunity. if it cannot be achieved naturally, then sweden and those who promote the herd immunity response are deathly wrong. promoting herd immunity as a solution, with very little understanding of short and long term immune response, is reckless. i would like nothing more than to know that long term immunity occurs and herd immunity is achievable. this gets us back to “normal” the fastest. but i do not see much data supporting this outcome at this time.

Stephen Moore alert:

https://talkingpointsmemo.com/news/trump-economic-adviser-to-launch-another-effort-to-discredit-fauci

Stephen Moore, a member of the White House’s task force on reopening the economy, is preparing a new attack against White House COVID-19 task force health expert Dr. Anthony Fauci in the form of a memo titled “Dr. Wrong.” Moore, who is also the co-founder of the Committee to Unleash Prosperity, told the Daily Beast on Monday that he and his organization have spent weeks crafting the memo, which supposedly shows “how many times Dr. Fauci’s been wrong” during “his entire career,” including the pandemic. The document is titled “Dr. Wrong,” and Moore said he will publicize the memo upon completion and send it to President Donald Trump.

Let’s get Menzie a copy of this memo as soon as we can as I’m sure Menzie has lots of materials ready to go on how Moore has been Mr. Wrong on everything (we cannot call him doctor after all).

Stephen MoreUntrue has the chutzpah to accuse someone else of being wrong?!?!?! One could have become wealthy by betting against Spurious Stephen’s predictions over the years. Anyone who has listened to him should have their head examined. After all, who else has gotten themselves banned from a newspaper for writing things that had already been conclusively proven wrong?

He, Ludlow, and Laffer have done disproportionately more to give economics a bad name than anyone else I can think of. I didn’t spend all those years studying, practicing, and teaching the subject for charlatans like them to besmirch it so much. And I have much less reason to despise him than our host since I have much less of a reputation for him to sully.

If he’d paid more attention to Dr. Fauci over the years, he could have learned a hell of a lot about science, especially the difference between good mistakes (those made by using the best information available at the time) and extremely poor mistakes (those made by relying on disproven theories and incomplete or fraudulent data).

As promised, here is the graphic representation of the weekly Covid-19 deaths as of July 14. Please note that there has been a substantial adjustment by the CDC to the numbers in April and the first week in May in the most recent report which was not evident last week; well before the states removed many of the restrictions and before the BLM protests. In fact, the changes to the period up to June 6 are 52% of the total reported increase in the July 14 report date versus the June 30 report date.

https://www.dropbox.com/s/jl8vlw7vkzzmtjt/Covid-19%20Weekly%20Death%20-%207-14-20%20Report.pdf?dl=0

If people are only looking at the total deaths and not to the time period to which those deaths are attributed, then they may presume that the 8,915 increase in deaths since the 6-30 report occurred just recently. This may give a false sense that deaths in the current period are accelerating rapidly. Florida’s total Covid-19 deaths are shown below the national totals because much attention has been given to the record number of daily cases being attributed to Florida. That statistic may be in question also since the previous daily record of 12.2K new cases on April 4 in New York was based on approximately 20K tests while the 15.5K cases in Florida was based on approximately 60K tests. It is reasonable to presume that had New York tested 60K people on April 4, substantially more daily “cases” would have been uncovered.

I don’t know what this is you have linked to, but it does not look remotely like what I see every day in the Washington Post, which shows ongoing graphs of daily new cases and a seven day average of deaths. The latter had been declining, but recently has turned up.

All reports have the death toll rising quite sharply is several of those larger states with major outbreaks: Florida, Texas, California, Arizona, although there continue to be declines in other parts of the nation, with New York City finally having its first day in many months with no deaths from Covid-19.

All you have to do is go to the CDC which is the official source of Covid-19 statistics. https://www.cdc.gov/nchs/nvss/vsrr/covid19/index.htm

Because the CDC does not archive the weekly reports with “as of dates”, I download the reports and then do the comparison to see when the “week ending” data changes. Johns Hopkins and news outlets may use their own or other model estimates. CDC uses death certificate with cause of death.

The most current “week ending” will be incomplete as annotated on my graphic because death certificates have not been processed. This causes adjustments to the numbers.

With regard to Florida:

Bruce Hall: There are substantial revisions in the several weeks (at least 4) before the latest week available. So much so I think it pretty misleading to report them without a big footnote.

These are the footnotes from the CDC. I don’t believe all are applicable to the Covid-19 summary, but I guess I could include them on the chart which already says: “The number of deaths each week may be adjusted as new death certificates are processed.” The footnotes, in my estimation are a detailed way of saying that. That’s why I compare weekly analyses for the changes. One footnote says changes can occur between 1 and 8 weeks of the report date, but the latest report shown (7/14) shows changes in 17 weeks of data, so the CDC footnote is misleading to the extent that in the latest report, 9 additional (older) weeks of data were adjusted.

If I simply said the number of deaths went from 112K on the 6/30 report to 121K on the 7/14 report without showing the changes to the weeks, the the inference is that the additional 9K deaths occurred between 6/30 and 7/14. I don’t believe you would want your economics data to be handled that way (without an explanation of the historical adjustments).

________________________

NOTE: Number of deaths reported in this table are the total number of deaths received and coded as of the date of analysis and do not represent all deaths that occurred in that period. Counts of deaths occurring before or after the reporting period are not included in the table. The United States population, based on 2018 postcensal estimates from the U.S. Census Bureau, is 327,167,434.

*Data during this period are incomplete because of the lag in time between when the death occurred and when the death certificate is completed, submitted to NCHS and processed for reporting purposes. This delay can range from 1 week to 8 weeks or more, depending on the jurisdiction and cause of death.

1Deaths with confirmed or presumed COVID-19, coded to ICD–10 code U07.1

2Percent of expected deaths is the number of deaths for all causes for this week in 2020 compared to the average number across the same week in 2017–2019. Previous analyses of 2015–2016 provisional data completeness have found that completeness is lower in the first few weeks following the date of death (<25%), and then increases over time such that data are generally at least 75% complete within 8 weeks of when the death occurred (8).

3Counts of deaths involving pneumonia include pneumonia deaths that aso involve COVID-19 and exclude pneumonia deaths involving influenza.

4Counts of deaths involving influenza include deaths with pneumonia or COVID-19 also listed as a cause of death.

5Deaths with confirmed or presumed COVID-19, pneumonia, or influenza, coded to ICD–10 codes U07.1 or J09–J18.9

Bruce Hall: The spreadsheet itself notes (column Q) that all data back to February are incomplete.

Bruce,

The US just hit 1000 Covid-19 deaths yesterday for the first time since June 9. Do you really want to keep pushing some link that shows deaths declining sharply? This is clearly no longer the case, far from it, just plain dead wrong.

I honestly don’t think Wall Street believes in a real economic recovery, but they do believe that the government (Right or Left) will hand out trillions to investors, banks and large corporations to keep the 1% in caviar and Maserati’s. Negative interest rates, asset purchases, printing, tax breaks, direct hand-outs. Whatever it takes to keep the rich getting richer.

As an American who has lived abroad for thirty years, I am still amazed every day when I wake up and see that so-called freedom loving patriots have not burned Washington and Wall Street to the ground. Au contraire! Even the most ignorant, low-IQ, MAGA-hatted deplorable worships Washington and Wall Street. Stunning.