A little less than a year ago, I think I was in the “Swoosh” camp; I’m still in the “Reverse Radical” camp now, but it is amazing how fast GDP is rising.

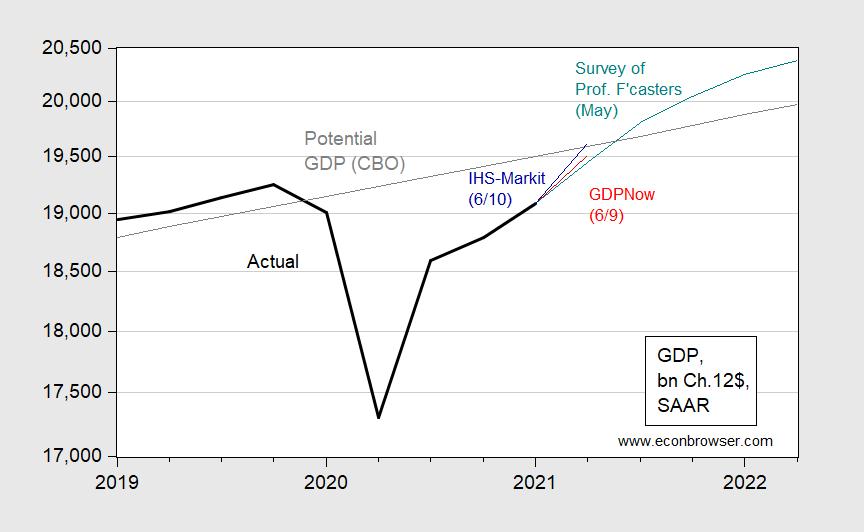

Figure 1: GDP (black), Survey of Professional Forecasters May mean (red), IHS-Markit nowcast (blue), Atlanta Fed GDPNow (red), all in billions Chained 2012$, SAAR, on log scale. Implied GDP level calculated by adding growth rates to 2021Q1 reported. Source: BEA (2021Q1 2nd release), Philadelphia Fed, IHS-Markit, Atlanta Fed, and author’s calculations.

What we know now of the trajectory of the economy doesn’t quite fit any of the letters discussed in the typology forwarded Bec, Bouabdallah, and Ferrara in their paper.

What’s those things people sometimes use while they’re walking their dog?? Shaped like a used bread bag turned inside out???

Eh, I’m just trying to gross out Menzie, but he still has my June 2020 email I guess. Waaaaaaaaaaaaaaaaaaaay at the bottom of his email trashbin.

But…but…but, Moses. The economy has actually more than recovered…for those that matter! “Even in a gilded age for executive pay, 2020 was a blowout year.”

https://www.nytimes.com/2021/06/11/business/ceo-pay-compensation-stock.html

Stock prices are at an all time high. Bond prices are way up. What’s an economist to complain about?

@JohnH

The best way to solve this is shareholder activism. But individual investors’ voting powers have been choked off, for varying reasons. If that can’t be corrected then I would hope a law could be passed related to executive salary ceilings as a percentage of profit margins or possibly other performance metrics which would reward efficiency but not be exorbitant/predatory of either laborers or shareholders.

it’s aggravating to watch.

Oh dear, Menzie, I am unclear why you put this post up given how it is both now getting to be rather yesterday history as well as it was a period of large changes leading to long and unpleasant arguments on this blog. Sigh….

So, duh, just to go past, it was a V last mid-year except that it stalled out before getting all the way back up to where it started falling sharply. Since then all this letter stuff has been irrelevant and we have been into more “normal” complicated patterns. Duh.

Such good times…….. This statement made by a “mathematical economist”, in the middle of June 2020, 6 days short of a FULL year ago.

“If this continues even somewhat, we may see what I had pompously dismissed numerous times here, that V-shaped recovery pattern, with most of the economics profession also being skeptical on this point. At the top of this surge are some sectors that may represent one-time buying, such as furniture. But other sectors may continue to see strong sales increases. This is the largest part of consumption, which is the largest part of GDP. It may well end up that growth in May and June will offset the sharp decline in April, leading to a situation of net positive GDP growth in the second quarter, and thus no recession in the journalistic sense of two consecutive quarters of net economic decline. “

https://econbrowser.com/archives/2020/06/business-cycle-indicators-june-16-2020#comment-237508

What did we see in June of 2020 as it relates to pandemics and an efficacious vaccine (not bleach mind you, nor a pen light shone onto the skin for that matter) months off?? If this comment had been made anonymously, we’d never have known which career comedian had authored it, or might have even guessed they wore a red MAGA dunce cap to work every day.

I do have to say though, this may be my personal favorite of many joy-inducing Barkley-isms:

“This recession may amount to only two months, March and April, …….. ”

https://econbrowser.com/archives/2020/06/business-cycle-indicators-june-16-2020#comment-237507

I’m taking requests for favorites. Just give me a paraphrase of the comment and I will hunt down the verbatim original. Anything to entertain the masses.

Moses Herzog: Using the NBER peak dated at February 2020, and troughs in (i) monthly GDP, (ii) nonfarm payroll employment, (iii) industrial production, (iv) personal income ex-current transfers, (v) manufacturing and trade industry sales, and (vi) consumption in April 2020 (as shown in this post), I can well imagine it plausible that the NBER Business Cycle Dating Committee could determine the recession to end at April 2020. (The shortest recession to date is the 1980 recession, 6 months duration.)

Menzie, it should go without saying I respect your opinion greatly, and if your discernment contradicts my thoughts, always makes me take 2-3 steps back and more than a modicum of angst. But….. I hope that’s not an actual prediction on your part, (it seems it’s NOT a prediction, but you are saying “this is very much in the cards” or “strongly within the realm of possibility”) because from my view (and I say this respectfully) calling end of April 2020 the end of the recession is very shaky ground. And I’ll tell you this much, even if you and/or NBER believe that, or just NBER believes that, I think it will hurt NBER’s reputation with the general public if they put that stance out there. People will be offended by it, and some even feel personally insulted by it.

Moses Herzog: To quote from the NBER BCDC’s latest announcement:

If you look at the graph of the six monthly indicators, a straightforward interpretation is (at a monthly frequency) February peak, April trough, recession lasts two months. I have no inside information on what the current BCDC members think, but I have some insight on how they interpret the data, and that is what informs my views about what they *might* conclude.

I don’t see how such a decision could “hurt” BCDC’s reputation; rather, a drastically different conclusion would require a very good explanation.

@ Menzie

Understanding what you are saying, respecting (to a degree) NBER’s view of it and the difficulty in defining what is a “recession”, and not taking any kind of a “I’m right, and you/they/so-and-so are ‘wrong’ ” stance. Could maybe a better way of interpreting that from say “a ‘turn’ in economic activity” might be a general level of unhappiness or how to say it, a “certain rise above the ‘base effects’ “?? That is to say a “level” above the “base effects” that has been “met” or “attained” rather than an “upward turn” in economic activity.

What am I saying?? That is, if you have an unemployment rate, higher than 10% going clear into July and Joe-Six-Pack reads a WSJ headline “NBER defines 2020 virus induced recession only lasted two months”, he’s not going to take it too well on an emotional level (I would argue he shouldn’t digest this well). Joe Six-Pack, i.e. the general public is going to lose total respect for research bureaus (“independent” or otherwise) telling them that when unemployment was still above 10%, the recession ended two months back. And this gets back to how economists communicate their message to the public and getting the public to LISTEN to what credentialed economists have to say to them—on things such as free trade, lower producer costs etc. How are they to respect a body of researchers telling them a recession has ended when unemployment was still above 10% two months after their “end demarcation” ???

Moses Herzog: Well, your point could be applied to many episodes. The 2007-09 recession (“contraction”) lasted six quarters. Yet, the average person on the street would say it lasted much longer into 2009 and 2010 even when the “expansion” was underway. This is the difference between contraction/expansion (first derivative) and output gap (deviation from trend).

I should have stated, NBER’s possible interpretation of it, which is what you clearly stated.

Barkley Rosser: Point of the post is that pretty much nobody was right in the end.

The old joke applies. Why do economists forecast? To make the weather man look good.

This is why an outhouse economist like me has a tinker’s chance of being correct once and a while.

Well, Menzie, do you deny that it looked like a V until it stopped rising so rapidly? Sure still looks like one to me. Again, although I am not going to go dredging through past posts to find it, I believe I repeatedly forecast that it would stop rising so rapidly before it got all the way back up. Your argument that it was not a V because it stopped rising before it got all the way back up does not disagree with that at all.

I do not know what to call the whole shape. “Reverse radical”? Oh, maybe. But you have shown a lot of data showing some odd wiggling since the rapid increase stopped. I agree that it is hard to apply any letter to the whole thing (and “reverse radical” is not a letter).

Of course, exactly what I expected to happen did, that Moses would erupt in a wild frenzy. He does seem to have made quite a fool of himself on this round with his absurd claim that I had somehow humiliated myself with my accurate forecast that the recession would only last two months, not to mention that he seems again to be ridiculing the accurate observation of a record rate of growth of consumption last May. Was that also your intention?

Barkley Rosser: My point was that I didn’t expect Q3 growth to be sufficient to bring Q3 level back to Q1 level (let alone 19Q4 level), hence *not* a “V”. As it was 2020Q3 GDP was 2.2% below 2020Q1, despite massive monetary and fiscal stimulus.

@ Menzie

Menzie, I’m going to “stand in for” and represent Barkley Rosser on a question I know he’s dying to ask you. Were you and all the macroeconomists who participated in the 538 blog/Booth School Survey of Quantitative Macroeconomic Economists aware at the time you filled out the survey that reverse radical “is not a letter”?? Meaning did the compilers of the survey make all of you macroeconomists aware of that just prior to filling out the survey?? This wasn’t really a question I had, but I knew Barkley would want to know if they had informed you prior to filling out the survey……. that reverse radical “is not a letter”. I think Barkley senses that all of you were confused on that when you filled out the survey, but he’s afraid to ask you.

i think the response of the economy has been much better than many people felt, compared to last spring/summer. as long as the virus was circulating, it was unrealistic to think it would return to trend. but it really did make a remarkable comeback. this is a testament to the impact government stimulus can have during unprecedented times.

To me the 2nd derivative of the most recent data point is too great to be “reverse radical” – a rose by any other name…

To quote our host:

“This is the difference between contraction/expansion (first derivative) and output gap (deviation from trend).”

Maybe you flunked calculus I but the 2nd derivative is not the same thing as a deviation from trend.

Then again – you love to write terms you cannot apply to the topic at hand.

As you note, that was Menzie’s comment and not mine – where did I say anything about 2nd derivative being the same thing as a deviation from trend? I was specific in my comment and didn’t come close to referencing deviation from trend. Clown.

But, EConned, the third derivative does show it to be a reverse radical! tsk tsk.

To be picky, when using discrete measurements, the concept of a derivative at a particular point is not well defined. The last point does not really have a derivative. One difference between infinitesimal calculus and finite calculus.

Suppression, not recession.

You still spewing terms you cannot even define. Oh wait – that is your job as chief economist for Fox and Friends. Carry on.

https://fred.stlouisfed.org/graph/?g=z21W

January 15, 2018

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2017-2021

https://fred.stlouisfed.org/graph/?g=z21I

January 15, 2018

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2017-2021

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=AuPx

January 15, 2020

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2021

https://fred.stlouisfed.org/graph/?g=AuPM

January 15, 2020

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2021

(Indexed to 2020)

https://pbs.twimg.com/media/E3jaWzAXoAAMQ6j?format=jpg&name=large

June 11, 2021

Results of the presidential election in Peru, reflecting a profound class and ethnic division as in Bolivia. As in Bolivia, settled in favor of the rural indigenous population.

https://www.nytimes.com/2021/06/11/business/ceo-pay-compensation-stock.html

June 11, 2021

Meager Rewards for Workers, Exceptionally Rich Pay for C.E.O.s

The gap between workers and C.E.O.s widened during the pandemic as public companies granted top executives some of the richest pay packages ever.

By Peter Eavis

Even in a gilded age for executive pay, 2020 was a blowout year….

https://www.propublica.org/article/the-secret-irs-files-trove-of-never-before-seen-records-reveal-how-the-wealthiest-avoid-income-tax

June 8, 2021

The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax

By Jesse Eisinger, Jeff Ernsthausen and Paul Kiel

ProPublica has obtained a vast cache of IRS information showing how billionaires like Jeff Bezos, Elon Musk and Warren Buffett pay little in income tax compared to their massive wealth — sometimes, even nothing….

People may be shocked that their tax returns were disclosed but no one paying attention was shocked that this crew accomplished tax evasion. After all the rich pay a whole lot for lobbyists, bribed members of Congress, and of course shady tax attorneys. This is a feature of their system – not a bug.

http://www.xinhuanet.com/english/2021-06/11/c_1310002829.htm

June 11, 2021

Over 845 mln COVID-19 vaccine doses administered across China

BEIJING — Over 845.2 million doses of COVID-19 vaccines had been administered across China as of Thursday, the National Health Commission (NHC) said Friday.

[ Domestically, 7 Chinese vaccines are now being administered at a rate of 20 million doses daily. Internationally, more than 350 million Chinese vaccine doses have been distributed to more than 75 nations. A number of nations are being assisted in producing Chinese vaccines. ]

And of course as a percentage of their population this is still below what the US is doing. And of course you refuse to acknowledge what the US is doing for the rest of the world. Or the efficacy of the respective vaccines.

Look if you cannot be even remotely honest on this issue stop polluting the comment section with PRC sponsored spin.

https://www.nature.com/articles/d41586-021-01545-3

June 9, 2021

China is vaccinating a staggering 20 million people a day

Scientists are impressed by China’s juggernaut of a vaccination drive, through which it is currently administering nearly 60% of all COVID-19 vaccine doses globally.

By Smriti Mallapaty

For more than a week, an average of about 20 million people have been vaccinated against COVID-19 every day in China. At this rate, the nation would have fully vaccinated the entire UK population in little more than six days. China now accounts for more than half of the 35 million or so people around the world receiving a COVID-19 shot each day….

Didn’t you already post this in at least one other thread? It’s exceedingly rude of you to repeatedly hijack a thread in order to propagandize on behalf of the CCP, especially when most of the posts are just a daily update of previous propaganda (functionally, a repeat of a previous post). If, however, you are actually repeating the exact same propaganda, that’s reprehensible.

I had nothing but scorn for the pro-Trump propaganda by the Usual Suspects, and I likewise have nothing but scorn for your pro-Xi BS. The two are equally unuseful and equally detestable.

I strongly suggest, AGAIN, that you get your own blog. You’ll be able to propagandize to your heart’s content, and we’ll be able to avoid getting pissed off because we have to, yet again, scroll past all your crap.

http://www.xinhuanet.com/english/2021-06/11/c_1310001406.htm

June 11, 2021

Nigeria flags off full commercial operation of China-assisted railway

By Olatunji Saliu and Bosun Awoniyi

LAGOS — Nigeria on Thursday officially started the full commercial operation of a China-assisted railway linking the southwestern cities of Lagos and Ibadan, to ease public transportation and fuel goods movement in the west African country.

At a ceremony to flag off the commercial operation of the Lagos-Ibadan railway at the Mobolaji Johnson Railway Station in Lagos, the country’s economic hub and most populous city, Nigerian President Muhammadu Buhari described the completion of the project as “another milestone in the drive to revitalize the railway system in Nigeria.”

Buhari said the commencement of full operations of the rail line, constructed by the China Civil Engineering Construction Corporation (CCECC), will also establish the railway in Nigeria “as a choice of transportation for both passengers and freight.”

The new rail line covers about 157 km with an extension of about 7 km to a busy port in Lagos, with a design speed of 150 km per hour.

Railway construction is a major part of the China-African cooperation and a flagship project of China-Nigeria practical cooperation and bilateral relations.

The Lagos-Ibadan railway is a segment of the Lagos-Kano standard gauge railway under construction in Nigeria.

Rotimi Amaechi, the minister of Transportation, told Xinhua in an interview at the ceremony that the railway is an “impact we have on the economy,” because it will move goods, personnel and services in a record time.

“It has very good quality,” Amaechi said.

Governor of Lagos Babajide Sanwo-Olu acknowledged the rail project as “a big boost to the overall vision of the national integration,” saying it will encourage the private sector, local communities, and individuals to take advantage of the opportunity that the rail line has thrown up.

“With the commissioning of this rail line today (Thursday), it will now be possible for people to work in Lagos and live outside Lagos, and vice versa,” the governor said. “It will radically transform the life, work, and the leisure for multitudes of our citizens along this (Lagos-Ibadan) corridor. It will open opportunities for investments, real estate corridor, urban development, commerce, and so on.”

The Mobolaji Johnson Station in Lagos, where the flag-off ceremony took place, is one of the largest railway stations in West Africa, with a holding capacity of 6,000 passengers.

Chinese Ambassador to Nigeria Cui Jianchun said aside from transporting people and goods, the smooth opening of the commercial operation of the Lagos-Ibadan railway is also a real way to change and improve the quality of Nigerian people’s life.

“This flag-off ceremony not only reflects China’s support for Nigeria’s economic and social development, but it is also a testimony of the far-sighted decision of the Nigerian government,” said Cui….

This one is especially a laugh riot if people here knew how much mainland China on their TV and in their schools badmouths colonialism. There is no lie that exists too big to be told by Beijing. They’d just as soon spit on Nigerians as to profit off them. And then walk around trying to sell the world on their “benevolence” is the added kicker. Beijing apparently assumes everyone outside their country is as easy to dupe as the citizenry they have brainwashed from birth.